|

市場調查報告書

商品編碼

1851801

機器人作業系統:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Robot Operating System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

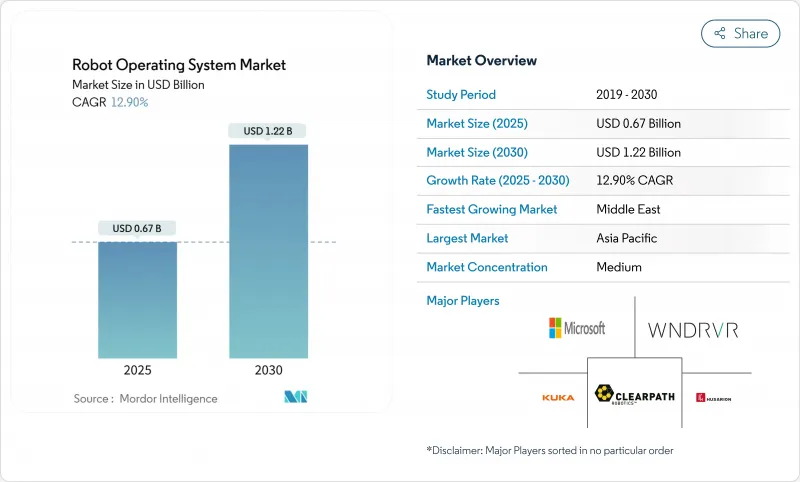

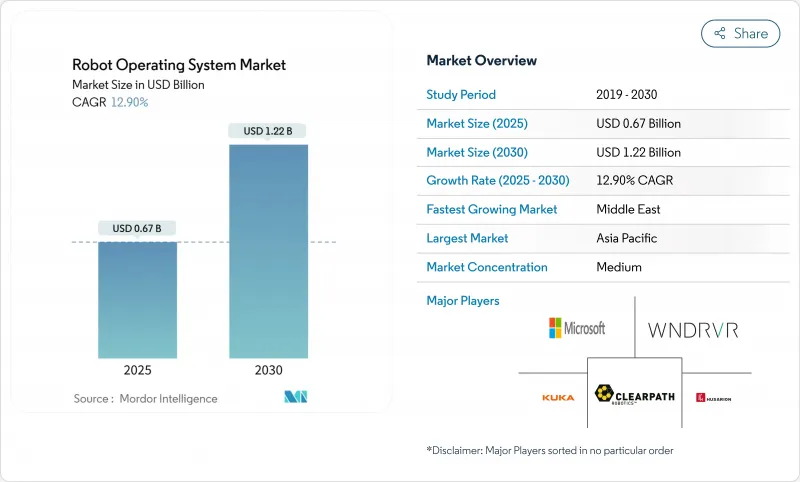

預計到 2025 年,機器人作業系統市場價值將達到 6.7 億美元,到 2030 年將達到 12.2 億美元,年複合成長率為 12.9%。

工業自動化程度的提高、互通性需求的不斷成長以及向開放式模組化軟體的轉變推動了ROS的發展。這種軟體使機器人能夠適應不斷變化的現場環境,而無需進行大規模的重新設計。邊緣運算和5G技術的進步使即時控制更貼近機器人,而雲端模擬和機器人即服務(ROaaS)模式降低了機器人技術新進入者的門檻。 ROS-Industrial庫的廣泛應用實現了運動、感知和安全功能的標準化,從而縮短了部署時間。汽車、電子和醫療保健製造商是ROS的主要採用者,他們需要在滿足大量生產需求的同時,兼顧靈活的工具配置。隨著ROS 1將於2025年5月停止支持,那些提供長期支援、增強安全性和更新編配的平台供應商正在將自身定位為高階服務提供者。

全球機器人作業系統市場趨勢與洞察

搭載ROS技術的協作機器人正在汽車組裝得到越來越廣泛的應用。

汽車集團正加速採用協作機器人,以縮短節拍時間並解決技術純熟勞工短缺問題。大眾、通用汽車和特斯拉正在整合基於ROS的協作機器人,用於粘合、檢測和擰螺絲等任務,以提高工位吞吐量並保持較高的一次產量比率。 Stellantis公司在位於米拉菲奧裡的工廠透過將行動機械手臂與擴增實境引導數位雙胞胎回饋同步,實現了組裝效率27%的提升。配置了ROS 2的協作機器人受益於DDS中間件,該中間件消除了單點故障並支援安全參數的即時更新。感測器成本的下降和即插即用工具的出現,進一步縮短了混合車型生產線的整合時間,從而持續推動著這一成長。

擴展雲端基礎的模擬平台

工業開發人員擴大在虛擬環境中檢驗機器人的全部工作負載,然後再將硬體部署到工廠車間。 FogROS2-FT 框架透過將運算密集型運動規劃查詢卸載到多個雲端點,將模擬成本降低了 2.2 倍,並提高了容錯能力。 AWS RoboMaker 和類似服務提供持續整合鉤子,每次程式碼提交都會觸發自動回歸測試,從而縮短開發週期。開發人員利用這些管線迭代感知和抓取演算法,而無需停止實際生產線,從而加快新產品上線速度。

分散式 ROS 網路中的網路安全漏洞

ROS 1 節點依賴未加密的 TCPROS 主題,這些主題容易被偽造和重播,從而可能暴露安全關鍵型致動器。 ROS 2 透過 DDS 整合了身份驗證和存取控制插件,但當叢集跨越多個 VLAN 時,配置錯誤仍然很常見。最近的滲透測試揭示了醫療機器人部署中存在的憑證管理漏洞,促使營運商實施零信任策略、網路分段和即時異常檢測。產業聯盟目前正在發布安全加固指南,但中小製造商往往缺乏網路安全負責人來應用建議的修補程式。

細分市場分析

工業機器人因其在焊接、碼垛、數控加工等領域的長期應用,預計到2024年將佔總收入的57%。發那科(FANUC)的100萬台機器人銷售里程碑凸顯了其龐大且成熟的裝置量。在這一領域,協作機器人(cobot)佔汽車部署的四分之一,凸顯了其在混合車型生產線上實現人機協作的潛力。服務機器人,尤其是物流機器人(AMR)和醫院運輸機器人,預計到2030年將以16.8%的複合年成長率成長,這主要得益於電子商務履約壓力和患者照護品質的舉措。

服務領域的成長動能也體現在導航平台與人工智慧視覺技術結合,應用於貨架補貨和自主清潔等領域的日益普及。供應商正利用 ROS 2 的即時服務品質設置,確保大型設施內 SLAM 地圖的一致性。隨著訂閱價格與設施管理預算相符,面向專業環境的服務小組的機器人作業系統市場規模預計將迅速擴大。工業設備製造商正擴大將分析儀表板和預測性維護功能整合到系統中,從而提升運作指標。

汽車製造商利用基於 ROS 的運動規劃和品質檢測流程,在不造成生產線停機的情況下管理更高的車型差異。六足機器人對準系統支援駕駛輔助功能所需的頭燈校準和光學感測器定位。一項連網自動駕駛車輛展示了由 ROS 2 同步的 AMR 標籤器如何實現零件箱的即時補充,從而提高生產線末端工位的吞吐量。

醫療保健產業成長最為迅猛,複合年成長率高達15.91%。基於ROS的手術輔助設備採用確定性循環時序來協調多軸刀具路徑,從而實現嚴格的運動學精度目標。諸如PeTRA之類的醫院物流平台將ROS 2與先進的人機互動(HRI)模組相結合,能夠在人群中導航並即時回應患者生命徵象。隨著醫療機構手術室的數位化,醫療機器人的機器人作業系統市場規模預計將擴展到診斷和復健領域。

機器人作業系統市場按機器人類型(工業機器人、服務機器人)、最終用戶產業(汽車、其他)、元件(軟體堆疊、服務)、部署模式(本地部署、雲端部署)、作業系統發行版(ROS 1、其他)、硬體架構支援(x86、其他)和地區進行細分。市場預測以美元計價。

區域分析

亞太地區預計到2024年將佔全球收入的38%,這主要得益於中國、日本和韓國的大規模自動化投資。超過200家公司參加了在上海舉行的ROSCon China大會,充分展現了該地區機器人作業系統社群的強大實力。政府資助正在加速技術的應用:韓國的Tech Valley撥款資助了針對小批量電子工廠的人工智慧推理加速器項目,而新加坡的ART C測試平台正在試點一個先進的3D視覺庫。隨著國內供應商將低成本機器人引入東協製造走廊,該地區的機器人作業系統市場規模預計將保持成長動能。

到2030年,中東地區將以17.1%的複合年成長率實現最快成長。沙烏地阿拉伯的「2030願景」和阿拉伯聯合大公國的「30,000億行動」等國家計畫都著重發展機器人技術,以擺脫對碳氫化合物的依賴。杜拜政府支持的示範區簡化了監管合規流程,並允許對倉儲機器人和手術機器人進行快速測試。區域系統整合商正與歐洲零件製造商合作,以實現供應鏈本地化,並增強自給自足能力。

北美仍然是創新中心,匯聚了ROS的核心維護者和超大規模雲端服務供應商。 ROS工業聯盟美洲分會為其成員(涵蓋航太、石油舉措和食品加工等產業)引入了開放原始碼品質保證流程。各大學擁有豐富的新興企業資源,將適應性運籌學成果轉化為能夠獲得創業投資的衍生公司。此外,製造業回流計畫和先進製造設備的稅收優惠政策也進一步推動了市場需求。

歐洲擁有高度密集的工業機器人,並且各國政府都強制要求網路安全自動化。光是德國就擁有歐洲三分之一的機器人裝機量,並正在推動基於ROS的維修,作為其工業4.0框架的一部分。西班牙和匈牙利等國在2024年實現了兩位數的機器人存量成長。在歐登塞進行的一項調查顯示,丹麥協作機器人製造商正與人工智慧研究人員進行合作研發,以實現自適應取放功能的商業化。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 搭載 ROS 技術的協作機器人正擴大應用於汽車組裝(亞洲)

- 雲端基礎模擬平台擴充(北美、歐洲)

- 政府資助的機器人測試平台數量激增(亞太和中東地區)

- 將 ROS 2 與 5G 和邊緣 AI 整合,用於 AMR(全球)

- 快速採用開放原始碼工業庫(ROS-Industrial)

- 廠商轉向長期支援(LTS)發行版

- 市場限制

- 分散式 ROS 網路中的網路安全漏洞

- 跨OEM廠商的細粒硬體抽象層

- 新興市場ROS認證人員短缺

- 安全關鍵應用中即時確定性面臨的挑戰

- 價值/供應鏈分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按機器人類型

- 工業機器人

- 鉸接式

- Scala

- 平行/Delta

- 笛卡兒/線性

- 協作機器人(cobots)

- 服務機器人

- 專業服務機器人

- 物流機器人

- 醫療保健/醫療機器人

- 國防與安全機器人

- 農業機器人

- 個人與家庭服務機器人

- 工業機器人

- 按最終用戶行業分類

- 車

- 電氣和電子

- 醫療保健和生命科學

- 電子商務與物流

- 航太與國防

- 飲食

- 農業

- 教育與研究

- 其他(金屬、塑膠等)

- 按組件

- 軟體堆疊

- 核心 ROS 庫

- 中介軟體/通訊工具

- 仿真和視覺化(Gazebo、RViz)

- 服務

- 系統整合和諮詢

- 支援與維護

- 培訓和認證

- 軟體堆疊

- 按作業系統發行

- ROS 1

- ROS 2

- 其他變體(ROS-工業版、微型ROS)

- 透過支援的硬體架構

- x86

- ARM

- RISC-V 等。

- 透過部署模式

- 本地部署

- 雲端基礎的(ROS-aaS)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 北歐國家

- 瑞典

- 挪威

- 丹麥

- 芬蘭

- 冰島

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 印尼

- 亞太其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Microsoft Corporation

- Amazon Web Services Inc.

- Clearpath Robotics Inc.

- KUKA AG

- Bosch Rexroth AG

- ABB Ltd.

- FANUC Corp.

- Yaskawa Electric Corp.

- Universal Robots A/S

- Open Robotics(Intrinsic)

- Wind River Systems Inc.

- Husarion Inc.

- Brain Corporation

- Neobotix GmbH

- PAL Robotics SL

- Locus Robotics Corp.

- Milvus Robotics

- iRobot Corporation

- Omron Corporation

- Siasun Robot & Automation

- Fetch Robotics(Zebra)

- Teradyne Mobility(AGV)

第7章 市場機會與未來展望

The robot operating system market size is estimated at USD 0.67 billion in 2025 and is forecast to reach USD 1.22 billion by 2030, advancing at a 12.9% CAGR.

Growth stems from rising industrial automation, wider interoperability requirements, and the shift toward open, modular software that lets robots adapt to changing floor-shop conditions without extensive re-engineering. Advances in edge computing and 5G are pulling real-time control closer to the robot, while cloud simulation and Robot-as-a-Service models lower entry barriers for firms new to robotics. The wide availability of ROS-Industrial libraries is standardizing motion, perception, and safety functions, accelerating deployment times. Automotive, electronics, and healthcare producers are leading adopters because they balance high volumes with a need for flexible tooling. Platform vendors that bundle long-term support, security hardening, and update orchestration are carving out premium service positions as ROS 1 approaches end-of-life in May 2025.

Global Robot Operating System Market Trends and Insights

Growing Adoption of ROS-enabled Cobots in Automotive Assembly Lines

Automotive groups are boosting collaborative-robot deployment to improve takt times and address skilled-labour gaps. Volkswagen, General Motors, and Tesla have integrated ROS-based cobots for gluing, inspection, and screw-fastening tasks, lifting station throughput and maintaining high first-pass yields. Stellantis demonstrated a 27% assembly-efficiency gain by synchronizing mobile manipulators with augmented-reality guidance and digital-twin feedback at its Mirafiori plant. Cobots configured with ROS 2 benefit from DDS middleware, which removes single points of failure and enables live safety-parameter updates. Growth remains linked to falling sensor costs and plug-and-play tooling that cuts integration time for mixed-model lines.

Expansion of Cloud-based Simulation Platforms

Industrial developers increasingly validate full robot workloads in virtual environments before placing hardware on a factory floor. The FogROS2-FT framework offloads compute-heavy motion-planning queries to multiple cloud endpoints, reducing simulation costs by 2.2X and strengthening fault tolerance. AWS RoboMaker and similar services attach continuous-integration hooks, so each code commit triggers automated regression tests, shortening development sprints. Developers use these pipelines to iterate perception and grasping algorithms without halting physical production lines, accelerating go-live timelines for new SKUs.

Cyber-Security Vulnerabilities in Distributed ROS Networks

ROS 1 nodes rely on unencrypted TCPROS topics that can be spoofed or replayed, exposing safety-critical actuators. Although ROS 2 embeds authentication and access-control plugins through DDS, misconfigurations remain common when fleets span multiple VLANs. Recent penetration tests revealed weak certificate management in healthcare robotics deployments, prompting operators to institute zero-trust policies, segmented networks, and real-time anomaly detection. Industry consortia now issue hardening guides, yet small and medium manufacturers often lack cyber-security personnel to apply recommended patches.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Government-Funded Robotics Testbeds

- Integration of ROS 2 with 5G and Edge-AI for AMRs

- Scarcity of Certified ROS Talent in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial robots contributed 57% of 2024 revenue, reflecting long-established use in welding, palletizing, and CNC tending tasks. FANUC's one-millionth unit milestone underscores the scale and installed base maturity. Within that cohort, cobots represent one-quarter of automotive deployments, highlighting the push toward human-machine collaboration on mixed-model lines. Service robots, particularly logistics AMRs and hospital couriers, are set to post a 16.8% CAGR through 2030, propelled by e-commerce fulfilment pressures and patient-care quality initiatives.

Service-segment momentum is evident in rising deployments of navigation-ready platforms paired with AI vision for shelf-restocking and autonomous cleaning. Vendors leverage ROS 2's real-time quality-of-service settings to keep SLAM maps consistent across large facilities. The Robot operating system market size for service units serving professional environments is forecast to expand rapidly as subscription pricing aligns with facility-management budgets. Industrial manufacturers increasingly bundle analytics dashboards, adding predictive-maintenance overlays that sharpen uptime metrics.

Automotive producers accounted for a commanding 24% slice of 2024 revenue, using ROS-based motion planning and quality-inspection pipelines to manage higher model variants without line stoppages. Hexapod alignment systems support headlamp calibration and optical-sensor positioning needed for driver-assistance features. Connected automated vehicle demonstrators further show how AMR tuggers synchronized by ROS 2 can replenish parts bins just-in-time, lifting throughput across end-of-line stations.

Healthcare records the steepest ascent with a 15.91% CAGR. ROS-based surgical assistants employ deterministic loop timing to coordinate multi-axis tool paths, meeting stringent kinematic accuracy targets. Hospital logistics platforms such as PeTRA combine ROS 2 with advanced HRI modules to navigate crowds and respond to patient vitals in real time. As providers digitize operating rooms, the Robot operating system market size for healthcare robotics is expected to broaden into diagnostics and rehabilitation.

Robot Operating System Market Segmented by Robot Type (Industrial Robots, Service Robots), End-User Industry (Automotive, and More), Component (Software Stack, Services), Deployment Mode (On-Premise, Cloud), Operating System Distribution (ROS 1, and More), Hardware Architecture Support (x86, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 38% of global revenue in 2024 due to heavy automation investment in China, Japan, and South Korea. Shanghai's ROSCon China attracted more than 200 firms, signifying local community depth. Government funding accelerates adoption: South Korea's Tech Valley subsidies underwrite AI inference accelerators for small-batch electronics plants, while Singapore's ART C testbeds trial advanced 3D vision libraries. The Robot operating system market size in the region is projected to keep pace as domestic suppliers extend low-cost arms into ASEAN manufacturing corridors.

The Middle East records the fastest 17.1% CAGR through 2030. National programs such as Saudi Arabia's Vision 2030 and the UAE's Operation 300bn lean on robotics to diversify away from hydrocarbons. Government-backed demonstration zones in Dubai simplify regulatory compliance, allowing rapid pilot launch for warehouse and surgical robots. Regional system integrators partner with European component makers to localize supply chains, reinforcing self-sufficiency goals.

North America remains an innovation nucleus, hosting core ROS maintainers and hyperscale cloud providers. The ROS-Industrial Consortium Americas showcases open-source quality-assurance pipelines to a membership spanning aerospace, oil & gas, and food processing. Universities funnel research on adaptive manipulation into spin-offs that secure venture capital, sustaining a rich start-up pipeline. Demand is further buoyed by reshoring initiatives and tax incentives for advanced manufacturing equipment.

Europe combines strong industrial-robot density with government mandates for cyber-secure automation. Germany alone houses one-third of Europe's installed base and pushes ROS-based retrofits as part of its Industrie 4.0 framework. Countries such as Spain and Hungary logged double-digit robot-stock growth in 2024. Conferences in Odense underscore collaborative R&D, linking Danish cobot makers with AI researchers to commercialize adaptive pick-and-place functions.

- Microsoft Corporation

- Amazon Web Services Inc.

- Clearpath Robotics Inc.

- KUKA AG

- Bosch Rexroth AG

- ABB Ltd.

- FANUC Corp.

- Yaskawa Electric Corp.

- Universal Robots A/S

- Open Robotics (Intrinsic)

- Wind River Systems Inc.

- Husarion Inc.

- Brain Corporation

- Neobotix GmbH

- PAL Robotics SL

- Locus Robotics Corp.

- Milvus Robotics

- iRobot Corporation

- Omron Corporation

- Siasun Robot & Automation

- Fetch Robotics (Zebra)

- Teradyne Mobility (AGV)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Adoption of ROS-enabled Cobots in Automotive Assembly Lines (Asia)

- 4.2.2 Expansion of Cloud-based Simulation Platforms (North America and Europe)

- 4.2.3 Surge in Government-funded Robotics Testbeds (APAC and Middle East)

- 4.2.4 Integration of ROS 2 with 5G & Edge-AI for AMRs (Global)

- 4.2.5 Rapid Proliferation of Open-Source Industrial Libraries (ROS-Industrial)

- 4.2.6 Vendor Shift toward Long-Term Support (LTS) Distributions

- 4.3 Market Restraints

- 4.3.1 Cyber-Security Vulnerabilities in Distributed ROS Networks

- 4.3.2 Fragmented Hardware Abstraction Layers Across OEMs

- 4.3.3 Scarcity of Certified ROS Talent in Emerging Markets

- 4.3.4 Real-Time Determinism Challenges in Safety-Critical Apps

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Robot Type

- 5.1.1 Industrial Robots

- 5.1.1.1 Articulated

- 5.1.1.2 SCARA

- 5.1.1.3 Parallel/Delta

- 5.1.1.4 Cartesian/Linear

- 5.1.1.5 Collaborative Robots (Cobots)

- 5.1.2 Service Robots

- 5.1.2.1 Professional Service Robots

- 5.1.2.1.1 Logistics Robots

- 5.1.2.1.2 Healthcare and Medical Robots

- 5.1.2.1.3 Defense and Security Robots

- 5.1.2.1.4 Agricultural Robots

- 5.1.2.2 Personal and Domestic Service Robots

- 5.1.1 Industrial Robots

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.2 Electrical and Electronics

- 5.2.3 Healthcare and Life Sciences

- 5.2.4 E-commerce and Logistics

- 5.2.5 Aerospace and Defense

- 5.2.6 Food and Beverage

- 5.2.7 Agriculture

- 5.2.8 Education and Research

- 5.2.9 Others (Metal, Plastics, etc.)

- 5.3 By Component

- 5.3.1 Software Stack

- 5.3.1.1 Core ROS Libraries

- 5.3.1.2 Middleware / Communication Tools

- 5.3.1.3 Simulation & Visualization (Gazebo, RViz)

- 5.3.2 Services

- 5.3.2.1 System Integration and Consulting

- 5.3.2.2 Support and Maintenance

- 5.3.2.3 Training and Certification

- 5.3.1 Software Stack

- 5.4 By Operating System Distribution

- 5.4.1 ROS 1

- 5.4.2 ROS 2

- 5.4.3 Other Variants (ROS-Industrial, micro-ROS)

- 5.5 By Hardware Architecture Support

- 5.5.1 x86

- 5.5.2 ARM

- 5.5.3 RISC-V and Others

- 5.6 By Deployment Mode

- 5.6.1 On-premise

- 5.6.2 Cloud-based (ROS-aaS)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Rest of Europe

- 5.7.4 Nordics

- 5.7.4.1 Sweden

- 5.7.4.2 Norway

- 5.7.4.3 Denmark

- 5.7.4.4 Finland

- 5.7.4.5 Iceland

- 5.7.5 Middle East

- 5.7.5.1 GCC

- 5.7.5.2 Turkey

- 5.7.5.3 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Rest of Africa

- 5.7.7 Asia-Pacific

- 5.7.7.1 China

- 5.7.7.2 Japan

- 5.7.7.3 South Korea

- 5.7.7.4 India

- 5.7.7.5 Indonesia

- 5.7.7.6 Rest of Asia-Pacific

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Microsoft Corporation

- 6.4.2 Amazon Web Services Inc.

- 6.4.3 Clearpath Robotics Inc.

- 6.4.4 KUKA AG

- 6.4.5 Bosch Rexroth AG

- 6.4.6 ABB Ltd.

- 6.4.7 FANUC Corp.

- 6.4.8 Yaskawa Electric Corp.

- 6.4.9 Universal Robots A/S

- 6.4.10 Open Robotics (Intrinsic)

- 6.4.11 Wind River Systems Inc.

- 6.4.12 Husarion Inc.

- 6.4.13 Brain Corporation

- 6.4.14 Neobotix GmbH

- 6.4.15 PAL Robotics SL

- 6.4.16 Locus Robotics Corp.

- 6.4.17 Milvus Robotics

- 6.4.18 iRobot Corporation

- 6.4.19 Omron Corporation

- 6.4.20 Siasun Robot & Automation

- 6.4.21 Fetch Robotics (Zebra)

- 6.4.22 Teradyne Mobility (AGV)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment