|

市場調查報告書

商品編碼

1851844

智慧氣動元件:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Smart Pneumatics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

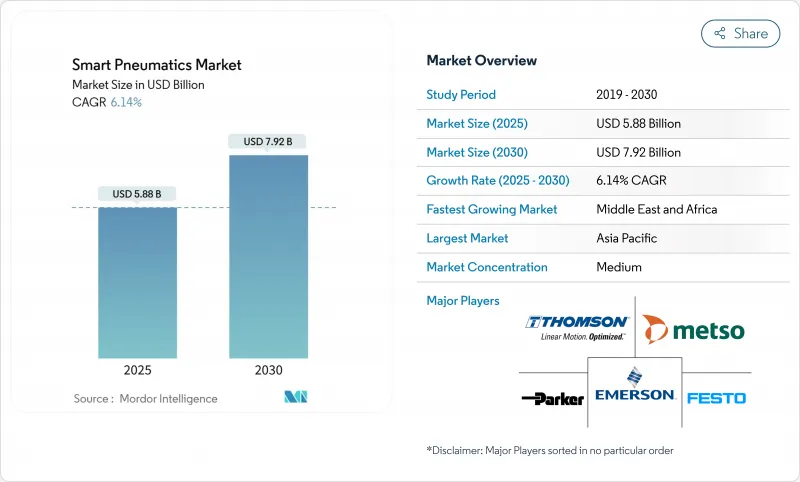

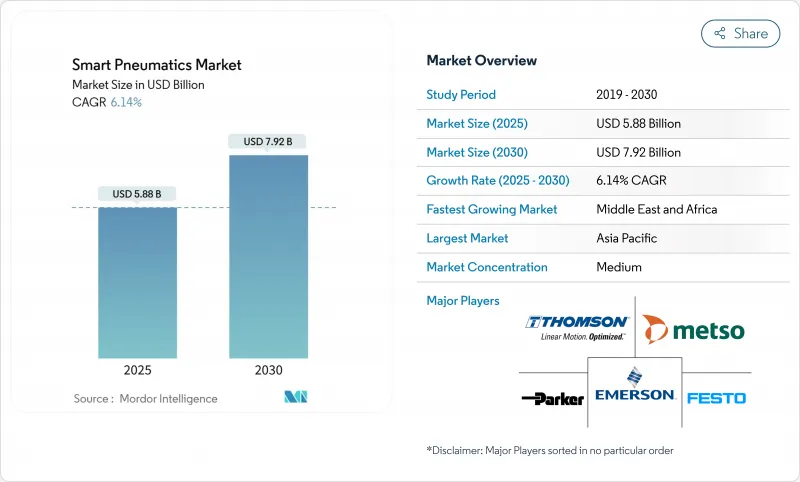

預計到 2025 年,智慧氣動市場規模將達到 58.8 億美元,到 2030 年將達到 79.2 億美元,複合年成長率為 6.14%。

壓縮空氣動力與工業物聯網 (IIoT) 連接的整合正在推動成長,這使得工廠環境中的即時監控、能源最佳化和預測性維護成為可能。製造商正優先進行氣動系統升級,以減少計劃外停機時間、降低壓縮空氣洩漏,並與製造執行系統 (MES) 和雲分析無縫整合。亞太地區成長勢頭最為強勁,半導體領域的巨額投資和政府自動化專案正在擴大連網氣動設備的裝置量。同時,中東地區在油氣井口應用領域也迅速普及,即時健康診斷有助於安全關鍵閥門的運作。數據管理是競爭的核心,領先的供應商正在增加人工智慧 (AI) 功能,以將感測器數據轉化為可執行的洞察。

全球智慧氣動市場趨勢與洞察

一級汽車工廠對預測性維護的需求

一級汽車供應商正在氣缸組件中嵌入壓力、流量和溫度感測器,以便在故障發生前數週檢測到磨損模式。歐洲白車身生產線透過將氣壓感測器資料流與機器學習演算法相結合,識別異常叢集,從而實現了維護成本降低 20-30%,並將計劃外停機次數降至幾乎為零。北美動力傳動系統工廠正在複製這個模式以保障生產線的節拍時間,而亞洲的原始設備製造商 (OEM) 則在當地勞動力短缺日益嚴重的背景下進行試點。隨著電動車專案的擴展,混合車型組裝需要依靠準確的故障預測來維持每小時的產量。因此,來自智慧氣動設備的預測性健康數據正在將維護計劃從日曆式轉變為基於狀態的邏輯,從而維持運作並減少關鍵備件庫存。

將相容IO-Link的感測器整合到氣壓閥中

IO-Link 將閥門從被動式氣動開關轉變為可尋址的現場設備。艾默生現場數據顯示,閥門島的自識別功能和控制器標籤的自動填充可將試運行時間縮短 40%。單一主控器上的八個 A 級連接埠支援流量、壓力和位置感測器的組合,這些感測器可安裝在距離 PLC 控制櫃最遠 30 公尺的位置,且不會造成訊號遺失。更快的設備更換速度縮短了平均維修時間,參數備份功能可防止手動設定點錯誤。在日本和韓國,由於需要頻繁更換模具,IO-Link 在電子封裝生產線上的應用正在加速。隨著工廠採用 IO-Link 標準化感測器連接,氣動診斷資料被傳輸到邊緣閘道器,邊緣閘道器再將警報資料包推送至 CMMS 應用,從而形成運作和維護之間的閉迴路。

乙太網路-IP與傳統現場匯流排孤島缺乏互通性

棕地計畫通常運行著 PROFIBUS、DeviceNet 或 CC-Link 等獨立網路,這些網路本身無法交換 CIP 物件。增加通訊協定閘道器會引入 5-15 毫秒的延遲,從而危及高速取放單元對時間要求極高的吹氣序列。孤立的自動化模組阻礙了端到端的資料視覺性,維修團隊不得不同時使用多種診斷工具。多重通訊協定節點和時間敏感型網路有望緩解這一問題,但它們需要等待資本預算週期和廣泛部署。在此之前,系統整合必須設計混合產品,這需要在速度和成本之間做出妥協,從而延緩了旨在擴大智慧氣動市場的更新計劃。

細分市場分析

智慧氣動閥為大多數產業提供配備豐富感測器的歧管平台,這些平台可將壓力、流量和循環次數等數據傳輸至PLC,預計2024年智慧氣動市場收入將佔比45%。閥門健康指標可用於制定基於狀態的檢修計劃,幫助汽車噴漆車間避免因壓力漂移而導致的過噴缺陷。將IO-Link整合到歧管模組中,簡化了擴充流程,因為8通主閥無需更改線路即可熱插拔模組。附加元件分析功能可計算每個閥門的洩漏量,從而揭示舊有系統中隱藏的能量損失。半導體工廠正在採用符合無塵室顆粒物標準的不銹鋼閥門,以提高生產連續性。

到2030年,智慧氣壓模組將以8.5%的複合年成長率快速成長,透過將閥門控制、壓力調節和邊緣運算整合機殼,超越單一功能組件。 Festo的運動終端運行一個可下載的應用程式,可在幾分鐘內將模組從開關控制切換到比例控制或真空生成。這種靈活性減少了SKU數量,並加快了快速消費品工廠的產品切換速度。這些模組還整合了節能演算法,可自動降低待機壓力,從而支援工廠整體的脫碳目標。模組在系統級編配中的作用正在不斷擴大,使其成為智慧氣動市場的重要組成部分,尤其是在為即插即用擴充性而設計的待開發區線中。

到2024年,硬體銷售額將佔總銷售額的60%,這反映了工廠車間閥門、氣缸、穩壓器和歧管等設備的更換週期。新一代汽缸整合了磁編碼器,可提供0.1毫米解析度的位置回饋,從而實現包裝單元中的多軸協同運動。微型流量感測器安裝在穩壓器本體上,用於逐升擷取消耗資料。供應商擴大提供具有安全啟動韌體符合OT網路安全框架,可防止未經授權的代碼注入。

服務是成長最快的組成部分,2025 年至 2030 年的複合年成長率 (CAGR) 為 10%。雲端儀表板彙總閥島關鍵績效指標 (KPI),按異常風險對其進行排序,並在電腦化維護管理系統 (CMMS) 平台上自動產生工單。能源審核服務利用數據為洩漏分配成本值,並說服財務部門為航空公司維修提供資金。遠端協助訂閱服務使供應商專家能夠存取設備日誌,並指導工廠技術人員進行糾正措施,從而減少差旅。從長遠來看,此類數據主導服務層可將交易型產品銷售轉化為經常性收入。

智慧氣動市場按產品類型(智慧氣動閥、智慧氣動致動器、智慧氣動模組)、組件、設備類型、終端用戶產業(汽車、石油天然氣、食品飲料)、通訊協定(EtherNet/IP、PROFINET、IO-Link)、分銷通路和地區進行細分。市場預測以美元計價。

區域分析

2024年,亞太地區將佔全球銷售額的38%,這主要得益於中國「中國製造2025」的自動化策略以及台灣地區329億新台幣的半導體投資。高密度工廠集群正在採用內置分析功能的閥組,以便在壓縮空氣洩漏導致能源費用飆升之前及時發現並採取措施。日本汽車工廠正在壓平機上部署支援IO-Link技術的汽缸,以縮短多車型輪班期間的換型時間。寧波智慧氣動等本地供應商正在為該地區的中小型企業提供成本最佳化的客製化模組,這加劇了市場競爭,並推動了性價比的快速提升,從而鞏固了其區域優勢。

北美是一個成熟且充滿創新精神的買家市場。汽車原始設備製造商 (OEM) 正在將閥島連接到雲端人工智慧引擎,以便提前 30 天預測生產線停機,從而減少停機損失。 CHIPS 法案為亞利桑那州、德克薩斯和俄亥俄州的新建工廠提供獎勵,這些工廠均要求配備符合 ISO 1 級標準的潔淨壓縮空氣網路以及即時露點警報系統。節能減排的要求正促使工廠採用空氣管理系統,該系統可在閒置期間關閉供氣管線,這反映了智慧氣動市場向永續性發展的趨勢。

預計到2030年,中東地區的複合年成長率將達到7.5%。各國石油公司正在對井口維修,加裝基於PLC的安全停機裝置,該裝置整合了雙冗餘氣動致動器,用於將閥桿運動曲線傳輸至中央控制室。惡劣的氣候條件推動了對耐腐蝕合金、高溫密封件以及能夠預測砂粒侵入的自我診斷閥塊的需求。除了石油和天然氣產業,海灣國家也在投資食品和製藥廠以實現經濟多元化,並採用模組化氣動系統來滿足那些本地工程支援有限的偏遠工廠的需求。這種新興需求正在擴大智慧氣動市場供應商的地域覆蓋範圍。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場促進因素

- 歐洲一級汽車工廠對預測性維護的需求

- 將支援 IO-Link 的感測器整合到氣動閥中(北美)

- 加速中國大陸和台灣半導體產能擴張

- 中東地區油氣井口安全關鍵型應用

- 市場限制

- 乙太網路/IP與傳統現場匯流排孤島缺乏互通性

- 輕型生產線中高總擁有成本與電子機械替代方案的比較

- 價值/供應鏈分析

- 監管或技術環境

- 全球 ISO 5599-2 數位閥門標準化

- 波特五力分析

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 智慧氣動致動器

- 智慧氣動模組

- 按組件

- 硬體

- 軟體

- 服務

- 依設備類型

- 圓柱

- 感應器

- 轉變

- 按最終用戶行業分類

- 車

- 石油和天然氣

- 飲食

- 透過通訊協定

- EtherNet/IP

- PROFINET

- IO-Link

- 透過分銷管道

- 直銷

- 間接/系統整合商

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞洲地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 策略趨勢

- 市佔率分析

- 公司簡介

- Emerson Electric Co.(incl. Aventics)

- Festo SE and Co. KG

- Parker Hannifin Corporation

- SMC Corporation

- Bosch Rexroth AG

- Siemens AG(Industrial Automation)

- Rotork plc

- IMI Norgren(part of IMI plc)

- Bimba Manufacturing Co.(a part of IMI)

- PHD Inc.

- PNEUMAX SpA

- Cypress EnviroSystems Corp.

- AirTAC International Group

- Ningbo Smart Pneumatic Co. Ltd.

- Bosch Rexroth AG

- Thomson Industries Inc.

- The Smart Actuator Company Ltd.

- Aventics(now part of Emerson)

- Ham-Let Group

- Metso Automation(Flow Control)

第7章 市場機會與未來展望

The smart pneumatics market is valued at USD 5.88 billion in 2025 and is forecast to reach USD 7.92 billion by 2030, reflecting a 6.14% CAGR.

Growth is propelled by the fusion of compressed-air power with IIoT connectivity, which allows real-time monitoring, energy optimization, and predictive maintenance within factory environments. Manufacturers are prioritizing pneumatic upgrades that reduce unplanned downtime, cut compressed-air leaks, and integrate seamlessly with MES and cloud analytics. Regional momentum is strongest in Asia-Pacific, where large-scale semiconductor investments and government automation programs are expanding the installed base of connected pneumatic devices. Meanwhile, the Middle East shows rapid uptake in oil-and-gas wellhead applications, where safety-critical valve actuation benefits from live health diagnostics. Competition centers on data stewardship, with leading suppliers adding AI capabilities that convert sensor data into actionable insights.

Global Smart Pneumatics Market Trends and Insights

Predictive-maintenance imperatives in automotive tier-1 plants

Automotive tier-1 suppliers are embedding pressure, flow, and temperature sensors into cylinder assemblies to detect wear patterns weeks before failure. European body-in-white lines have documented 20-30% maintenance cost reductions and near-zero unplanned stops by coupling pneumatic sensor streams with machine-learning algorithms that flag anomaly clusters. North American power-train plants replicate the model to protect line takt times, and Asian OEMs are piloting it as local labour shortages intensify. As electrified vehicle programs expand, mixed-model assembly lines rely on fault-prediction accuracy to sustain hourly throughput. Predictive health data from smart pneumatic devices therefore shifts maintenance planning from calendar to condition-based logic, preserving uptime and compressing inventory of critical spares.

Integration of IO-Link-ready sensors in pneumatic valves

IO-Link converts valves from passive air switches into addressable field devices. Emerson field data indicates commissioning time cuts of 40% when valve islands self-identify and auto-populate controller tags. Eight Class A ports on a single master support combinations of flow, pressure, and position sensors placed up to 30 m from PLC cabinets without signal loss. Faster device replacement lowers mean-time-to-repair, while parameter backups prevent manual set-point errors. Japan and South Korea have accelerated adoption in electronics packaging lines that must swap tooling frequently. As factories unify sensor connectivity on IO-Link, pneumatic diagnostics feed edge gateways that push alarm packets to CMMS applications, closing the loop between operations and maintenance.

Lack of Ethernet-IP interoperability with legacy fieldbus islands

Brownfield sites often operate PROFIBUS, DeviceNet, or CC-Link islands that cannot natively exchange CIP objects. Adding protocol gateways introduces 5-15 ms latency, which jeopardizes time-critical blow-off sequences in high-speed pick-and-place units. Isolated automation pockets hinder end-to-end data visibility, forcing maintenance teams to juggle multiple diagnostic tools. Multi-protocol nodes and Time-Sensitive Networking promise relief, yet widespread deployment awaits capital-budget cycles. Until then, system integrators must design hybrids that compromise on either speed or cost, slowing refresh projects that would otherwise expand the smart pneumatics market.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated semiconductor capacity build-out in China and Taiwan

- Safety-critical adoption in oil and gas well-heads

- High TCO versus electromechanical alternatives in light-duty lines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smart pneumatic valves anchored the smart pneumatics market with 45% revenue in 2024, supplying most industries with sensor-rich manifold platforms that broadcast pressure, flow, and cycle counts to PLCs. Valve health metrics inform condition-based overhaul schedules, helping automotive paint shops avoid overspray defects linked to pressure drift. Integration of IO-Link within manifold blocks simplifies expansion, as eight-way masters accept hot-swap cartridges without rewiring. Add-on analytics calculate leakage per valve, highlighting energy losses invisible in legacy systems. Semiconductor fabs adopt stainless-steel variants that comply with cleanroom particulate standards, reinforcing demand continuity.

Smart pneumatic modules are accelerating at an 8.5% CAGR through 2030, outpacing single-function components by bundling valve control, pressure regulation, and edge computing in one enclosure. Festo's Motion Terminal runs downloadable apps that switch a module from on/off control to proportional regulation or vacuum generation in minutes. Such flexibility lowers SKU counts and speeds product changeovers in fast-moving consumer-goods plants. Modules also embed energy-savings algorithms that auto-reduce stand-by pressure, supporting factory-wide decarbonization goals. Their expanding role in system-level orchestration positions them as pivotal contributors to the smart pneumatics market, particularly in greenfield lines designed for plug-and-play scalability.

Hardware accounted for 60% of 2024 revenue, reflecting the replacement cycle of valves, cylinders, regulators, and manifolds that populate factory floors. New-generation cylinders incorporate magnetic encoders delivering 0.1 mm resolution positional feedback, enabling coordinated multi-axis moves in packaging cells. Miniaturized flow sensors fit into regulator bodies, capturing consumption data down to the litre. Vendors increasingly ship hardware with secure boot firmware to guard against unauthorized code injection, aligning with OT cybersecurity frameworks.

Services represent the fastest-growing component at a 10% CAGR from 2025-2030. Cloud dashboards aggregate valve-island KPIs, rank them by anomaly risk, and generate automatic work orders in CMMS platforms. Energy-audit services use the data to assign cost values to leaks, convincing finance departments to fund air-line retrofits. Remote-assist subscriptions let vendor specialists access device logs, guiding plant technicians through corrective actions and reducing travel. Over time, this data-driven service layer converts transactional product sales into recurring revenue, an approach echoed by similar transitions in the smart pneumatics industry.

Smart Pneumatics Market Segmented by Product Type (Smart Pneumatic Valves, Smart Pneumatic Actuators and Smart Pneumatic Modules), Component, Instrument Type, End-User Industry (Automotive, Oil & Gas and Food & Beverage), Communication Protocol (EtherNet/IP, PROFINET and IO-Link), Distribution Channel and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 38% revenue in 2024, supported by China's automation drive under "Made in China 2025" and Taiwan's NT$32.9 billion semiconductor investments. High-density factory clusters adopt valve manifolds with built-in analytics that flag compressed-air leaks before they inflate utility bills. Japanese automotive plants roll out IO-Link enabled cylinders across stamping presses, cutting changeover times during multi-model shifts. Local vendors such as Ningbo Smart Pneumatic supply cost-optimized modules tailored to regional SMEs, intensifying competition and stimulating rapid price-performance improvements that strengthen regional dominance.

North America represents a mature yet innovation-focused buyer base. Automotive OEMs connect valve islands to cloud AI engines that predict line stoppages 30 days in advance, reducing downtime penalties. The CHIPS Act incentivizes new fabs in Arizona, Texas, and Ohio, each specifying ISO Class 1 clean-compressed-air networks with live dew-point alarms. Energy-reduction mandates push plants to adopt air-management systems capable of shutting off feed lines during idle periods, reflecting a broader push toward sustainability in the smart pneumatics market.

The Middle East is expected to grow at 7.5% CAGR through 2030. National oil companies retrofit wellheads with PLC-based safety shutdown units integrating dual-redundant pneumatic actuators that broadcast stem-movement profiles to central control rooms. The harsh climate drives demand for corrosion-resistant alloys, extended-temperature seals, and self-diagnosing valve blocks that anticipate sand ingress. Beyond oil and gas, Gulf states invest in food and pharmaceutical plants to diversify economies, adopting modular pneumatics that fit isolated facilities with limited local engineering support. This emerging demand widens the geographic footprint of smart pneumatics market suppliers.

- Emerson Electric Co. (incl. Aventics)

- Festo SE and Co. KG

- Parker Hannifin Corporation

- SMC Corporation

- Bosch Rexroth AG

- Siemens AG (Industrial Automation)

- Rotork plc

- IMI Norgren (part of IMI plc)

- Bimba Manufacturing Co. (a part of IMI)

- PHD Inc.

- PNEUMAX S.p.A.

- Cypress EnviroSystems Corp.

- AirTAC International Group

- Ningbo Smart Pneumatic Co. Ltd.

- Bosch Rexroth AG

- Thomson Industries Inc.

- The Smart Actuator Company Ltd.

- Aventics (now part of Emerson)

- Ham-Let Group

- Metso Automation (Flow Control)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Predictive-maintenance imperatives in automotive tier-1 plants (Europe)

- 4.1.2 Integration of IO-Link-ready sensors in pneumatic valves (North America)

- 4.1.3 Accelerated semiconductor capacity build-out in China and Taiwan

- 4.1.4 Safety-critical adoption in oil and gas well-heads (Middle East)

- 4.2 Market Restraints

- 4.2.1 Lack of Ethernet-IP interoperability with legacy fieldbus islands

- 4.2.2 High TCO versus electromechanical alternatives in light-duty lines

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory or Technological Outlook

- 4.4.1 Global ISO 5599-2 digital valve standardization

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Smart Pneumatic Actuators

- 5.1.1 Smart Pneumatic Modules

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Instrument Type

- 5.3.1 Cylinders

- 5.3.2 Transducers

- 5.3.3 Switches

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Oil and Gas

- 5.4.3 Food and Beverage

- 5.5 By Communication Protocol

- 5.5.1 EtherNet/IP

- 5.5.2 PROFINET

- 5.5.3 IO-Link

- 5.6 By Distribution Channel

- 5.6.1 Direct Sales

- 5.6.2 Indirect / System-Integrator

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia

- 5.7.4 Middle East

- 5.7.4.1 Israel

- 5.7.4.2 Saudi Arabia

- 5.7.4.3 United Arab Emirates

- 5.7.4.4 Turkey

- 5.7.4.5 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Egypt

- 5.7.5.3 Rest of Africa

- 5.7.6 South America

- 5.7.6.1 Brazil

- 5.7.6.2 Argentina

- 5.7.6.3 Rest of South America

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Emerson Electric Co. (incl. Aventics)

- 6.3.2 Festo SE and Co. KG

- 6.3.3 Parker Hannifin Corporation

- 6.3.4 SMC Corporation

- 6.3.5 Bosch Rexroth AG

- 6.3.6 Siemens AG (Industrial Automation)

- 6.3.7 Rotork plc

- 6.3.8 IMI Norgren (part of IMI plc)

- 6.3.9 Bimba Manufacturing Co. (a part of IMI)

- 6.3.10 PHD Inc.

- 6.3.11 PNEUMAX S.p.A.

- 6.3.12 Cypress EnviroSystems Corp.

- 6.3.13 AirTAC International Group

- 6.3.14 Ningbo Smart Pneumatic Co. Ltd.

- 6.3.15 Bosch Rexroth AG

- 6.3.16 Thomson Industries Inc.

- 6.3.17 The Smart Actuator Company Ltd.

- 6.3.18 Aventics (now part of Emerson)

- 6.3.19 Ham-Let Group

- 6.3.20 Metso Automation (Flow Control)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Analysis