|

市場調查報告書

商品編碼

1851770

現場可程式閘陣列(FPGA):市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Field Programmable Gate Array (FPGA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

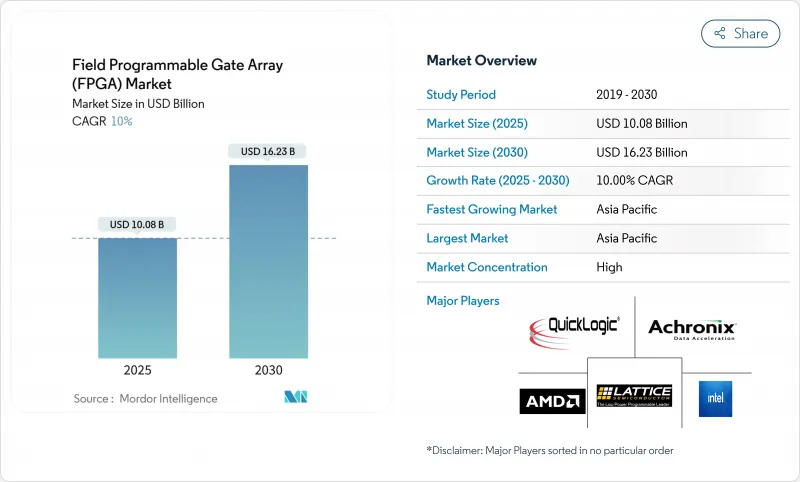

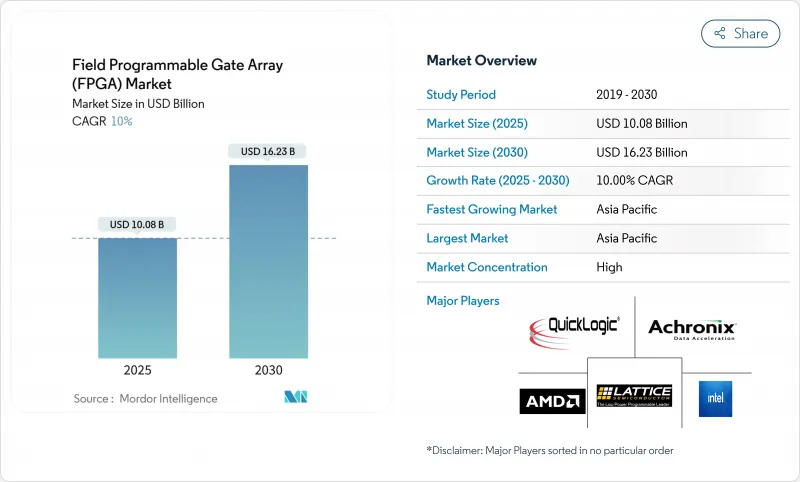

預計到 2025 年,現場可程式閘陣列(FPGA) 市場規模將達到 100.8 億美元,到 2030 年將擴大到 162.3 億美元,複合年成長率為 10.00%。

邊緣人工智慧推理在超大規模資料中心的快速普及、向5G開放式無線架構的轉型,以及汽車和航太電子產品對部署後重建日益成長的需求,都為市場提供了強勁的推動力。儘管高階設備仍然是主要的收入來源,但隨著設計團隊在對成本敏感的工業、物聯網和消費系統中部署FPGA技術,中階產品也實現了快速成長。亞太地區已成為最大的製造地和成長最快的需求中心,受惠於電動車動力傳動系統和新型太空衛星群。英特爾同意剝離Altera後,日益激烈的競爭重塑了供應商格局,而出口限制則刺激了中國國內的平行發展。此外,300毫米晶圓代工廠工廠產能緊張以及向成本高昂的16奈米及以下製程節點的過渡,迫使供應商優先考慮高利潤應用,並與台積電和三星簽訂長期晶圓預訂協議。

全球現場可程式閘陣列(FPGA) 市場趨勢與洞察

超大規模資料中心對邊緣AI推理的需求

隨著延遲和功耗預算開始超過原始處理容量要求,超大規模營運商開始採用 FPGA 來加速 AI 推理。 AMD 的第二代 Versal AI Edge 裝置的 TOPS/W 比第一代產品高出 3 倍,在降低營運成本的同時,實現了即時視覺分析。 Achronix 報告稱,在運行大型語言模型時,FPGA 的成本和功耗比 GPU 方案低 200%,凸顯了 FPGA 在記憶體受限工作負載中的效率。這種轉變使得分散式計算模型得以實現,該模型將推理處理更靠近資料來源,從而緩解了頻寬限制和資料主權風險。將封裝內 HBM 和增強型 AI 引擎整合到領先的 FPGA 系列中,進一步鞏固了 FPGA 在雲端邊緣拓撲結構中的地位。因此,現場可程式閘陣列)市場已成為超大規模資本支出計畫中不可或缺的成長支柱。

向 5G ORAN 的過渡需要在無線電中採用可程式設計邏輯

開放式無線存取網計畫促使通訊業者採用廠商中立的無線電單元,這些單元可以透過軟體升級進行演進,而無需進行整體更換。英特爾的 Agilex 產品組合採用 10 奈米 SuperFin 工藝,提供軟體定義無線電,能夠適應新的 5G 版本,並降低整體擁有成本。萊迪思半導體 (Lattice Semiconductor) 為此硬體提供了參考協定棧,可為分散式網路提供零信任安全性和即時加密。 AMD 的 Zynq RFSoC DFE 的每瓦效能比之前的裝置提高了一倍,使營運商能夠在緊湊、功耗受限的射頻單元中支援多頻段運作。靈活的邏輯縮短了部署週期,這對於通訊業者融合私人 5G、固定無線存取和毫米波服務至關重要。

美國和歐盟對高效能FPGA出口中國實施限制。

美國工業與安全局的新規將於2023年下半年取消對華先進FPGA(現場可程式閘陣列)的民用豁免,限制了適用於人工智慧和軍事應用的裝置。這項變更迫使AMD-Xilinx和Intel-Altera暫停或授權大量訂單,導致短期內銷售下降。中國供應商如高文科技和盤古科技試圖彌補缺口,但由於取得設計工具、智慧財產權和先進製程的門檻很高,短期內難以實現替代。跨國客戶將敏感的生產轉移到中國以外,或重新設計系統以適應非美國裝置,擾亂了原本的全球供應鏈。在新貿易規則穩定之前,這種情況對現場閘陣列市場造成了壓力。

細分市場分析

到2024年,高階元件將佔據現場可程式閘陣列)市場66.5%的佔有率,這反映了它們在資料中心加速和5G基礎設施中的核心作用。這些平台通常擁有超過100萬個邏輯單元,提供卓越的平均售價(ASP),同時還能實現GPU無法提供的確定性延遲,使其在安全關鍵型航太和金融科技工作負載中極具吸引力。 2030年,隨著Lattice等製造商推出配備強化型AI引擎的成本最佳化產品以滿足邊緣運算預算,中階低階裝置的複合年成長率(CAGR)將達到11.2%。設計工具也變得更加直覺,使嵌入式工程師無需具備硬體知識即可採用可配置邏輯。

AMD推出Spartan UltraScale+後,其價值提案發生了轉變。此技術功耗降低30%,I/O數量空前豐富,從高階市場直接進軍中階。同時,模組廠商推出了預檢驗電路板,簡化了引腳規劃和PCB佈局,縮短了設計週期。雖然這種轉變有望縮小不同層級產品之間的價格差距,但隨著新的AI和網路標準的出現,高階元件仍將佔據現場可程式閘陣列)市場的大部分佔有率,因為只有頂級製程節點的晶片才能滿足這些標準。

預計到2024年,基於SRAM的解決方案將佔總收入的55.4%,年複合成長率將達到11.8%,這得益於其無限次的重編程週期和強大的軟體生態系統。然而,在穿戴式裝置和汽車遠端耐熔熔絲平台在國防航空電子設備領域佔據著獨特的地位,其一次性可編程性消除了篡改的風險。

軟體可移植性正在打破歷史壁壘,使設計人員能夠基於功耗和安全性而非工具熟悉程度做出選擇。新興的異質架構將SRAM結構與片上非揮發性域整合,兼具兩者的優勢。雖然SRAM元件仍將主導現場可程式閘陣列)市場的收入,但由於快閃記憶體和耐熔熔絲產品功耗更低且適用於嚴苛環境,它們有望獲得更大的市場佔有率。

現場可程式閘陣列按配置(高階 FPGA、中階/低階 FPGA)、架構(基於 SRAM 的 FPGA、基於快閃記憶體的 FPGA 等)、技術節點(90nm 以上、20-90nm、16nm 以下)、終端市場(資料中心和雲端運算、通訊和 5G 基礎設施、歐洲汽車等)以及中東地區(北美汽車和歐洲亞洲)。

區域分析

亞太地區將在2024年佔據現場可程式閘陣列)市場的主導地位,市佔率將達到39.3%,預計到2030年將以17.1%的複合年成長率成長。中國大力推動半導體自主研發,尤其是在電動車驅動裝置和衛星有效載荷領域湧現的創新者,推動了FPGA的大規模量產。台灣和韓國提供了先進的製造程序,而日本則專注於汽車模組和工廠自動化子系統。印度的設計服務產業也取得了進展,萊迪思(Lattice)在普納設立了研發中心,擴大了其工程人才儲備。

北美在資料中心基礎設施、高可靠性航太和EDA軟體領域保持領先地位。超大規模資料中心業者資料中心營運商為自我調整加速器投入巨額資本預算,以控制人工智慧服務成本,從而在該地區佔據了強大的市場佔有率。出口許可證審查影響了運輸模式,同時也促使國內加大對先進封裝和OSAT能力的投資,以支持現場可程式閘陣列)市場的發展。

歐洲傾向德國汽車供應鏈和北歐通訊設備供應商。 ISO 26262合規性促進了汽車應用的發展,而能源轉型計劃則創造了對低損耗功率轉換器的需求。歐盟的「數位十年」政策鼓勵了可重構邊緣運算平台的發展。儘管南美洲和中東及非洲目前所佔佔有率較小,但預計在預測期內,5G基礎設施和工業現代化帶來的成長潛力將提升其市場佔有率。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 超大規模資料中心對邊緣AI推理的需求

- 5G ORAN 轉換需要無線電中的可重程式邏輯

- ASIC/SoC 製程尺寸縮小週期(7 奈米及以下)的快速原型製作需求

- 汽車功能安全合規性(ISO 26262)

- 新型太空衛星群的抗輻射設計

- 中國電動車動力傳動系統總成廠商採用eFPGA實現馬達控制

- 市場限制

- 美國和歐盟對中國高效能FPGA出口實施限制。

- 300毫米鑄造能力分配變異性

- 與專用ASIC相比,靜態功耗更高

- 價值鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟趨勢對FPGA產業的影響

第5章 市場規模與成長預測

- 成分

- 高階FPGA

- 中階低階FPGA

- 建築設計

- 基於SRAM的FPGA

- 基於快閃記憶體的FPGA

- 耐熔熔絲FPGA

- 依技術節點

- >90 奈米

- 20-90 nm

- 16奈米或更小

- 按終端市場分類

- 資料中心和雲端運算

- 通訊和5G基礎設施

- 汽車(ADAS、電氣化)

- 工業自動化與機器人

- 航太與國防(航空電子設備、衛星通訊)

- 消費性電子產品和穿戴式裝置

- 測試、測量和醫療設備

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 北歐國家(瑞典、挪威、芬蘭、丹麥)

- 其他歐洲地區

- 亞太地區

- 中國

- 台灣

- 日本

- 韓國

- 印度

- ASEAN

- 亞太其他地區

- 南美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Advanced Micro Devices Inc.(Xilinx)

- Intel Corporation

- Lattice Semiconductor Corp.

- Microchip Technology Inc.(Microsemi)

- Achronix Semiconductor Corp.

- QuickLogic Corporation

- Efinix Inc.

- GOWIN Semiconductor Corp.

- Flex Logix Technologies Inc.

- NanoXplore SAS

- Anlogic Infotech Co. Ltd.

- Pango Microsystems Inc.

- Shenzhen S2C Ltd.

- BittWare(Molex Company)

- Digilent Inc.

- AlphaData Parallel Systems Ltd.

- Colfax International

- Reflex Ces SAS

- Aldec Inc.

- Beijing Tsinghua Tongfang Co. Ltd.

第7章 市場機會與未來展望

The field programmable gate array market size reached USD 10.08 billion in 2025 and is forecast to expand to USD 16.23 billion by 2030 at a 10.00% CAGR.

Rapid adoption of edge-AI inference in hyperscale data centers, the migration to 5G open radio architectures, and the rising need for post-deployment reconfigurability in automotive and aerospace electronics gave the market clear momentum. High-end devices continued to anchor revenues, yet mid-range and low-end products climbed quickly as design teams pushed FPGA technology into cost-sensitive industrial, IoT, and consumer systems. Asia-Pacific emerged as both the largest manufacturing base and the fastest-growing demand center, benefiting from electric-vehicle powertrains and new-space constellations. Competitive intensity increased after Intel agreed to carve out Altera, reshaping supplier dynamics while export controls spurred parallel domestic development in China. Tighter 300 mm foundry capacity and the costly transition to <=16 nm nodes also forced vendors to prioritize high-margin applications and long-term wafer reservations with TSMC and Samsung.

Global Field Programmable Gate Array (FPGA) Market Trends and Insights

Edge-AI inference demand in hyperscale data centers

Hyperscale operators deployed FPGAs to accelerate AI inference once latency and power budgets began outweighing raw throughput requirements. AMD's Versal AI Edge Gen 2 devices delivered up to 3 X higher TOPS-per-watt than first-generation parts, enabling real-time vision analytics while containing operating expenses. Achronix reported 200 % cost and power advantages versus GPU alternatives when running large language models, underscoring FPGA efficiency in memory-bound workloads. This shift unlocked a distributed compute model where inference processing moved closer to data sources, easing bandwidth constraints and data-sovereignty risks. Integration of on-package HBM and hardened AI engines within leading FPGA families strengthened their position in cloud-edge topologies. Consequently, the field programmable gate array market found a durable growth pillar in hyperscale capital expenditure plans.

5G ORAN shift requiring re-programmable logic in radios

Open radio access network initiatives pushed carriers to adopt vendor-agnostic radio units that could evolve with software upgrades rather than forklift replacements. Intel's Agilex portfolio used 10 nm SuperFin technology to deliver software-defined radios that adapt to new 5G releases at a lower total cost of ownership. Lattice Semiconductor complemented that hardware with a reference stack providing zero-trust security and real-time encryption for disaggregated networks. AMD's Zynq RFSoC DFE doubled performance per watt versus prior devices, letting operators support multi-band operation inside compact, power-constrained radio heads. Flexible logic shortened rollout cycles, a critical factor as carriers blended private-5G, fixed-wireless access, and mmWave services. That flexibility secured a new volume opportunity for the field programmable gate array market across telecom infrastructure.

US-EU export controls on high-performance FPGAs to China

New Bureau of Industry and Security rules removed civilian exemptions for advanced FPGA shipments to China in late 2023, restricting devices suited for AI or military use. The shift forced AMD-Xilinx and Intel-Altera to halt or license-screen many orders, reducing near-term unit volumes. Chinese suppliers such as GOWIN and Pango sought to close the gap, yet hurdles in design tools, IP, and advanced process access limited immediate substitution. Multinational customers moved sensitive production away from China or redesigned systems to qualify non-US devices, fracturing previously global supply chains. The resulting uncertainty weighed on the field programmable gate array market until new trade norms stabilized.

Other drivers and restraints analyzed in the detailed report include:

- Rapid prototyping needs for ASIC/SoC shrink cycles (<=7 nm)

- Functional safety compliance in automotive (ISO 26262)

- Volatility in 300 mm foundry capacity allocation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

High-end devices held 66.5% of the field programmable gate array market share in 2024, reflecting their central role in data-center acceleration and 5G infrastructure. These platforms, often exceeding 1 million logic cells, carried premium ASPs yet delivered deterministic latency unavailable in GPUs, preserving their appeal for safety-critical aerospace and fintech workloads. Mid-range and low-end devices exhibited an 11.2% CAGR to 2030 as manufacturers like Lattice shipped cost-optimized parts with hardened AI engines that met edge-compute budgets. Design tools have grown more intuitive, letting embedded engineers adopt configurable logic without hardware backgrounds.

The value proposition evolved as AMD introduced Spartan UltraScale+ with 30% lower power and unrivaled I/O count, attacking the mid-range from above. Simultaneously, module vendors supplied pre-validated boards that abstracted pin-planning and PCB layout, trimming design cycles. These shifts are expected to compress the pricing gap between tiers, although high-end devices still command a majority of the field programmable gate array market size when new AI or networking standards emerge that only top-node silicon can satisfy.

SRAM-based solutions owned 55.4% revenue in 2024 and posted an 11.8% CAGR outlook thanks to unlimited reprogram cycles and a deep software ecosystem. Yet flash-based variants gained mindshare in wearables and automotive telematics, where instant-on behavior is vital. Microchip's RT PolarFire achieved MIL-STD-883 Class B, offering 50% lower power than equivalent SRAM parts while tolerating 100 krad radiation. Anti-fuse platforms sustained a niche in defense avionics where one-time programmability eliminates tampering risk.

Software portability is shrinking historical barriers, so designers can now choose based on power and security rather than tool familiarity. Emerging heterogeneous architectures integrate SRAM fabric with on-die non-volatile domains, providing the best-of-both options. While SRAM devices will continue leading the field programmable gate array market revenue, flash and anti-fuse offerings should carve larger shares in low-power and harsh-environment deployments.

Field Programmable Gate Array is Segmented by Configuration (High-End FPGA, and Mid-range/Low-end FPGA), Architecture (SRAM-Based FPGA, Flash-Based FPGA, and More), Technology Node (>=90 Nm, 20-90 Nm, and <=16 Nm), End Market (Data Centre and Cloud Computing, Telecommunications and 5G Infrastructure, Automotive, and More), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa).

Geography Analysis

Asia-Pacific dominated the field programmable gate array market with 39.3% revenue in 2024 and showed a 17.1% CAGR outlook to 2030. China's push for semiconductor self-reliance, highlighted by domestic innovators in electric vehicle drives and satellite payloads, pulled in significant FPGA volumes. Taiwan and South Korea supplied advanced fabrication, while Japan specialized in automotive modules and factory automation subsystems. India's design-service sector advanced after Lattice opened an R&D center in Pune, broadening engineering talent pools.

North America maintained leadership in data-center infrastructure, high-reliability aerospace, and EDA software. Hyperscalers directed large capital budgets toward adaptive accelerators to manage AI service costs, ensuring the region's strong purchase share. Export-license reviews shaped shipment patterns but also prompted domestic investment in advanced packaging and OSAT capacity that supports the field programmable gate array market.

Europe leaned on Germany's automotive supply chain and Nordic telecom equipment providers. ISO 26262 compliance spurred in-vehicle usage, while energy-transition projects created demand for low-loss power converters. EU Digital Decade policies encouraged sovereign edge computing platforms that favor reconfigurability. Although South America and the Middle East, and Africa hold smaller slices today, growth potential in 5G infrastructure and industrial modernization should boost their contribution over the forecast period.

- Advanced Micro Devices Inc. (Xilinx)

- Intel Corporation

- Lattice Semiconductor Corp.

- Microchip Technology Inc. (Microsemi)

- Achronix Semiconductor Corp.

- QuickLogic Corporation

- Efinix Inc.

- GOWIN Semiconductor Corp.

- Flex Logix Technologies Inc.

- NanoXplore SAS

- Anlogic Infotech Co. Ltd.

- Pango Microsystems Inc.

- Shenzhen S2C Ltd.

- BittWare (Molex Company)

- Digilent Inc.

- AlphaData Parallel Systems Ltd.

- Colfax International

- Reflex Ces SAS

- Aldec Inc.

- Beijing Tsinghua Tongfang Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Edge-AI Inference Demand in Hyperscale Data Centres

- 4.2.2 5G ORAN Shift Requiring Re-programmable Logic in Radios

- 4.2.3 Rapid Prototyping Needs for ASIC/SoC Shrink Cycles (<=7 nm)

- 4.2.4 Functional Safety Compliance in Automotive (ISO 26262)

- 4.2.5 Radiation-Tolerant Designs for New-Space Constellations

- 4.2.6 Chinese EV Power-train OEMs Adopting eFPGAs for Motor Control

- 4.3 Market Restraints

- 4.3.1 US-EU Export Controls on High-performance FPGAs to China

- 4.3.2 Volatility in 300 mm Foundry Capacity Allocation

- 4.3.3 Higher Static Power Consumption vs. Dedicated ASIC

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Trends on the FPGA Industry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Configuration

- 5.1.1 High-end FPGA

- 5.1.2 Mid-range/Low-end FPGA

- 5.2 By Architecture

- 5.2.1 SRAM-based FPGA

- 5.2.2 Flash-based FPGA

- 5.2.3 Anti-fuse FPGA

- 5.3 By Technology Node

- 5.3.1 >=90 nm

- 5.3.2 20-90 nm

- 5.3.3 <=16 nm

- 5.4 By End Market

- 5.4.1 Data Centre and Cloud Computing

- 5.4.2 Telecommunications and 5G Infrastructure

- 5.4.3 Automotive (ADAS, Electrification)

- 5.4.4 Industrial Automation and Robotics

- 5.4.5 Aerospace and Defense (Avionics, SATCOM)

- 5.4.6 Consumer Electronics and Wearables

- 5.4.7 Test, Measurement and Medical Devices

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Nordics (Sweden, Norway, Finland, Denmark)

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Taiwan

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 India

- 5.5.3.6 ASEAN

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global and Market Overview, Core Segments, Financials, Strategy, Rank/Share, Products, Recent Moves)

- 6.4.1 Advanced Micro Devices Inc. (Xilinx)

- 6.4.2 Intel Corporation

- 6.4.3 Lattice Semiconductor Corp.

- 6.4.4 Microchip Technology Inc. (Microsemi)

- 6.4.5 Achronix Semiconductor Corp.

- 6.4.6 QuickLogic Corporation

- 6.4.7 Efinix Inc.

- 6.4.8 GOWIN Semiconductor Corp.

- 6.4.9 Flex Logix Technologies Inc.

- 6.4.10 NanoXplore SAS

- 6.4.11 Anlogic Infotech Co. Ltd.

- 6.4.12 Pango Microsystems Inc.

- 6.4.13 Shenzhen S2C Ltd.

- 6.4.14 BittWare (Molex Company)

- 6.4.15 Digilent Inc.

- 6.4.16 AlphaData Parallel Systems Ltd.

- 6.4.17 Colfax International

- 6.4.18 Reflex Ces SAS

- 6.4.19 Aldec Inc.

- 6.4.20 Beijing Tsinghua Tongfang Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment