|

市場調查報告書

商品編碼

1851892

自動貼標機:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automatic Labeling Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

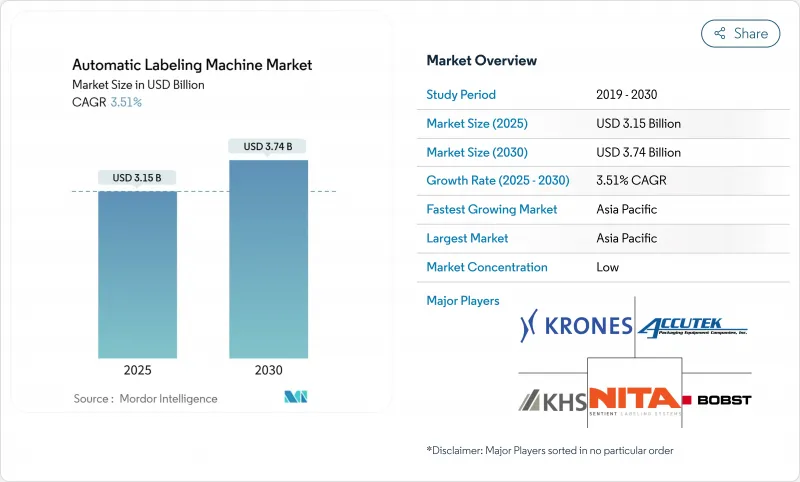

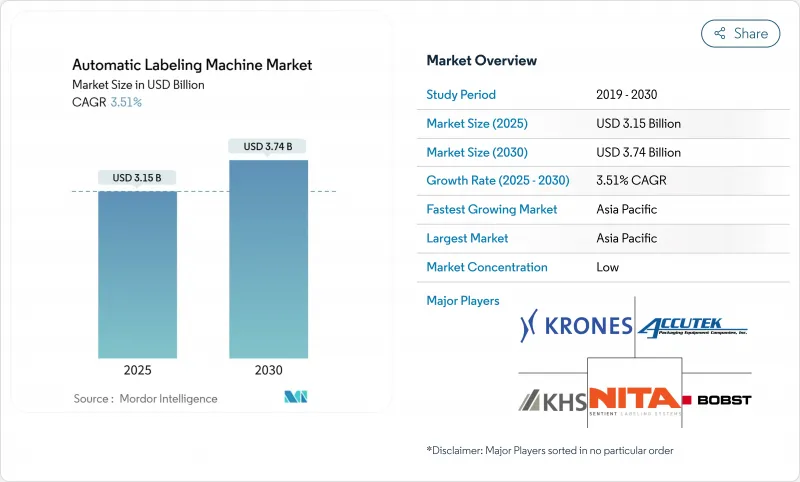

預計到 2024 年,自動貼標機市場規模將達到 30.6 億美元,到 2030 年將擴大到 37.4 億美元,複合年成長率為 3.51%。

這一前景反映了包裝產業日趨成熟但穩定擴張的趨勢,監管合規、工廠級自動化和智慧包裝能力不斷推動設備升級。藥品產業更嚴格的序列化法規、精釀飲料SKU的激增、物流自動化以及無內襯永續性要求,都在增強對設備的需求。如今,競爭優勢的關鍵在於整合RFID/NFC功能、人工智慧主導的品管和預測性維護,以減少停機時間和整體擁有成本。儘管黏合劑和標籤價格波動以及勞動力短缺仍然是限制因素,但由於合規期限依然緊迫且產能壓力持續存在,大多數終端用戶仍在繼續投資自動化。

全球自動貼標機市場趨勢與洞察

對智慧包裝可追溯性的需求日益成長

品牌擁有者如今將標籤視為認證和消費者互動的重要觸點。區塊鏈溯源計畫要求所有商品都必須擁有唯一的數位ID,引導買家使用視覺認證和RFID編碼的列印貼上系統。製藥公司正在積極回應,因為序列化包裝已成為強制性要求;而食品和個人護理品牌則利用QR碼來儲存食譜資料、進行會員宣傳活動並提供仿冒品保障。因此,生產線製造商正在整合物聯網感測器和人工智慧演算法,以即時檢驗2D碼並將精細的生產數據傳輸到ERP系統中。即將訂定的歐盟數位產品護照法案很可能將智慧標籤確立為基本要求,而非一項進階功能。因此,資本預算越來越重視連結性和資料完整性,而非原始的處理能力。

小批量精釀飲料SKU的激增

獨立啤酒廠和特色飲料品牌正在大力推動前所未有的口味輪換和季節性包裝。 500 至 5000 件的大量生產要求印刷機能夠在幾分鐘內而非幾小時內完成換版。模組化印刷頭和伺服控制送料器最大限度地減少了停機時間,而整合式數位印刷機無需儲存印刷捲即可處理可變圖形。這項技術在美國和西歐的應用最為廣泛,但在澳洲和日本的精釀啤酒產業也開始興起。供應商正在積極回應,推出將印刷、防篡改封條貼附和攝影機偵測整合在單一托盤上的緊湊型系統。這種多功能性使小型生產商能夠快速推出小眾口味,同時也能滿足大型零售商對標籤精度的要求。

高資本支出與租賃/合約打包方案的比較

配備序列化、視覺識別和OEE分析功能的先進模組化貼標機售價可能超過50萬美元,這令注重現金流的小型品牌望而卻步。合約包裝公司正在大力推廣計量型的服務模式,雖然降低了固定成本,但隨著時間的推移卻會推高單價。設備製造商正在嘗試租賃和機器人即服務(RaaS)模式,但用戶擔心技術鎖定和合約期間內升級帶來的干擾。製藥和個人護理公司由於其產品需要頻繁更新包裝設計,因此傾向於外包,並可能推遲內部投資,直到銷售穩定下來。

細分市場分析

由於壓敏貼標機能夠處理玻璃、PET 和金屬等多種材質,且只需極少的更換零件,預計到 2024 年,其收入將保持 39.84% 的成長。這類貼標機佔據自動化貼標機市場最大的佔有率,規模達 12.2 億美元。收縮套標和拉伸套成長最為強勁,複合年成長率 (CAGR) 為 5.65%,這主要得益於飲料公司對全方位品牌推廣和防拆封的需求,尤其是在精釀產品方面。套標還能增強薄壁寶特瓶的強度,因為輕量化設計需要結構支撐。濕式貼標機將在大批量啤酒和罐頭食品生產線上蓬勃發展,因為在這些行業中,單張標籤的成本比多功能性更為重要。套模技術雖然仍處於小眾市場,但在個人護理標籤領域正逐漸獲得認可,因為這些標籤需要具有防潮性和高階美觀。

容器重量的減輕和優質化趨勢正朝著相反的方向推動技術發展。輕質瓶身更適合使用套標,而頂級烈酒則偏好紋理紙,這種紙張只能透過壓敏噴頭以極高的精度進行貼標。可在膠合和套標模式之間切換的混合工作站有助於管理SKU多樣性,而無需增加平行生產線,從而增強了市場對可轉換平台的需求。數位印刷單元現在可以直接連接到扭矩控制施用器上,無需單獨的倉庫即可實現符合當地法規的後期圖形設計。無論採用何種技術,供應商都透過可回收標籤材料、水溶性黏合劑和智慧標籤相容性來滿足未來工廠佈局的需求,從而實現差異化競爭。

至2024年,線上式貼標機將佔總銷售量的62.54%,凸顯其作為高速填充、罐裝和裝箱生產線基準的地位。這一地位使其成為自動化貼標機市場佔有率中佔比最大的部分。然而,隨著生產商優先考慮縮短產品週期所需的靈活規格,模組化/混合式架構正以6.36%的複合年成長率成長。伺服分度器和滑入式施用器頭使操作人員能夠在10分鐘內完成從環繞式貼標到頂部貼標的切換。雖然旋轉式轉盤貼標機對於每小時產量5萬瓶的啤酒廠仍然至關重要,但基於伺服的線性平台現在可以在降低零件尺寸複雜性的同時,達到類似的貼標速度。

配置決策越來越依賴數位化連接。使用者希望整合 OPC UA 或 MQTT 閘道器,將 OEE 資料流傳輸到 MES 控制面板,並傾向於選擇擁有成熟的工業 4.0 庫的供應商。列印貼標模組在電商平台中佔據主導地位,每個標籤都由可變數據驅動;協作機器人將貼標頭安裝在移動底座上,以支援多行列印的靈活性。供應商透過預測性維護演算法來區分其產品,這些演算法可以標記潛在的膠水加熱器故障或捲材斷裂,從而在嚴格的履約等級協定 (SLA) 下減少非計劃性停機時間。

區域分析

亞太地區預計到2024年將佔全球銷售額的40.36%,並將在2030年之前保持領先地位,年複合成長率(CAGR)為6.35%。中國的飲料工廠現代化改造正在蓬勃發展,而印度的標準化生產措施正在推動單廠投資超過2,000萬美元的大型計劃。勞動力短缺促使日本和韓國的工廠部署人工智慧輔助視覺和預測性維護系統,以維持設備綜合效率(OEE)在85%以上。隨著跨國消費品公司供應鏈的區域化,東南亞的合約包裝商正在崛起,推動了對中階貼標機的需求。

北美市場的需求仍受監管主導。 《藥品供應鏈安全法案》設定了2027年的明確里程碑,確保了改造和新藥品訂單的穩定成長。由於產品庫存週轉快,美國和加拿大的精釀飲料製造商擴大採用模組化系統。加州強制使用再生材料等永續性舉措,正在推動無襯紙包裝和可回收黏合劑的應用,並促使與大學和設備原始設備製造商開展先導計畫。

歐洲整體經濟成長放緩,但產品規格水準卻在不斷提高。德國啤酒製造商正大力投資產能超過每小時6萬瓶的旋轉式包裝機,而義大利化妝品工廠則採用套貼技術打造高階產品。歐盟的循環經濟目標正在加速無底紙非標籤藥物的普及,並促使供應商在報價階段提供碳足跡認證。受電子和汽車供應鏈近岸外包的推動,東歐正在升級為符合規範的危險品運輸標籤列印貼上系統。

拉丁美洲和中東/非洲地區仍蘊藏著巨大的機會。巴西價值2,310億美元的食品業正在投資半自動化設備,以提高出口到美國和歐盟產品的包裝一致性。墨西哥的標籤市場規模將從2025年的13.1億美元成長到2030年的16.2億美元,這將使提供西班牙語人機介面和本地服務網點的供應商受益。海灣地區的飲料製造商和非洲的農產品加工商正在試行使用雲端貼標機,以彌補現場技術人員的短缺,並在寬頻網路不穩定的地區利用衛星連接進行遠距離診斷。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 智慧包裝對可追溯性的需求日益成長

- 小批量精釀飲料SKU的激增

- 履約中心的成長

- 更嚴格的序列化/UDI規則(藥品和醫療設備)

- 數位按需印刷整合

- 永續性主導的無襯紙標籤轉型

- 市場限制

- 高資本支出與租賃/合約打包方案的比較

- 缺乏控制和維護技能

- 原料(標籤庫存)價格不穩定

- 多廠商產品線之間的互通性差距

- 供應鏈分析

- 監管環境

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 進出口分析

- 投資分析

第5章 市場規模與成長預測

- 透過技術

- 壓敏/自黏標籤機

- 收縮套標機

- 膠黏式(冷熔、熱熔)標籤機

- 袖標機(拉伸,耐熱)

- 套模貼標機

- 其他技術

- 透過機器配置

- 線上貼標機

- 旋轉式/旋轉伺服貼標機

- 列印貼上系統

- 模組化/混合系統

- 透過標記速度

- 低於每分鐘 60 次

- 61-200 BPM

- 201-400 BPM

- 超過 400 BPM

- 最終用戶

- 食物

- 飲料

- 製藥

- 個人護理和化妝品

- 化學和工業

- 物流與電子商務

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Krones AG

- Sidel Group(Tetra Laval)

- KHS GmbH

- SACMI Imola SC

- Accutek Packaging Company, Inc.

- ProMach Inc.

- HERMA GmbH

- Domino Printing Sciences PLC

- Fuji Seal International

- Avery Dennison Corporation

- Weber Packaging Solutions

- Markem-Imaje(Dover)

- Videojet Technologies

- PE Labellers SpA

- Nita Labeling Systems

- Quadrel Labeling Systems

- Pack Leader Machinery

- World Pack Automation Systems

- Arca Labeling & Marking

- Bobst Group SA

- Sato Holdings Corporation

第7章 市場機會與未來展望

The automatic labeling machine market size generated USD 3.06 billion in 2024 and is projected to advance to USD 3.74 billion by 2030 while registering a 3.51% CAGR.

The outlook reflects a maturing but steadily expanding sector where regulatory compliance, plant-level automation, and smart packaging features continue to stimulate equipment upgrades. Heightened serialization rules in pharmaceuticals, craft beverage SKU proliferation, logistics automation, and linerless sustainability mandates all reinforce equipment demand. Competitive differentiation now hinges on integrating RFID/NFC functionality, AI-driven quality control, and predictive maintenance to lower downtime and total cost of ownership. Volatile adhesive and label-stock pricing plus technician shortages remain limiting factors, yet most end users keep automation investments in place because compliance deadlines are non-negotiable and throughput pressures persist.

Global Automatic Labeling Machine Market Trends and Insights

Rising Demand for Smart Packaging Traceability

Brand owners now see labeling as an authentication and consumer-engagement touchpoint. Blockchain traceability programs oblige every item to carry a unique digital identity, nudging purchasers toward print-and-apply systems with vision verification and RFID encoding. Pharma producers comply because serialized packs are mandatory, while food and personal-care brands leverage QR codes for recipe data, loyalty campaigns, and anti-counterfeit assurance. Line builders thus embed IoT sensors plus AI algorithms to validate codes in real time and feed ERP systems with granular production data. The upcoming EU Digital Product Passport law will cement smart labels as a baseline requirement rather than a premium feature. Consequently, capital budgets increasingly prioritize connectivity and data integrity over raw throughput.

Surge in Craft Beverage Short-Run SKUs

Independent breweries and specialty drink brands push unprecedented flavor rotations and seasonal packaging. Batch volumes of 500-5,000 units demand presses that change formats in minutes instead of hours. Modular heads and servo-controlled feeders minimize downtime, while integrated digital printers handle variable graphics without storing pre-printed rolls. Adoption is strongest in the United States and Western Europe, but is now visible in the Australian and Japanese craft segments. Suppliers respond with compact systems combining printing, tamper-band application, and camera inspection within a single skid. Such versatility allows smaller producers to launch niche flavors quickly yet still meet labeling accuracy targets that large retailers enforce.

High CAPEX vs. Rental/Contract Packaging Options

A state-of-the-art modular labeler with serialization, vision, and OEE analytics can exceed USD 500,000, deterring small brands that value cash preservation. Contract packagers pitch pay-as-you-go service models, reducing fixed costs yet often raising unit economics over time. Equipment builders experiment with leasing and Robotics-as-a-Service, but users fear technological lock-in or disruptive mid-contract upgrades. Pharmaceutical and personal-care firms, whose products demand frequent artwork updates, find outsourcing appealing and may postpone in-house investments until volumes stabilize.

Other drivers and restraints analyzed in the detailed report include:

- Growth of E-commerce Fulfillment Centers

- Stricter Serialization/UDI Rules (Pharma and Med-Device)

- Skill Shortage in Controls and Maintenance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pressure-sensitive units retained 39.84% revenue in 2024 because they handle glass, PET, and metal formats with minimal change parts. That share equates to the largest slice of the automatic labeling machine market size at USD 1.22 billion. Shrink and stretch sleeves, however, clock the most vigorous 5.65% CAGR, propelled by beverage firms seeking 360-degree branding and tamper evidence, especially among craft SKUs. Sleeve labels also bolster thin-wall PET bottles, which need structural support once supplied in lightweight designs. Wet-glue machines survive in mass-volume beer and canned food lines where the cost per label eclipses versatility concerns. In-mold technology, while niche, gains traction in personal-care tubs that demand moisture resistance and premium aesthetics.

Container-lightweighting and premiumization pull technology trends in opposite directions. Lightweight bottles favor sleeve support, whereas premium spirits prefer tactile paper stocks only pressure-sensitive heads can dispense at low tolerances. Hybrid stations that switch between adhesive and sleeve modes help users manage SKU diversity without adding a parallel line, reinforcing market appetite for convertible platforms. Digital print units now bolt directly onto torque-controlled applicators, enabling late-stage graphics that meet regional regulations without separate warehousing. Across technology types, vendors court differentiation via recyclable label materials, water-soluble glues, and smart-label compatibility to future-proof capital layouts.

In-line equipment captured 62.54% of 2024 unit sales, underscoring its role as the baseline for high-speed bottling, canning, and case-packing lines. That position equals the largest component of the automatic labeling machine market share. Yet modular/hybrid architectures are rising at 6.36% CAGR as producers prioritize format agility for shorter product cycles. Servo indexers plus slide-in applicator heads let operators swap from wrap-around to top-apply in under 10 minutes. Rotary carousel machines remain essential for 50,000-bottles-per-hour beer plants, but servo-based linear platforms now reach similar speeds while easing size-part complexity.

Configuration decisions increasingly hinge on digital connectivity. Users want embedded OPC UA or MQTT gateways to stream OEE data into MES dashboards, favoring suppliers with proven Industry 4.0 libraries. Print-and-apply modules dominate e-commerce hubs where variable data drives each label, while collaborative robots mount label heads on mobile bases to support multi-line flexibility. Vendors distinguish offers through predictive-maintenance algorithms that flag glue-heater faults or web-break probability, trimming unplanned downtime under tight fulfillment SLAs.

The Automatic Labeling Machine Market Report is Segmented by Technology (Pressure-Sensitive/Self-Adhesive Labelers, Shrink Sleeve Labelers, and More), Machine Configuration(In-Line Labeling Machines, Rotary/Rotary-Servo Labelers, and More), Labelling Speed (61-200 BPM, 201-400 BPM, and More), End User (Food, Beverages, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 40.36% of global revenue in 2024 and preserves first-place momentum with a 6.35% CAGR to 2030. Surging beverage-plant modernization in China and serialization compliance in India underpin big-ticket projects exceeding USD 20 million per facility. Japanese and South Korean factories, pressured by labor shortages, install AI-assisted vision and predictive-maintenance suites to maintain OEE above 85%. Southeast Asian contract packagers multiply as multinational CPG firms regionalize supply chains, boosting mid-range labeler purchases.

North America's demand remains regulatory-driven. The Drug Supply Chain Security Act sets firm milestones through 2027, keeping a steady pipeline of retrofit and greenfield pharmaceutical orders. Craft beverage producers in the United States and Canada account for many modular system deployments owing to brisk SKU turnover. Sustainability pushes, such as California's recycled-content mandate, encourage linerless adoption and recyclable adhesive chemistries, fostering pilot projects with universities and equipment OEMs.

Europe exhibits modest headline growth yet commands high specification levels. German brewers spend heavily on carousel machines surpassing 60,000 BPH, while Italian cosmetics plants adopt sleeve-over-sleeve techniques for premium finishes. EU circular-economy targets accelerate linerless and wash-off label uptake, spurring suppliers to certify carbon footprints at quote stage. Eastern Europe, buoyed by near-shoring electronics and automotive supply chains, upgrades to print-apply systems that comply with hazardous-substance transport labels.

Latin America, Middle East, and Africa remain opportunity pockets. Brazil's USD 231 billion food sector invests in semi-automatic units to lift packaging consistency for exports to the United States and EU. Mexico's label market will stretch from USD 1.31 billion in 2025 to USD 1.62 billion by 2030, rewarding vendors who offer Spanish-language HMIs and regional service depots. Gulf States beverages and African agro-processors pilot cloud-linked labelers to compensate for scarce on-site engineering talent, using remote diagnostics via satellite connections where broadband is unreliable.

- Krones AG

- Sidel Group (Tetra Laval)

- KHS GmbH

- SACMI Imola SC

- Accutek Packaging Company, Inc.

- ProMach Inc.

- HERMA GmbH

- Domino Printing Sciences PLC

- Fuji Seal International

- Avery Dennison Corporation

- Weber Packaging Solutions

- Markem-Imaje (Dover)

- Videojet Technologies

- P.E. Labellers S.p.A.

- Nita Labeling Systems

- Quadrel Labeling Systems

- Pack Leader Machinery

- World Pack Automation Systems

- Arca Labeling & Marking

- Bobst Group SA

- Sato Holdings Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for smart packaging traceability

- 4.2.2 Surge in craft beverage short-run SKUs

- 4.2.3 Growth of e-commerce fulfillment centers

- 4.2.4 Stricter serialization/UDI rules (pharma and med-device)

- 4.2.5 Digital print-on-demand integration

- 4.2.6 Sustainability-driven shift to linerless labels

- 4.3 Market Restraints

- 4.3.1 High CAPEX vs. rental/contract packaging options

- 4.3.2 Skill shortage in controls and maintenance

- 4.3.3 Volatile raw-material (label stock) prices

- 4.3.4 Interoperability gaps across multi-vendor lines

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Anlaysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Import and Export Analysis

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Pressure-Sensitive / Self-Adhesive Labelers

- 5.1.2 Shrink-Sleeve Labelers

- 5.1.3 Glue-Based (Cold, Hot-Melt) Labelers

- 5.1.4 Sleeve (Stretch, Heat) Labelers

- 5.1.5 In-mold Labelers

- 5.1.6 Other Technologies

- 5.2 By Machine Configuration

- 5.2.1 In-line Labeling Machines

- 5.2.2 Rotary / Rotary-Servo Labelers

- 5.2.3 Print-and-Apply Systems

- 5.2.4 Modular / Hybrid Systems

- 5.3 By Labelling Speed

- 5.3.1 less than 60 BPM

- 5.3.2 61-200 BPM

- 5.3.3 201-400 BPM

- 5.3.4 More than 400 BPM

- 5.4 By End User

- 5.4.1 Food

- 5.4.2 Beverages

- 5.4.3 Pharmaceutical

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Chemicals and Industrial

- 5.4.6 Logistics and E-commerce

- 5.4.7 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Krones AG

- 6.4.2 Sidel Group (Tetra Laval)

- 6.4.3 KHS GmbH

- 6.4.4 SACMI Imola SC

- 6.4.5 Accutek Packaging Company, Inc.

- 6.4.6 ProMach Inc.

- 6.4.7 HERMA GmbH

- 6.4.8 Domino Printing Sciences PLC

- 6.4.9 Fuji Seal International

- 6.4.10 Avery Dennison Corporation

- 6.4.11 Weber Packaging Solutions

- 6.4.12 Markem-Imaje (Dover)

- 6.4.13 Videojet Technologies

- 6.4.14 P.E. Labellers S.p.A.

- 6.4.15 Nita Labeling Systems

- 6.4.16 Quadrel Labeling Systems

- 6.4.17 Pack Leader Machinery

- 6.4.18 World Pack Automation Systems

- 6.4.19 Arca Labeling & Marking

- 6.4.20 Bobst Group SA

- 6.4.21 Sato Holdings Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment