|

市場調查報告書

商品編碼

1851815

互聯物流:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Connected Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

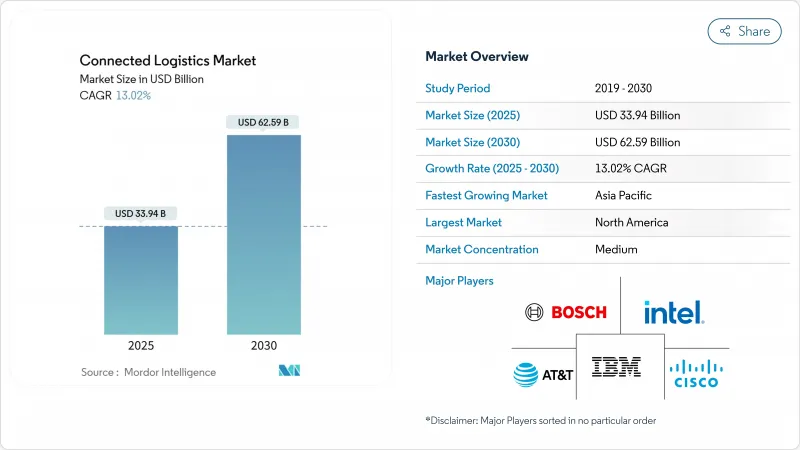

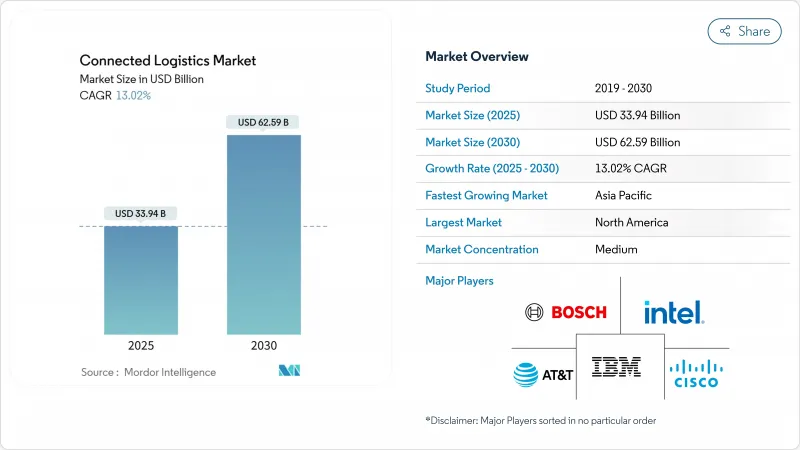

預計到 2025 年,互聯物流市場規模將達到 339.4 億美元,到 2030 年將達到 625.9 億美元。

托運人對端到端貨物透明度的堅持、物聯網感測器的快速普及以及港口和堆場5G專用網路的興起,都推動了這一領域的擴張。平台供應商提供整合的資產追蹤、即時視覺化和預測分析套件,從而降低了承運人和托運人的整體擁有成本。網路安全韌性和資料主權合規性仍然是核心設計標準,促使供應商轉向零信任架構和區域資料處理節點。透過數位孿生技術降低供應鏈風險的競賽正在加速對人工智慧驅動的中斷預測試點專案的投資,尤其是在製造地和出口導向經濟體。

全球互聯物流市場趨勢與洞察

物聯網賦能的資產追蹤激增

低功耗感測器和全球低功耗廣域網路 (LPWAN) 覆蓋範圍使企業能夠即時監控位置、溫度和衝擊情況,在某些 LoRaWAN 部署中,電池壽命可延長至 10 年。 BMW利用藍牙信標追蹤倉庫中的車輛,顯著縮短了搜尋時間。康德樂 (Cardinal Health) 的智慧感測器試點計畫改善了醫院供應室的過期藥品管理。人工智慧分析將歷史數據轉化為預測性維護警報,使車隊從被動調整轉變為主動調整。

托運人要求即時貨物可視性

FourKites 收購 TrackX Yard Solutions,將堆場管理資料與路邊視覺性結合,為托運人提供每小時更新的拖車位置資訊。汽車塗裝中心的 RFID 部署可將即時狀態傳輸至 OEM 的 ERP 系統,滿足嚴格的準時制指標。生命科學領域的托運人部署多感測器標籤,以滿足良好分銷規範 (GDP) 中關於持續溫度記錄的規定。可視性驅動的生成式 AI 路線最佳化入口網站預計到 2028 年將處理四分之一的物流 KPI 報告。

多租戶機房的網路安全責任

針對車隊遠端資訊處理和電子記錄設備的勒索軟體攻擊將導致2024年報告的資料外洩事件增加181%。貨物失竊造成的損失將達到4.55億美元,通常涉及冒充仲介和重新安排整車貨物的運輸路線。物流(CISO)目前正計劃將安全支出預算為兩位數成長,這與馬士基預測的到2037年達到366億美元的目標相符。多租戶SaaS平台使租戶隔離更加複雜,並增加了橫向移動的風險。

細分市場分析

到2024年,資產管理將佔互聯物流市場規模的41.0%,使企業能夠透過減少閒置時間和周轉率實現立竿見影的投資回報。企業正在將RFID、GNSS和環境感測器整合到統一的控制面板中,以即時標記運作拖車和高溫情況。流式分析正以16.45%的複合年成長率成長。企業需要亞秒級的卡車預計到達時間偏差和停留時間熱點訊息,從而推動預測性路線重排引擎的發展。

不斷發展的倉庫物聯網疊加層擴展了應用場景,從揀貨員引導到氣候最佳化,從而降低低溫運輸SKU的損耗率。安全分析套件分析異常資料封包流,以偵測設備入侵的早期跡象。隨著微軟將其邊緣AI套件擴展到物流閘道器,供應商將資產健康狀況和流量預測整合到單一的推薦引擎中。

到2024年,設備管理市場佔有率將達到44.0%,反映出韌體修補和認證數千個卡車、托盤和堆場感測器的複雜性。零接觸式入駐工具將縮短卡車裝卸平台的啟動時間,並支援大規模更新週期。隨著專用5G和衛星連結的增加,需要針對每個資產進行編配的訂閱模式也隨之增加,連線管理正以15.67%的複合年成長率成長。

應用程式管理平台可在雲端域和邊緣閘道器之間遷移工作負載,從而滿足延遲預算和資料保留限制。騰訊和三星的專利申請描述了新型流量優先權演算法,該演算法可根據車速調整無線電參數。支援區塊鏈的設備將配備加密模組,從而帶來更高水準的設備生命週期編配。

2024年,公路將佔物流市場佔有率的38.5%,主要得益於最後一公里網路密集化和車載資訊科技的日益成熟。基於攝影機的ADAS(高級駕駛輔助系統)和ELD(電子記錄設備)的強制實施將推動資料流,從而提升駕駛員安全性和合規性。海運預計將以15.10%的複合年成長率成長,這主要得益於智慧貨櫃遙測技術和自動化碼頭作業的普及。

鐵路公司採用路邊感測器陣列進行現代化改造,預測車輪爆胎,減少對線路營運的干擾;航空公司在貨運樞紐部署ULD追蹤器和人工智慧驅動的艙位管理工具;Eurotainer的槽式貨櫃遙測技術透過縮短加熱週期,將供應鏈成本降低了40%;Aurora Innovation的達拉斯-休士頓汽車操作的達拉斯-12012012092009人駕駛貨運操作的情況下行駛。

互聯物流市場報告按軟體解決方案(資產管理、安全、其他)、產品類型(設備管理、應用程式管理、其他)、運輸方式(公路、鐵路、其他)、最終用戶行業(汽車、製造業、其他)、服務類型(託管服務、其他)、部署模式(雲端、混合、其他)、組織規模(大型企業、其他)和地區進行細分。

區域分析

北美地區預計到2024年將保持35.2%的市場佔有率,這得益於其強大的高速公路網路和支持自動駕駛汽車試點項目的創新沙盒環境。亞馬遜正投資40億美元,將其次日達服務擴大至4,000個鄉村社區,凸顯了其基礎建設投資的規模。 UPS收購Andlauer Healthcare Group進一步增強了其在該地區的低溫運輸技術實力。網路風險依然嚴峻,但資金籌措和公私合作試驗平台正在加速技術的應用。

預計到2030年,亞太地區將以13.5%的複合年成長率引領成長。日本運輸部省正在評估一條連接東京和大阪的500公里自動化貨運線。澳洲在物流自動化領域的支出超過40億美元,涵蓋倉庫機器人和集散中心自動化。 GEODIS正將GPS追蹤公路走廊從新加坡延伸至中國,預計該地區物流市場規模將達到4.5兆美元。越南正透過舉辦2025年國際貨運代理聯合會(FIATA)世界大會,將自身定位為東協物流中心。

歐洲正努力在嚴格的資料保護規則與推動車隊使用電動車和永續航空燃料的脫碳目標之間取得平衡。 CEVA新增23輛電動卡車,使其低碳車隊規模超過1,100輛。詳情請瀏覽cevalogistics.com。 DHL與Neste合作開發永續航空燃料(SAF)供應模式,以支持歐盟的淨零排放運輸目標。歐盟委員會估計區域物流經濟規模達8,780億歐元,並持續協調相關規則以減少跨國文書工作。

其他好處

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 物聯網賦能的資產追蹤激增

- 托運人要求即時掌握貨物資訊

- MandA主導的平台整合

- 碼頭和港口的5G專用網路

- 利用數位雙胞胎規避供應鏈風險

- 市場限制

- 多租戶機房的網路安全責任

- 數據主權法律體系碎片化的世界

- 棕地資產互通API的匱乏

- 「免運費」電商模式帶來的獲利壓力

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過軟體解決方案

- 資產管理

- 倉庫物聯網

- 安全

- 資料管理

- 網管

- 流分析

- 依產品類型

- 設備管理

- 應用程式管理

- 連線管理

- 透過運輸方式

- 路

- 鐵路

- 航空

- 海上運輸

- 按最終用戶行業分類

- 車

- 製造業

- 石油和天然氣

- 資訊科技和電訊

- 衛生保健

- 零售與電子商務

- 飲食

- 其他行業

- 按服務類型

- 諮詢與整合

- 託管服務

- 支援與維護

- 透過部署模式

- 雲

- 本地部署

- 混合

- 按公司規模

- 主要企業

- 中小企業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 中東和非洲

- 中東

- 海灣合作理事會(沙烏地阿拉伯、阿拉伯聯合大公國、卡達等)

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Bosch Service Solutions GmbH

- Cisco Systems Inc.

- AT&T Inc.

- IBM Corporation

- Intel Corporation

- SAP SE

- Oracle Corporation

- Freightgate Inc.

- ORBCOMM Inc.

- HCL Technologies Ltd.

- Honeywell International Inc.

- Microsoft Corporation

- Siemens AG

- Zebra Technologies Corp.

- Trimble Inc.

- Descartes Systems Group

- Sensitech Inc.

- Project44 Inc.

- FourKites Inc.

- Huawei Technologies Co. Ltd.

- JD Logistics

- DHL Supply Chain

- FedEx Corp.

- UPS Inc.

The connected logistics market reached USD 33.94 billion in 2025 and is forecast to climb to USD 62.59 billion by 2030, reflecting a solid 13.02% CAGR.

Shippers' insistence on end-to-end freight transparency, the rapid roll-out of IoT sensors, and the rise of 5G private networks in ports and yards underpin this expansion. Platform vendors are merging asset tracking, real-time visibility, and predictive analytics into unified suites that lower total cost of ownership for carriers and shippers alike. Cyber-resilience and data-sovereignty compliance remain central design criteria, nudging providers toward zero-trust architectures and regional data-processing nodes. The race to de-risk supply chains through digital twins accelerates pilot investments in AI-driven disruption forecasting, especially in manufacturing hubs and export-oriented economies.

Global Connected Logistics Market Trends and Insights

Surge in IoT-enabled asset tracking

Low-power sensors and global LPWAN coverage let companies monitor location, temperature, and shock in real time, extending battery life to a decade in some LoRaWAN deployments. BMW's use of Bluetooth beacons to trace vehicles across warehouses cut search times dramatically. Cardinal Health's smart-sensor pilots improve expiry management in hospital supply rooms. Converging AI analytics transform historical data into predictive maintenance alerts, shifting fleets from reactive to proactive coordination.

Real-time freight visibility mandates from shippers

FourKites' purchase of TrackX Yard Solutions pairs yard-management data with over-the-road visibility, giving shippers sub-hourly updates on trailer locations. RFID deployments in automotive finishing centers stream live status to OEM ERP systems, satisfying strict just-in-time metrics. Life-science consignors deploy multi-sensor tags to meet continuous-temperature logging rules under Good Distribution Practice. Visibility feeds generative-AI route optimization portals expected to handle one-quarter of logistics KPI reporting by 2028.

Cyber-security liabilities across multi-tenant fleets

Reported breaches in transport rose 181% in 2024, with ransomware targeting fleet telematics and electronic logging devices. Cargo theft hit USD 455 million, often via broker impersonation that reroutes entire truckloads. Logistics CISOs now budget double-digit growth in security spend, mirroring Maersk's forecast of USD 36.6 billion by 2037. Multi-tenant SaaS platforms complicate isolation-of-tenants, elevating lateral-movement risks

Other drivers and restraints analyzed in the detailed report include:

- M&A-driven platform consolidation

- 5G private networks in yards and ports

- Fragmented global data-sovereignty laws

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Asset Management represented 41.0% of the connected logistics market size in 2024 thanks to the immediate ROI firms gain by trimming idle time and improving container turns. Enterprises mesh RFID, GNSS, and environmental sensors into unified dashboards that flag under-utilized trailers and temperature excursions in real time. Streaming Analytics is advancing at 16.45% CAGR as organizations demand sub-second insight into truck ETA variance and dwell-time hot spots, fueling predictive rerouting engines.

Evolving warehouse IoT overlays expand use cases from picker guidance to climate optimization, cutting spoilage rates for cold-chain SKUs. Security analytics suites analyze atypical data-packet flows to detect early indicators of device compromise. As Microsoft extends edge AI toolkits into logistics gateways, providers stitch asset health and traffic forecasts into single recommendation engines.

Device Management captured 44.0% share in 2024, reflecting the complexity of patching firmware and certifying thousands of truck, pallet, and yard sensors. Zero-touch onboarding tools reduce truck-dock activation times, supporting large-scale refresh cycles. Connectivity Management is rising at a 15.67% CAGR as private 5G and satellite links multiply subscription profiles that must be orchestrated per asset.

Application Management platforms move workloads between cloud regions and edge gateways to honor latency budgets and data-residency constraints. Patent filings by Tencent and Samsung illustrate new traffic-prioritization algorithms that adapt radio parameters by vehicle speed. Blockchain-enabled devices now embed cryptographic modules, raising the bar for device-lifecycle orchestration

Roadways held 38.5% of the connected logistics market share in 2024 due to dense last-mile networks and mature telematics retrofits. Camera-based ADAS and ELD mandates fuel data flows that improve driver safety and regulatory compliance. Seaways is expected to post a 15.10% CAGR, propelled by smart-container telemetry and automated terminal operations.

Railways modernize with wayside-sensor arrays that predict wheel-flat defects, reducing line-haul interruptions. Airways integrate ULD trackers and AI-driven slot-management tools at cargo hubs. Eurotainer's tank-container telemetry cut supply-chain costs 40% by shrinking heating cycles. Aurora Innovation's driverless freight corridor between Dallas and Houston logged 1,200 miles without a human operator

The Connected Logistics Market Report is Segmented by Software Solution (Asset Management, Security, and More), Product Type (Device Management, Application Management, and More), Transportation Mode (Roadways, Railways, and More), End-User Industry (Automotive, Manufacturing and More), Service Type (Managed Services and More), Deployment Mode (Cloud, Hybrid, and More), Organization Size (Large Enterprises and More), and Geography.

Geography Analysis

North America retained 35.2% share in 2024, buoyed by robust highway networks and supportive innovation sandboxes for autonomous vehicle pilots. Amazon is investing USD 4 billion to extend next-day coverage to 4,000 rural communities, underscoring the scale of infrastructure spend. UPS's purchase of Andlauer Healthcare Group deepens cold-chain specialization in the region. Cyber-risk remains acute, yet venture funding and public-private testbeds accelerate technology diffusion.

Asia Pacific is projected to lead growth at a 13.5% CAGR through 2030. Japan's transport ministry is evaluating a 500-kilometer automated freight link between Tokyo and Osaka. Australia's logistics-automation outlays exceed USD 4 billion, spanning warehouse robotics and yard automation. GEODIS is extending GPS-tracked road corridors from Singapore to China in anticipation of a USD 4.5 trillion regional logistics sector. Vietnam positions itself as an ASEAN logistics pivot by hosting the 2025 FIATA World Congress.

Europe balances stringent data-protection rules with decarbonization mandates that push fleets toward EVs and sustainable aviation fuels. CEVA added 23 electric trucks, raising its low-carbon fleet beyond 1,100 vehicles cevalogistics.com. DHL collaborates with Neste on SAF supply models, supporting the EU's net-zero transport goal. The European Commission estimates the regional logistics economy at EUR 878 billion and continues harmonizing rules to cut cross-border paperwork

- Bosch Service Solutions GmbH

- Cisco Systems Inc.

- AT&T Inc.

- IBM Corporation

- Intel Corporation

- SAP SE

- Oracle Corporation

- Freightgate Inc.

- ORBCOMM Inc.

- HCL Technologies Ltd.

- Honeywell International Inc.

- Microsoft Corporation

- Siemens AG

- Zebra Technologies Corp.

- Trimble Inc.

- Descartes Systems Group

- Sensitech Inc.

- Project44 Inc.

- FourKites Inc.

- Huawei Technologies Co. Ltd.

- JD Logistics

- DHL Supply Chain

- FedEx Corp.

- UPS Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in IoT-enabled asset tracking

- 4.2.2 Real-time freight visibility mandates from shippers

- 4.2.3 MandA-driven platform consolidation

- 4.2.4 5G private networks in yards and ports

- 4.2.5 De-risking supply chains via digital twins

- 4.3 Market Restraints

- 4.3.1 Cyber-security liabilities across multi-tenant fleets

- 4.3.2 Fragmented global data-sovereignty laws

- 4.3.3 Scarcity of interoperable APIs for brown-field assets

- 4.3.4 Margin pressure from "ship-for-free" e-commerce models

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Software Solution

- 5.1.1 Asset Management

- 5.1.2 Warehouse IoT

- 5.1.3 Security

- 5.1.4 Data Management

- 5.1.5 Network Management

- 5.1.6 Streaming Analytics

- 5.2 By Product Type

- 5.2.1 Device Management

- 5.2.2 Application Management

- 5.2.3 Connectivity Management

- 5.3 By Transportation Mode

- 5.3.1 Roadways

- 5.3.2 Railways

- 5.3.3 Airways

- 5.3.4 Seaways

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Manufacturing

- 5.4.3 Oil and Gas

- 5.4.4 IT and Telecom

- 5.4.5 Healthcare

- 5.4.6 Retail and E-commerce

- 5.4.7 Food and Beverage

- 5.4.8 Other Industries

- 5.5 By Service Type

- 5.5.1 Consulting and Integration

- 5.5.2 Managed Services

- 5.5.3 Support and Maintenance

- 5.6 By Deployment Mode

- 5.6.1 Cloud

- 5.6.2 On-Premise

- 5.6.3 Hybrid

- 5.7 By Organisation Size

- 5.7.1 Large Enterprises

- 5.7.2 Small and Medium Enterprises (SMEs)

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Chile

- 5.8.2.4 Rest of South America

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 United Kingdom

- 5.8.3.3 France

- 5.8.3.4 Italy

- 5.8.3.5 Spain

- 5.8.3.6 Netherlands

- 5.8.3.7 Russia

- 5.8.3.8 Rest of Europe

- 5.8.4 Asia Pacific

- 5.8.4.1 China

- 5.8.4.2 India

- 5.8.4.3 Japan

- 5.8.4.4 South Korea

- 5.8.4.5 ASEAN

- 5.8.4.6 Rest of Asia Pacific

- 5.8.5 Middle East and Africa

- 5.8.5.1 Middle East

- 5.8.5.1.1 GCC (Saudi Arabia, UAE, Qatar, etc.)

- 5.8.5.1.2 Turkey

- 5.8.5.1.3 Rest of Middle East

- 5.8.5.2 Africa

- 5.8.5.2.1 South Africa

- 5.8.5.2.2 Rest of Africa

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Bosch Service Solutions GmbH

- 6.4.2 Cisco Systems Inc.

- 6.4.3 AT&T Inc.

- 6.4.4 IBM Corporation

- 6.4.5 Intel Corporation

- 6.4.6 SAP SE

- 6.4.7 Oracle Corporation

- 6.4.8 Freightgate Inc.

- 6.4.9 ORBCOMM Inc.

- 6.4.10 HCL Technologies Ltd.

- 6.4.11 Honeywell International Inc.

- 6.4.12 Microsoft Corporation

- 6.4.13 Siemens AG

- 6.4.14 Zebra Technologies Corp.

- 6.4.15 Trimble Inc.

- 6.4.16 Descartes Systems Group

- 6.4.17 Sensitech Inc.

- 6.4.18 Project44 Inc.

- 6.4.19 FourKites Inc.

- 6.4.20 Huawei Technologies Co. Ltd.

- 6.4.21 JD Logistics

- 6.4.22 DHL Supply Chain

- 6.4.23 FedEx Corp.

- 6.4.24 UPS Inc.