|

市場調查報告書

商品編碼

1851752

資料中心轉型:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Data Center Transformation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

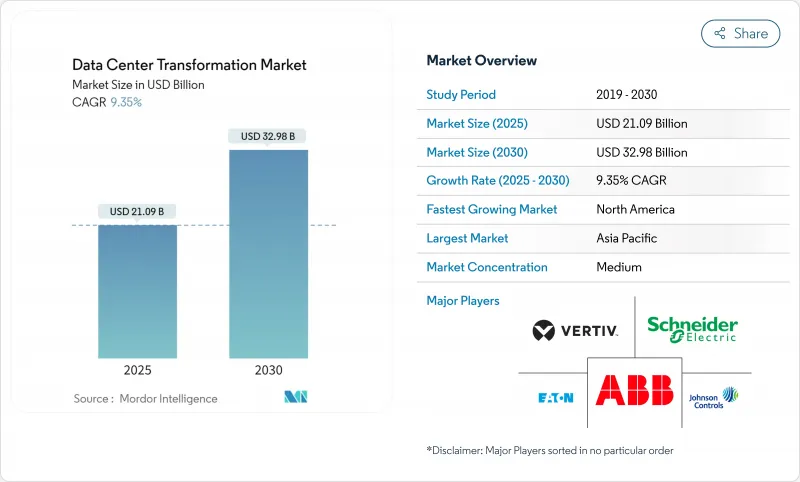

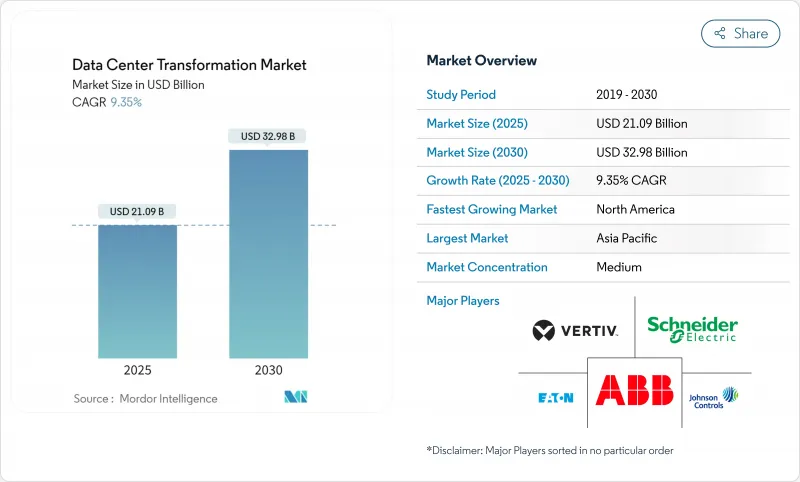

預計資料中心轉型市場將從 2025 年的 210.9 億美元成長到 2030 年的 329.8 億美元,複合年成長率為 9.35%。

人工智慧 (AI) 工作負載的日益成長、機架功率密度的不斷提高以及軟體定義資料中心的日益普及,正在推動對現代化服務的需求,包括整合、最佳化、自動化和遷移。隨著 AI 功率密度從每機架 5-10kW 提升至每機架 40-140kW,企業正從傳統的風冷技術轉向液冷技術。雲端原生設計原則正在滲透到託管資料中心,而超大規模營運商正在加速邊緣節點的部署,以支援對延遲敏感的應用。來自機構投資者和永續性相關金融機構的資金流入正在縮短三級和四級資料中心的建設週期。雖然亞太地區在容量擴張方面處於領先領先,但北美透過與 AI 基礎設施合作以及採購可再生能源,保持其先發優勢。

全球資料中心轉型市場趨勢與洞察

降低成本和提高效率的必要性

更低的總體擁有成本正在推動伺服器整合、儲存虛擬化和冷卻系統最佳化等現代化計劃。約旦首都銀行利用 IBM Cloud Pak for Data 將資料遷移時間縮短了 95%,使員工能夠騰出時間從事更高價值的工作。 Salling Group 整合了基礎設施,在每天處理 900 萬筆零售交易的同時,每年節省了 52 萬美元。由於資料中心消耗了全球 1-2% 的電力需求,不斷上漲的電價和永續性要求促使人們更加關注能源效率。營運商現在以低於 1.2 的電源使用效率 (PUE) 目標作為設計基準,從而推動了先進冷水機組和後門式熱交換器的應用。在區域層面,財務團隊現在將計劃核准與檢驗的兆瓦時和人工成本節約掛鉤。

快速採用雲端和混合雲端架構

企業正透過將工作負載分佈在公有雲、本地叢集和託管機房中,來平衡敏捷性和管治。例如,阿育他亞銀行將其關鍵業務系統遷移到亞馬遜雲端服務 (AWS) 上的混合架構,實現了配置流程的自動化,同時提升了可觀測性和安全性。在英國,國民醫療服務體系 (NHS) 將記錄和分析功能遷移到雲端基礎設施後,淘汰了傳統基礎設施,從而降低了固定成本和碳排放。軟體定義資料中心市場預計到 2032 年將以 20.1% 的複合年成長率成長,這凸顯了基於策略的自動化和微隔離在支援混合策略方面的重要性。隨著對延遲敏感型人工智慧推理的需求不斷成長,企業正在採用雲端爆發技術來快速啟動 GPU叢集,同時將敏感資料庫保留在可信賴的設施中。因此,服務供應商更重視區域間的直連架構和低延遲連結。

高額資本支出與投資報酬率不確定性

建造一座配備液冷系統、100兆瓦變電站和冗餘光纖線路的AI賦能大廳,每遷移Terabyte資料的成本可能超過1.5萬美元,而人事費用和停機時間成本則會使儲存購置成本翻倍。開關設備和發電機的前置作業時間現已延長至6-12個月,迫使買家在需求完全顯現之前就鎖定設計方案。 GPU晶片短缺和激烈的市場競爭加劇了價格風險,並使商業案例預測變得更加複雜。與永續性掛鉤的融資機制的激增,要求企業設定溫室氣體排放目標,增加了合規成本。利率上升使得小型企業難以獲得棕地維修資金籌措,從而延緩了除一線城市以外地區的產能擴張。

細分市場分析

到2024年,最佳化將佔資料中心轉型市場28.3%的佔有率,企業將透過工作負載部署、合理配置和氣流分析等方式釋放現有資產的剩餘容量。自動化預計將以11.2%的複合年成長率成為成長最快的領域,這主要得益於人工智慧主導的編配引擎,它們可以調整功率上限、啟動即時遷移並觸發預測性維護。整合計劃仍然重要,剝離和合併旨在減少機架佔用空間。隨著營運商將監控外包給託管服務專家,基礎設施管理合約的需求正在成長,尤其是在服務等級協議要求提供全天候支援的情況下。

隨著企業從單體系統轉向運行在GPU密集型節點上的容器集群,遷移和升級的需求將會增加。以自動化為中心的資料中心轉型市場預計到2030年將達到1,17億美元,而2025年為84億美元。勞動力短缺是推動這一趨勢的主要因素,58%的營運商面臨招聘難題,因此他們開始採用營運手冊自動化來擴展容量,而無需線性增加員工人數。供應商正在將數位雙胞胎融入其服務組合,使客戶能夠在重新安裝設備之前對熱感區進行建模,從而減少工期延誤。

三級資料中心將實現 99.982% 的運轉率,並佔據 2024 年資料中心轉型市場佔有率的 51.4%,主要服務於能夠容忍較短維護視窗的企業級工作負載。然而,四級資料中心將以 12.4% 的複合年成長率成長,因為人工智慧模型訓練、高頻交易和關鍵任務型健康平台對計劃外停機時間的要求極高,因此四級資料中心的市場佔有率將大幅下降。營運商透過差異化的服務等級協定、容錯架構和安全的園區設計來證明其高昂成本的合理性。

一級和二級資料中心主要針對研發實驗室和歸檔儲存等小眾應用場景,在這些場景中,預算限制優先於維修目標。四級資料中心改造市場預計將從2025年的52億美元成長到2030年的94億美元。 Equinix和Digital Realty等超大規模資料中心營運商透過增加N+2電源路徑和液冷歧管來延長舊園區的使用壽命,從而有效地將其升級到四級資料中心,而無需徹底重建。隨著監管機構將運作閾值納入數位銀行指南,對高階設計的需求可能會增加。

資料中心轉型市場報告按服務類型(整合服務、最佳化服務等)、資料中心類型(Tier 1、Tier 2、Tier 3、Tier 4)、最終用戶(資料中心供應商、企業)、部署模式(本地部署、託管等)和地區(北美、歐洲等)對產業進行細分。市場預測以美元計價。

區域分析

到2024年,北美將佔據資料中心轉型市場37.4%的佔有率,這得益於其成熟的超大規模生態系統、成熟的可再生能源信用額度以及密集的網際網路。亞馬遜在賓州投資200億美元的項目以及Vantage Data Centers 92億美元的注資,都顯示該地區的發展勢頭持續強勁。預計到2030年,北美地區的複合年成長率將達到9.8%,該地區正受益於與核能相連的人工智慧晶片叢集,這些集群緩解了電網壓力。維吉尼亞、德克薩斯州和俄亥俄州提供的與能源效率指標掛鉤的房產稅減免等州級激勵措施,正在擴大現有企業的競爭基準化分析。

亞太地區正以12.7%的複合年成長率高速成長,這主要得益於電子商務的蓬勃發展、智慧型手機的普及以及有利的政策框架。印度計畫在2026年新增850兆瓦的雲端容量,這主要得益於亞馬遜雲端服務(AWS)127億美元的投資承諾以及NTT 15億美元的擴張計畫。隨著企業遵守資料本地化法規和人工智慧就緒目標,Oracle將在日本投資超過80億美元用於主權雲端建置。馬來西亞柔佛新山走廊已安裝1.6吉瓦的雲端容量,並正在崛起為區域中心,吸引了Google、英偉達和微軟等公司的投資。

永續性是歐洲關注的重點,能源效率指令強制要求能源消耗透明化和可再生能源採購。營運商正積極響應,將熱能循環利用系統納入區域供熱,並簽署全天候無碳電力合約。 Vantage 資料中心近期撥款 14 億歐元用於歐洲、中東和非洲地區的擴張,重點是低碳材料和模組化電池。在沙烏地阿拉伯和阿拉伯聯合大公國,符合智慧城市規劃的待開發區區域正在快速建設中。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力:波特五力分析

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 資料中心降低成本和提高效率的需求

- 採用雲端基礎服務

- 電子商務資料庫的重要性日益凸顯,預計將大幅成長。

- 市場限制

- 載入資料中心投資的報酬率問題

第6章 市場細分

- 透過服務

- 整合服務

- 最佳化服務

- 自動化服務

- 基礎設施管理

- 按資料中心級別

- 一級

- 二級

- 三級

- 第四級

- 最終用戶

- 資料中心提供者

- 公司

- 資訊科技和電信

- BFSI

- 衛生保健

- 零售

- 製造業

- 航太、國防與情報

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第7章 競爭情勢

- 公司簡介

- IBM Corporation

- Cisco Systems, Inc.

- NetApp, Inc.

- NTT Communications

- Dell EMC(Dell Inc.)

- Microsoft Corporation

- Schneider Electric SE

- HCL Technologies Limited

- Accenture plc

- Wipro Technologies

- Hitachi Vantara Federal, Corporation

- Emerson Network Power, Inc

第8章 投資分析

第9章 市場機會與未來趨勢

The data center transformation market is valued at USD 21.09 billion in 2025 and is forecast to advance to USD 32.98 billion by 2030, translating into a 9.35% CAGR.

Intensifying artificial intelligence (AI) workloads, escalating rack power densities, and rising adoption of software-defined data centers are expanding demand for modernization services across consolidation, optimization, automation, and migration. Enterprises are shifting from conventional air cooling to liquid technologies as power densities for AI move from 5-10 kW per rack toward 40-140 kW. Cloud-native design principles are permeating colocation sites, while hyperscale operators accelerate edge nodes to support latency-sensitive applications. Capital inflows from institutional investors and sustainability-linked finance are compressing build times for Tier 3 and Tier 4 facilities. Asia-Pacific is racing ahead on capacity additions, yet North America retains early-mover advantages in AI infrastructure partnerships and renewable-energy sourcing.

Global Data Center Transformation Market Trends and Insights

Need to Reduce Costs and Improve Efficiency

Lowering total cost of ownership propels modernization projects that consolidate servers, virtualize storage, and fine-tune cooling systems. Capital Bank of Jordan cut data-migration time by 95% through IBM Cloud Pak for Data, freeing staff for higher-value tasks. Salling Group captured USD 520,000 in yearly savings by consolidating infrastructure while still handling 9 million daily retail transactions, illustrating how operating efficiency can coexist with performance gains. Rising electricity prices and sustainability mandates intensify focus on energy efficiency because data centers consume 1-2% of global power demand. Operators now benchmark designs against power-usage-effectiveness (PUE) targets below 1.2, pushing adoption of advanced chillers and rear-door heat exchangers. Across regions, finance teams increasingly link project approval to verifiable reductions in megawatt hours and labor overhead.

Rapid Adoption of Cloud and Hybrid-Cloud Architectures

Organizations balance agility and governance by scattering workloads across public clouds, on-premises clusters, and colocation suites. Bank of Ayudhya migrated core systems onto a hybrid Amazon Web Services stack, improving observability and security while automating deployment pipelines. In the United Kingdom, the NHS decommissioned legacy halls after shifting records and analytics to cloud infrastructure, shrinking fixed costs and carbon footprint. The software-defined data center market is forecast to expand at 20.1% CAGR to 2032, underscoring how policy-based automation and micro-segmentation underpin hybrid strategies. As latency-critical AI inference demands rise, enterprises adopt cloud bursting to spin up GPU clusters while retaining sensitive databases in trusted facilities. Consequently, service providers emphasize direct-connect fabrics and inter-region low-latency links.

High CAPEX and ROI Uncertainty

Building AI-ready halls with liquid cooling, 100 MW substations, and redundant fiber routes can exceed USD 15,000 per terabyte of data migrated, doubling storage acquisition costs once labor and downtime are included. Lead times for switchgear and generators now stretch to 6-12 months, forcing buyers to lock in designs long before demand crystallizes. Chip shortages and intense competition for GPUs raise pricing risk, complicating business-case projections. Financing structures increasingly feature sustainability-linked loans requiring greenhouse-gas targets, adding compliance costs. Amid rising interest rates, smaller operators struggle to fund brownfield retrofits, slowing capacity additions outside Tier 1 metros.

Other drivers and restraints analyzed in the detailed report include:

- AI-Driven Infrastructure Optimization

- Edge Computing Proliferation

- Security and Regulatory Compliance Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Optimization held 28.3% of the data center transformation market in 2024 as enterprises wrung extra capacity from existing assets through workload placement, right-sizing, and airflow analytics. Automation is projected to register the fastest 11.2% CAGR, propelled by AI-driven orchestration engines that calibrate power caps, initiate live migration, and trigger predictive maintenance. Consolidation projects remain relevant for carve-outs and merger integrations seeking to shrink rack footprints. Infrastructure-management contracts grow as operators outsource monitoring to managed-service experts, especially where 24X7 support is mandatory under service level agreements.

Demand for migration and upgradation strengthens when firms pivot from monolithic systems to container clusters running on GPU-dense nodes. The data center transformation market size for automation-centric engagements is forecast to reach USD 11.7 billion by 2030 compared with USD 8.4 billion in 2025. Labor constraints intensify adoption because 58% of operators report hiring challenges, leading them to deploy run-book automation that ramps capacity without linear head-count growth. Vendors embed digital-twins into service portfolios so customers can model thermal zones before re-racking equipment, trimming schedule overruns.

Tier 3 facilities delivered 99.982% uptime and captured 51.4% of the data center transformation market share in 2024, serving enterprise workloads that tolerate short maintenance windows. Tier 4 halls, however, are growing at 12.4% CAGR as AI model training, high-frequency trading, and mission-critical health platforms treat unplanned outages as unacceptable. Operators justify premium costs through differentiated service-level agreements, fault-tolerant architecture, and secure campus designs.

Tier 1 and Tier 2 sites remain niche for development labs and archival storage where budget limitations override availability targets. The data center transformation market size for Tier 4 retrofits is projected to expand from USD 5.2 billion in 2025 to USD 9.4 billion by 2030. Hyperscalers such as Equinix and Digital Realty prolong the life of older campuses by adding N+2 power paths and liquid-cooling manifolds, effectively migrating them toward Tier 4 capabilities without full rebuilds. As regulators embed uptime thresholds into digital-banking guidelines, demand for premium designs will further escalate.

Data Center Transformation Market Report Segments the Industry Into Services (Consolidation Services, Optimization Services, and More), Data Center (Tier 1, Tier 2, Tier 3, Tier 4), by End User (Data Center Providers, Enterprises), Deployment Model(On-Premises, Colocation and More)and by Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 37.4% of the data center transformation market in 2024, underpinned by an entrenched hyperscale ecosystem, mature renewable-energy credits, and dense interconnect fabrics. Amazon's USD 20 billion Pennsylvania program and Vantage Data Centers' USD 9.2 billion equity injection signal continued build-out momentum. The region's 9.8% projected CAGR to 2030 benefits from AI chip clusters linked to nuclear-powered campuses that mitigate grid constraints. State incentives across Virginia, Texas, and Ohio offer property-tax abatements tied to energy-efficiency benchmarks, extending the competitive advantage of incumbent operators.

Asia-Pacific is racing ahead with a 12.7% CAGR, buoyed by e-commerce expansion, smartphone penetration, and supportive policy frameworks. India plans to add 850 MW of capacity by 2026, fueled by an AWS commitment of USD 12.7 billion and NTT's USD 1.5 billion expansion. Japan attracts sovereign-cloud investments exceeding USD 8 billion from Oracle as enterprises comply with data-localization rules and AI readiness targets. Malaysia's Johor Bahru corridor is emerging as a regional hub with 1.6 GW installed, luring capital from Google, Nvidia, and Microsoft.

Europe emphasizes sustainability, mandating energy-consumption transparency and renewable sourcing under the Energy Efficiency Directive. Operators respond by integrating heat-re-use loops into district heating and procuring 24X7 carbon-free electricity contracts. Vantage Data Centers recently allocated EUR 1.4 billion for EMEA expansions focusing on low-carbon materials and modular batteries. The Middle East and Africa trail in absolute capacity but benefit from government-backed digital agendas; Saudi Arabia and the United Arab Emirates are fast-tracking greenfield zones aligned with smart-city blueprints.

- IBM Corporation

- Cisco Systems, Inc.

- NetApp, Inc.

- NTT Communications

- Dell EMC (Dell Inc.)

- Microsoft Corporation

- Schneider Electric SE

- HCL Technologies Limited

- Accenture plc

- Wipro Technologies

- Hitachi Vantara Federal, Corporation

- Emerson Network Power, Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need to Reduce Costs and Increase Efficiency of Data Centers

- 5.1.2 Adoption of Cloud-based Services

- 5.1.3 Increasing Significance of E-commerce Databases are Expected to Grow at a Significant Rate

- 5.2 Market Restraints

- 5.2.1 ROI Concerns Over the Investment across Low Load Data Centers

6 MARKET SEGMENTATION

- 6.1 By Services

- 6.1.1 Consolidation Services

- 6.1.2 Optimization Services

- 6.1.3 Automation Services

- 6.1.4 Infrastructure Management

- 6.2 By Level of Data Center

- 6.2.1 Tier 1

- 6.2.2 Tier 2

- 6.2.3 Tier 3

- 6.2.4 Tier 4

- 6.3 By End User

- 6.3.1 Data Center Providers

- 6.3.2 Enterprises

- 6.3.2.1 IT and Telecom

- 6.3.2.2 BFSI

- 6.3.2.3 Healthcare

- 6.3.2.4 Retail

- 6.3.2.5 Manufacturing

- 6.3.2.6 Aerospace, Defense, and Intelligence

- 6.3.2.7 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 South America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Cisco Systems, Inc.

- 7.1.3 NetApp, Inc.

- 7.1.4 NTT Communications

- 7.1.5 Dell EMC (Dell Inc.)

- 7.1.6 Microsoft Corporation

- 7.1.7 Schneider Electric SE

- 7.1.8 HCL Technologies Limited

- 7.1.9 Accenture plc

- 7.1.10 Wipro Technologies

- 7.1.11 Hitachi Vantara Federal, Corporation

- 7.1.12 Emerson Network Power, Inc