|

市場調查報告書

商品編碼

1851847

英國設施管理:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)United Kingdom (UK) Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

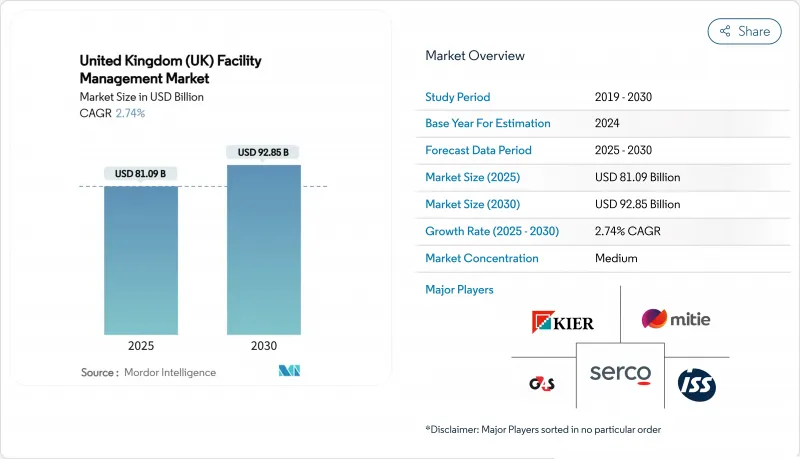

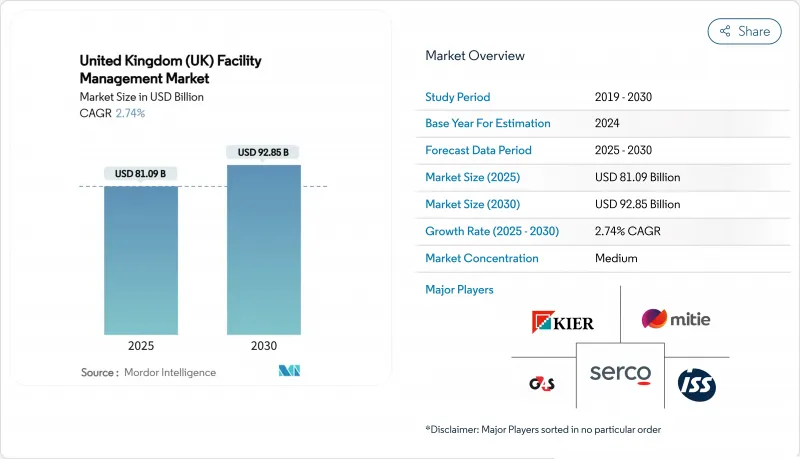

英國設施管理市場預計到 2025 年將達到 810.9 億美元,到 2030 年將達到 928.5 億美元,在此期間的複合年成長率為 2.74%。

這一市場規模標誌著一個成熟產業的演進,其驅動力包括能源效率的提高、數位轉型以及對外包服務模式的持續偏好。硬性服務至關重要,因為老舊建築需要嚴格的機械、電氣和管道維護才能達到最低能源效率標準。從物聯網感測器網路到人工智慧驅動的分析,技術整合能夠加快響應速度、降低能耗,並支援基於績效的契約,從而在不相應增加員工人數的情況下擴大收入規模。外包勢頭持續強勁,公共和私營客戶都在尋求專業知識,以確保合規性並在投入價格波動的情況下提供成本確定性。英國脫歐相關的勞動力短缺和成本上漲正在壓縮淨利率,但公共部門維修資金的增加和靈活辦公空間的普及為快速創新的服務提供者提供了擴張途徑。

英國設施管理市場趨勢與洞察

技術整合(物聯網、人工智慧、自動化)

人工智慧驅動的建築管理平台正在重新定義服務交付方式。智慧財產局在推出數位化工單入口網站後,將維護回應時間從14天縮短至幾秒鐘。智慧感測器即時傳輸運作、溫度和空氣品質數據,使服務供應商能夠從被動維護轉向預測性維護,同時降低能源消耗並提升員工舒適度。世邦魏理仕進軍超大規模資料中心設施管理領域,凸顯了該領域24小時不間斷分析監控的巨大獲利潛力。醫療保健和教育行業的客戶正在引領這一領域的應用,因為合規要求必須進行持續的環境監測。隨著數位化儀錶板整合軟體和硬體服務,服務提供者將清潔、保全、辦公室支援和資產維護等服務打包到資料豐富的合約中,從而獲得更高的價格。

商業不動產的快速擴張

根據英國英國特許測量師學會的數據,2025年第一季租戶需求轉正,預計到年底倫敦市中心黃金地段的辦公大樓租金將上漲近5%。工業資產的投資熱情最為強勁,受電子商務和近岸外包的推動,投資者需求淨成長18%。新開發項目帶動了對試運行、全生命週期資產管理和持續合規審核的需求。設施管理人員與開發商早期合作,透過整合ESG(環境、社會和治理)儀錶板的智慧建築,確保了多年的穩定收入來源。物流的成長同樣推動了客製化設施管理方案的需求,這些方案結合了庫存追蹤技術、碼頭管理和先進的消防安全維護,適用於高吞吐量的倉庫。

勞動力短缺和技能差距

英國脫歐後,飯店、清潔和餐飲業面臨13.2萬個職缺,對設施管理人員數量造成壓力。 2025年移民白皮書將技術純熟勞工簽證閾值提高至RQF 6級,限制了外籍員工進入入門設施管理職缺。自2005年以來,雇主對員工教育的投資下降了28%,導致技能短缺,同時,建築物卻在採用先進的數位系統。企業正透過諸如JPC by Samsic的12模組「下一代」專案等供電督導培訓機構來應對這項挑戰,該專案專注於領導力和技術發展。然而,高離職率和員工老化仍然是該行業產能的限制因素。

細分市場分析

到2024年,硬性服務將佔英國設施管理市場佔有率的60.54%,這主要得益於英國國民醫療服務體系(NHS)高達116億英鎊(31.9億美元)的維護積壓以及積極的能源性能證書(EPC)升級時間表。由於28%的商業建築的EPC評級仍為D級或以下,英國硬性服務合約的設施管理市場規模預計將會擴大,這迫使機械、電氣和管道系統加快改造。機電和暖通空調(HVAC)產業受益於淨零排放的監管路徑,該路徑要求到2035年將排放減少47%至62%。資產數位化將進一步推動對預測性維護分析的需求,使服務提供者能夠在資產發生故障之前進行干預,同時滿足合規報告要求。

目前規模較小的軟性服務預計到2030年將以2.89%的複合年成長率成長,這主要得益於醫院級清潔標準和職場體驗創新。更嚴格的感染控制法規推高了機器人消毒系統和感測器檢驗衛生通訊協定的溢價。共享辦公空間營運商需要智慧門禁系統,從而推動了保全服務的現代化。格倫費爾大廈火災後的相關立法升級增加了對整合警報測試和疏散規劃服務的需求。因此,服務提供者的產品正轉向將卓越的軟性服務與資料支援的合規性相結合的綜合方案。

其他好處

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 目前運轉率

- 主要FM玩家的獲利能力

- 勞動指標 - 勞動參與率

- 按服務類型分類的設施管理市場佔有率(%)

- 設施管理市場佔有率(%):以硬體服務分類

- 按軟體服務分類的設施管理市場佔有率(%)

- 主要城市的都市化和人口成長

- 英國基礎建設項目投資重點領域

- 與勞動和安全標準相關的監管因素

- 市場促進因素

- 商業不動產的快速擴張

- 技術整合(物聯網、人工智慧、自動化)

- 外包趨勢日益成長

- 更重視工作場所體驗和員工福祉

- 嚴格的節能和淨零排放法規

- 靈活辦公空間的興起對靈活的設施管理合約提出了更高的要求。

- 市場限制

- 人手不足和技能差距

- 營運成本上升給利潤率帶來壓力。

- 供應商生態系統分散阻礙了服務標準化。

- 智慧建築系統中的資料安全問題

- 價值鏈分析

- PESTEL 分析

- 市場准入的監管和法律體制

- 宏觀經濟指標對FM需求的影響

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資與資金籌措分析

第5章 市場規模與成長預測

- 按服務類型

- 硬服務

- 資產管理

- 機電及暖通空調服務

- 消防系統與安全

- 其他硬體維修服務

- 軟服務

- 辦公室支援與安全

- 清潔服務

- 餐飲服務

- 其他軟性調頻服務

- 硬服務

- 按產品類型分類

- 內部

- 外包

- 單頻調頻

- Bundle FM

- 整合調頻

- 按最終用戶行業分類

- 商業(IT/通訊、零售、倉儲等)

- 餐飲服務業(飯店、餐廳、大型餐廳)

- 設施和公共基礎設施(政府、教育、交通)

- 醫療保健(公共和私立機構)

- 工業和流程(製造業、能源業、採礦業)

- 其他終端用戶產業(多用戶住宅、娛樂、運動和休閒)

第6章 競爭情勢

- 市場集中度

- 策略轉移與夥伴關係

- 市佔率分析

- 公司簡介

- ISS UK

- Mitie Group PLC

- Serco Group PLC

- Kier Group PLC

- G4S Facilities Management UK Limited

- Sodexo Facilities Management Services

- Compass Group

- Equans

- VINCI Facilities Limited

- Aramark Facilities Services

- Andron Facilities Management

- CSM Facilities Management Group

- Orton Group

- Global Facilities.

- BGIS

第7章 市場機會與未來展望

The United Kingdom facility management market size stands at USD 81.09 billion in 2025 and is forecast to reach USD 92.85 billion by 2030, reflecting a 2.74% CAGR over the period.

The measured trajectory signals a mature sector advancing under energy-efficiency mandates, digital transformation, and a sustained preference for outsourced service models. Hard services hold prime importance because ageing building stock demands strict mechanical, electrical, and plumbing upkeep to meet Minimum Energy Efficiency Standards, while soft services evolve quickly to address workplace well-being and stringent hygiene rules. Technology integration from IoT sensor grids to AI-powered analytics-cuts response times, trims energy consumption, and enables outcome-based contracts that grow revenue without proportionate head-count expansion. Outsourcing momentum continues as public and private clients seek specialist expertise that guarantees compliance and delivers cost certainty amid volatile input prices. Although Brexit-linked labour shortages and cost inflation compress margins, rising public-sector refurbishment funding and the spread of flexible workspaces offer expansion lanes for providers that innovate fast.

United Kingdom (UK) Facility Management Market Trends and Insights

Technology Integration (IoT, AI, Automation)

AI-driven building-management platforms are redefining service delivery, with the Intellectual Property Office cutting maintenance response times from 14 days to seconds after launching a digital work-order portal. Smart sensors relay live occupancy, temperature, and air-quality data, letting providers shift from reactive to predictive maintenance while lowering energy use and elevating employee comfort. CBRE's entry into hyperscale data-center facilities management underscores the high-margin potential in segments that demand 24-hour analytical monitoring. Healthcare and education clients lead adoption because compliance regimes mandate continuous environmental monitoring. As digital dashboards merge soft and hard services, providers package cleaning, security, office support, and asset maintenance into data-rich contracts that command price premiums.

Rapid Commercial Real Estate Expansion

Royal Institution of Chartered Surveyors data show occupier demand turned positive in Q1 2025, and prime office rents in Central London are projected to rise nearly 5% in the year. Industrial assets register the strongest investment appetite, with an +18% net balance in investor demand, propelled by e-commerce and near-shoring. New developments increase demand for commissioning, lifecycle asset management, and ongoing compliance auditing. Facility managers partnering early with developers secure multi-year revenue streams in smart-ready buildings that integrate ESG dashboards from day one. Logistics growth similarly drives tailored FM packages that combine inventory tracking technologies, dock management, and advanced fire-suppression maintenance for high-throughput warehouses.

Labor Shortages and Skill Gaps

Hospitality, cleaning, and catering units face 132,000 job vacancies post-Brexit, straining FM rosters. The 2025 Immigration White Paper raises the Skilled Worker visa threshold to RQF Level 6, curtailing access to international staff for entry-level FM roles. Employer training investment has fallen 28% since 2005, creating a skills deficit just as buildings adopt sophisticated digital systems. Firms counteract with supervisor academies such as JPC by Samsic's 12-module Next Gen programme focusing on leadership and technical upskilling. Nonetheless, high turnover and an aging workforce continue to limit sector capacity.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Outsourcing Trend

- Rising Focus on Workplace Experience and Employee Well-being

- Margin Pressure from Rising Operational Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard services held 60.54% of United Kingdom facility management market share in 2024, anchored by the NHS's GBP 11.6 billion (USD 3.19 billion) maintenance backlog and stringent EPC upgrade timelines. The United Kingdom facility management market size for hard-service contracts is poised to expand as 28% of commercial properties still rate D or lower on EPC scale, forcing accelerated mechanical, electrical, and plumbing overhauls. MEP and HVAC segments benefit from regulatory pathways to net-zero that mandate 47%-62% emissions cuts by 2035. Asset digitization further lifts demand for predictive-maintenance analytics, letting providers intervene before asset failure while meeting compliance reporting needs.

Soft services, while smaller today, are forecast to grow 2.89% CAGR through 2030, propelled by hospital-grade cleaning standards and workplace-experience innovations. Heightened infection-control rules elevate the premium for robotic disinfection systems and sensor-verified hygiene protocols. Co-working operators require smart access control, driving security-service modernization. Fire-safety upgrades tied to post-Grenfell legislation amplify demand for integrated alarm testing and evacuation-planning services. Together, these forces shift provider offerings toward comprehensive packages that merge soft-service excellence with data-backed compliance.

The United Kingdom Facility Management Market Report is Segmented by Service Type (Hard Services, Soft Services), Offering Type (In-House, Outsourced), End-User Industry (Commercial, Hospitality, Institutional and Public Infrastructure, Healthcare, Industrial and Process, Other End-User Industries). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ISS UK

- Mitie Group PLC

- Serco Group PLC

- Kier Group PLC

- G4S Facilities Management UK Limited

- Sodexo Facilities Management Services

- Compass Group

- Equans

- VINCI Facilities Limited

- Aramark Facilities Services

- Andron Facilities Management

- CSM Facilities Management Group

- Orton Group

- Global Facilities.

- BGIS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates

- 4.1.2 Profitability Rates of Major FM Players

- 4.1.3 Workforce Indicators - Labor Participation

- 4.1.4 Facility Management Market Share (%), by Service Type

- 4.1.5 Facility Management Market Share (%), by Hard Services

- 4.1.6 Facility Management Market Share (%), by Soft Services

- 4.1.7 Urbanization and Population Growth in Major Metros

- 4.1.8 Sector Investment Priorities in United Kingdom's Infrastructure Pipeline

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2 Market Drivers

- 4.2.1 Rapid Commercial Real Estate Expansion

- 4.2.2 Technology Integration (IoT, AI, Automation)

- 4.2.3 Increasing Outsourcing Trend

- 4.2.4 Rising Focus on Workplace Experience and Employee Well-being

- 4.2.5 Stringent Energy-Efficiency and Net-Zero Regulations

- 4.2.6 Rise of Flexible Workspaces Requiring Agile FM Contracts

- 4.3 Market Restraints

- 4.3.1 Labor Shortages and Skill Gaps

- 4.3.2 Margin Pressure from Rising Operational Costs

- 4.3.3 Fragmented Supplier Ecosystem Hindering Service Standardization

- 4.3.4 Data-Security Concerns in Smart Building Systems

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses, etc.)

- 5.3.2 Hospitality (Hotels, Eateries, Large-scale Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Govt, Education, Transportation)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ISS UK

- 6.4.2 Mitie Group PLC

- 6.4.3 Serco Group PLC

- 6.4.4 Kier Group PLC

- 6.4.5 G4S Facilities Management UK Limited

- 6.4.6 Sodexo Facilities Management Services

- 6.4.7 Compass Group

- 6.4.8 Equans

- 6.4.9 VINCI Facilities Limited

- 6.4.10 Aramark Facilities Services

- 6.4.11 Andron Facilities Management

- 6.4.12 CSM Facilities Management Group

- 6.4.13 Orton Group

- 6.4.14 Global Facilities.

- 6.4.15 BGIS

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)

- 7.3 ESG-compliant FM Solutions Demand

- 7.4 Future Service-Model Shifts (Outcome-based Contracts)