|

市場調查報告書

商品編碼

1851856

電池能源儲存系統(BESS):市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Battery Energy Storage System (BESS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

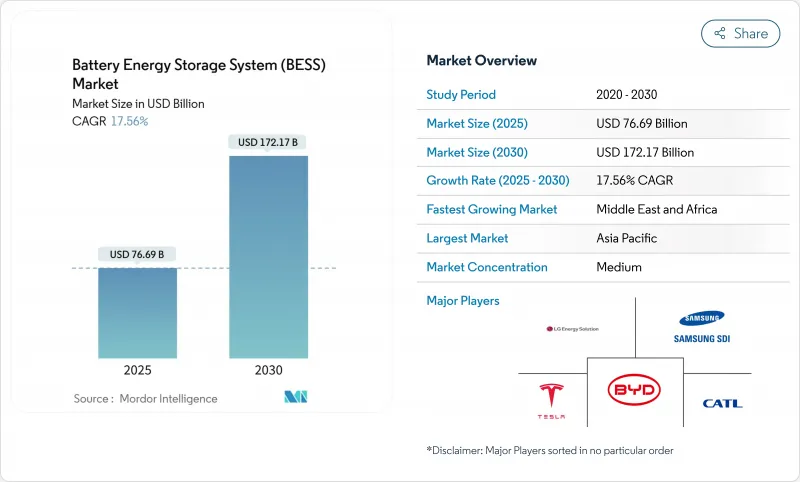

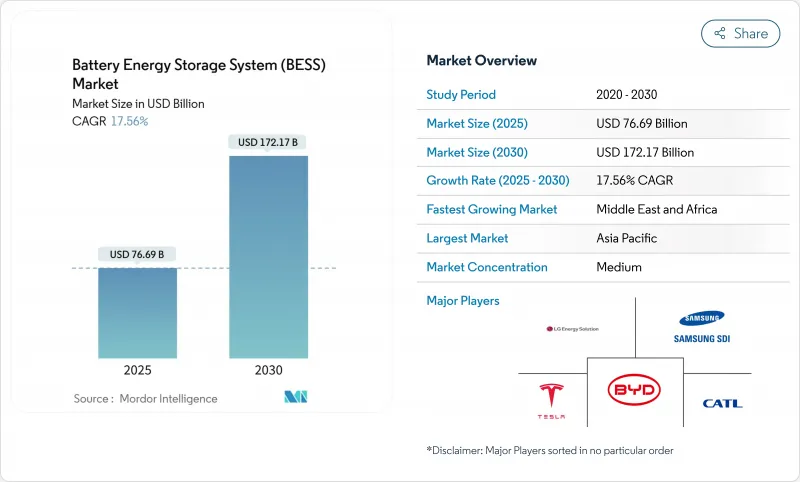

預計到 2025 年,電池能源儲存系統市場規模將達到 766.9 億美元,到 2030 年將達到 1,721.7 億美元,預測期(2025-2030 年)複合年成長率為 17.56%。

鋰離子電池成本的快速下降、有利的採購政策以及不斷成長的電網現代化支出,正將大規模儲能從一種小眾的可靠性工具轉變為主流基礎設施。諸如美國《通膨降低法案》和歐盟《淨零排放產業法案》等政策利多因素,正在推動數吉瓦級計劃的發展。同時,電網整形逆變器的要求也拓展了儲能的收入來源,使其不再侷限於能源套利。此外,澳洲和智利已實現了太陽能和電池聯合購電協議(PPA)的價格持平,證明四小時儲能電池能夠以具有競爭力的價格,提供可靠的晚高峰供電。不斷成長的資料中心電力需求以及受政策驅動的供應鏈資源配置,進一步推動了該行業的蓬勃發展。

全球電池能源儲存系統(BESS)市場趨勢與洞察

美國、中國和歐盟的公用事業規模採購強制規定

強制採購正在再形成開發格局。加州2吉瓦、中國電力16吉瓦時以及韓國540兆瓦/3240兆瓦時的長期招標項目,都為開發商展現了收入和資金籌措的可能性。在歐洲,淨零排放產業法規獎勵國產產品,而中國近期的改革取消了嚴格的配額限制,讓市場基本面主導經濟運作。此類專案降低了融資成本,並將電力輸送給符合電網服務性能保證的合格整合商。

採用併網逆變器可釋放共置資料中心的價值。

從電網跟隨架構轉向電網整形架構,使得電池能夠提供合成慣性和電壓支撐,這些服務先前由電網營運商從同步發電中獲取。 TransGrid 的研究表明,電網整形需要 4.8 吉瓦的容量,而 Fluence 在澳洲的 300 兆瓦計劃也凸顯了其商業性可行性。歐洲營運商 TenneT 預計到 2030 年儲能裝置容量將達到 5.2 至 12.7 吉瓦,凸顯了其廣泛的適用性。慣性產品帶來的額外收入以及連網條件的改善,提升了計劃的經濟效益,並有利於混合光伏-儲能專案的發展。

鋰和石墨加工瓶頸

中國加工了全球90%的石墨,而印尼禁止鎳出口的政策刺激了國內提煉,這帶來了市場集中度過高的風險。材料短缺威脅電池生產,同時,數吉瓦級競標卻在激增。像Group14這樣的新興企業正在試行富矽陽極,但距離商業化生產仍需數年時間。回收項目可以緩解原生材料的需求,但物流方面的障礙限制了它們對需要高純度原料的公用事業規模計劃的直接影響。

細分市場分析

到2024年,鋰離子電池將維持88.6%的能源儲存系統市場佔有率。然而,磷酸鐵鋰電池(LFP)在成本和熱穩定性方面的優勢,例如比亞迪在2024年部署的40GWh容量,將推動其實現19%的複合年成長率。在能量密度至關重要的領域,NMC電池仍將發揮重要作用,而釩液流電池和鈉離子電池技術在長時和高循環應用領域正逐漸獲得關注。隨著電池小型化降低每度電成本,鋰離子電池能源儲存系統系統的市場規模預計將會擴大。化學成分的多樣化降低了供應鏈風險,並使計劃資金籌措能夠採用針對特定資產的對沖結構。

不同地區的實施方案各不相同:中國電力公司提供超低成本的磷酸鐵鋰電池組,歐洲電力公司正在測試鈉離子電池以提高其耐寒性,而美國電網營運商正在試驗鋅溴液流電池,以滿足8小時供電需求。這些並行路徑表明,電池化學成分的選擇正朝著針對工作循環進行最佳化的方向發展,而非採用一刀切的模式。

併網系統在標準化互聯和強勁的商業商機的推動下,預計到2024年將佔總裝機量的78%。然而,受農村電氣化和工業韌性需求的驅動,離網領域正以18.5%的複合年成長率快速發展。巴基斯坦預計2030年將進口8.75吉瓦時的電力,顯示市場對繞過薄弱國家基礎設施的微電網的需求正在成長。

混合配置可在併網模式和孤島模式之間切換,是目前應用領域中日益成長的一個子集,它能為需求者提供需求電價降低和備用電源。這些靈活的資產透過虛擬電廠聚合參與批發市場。目前,美國多家獨立系統營運商正將其納入電價調整方案中。

電池能源儲存系統(BESS) 市場報告按電池類型(鋰離子電池、磷酸鋰鐵、其他電池)、連接類型(併網、離網)、組件(電池組和支架、電力轉換系統、其他電池)、能量容量範圍(小於 100 MWh、其他能量容量範圍)、最終用戶應用(公共產業、住宅、其他公用事業)和地區細分(北美、歐洲、其他地區)。

區域分析

亞太地區預計到2024年將維持50.4%的市場佔有率,其中中國70吉瓦時的裝置容量將以每年翻倍的速度成長。印度SECI的1吉瓦/2吉瓦時競標標誌著該地區的能源市場迎來轉捩點,而日本則透過1.67吉瓦時的容量市場競標展現了儲能技術在滿足產能需求方面的重要作用。韓國推進了540兆瓦的競標,LG能源解決方案公司向歐洲和日本出口了多吉瓦時的儲能系統,凸顯了該地區的製造業實力。

中東和非洲是成長最快的地區,年複合成長率達19.5%。沙烏地阿拉伯與陽光電源夥伴關係的7.8吉瓦計畫以及埃及由非洲開發銀行資助的200兆瓦時計劃,都體現了大規模的能源投入。南非獲得的1吉瓦計畫凸顯了儲能技術如何解決電網長期不穩定的問題。此外,阿拉伯聯合大公國正在整合19吉瓦時的儲能容量,其中包括5.2吉瓦的太陽能發電廠,率先在沙漠氣候地區發展基本負載可再生能源。

北美和歐洲仍然佔據絕對規模的主導地位。美國已宣布投資1000億美元,但其中2600吉瓦的計劃仍需等待四年才能併網。歐洲的《淨零排放產業法案》旨在實現供應鏈區域化,但已宣布的超級工廠項目中超過一半面臨資金籌措延遲。區域政策的多樣性——例如英國的產能市場、義大利的工廠義務以及加拿大的生產補貼——為經驗豐富的開發商創造了多種多樣的收入模式,可供他們進行套利。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和調查方法的範圍

- 市場定義

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 近期趨勢與創新

- 市場促進因素

- 美國、中國和歐盟的公用事業規模採購指令訂單了吉瓦級訂單的成長。

- 電網整形逆變器需求釋放託管價值堆疊

- 澳洲和智利光電+儲能購電協議的價格持平

- 歐盟和美國的電池供應鏈模式促進了國內製造業的發展。

- 資料中心和人工智慧負載不斷成長,推動北美地區對4小時儲存的需求

- 亞洲電動汽車電池回收再利用降低了資本支出。

- 市場限制

- 印尼和非洲的鋰和石墨加工瓶頸

- 由於消防安全法規(UL-9540A、NFPA-855)的加強,工廠平衡成本增加。

- 美國獨立系統營運商(ISO)漫長的互聯排隊導致FTM計劃收入延遲

- 高利率環境對商家收入帶來壓力

- 供應鏈分析

- 監管和政策環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依電池類型

- 鋰離子

- 磷酸鋰鐵(LFP)

- 鎳錳鈷(NMC)

- 鉛酸電池

- 其他電池類型包括:液流電池(釩液流電池、鋅溴液流電池)、鈉基電池(NaS液流電池、鈉離子電池)

- 按連線類型

- 併網(公用事業互聯)

- 離網(微電網、混合電網)

- 按組件

- 電池組和支架

- 電源轉換系統(PCS)

- 能源管理軟體(EMS)

- 工廠平衡和服務

- 按能量容量範圍

- 小於100兆瓦時

- 101~500 MWh

- 超過500兆瓦時

- 透過最終用戶使用

- 住宅

- 商業和工業

- 公用事業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 北歐國家

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、夥伴關係、購電協議)

- 市場佔有率分析(主要企業的市場排名/佔有率)

- 公司簡介

- BYD Company Limited

- Contemporary Amperex Technology Co. Ltd.(CATL)

- LG Energy Solution Ltd.

- Panasonic Holdings Corp.

- Tesla Inc.

- Samsung SDI Co. Ltd.

- Fluence Energy Inc.

- ABB Ltd.

- Siemens Energy AG

- GE Vernova

- Hitachi Energy Ltd.

- Mitsubishi Power

- Sungrow Power Supply Co.

- Eaton Corporation plc

- Toshiba Corp.

- EVE Energy Co.

- VARTA AG

- Saft SAS(TotalEnergies)

- CellCube Energy Storage Systems Inc.

- Enphase Energy Inc.

第7章 市場機會與未來展望

The Battery Energy Storage System Market size is estimated at USD 76.69 billion in 2025, and is expected to reach USD 172.17 billion by 2030, at a CAGR of 17.56% during the forecast period (2025-2030).

Rapid cost declines in lithium-ion cells, supportive procurement mandates, and rising grid-modernization spending are turning large-scale storage from a niche reliability tool into mainstream infrastructure. Policy tailwinds such as the Inflation Reduction Act in the United States and the Net-Zero Industry Act in the European Union have anchored multi-gigawatt project pipelines, while grid-forming inverter requirements are expanding revenue streams beyond energy arbitrage. Simultaneously, price parity for solar-plus-storage power purchase agreements (PPAs) in Australia and Chile proves that four-hour batteries can offer firm, evening-peak supply at competitive rates. Growing data-center electricity demand and politically driven supply-chain reshoring further reinforce the sector's momentum.

Global Battery Energy Storage System (BESS) Market Trends and Insights

Utility-scale procurement mandates in the United States, China, and the European Union

Mandated procurements are reshaping the development landscape. California's long-duration solicitation targets 2 GW, Power China tender seeks 16 GWh, and South Korea awarded 540 MW/3,240 MWh, giving developers visibility on revenue and bankability. In Europe, the Net-Zero Industry Act incentivizes domestic content, while recent Chinese reforms removed rigid allocation rules, letting market fundamentals guide economics. Such programs lower financing costs and channel volume to qualified integrators who meet grid-service performance guarantees.

Grid-forming inverter adoption unlocking co-location value

Moving from grid-following to grid-forming architectures lets batteries deliver synthetic inertia and voltage support, services that grid operators historically procured from synchronous generation. Transgrid's study showing 4.8 GW of grid-forming needs and Fluence's 300 MW Australian project highlight commercial viability. European operator TenneT foresees 5.2-12.7 GW storage by 2030, underscoring broad applicability. Added revenue from inertia products and strengthened interconnection terms improve project economics and favor hybrid solar-storage development.

Lithium and graphite processing bottlenecks

China processes 90% of global graphite, and Indonesia's nickel export bans push domestic refining, introducing concentration risk. Material shortages threaten cell production just as multi-gigawatt auctions surge. Start-ups such as Group14 are piloting silicon-rich anodes, but commercial volumes remain years away. Recycling programs can ease primary demand, yet logistic hurdles limit immediate impact for utility-scale projects that require high-purity inputs.

Other drivers and restraints analyzed in the detailed report include:

- PV-plus-storage PPA price parity in Australia and Chile

- EU and US supply-chain acts catalyzing domestic manufacturing

- Fire-safety code tightening under UL-9540A and NFPA-855

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lithium-ion maintained 88.6% battery energy storage system market share in 2024. Yet LFP's cost and thermal-stability advantages drive its 19% CAGR, exemplified by BYD's 40 GWh 2024 installations. NMC chemistries remain relevant where energy density matters, while vanadium flow and sodium-ion technologies attract niche interest for long-duration or high-cycle use. Lithium-ion variants' battery energy storage system market size is projected to widen as scaling lowers per-kilowatt-hour costs. Diversification across chemistries reduces supply-chain risk and opens project financing to asset-specific hedging structures.

Implementation tactics vary by region. Chinese players offer ultra-low-priced LFP racks, European utilities test sodium-ion for cold-weather resilience, and U.S. grid operators pilot zinc-bromine flow batteries for eight-hour services. These parallel pathways illustrate how chemistry choice is increasingly optimized for duty cycle rather than a one-size-fits-all paradigm.

On-grid systems captured 78% of 2024 deployments, supported by standardized interconnection and robust merchant revenue opportunities. The off-grid segment, however, is accelerating at 18.5% CAGR owing to rural electrification and industrial resilience requirements. Pakistan's import projection of 8.75 GWh by 2030 typifies emerging-market demand for microgrids that bypass weak national infrastructure.

Hybrid configurations that switch between grid and islanded mode are a rising subset, offering customers demand-charge reduction plus backup power. These flexible assets partake in wholesale markets through virtual-power-plant aggregation, a trend now codified in several U.S. independent system operators' tariff updates.

The Battery Energy Storage System (BESS) Market Report is Segmented Into Battery Type (Lithium-Ion, Lithium Iron Phosphate, and Others), Connection Type (On-Grid and Off-Grid), Components (Battery Pack and Racks, Power Conversion System, and Others), Energy Capacity Range (Below 100 MWh, and Others), End-User Application (Utility, Residential, and Others), and Geography (North America, Europe, Asia-Pacific, and Others).

Geography Analysis

Asia-Pacific retained a 50.4% share in 2024, powered by China's 70 million kW installed base that doubled yearly. India reached an inflection point with SECI's 1 GW/2 GWh auction, and Japan's 1.67 GW capacity-market awards validated storage's role in capacity adequacy. South Korea advanced a 540 MW tender, and LG Energy Solution exported multi-GWh systems to Europe and Japan, underscoring the region's manufacturing clout.

The Middle East and Africa are the fastest-growing regions at 19.5% CAGR. Saudi Arabia's 7.8 GW partnership with Sungrow and Egypt's 200 MWh AfDB-financed project illustrate large-scale commitments. South Africa's 1 GW awards highlight how storage addresses chronic grid instability. Moreover, the United Arab Emirates integrates 19 GWh with a 5.2 GW solar plant, pioneering baseload renewables in desert climates.

North America and Europe continue to post high absolute volumes. The United States hosts USD 100 billion in announced investments but suffers four-year interconnection queues for 2,600 GW of projects. Europe's Net-Zero Industry Act seeks to localize supply chains, yet over half of announced gigafactories face financing delays. Regional policy diversity-capacity markets in the United Kingdom, fleet mandates in Italy, and production credits in Canada-produces a mosaic of revenue models that sophisticated developers arbitrage.

- BYD Company Limited

- Contemporary Amperex Technology Co. Ltd. (CATL)

- LG Energy Solution Ltd.

- Panasonic Holdings Corp.

- Tesla Inc.

- Samsung SDI Co. Ltd.

- Fluence Energy Inc.

- ABB Ltd.

- Siemens Energy AG

- GE Vernova

- Hitachi Energy Ltd.

- Mitsubishi Power

- Sungrow Power Supply Co.

- Eaton Corporation plc

- Toshiba Corp.

- EVE Energy Co.

- VARTA AG

- Saft SAS (TotalEnergies)

- CellCube Energy Storage Systems Inc.

- Enphase Energy Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Methodology Scope

- 1.2 Market Definition

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Recent Trends & Innovations

- 4.3 Market Drivers

- 4.3.1 Utility-Scale Procurement Mandates in U.S., China & EU Accelerating Gigawatt-Scale Orders

- 4.3.2 Grid-Forming Inverter Requirements Unlocking Co-Location Value Stacks

- 4.3.3 PV-Plus-Storage PPA Price Parity in Australia & Chile

- 4.3.4 EU & U.S. Battery Supply-Chain Acts Creating Domestic Manufacturing Pull-Through

- 4.3.5 Data-Center & AI Load Growth Driving 4-Hr Storage Demand in North America

- 4.3.6 Second-Life EV Battery Availability Reducing CapEx in Asia

- 4.4 Market Restraints

- 4.4.1 Lithium & Graphite Processing Bottlenecks in Indonesia and Africa

- 4.4.2 Fire-Safety Code Tightening (UL-9540A, NFPA-855) Inflating Balance-of-Plant Costs

- 4.4.3 Long Interconnection Queues in U.S. ISOs Delaying FTM Project Revenues

- 4.4.4 High Interest-Rate Environment Compressing Merchant Revenue Stacks

- 4.5 Supply-Chain Analysis

- 4.6 Regulatory and Policy Outlook

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lithium Iron Phosphate (LFP)

- 5.1.3 Nickel-Manganese-Cobalt (NMC)

- 5.1.4 Lead-acid

- 5.1.5 Others [Flow Batteries (Vanadium, Zinc-Br), Sodium-based (NaS, Na-ion)]

- 5.2 By Connection Type

- 5.2.1 On-Grid (Utility Interconnected)

- 5.2.2 Off-Grid (Micro-Grid, Hybrid)

- 5.3 By Component

- 5.3.1 Battery Pack and Racks

- 5.3.2 Power Conversion System (PCS)

- 5.3.3 Energy Management Software (EMS)

- 5.3.4 Balance-of-Plant and Services

- 5.4 By Energy Capacity Range

- 5.4.1 Below 100 MWh

- 5.4.2 101 to 500 MWh

- 5.4.3 Above 500 MWh

- 5.5 By End-user Application

- 5.5.1 Residential

- 5.5.2 Commercial and Industrial

- 5.5.3 Utility

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Nordic Countries

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Malaysia

- 5.6.3.6 Thailand

- 5.6.3.7 Indonesia

- 5.6.3.8 Vietnam

- 5.6.3.9 Australia

- 5.6.3.10 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Egypt

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 BYD Company Limited

- 6.4.2 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.3 LG Energy Solution Ltd.

- 6.4.4 Panasonic Holdings Corp.

- 6.4.5 Tesla Inc.

- 6.4.6 Samsung SDI Co. Ltd.

- 6.4.7 Fluence Energy Inc.

- 6.4.8 ABB Ltd.

- 6.4.9 Siemens Energy AG

- 6.4.10 GE Vernova

- 6.4.11 Hitachi Energy Ltd.

- 6.4.12 Mitsubishi Power

- 6.4.13 Sungrow Power Supply Co.

- 6.4.14 Eaton Corporation plc

- 6.4.15 Toshiba Corp.

- 6.4.16 EVE Energy Co.

- 6.4.17 VARTA AG

- 6.4.18 Saft SAS (TotalEnergies)

- 6.4.19 CellCube Energy Storage Systems Inc.

- 6.4.20 Enphase Energy Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment