|

市場調查報告書

商品編碼

1851745

行動人工智慧:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Mobile Artificial Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

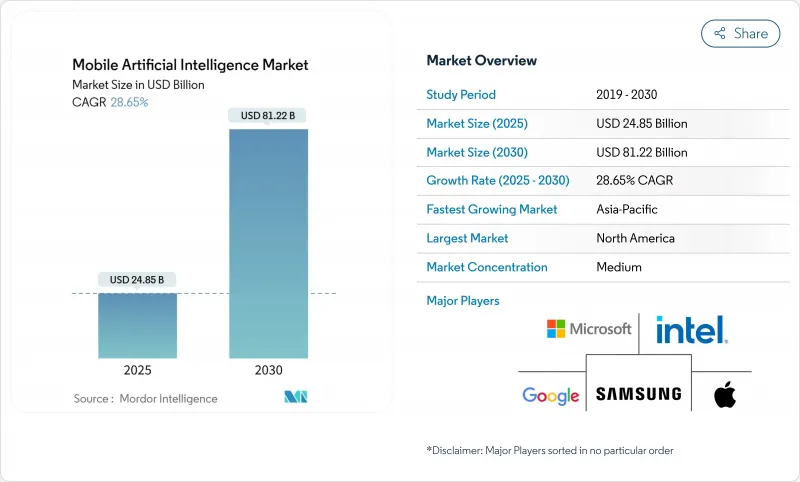

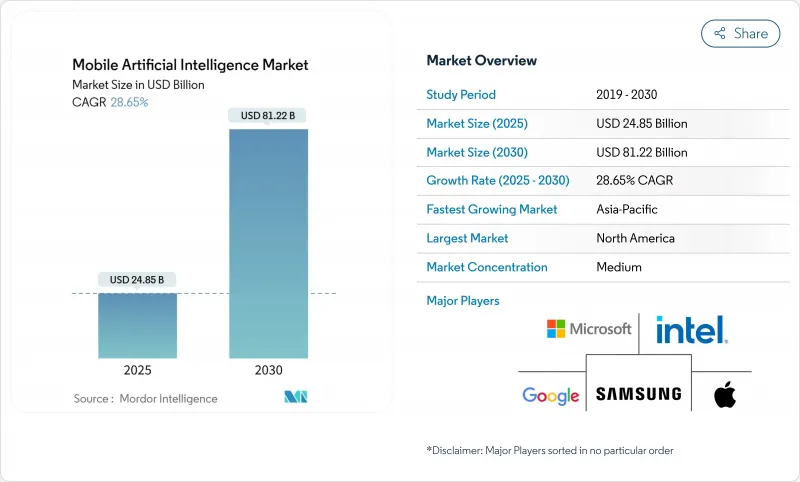

預計到 2025 年,行動人工智慧市場規模將達到 248.5 億美元,到 2030 年將達到 812.2 億美元,預測期(2025-2030 年)複合年成長率為 28.65%。

日益嚴格的資料主權法規、神經處理單元 (NPU) 的快速創新以及企業對低延遲推理的需求是關鍵的成長要素。高通驍龍 8 Elite 和 ARM Cortex-X925 等突破性晶片設計正在重新定義智慧型手機、汽車和工業設備的性能基準。供應商的策略現在強調垂直整合的軟硬體堆疊,以加快產品上市速度並實現差異化的裝置端 AI 功能。先進基板和高頻寬記憶體的供應鏈限制仍然影響著價格和供貨,但亞太地區的產能擴張表明,這種情況在 2026 年後有望得到緩解。

全球行動人工智慧市場趨勢與洞察

對人工智慧處理器的需求激增

人工智慧晶片組的空前普及正在重塑設備架構。 ARM 的 3nm Cortex-X925 處理器在 3.8GHz 的主頻下,吞吐量比上一代核心提升了 46%,同時保持了適用於高階行動電話的功耗上限。像高通和英偉達這樣獲得長期晶圓代工廠訂單的代工廠,能夠降低供應風險,確保具有競爭力的成本結構。三星 Galaxy S25 的 NPU 效能提升了 40%,凸顯了效能行銷策略的轉變,即從傳統的 CPU 指標轉向持續的 AI 推理能力。晶片需求也推動了固態散熱技術的創新,使得手持外形規格也能實現 25 瓦的散熱能力。由此帶來的效能餘量加速了對話式介面、即時視覺和裝置端分析等過去依賴雲端服務的應用。

搭載生成式人工智慧技術的智慧型手機發布

生成式人工智慧正從旗艦機型走向大眾市場。 Canalys預測,到2028年,全球54%的行動電話出貨量將具備人工智慧功能,這快速普及的趨勢與以往LTE技術的過渡類似。蘋果的神經網路引擎目前可為即時通訊提供裝置端情境建模,而三星的Galaxy AI則提供即時翻譯和內容創作功能。印度市場對價格的敏感度阻礙了人工智慧的普及。預計到2024年,售價低於600美元的設備僅佔出貨量的4-5%,將限制人工智慧的早期應用。為了彌合這一差距,聯發科發布了天璣9400,這是一款專為中階裝置打造的整合式NPU晶片。 OPPO已承諾透過與Google和微軟的合作,在5000萬部設備中嵌入生成式人工智慧功能。

AI晶片組定價較高

入門級AI智慧型手機的售價仍在600美元左右,這限制了其在具備大規模生產能力的新興經濟體中的普及。美光和SK海力士已將產能預留至2025年,導致高頻寬記憶體持續短缺,材料成本不斷上漲。台積電CoWoS生產線的封裝瓶頸也為行動裝置製造商帶來了額外的成本壓力。廠商的因應策略是分層設計功能集:透過對傳統晶片進行軟體最佳化來實現基本的AI功能,而高階機型則增加了先進的NPU加速功能。 2026年起,台灣和日本的新晶圓廠運作,可望逐步縮小AI晶片組和非AI晶片組之間的價格差距。

細分市場分析

智慧型手機將在2024年佔據56%的收入佔有率,而車載應用預計到2030年將以29.40%的複合年成長率成長,因為對話式車載助手和自動駕駛功能正從高階配置走向主流功能。隨著L3級高速公路自動駕駛系統成為高階車型的標配,車載系統的行動人工智慧市場規模預計將迅速擴張。 SoundHound與騰訊的夥伴關係證明,多語言語音控制可以與現有的資訊娛樂系統整合。相機應用將繼續在夜間模式和降噪流程中採用人工智慧技術,而無人機將利用邊緣推理技術在無GNSS訊號覆蓋區域實現避障。

汽車產業的高速成長反映了電控系統的結構性變革,人工智慧正在管理感知、意圖預測和個人化使用者體驗。賓士正透過其CARIAD平台整合大規模語言模型,以學習駕駛員的駕駛習慣並主動安排保養服務。工業機器人和醫療穿戴式裝置代表了其他高價值的細分市場,凸顯了行動人工智慧市場已從消費者通訊擴展到關鍵任務。

到2024年,硬體支出將佔總支出的64%,這主要得益於NPU、GPU以及嵌入式毫米波感測器的普及。然而,隨著企業將模型訓練、微調和生命週期管理外包,業務收益預計將以27.00%的複合年成長率成長。 Verizon和SK Telecom提供的託管服務將雲端GPU、邊緣節點和編配軟體捆綁在一起,使企業無需前期投資即可添加人工智慧功能。 ARM的Kleidi等軟體庫可加速通用CPU上的N維張量運算,進而提高晶片的利用率。

感測器技術的演進進一步模糊了硬體和軟體之間的界限,其整合的微控制器能夠本地運行初步的人工智慧程式。由此產生的數據經濟為分析、更新和合規服務創造了持續的收入來源,檢驗了平台模式將如何再形成行動人工智慧市場。

行動裝置與其他應用程式(智慧型手機、相機、無人機、機器人、汽車和其他應用)、組件(硬體、軟體和服務)、技術(CPU、GPU、NPU/AI 加速器、DSP)、處理類型(設備端/邊緣、雲端基礎和混合)、終端用戶產業(消費性電子、汽車和移動出行、工業和製造業等)以及工業地區製造業等)以及工業地區製造業等)以及進行人工智慧細分。

區域分析

預計到2024年,北美將佔全球營收佔有率的35%,這主要得益於企業快速採用私有5G和邊緣節點來託管本地AI工作負載。包括OpenAI 400億美元資金籌措在內的大規模資金籌措,進一步鞏固了該地區在基礎模型研究和商業性應用領域的領先地位。政府撥款和國防合約也進一步刺激了對符合嚴格合規標準的安全設備端解決方案的需求。

亞太地區是成長最快的地區,預計到2030年將以24.80%的複合年成長率成長,這主要得益於Softbank Corporation9.6億美元的基礎設施計畫和SK集團65億美元的資料中心建設。日本的Cristal Intelligence計畫和韓國的GPU即服務將使缺乏內部專業知識的中型企業也能獲得人工智慧能力。在印度,智慧型手機在農村地區的普及以及本土語言模型計劃的推進表明下游需求強勁。

歐洲正受益於以德國、法國和英國主導的穩定擴張,這三個國家都將歐盟人工智慧法律下的嚴格隱私規則與汽車和產業政策融合。中東正將石油收入投入人工智慧中心建設,而非洲則利用行動優先的使用模式,在農業和金融科技領域試行人工智慧服務。整體而言,區域差異主要體現在基礎設施成熟度、法規環境和設備價格等方面,這些因素共同影響行動人工智慧市場的部署速度。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對人工智慧處理器的需求激增

- 搭載生成式人工智慧技術的智慧型手機發布

- 提高邊緣人工智慧晶片的能源效率

- 消費者隱私和低延遲需求

- 行動最佳化型LLM框架

- 5G通訊人工智慧功能包

- 市場限制

- AI晶片組定價較高

- 熱預算和功率預算限制

- 對設備端資料的監管

- 先進基板供應短缺

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過使用

- 智慧型手機

- 相機

- 無人機

- 機器人技術

- 車

- 其他用途

- 按組件

- 硬體(人工智慧晶片組、感測器)

- 軟體(SDK、框架)

- 服務(整合、維護)

- 透過技術

- CPU

- GPU

- NPU/AI加速器

- DSP

- 按處理類型

- 設備端/邊緣端

- 雲端基礎的

- 混合

- 按最終用戶行業分類

- 消費性電子產品

- 汽車與出行

- 工業和製造業

- 醫療保健和生命科學

- 國防/航太

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Qualcomm Technologies

- Apple Inc.

- Samsung Electronics

- MediaTek Inc.

- Huawei Technologies(HiSilicon)

- Alphabet Inc.(Google)

- Nvidia Corporation

- Intel Corporation

- Microsoft Corporation

- IBM Corporation

- ARM Ltd.

- OPPO

- Xiaomi Corp.

- Vivo

- Honor Device Co.

- Baidu Inc.

- TSMC

- Synopsys

- Cadence Design Systems

- Graphcore

- Cerebras Systems

第7章 市場機會與未來展望

The Mobile Artificial Intelligence Market size is estimated at USD 24.85 billion in 2025, and is expected to reach USD 81.22 billion by 2030, at a CAGR of 28.65% during the forecast period (2025-2030).

Heightened regulatory focus on data sovereignty, rapid neural-processing-unit (NPU) innovation, and enterprise demand for low-latency inference are the primary growth catalysts. Breakthrough chip designs such as Qualcomm's Snapdragon 8 Elite and ARM's Cortex-X925 are resetting performance baselines for smartphones, vehicles, and industrial devices. Vendor strategies now emphasize vertically integrated hardware-software stacks that shorten time-to-market and enable differentiated on-device AI features. Supply-chain constraints in advanced substrates and high-bandwidth memory continue to influence pricing and availability, yet committed capacity expansions in Asia Pacific signal relief after 2026.

Global Mobile Artificial Intelligence Market Trends and Insights

AI-Capable Processor Demand Surge

Unprecedented uptake of AI-centric chipsets is reshaping device architecture. ARM's 3 nm Cortex-X925 delivers 46% higher throughput than prior cores at 3.8 GHz while holding power ceilings suitable for premium phones. Manufacturers securing long-term foundry allocation, such as Qualcomm and NVIDIA, mitigate supply risk and lock in competitive cost structures. Samsung's Galaxy S25 showcases a 40% NPU boost, underscoring how performance marketing has shifted from general CPU metrics to sustained AI inference capability. Chip demand is also driving innovation in solid-state cooling that supports 25-watt dissipation in handheld form factors. The resulting performance headroom accelerates conversational interfaces, real-time vision, and on-device analytics that previously relied on cloud services.

Generative-AI Smartphone Launches

Generative AI is moving from flagship exclusivity toward mass-market availability. Canalys projects that 54% of global handset shipments will be AI-ready by 2028, a steep adoption curve that mirrors past LTE transitions. Apple's Neural Engine now performs on-device context modeling for messaging, while Samsung's Galaxy AI offers live translation and content drafting. Price sensitivity in India illustrates adoption friction: sub-USD 600 devices represent only 4-5% of 2024 shipments, limiting early AI penetration. To bridge the gap, MediaTek introduced Dimensity 9400 with an integrated NPU tuned for mid-range handsets. Enterprise fleets also drive volume, with OPPO pledging to embed generative-AI features in 50 million units via Google and Microsoft partnerships.

Premium Pricing of AI Chipsets

Entry-level AI smartphones still debut near USD 600, limiting penetration in high-volume growth economies. High-bandwidth-memory shortages persist because Micron and SK Hynix have capacity booked out through 2025, sustaining elevated bill-of-materials costs. Packaging bottlenecks around TSMC's CoWoS lines add further cost pressure for mobile device makers. Vendors respond by tiering feature sets: essential AI functions are delivered via software optimization on legacy silicon, while premium models add advanced NPU acceleration. New fabs coming online in Taiwan and Japan after 2026 may gradually reduce the price delta between AI and non-AI chipsets.

Other drivers and restraints analyzed in the detailed report include:

- Edge-AI Chip Energy-Efficiency Gains

- Consumer Privacy and Low-Latency Need

- Thermal and Power-Budget Constraints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smartphones retained 56% of 2024 revenue, yet automotive applications are set to post a 29.40% CAGR through 2030 as conversational in-car assistants and autonomous functions transition from luxury options to mainstream features. The mobile artificial intelligence market size for automotive systems is projected to scale rapidly once Level-3 highway pilots become standard equipment in premium models. Partnerships like SoundHound-Tencent prove that multilingual voice control can be integrated with existing infotainment stacks. Camera apps continue adopting AI for night-mode and de-noise pipelines, while drones leverage edge inference for obstacle avoidance in GNSS-denied zones.

High growth in vehicles reflects structural changes in electronic control units, where AI now governs perception, intent prediction, and personalized user experience. Mercedes-Benz integrates large language models via CARIAD platforms that learn driver routines and proactively schedule servicing. Industrial robots and medical wearables represent additional high-value niches, underscoring how the mobile artificial intelligence market is broadening beyond consumer messaging to mission-critical domains.

Hardware held 64% of the 2024 spend thanks to NPUs, GPUs, and mm-wave sensors embedded across devices. Nevertheless, services revenue is forecast to climb 27.00% CAGR as enterprises outsource model training, fine-tuning, and lifecycle management. Managed offerings from Verizon and SK Telecom bundle cloud GPUs, edge nodes, and orchestration software, letting firms add AI features without upfront capex. Software libraries such as ARM's Kleidi accelerate N-dimensional tensor operations on generic CPUs, improving utilization of installed silicon.

Sensor evolution further blurs hardware-software boundaries by embedding micro-controllers that execute first-pass AI locally. The resulting data economy creates recurring revenue for analytics, updates, and compliance services, validating how platform models reshape the mobile artificial intelligence market.

The Mobile Artificial Intelligence Market Report is Segmented by Application (Smartphone, Camera, Drone, Robotics, Automotive, and Other Applications), Component (Hardware, Software, and Services), Technology (CPU, GPU, NPU/AI Accelerator, and DSP), Processing Type (On-device/Edge, Cloud-Based, and Hybrid), End-User Industry (Consumer Electronics, Automotive and Mobility, Industrial and Manufacturing, and More), and Geography.

Geography Analysis

North America held 35% revenue share in 2024 as enterprises rapidly deployed private 5G and edge nodes to host on-premises AI workloads. Large funding rounds, including OpenAI's USD 40 billion raise, reinforce the region's leadership in foundational-model research and commercial adoption. Government grants and defense contracts further stimulate demand for secure on-device solutions that meet stringent compliance standards.

Asia Pacific is the fastest-growing territory with a 24.80% CAGR through 2030, propelled by SoftBank's USD 960 million infrastructure plan and SK Group's USD 6.5 billion data-center build-out. Japan's Cristal Intelligence initiative and South Korea's GPU-as-a-Service offerings extend AI capabilities to mid-market enterprises without in-house expertise. India's smartphone expansion into rural districts and indigenous language model projects point to robust downstream demand.

Europe contributes steady expansion led by Germany, France, and the United Kingdom, each aligning automotive and industrial policy with strict privacy rules under the EU AI Act. The Middle East is channeling oil-windfall funds into AI hubs, while Africa leverages mobile-first usage patterns to pilot AI services in agriculture and fintech. Altogether, regional divergences center on infrastructure maturity, regulatory climate, and device affordability, factors that collectively shape deployment velocity in the mobile artificial intelligence market.

- Qualcomm Technologies

- Apple Inc.

- Samsung Electronics

- MediaTek Inc.

- Huawei Technologies (HiSilicon)

- Alphabet Inc. (Google)

- Nvidia Corporation

- Intel Corporation

- Microsoft Corporation

- IBM Corporation

- ARM Ltd.

- OPPO

- Xiaomi Corp.

- Vivo

- Honor Device Co.

- Baidu Inc.

- TSMC

- Synopsys

- Cadence Design Systems

- Graphcore

- Cerebras Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-capable processor demand surge

- 4.2.2 Generative-AI smartphone launches

- 4.2.3 Edge-AI chip energy-efficiency gains

- 4.2.4 Consumer privacy and low-latency need

- 4.2.5 Mobile-optimised LLM frameworks

- 4.2.6 5G-telco AI-feature bundles

- 4.3 Market Restraints

- 4.3.1 Premium pricing of AI chipsets

- 4.3.2 Thermal and power-budget constraints

- 4.3.3 Regulatory scrutiny on on-device data

- 4.3.4 Advanced substrate supply crunch

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Smartphone

- 5.1.2 Camera

- 5.1.3 Drone

- 5.1.4 Robotics

- 5.1.5 Automotive

- 5.1.6 Other Applications

- 5.2 By Component

- 5.2.1 Hardware (AI Chipsets, Sensors)

- 5.2.2 Software (SDKs, Frameworks)

- 5.2.3 Services (Integration, Maintenance)

- 5.3 By Technology

- 5.3.1 CPU

- 5.3.2 GPU

- 5.3.3 NPU/AI Accelerator

- 5.3.4 DSP

- 5.4 By Processing Type

- 5.4.1 On-device/Edge

- 5.4.2 Cloud-based

- 5.4.3 Hybrid

- 5.5 By End-user Industry

- 5.5.1 Consumer Electronics

- 5.5.2 Automotive and Mobility

- 5.5.3 Industrial and Manufacturing

- 5.5.4 Healthcare and Life-Sciences

- 5.5.5 Defense and Aerospace

- 5.5.6 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Qualcomm Technologies

- 6.4.2 Apple Inc.

- 6.4.3 Samsung Electronics

- 6.4.4 MediaTek Inc.

- 6.4.5 Huawei Technologies (HiSilicon)

- 6.4.6 Alphabet Inc. (Google)

- 6.4.7 Nvidia Corporation

- 6.4.8 Intel Corporation

- 6.4.9 Microsoft Corporation

- 6.4.10 IBM Corporation

- 6.4.11 ARM Ltd.

- 6.4.12 OPPO

- 6.4.13 Xiaomi Corp.

- 6.4.14 Vivo

- 6.4.15 Honor Device Co.

- 6.4.16 Baidu Inc.

- 6.4.17 TSMC

- 6.4.18 Synopsys

- 6.4.19 Cadence Design Systems

- 6.4.20 Graphcore

- 6.4.21 Cerebras Systems

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment