|

市場調查報告書

商品編碼

1851790

區塊鏈在製造業的應用:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Blockchain In Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

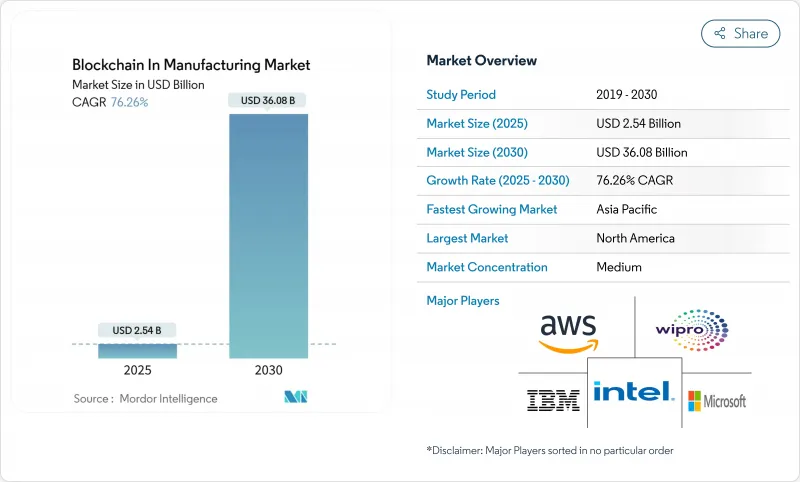

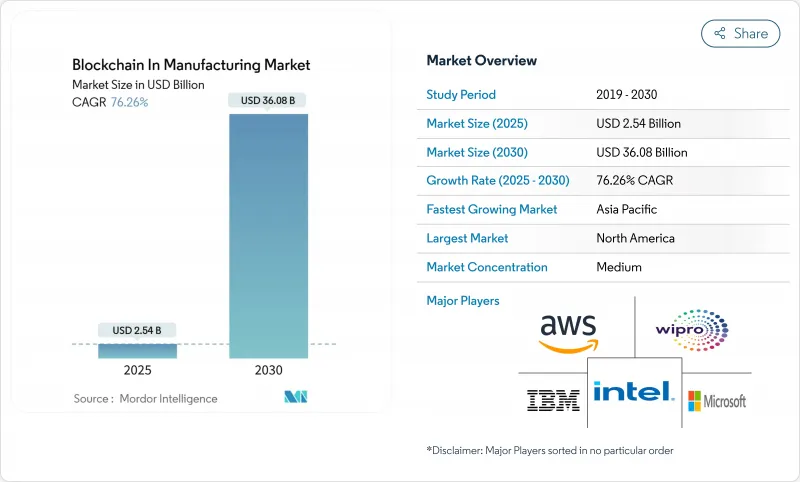

預計到 2025 年,製造業區塊鏈市場規模將達到 25.4 億美元,到 2030 年將達到 360.8 億美元,預測期(2025-2030 年)複合年成長率為 76.26%。

採用不可篡改的帳本進行批量認證、防偽和設備代幣化的應用日益普及,加速了從先導計畫向企業級部署的過渡。日益嚴格的監管審查,尤其是在《藥品供應鏈安全法案》的推動下,迫使製造商採用分散式帳本來實現序列化和召回管理的自動化。雲端基礎的區塊鏈即服務 (BaaS) 平台也降低了中小型工廠的進入門檻。儘管標準分散和精通區塊鏈的操作技術短缺阻礙了短期內的應用,但雲端超大規模資料中心業者雲端服務商和工業原始設備製造商 (OEM) 之間的戰略夥伴關係正在彌合能力差距。

全球製造業區塊鏈市場趨勢與洞察

離散製造業中BaaS(後端即服務)的日益普及

目前,雲端交付的區塊鏈即服務 (BaaS) 在離散製造業的採用率已達 61.8%,這主要得益於其承包的環境,無需專門的節點管理。將區塊鏈遙測數據整合到微軟 Fabric 分析套件中,用戶可以查詢生產線事件以及企業數據,從而將系統整合時間縮短 35%。這種成本節約和簡化 DevOps 的組合,必將使 BaaS 成為汽車、電子和工業設備工廠的熱門選擇,因為這些工廠需要快速上線和嚴格的執行時間。

強制性供應鏈認證和可追溯性

美國食品藥物管理局 (FDA) 延長了食品可追溯性規則的最後期限,但重申區塊鏈非常適合滿足批次級不可篡改的報告要求。歐盟的同期數位產品護照法規也強調了在產品生命週期的每個階段建立分散式記錄的必要性。製藥、航太和消費性電子產品製造商將序列資料嵌入共用帳本,用於自動召回,從而將人工審核成本降低了 28%。

標準碎片化和互通性差距

由於缺乏通用資料模型,供應商必須為每個交易對象建造成本高昂的中間件橋接器。 GS1 和 ISO工作小組正在起草通用模式,但其應用進度落後於快速推進的實施期限。汽車和化學工業正在進行基於聯盟的試點項目,但這些項目規模仍然較小,遠未達到標準水準。

細分市場分析

預計到2030年,品管和合規工具的複合年成長率將達到77.4%,超過物流管理。物流管理在2024年佔據了製造業區塊鏈市場佔有率的46%。進行FDA序列化測試的製藥公司報告稱,當批次歷史記錄儲存在分散式帳本上時,偏差解決速度提高了30%。自動簽發審核證書的智慧合約工作流程取代了紙本記錄,將合規時間縮短了40%。第二波應用程式包括預測性維修日誌和保固裁決,其中不可篡改的歷史記錄降低了爭議率。仿冒品檢測仍然至關重要,因為高級化學標籤會將真偽雜湊值輸入公共帳本,從而增強消費者信心。隨著應用案例的不斷增加,區塊鏈在製造業市場,無論是在待開發區還是棕地工廠,都獲得了顯著的關注。

品質體係也構成了積層製造領域新型智慧財產權保護方案的基石,它利用零知識證明來驗證設計合規性,同時又不洩漏商業機密。電子元件製造商正在將設備上的加密簽章整合到帳本中,以提高召回的準確性。品質、合規性和防偽的融合正在加速企業對互通平台的興趣,並強化區塊鏈在製造業市場成長中的作用。

汽車工廠在2024年的收入中佔據主導地位,佔比31.2%,這反映了零部件可追溯性的廣泛要求和成熟的工業4.0投資。然而,隨著全球醫療保健法規強制要求序列化、低溫運輸追蹤和患者級驗證,生命科學製造商預計將擴大該領域區塊鏈在製造業的市場規模,到2030年將以78.06%的複合年成長率成長。與IBM和默克合作的製藥製造商報告稱,在模擬審核中,召回執行速度提高了25%。航太和國防整合商正在採用安全的3D列印零件系譜帳本來降低篡改風險。消費電子品牌正在產品中嵌入保固令牌以簡化售後服務,而食品和飲料加工商正在實施從農場到餐桌的追蹤,以滿足永續性審核。這些垂直領域的多元化發展正在推動區塊鏈在製造業領域超越其早期開拓者的地位。

製造業區塊鏈市場報告按應用(物流和供應鏈管理、仿冒品控制、品管和合規性等)、最終用戶產業(汽車、航太和國防、製藥和生命科學等)、部署模式(本地部署、雲端/區塊鏈即服務、混合/邊緣部署)、區塊鏈類型(公共區塊鏈、私有地區/區塊鏈等)和私人地區進行細分。

區域分析

北美地區佔2024年總收入的44.3%,這主要得益於FDA的強制規定、成熟的雲端基礎設施以及創業投資對帳本新興企業的大力支持。藥品序列化和航太零件溯源認證的要求推動了早期示範應用,隨後擴展到多工廠部署。各州政府的獎勵進一步促進了中小企業採用該技術。

亞太地區預計在2025年至2030年間將實現78.34%的最高複合年成長率,這主要得益於數位化舉措,例如中國的工業區塊鏈試點計畫和日本的「社會5.0」智慧工廠藍圖。亞洲開發銀行的「十三邊形計畫」反映了該地區致力於在製造業出口信貸領域實現銀行間去中心化結算的決心。印度的電子產業叢集和韓國的電池供應鏈協定正在加速發展,推動了二級供應商的採用。

歐洲正崛起為以永續性發展為核心的領導者,利用數位產品護照記錄碳足跡和循環經濟指標。德國汽車製造商採用聯合帳本追蹤再生鋼材含量,法國航太巨頭則利用區塊鏈管理積層製造粉末。北歐製造商透過水力和風力發電為許可型網路供電,滿足了環境、社會和治理(ESG)方面的期望。跨境資料計劃正在促進互通性,這表明隨著區塊鏈在全球製造業市場的成熟,區域性實施方案將在通用管治下趨於一致。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 離散製造業中BaaS(後端即服務)的日益普及

- 供應鏈中原產地和可追溯性的強制性認證

- 針對昂貴零件的防偽措施需求

- 利用令牌化實現設備即服務模型

- 與積層製造整合,實現安全的零件譜系

- 「保護隱私的零知識證明在智慧財產權保護中的應用」試點項目

- 市場限制

- 標準碎片化和互通性差距

- 區塊鏈人才在營運技術環境中的局限性

- 人們越來越關注鏈上可追溯性的能源消耗問題

- 後量子時代安全要求的不確定性

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 疫情與地緣政治影響評估

第5章 市場規模與成長預測

- 透過使用

- 物流供應鏈管理

- 仿冒品管理

- 品管與合規性

- 預測性維護和資產追蹤

- 採購智慧合約

- 其他用途

- 按最終用戶行業分類

- 車

- 航太/國防

- 製藥和生命科學

- 消費性電子產品

- 工業機械

- 飲食

- 其他行業

- 透過部署模式

- 本地部署

- 雲端/區塊鏈即服務 (BaaS)

- 混合/邊緣

- 按區塊鏈類型

- 公共

- 私人/許可

- 聯盟

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 肯亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措和夥伴關係

- 市佔率分析

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Amazon Web Services Inc.

- Accenture PLC

- Wipro Limited

- Infosys Ltd

- Intel Corporation

- Advanced Micro Devices Inc.

- VeChain Technology

- Chronicled Inc.

- SyncFab

- Siemens AG

- Honeywell International Inc.

- General Electric

- R3 LLC

- ConsenSys

- Kaleido

- BlockApps Inc.

第7章 市場機會與未來展望

The Blockchain In Manufacturing Market size is estimated at USD 2.54 billion in 2025, and is expected to reach USD 36.08 billion by 2030, at a CAGR of 76.26% during the forecast period (2025-2030).

Rising deployment of immutable ledgers for batch provenance, anti-counterfeiting, and equipment tokenization is accelerating the transition from pilot projects to enterprise-wide rollouts. Heightened regulatory scrutiny, especially under the Drug Supply Chain Security Act, is compelling manufacturers to adopt distributed ledgers that automate serialization and recall management. Equipment-as-a-service initiatives are unlocking new revenue streams, while cloud-based Blockchain-as-a-Service (BaaS) platforms lower entry barriers for small and mid-sized factories. Although fragmentation in standards and shortages of blockchain-skilled operational-technology talent temper near-term adoption, strategic partnerships between cloud hyperscalers and industrial OEMs are closing capability gaps.

Global Blockchain In Manufacturing Market Trends and Insights

Escalating Adoption of BaaS Across Discrete Manufacturing

Cloud-delivered BaaS now represents 61.8% of implementation preferences among discrete manufacturers, a share propelled by turnkey environments that eliminate the need for specialized node management. Microsoft's integration of blockchain telemetry into its Fabric analytics suite allows users to query production-line events alongside enterprise data, reducing system-integration time by 35%. Cost savings combine with simplified DevOps to ensure that BaaS gains traction in automotive, electronics, and industrial equipment factories that require rapid onboarding yet stringent uptime.

Supply-Chain Provenance and Traceability Mandates

The FDA extended its Food Traceability Rule deadline yet reaffirmed blockchain's suitability for immutable lot-level reporting requirements. Parallel EU Digital Product Passport rules reinforce the need for distributed records across every product lifecycle phase. Pharmaceutical, aerospace, and consumer electronics producers are embedding serialization data onto shared ledgers to automate recall, thereby trimming manual audit costs by 28%.

Fragmented Standards and Interoperability Gaps

The absence of universal data models forces suppliers to build costly middleware bridges for each trading partner. GS1 and ISO working groups are drafting common schemas, yet adoption lags fast-moving implementation deadlines. Consortium-based pilots in automotive and chemicals signal progress but remain pockets rather than norms.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Counterfeit Mitigation in High-Value Components

- Tokenization Enabling Equipment-as-a-Service Models

- Limited Blockchain Talent in OT Environments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Quality control and compliance tools are projected to post a 77.4% CAGR to 2030, outpacing logistics management despite the latter's 46% hold on the blockchain in manufacturing market share in 2024. Pharmaceutical firms running FDA serialization pilots report 30% faster deviation resolution when batch histories sit on a distributed ledger. Smart-contract workflows that auto-issue audit certificates replace paper record-keeping, cutting compliance hours by 40%. Second-wave applications include predictive maintenance logs and warranty adjudication, where immutable histories lower dispute rates. Counterfeit detection remains central as luxury-grade chemical tags feed authenticity hashes into public ledgers, enhancing consumer trust. As use cases multiply, the blockchain in the manufacturing market registers significant traction across both greenfield and brownfield plants.

Quality systems also form the backbone for emerging intellectual-property protection schemes in additive manufacturing, where zero-knowledge proofs confirm design compliance without revealing trade secrets. Electronic-component makers integrate on-device cryptographic signatures with the ledger, strengthening recall precision. This convergence of quality, compliance, and anti-counterfeiting accelerates enterprise interest in interoperable platforms, reinforcing the blockchain in the manufacturing market growth narrative.

Automotive factories dominated revenue with 31.2% in 2024, reflecting extensive part traceability obligations and mature Industry 4.0 investments. Nonetheless, life-sciences producers will expand the blockchain in the manufacturing market size for their segment at a 78.06% CAGR through 2030 as serialization, cold-chain tracking, and patient-level provenance become mandatory under global health regulations. Drug makers collaborating with IBM and Merck reported 25% faster recall execution during simulated audits. Aerospace and defense integrators adopt secure part genealogy ledgers for 3D-printed components, mitigating tampering risks. Consumer-electronics brands embed warranty tokens into products to streamline after-sales service, while food and beverage processors deploy farm-to-fork tracking to satisfy sustainability audits. Collectively, vertical diversification broadens the blockchain in the manufacturing industry footprint beyond early movers.

The Blockchain in Manufacturing Market Report is Segmented by Application (Logistics and Supply Chain Management, Counterfeit Management, Quality Control and Compliance, and More), End-User Vertical (Automotive, Aerospace and Defense, Pharmaceutical and Life Sciences, and More), Deployment Mode (On-Premises, Cloud/Blockchain-as-a-Service, and Hybrid/Edge), Blockchain Type (Public, Private/Permissioned, and More), and Geography.

Geography Analysis

North America held 44.3% of 2024 revenue owing to FDA mandates, established cloud infrastructure, and strong venture capital backing for ledger startups. Pharmaceutical serialization and aerospace part pedigree requirements drove early proofs that have since scaled to multi-plant deployments. State-level incentives further supported SME adoption.

Asia Pacific registers the highest 78.34% CAGR forecast between 2025 and 2030, reflecting sweeping digitization initiatives such as China's industrial blockchain pilots and Japan's Society 5.0 smart-factory roadmap. The Asian Development Bank's Project Tridecagon showcases regional commitment to inter-bank distributed settlements that align with manufacturing export-credit flows. India's electronics clusters and South Korea's battery-supply chain agreements add momentum, catalyzing adoption by Tier-2 suppliers.

Europe emerges as a sustainability-centric adopter, leveraging Digital Product Passports to document carbon footprints and circular-economy metrics. Germany's automotive OEMs employ joint ledgers to track recycled steel content, while France's aerospace primes adopt blockchain to manage additive-manufacturing powders. Nordic manufacturers power permissioned networks with hydro and wind energy, addressing ESG expectations. Cross-border data-spaces projects promote interoperability, suggesting that regional implementations will converge under common governance as the blockchain in the manufacturing market matures globally.

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Amazon Web Services Inc.

- Accenture PLC

- Wipro Limited

- Infosys Ltd

- Intel Corporation

- Advanced Micro Devices Inc.

- VeChain Technology

- Chronicled Inc.

- SyncFab

- Siemens AG

- Honeywell International Inc.

- General Electric

- R3 LLC

- ConsenSys

- Kaleido

- BlockApps Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating adoption of BaaS across discrete manufacturing

- 4.2.2 Supply-chain provenance and traceability mandates

- 4.2.3 Demand for counterfeit mitigation in high-value components

- 4.2.4 Tokenisation enabling equipment-as-a-service models

- 4.2.5 Integration with additive manufacturing for secure part genealogy

- 4.2.6 Privacy-preserving zero-knowledge-proof pilots for IP protection

- 4.3 Market Restraints

- 4.3.1 Fragmented standards and interoperability gaps

- 4.3.2 Limited blockchain talent in OT environments

- 4.3.3 Rising energy-use concerns for on-chain traceability

- 4.3.4 Uncertainty around post-quantum security requirements

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pandemic and Geopolitical Impact Assessment

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Logistics and Supply Chain Management

- 5.1.2 Counterfeit Management

- 5.1.3 Quality Control and Compliance

- 5.1.4 Predictive Maintenance and Asset Tracking

- 5.1.5 Smart Contracts for Procurement

- 5.1.6 Other Applications

- 5.2 By End-user Vertical

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Pharmaceutical and Life Sciences

- 5.2.4 Consumer Electronics

- 5.2.5 Industrial Machinery

- 5.2.6 Food and Beverage

- 5.2.7 Other Verticals

- 5.3 By Deployment Mode

- 5.3.1 On-premises

- 5.3.2 Cloud/Blockchain-as-a-Service (BaaS)

- 5.3.3 Hybrid/Edge

- 5.4 By Blockchain Type

- 5.4.1 Public

- 5.4.2 Private/Permissioned

- 5.4.3 Consortium

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Kenya

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 SAP SE

- 6.4.4 Oracle Corporation

- 6.4.5 Amazon Web Services Inc.

- 6.4.6 Accenture PLC

- 6.4.7 Wipro Limited

- 6.4.8 Infosys Ltd

- 6.4.9 Intel Corporation

- 6.4.10 Advanced Micro Devices Inc.

- 6.4.11 VeChain Technology

- 6.4.12 Chronicled Inc.

- 6.4.13 SyncFab

- 6.4.14 Siemens AG

- 6.4.15 Honeywell International Inc.

- 6.4.16 General Electric

- 6.4.17 R3 LLC

- 6.4.18 ConsenSys

- 6.4.19 Kaleido

- 6.4.20 BlockApps Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment