|

市場調查報告書

商品編碼

1851817

印度設施管理:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)India Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

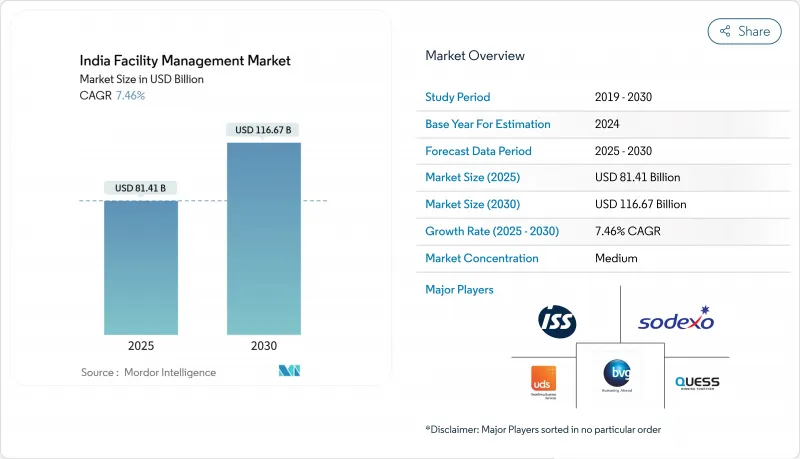

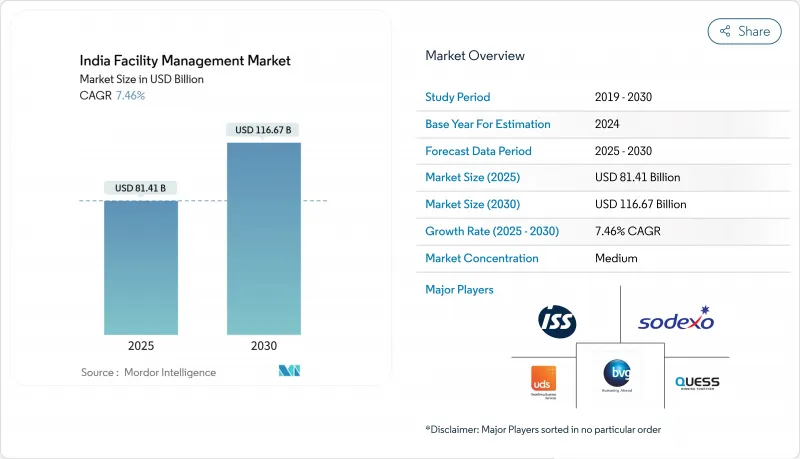

預計到 2025 年,印度設施管理市場規模將達到 1,596.1 億美元,到 2030 年將達到 2,277.5 億美元,預測期內複合年成長率為 7.37%。

這一上升趨勢得益於商業房地產的快速發展、技術的日益普及以及從內部服務轉向外包服務模式的加速轉變。儘管硬性服務仍然是印度設施管理市場的基礎,但隨著雇主越來越重視職場體驗和員工福祉,對軟性服務的需求也不斷成長。技術整合,特別是物聯網感測器、人工智慧主導的分析和自動化平台,正在重塑成本結構,並實現預測性維護,將營運成本降低高達 20%。雖然外包仍然是首選的交付方式,但一些大型企業正在選擇性地重組其內部團隊以維持資料控制權,這迫使供應商更加重視基於可衡量績效結果的提案主張。隨著全球巨頭整合區域專家並建立能夠提供高價值捆綁交易的綜合產品組合,競爭日益激烈。

印度設施管理市場趨勢與洞察

商業不動產的快速擴張

班加羅爾、海德拉巴、普納和艾哈默德巴德等地新建的甲級辦公室和倉庫從一開始就需要整合硬體和軟體服務,這為供應商創造了長期穩定的收入來源。如今,設施管理團隊在建築施工階段就將維修方案、能源儀錶板、空間規分類析等功能融入設計,而非後製維修。開發人員越來越傾向於強制要求智慧建築規範,例如自動化消防安全測試和雲端基礎的資產清單,並將技術能力作為服務合約的預審標準。全球能力中心湧入二線城市,雖然使地域需求多元化,但也導致認證技術人員日益短缺,促使主要供應商建立區域培訓學院。由於每個新的商業計劃通常都包含一份多年服務契約,印度設施管理市場在暖通空調、電氣、安防和衛生等領域都能獲得持續的收入。

技術整合(物聯網、人工智慧、自動化)

嵌入冷水機組、水泵、照明設備和電梯中的物聯網設備能夠檢測異常情況,並將即時數據傳輸到人工智慧引擎,從而安排及時干預措施,延長設備使用壽命。早期部署已實現節能15-20%,緊急故障減少高達30%,投資回收期縮短至24個月以內。將分析儀表板與傳統人力資源服務捆綁銷售的供應商正在獲得更大的定價權和更牢固的客戶關係。隨著建築資料遷移到雲端平台,網路安全和資料管理的專業知識正成為差異化優勢。技術應用也使得基於結果的定價成為可能,供應商不再僅僅按工時計費,而是保證達到能源強度閾值和室內空氣品質指標。因此,數位化能力是贏得印度設施管理市場大型綜合合約的關鍵因素。

勞動力短缺和技能差距

智慧建築的快速普及加劇了暖通空調自動化、消防安全系統和建築管理系統(BMS)分析領域合格技術人員的短缺。二、三線城市面臨嚴重的人手不足,薪資水準比第一線城市高出15-20%,供應商利潤空間進一步縮小。儘管一些領先的供應商已推出課堂教學與現場輪調相結合的學徒計劃,但這種人才培養模式仍無法有效滿足當前的市場需求。持續存在的人才缺口導致加班現象增多,服務品質違規事件增加,合約執行速度受阻,最終限制了印度設施管理市場的成長潛力。

細分市場分析

到2024年,硬性服務將佔印度設施管理市場58.37%的佔有率,這反映出它們在合規性和資產可靠性方面發揮著至關重要的作用。電氣維護、暖通空調最佳化和消防安全檢查等高優先級類別佔據了設施預算的很大一部分,尤其是在數據密集型行業,停機成本極其高昂。軟性服務雖然在絕對佔有率上落後於硬性服務,但預計到2030年將以7.89%的複合年成長率成長。隨著健康計劃成為合約中的必要條款,軟性服務市場規模預計將穩步擴大。技術正在模糊這兩類服務之間的界限,例如,機器人清潔地板的同時,還能將營運數據傳輸到與冷水機組性能追蹤相同的分析平台,這使得供應商能夠交叉銷售捆綁式解決方案。

綠建築認證需求的不斷成長推動了技能要求,促使硬性服務團隊採用能源基準化分析軟體和物聯網故障檢測技術。同時,靈活辦公空間營運商正以績效為導向,將茶水間和前台服務外包,並將供應商報酬與租戶滿意度指標掛鉤。安保服務也越來越多整合人工智慧驅動的CCTV分析技術,在減少保全人員數量的同時,提高了事件回應的準確性。這些轉變正在將硬性服務和軟性服務從同質化的商品類別轉變為印度設施管理市場中租戶實現差異化的策略槓桿。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 目前運轉率

- 主要FM業者的獲利能力

- 勞動指標—勞動參與率

- 按服務類型分類的設施管理市場佔有率(%)

- 按硬體服務分類的設施管理市場佔有率(%)

- 按軟體服務分類的設施管理市場佔有率(%)

- 大都會圈的都市化和人口成長

- 國家基礎建設中的產業投資優先事項

- 與職業安全標準相關的監管因素

- 市場促進因素

- 商業不動產的快速擴張

- 技術整合(物聯網、人工智慧、自動化)

- 外包趨勢日益明顯

- 更重視工作場所體驗和員工福祉

- 共享辦公空間和彈性辦公模式的成長

- 疫情後強制性衛生健康合規措施

- 市場限制

- 勞動力短缺和技能差距

- 營運成本上升給利潤率帶來壓力。

- 對價格高度敏感和採購慣例分散

- 公共部門合約中的監管複雜性和付款延遲

- 價值鏈分析

- PESTEL 分析

- 市場准入的監管和法律體制

- 宏觀經濟指標對FM需求的影響

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資與資金籌措分析

第5章 市場規模與成長預測

- 按服務類型

- 硬服務

- 資產管理

- 機電及暖通空調服務

- 消防系統與安全

- 其他硬體維修服務

- 軟服務

- 辦公室支援與安全

- 清潔服務

- 餐飲服務

- 其他軟性調頻服務

- 硬服務

- 按產品類型分類

- 內部

- 外包

- 單頻調頻

- Bundle FM

- 整合調頻

- 按最終用戶行業分類

- 商業(IT/通訊、零售、倉儲)

- 飯店餐飲業(飯店、餐廳等)

- 設施和公共基礎設施(政府、教育、交通)

- 醫療保健(公共和私立機構)

- 工業和流程(製造業、能源業、採礦業)

- 其他終端用戶產業(多用戶住宅、娛樂、運動和休閒)

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ISS Facility Management

- Sodexo Facilities Management Services India Pvt. Ltd.

- Quess Corporation

- Updater Services Pvt. Ltd.

- BVG India Ltd.

- Dusters Total Solutions Ltd.

- EFS Facilities Services

- G4S India

- Mortice Group PLC(TenonFM)

- ServiceMax Facility Management Pvt. Ltd.

- Knight Frank India

- Avon Facility Management Services Pvt. Ltd.

- Kleen Tek Solutions

- DTSS Facility Services

- Tenon Facility Management Pvt. Ltd.

- CBRE South Asia Pvt. Ltd.

- JLL Integrated Facilities Management

- Cushman & Wakefield Facilities Services India

- Colliers India

- Johnson Controls India

- Bharat Vikas Group(BVG)Soft Services

第7章 市場機會與未來展望

The India facility management market size reached USD 159.61 billion in 2025 and is projected to rise to USD 227.75 billion by 2030, reflecting a 7.37% CAGR during the forecast period.

The upward trajectory is underpinned by rapid commercial real-estate development, widening technology adoption, and the accelerating shift from in-house to outsourced service models. Hard services continue to anchor the India facility management market, yet soft-service demand is climbing as employers emphasise workplace experience and wellness. Technology integration-particularly IoT sensors, AI-driven analytics, and automation platforms-is reshaping cost structures and enabling predictive maintenance that trims operating costs by up to 20%. Outsourcing remains the preferred delivery approach, but several large occupiers are selectively rebuilding internal teams to retain data control, forcing vendors to sharpen value propositions rooted in measurable performance outcomes. Competitive intensity is increasing as global majors consolidate regional specialists to assemble integrated portfolios capable of serving high-value bundled contracts.

India Facility Management Market Trends and Insights

Rapid Commercial Real-Estate Expansion

New Grade-A offices and warehouses in Bangalore, Hyderabad, Pune, and Ahmedabad demand integrated hard and soft services from the first day of occupancy, creating long-tail revenue streams for vendors. Facility teams must now design maintenance regimes, energy dashboards, and space-planning analytics during construction rather than retrofitting later. Developers increasingly mandate smart-building specifications such as automated fire-safety testing and cloud-based asset inventories, making technology-ready capability a pre-qualification criterion for service contracts. The rising influx of Global Capability Centers into tier-2 cities diversifies geographic demand but intensifies the shortage of certified technicians, prompting large vendors to establish regional training academies. As each fresh commercial project typically locks in multi-year service agreements, the India facility management market secures recurring income across HVAC, electrical, security, and hygiene categories.

Technology Integration (IoT, AI, Automation)

IoT devices embedded in chillers, pumps, lighting, and elevators feed real-time data to AI engines that detect anomalies, schedule just-in-time interventions, and prolong asset life. Early deployments show energy savings of 15-20% and up to 30% fewer emergency breakdowns, translating into tangible payback periods of fewer than 24 months. Vendors that bundle analytics dashboards with conventional manpower services gain pricing power and stickier client relationships. Cyber-security and data-governance expertise have become differentiators as building data shifts to cloud platforms. Technology adoption also unlocks outcome-based pricing in which suppliers guarantee energy-intensity thresholds or indoor-air-quality indices instead of billing only labour hours. Consequently, digital competence is now table-stakes for winning large integrated contracts within the India facility management market.

Labour Shortages and Skill Gaps

The surge of smart-building deployments magnifies the scarcity of technicians certified in HVAC automation, fire-safety systems, and BMS analytics. Tier-2 and tier-3 cities suffer deeper shortages, inflating wage premiums by 15-20% over metropolitan levels and eroding vendor margins. Leading providers have launched apprenticeship programmes that pair classroom instruction with on-site rotations, but the pipeline effect trails immediate market needs. Persistent gaps elevate overtime reliance, increase service-level breaches, and impede rapid contract mobilisation, ultimately limiting the growth potential of the India facility management market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Outsourcing Trend

- Rising Focus on Workplace Experience and Employee Wellbeing

- Margin Pressure from Rising Operational Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard services commanded 58.37% of the India facility management market in 2024, reflecting their indispensable role in compliance and asset reliability. High-priority categories such as electrical maintenance, HVAC optimisation, and fire-safety inspections absorb the bulk of facility budgets, particularly in data-centric sectors where downtime costs are punitive. Soft services trail in absolute share yet register a 7.89% CAGR through 2030 as occupants prioritise cleanliness, security, and hospitality to support hybrid workforces. The India facility management market size attributed to soft services is forecast to widen steadily as wellness-linked programs become contractual must-haves. Technology is blurring the line between the two categories-robots now scrub floors while feeding operational data into the same analytics platforms that track chiller performance-allowing vendors to cross-sell bundled solutions.

Growing demand for green-building certifications pushes hard-service teams to adopt energy-benchmarking software and IoT-enabled fault detection, elevating skill requirements. Simultaneously, flexible workspace operators are outsourcing pantry and front-of-house services on outcome-based terms that tie vendor rewards to tenant-satisfaction indices. Security services increasingly integrate AI-enabled CCTV analytics that cut guard headcount while boosting incident response precision. Together, these shifts reposition both hard and soft categories from commoditised line items into strategic levers for occupier differentiation within the broader India facility management market.

The India Facility Management Market Report is Segmented by Service Type (Hard Services, Soft Services), Offering Type (In-House, Outsourced), and End-User Industry (Commercial, Hospitality, Institutional and Public Infrastructure, Healthcare, Industrial and Process, Other End-User Industries). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ISS Facility Management

- Sodexo Facilities Management Services India Pvt. Ltd.

- Quess Corporation

- Updater Services Pvt. Ltd.

- BVG India Ltd.

- Dusters Total Solutions Ltd.

- EFS Facilities Services

- G4S India

- Mortice Group PLC (TenonFM)

- ServiceMax Facility Management Pvt. Ltd.

- Knight Frank India

- Avon Facility Management Services Pvt. Ltd.

- Kleen Tek Solutions

- DTSS Facility Services

- Tenon Facility Management Pvt. Ltd.

- CBRE South Asia Pvt. Ltd.

- JLL Integrated Facilities Management

- Cushman & Wakefield Facilities Services India

- Colliers India

- Johnson Controls India

- Bharat Vikas Group (BVG) Soft Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates

- 4.1.2 Profitability Rates of Major FM Players

- 4.1.3 Workforce Indicators - Labour Participation

- 4.1.4 Facility Management Market Share (%) by Service Type

- 4.1.5 Facility Management Market Share (%) by Hard Services

- 4.1.6 Facility Management Market Share (%) by Soft Services

- 4.1.7 Urbanisation and Population Growth in Major Metros

- 4.1.8 Sector Investment Priorities in National Infrastructure Pipeline

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2 Market Drivers

- 4.2.1 Rapid Commercial Real Estate Expansion

- 4.2.2 Technology Integration (IoT, AI, Automation)

- 4.2.3 Increasing Outsourcing Trend

- 4.2.4 Rising Focus on Workplace Experience and Employee Wellbeing

- 4.2.5 Growth of Co-working Spaces and Flexible Office Models

- 4.2.6 Post-Pandemic Hygiene and Health Compliance Mandates

- 4.3 Market Restraints

- 4.3.1 Labor Shortages and Skill Gaps

- 4.3.2 Margin Pressure from Rising Operational Costs

- 4.3.3 High Client Price Sensitivity and Fragmented Procurement Practices

- 4.3.4 Regulatory Complexity and Delayed Payments in Public Sector Contracts

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses)

- 5.3.2 Hospitality (Hotels, Eateries, Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Govt, Education, Transport)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 ISS Facility Management

- 6.4.2 Sodexo Facilities Management Services India Pvt. Ltd.

- 6.4.3 Quess Corporation

- 6.4.4 Updater Services Pvt. Ltd.

- 6.4.5 BVG India Ltd.

- 6.4.6 Dusters Total Solutions Ltd.

- 6.4.7 EFS Facilities Services

- 6.4.8 G4S India

- 6.4.9 Mortice Group PLC (TenonFM)

- 6.4.10 ServiceMax Facility Management Pvt. Ltd.

- 6.4.11 Knight Frank India

- 6.4.12 Avon Facility Management Services Pvt. Ltd.

- 6.4.13 Kleen Tek Solutions

- 6.4.14 DTSS Facility Services

- 6.4.15 Tenon Facility Management Pvt. Ltd.

- 6.4.16 CBRE South Asia Pvt. Ltd.

- 6.4.17 JLL Integrated Facilities Management

- 6.4.18 Cushman & Wakefield Facilities Services India

- 6.4.19 Colliers India

- 6.4.20 Johnson Controls India

- 6.4.21 Bharat Vikas Group (BVG) Soft Services

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)

- 7.3 ESG-compliant FM Solutions Demand

- 7.4 Future Service-Model Shifts (Outcome-based Contracts)

- 7.5 Data-driven Energy Optimisation and Carbon Reporting Services