|

市場調查報告書

商品編碼

1851819

低溫運輸包裝:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Cold Chain Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

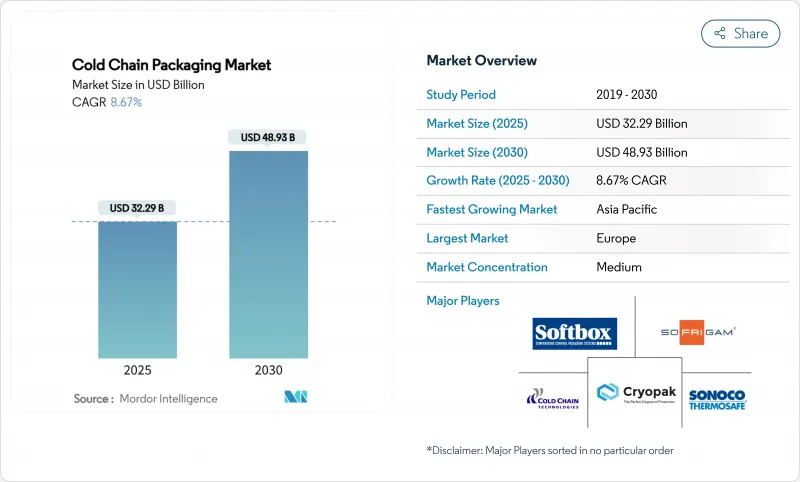

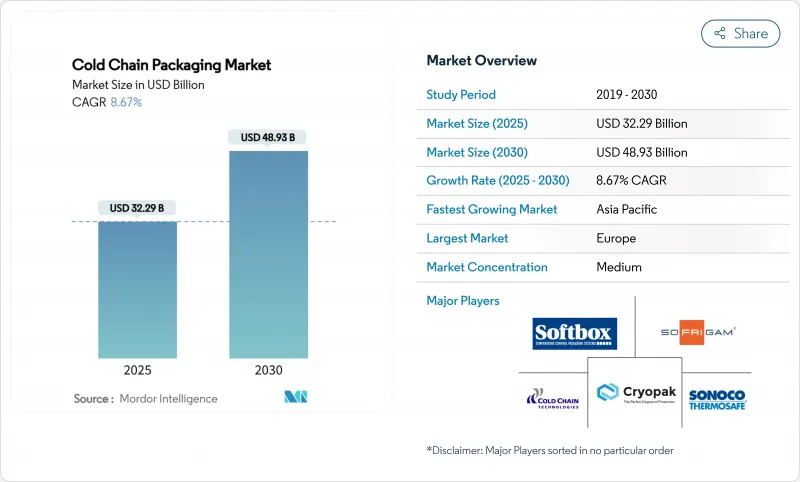

預計到 2025 年,低溫運輸包裝市場規模將達到 322.9 億美元,到 2030 年將達到 489.3 億美元,年複合成長率為 8.67%。

生技藥品需求量的成長、電商生鮮履約的擴張以及全球疫苗計畫對溫控配送的標準化,共同推動了冷鏈包裝市場的發展。美國食品藥物管理局(FDA) 的 21 CFR 600.15法律規範和歐盟 (EU) 新的包裝及包裝廢棄物法規等監管框架,要求採用有效的解決方案,而即時物聯網監控則提高了人們對包裝性能的期望。此外,企業環境、社會和治理 (ESG) 目標的推進,也加速了向可重複使用和生物基包裝形式的轉變,重塑了低溫運輸包裝市場的供應商策略。

全球低溫運輸包裝市場趨勢與洞察

生技藥品、細胞和基因治療物流的蓬勃發展

近一半的新藥需要溫度控制,許多先進療法更需要在低於-150°C的低溫條件下進行。 2025年1月,Cryoport推出了HV3運輸箱,該運輸箱能夠長時間維持超低溫,標誌著該領域正朝著專業化設計方向發展。美國食品藥物管理局(FDA)的生技藥品許可要求提供運輸過程中穩定性的有效證據,因此包裝合格對於產品認證至關重要。個人化醫療的發展趨勢正在推動運輸頻率和出貨收益的提升,從而帶動低溫運輸包裝市場的高階需求。

電子商務雜貨和食材自煮包宅配服務的擴張

隨著冷藏和冷凍食品的線上銷售量成長,對輕便、節省空間且能應對「最後一公里」運輸波動的隔熱材料的需求也日益成長。 HelloFresh 利用人工智慧技術,根據特定天氣和路線調整包裝配置,從而展示了數據驅動的材料選擇方法。 Ranpak 於 2024 年 4 月推出的可路邊回收的 climaliner Plus 保溫材料,可提供 72 小時的保溫保護,滿足了消費者永續性的期望。這些創新將低溫運輸包裝市場拓展到傳統醫藥領域之外。

聚合物原料價格波動

聚乙烯和聚丙烯價格上漲可能會擠壓加工商的利潤空間,並延緩可重複使用包裝的轉型,因為可重複使用包裝的前期成本更高。小型製造商往往缺乏對沖機制,這促使它們調整產品組合,優先考慮價值較高的製藥客戶。

細分市場分析

保溫容器將成為運輸的支柱,到2024年將佔據低溫運輸包裝市場35.53%的佔有率。儘管保溫容器佔據主導地位,但隨著供應鏈對持續可視性的需求,溫度監測設備預計將以12.95%的複合年成長率成長。像Timestrip的Semaglutide指示器這樣的智慧標籤正在擴大高價值生技藥品的合規性,並被醫療保健機構廣泛採用。

物聯網晶片與低功耗網路的融合,將被動式設備升級為互聯資產。 SkyCell 的 1500X 混合型貨櫃可連續運作270 小時,並即時傳輸資料。諸如此類的進步正吸引保險公司,他們如今更青睞經實踐驗證的風險緩解措施,同時也為低溫運輸包裝市場的設備製造商拓展了潛在業務量。

被動式冷鏈包裝箱預計在2024年仍將佔據低溫運輸包裝市場55.32%的佔有率,其優勢在於操作簡單且符合相關法規。然而,混合式冷鏈包裝箱將以10.32%的複合年成長率成為成長最快的選擇,它們透過在傳統箱體內部整合感測器和有限的電力輔助功能,實現了成本和控制之間的平衡。 Va-Q-Tec公司的Thermal Coat熱塗層為傳統包裝箱增加了一層智慧層,從而減少了對全功率設備的依賴。

全球航空公司正在收緊鋰電池運輸規定,設定30%的充電狀態限制。太陽能採集和超級電容的整合正在緩解這一障礙,推動製造商轉向被動-主動混合電池。隨著合規性審核的加強,托運人將越來越傾向於購買具有內建可追溯性的電池,這將促進混合動力汽車在低溫運輸包裝市場的成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 生技藥品、細胞和基因治療的物流繁榮

- 電子商務雜貨和食材自煮包宅配業務蓬勃發展

- 新興國家的全球疫苗計劃

- 分散式臨床實驗小包裹的需求

- 採用可重複使用的被動式托運人以實現ESG目標

- 保險公司主導的智慧指標推廣

- 市場限制

- 聚合物原料價格波動

- 歐盟關於EPS的循環經濟法規

- 大型貨主航空貨運能力下降

- 鋰電池在主動系統中的局限性

- 供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品

- 保溫容器

- 保溫運輸箱

- 冷媒凝膠包和相變材料

- 溫度監測裝置

- 真空絕熱板

- 乾冰系統

- 透過包裝系統

- 主動系統

- 被動系統

- 混合系統

- 材料

- 發泡聚苯乙烯(EPS)

- 聚氨酯(PUR)

- 真空絕熱板(VIP)

- 發泡聚丙烯(EPP)

- 生物基相變材料

- 有阻隔襯墊的瓦楞紙板

- 高性能泡沫(酚醛、聚異氰脲酸酯)

- 透過可用性

- 一次使用

- 可重複使用的

- 透過使用

- 製藥和生物技術

- 臨床試驗和診斷

- 乳製品和冷凍甜點

- 肉類和水產品

- 其他應用

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Sonoco ThermoSafe

- Cold Chain Technologies

- Pelican BioThermal

- Softbox Systems

- Intelsius(DGP)

- Cryopak

- Sofrigam

- Tempack

- CSafe Global

- Va-Q-Tec

- SkyCell

- CrodaTherm

- Sealed Air Corp.

- DS Smith(International Paper)

- Storopack

- Cascades Inc.

- Cryoport

- Thermo King

- Marken

- Timestrip

第7章 市場機會與未來展望

The cold chain packaging market size stands at USD 32.29 billion in 2025 and is projected to reach USD 48.93 billion by 2030, expanding at an 8.67% CAGR.

Growth is underpinned by rising biologics volumes, expanding e-commerce grocery fulfilment, and global vaccine initiatives that standardize temperature-controlled distribution. Regulatory frameworks such as the United States Food and Drug Administration's 21 CFR 600.15 and the European Union's new Packaging and Packaging Waste Regulation compel validated solutions, while real-time IoT monitoring elevates performance expectations. Consolidation among logistics majors amplifies technology diffusion, and corporate ESG targets accelerate the pivot toward reusable and bio-based formats, reshaping supplier strategies across the cold chain packaging market.

Global Cold Chain Packaging Market Trends and Insights

Boom in Biologics and Cell-/Gene-Therapy Logistics

Nearly half of new pharmaceuticals require temperature control, and many advanced therapies need cryogenic conditions below -150 °C. In January 2025 Cryoport introduced the HV3 shipper that maintains such ultra-low levels for prolonged periods, illustrating the sector's shift toward specialised designs. The FDA's biologics licensing requirements demand validated evidence of stability throughout transit, making packaging qualification integral to product approval. Personalised medicine trends intensify shipment frequency and value, driving premium demand across the cold chain packaging market.

Expansion of E-commerce Grocery and Meal-Kit Delivery

Online grocery volumes for chilled and frozen foods increase the need for lightweight, space-efficient insulation that withstands last-mile variability. HelloFresh employs AI to adjust pack configuration to weather and route specifics, demonstrating how data drives material selection. Ranpak's curbside-recyclable climaliner Plus, launched April 2024, offers 72 hours of thermal protection and responds to consumers' sustainability expectations. These innovations expand the cold chain packaging market beyond traditional pharmaceutical lanes.

Polymer Feedstock Price Volatility

Upward swings in polyethylene and polypropylene costs compress converter margins and can delay switching to reusable packaging that carries higher upfront spend. Smaller producers often lack hedging mechanisms, prompting them to rationalise portfolios and prioritise high-value pharmaceutical accounts.

Other drivers and restraints analyzed in the detailed report include:

- Global Vaccine Initiatives in Emerging Nations

- Decentralized Clinical-Trial Parcel Demand

- EU Circular-Economy Limits on EPS

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Insulated containers provided the backbone of shipments and accounted for 35.53% of the cold chain packaging market in 2024. Despite this dominance, temperature-monitoring devices post a 12.95% CAGR as supply chains demand continuous visibility. Smart labels such as Timestrip's semaglutide indicator extend compliance to high-value biologics, capturing adoption across healthcare providers.

The convergence of IoT chips and low-power networks upgrades passive boxes into connected assets. SkyCell's 1500X hybrid container runs for 270 hours and transmits live data, illustrating how monitoring devices integrate with insulation substrates to limit excursions. These advances attract insurers that now reward proven risk reduction, expanding addressable volumes for device makers within the cold chain packaging market.

Passive shippers retained 55.32% share of the cold chain packaging market size in 2024, valued for simplicity and regulatory familiarity. Hybrid formats, however, post the fastest 10.32% CAGR by embedding sensors and limited power assistance inside traditional shells, thereby balancing cost and control. Va-Q-Tec's Thermal Coat adds an intelligent layer to legacy boxes and reduces reliance on fully powered units.

Global airlines tighten lithium-battery carriage rules, capping state-of-charge at 30%, which constrains active container usage. Solar harvesting and supercapacitor integration mitigate this hurdle and push manufacturers toward passive-active hybrids. As compliance audits intensify, shippers with built-in traceability gain procurement preference, strengthening hybrid growth across the cold chain packaging market.

The Global Cold Chain Packaging Market Report is Segmented by Product (Insulated Containers, Insulated Shippers, Refrigerants, and More), Packaging System (Active, Passive, Hybrid), Material (EPS, PUR, VIP, EPP, and More), Usability (Single-Use, Reusable), Application (Pharmaceuticals and Biotechnology, Clinical Trials and Diagnostics, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Sonoco ThermoSafe

- Cold Chain Technologies

- Pelican BioThermal

- Softbox Systems

- Intelsius (DGP)

- Cryopak

- Sofrigam

- Tempack

- CSafe Global

- Va-Q-Tec

- SkyCell

- CrodaTherm

- Sealed Air Corp.

- DS Smith (International Paper)

- Storopack

- Cascades Inc.

- Cryoport

- Thermo King

- Marken

- Timestrip

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Boom in biologics and cell-/gene-therapy logistics

- 4.2.2 Expansion of e-commerce grocery and meal-kit delivery

- 4.2.3 Global vaccine initiatives in emerging nations

- 4.2.4 Decentralized clinical-trial parcel demand

- 4.2.5 Reusable passive shipper adoption for ESG targets

- 4.2.6 Insurer-driven smart indicator uptake

- 4.3 Market Restraints

- 4.3.1 Polymer feedstock price volatility

- 4.3.2 EU circular-economy limits on EPS

- 4.3.3 Air-freight capacity squeeze for bulky shippers

- 4.3.4 Lithium-battery limits on active systems

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Insulated Containers

- 5.1.2 Insulated Shippers

- 5.1.3 Refrigerants Gel Packs and PCMs

- 5.1.4 Temperature-Monitoring Devices

- 5.1.5 Vacuum-Insulated Panels

- 5.1.6 Dry-Ice Systems

- 5.2 By Packaging System

- 5.2.1 Active Systems

- 5.2.2 Passive Systems

- 5.2.3 Hybrid Systems

- 5.3 By Material

- 5.3.1 Expanded Polystyrene (EPS)

- 5.3.2 Polyurethane (PUR)

- 5.3.3 Vacuum Insulation Panels (VIP)

- 5.3.4 Expanded Polypropylene (EPP)

- 5.3.5 Bio-based PCMs

- 5.3.6 Corrugated Cardboard with Barrier Liners

- 5.3.7 High-performance Foams (Phenolic, PIR)

- 5.4 By Usability

- 5.4.1 Single-use

- 5.4.2 Reusable

- 5.5 By Application

- 5.5.1 Pharmaceuticals and Biotechnology

- 5.5.2 Clinical Trials and Diagnostics

- 5.5.3 Dairy and Frozen Desserts

- 5.5.4 Meat and Seafood

- 5.5.5 Other Application

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Sonoco ThermoSafe

- 6.4.2 Cold Chain Technologies

- 6.4.3 Pelican BioThermal

- 6.4.4 Softbox Systems

- 6.4.5 Intelsius (DGP)

- 6.4.6 Cryopak

- 6.4.7 Sofrigam

- 6.4.8 Tempack

- 6.4.9 CSafe Global

- 6.4.10 Va-Q-Tec

- 6.4.11 SkyCell

- 6.4.12 CrodaTherm

- 6.4.13 Sealed Air Corp.

- 6.4.14 DS Smith (International Paper)

- 6.4.15 Storopack

- 6.4.16 Cascades Inc.

- 6.4.17 Cryoport

- 6.4.18 Thermo King

- 6.4.19 Marken

- 6.4.20 Timestrip

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment