|

市場調查報告書

商品編碼

1851769

自動化液體處理系統:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automated Liquid Handlers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

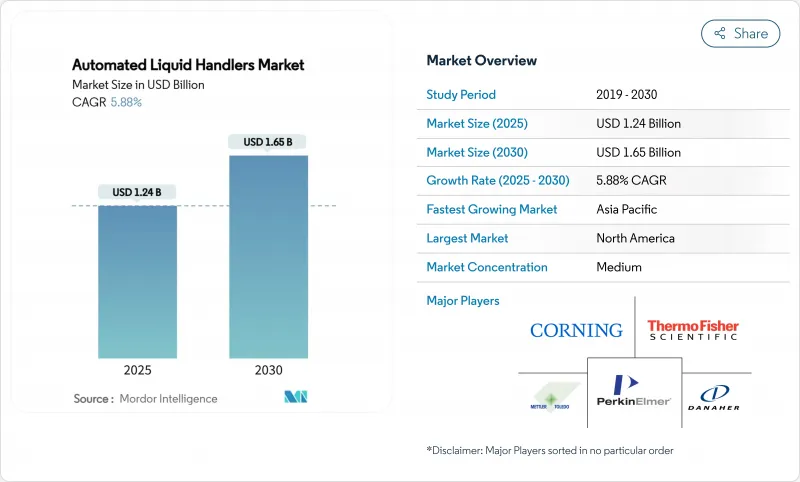

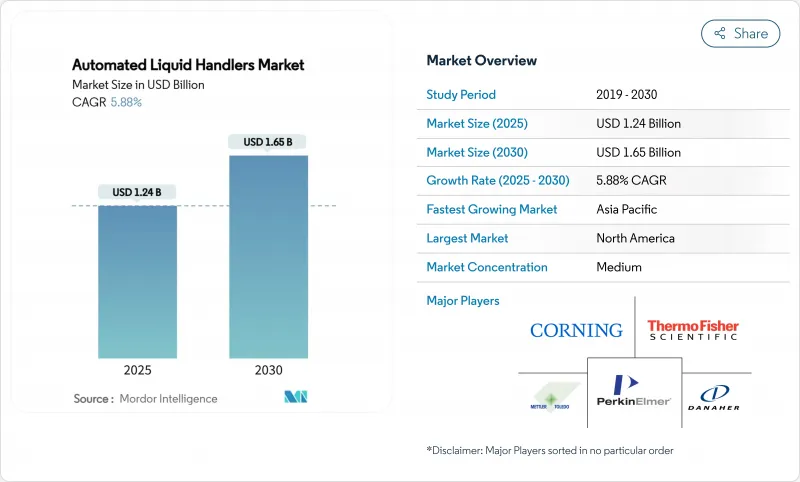

預計到 2025 年,自動化液體處理市場價值將達到 12.4 億美元,到 2030 年將達到 16.5 億美元,年複合成長率為 5.88%。

這一穩步成長反映了對大規模分子診斷能力的需求、人工智慧主導的實驗室平台的快速普及以及從手動移液到精密機器人移液的轉變。高通量基因組工作流程的推進得益於硬體升級,將文庫製備時間從數小時縮短至數分鐘。中等通量系統也推動了市場需求,這些系統能夠滿足大多數臨床和研究實驗室的日常樣本量,從而為自動化液體處理市場耗材銷售提供了穩定的基準。亞太地區政府的資助以及北美地區穩定的設備更換週期,都保證了該市場的長期前景良好。

全球自動化液體處理市場趨勢與洞察

與人工智慧主導的藥物發現平台整合,可加快從發現先導化合物到獲得前置作業時間。

自動化工作站結合機器學習演算法,如今無需人工干預即可執行迭代式設計-執行-分析循環。配備<sup>19</sup>F NMR感測器的機器人可並行評估21種反應,使藥物研發團隊能夠將先導化合物的發現週期縮短75%。Astra Zeneca和威爾康奈爾醫學院的案例研究表明,這些閉合迴路系統提高了協同化合物預測的準確性,同時還能捕捉詳細的分析元資料,為深度學習模型提供數據。節省的時間和更豐富的數據直接轉化為更快的專利申請速度和更高的臨床成功率,這使得自動化液體處理市場在製藥數位數位化中佔據了有利地位。

大規模基因組篩檢(北美)對處理容量要求不斷提高

疫情期間迅速擴大規模的美國參考實驗室,如今每天處理數千份臨床基因組樣本。像 Biomek Echo One 這樣的機器人移液解決方案,可以將樣本製備時間從兩小時縮短到十分鐘——這只有全自動工作流程才能實現。隨著保險公司擴大次世代定序儀的報銷範圍,大容量系統正成為首選,進一步鞏固了北美在自動化液體處理市場的領先地位。

新興市場靈活辦公空間的初始資本投入較高

進口關稅和多層分銷導致標價上漲高達116%,在非洲部分地區,一套原價35萬美元的系統價格飆升至75萬美元以上。津貼很少涵蓋培訓或維護,迫使實驗室簽訂他們無法負擔的服務合約。結果是能力差距不斷擴大,這有可能將新興市場排除在全球基因組學聯盟之外,從而削弱這些地區的自動化液體處理市場。

細分市場分析

機器人工作站佔據自動化液體處理市場最大佔有率,預計2024年將佔46%的市場佔有率。然而,隨著人工智慧模組能夠安排點膠流程並預測吸頭使用情況,軟體和服務預計將以7.7%的複合年成長率成長,從而立即降低成本。機器人安裝量的增加確保了耗材的穩定供應,而潤滑吸頭則減少了黏稠樣本中的殘留。

產品組合正轉向平台許可,以解鎖工作流程庫和雲端分析功能。供應商現在將訂閱儀表板捆綁銷售,這些儀表板可以監控執行時間並在出現異常情況時發出警報,從而進一步推動軟體收入成長。這種轉變正在改變競爭動態,促進生態系統夥伴關係,並使程式碼庫成為自動化液體處理市場的核心差異化因素。

中型通量系統(每次運行處理 100 至 1000 個樣本)將在 2024 年佔據自動化液體處理市場 53.5% 的佔有率。這類系統兼顧速度和價格,能夠滿足臨床實驗室和中型生物技術公司典型的大量處理需求。高通量系統(每次運行處理超過 1000 個樣本)將以 6.3% 的複合年成長率 (CAGR) 實現最快成長,這主要得益於藥物研發領域大規模篩檢宣傳活動(每天進行超過 10 萬次檢測)的推動。

隨著每日處理量超過 5000 個培養皿,單位經濟效益顯著提升,促使合約研究組織 (CRO) 在產能瓶頸領先進行設備升級。這一趨勢推高了多臂配置和加長吸頭架的機器人平台的價格。同時,這也拓展了預測性維護的服務機會,為自動化液體處理市場的收入來源提供了穩定性。

區域分析

北美地區憑藉其完善的分子診斷基礎設施和集中的製藥產業叢集,預計到2024年將佔據自動化液體處理設備市場38.5%的佔有率。總部位於美國的賽默飛世爾科技公司已投資20億美元用於本土生產,以確保短供應鏈和合規支援。加拿大在基因組研究領域實力雄厚,墨西哥則在農業基因體學領域應用自動化技術。該地區受益於創投對人工智慧主導的實驗室技術新興企業的資助,但機器人程式設計人員的短缺仍然是限制其規模化發展的瓶頸。

亞太地區是成長最快的地區,預計到2030年將以6.9%的複合年成長率成長,這主要得益於中國兆元人民幣的機器人計畫和韓國1.28億美元的智慧機器人計畫。日本正充分利用數十年的自動化傳統,而澳洲則利用聯邦政府補貼建造符合GMP標準的生物加工設施。本地化服務中心克服了以往對進口技術人員的依賴,並減少了停機時間。政府有利於國內供應商的採購政策將加速裝機量的擴張,鞏固亞太地區作為自動化液體處理市場主要收入來源的地位。

歐洲憑藉德國、英國和法國強大的製藥產品線,在自動化液體處理設備市場中佔有穩固地位。歐盟內部的監管協調促進了跨境技術轉讓,而永續性要求則青睞經過檢驗的低碳排放機器人。南歐的實驗室正在食品和環境檢測領域採用自動化技術,擴大了潛在市場需求。與設備供應商合作的學徒計畫有效彌補了技能缺口,確保了設備的穩定運作並降低了服務成本。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 大規模基因組篩檢(北美)對通量需求的不斷成長

- 採用緊湊型檢測方法可降低試劑成本

- 與人工智慧主導的藥物發現平台整合可加快先導化合物發現速度

- 個人化醫療的擴展推動了高精準度液體處理技術的發展(歐洲和美國)

- 新冠疫情後永久性分子診斷能力(全球參考實驗室)

- 亞太地區政府對自動化生物加工的資助

- 市場限制

- 新興市場靈活辦公空間的初始資本投入較高

- 機器人系統編程和維護方面的技能差距

- 高黏度液體中存在樣品交叉污染的風險

- 大型製藥企業實驗室傳統LIMS系統整合面臨的挑戰

- 生態系分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 機器人液體處理工作站

- 移液系統

- 試劑分配器

- 耗材(晶片、培養板、試劑)

- 軟體和服務

- 按吞吐能力

- 低通量(每次運行少於100個樣本)

- 中等通量(每次運行 100-1000 個樣本)

- 高通量(每次運行超過1000個樣本)

- 按平台配置

- 獨立式桌上型系統

- 整合模組化平台

- 透過使用

- 藥物發現及先導藥物最適化

- 基因組學和蛋白質組學

- 臨床診斷

- 細胞生物學和幹細胞研究

- 合成生物學和生物製程開發

- 其他用途

- 最終用戶

- 製藥和生物技術公司

- 合約研究組織 (CRO) 和合約生產組織 (CMO)

- 學術研究機構

- 臨床檢測與診斷實驗室

- 法醫學與環境檢測實驗室

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 東南亞

- 亞太其他地區

- 南美洲

- 巴西

- 其他南美洲

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Thermo Fisher Scientific Inc.

- Danaher Corp.(Beckman Coulter Life Sciences)

- Tecan Group Ltd.

- Hamilton Company

- PerkinElmer Inc.(Revvity)

- Agilent Technologies Inc.

- Mettler-Toledo International Inc.

- Becton, Dickinson and Company

- Eppendorf AG

- Formulatrix Inc.

- Aurora Biomed Inc.

- Sartorius AG(Biohit)

- Synchron Lab Automation

- Hudson Robotics Inc.

- Analytik Jena AG(Endress+Hauser)

- Opentrons Labworks Inc.

- Biosero Inc.(BICO Group)

- Gilson Inc.

- Lab Services BV

- Andrew Alliance SA(Waters)

- Integra Biosciences AG

- Corning Incorporated

- SPT Labtech Ltd.

- Festo AG and Co. KG

- Starlab International GmbH

第7章 市場機會與未來展望

The automated liquid handlers market size is estimated at USD 1.24 billion in 2025 and is projected to reach USD 1.65 billion by 2030, expanding at a 5.88% CAGR.

The steady rise reflects the push for large-scale molecular diagnostics capacities, rapid uptake of AI-driven laboratory platforms, and the shift from manual pipetting to robotic precision. Hardware upgrades that shorten library-prep from hours to minutes in high-throughput genomic workflows add further momentum. Demand is also supported by mid-sized throughput systems that fit the daily sample volume of most clinical and research laboratories, giving the automated liquid handlers market a resilient baseline of recurring consumable sales. Emerging government funding in Asia-Pacific and steady replacement cycles in North America keep long-term visibility high.

Global Automated Liquid Handlers Market Trends and Insights

Integration with AI-Driven Drug-Discovery Platforms Accelerating Hit-to-Lead Timelines

Automated workstations that pair with machine-learning algorithms now run iterative design-execute-analyse loops without human intervention. Robots equipped with 19F NMR sensors can evaluate 21 reactions in parallel, enabling discovery teams to compress hit-to-lead cycles by 75%. Case studies at AstraZeneca and Weill Cornell show these closed-loop systems improving predictive accuracy for synergistic compounds while capturing granular assay metadata that feeds deep-learning models. The time savings and data richness directly translate into earlier patent filings and a better probability of clinical success, keeping the automated liquid handlers market firmly aligned with pharmaceutical digitalization.

Growing Throughput Requirements in High-Volume Genomic Screening (North America)

US reference labs that scaled up during the pandemic now process thousands of clinical genomes daily. Robotic pipetting solutions like the Biomek Echo One trim sample-prep from two hours to 10 minutes. The underlying economics reward laboratories able to push the cost per sequence below USD 100, which is only feasible when workflows are fully automated. As insurers broaden reimbursement for next-generation sequencing, high-capacity systems become default purchases, reinforcing North American leadership in the automated liquid handlers market.

High Initial CapEx for Flexible Deck Workstations in Emerging Markets

Import duties and multi-layer distribution inflate list prices by up to 116%, pushing a USD 350,000 system above USD 750,000 in parts of Africa. Grants rarely cover training or maintenance, leaving labs with unaffordable service contracts. The result is a widening capability gap that risks excluding emerging markets from global genomics consortia, dampening the automated liquid handlers market in these regions.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Miniaturized Assay Formats Reducing Reagent Costs

- Expansion of Personalized Medicine Driving High-Accuracy Liquid Handling

- Skill Gap in Programming and Maintenance of Robotic Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Robotic workstations represent the largest slice of the automated liquid handlers market, holding 46% market share in 2024, because laboratories still prioritize mechanical precision for repeatable pipetting. Software and services, however, are forecast to grow at 7.7% CAGR as AI modules that schedule runs and predict tip usage deliver immediate cost savings. A growing installed base of robots ensures a recurring stream of consumables, and lubricant-infused tips reduce carry-over in viscous samples.

The product mix is shifting toward platform licences that unlock workflow libraries and cloud analytics. Vendors now bundle subscription dashboards that monitor uptime and flag anomalies, which further elevate software revenue. This pivot transforms competitive dynamics, encouraging ecosystem partnerships and making code libraries a core differentiator in the automated liquid handlers market.

Medium-throughput systems processing 100-1,000 samples per run accounted for 53.5% of the automated liquid handlers market size in 2024. They match typical batch volumes at clinical labs and mid-sized biotechs, offering balanced speed and price. High-throughput units that exceed 1,000 samples log the fastest 6.3% CAGR, thanks to large screening campaigns in drug discovery that surpass 100,000 assays a day.

Unit economics improve sharply once workflows cross 5,000 daily plates, prompting CROs to upgrade ahead of capacity bottlenecks. This trend anchors price premiums for robotic decks with multi-arm configurations and expanded tip racks. It also widens service opportunities in predictive maintenance, adding stability to revenue streams within the automated liquid handlers market.

The Automated Liquid Handlers Market Report is Segmented by Product Type (Robotic Liquid-Handling Workstations, and More), Throughput Capability (Low, Medium, and High), Platform Configuration (Stand-Alone Benchtop Systems, and Integrated Modular Platforms), Application (Drug Discovery, Genomics, and More), End User (CROs and CMOs, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 38.5% share of the automated liquid handlers market in 2024 on the back of permanent molecular diagnostic infrastructure and concentrated pharmaceutical clusters. US-based Thermo Fisher invested USD 2 billion in domestic manufacturing, ensuring short supply chains and compliance support. Canada adds strength in genomics research, while Mexico adopts automation for agrigenomics. The region benefits from venture capital that funds AI-driven lab-tech start-ups, though staffing shortages in robot programming still constrain scale.

Asia-Pacific is the fastest-growing region with a 6.9% CAGR through 2030, boosted by China's 1 trillion yuan robotics initiative and Korea's USD 128 million intelligent-robot program. Japan leverages decades of automation heritage, and Australia uses federal grants to build GMP-grade bioprocessing sites. Localized service centers cut downtime, overcoming historic reliance on imported technicians. Government procurement policies that favor domestic suppliers accelerate installed-base expansion, cementing Asia-Pacific as the primary incremental revenue source for the automated liquid handlers market.

Europe maintains a firm foothold in the automated liquid handlers market through stable pharma pipelines in Germany, the United Kingdom, and France. Regulatory alignment across the EU smooths cross-border tech transfer, while sustainability mandates drive preference for robots with validated CO2 footprints. Southern European labs deploy automation in food and environmental testing, enlarging the addressable demand. Skills gaps are mitigated by apprenticeship programs tied to equipment suppliers, enabling consistent uptime and moderating service costs.

- Thermo Fisher Scientific Inc.

- Danaher Corp. (Beckman Coulter Life Sciences)

- Tecan Group Ltd.

- Hamilton Company

- PerkinElmer Inc. (Revvity)

- Agilent Technologies Inc.

- Mettler-Toledo International Inc.

- Becton, Dickinson and Company

- Eppendorf AG

- Formulatrix Inc.

- Aurora Biomed Inc.

- Sartorius AG (Biohit)

- Synchron Lab Automation

- Hudson Robotics Inc.

- Analytik Jena AG (Endress + Hauser)

- Opentrons Labworks Inc.

- Biosero Inc. (BICO Group)

- Gilson Inc.

- Lab Services B.V.

- Andrew Alliance S.A. (Waters)

- Integra Biosciences AG

- Corning Incorporated

- SPT Labtech Ltd.

- Festo AG and Co. KG

- Starlab International GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Throughput Requirements in High-Volume Genomic Screening (North America)

- 4.2.2 Adoption of Miniaturized Assay Formats Reducing Reagent Costs

- 4.2.3 Integration with AI-Driven Drug-Discovery Platforms Accelerating Hit-to-Lead Timelines

- 4.2.4 Expansion of Personalized Medicine Driving High-Accuracy Liquid Handling (Europe and US)

- 4.2.5 Permanent Molecular-Diagnostic capacity Post-COVID-19 (Global Reference Labs)

- 4.2.6 Government Funding for Automated Bioprocessing (Asia-Pacific)

- 4.3 Market Restraints

- 4.3.1 High Initial CapEx for Flexible Deck Workstations in Emerging Markets

- 4.3.2 Skill Gap in Programming and Maintenance of Robotic Systems

- 4.3.3 Sample Cross-Contamination Risks in High-Viscosity Liquids

- 4.3.4 Legacy LIMS Integration Challenges in Big-Pharma Labs

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Robotic Liquid-Handling Workstations

- 5.1.2 Pipetting Systems

- 5.1.3 Reagent Dispensers

- 5.1.4 Consumables (Tips, Plates, Reagents)

- 5.1.5 Software and Services

- 5.2 By Throughput Capability

- 5.2.1 Low Throughput (Less than 100 samples/run)

- 5.2.2 Medium Throughput (100-1000 samples/run)

- 5.2.3 High Throughput (Above 1 000 samples/run)

- 5.3 By Platform Configuration

- 5.3.1 Stand-Alone Benchtop Systems

- 5.3.2 Integrated Modular Platforms

- 5.4 By Application

- 5.4.1 Drug Discovery and Lead Optimization

- 5.4.2 Genomics and Proteomics

- 5.4.3 Clinical Diagnostics

- 5.4.4 Cell Biology and Stem-Cell Research

- 5.4.5 Synthetic Biology and Bioprocess Development

- 5.4.6 Other Applications

- 5.5 By End User

- 5.5.1 Pharmaceutical and Biotechnology Companies

- 5.5.2 CROs and CMOs

- 5.5.3 Academic and Research Institutes

- 5.5.4 Clinical and Diagnostic Laboratories

- 5.5.5 Forensic and Environmental Testing Labs

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 South Korea

- 5.6.3.4 India

- 5.6.3.5 South East Asia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Thermo Fisher Scientific Inc.

- 6.4.2 Danaher Corp. (Beckman Coulter Life Sciences)

- 6.4.3 Tecan Group Ltd.

- 6.4.4 Hamilton Company

- 6.4.5 PerkinElmer Inc. (Revvity)

- 6.4.6 Agilent Technologies Inc.

- 6.4.7 Mettler-Toledo International Inc.

- 6.4.8 Becton, Dickinson and Company

- 6.4.9 Eppendorf AG

- 6.4.10 Formulatrix Inc.

- 6.4.11 Aurora Biomed Inc.

- 6.4.12 Sartorius AG (Biohit)

- 6.4.13 Synchron Lab Automation

- 6.4.14 Hudson Robotics Inc.

- 6.4.15 Analytik Jena AG (Endress + Hauser)

- 6.4.16 Opentrons Labworks Inc.

- 6.4.17 Biosero Inc. (BICO Group)

- 6.4.18 Gilson Inc.

- 6.4.19 Lab Services B.V.

- 6.4.20 Andrew Alliance S.A. (Waters)

- 6.4.21 Integra Biosciences AG

- 6.4.22 Corning Incorporated

- 6.4.23 SPT Labtech Ltd.

- 6.4.24 Festo AG and Co. KG

- 6.4.25 Starlab International GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment