|

市場調查報告書

商品編碼

1851791

公司治理、風險與合規:市場佔有率分析、產業趨勢、統計數據與成長預測(2025-2030 年)Enterprise Governance, Risk And Compliance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

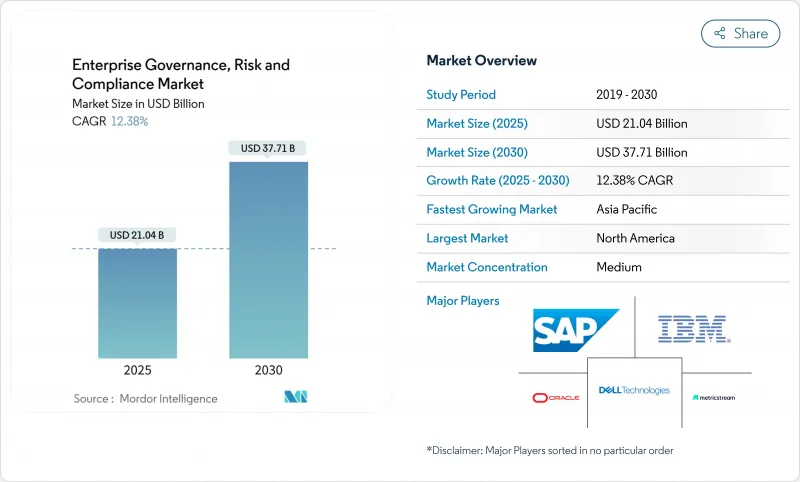

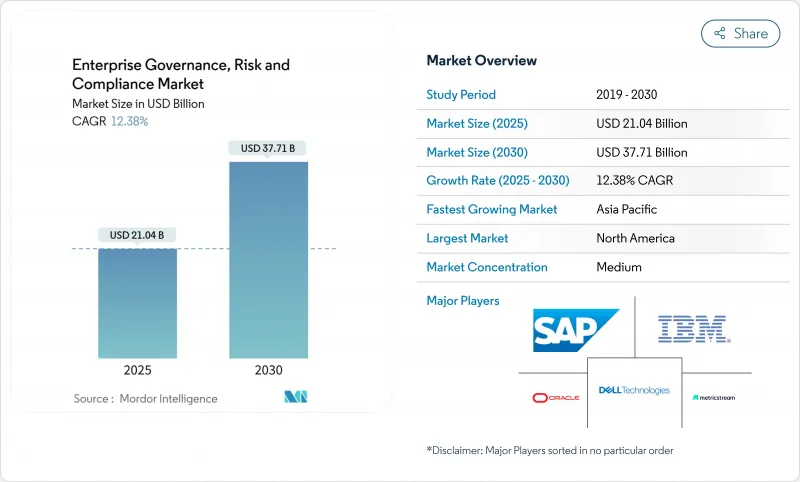

企業管治、風險和合規市場預計將在 2025 年達到 210.4 億美元,到 2030 年達到 377.1 億美元,在預測期內以 12.38% 的複合年成長率成長。

隨著各組織面臨監管要求激增,尤其是《數位營運彈性法案》(DORA) 的實施,同時積極採用人工智慧來自動化控制、解讀快速變化的規則並即時檢測異常情況,市場需求正在加速成長。整合套件將以往各自獨立的審核、政策和網路安全工作流程整合到單一資料來源中,從而顯著降低成本並加快問題解決速度,平台採用率也因此不斷提高。早期採用者報告稱,透過將人工智慧驅動的管治分析整合到安全遠端檢測中,誤報率降低了高達 42%。此外,保險公司利用即時 GRC 指標來確定保費,將卓越的治理績效與保費折扣和競爭優勢掛鉤,這進一步推動了市場發展。

全球公司治理、風險與合規市場趨勢及洞察

嚴格的政府法規和指令推動平台整合

《資料保護條例》(DORA) 將於 2025 年 1 月生效,該條例要求歐盟金融機構納入資訊通訊技術 (ICT) 風險框架,涵蓋事件回應、彈性測試和第三方監控。目前,各機構每天要監控超過 250 項監理變更,速度遠超過人工流程。機器學習模型能夠解析新法規,評估其相關性,並在幾分鐘內將任務分配給相關負責人,使合規團隊能夠專注於策略風險分析。因此,提供多司法管轄區映射和自動更新引擎的供應商在各公司的候選名單中名列前茅。不合規不僅會面臨巨額罰款,還會損害聲譽,而儘早採取合規措施則能展現其營運的彈性,從而確保投資者信心。

日益嚴峻的網路安全威脅推動了GRC技術的整合

到2024年,網路安全事件將激增75%,迫使資訊安全長(CISO)將安全態勢指標納入核心管治儀表板,而不是孤立地看待它們。將策略檢查與威脅遠端檢測疊加的單一主機可以減少重複工作,並加快混合環境中漏洞的修復速度。採用人工智慧賦能的GRC套件的醫療保健機構,其風險檢測率提高了37%,誤報率降低了42%,這充分證明了整合合規性和安全數據的價值。 70%的組織認為其目前的雲端風險分配流程效率低下,因此對集中式、與雲端無關的管理方案的需求日益成長。提供可操作儀表板而非原始警報的供應商,透過減少用戶疲勞並使專家能夠專注於高影響威脅,正逐漸贏得市場青睞。

對舊有系統進行現代化改造面臨高昂的初始整合成本。

主流套件的年度訂閱費用從 5 萬美元到 50 萬美元不等,但實施成本通常是許可費的兩到六倍,這給使用老舊 ERP 系統的公司帶來了沉重的預算負擔。 SaaS 價格通膨率高達 11.3%,供應商甚至在員工人數保持不變的情況下仍將價格提高 25%,這進一步加劇了價格敏感度。將現代 GRC 工具與客製化的財務、人力資源和製造系統整合通常需要客製化 API 和變更管理程序,從而延長了專案週期。基於結果的許可和低程式碼連接器正日益普及,它們將資本支出轉化為營運支出,並透過可量化的風險降低指標來證明投資回報。

細分市場分析

解決方案將佔2024年收入的67.30%,凸顯了買家對端到端套件的偏好,這些套件將策略庫、審核追蹤、風險評分和事件回應整合到單一平台中。這種主導地位反映了企業在企業管治、風險和合規市場中對單一供應商課責和跨所有職能部門一致使用者體驗的重視。諮詢、整合和託管服務雖然絕對值較小,但預計到2030年將成長12.70%,因為企業會尋求外部專家進行監管解讀和複雜系統部署。風險管理和審核管理模組的採用速度最快,因為它們取代了電子表格工作流程,並提供高階主管可以透過行動應用程式追蹤的即時分析。供應鏈衝擊造成平均1.84億美元的損失後,對業務永續營運能力的需求激增,促使企業將業務連續性計畫與供應商評分卡直接關聯起來。

銀行和醫院對本地儲存敏感記錄的需求將推動本地部署收入在2024年成長54.20%,但隨著資訊長們青睞彈性運算能力以應對人工智慧工作負載,雲端合約將在2030年前以每年13.50%的速度成長。雲端平台能夠自動升級、縮短引進週期並賦能遠端團隊,使其對中小企業和跨國公司都極具吸引力。監管機構透過資料流分析(DORA)對第三方彈性進行審查,將促使企業要求對外部雲端供應商進行持續監督。混合模式將關鍵資料保留在企業內部,並將分析工作遷移到雲端,使風險規避型企業能夠在不違反資料駐留規則的情況下嘗試雲端服務。

服務供應商透過提供客戶管理的加密金鑰和經本地合規認證的主權雲端區域來緩解安全漏洞。他們還利用基礎設施即程式碼範本簡化部署,使用戶能夠在數小時內而非數週內建立完整的環境。由於人工智慧演算法需要龐大的訓練資料集和可擴展的GPU,雲端部署正成為配置合規分析的首選方案,這進一步鞏固了雲端在未來企業管治、風險和合規市場格局中的重要地位。

企業管治、風險與合規市場按組件(軟體和服務)、部署模式(本地部署和雲端部署)、組織規模(中小企業、大型企業)、最終用戶行業垂直領域(銀行、金融服務和保險、醫療保健和生命科學、製造業、IT和電信、能源和公共產業、其他)以及地區進行細分。市場預測以美元(USD)計價。

區域分析

北美地區擁有成熟的監管體系和雄厚的技術預算,預計2024年將貢獻全球35.2%的收入。金融機構每年在合規方面支出610億美元,99%的機構預計成本將會增加,這推動了對自動化解決方案的需求,以降低成本率。聯邦指南鼓勵企業進行自我報告和維持穩健的營運,促使企業將GRC(治理、風險和合規)投資視為競爭優勢。 ServiceNow和Visa等機構的夥伴關係表明,技術供應商如何共同開發人工智慧工作流程,在確保合規性的同時,增強爭議管理。

亞太地區預計將以13.1%的複合年成長率成為全球成長最快的地區。新加坡、澳洲和印度政府已推出與英國《反賄賂法》類似的法人責任法規,迫使企業投資現代化的合規架構。此外,亞太地區的銀行業面臨高達450億美元的金融犯罪合規成本,其中70%的銀行預計在2024年將增加軟體支出。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 嚴格的政府法規和指令

- 數位轉型帶來了日益嚴峻的網路安全威脅

- 向整合風險管理平台過渡

- 環境、社會及公司治理(ESG)報告及非財務資訊揭露規則所面臨的壓力

- 採用人工智慧驅動的預測性合規分析

- 承保對即時 GRC 指標的依賴

- 市場限制

- 熟練的GRC專業人員短缺

- 整合到傳統環境的初始成本很高

- 多重雲端下資料駐留與主權的複雜性

- 組織治理、風險與合規疲勞與警報過載

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估市場的宏觀經濟因素

第5章 市場規模與成長預測

- 按組件

- 解決方案

- 政策合規管理

- 審核管理

- 風險管理

- 事件管理

- 業務永續營運和災害復原

- 服務

- 諮詢

- 整合與實施

- 培訓和支持

- 解決方案

- 按部署模式

- 本地部署

- 雲

- 按公司規模

- 小型企業

- 主要企業

- 按最終用戶行業分類

- BFSI

- 醫療保健和生命科學

- 製造業

- 資訊科技和電訊

- 能源與公共產業

- 零售和消費品

- 政府和公共部門

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 亞太其他地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Dell Technologies(incl. RSA Security)

- IBM Corporation

- SAP SE/GRC Suite

- Oracle Corporation

- MetricStream Inc.

- Wolters Kluwer/Enablon

- SAS Institute Inc.

- Software AG

- NAVEX Global

- Thomson Reuters Corp.

- ServiceNow Inc.

- Riskonnect Inc.

- LogicManager Inc.

- OneTrust LLC

- Galvanize(Diligent)

- Ideagen Plc

- SAI Global

- AxiomSL(Adenza)

- Cura Software

- BWise(SandP Global)

- FutureShield Inc.

- Maclear LLC

- RSA Archer Suite

第7章 市場機會與未來展望

The enterprise governance risk compliance market is valued at USD 21.04 billion in 2025 and is set to reach USD 37.71 billion by 2030, advancing at a 12.38% CAGR during the forecast period.

Demand accelerates as organizations confront a surge in regulatory obligations, most notably the Digital Operational Resilience Act (DORA), while adopting AI to automate controls, interpret fast-changing rules, and flag anomalies in real time. Platform uptake intensifies because integrated suites consolidate previously siloed audit, policy, and cybersecurity workflows into a single source of truth, producing measurable cost savings and faster issue resolution. Early adopters report efficiency gains of up to 42% in false-positive reduction after embedding AI-driven compliance analytics alongside security telemetry. Momentum is further reinforced by insurers that now price coverage using real-time GRC metrics, translating strong governance performance into premium discounts and competitive advantage.

Global Enterprise Governance, Risk And Compliance Market Trends and Insights

Stringent government regulations and mandates drive platform consolidation

Heightened rulemaking continues to swell the enterprise governance risk compliance market as DORA, effective January 2025, obliges EU financial entities to embed ICT risk frameworks covering incident response, resilience testing, and third-party oversight. Firms now monitor more than 250 regulatory changes each day, a pace that outstrips manual processes. Machine-learning models parse new statutes, rank their relevance, and route tasks to accountable owners within minutes, enabling compliance teams to redeploy effort toward strategic risk analysis. Vendors offering multijurisdictional mapping and automated update engines have therefore moved to the top of enterprise shortlists. Failure to comply risks both material penalties and reputational damage, whereas early movers secure investor confidence by demonstrating operational resilience.

Rising cybersecurity threats accelerate GRC technology integration

Cyber incidents spiked 75% in 2024, pushing CISOs to embed security posture metrics into core governance dashboards instead of handling them in isolation. A single console that overlays policy checks onto threat telemetry cuts duplication and shrinks time to remediate vulnerabilities across hybrid environments. Healthcare providers adopting AI-enabled GRC suites recorded 37% stronger risk detection rates and 42% fewer false positives, illustrating the value of unifying compliance and security data. Because 70% of organizations label current cloud-risk assignment processes ineffective, appetite for centralised, cloud-agnostic controls has intensified. Suppliers that deliver actionable dashboards-rather than raw alerts-win traction by easing user fatigue and freeing specialists to focus on high-impact threats.

High initial integration costs challenge legacy system modernization

Annual subscriptions for leading suites range from USD 50,000 to USD 500,000, while implementation often costs two to six times the license fees, straining budgets for firms running ageing ERP backbones. SaaS inflation running at 11.3% further heightens price sensitivity as vendors impose 25% hikes despite flat headcount. Integrating modern GRC tools with bespoke finance, HR, and manufacturing systems often demands custom APIs and change-management programmes that extend timelines. Outcome-based licensing and low-code connectors are gaining popularity by shifting capital expenditure to operating expense and demonstrating payback through quantifiable risk-reduction metrics.

Other drivers and restraints analyzed in the detailed report include:

- AI-powered predictive compliance analytics transform risk management

- ESG reporting pressure creates new compliance categories

- Organizational GRC-fatigue impedes platform adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 67.30% of 2024 revenue, underscoring buyer preference for end-to-end suites that blend policy libraries, audit trails, risk scoring, and incident response into one stack. This dominance reflects how enterprises value single-vendor accountability and consistent user experience across all functions of the enterprise governance risk compliance market. Consulting, integration, and managed services, though smaller in absolute value, are set to grow 12.70% through 2030 as buyers turn to external experts for regulatory interpretation and complex system rollouts. Risk Management and Audit Management modules experience the fastest take-up because they replace spreadsheet workflows and provide real-time analytics that executives can track on mobile apps. Demand for Business Continuity features surged after supply-chain shocks averaged USD 184 million in losses, prompting firms to link continuity plans directly to supplier scorecards.

On-premise installations retained 54.20% of 2024 revenue because banks and hospitals must store sensitive records locally, but cloud subscriptions will expand 13.50% annually through 2030 as CIOs favor elastic compute for AI workloads. Cloud platforms automate upgrades, shorten implementation cycles, and empower remote teams, making them attractive to SMEs and multinationals alike. Regulatory scrutiny on third-party resilience through DORA pushes firms to demand continuous oversight of external cloud providers-a capability that cloud-native GRC suites embed by design. Hybrid models, which keep critical data on-site while shifting analytics to the cloud, enable risk-averse firms to test the waters without breaching residency rules.

Providers mitigate perceived security gaps by offering customer-managed encryption keys and sovereign-cloud regions certified for local compliance regimes. They also streamline deployment through infrastructure-as-code templates that stand up full environments in hours rather than weeks. As AI algorithms require large training sets and scalable GPUs, cloud deployments become the default choice for predictive compliance analytics-cementing their role in the future landscape of the enterprise governance risk compliance market.

Enterprise Governance Risk Compliance Market is Segmented by Component (Software and Services), Deployment Model (On-Premises and Cloud), Organisation Size (Small and Medium Enterprises, Large Enterprises), End-User Industry (BFSI, Healthcare and Life Sciences, Manufacturing, IT and Telecom, Energy and Utilities, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 35.2% of global revenue in 2024, supported by mature regulatory ecosystems and robust technology budgets. Financial institutions spend USD 61 billion annually on compliance, and 99% expect costs to rise, reinforcing demand for automated solutions that lower expense ratios. Federal guidelines reward self-reporting and resilient operations, so firms treat GRC investment as a competitive edge. Partnerships such as ServiceNow-Visa illustrate how technology vendors co-create AI workflows that enhance dispute management while ensuring regulatory adherence.

Asia-Pacific is projected to log a 13.1% CAGR, the highest globally. Governments in Singapore, Australia, and India introduce corporate liability rules mirroring the UK Bribery Act, compelling companies to invest in modern compliance architecture. APAC banks also confront USD 45 billion in financial-crime compliance costs, with 70% citing higher software spend in 2024, driving cloud-native uptake that aligns with rapid digitalization.

- Dell Technologies (incl. RSA Security)

- IBM Corporation

- SAP SE / GRC Suite

- Oracle Corporation

- MetricStream Inc.

- Wolters Kluwer / Enablon

- SAS Institute Inc.

- Software AG

- NAVEX Global

- Thomson Reuters Corp.

- ServiceNow Inc.

- Riskonnect Inc.

- LogicManager Inc.

- OneTrust LLC

- Galvanize (Diligent)

- Ideagen Plc

- SAI Global

- AxiomSL (Adenza)

- Cura Software

- BWise (SandP Global)

- FutureShield Inc.

- Maclear LLC

- RSA Archer Suite

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent government regulations and mandates

- 4.2.2 Rising cybersecurity threats with digital transformation

- 4.2.3 Move toward integrated risk-management platforms

- 4.2.4 ESG reporting pressure and non-financial disclosure rules

- 4.2.5 AI-powered predictive compliance analytics adoption

- 4.2.6 Insurance underwriting dependencies on real-time GRC metrics

- 4.3 Market Restraints

- 4.3.1 Lack of skilled GRC professionals

- 4.3.2 High initial integration cost for legacy environments

- 4.3.3 Data-residency and sovereignty complexity in multi-cloud

- 4.3.4 Organisational GRC-fatigue and alert overload

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Policy and Compliance Management

- 5.1.1.2 Audit Management

- 5.1.1.3 Risk Management

- 5.1.1.4 Incident Management

- 5.1.1.5 Business Continuity and Disaster Recovery

- 5.1.2 Services

- 5.1.2.1 Consulting

- 5.1.2.2 Integration and Implementation

- 5.1.2.3 Training and Support

- 5.1.1 Solutions

- 5.2 By Deployment Model

- 5.2.1 On-premises

- 5.2.2 Cloud

- 5.3 By Organisation Size

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Manufacturing

- 5.4.4 IT and Telecom

- 5.4.5 Energy and Utilities

- 5.4.6 Retail and Consumer Goods

- 5.4.7 Government and Public Sector

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Dell Technologies (incl. RSA Security)

- 6.4.2 IBM Corporation

- 6.4.3 SAP SE / GRC Suite

- 6.4.4 Oracle Corporation

- 6.4.5 MetricStream Inc.

- 6.4.6 Wolters Kluwer / Enablon

- 6.4.7 SAS Institute Inc.

- 6.4.8 Software AG

- 6.4.9 NAVEX Global

- 6.4.10 Thomson Reuters Corp.

- 6.4.11 ServiceNow Inc.

- 6.4.12 Riskonnect Inc.

- 6.4.13 LogicManager Inc.

- 6.4.14 OneTrust LLC

- 6.4.15 Galvanize (Diligent)

- 6.4.16 Ideagen Plc

- 6.4.17 SAI Global

- 6.4.18 AxiomSL (Adenza)

- 6.4.19 Cura Software

- 6.4.20 BWise (SandP Global)

- 6.4.21 FutureShield Inc.

- 6.4.22 Maclear LLC

- 6.4.23 RSA Archer Suite

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment