|

市場調查報告書

商品編碼

1851736

支付安全:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Payment Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

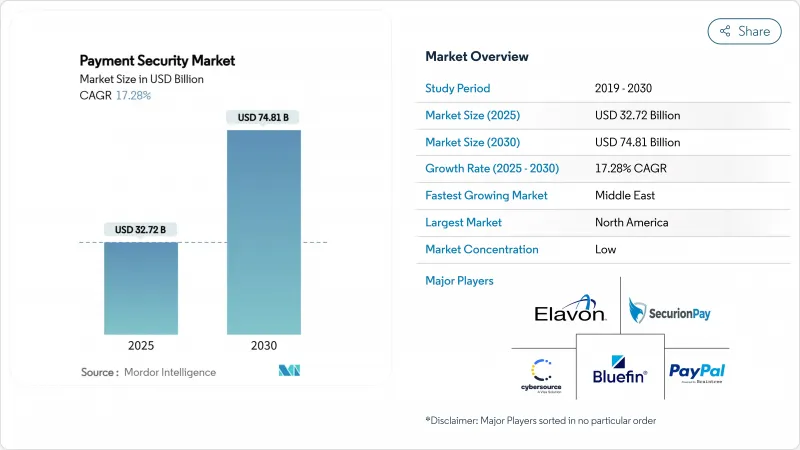

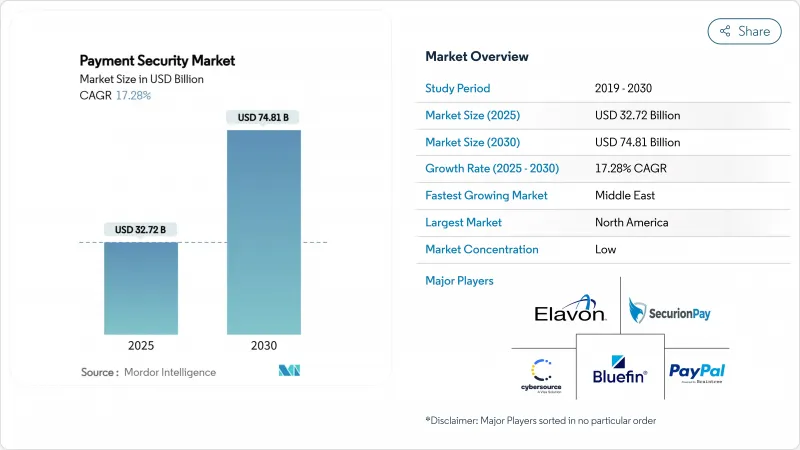

全球支付安全市場預計到 2025 年將達到 337.2 億美元,到 2030 年將達到 748.1 億美元,複合年成長率為 17.28%。

這一強勁的發展趨勢與日益嚴格的監管、數位通路交易量的成長以及檢測技術的不斷創新相吻合。為因應PCI DSS 4.0的最後期限而進行的持續合規投資、人工智慧在詐欺分析中的廣泛應用以及行動優先錢包的普及,正在影響著企業的支出重點。儘管令牌化和加密仍然是基礎,但隨著發卡機構和商家應對合成身分攻擊,即時行為分析和多因素認證正在佔據越來越大的預算佔有率。與技術升級同步,各支付網路和處理商之間也在加速整合競爭情報,透過整合威脅情報平台和擴大全球商家基礎來保護其在支付安全市場的佔有率。

全球支付安全市場趨勢與洞察

PCI DSS 4.0 合規性監理加大

符合 PCI DSS 4.0 標準(該標準將於 2025 年 3 月起強制執行)正在重塑北美各地的安全預算。企業在 1 級合規方面每年需支出高達 25 萬美元,這反映了該標準新增的 64 項要求,涵蓋持續日誌分析和付款頁面腳本完整性。違規罰款最高可達每月 50 萬美元,促使企業立即採取補救措施,並推動令牌化和自動化加密服務的快速普及。歐洲收購方已開始將 PSD3 條款與 PCI 控制措施進行映射,由此產生的連鎖反應將使投資動能持續到 2027 年。

基於人工智慧的詐欺分析正在興起

金融機構正在加速從基於規則的引擎向自適應機器學習模型轉型,這些模型能夠即時分析超過100個情境訊號。 Visa報告稱,到2024年,人工智慧應用將攔截價值400億美元的非法貿易,誤報率降低85%,核准率提高。雲端處理器將這些模型以微服務的形式整合,使商家無需耗費大量整合工作即可微調風險閾值。新興市場可以透過消除對傳統本地基礎設施的需求,實現雲端規模帶來的優勢。

中小企業初始整合成本高昂

中小企業 (SME) 的年度安全支出通常在 5,000 美元到 50,000 美元之間,這對於整體 IT 預算較小的新興經濟體而言,無疑是一筆不小的開支,給其現金流帶來了壓力。許多中小企業依賴捆綁式雲端訂閱服務來進行複雜的範圍界定,但對資料駐留和供應商鎖定的擔憂減緩了它們向雲端遷移的步伐。因此,低成本的插件解決方案在低流量的網路商店中佔據主導地位,導致高級風險分析方面存在空白。隨著成本曲線的下降,提供基於使用量的分級服務的安全廠商有望抓住中小企業的潛在需求。

細分市場分析

到2024年,代幣化將佔據支付安全市場31%的佔有率,這凸顯了其在從商家系統中移除主帳號和縮小審核範圍方面的重要作用。 Visa在2024年處理了100億筆代幣化交易,較去年同期成長45%,展現了其在實體店和電商領域的可擴展性。資料外洩的處罰在銀行業和醫療保健行業尤為嚴厲。整合機器學習管道的詐欺偵測平台預計將以21.03%的複合年成長率成長,反映出市場對能夠從不斷演變的攻擊向量中自我學習的自適應控制的需求。其他新興解決方案,例如量子安全密碼學和分散式帳本檢驗,目前主要針對特定應用場景,但隨著標準的成熟,它們將展現出長期的成長潛力。能夠將代幣服務與人工智慧驅動的分析相結合的供應商可以提供整合服務,在降低人工審核成本的同時,減少誤報。這種能力有助於提升銷售,使整合平台成為支付安全市場整體收入的重要貢獻者。

各類解決方案的成長將影響支付安全市場規模的預測,尤其是在支出從基礎合規工具轉向智慧編配引擎的情況下。供應商之間的競爭側重於功能的廣度而非單一功能,並且傾向於簽訂長期契約,特別是與那些偏好整合審核報告儀錶板的公司簽訂契約。隨著收購方環境中令牌庫密度的增加,對虛擬金鑰管理模組的需求正在加速成長,因為供應鏈晶片短缺可能會影響硬體 HSM 的更新計畫。

2024年,基於Web的部署將主導支付安全市場,佔據47%的市場佔有率,這主要得益於根深蒂固的桌面購物模式和成熟的支付閘道器整合。然而,行動平台才是真正的成長引擎,預計到2030年將以23.15%的複合年成長率成長。中國目前已有82%的線上購物籃支付透過行動電子錢包完成,而印度的UPI系統現在能夠實現亞秒級的P2P轉賬,速度已超過銀行卡支付。這些趨勢推動了應用層對生物識別、網路代幣配置和設備認證的需求。因此,安全藍圖的核心重點是建立SDK,使商家能夠在原生行動應用程式、瀏覽器和漸進式網頁應用程式流程中編配通用的策略。

全通路策略正在縮小實體店刷卡和非刷卡交易安全標準之間長久以來的差距。在NFC和MPoC指南的支援下,店內「輕觸智慧型手機」舉措方式引入了與電商相同的即時風險洞察。行動網際網路的興起也使得網路平台能夠採用現代化的會話完整性控制,從而確保零售商在整個客戶互動週期中提供一致的客戶體驗。

支付安全市場按解決方案類型(加密、令牌化等)、平台(行動端、網頁端、店內/POS)、組織規模(中小企業、大型企業)、終端用戶行業(零售和電子商務、銀行、金融服務和保險等)以及地區進行細分。市場預測以美元計價。

區域分析

預計到2024年,北美將貢獻支付安全市場30%的收入,這主要得益於PCI DSS 4.0的早期遷移以及大型全通路商戶的持續升級。企業預算優先考慮人工智慧驅動的風險引擎,而卡片組織則將增值保全服務捆綁到處理費中。儘管與3DS 2.2延遲相關的實施挑戰仍在影響核准率,但監管確定性以及更清晰的執行時間表正在支撐穩定的採購流程。諸如萬事達卡在2024年以26.5億美元收購Recorded Future等策略性收購,凸顯了將原生威脅情報源整合到網路堆疊中的持續趨勢。

亞太地區仍是成長的中心。在政府支持的即時支付基礎設施和積極的普惠金融政策的推動下,行動錢包目前已佔電子商務交易總額的70%。基礎設施的飛躍式發展使商家能夠跳過傳統的磁條系統,並儘早採用雲端原生閘道器。跨國2D碼聯盟,例如新加坡PayNow與泰國PromptPay的合作,進一步增加了需要端到端安全保障的交易數量。因此,該地區的需求傾向於輕量級SDK,這些SDK整合了設備綁定和行為生物識別技術,且不會增加結帳流程的阻力。

歐洲在嚴格的消費者保護標準和快速的POS技術更新週期之間取得了平衡。 PCI MPoC和PSD3在27個成員國之間建構了統一的合規框架,推動了汽車、旅館和運輸業非接觸式和物聯網終端的普及。同時,從中東和非洲地區到2030年將以20.52%的複合年成長率(CAGR)領跑,這主要得益於行動支付平台為此前銀行帳戶服務的人群提供的服務。區域監管機構正在加速推進數位身分框架的建設,並支援託管在符合本地標準的資料中心的雲端令牌庫。儘管這些措施將擴大該地區的整體支付安全市場規模,但中小企業的購買力仍然有限。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 北美地區對PCI-DSS 4.0合規性的監管更加嚴格

- 基於人工智慧的詐欺分析在雲端支付處理商中迅速普及

- 先買後付(BNPL)模式的成長需要安全的代幣庫。

- 歐洲物聯網POS終端快速成長

- 亞洲新興市場行動優先錢包蓬勃發展

- 市場限制

- 對於中小型商家而言,系統整合的初始成本很高。

- 3-D Secure 2.2 部署中的交易延遲問題

- 新興國家資料保護法律的碎片化和重疊

- 消費者對行為生物辨識技術的隱私擔憂

- 價值鏈分析

- 監理展望

- 波特五力分析

- 供應商的議價能力

- 買方/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估市場宏觀經濟趨勢

第5章 市場規模與成長預測

- 按解決方案類型

- 加密

- 分詞

- 詐欺檢測與預防

- 其他解決方案

- 按平台

- 基於行動裝置的

- 基於網路的

- 店內/POS

- 按組織規模

- 中小企業

- 主要企業

- 按最終用戶行業分類

- 零售與電子商務

- BFSI

- 衛生保健

- 資訊科技和電訊

- 旅遊與飯店

- 政府機構

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Visa Inc.(CyberSource Corporation)

- Bluefin Payment Systems LLC

- PayPal Holdings Inc.(Braintree)

- Elavon Inc.

- SecurionPay

- Global Payments Inc.

- Worldline SA

- Broadcom Inc.(Symantec)

- Stripe Inc.

- Fiserv Inc.(First Data)

- Signifyd Inc.

- Adyen NV

- Shift4 Payments Inc.

- TokenEx Inc.

- Forter Ltd.

- ACI Worldwide Inc.

- RSA Security LLC

- F5 Inc.(Shape Security)

- Thales Group(Gemalto)

- Transaction Network Services(TNS)

第7章 市場機會與未來展望

The global payment security market size holds a current value of USD 33.72 billion in 2025 and is forecast to advance to USD 74.81 billion by 2030, translating into a 17.28% CAGR.

This solid trajectory aligns with tightening regulatory mandates, rising transaction volumes across digital channels, and continued innovation in detection technologies. Continuous compliance investments linked with the final PCI DSS 4.0 deadline, wide-scale application of artificial intelligence in fraud analytics, and the proliferation of mobile-first wallets are shaping enterprise spending priorities. Tokenization and encryption remain foundational, yet real-time behavioral analytics and multi-factor authentication are taking a larger budget share as issuers and merchants confront synthetic identity attacks. Parallel to technology upgrades, competitive consolidation among networks and processors is accelerating as firms integrate threat-intelligence platforms and expand global merchant bases to defend share in the payment security market

Global Payment Security Market Trends and Insights

Regulatory push for PCI DSS 4.0 compliance

Mandatory adherence to PCI DSS 4.0 beginning in March 2025 is reshaping security budgets across North America. Enterprises face annual outlays that climb to USD 250,000 at Level 1, reflecting the standard's 64 new requirements covering continuous log analysis and payment-page script integrity. Non-compliance fines of up to USD 500,000 per month sharpen the focus on immediate remediation, prompting rapid adoption of tokenization and automated encryption services. European acquirers are already mapping PSD3 provisions to PCI controls, creating a spill-over effect that sustains investment momentum through 2027.

Surge in AI-based fraud analytics

Financial institutions increasingly pivot from rule-based engines to adaptive machine-learning models that inspect more than 100 contextual signals in real time. Visa reports that AI applications blocked USD 40 billion in fraudulent transactions during 2024, cutting false positives by 85% and improving authorization rates. Cloud processors embed these models as micro-services, allowing merchants to fine-tune risk thresholds without lengthy integrations. Emerging markets benefit from cloud scale because it removes the need for legacy on-premise infrastructure, a dynamic that supports uniform global deployment of next-generation fraud analytics.

High upfront integration costs for SMEs

Typical annual security spend for a small merchant can range from USD 5,000 to USD 50,000, an amount that strains cash flows in emerging economies where total IT budgets are modest. Complex scoping exercises push many SMEs toward bundled cloud subscriptions, yet concerns around data residency and vendor lock-in slow conversions. As a result, low-cost plug-in solutions dominate lower-volume web stores, leaving gaps in advanced risk analytics. Security vendors that can tier services according to volume thresholds are expected to capture latent SME demand once cost curves decline.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of BNPL requiring secure token vaults

- Rapid growth of IoT-enabled POS terminals

- Transaction-latency issues in 3-D Secure 2.2 roll-outs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tokenization accounted for 31% of payment security market share in 2024, underscoring its role in removing primary account numbers from merchant systems and shrinking audit scope. Visa processed 10 billion tokenized transactions in 2024, up 45% from the prior year, proving scalability in both in-store and e-commerce settings. Encryption remains mandatory for data-in-transit, particularly in banking and healthcare where breach disclosure rules impose heavy penalties. Fraud detection platforms that embed machine-learning pipelines are projected to expand at 21.03% CAGR, reflecting demand for adaptive controls that self-learn from evolving attack vectors. Other emerging solutions, including quantum-safe cryptography and distributed-ledger verification, currently capture niche use-cases but hold long-term upside as standards mature. Vendors able to interlink token services with AI-driven analytics create combined offerings that minimize manual review costs while keeping false positives in check. This capability supports upsell cycles, positioning integrated platforms for outsized contribution to overall payment security market revenue.

Growth across solution types will influence payment security market size forecasts, specifically by shifting spend from basic compliance tools to intelligent orchestration engines. Vendors competing on breadth rather than point functionality tend to secure longer-term contracts, especially with enterprises that favor consolidated dashboards for audit reporting. As token vault density increases inside acquirer environments, supply-chain chip shortages may hit hardware HSM refresh plans, thereby accelerating interest in virtualized key-management modules.

Web-based deployments led the payment security market in 2024 with a 47% share, driven by entrenched desktop shopping patterns and mature gateway integrations. However, mobile platforms are the clear growth engine at 23.15% CAGR through 2030. China already records that 82% of online baskets close via mobile wallets, while India's UPI system enables sub-second peer-to-merchant transfers that now outpace card usage. These trends elevate requirements for biometric authentication, network-token provisioning, and device attestation directly in the app layer. As a result, security roadmaps center on building SDKs that allow merchants to orchestrate common policies across native mobile, browser, and progressive web-app flows.

Omnichannel strategies are narrowing the historical gap between card-present and card-not-present security standards. In-store tap-to-phone initiatives, enabled by NFC and MPoC guidelines, introduce the same real-time risk insights present in e-commerce. The rise of mobile also acts as a forcing function for web platforms to adopt modern session integrity controls, ensuring that customer experience remains consistent across a retailer's full engagement cycle.

Payment Security Market is Segmented by Solution Type (Encryption, Tokenization and More), Platform (Mobile-Based, Web-Based, In-Store / POS), Organization Size (Small & Medium-Sized Enterprises (SMEs), Large Enterprises), End-User Industry (Retail & E-Commerce, BFSI and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 30% of payment security market revenue in 2024, boosted by early PCI DSS 4.0 migrations and continued upgrades among large omnichannel merchants. Enterprise budgets prioritise AI-powered risk engines, while card networks bundle value-added security services inside processing tariffs. Implementation challenges linked to 3DS 2.2 latency still influence approval ratios, yet the regulatory certainty of defined enforcement timelines underpins steady procurement pipelines. Strategic acquisitions, such as Mastercard's USD 2.65 billion purchase of Recorded Future in 2024, highlight an ongoing drive to embed native threat-intelligence feeds inside network stacks.

Asia-Pacific remains the growth nucleus. Mobile wallets now drive 70% of total ecommerce volume, supported by government-backed real-time payment rails and aggressive financial inclusion policies. Infrastructure leapfrogging lets merchants skip legacy mag-stripe systems, installing cloud-native gateways from inception. Cross-border QR alliances, typified by the linkage between Singapore's PayNow and Thailand's PromptPay, further increase transaction counts that must be secured end-to-end. As a result, regional demand skews toward lightweight SDKs that embed device binding and behavioral biometrics without adding checkout friction.

Europe balances strong consumer-protection norms with rapid POS technology refresh cycles. PCI MPoC and PSD3 create a harmonised compliance backdrop across 27 member states, spurring automotive, hospitality, and transport sectors to adopt contactless and IoT-enabled terminals. Meanwhile, the Middle East and Africa show the highest CAGR at 20.52% through 2030, driven by mobile-money platforms that serve previously unbanked populations. Regional regulators accelerate digital-identity frameworks, supporting cloud token vaults hosted in locally compliant data centres. These initiatives collectively expand regional payment security market size, although SME affordability constraints persist.

- Visa Inc. (CyberSource Corporation)

- Bluefin Payment Systems LLC

- PayPal Holdings Inc. (Braintree)

- Elavon Inc.

- SecurionPay

- Global Payments Inc.

- Worldline SA

- Broadcom Inc. (Symantec)

- Stripe Inc.

- Fiserv Inc. (First Data)

- Signifyd Inc.

- Adyen N.V.

- Shift4 Payments Inc.

- TokenEx Inc.

- Forter Ltd.

- ACI Worldwide Inc.

- RSA Security LLC

- F5 Inc. (Shape Security)

- Thales Group (Gemalto)

- Transaction Network Services (TNS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory Push for PCI-DSS 4.0 Compliance in North America

- 4.2.2 Surge in AI-based Fraud Analytics among Cloud Payment Processors

- 4.2.3 Expansion of Buy-Now-Pay-Later (BNPL) Requiring Secure Token Vaults

- 4.2.4 Rapid Growth of IoT-Enabled POS Terminals in Europe

- 4.2.5 Mobile-First Wallet Boom across Emerging Asian Markets

- 4.3 Market Restraints

- 4.3.1 High Up-front Integration Costs for Small & Mid-Sized Merchants

- 4.3.2 Transaction-Latency Issues in 3-D Secure 2.2 Roll-outs

- 4.3.3 Fragmented & Overlapping Data-Protection Statutes in Emerging Nations

- 4.3.4 Consumer Privacy Concerns over Behavioral Biometrics

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Solution Type

- 5.1.1 Encryption

- 5.1.2 Tokenization

- 5.1.3 Fraud Detection & Prevention

- 5.1.4 Other Solutions

- 5.2 By Platform

- 5.2.1 Mobile-Based

- 5.2.2 Web-Based

- 5.2.3 In-Store / POS

- 5.3 By Organization Size

- 5.3.1 Small & Medium-Sized Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 Retail and E-commerce

- 5.4.2 BFSI

- 5.4.3 Healthcare

- 5.4.4 IT and Telecom

- 5.4.5 Travel and Hospitality

- 5.4.6 Government

- 5.4.7 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Visa Inc. (CyberSource Corporation)

- 6.4.2 Bluefin Payment Systems LLC

- 6.4.3 PayPal Holdings Inc. (Braintree)

- 6.4.4 Elavon Inc.

- 6.4.5 SecurionPay

- 6.4.6 Global Payments Inc.

- 6.4.7 Worldline SA

- 6.4.8 Broadcom Inc. (Symantec)

- 6.4.9 Stripe Inc.

- 6.4.10 Fiserv Inc. (First Data)

- 6.4.11 Signifyd Inc.

- 6.4.12 Adyen N.V.

- 6.4.13 Shift4 Payments Inc.

- 6.4.14 TokenEx Inc.

- 6.4.15 Forter Ltd.

- 6.4.16 ACI Worldwide Inc.

- 6.4.17 RSA Security LLC

- 6.4.18 F5 Inc. (Shape Security)

- 6.4.19 Thales Group (Gemalto)

- 6.4.20 Transaction Network Services (TNS)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment