|

市場調查報告書

商品編碼

1851758

虹膜辨識:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Iris Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

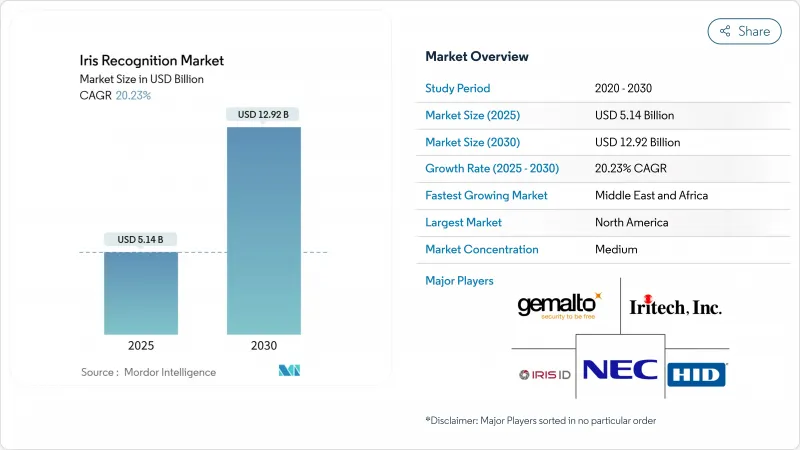

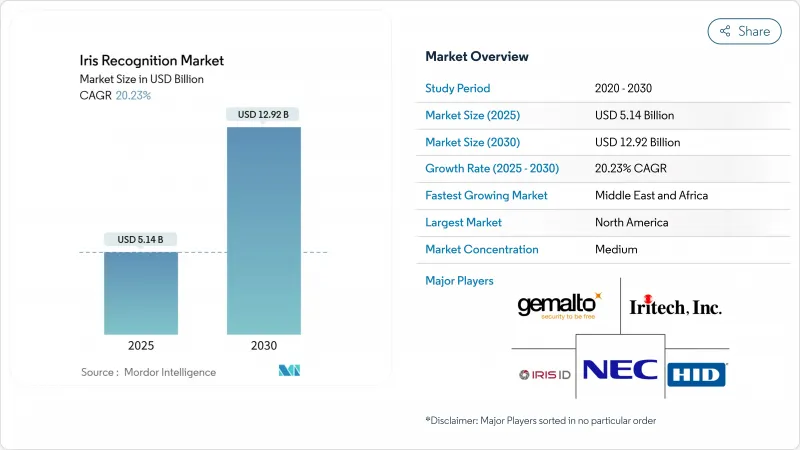

預計到 2025 年,虹膜辨識市場規模將達到 51.4 億美元,到 2030 年將達到 129.2 億美元,複合年成長率為 20.23%。

這一強勁的發展軌跡標誌著該技術正從政府的特定部署領域走向日常消費環境。對非接觸式身分驗證日益成長的需求、網路威脅風險的增加以及監管合規要求的提高,都在加速銀行、醫療保健、旅遊和消費電子等行業的應用。儘管硬體仍然是最大的成本中心,但隨著雲端原生匹配引擎速度的提升和中階買家准入門檻的降低,軟體的戰略地位正在日益凸顯。亞太地區憑藉大規模的國家識別項目獲得了先發優勢,而中東地區則在機場現代化和旅遊業便利化的推動下,實現了最快的複合年成長率。日益激烈的競爭圍繞著演算法的準確性、多模態整合以及能夠應對不斷變化的資料主權規則的以隱私為中心的設計特性。

全球虹膜辨識市場趨勢與洞察

亞洲國民身分證和電子護照計畫擴展

亞太地區各國政府持續推廣虹膜辨識數位身分平台,以簡化公共服務流程並促進普惠金融。印度的DigiLocker升級允許企業透過Aadhaar資料庫驗證員工身份,從而將服務對象擴展到個人公民之外。泰國公共衛生部門正在為外來務工人員部署多模態註冊自助服務終端,將虹膜掃描與疫苗接種和福利資格關聯起來。隨著大規模生產,光學模組的成本已降至個位數美元水平,為預算有限的機構提供了切入點。隨著註冊勢頭持續強勁,供應商看到了維護合約和定期感測器更新帶來的永續收入潛力,而這些都得益於性能標準的提升。

增加中東走廊邊境管制支出

海灣國家正在大規模部署虹膜辨識,以平衡主要機場的安全閾值和旅客流量目標。阿拉伯聯合大公國的eGate專案由IDEMIA公司提供,採用遠端虹膜辨識採集技術,無需接觸入境櫃檯即可完成居民和遊客的入境手續。沙烏地阿拉伯的「2030願景」工作小組要求所有新建航廈都必須配備多模態生物識別,這促使像Invixium這樣的供應商致力於建立在地化組裝線,以實現快速客製化。因此,採購流程傾向於高通量掃描器和雲端匹配引擎,這些設備每小時可處理數千名旅客的入境手續,同時也為入境官員記錄審核級別的證據。

機場多模態生物識別樞紐的高額資本支出

機場在對現有查核點進行改造,加裝包含虹膜、臉部和指紋辨識等多種功能的多模態安檢艙時,前期投入成本較高。運輸安全管理局(TSA) 的試點計畫顯示,此類系統能夠提高旅客吞吐量,但需要專用通道、LED 安全照明以及連接至中央匹配引擎的專用光纖回程傳輸。規模較小的美國機場通常會等到客流量達到投資回報週期後再部署,這迫使供應商採用模組化、計量收費的模式,分兩階段部署。

細分市場分析

由於需要精密的光學元件、可控的照明和堅固耐用的機殼,硬體仍將是虹膜辨識市場的主導力量,預計到2024年將佔總收入的73%。然而,隨著雲端推理引擎提升辨識速度並實現無需大規模更換設備的靈活功能更新,成長動力正逐漸轉向軟體。系統營運商報告稱,攝影機升級週期平均為四到五年,並按季度部署演算法補丁以提高識別精度,以適應不斷變化的人口結構。

從2025年到2030年,軟體產業的複合年成長率將達到22.8%,凸顯了從資本支出模式轉向訂閱模式的轉變。分層架構支援快速部署,以應對不斷湧現的新隱私法規,這對醫療保健和金融採購委員會而言是一個重要影響因素。同時,組件供應商正在縮小紅外線LED陣列的體積,並應用汽車級耐溫等級,以支援在光照條件難以預測的戶外環境中更廣泛地部署。開放API鏡頭支援跨模態融合,使操作人員能夠將虹膜和臉部影像從單一感測器傳輸到通用後端。

到2024年,1:N模式將佔據虹膜辨識市場66.2%的佔有率,並廣泛應用於邊境管制、選民登記和福利發放等領域,這些領域需要處理數百萬筆記錄的資料庫並進行一對多搜尋。各國政府會在旅遊旺季投入大量運算預算,檢驗該架構應對並發查詢的能力。

未來五年,一對一檢驗預計將以20.6%的複合年成長率成長,因為企業和行動錢包供應商將優先考慮快速用戶檢驗而非詳盡的去重。便利性也至關重要,因為延遲必須保持在250毫秒以下,以避免用戶放棄結帳。歐洲的先驅銀行目前正在將虹膜掃描與動態2D碼令牌相結合來綁定交易會話,從而在不明顯增加用戶摩擦的情況下降低網路釣魚風險。隨著這些解決方案的規模化,數據將被反饋到自適應閾值引擎中,以改善不同文化背景用戶群體中誤報和漏報之間的平衡。

區域分析

到2024年,亞太地區將佔全球收入的36%,這主要得益於印度超過12億公民的Aadhaar識別系統註冊以及智慧型手機的快速互動,使得生物識別互動變得普遍。中國行動電話廠商正在將虹膜解鎖功能整合到旗艦機型中,以支援支付寶和微信支付等支付方式;而日本NEC公司則正在將其生物辨識技術套件商業化,應用於公共運輸和零售自助結帳系統。監管環境的明朗化、行動資料通訊普及率高以及對價格敏感但又精通技術的消費者群體,為持續成長的用戶基數創造了有利條件。

中東地區預計到2030年將以21.3%的複合年成長率實現最快成長,這主要得益於海灣機場無縫旅客通道的建設以及各國數位識別藍圖的推進。阿拉伯聯合大公國決定逐步淘汰實體ID卡,轉而採用臉部認證和虹膜辨識驗證,凸顯了阿拉伯聯合大公國政府擺脫傳統卡片的決心。在沙烏地阿拉伯,本地供應商正在聯合生產掃描儀,這使得該地區成為需求和生產中心。

歐洲和北美正處於政策需求成熟的階段。 GDPR 的強制要求推動了對國內雲端節點和加密疊加層的投資,這需要採用以隱私為核心的設計架構。美國市場寄望聯邦政府為海關和邊防安全提供的資金,以擴大虹膜採集試點項目,並升級邊境口岸和航空樞紐。由於公民自由組織正在監督部署情況,因此準確的活體檢測和透明的審核追蹤對於獲得公眾認可至關重要。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲國民身分證和電子護照計畫擴展

- 增加中東走廊邊境管制支出

- 智慧型手機OEM廠商採用設備端虹膜感測器

- 美國醫療保健領域非接觸式患者身分識別強制措施的擴展

- 歐盟數位錢包計畫加速了電子身分驗證(e-KYC)的需求。

- 銀行、金融服務和保險業的跨境反洗錢合規

- 市場限制

- 機場多模態生物識別樞紐的高額資本支出

- 非合作捕獲場景下的精度劣化

- 資料主權和生物特徵模板儲存規範(歐盟GDPR)

- 北美公民意識與對自由的反彈

- 價值/供應鏈分析

- 監理與技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按組件

- 硬體

- 虹膜掃描儀

- 相機

- 整合虹膜辨識系統

- 其他光學模組和照明

- 軟體

- 獨立匹配引擎

- SDK 和中介軟體

- 雲端基礎的平台

- 硬體

- 透過身份驗證模式

- 1:1檢驗

- 1:N 歧視

- 透過使用

- 門禁和考勤

- 身分識別和邊境管制

- 交易和支付認證

- 病患識別與電子病歷整合

- 其他(KYC、監控、車載資訊娛樂系統)

- 按最終用戶行業分類

- 政府和執法部門

- 銀行、金融服務和保險(BFSI)

- 醫療保健和生命科學

- 消費性電子產品

- 軍事/國防

- 旅行和移民

- 商業和公司

- 其他(教育、汽車OEM廠商)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 新加坡

- 澳洲

- 紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 肯亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- NEC Corporation

- IDEMIA

- HID Global(ASSA ABLOY)

- Thales Group(Gemalto)

- Iris ID Inc.

- IriTech Inc.

- EyeLock LLC

- Princeton Identity Inc.

- BioEnable Technologies Pvt. Ltd.

- IrisGuard UK Ltd.

- Aware Inc.

- Vision-Box

- DERMALOG Identification Systems

- Cognitec Systems GmbH

- Smartmatic

- Samsung Electronics Co., Ltd.

- Fujitsu Limited

- CLEAR Inc.

- CMITech Company Ltd.

- SRI International

第7章 市場機會與未來展望

The iris recognition market size stands at USD 5.14 billion in 2025 and is forecast to expand to USD 12.92 billion by 2030, reflecting a compound annual growth rate (CAGR) of 20.23%.

This robust trajectory shows how the technology has moved beyond niche government deployments into everyday consumer environments. Heightened demand for contact-free authentication, rising cyber-threat exposure, and stronger compliance expectations from regulators have all accelerated adoption across banking, healthcare, travel, and consumer electronics. Hardware remains the largest cost center, yet software gains more strategic weight as cloud-native matching engines improve speed and lower entry barriers for mid-sized buyers. Asia-Pacific commands an early-mover advantage through scaled national identity programs, while the Middle East delivers the fastest CAGR on the back of airport modernization and tourism facilitation mandates. Intensifying competition now revolves around algorithmic accuracy, multimodal integration, and privacy-centric design features that can withstand evolving data-sovereignty rules.

Global Iris Recognition Market Trends and Insights

Growing National-ID & e-Passport Programs in Asia

Asia-Pacific governments keep scaling iris-enabled digital identity platforms to streamline public-service delivery and financial inclusion. India's DigiLocker upgrade now allows corporate entities to verify staff credentials through the Aadhaar database, widening the addressable base beyond individual citizens.Thailand's public-health authorities have introduced multimodal enrolment kiosks for migrant workers, linking iris scans to vaccination and benefits eligibility. Optical module costs have fallen toward single-digit USD levels in high-volume production, giving budget-constrained agencies an entry point. As enrollment momentum continues, vendors see durable revenue from maintenance contracts and periodic sensor refresh cycles that follow increased performance standards.

Rising Border-Control Spending Across Middle-East Corridors

Gulf states deploy iris recognition at scale to balance security thresholds with passenger-flow targets in flagship airports. The UAE's eGate program, delivered with IDEMIA, employs iris-at-distance capture to process residents and visitors without touching immigration counters. Saudi Arabia's Vision 2030 task force mandates multimodal biometrics for all new terminals, prompting suppliers such as Invixium to commit to local assembly lines for quicker customization. The resulting procurement pipeline favors high-throughput scanners and cloud-ready matching engines that can clear several thousand travelers per hour while logging audit-grade evidence for immigration officials.

High CAPEX of Multimodal Biometric Hubs at Airports

Airports face steep upfront costs when retrofitting existing checkpoints with multimodal pods that include iris, face, and fingerprint options. U.S. Transportation Security Administration trials show passenger throughput gains yet require specialized lanes, LED-safe lighting, and dedicated fiber backhauls to central matching engines. Smaller regional airports postpone rollouts until passenger volumes justify the payback, creating a two-tier adoption curve that suppliers must navigate with modular, pay-per-use pricing models.

Other drivers and restraints analyzed in the detailed report include:

- Smartphone OEM Adoption of On-Device Iris Sensors

- Expansion of Contactless Patient-ID Mandates in U.S. Healthcare

- Data-Sovereignty & Biometric-Template Storage Regulations (EU GDPR)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware accounted for 73% of 2024 revenue and continues to anchor the iris recognition market, given the need for precision optics, controlled illumination, and rugged housings. Growth, however, shifts toward software as cloud inference engines raise recognition speeds and enable agile feature updates without forklift replacements. System operators report average upgrade cycles of four to five years for cameras, yet deploy quarterly algorithm patches to improve accuracy against evolving demographic mixes.

Software's 22.8% CAGR from 2025-2030 underscores the pivot from capital expenditure to subscription models, letting smaller enterprises trial enterprise-grade accuracy through pay-as-you-go APIs. The layered architecture supports quick rollouts when new privacy mandates emerge, a factor that materially influences procurement committees in health and finance. In parallel, component suppliers miniaturize infrared LED arrays and apply automotive-grade temperature ratings, expanding outdoor deployment windows where lighting is unpredictable. Open-API lenses invite cross-modality fusion, letting operators stream both iris and face images from a single sensor to common back ends.

The 1:N mode represented 66.2% iris recognition market size in 2024, supported by border-control, voter registry, and welfare-benefit rollouts requiring one-to-many searches against multimillion-record galleries. Governments reserve significant compute budgets for peak travel seasons, validating the architecture's resilience for concurrent queries.

Over the next five years, 1:1 verification is expected to record a 20.6% CAGR as corporates and mobile-wallet providers focus on rapid user validation rather than exhaustive de-duplication. The convenience angle resonates where latency must stay below 250 milliseconds to avoid checkout abandonment. Early adopter banks in Europe now pair iris scans with dynamic QR tokens to bind the transaction session, reducing phishing risk without noticeable user friction. As these point solutions scale, they feed data back into adaptive thresholding engines that improve false-accept/false-reject balances across culturally diverse user cohorts.

The Iris Recognition Market Report is Segmented by Component (Hardware, Software), Authentication Mode (1:1 Verification, 1:N Identification), Application (Access Control and Time-Attendance, ID and Border Control, and More), End-User Industry (Government and Law-Enforcement, BFSI, and More), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 36% of global revenue in 2024, underpinned by India's Aadhaar enrollment of over 1.2 billion citizens and rapid smartphone penetration that normalizes biometric interactions. Chinese handset vendors bundle iris unlock in flagship models to underpin Alipay and WeChat Pay transfers, while Japan's NEC commercializes its Bio-IDiom suite across transportation and retail self-checkout lanes. Regulatory clarity, strong mobile data coverage, and price-sensitive yet tech-savvy consumers create a fertile setting for sustained installation growth.

The Middle East records the fastest trajectory at 21.3% CAGR through 2030, fueled by Gulf airports' shift to seamless passenger corridors and national digital-ID roadmaps. The UAE's decision to retire physical Emirates ID cards in favor of a facial-and-iris credential highlights the policy's will to leapfrog legacy cards. Saudi Arabia's localization drives push vendors to co-manufacture scanners, positioning the region as both a demand hub and a production base.

Europe and North America display mature yet policy-shaped demand curves. GDPR obligations force privacy-by-design architectures, prompting greater investment in in-country cloud nodes and encryption overlays. The U.S. market banks on federal funding to update border checkpoints and aviation hubs, with Customs and Border Protection extending iris capture pilots to additional crossings. Civil-liberties groups monitor deployments, so accurate liveness detection and transparent audit trails are critical to winning public acceptance.

- NEC Corporation

- IDEMIA

- HID Global (ASSA ABLOY)

- Thales Group (Gemalto)

- Iris ID Inc.

- IriTech Inc.

- EyeLock LLC

- Princeton Identity Inc.

- BioEnable Technologies Pvt. Ltd.

- IrisGuard UK Ltd.

- Aware Inc.

- Vision-Box

- DERMALOG Identification Systems

- Cognitec Systems GmbH

- Smartmatic

- Samsung Electronics Co., Ltd.

- Fujitsu Limited

- CLEAR Inc.

- CMITech Company Ltd.

- SRI International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing National-ID and e-Passport Programs in Asia

- 4.2.2 Rising Border-Control spending across Middle-East corridors

- 4.2.3 Smartphone OEM Adoption of On-Device Iris Sensors

- 4.2.4 Expansion of Contactless Patient ID mandates in U.S. Healthcare

- 4.2.5 EU Digital Wallet Initiatives accelerating e-KYC demand

- 4.2.6 Cross-Border Money-laundering Compliance in BFSI

- 4.3 Market Restraints

- 4.3.1 High CAPEX of Multimodal Biometric Hubs at Airports

- 4.3.2 Accuracy Degradation under Non-cooperative Capture Scenarios

- 4.3.3 Data-sovereignty and Biometric-template Storage Regulations (EU GDPR)

- 4.3.4 Public Perception and Civil-liberties Backlash in North America

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Iris Scanners

- 5.1.1.2 Cameras

- 5.1.1.3 Integrated Iris-Recognition Systems

- 5.1.1.4 Other Optical Modules and Illumination

- 5.1.2 Software

- 5.1.2.1 Stand-alone Matching Engines

- 5.1.2.2 SDKs and Middleware

- 5.1.2.3 Cloud-based Platforms

- 5.1.1 Hardware

- 5.2 By Authentication Mode

- 5.2.1 1:1 Verification

- 5.2.2 1:N Identification

- 5.3 By Application

- 5.3.1 Access Control and Time-Attendance

- 5.3.2 ID and Border Control

- 5.3.3 Transaction and Payment Authentication

- 5.3.4 Patient Identification and EMR Linkage

- 5.3.5 Others (KYC, Surveillance, Automotive Infotainment)

- 5.4 By End-user Industry

- 5.4.1 Government and Law-Enforcement

- 5.4.2 Banking, Financial Services and Insurance (BFSI)

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Consumer Electronics

- 5.4.5 Military and Defense

- 5.4.6 Travel and Immigration

- 5.4.7 Commercial and Enterprise

- 5.4.8 Others (Education, Automotive OEMs)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Singapore

- 5.5.4.6 Australia

- 5.5.4.7 New Zealand

- 5.5.4.8 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Kenya

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NEC Corporation

- 6.4.2 IDEMIA

- 6.4.3 HID Global (ASSA ABLOY)

- 6.4.4 Thales Group (Gemalto)

- 6.4.5 Iris ID Inc.

- 6.4.6 IriTech Inc.

- 6.4.7 EyeLock LLC

- 6.4.8 Princeton Identity Inc.

- 6.4.9 BioEnable Technologies Pvt. Ltd.

- 6.4.10 IrisGuard UK Ltd.

- 6.4.11 Aware Inc.

- 6.4.12 Vision-Box

- 6.4.13 DERMALOG Identification Systems

- 6.4.14 Cognitec Systems GmbH

- 6.4.15 Smartmatic

- 6.4.16 Samsung Electronics Co., Ltd.

- 6.4.17 Fujitsu Limited

- 6.4.18 CLEAR Inc.

- 6.4.19 CMITech Company Ltd.

- 6.4.20 SRI International

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment