|

市場調查報告書

商品編碼

1851897

滲透壓計:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Osmometers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

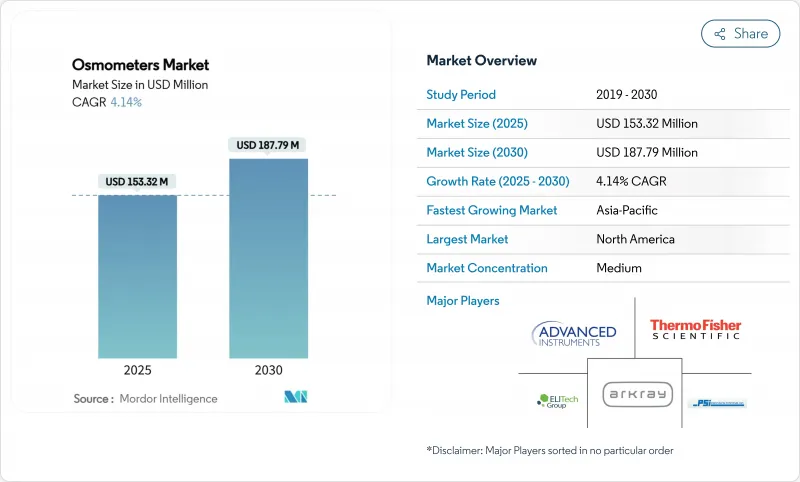

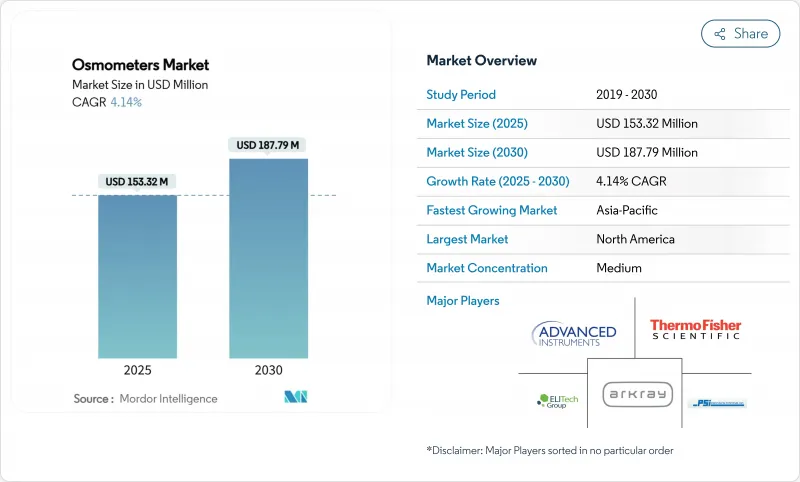

預計到 2025 年滲透壓計市場規模將達到 1.5332 億美元,到 2030 年將達到 1.8779 億美元。

實驗室自動化、更嚴格的合規規則以及生物製藥向高濃度生技藥品的轉型正在推動市場需求,即便歐盟醫療設備法規 (EU MDR) 下的器械核准有所延長。諸如 Advanced Instruments 以 22 億美元收購 Nova Biomedical 等策略整合,標誌著該產業正向能夠應對複雜全球法規的整合分析平台轉型。同時,歐盟新規要求製造商提前六個月向監管機構通報供應中斷情況,這正在重塑所有主要供應商的風險管理策略。在北美,對臨床基礎設施的持續投資支撐著穩定的更換需求;而在亞太地區,現代化改造推動了高於平均水平的銷售成長,並加劇了來自新型電阻式即時檢測參與企業的競爭。

全球滲透壓計市場趨勢與洞察

技術進步和自動化

歐洲實驗室正在採用全自動滲透壓工作站,這些工作站可直接與液相層析質譜儀 (LC-MS)、化學分析儀和實驗室資訊系統 (LIS) 連接,從而減少人工操作並最大限度地降低交叉污染的風險。北愛爾蘭 CoreLIMS 的全縣推廣應用展示了無縫整合,使得即時滲透壓數據能夠傳輸至血庫和微生物模組,從而提高了每天 1200 個樣本點的可追溯性。供應商目前正在銷售可在 60 秒內產生 HL7 格式結果的「連網」滲透壓計。因此,滲透壓計市場的平均售價因軟體、網路安全更新和遠距離診斷包等相關費用而上漲。雖然北美核心參考實驗室的應用最為廣泛,但歐盟各實驗室正在透過區域資助的數位健康計畫縮小差距。

研發成本上升及疾病負擔加重

全球在先進療法領域的研發投入正推動滲透壓成為製程分析的核心。近期臨床試驗表明,當生產商在培養過程中及時調整滲透壓時,腺結合病毒滴度可提高22%。歐盟成年人群中慢性腎臟病盛行率超過9%,促使人們需要依賴快速尿滲透壓測量的分散式腎功能篩檢。 Nova Biomedical公司獲得CE認證的肌酸酐/eGFR檢測儀可在兩分鐘內完成滲透壓和腎臟標記的檢測,使當地醫生無需中心實驗室支援即可對患者進行分診。因此,高疾病負擔正在擴大滲透壓計市場的臨床裝置量,並促使採購標準轉向兼具速度、分析深度和人體工學設計的設備。

固有精度/吞吐量限制

蛋白質濃度超過 150 mg/mL 時,冰點循環時間會超過 3 分鐘,這會降低大型實驗室的日處理量,而這些實驗室每年已經進行 8 億次檢測。蒸氣法儀器雖然能提高精度,但需要較長的平衡時間,這使得它們在 15 分鐘內完成檢測的快速檢測台上幾乎無法負擔。這種權衡促使一些買家轉向非接觸式屈光感測器,從而蠶食了它們在快速響應細分市場的潛在佔有率。

細分市場分析

到2024年,冰點分析儀將佔據滲透壓計市場68.78%的佔有率,這得益於數十年的臨床應用經驗和明確的監管核准。電阻計目前在滲透壓計市場中所佔佔有率較小,但由於可攜式設計適用於重症加護、透析和獸醫應用,因此正以7.73%的複合年成長率成長。蒸氣滲透壓計則佔據了高濃度生技藥品這一細分市場,其高性能彌補了週期較長的不足。目前,製造商正將維護合約、遠端韌體推送和自動校準功能捆綁銷售,以使合規成本更易於預測。

技術更新反映了產業向互聯互通和服務化方向發展的趨勢。電阻分析儀現在對20微升或更小的樣本即可達到95.5%的準確度,這對於新生兒篩檢和動物健康至關重要,並且可以直接連接到支援藍牙的患者應用程式。冰點分析儀領域的領先企業透過整合條碼掃描器、試劑批次追溯和基於人工智慧的品管警報來應對這一趨勢,從而減少不合格試劑的重複使用。蒸氣分析儀供應商則專注於不銹鋼濕潤路徑和符合美國聯邦法規21 CFR Part 11的審核追蹤,以吸引基因治療合約研發生產機構(CDMO)。

至2024年,單樣本分析儀將佔滲透壓計市場60.36%的佔有率。然而,多樣檢體分析儀正以8.12%的複合年成長率成長,它們配備了機器人裝載抽屜和實驗室資訊系統(LIS)介面,每小時最多可處理90個試管。因此,隨著醫院圍繞模組化自動化重新設計其核心實驗室,高通量分析儀的市場規模在預測期內應超過歷史平均值。

歐洲一家醫療機構正在部署24個配備智慧型手機式觸控螢幕的機架,使一名技術人員能夠同時監控電解質、葡萄糖和滲透壓測試。在鄉村醫療中心,緊湊型單檢體儀器仍在使用,但供應商正在對其進行升級,增加雲端記錄、簡化品管和一鍵維護等功能。這種平衡的需求使得兩類儀器之間形成了明顯的差異,而吞吐量和連接性則提供了合適的解決方案。

區域分析

到2024年,北美將佔據滲透壓計市場37.77%的佔有率,穩定的報銷政策和高檢測量支撐著設備的穩定升級。該地區擁有數量最多的CLIA認證實驗室,以及以製程分析技術為核心的密集生物製藥產業走廊。亞太地區以7.98%的複合年成長率成長,受益於中國、印度和韓國不斷擴大的全民健康保險、生技藥品產能的積極擴張以及床邊檢測技術的日益普及。歐洲雖然受到監管瓶頸的限制,但正利用自動化技術的進步和強大的疫苗研發管線保持競爭力。中東和非洲仍在發展中,但醫院建設項目和本地設備組裝獎勵的結合,正確保該地區實現兩位數的成長。

新加坡、韓國和中國的政府補貼正在推動對符合美國聯邦法規21 CFR Part 11標準的高通量設備的投資。歐盟醫療器材法規(EU MDR)漫長的認證週期將延緩部分產品的上市,但同時也為擁有預先公告機構策略的彈性供應商創造了空間。所有地區對能夠壓縮工作流程、統一資料流並降低總體擁有成本的平台的需求都在成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 技術進步和自動化

- 研發成本上升及疾病負擔加重

- 生物製藥向高濃度生技藥品的轉變

- 用於家庭腎臟護理的可攜式電阻式設備

- 監管機構推動生產過程中滲透壓測試。

- LIS在食品飲料工廠中的整合品質保證

- 市場限制

- 固有精度/吞吐量限制

- 熟練操作人員短缺

- 冰點感測器供應鏈風險

- 一種新的非接觸式溫度測量替代方案

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 冰點滲透壓計

- 蒸氣滲透壓計

- 薄膜滲透壓計

- 基於電阻的(其他)

- 按採樣能力

- 單樣品滲透壓計

- 多樣品滲透壓計

- 透過使用

- 臨床

- 製藥和生物技術

- 工業和食品品質控制

- 研究與學術

- 最終用戶

- 醫院

- 診斷和實驗室中心

- 生物製藥製造商

- 研究所

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 亞太其他地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 市佔率分析

- 公司簡介

- Advanced Instruments LLC

- Precision Systems Inc.

- ELITech Group

- ARKRAY Inc.

- ASTORI TECNICA

- KNAUER Wissenschaftliche Gerate GmbH

- Loser Messtechnik

- SanoTec GmbH

- TearLab Corporation

- Mechatronics Instruments BV

- Gonotec GmbH

- Shanghai Medical Instruments Co.

- Labnics Equipment

- Thermo Fisher Scientific

- Beijing Hiyi Technology Co., Ltd.

- Merck KGaA

- Bio-Techne Corporation

- Anton Paar GmbH

- Precision Systems Science Co. Ltd.

第7章 市場機會與未來展望

The osmometers market reached USD 153.32 million in 2025 and is forecast to climb to USD 187.79 million by 2030, reflecting a steady 4.14% CAGR that signals a mature but opportunity-rich landscape.

Demand is buoyed by laboratory automation, stricter compliance rules and biopharma's tilt toward high-concentration biologics, even as device approvals take longer under the European Union Medical Device Regulation (EU MDR). Strategic combinations-such as Advanced Instruments' pending USD 2.2 billion purchase of Nova Biomedical-underline an industry pivot toward integrated analytical platforms able to navigate complex global regulations. Meanwhile, the new EU rule that forces manufacturers to pre-alert regulators six months before supply interruptions is reshaping risk-management playbooks for every major supplier. In North America, continued clinical infrastructure investment supports stable replacement demand, while Asia-Pacific's modernization push drives above-trend unit growth and fuels competition from impedance-based, point-of-care (POC) newcomers.

Global Osmometers Market Trends and Insights

Technological Advancements & Automation

European laboratories are adopting fully automated osmometry workcells that link directly with analytical LC-MS, chemistry analyzers and laboratory information systems, shrinking manual steps and minimizing cross-contamination risks. A province-wide CoreLIMS roll-out in Northern Ireland has shown how seamless integration allows real-time osmolality data to flow into blood-bank and microbiology modules, improving traceability across 1,200 sample points per day. Vendors now position "connected" osmometers that generate HL7-formatted results in under 60 seconds, a capability that resonates with hospitals chasing zero-waste, high-throughput operations. The osmometers market is thus witnessing higher average selling prices tied to software, cyber-security updates and remote diagnostics bundles. Adoption is sharpest in North America's core reference labs, but EU-based networks are narrowing the gap through region-funded digital health programs.

Growing R&D Spend & Disease Burden

Global R&D outlays in advanced therapies push osmolality to the front line of process analytics, with recent trials showing adeno-associated virus titers jump 22% when producers orchestrate timed osmolality shifts mid-culture. Chronic kidney disease prevalence, now topping 9% of the EU adult population, heightens need for decentralized kidney-function screens that depend on rapid urine osmometry. Nova Biomedical's CE-marked creatinine/eGFR meter pairs osmolarity and kidney markers in a two-minute test, enabling rural physicians to triage patients without central lab support. High disease burden therefore amplifies the osmometers market's clinical installed base and shifts procurement criteria toward devices that blend speed, analytical depth and ergonomic design.

Intrinsic Accuracy/Throughput Limits

Freezing-point cycles surpass three minutes when protein loads exceed 150 mg/mL, throttling daily capacity inside mega-labs that already run 800 million tests annually. Vapor-pressure devices improve accuracy but require long equilibration; thus they seldom slot into STAT benches where 15-minute turnaround is non-negotiable. This trade-off steers some buyers to non-contact refractive sensors, eroding addressable share in rapid-response niches.

Other drivers and restraints analyzed in the detailed report include:

- Biopharma Shift To High-Concentration Biologics

- Portable Impedance-Based Devices For Home Renal Care

- Shortage Of Skilled Operators

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Freezing point instruments retained 68.78% of 2024 osmometers market share, underpinned by decades of clinical trust and clear regulatory acceptance. Impedance systems, though only a fraction of today's osmometers market size, are growing at 7.73% CAGR thanks to portable designs that suit critical care, dialysis and veterinary applications. Vapor-pressure units occupy a narrow high-concentration biologics niche where their performance premium offsets slower cycle times. Manufacturers now bundle maintenance contracts, remote firmware pushes and auto-calibration features to keep compliance costs predictable.

Technology updates echo industry moves toward connectivity and service. Impedance devices achieve 95.5% accuracy with sub-20 µL samples-critical for newborn screening and animal health-and plug directly into Bluetooth-enabled patient apps, expanding the osmometers industry footprint in decentralized setting. Freezing-point leaders respond by embedding barcode scanners, reagent-lot traceability and AI-based quality control alerts that slash out-of-spec reruns. Vapor-pressure suppliers focus on stainless-steel wetted paths and 21 CFR Part 11 audit trails that attract gene-therapy CDMOs.

Single-sample analyzers held 60.36% of the osmometers market in 2024 as clinics and emergency rooms favored lower purchase prices and easy workflows. Yet multi-sample versions, climbing at 8.12% CAGR, now ship with robotic load drawers and LIS hubs that process up to 90 tubes per hour-features North American mega-labs deem essential for value-based reimbursement targets. The osmometers market size for high-throughput units should therefore outpace historical averages over the forecast as hospitals redesign core labs around modular automation.

European sites adopt 24-place racks with smartphone-style touchscreens, allowing one technologist to oversee parallel electrolyte, glucose and osmolality tests. In rural health centers, compact single-sample devices persist, but vendors refresh them with cloud logging, simplified QC and one-button maintenance. This balanced demand keeps both categories relevant yet sharply differentiated on throughput and connectivity.

The Osmometers Market Report is Segmented by Product Type (Freezing Point Osmometers, Vapor Pressure Osmometers, and More), Sampling Capacity (Single-Sample and Multi-Sample Osmometers), Application (Clinical, Pharmaceutical & Biotech, and More), End User (Hospitals, Diagnostic and Laboratory Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America kept 37.77% of global osmometers market share in 2024 as reimbursement stability and high test volumes underpinned steady upgrades. The region benefits from the deepest base of CLIA-certified labs and a dense biopharma corridor that values process analytical technology. Asia-Pacific, compounding at 7.98% CAGR, benefits from national health insurance expansions, aggressive biologics capacity build-outs and rising adoption of bedside testing in China, India and South Korea. Europe, while hampered by regulatory bottlenecks, leverages automation uptake and strong vaccine pipelines to maintain competitive parity. Middle East and Africa remain nascent but secure double-digit unit growth where hospital build programs pair with local device assembly incentives.

Government subsidies in Singapore, Korea and China tilt capex toward high-throughput, 21 CFR Part 11-ready osmometers that future-proof regulatory filings. EU MDR's protracted certification cycles delay some product launches, but also create white-space for nimble suppliers with pre-notified-body strategies. Across all regions, demand gravitates toward platforms that compress workflow, integrate data streams and reduce total cost of ownership.

- Advanced Instrumentations

- Precision Systems

- ELITech Group

- Arkray

- ASTORI TECNICA

- KNAUER Wissenschaftliche Gerate GmbH

- Loser Messtechnik

- SanoTec GmbH

- TearLab Corporation

- Mechatronics Instruments BV

- Gonotec GmbH

- Shanghai Medical Instruments Co.

- Labnics Equipment

- Thermo Fisher Scientific

- Beijing Hiyi Technology Co., Ltd.

- Merck

- Bio-Techne

- Anton Paar

- Precision Systems Science Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Advancements & Automation

- 4.2.2 Growing R&D Spend & Disease Burden

- 4.2.3 Biopharma Shift To High-Concentration Biologics

- 4.2.4 Portable Impedance-Based Devices For Home Renal Care

- 4.2.5 Regulatory Push For In-Process Osmolality Testing

- 4.2.6 LIS-Integrated QA In Food & Beverage Plants

- 4.3 Market Restraints

- 4.3.1 Intrinsic Accuracy/Throughput Limits

- 4.3.2 Shortage Of Skilled Operators

- 4.3.3 Cryoscopic Sensor Supply-Chain Risks

- 4.3.4 Emerging Non-Contact T-Measurement Alternatives

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product Type

- 5.1.1 Freezing Point Osmometers

- 5.1.2 Vapor Pressure Osmometers

- 5.1.3 Membrane Osmometers

- 5.1.4 Impedance-Based (Others)

- 5.2 By Sampling Capacity

- 5.2.1 Single-sample Osmometers

- 5.2.2 Multi-sample Osmometers

- 5.3 By Application

- 5.3.1 Clinical

- 5.3.2 Pharmaceutical & Biotech

- 5.3.3 Industrial & Food QC

- 5.3.4 Research & Academic

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic & Laboratory Centers

- 5.4.3 Biopharma Manufacturers

- 5.4.4 Research Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Advanced Instruments LLC

- 6.3.2 Precision Systems Inc.

- 6.3.3 ELITech Group

- 6.3.4 ARKRAY Inc.

- 6.3.5 ASTORI TECNICA

- 6.3.6 KNAUER Wissenschaftliche Gerate GmbH

- 6.3.7 Loser Messtechnik

- 6.3.8 SanoTec GmbH

- 6.3.9 TearLab Corporation

- 6.3.10 Mechatronics Instruments BV

- 6.3.11 Gonotec GmbH

- 6.3.12 Shanghai Medical Instruments Co.

- 6.3.13 Labnics Equipment

- 6.3.14 Thermo Fisher Scientific

- 6.3.15 Beijing Hiyi Technology Co., Ltd.

- 6.3.16 Merck KGaA

- 6.3.17 Bio-Techne Corporation

- 6.3.18 Anton Paar GmbH

- 6.3.19 Precision Systems Science Co. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment