|

市場調查報告書

商品編碼

1851809

數位交易管理(DTM):市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Digital Transaction Management (DTM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

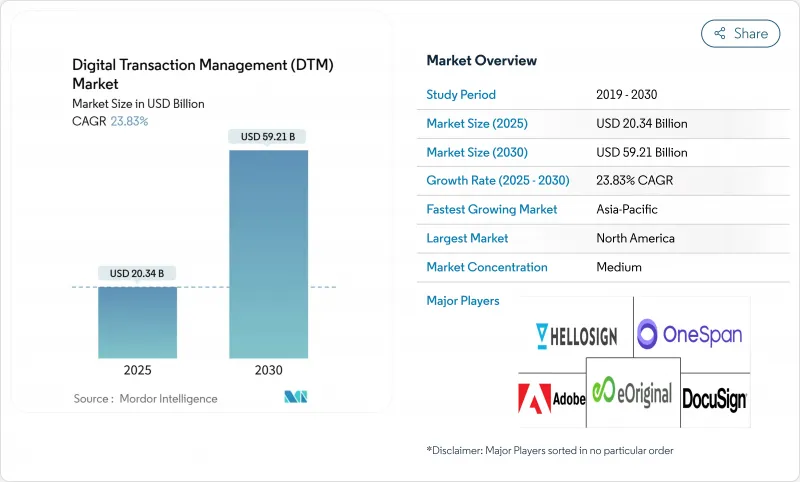

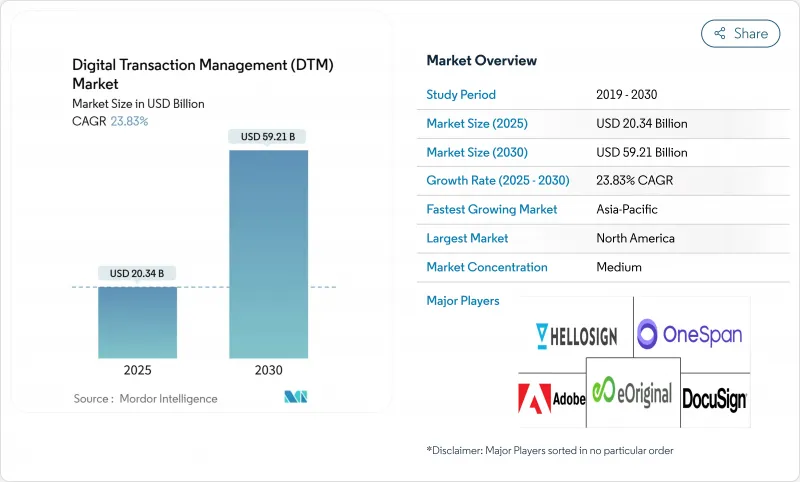

數位交易管理市場預計到 2025 年將達到 203.4 億美元,到 2030 年將達到 592.1 億美元,複合年成長率高達 23.83%。

投資人認為,這一發展趨勢表明,企業如今已將數位化工作流程視為核心策略的一部分,而非後勤部門最佳化措施。區塊鏈技術在防篡改審核追蹤方面的加速應用、遠端辦公政策的快速普及以及雲端交付模式的興起,以及生成式人工智慧文件工具的穩步發展,都在推動市場需求。以 HIPAA、GDPR 和 eIDAS 為代表的網路安全法規的整合,進一步強化了確保資料完整性、身分驗證和全球可執行性的解決方案的必要性。

全球數位交易管理 (DTM) 市場趨勢與洞察

電子簽章在受監管產業的應用加速發展

目前,美國已有43個州允許在選舉法規中使用電子簽章,運輸部也正在最終敲定修正案,將電子認證視為藥物檢測紀錄的法律效力來源。這些先例表明,法律的公開透明可以消除殘餘的疑慮,並使企業在確保合規的前提下,將文件處理週期縮短75%。例如,大型醫療機構正在使用合格的電子簽章來跨州同步同意書,避免了郵件延誤,從而提高了病患滿意度並降低了行政成本。

銀行、金融服務和保險機構以及政府機構轉向端到端合約生命週期自動化

銀行同時處理超過2萬份活躍合約,由於監管不力,可能面臨高達9%的收入損失。花旗銀行推出的基於區塊鏈的代幣服務,展示了即時結算如何降低營運風險,並為負責人釋放營運成本效益。政府機構也紛紛效仿,將採購文件集中到搜尋的儲存庫中,以實現近乎即時的政策審核並減少詐欺行為。這些舉措凸顯了為何超越簡單電子簽章的全面自動化正成為資訊長預算中必不可少的項目。

複雜的跨境加密簽名法規

儘管eIDAS高度重視合格電子簽章的證據效力,但歐盟以外的相互核准仍然不足(helpx.adobe.com)。此外,諸如GDPR之類的資料主權指令與美國《雲端法案》(CLOUD Act)規定的域外權利主張存在衝突(isaca.org)。這種監管體系的複雜性限制了數位交易管理市場近期的發展,因為其增加了法律諮詢成本,並延長了尋求支持跨國工作流程的供應商的市場推廣計劃。

細分市場分析

到2024年,解決方案將佔總收入的70%,但在數位交易管理市場中,預計到2030年,服務將維持最高的複合成長率,達到28.3%。金融機構在升級其傳統系統時,往往缺乏內部監管方面的專業知識,這增加了對整合、合規和託管支援的需求。在2024年的一個案例中,一個顧問團隊將電子簽章工作流程與核心銀行帳簿整合,從而減少了處理錯誤和營運成本。

區塊鏈模組嵌入了不可篡改的審核追蹤,人工智慧分類實現了數據採集的自動化,供應商也迅速發布了符合 HIPAA 和 SOC 2 標準的行業特定模板,從而縮短了醫療保健和金融客戶的價值實現時間。儘管如此,關鍵任務工作流程的複雜性仍然需要依賴外部專業知識,這也支撐了服務收入的成長。

2024年,雲端平台將佔75%的市場佔有率,年複合成長率達26.1%,到2030年,雲端部署的數位交易管理市場規模可望翻倍。企業重視訂閱定價模式、快速部署以及通過ISO 27001和FedRAMP審核的資料中心。多重雲端架構透過將敏感資料路由到本地主權雲,同時在公共基礎架構中預留突發容量,從而在敏捷性和合規性之間取得平衡。

國防、關鍵基礎設施和部分金融機構仍然保留本地部署,但即使是這些用戶也開始採用混合控制平面,在其防火牆後部署雲端功能。隨著加密金鑰管理、機密運算和零信任框架的日趨成熟,對全面雲端化的抵制可能會降低,從而繼續保持雲端採用率上升的趨勢。

區域分析

到2024年,北美將佔數位交易管理市場收入的30.21%。圍繞電子記錄的成熟法律法規正在推動私營部門和聯邦政府的採用。美國運輸部即將訂定的關於電子藥物試紙的規則表明,對數位信任的監管力度將繼續加強(federalregister.gov)。美國醫療保健合規藍圖同樣加速了電子記錄的普及,醫療服務提供者正在利用符合HIPAA標準的電子簽章系統來簡化理賠流程(iclg.com)。總部位於該地區的技術供應商不斷部署人工智慧功能,以提升服務品質並使其高價許可證更具吸引力。

亞太地區正經歷最快的成長,複合年成長率高達28.6%。該地區處理著全球一半以上的數位支付,預計到2027年,B2C電子商務規模將超過4兆歐元(4.3兆美元)(tmcnet.com)。印度的統一支付介面(UPI)旨在實現每年超過2000億筆交易,這將推動可擴展簽名引擎的需求。酒店、物流和政府部門也在積極採用數位契約,以滿足其移動優先的消費群的需求。儘管監管方面仍存在差異,但像印尼這樣的國家現在允許使用數位契約,只要滿足基本的同意原則即可(mondaq.com),這標誌著監管正在逐步趨同。

歐洲已實施eIDAS系統,該系統賦予電子簽章與手寫簽名同等的法律效力(helpx.adobe.com)。即將推出的eDAS 2.0法規和歐盟數位身分錢包預計將實現無縫的跨境簽名,從而增強市場信心。拉丁美洲和中東及非洲地區正經歷高速成長,儘管基準較小。巴西和海灣國家的政府數位化項目,以及不斷擴大的寬頻接入,為這些地區的數位交易管理產業創造了有利條件。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加速受監管產業電子簽章的普及應用

- 銀行、金融服務和保險機構以及政府機構轉向端到端合約生命週期自動化

- 強制遠端辦公促進了雲端基礎管理(DTM)的普及。

- 生成式人工智慧助理縮短了文件處理時間

- 點擊式廣告推動亞洲電子商務轉換率

- 數位身分框架(eIDAS 2.0、Aadhaar、NID)將推動其普及應用。

- 市場限制

- 複雜的跨境加密簽名法規

- 新興市場合格遠距身分認證的高成本

- 碎片化的傳統核心銀行工作流程阻礙了全面自動化。

- 農村地區5G/Edge基礎設施有限,減緩了行動數位地圖模型(DTM)的普及。

- 價值鏈分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟趨勢影響評估

- 投資分析

第5章 市場規模與成長預測

- 按組件

- 解決方案

- 服務

- 透過部署模式

- 雲

- 本地部署

- 按組織規模

- 小型企業

- 主要企業

- 按最終用戶行業分類

- 銀行、金融服務和保險

- 醫療保健和生命科學

- 零售與電子商務

- 政府和公共部門

- 資訊科技/通訊

- 教育

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Adobe Inc.

- DocuSign, Inc.

- Dropbox, Inc.

- Nintex Global Ltd.

- Namirial SpA

- OneSpan Inc.

- Wolters Kluwer NV

- Entrust Corporation

- SignEasy Inc.

- Mitratech Holdings Inc.

- Sertifi, Inc.

- Thales Group(Gemalto NV)

- Nitro Software Ltd.

- airSlate Inc.

- PandaDoc Inc.

- Conga(Apttus Corporation)

- Zoho Corporation Pvt. Ltd.

- ZorroSign, Inc.

- Topaz Systems Inc.

- InfoCert SpA

- AssureSign LLC

- eOriginal, Inc.

第7章 市場機會與未來展望

The digital transaction management market stands at USD 20.34 billion in 2025 and is projected to reach USD 59.21 billion by 2030, sustaining a robust 23.83% CAGR.

Investors view this trajectory as evidence that organizations now treat digital workflows as part of core strategy rather than back-office optimization. Accelerated deployment of blockchain for tamper-proof audit trails, rapid adoption of remote-work policies that favor cloud delivery, and a steady rise in generative-AI document tools collectively reinforce demand. Cyber-regulation alignment-most notably HIPAA, GDPR, and eIDAS-further legitimizes solutions that guarantee data integrity, identity assurance, and global enforceability.

Global Digital Transaction Management (DTM) Market Trends and Insights

Accelerating E-Signature Adoption Across Regulated Industries

U.S. election rules now allow e-signatures in 43 states, and the Department of Transportation is finalizing amendments that treat electronic attestations as legally valid for drug-testing records. These precedents demonstrate how statutory openness removes residual skepticism, letting enterprises shorten document cycles by 75% while maintaining compliance. Large health providers, for example, rely on qualified electronic signatures to synchronize cross-state consent forms without postal delays, thereby elevating patient satisfaction and trimming administrative overhead.

Shift Toward End-to-End Contract Lifecycle Automation in BFSI and Government

Banks process more than 20,000 active contracts simultaneously, exposing them to revenue leakage of up to 9% when oversight is weak. The rollout of blockchain-backed Citi Token Services shows how real-time settlement can shrink operational risk and unlock working-capital benefits for treasurers. Government agencies follow suit by centralizing procurement documents into searchable repositories, enabling near-instant policy audits and mitigating fraud. Together, these moves underscore why holistic automation-beyond simple e-signatures-is becoming mandatory budgeting line-item for CIOs.

Complex Cross-Border Crypto-Signature Regulations

eIDAS assigns top evidentiary weight to Qualified Electronic Signatures, yet mutual recognition outside the EU remains uneven (helpx.adobe.com). Additionally, data sovereignty mandates such as GDPR conflict with extraterritorial requests under the US CLOUD Act (isaca.org). This patchwork raises legal counsel costs and elongates go-to-market plans for providers trying to support multinational workflows, therefore tempering the digital transaction management market's near-term acceleration.

Other drivers and restraints analyzed in the detailed report include:

- Generative-AI Assistants Reducing Document Turn-Around Times

- Digital Identity Frameworks Catalyzing Adoption

- Limited 5G / Edge Infrastructure in Rural Areas Slowing Mobile DTM Usage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 70% of 2024 revenue, but services are forecast to expand at a 28.3% compound rate to 2030, the highest within the digital transaction management market. Financial institutions upgrading legacy stacks often lack in-house regulatory expertise, fueling demand for integration, compliance, and managed support. Example engagements in 2024 reduced processing errors and operating expense when consultancy teams unified e-signature workflows with core banking ledgers.

The solutions category is not stagnant; blockchain modules embed immutable audit trails while AI classification automates data capture. Vendors release vertical-specific templates that satisfy HIPAA and SOC 2 out-of-the-box, shortening time-to-value for healthcare and finance clients. Nevertheless, the intricate nature of mission-critical workflows implies ongoing reliance on external specialists, which sustains the services revenue curve.

Cloud platforms held 75% share in 2024, and their 26.1% CAGR means the digital transaction management market size for cloud deployments could double well before 2030. Enterprises value subscription pricing, rapid provisioning, and certified data centers that pass ISO 27001 and FedRAMP audits. Multi-cloud architectures now route sensitive data to local sovereign clouds while reserving burst capacity on public infrastructure, balancing agility with compliance.

On-premise installations still exist for defense, critical infrastructure, and select financial institutions, yet even these buyers adopt hybrid control planes that mirror cloud features behind the firewall. As encryption key management, confidential computing, and zero-trust frameworks mature, resistance to full cloud conversion will erode, maintaining the upward bias in cloud uptake.

The Digital Transaction Management Market Report is Segmented by Component (Solutions, Services), Deployment Mode (Cloud, On-Premise), Organization Size (Small and Medium Enterprises, Large Enterprises), End-User Industry (Banking, Financial Services and Insurance, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 30.21% of digital transaction management market revenue in 2024. Mature legal clarity around electronic records encourages both private-sector and federal adoption. The U.S. Department of Transportation's pending rule on electronic drug-testing forms demonstrates continuous regulatory reinforcement of digital trust (federalregister.gov). Healthcare compliance roadmaps in the United States similarly accelerate usage, as providers exploit HIPAA-compatible e-signature stacks to streamline claims (iclg.com). Technology vendors headquartered in the region continue to roll out AI features that differentiate service quality and justify premium licensing.

Asia-Pacific is the fastest-growing arena with a 28.6% CAGR. The region processes more than half of the world's digital payments, and B2C e-commerce is projected to exceed EUR 4 trillion (USD 4.3 trillion) by 2027 (tmcnet.com). India's Unified Payments Interface aims beyond 200 billion annual transactions, intensifying demand for scalable signature engines. Hospitality, logistics, and public administration segments likewise embrace digital contracts to keep pace with a mobile-first consumer base. Regulatory heterogeneity remains, yet countries such as Indonesia recognize digital contracts provided core consent principles are satisfied (mondaq.com), signaling gradual convergence.

Europe benefits from the harmonized eIDAS regime, where qualified electronic signatures hold equivalence with handwritten ones (helpx.adobe.com). The forthcoming eIDAS 2.0 provisions and the EU Digital Identity Wallet promise seamless cross-border signing, reinforcing market confidence. Latin America and the Middle East and Africa record smaller baselines but high growth rates. Government digitization programs in Brazil and Gulf economies, coupled with expanding broadband access, create favorable conditions for the digital transaction management industry in those territories.

- Adobe Inc.

- DocuSign, Inc.

- Dropbox, Inc.

- Nintex Global Ltd.

- Namirial S.p.A.

- OneSpan Inc.

- Wolters Kluwer N.V.

- Entrust Corporation

- SignEasy Inc.

- Mitratech Holdings Inc.

- Sertifi, Inc.

- Thales Group (Gemalto N.V.)

- Nitro Software Ltd.

- airSlate Inc.

- PandaDoc Inc.

- Conga (Apttus Corporation)

- Zoho Corporation Pvt. Ltd.

- ZorroSign, Inc.

- Topaz Systems Inc.

- InfoCert S.p.A.

- AssureSign LLC

- eOriginal, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating E-Signature Adoption Across Regulated Industries

- 4.2.2 Shift Toward End-to-End Contract Lifecycle Automation in BFSI and Government

- 4.2.3 Mandatory Remote-Work Compliance Spurring Cloud-Based DTM Uptake

- 4.2.4 Generative-AI Assistants Reducing Document Turn-Around Times

- 4.2.5 Click-Wrap Acceptance Driving E-Commerce Conversion in Asia

- 4.2.6 Digital Identity Frameworks (eIDAS 2.0, Aadhaar, NID) Catalyzing Adoption

- 4.3 Market Restraints

- 4.3.1 Complex Cross-Border Crypto-Signature Regulations

- 4.3.2 High Cost of Qualified Remote ID Assurance in Emerging Markets

- 4.3.3 Fragmented Legacy Core-Banking Workflows Hindering Full Automation

- 4.3.4 Limited 5G / Edge Infrastructure in Rural Areas Slowing Mobile DTM Usage

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Macroeconomic Trend Impact Assessment

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 Banking, Financial Services and Insurance

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Retail and E-commerce

- 5.4.4 Government and Public Sector

- 5.4.5 IT and Telecommunications

- 5.4.6 Education

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Adobe Inc.

- 6.4.2 DocuSign, Inc.

- 6.4.3 Dropbox, Inc.

- 6.4.4 Nintex Global Ltd.

- 6.4.5 Namirial S.p.A.

- 6.4.6 OneSpan Inc.

- 6.4.7 Wolters Kluwer N.V.

- 6.4.8 Entrust Corporation

- 6.4.9 SignEasy Inc.

- 6.4.10 Mitratech Holdings Inc.

- 6.4.11 Sertifi, Inc.

- 6.4.12 Thales Group (Gemalto N.V.)

- 6.4.13 Nitro Software Ltd.

- 6.4.14 airSlate Inc.

- 6.4.15 PandaDoc Inc.

- 6.4.16 Conga (Apttus Corporation)

- 6.4.17 Zoho Corporation Pvt. Ltd.

- 6.4.18 ZorroSign, Inc.

- 6.4.19 Topaz Systems Inc.

- 6.4.20 InfoCert S.p.A.

- 6.4.21 AssureSign LLC

- 6.4.22 eOriginal, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment