|

市場調查報告書

商品編碼

1851714

零售包裝:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Retail Ready Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

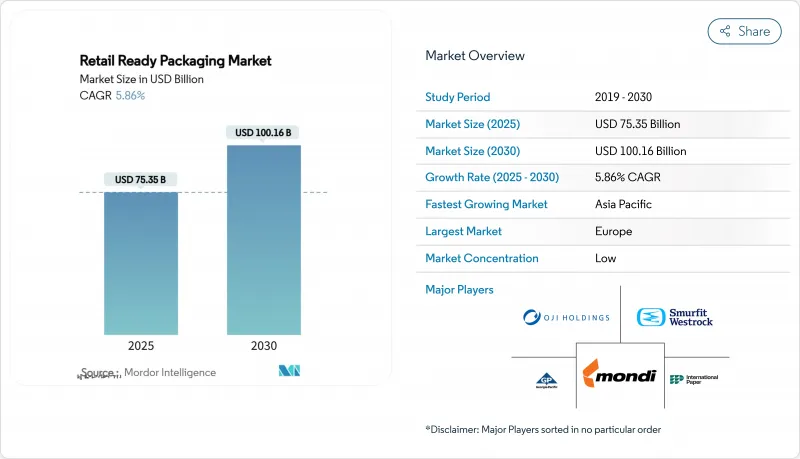

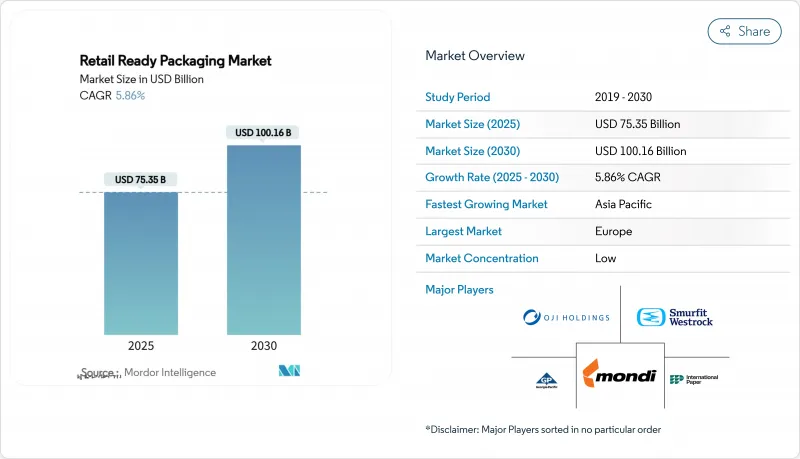

2025 年零售包裝市場規模價值為 753.5 億美元,預計到 2030 年將達到 1,001.6 億美元,複合年成長率為 5.86%。

電子商務銷售的擴張、零售商對即上架包裝形式需求的成長以及門市勞動力嚴重短缺,都在推動市場需求。如今,大型連鎖超市嚴格規定了包裝箱尺寸和開口設計,從而將補貨時間縮短了多達 40%。同時,歐洲和美國多個州的生產者延伸責任制(EPR)計畫正促使供應商轉向單纖維解決方案,以降低處置成本並簡化回收流程。諸如安姆科收購貝瑞全球以及索諾科收購 Eviosys 等併購案,擴大了垂直整合平台的規模,使其能夠為自動化和快速設計客製化提供資金,從而在與全球品牌所有者的交易中佔據優勢。作為回應,中型加工商正在增加對人工智慧設備的投入,以將生產線換線時間從數小時縮短至數分鐘,並實現盈利的小批量生產,從而支援本地促銷。

全球零售包裝市場趨勢與洞察

循環經濟法規加速了單纖維SRP的採用。

歐盟的《包裝和包裝廢棄物法規》(PPWR)將於2025年1月生效,該法規引入了可回收性閾值,使得多層複合材料在經濟上缺乏吸引力。受限組合的合規費用高達每噸739美元,這促使零售商和品牌所有者轉向使用單絲結構,以便無縫融入現有的路邊回收計劃。全球消費品公司正在跨區域推廣這些標準化的包裝形式,以避免管理重疊的規格,從而使符合規定的加工商獲得先發優勢。加拿大、日本和拉丁美洲等主要市場也已實施了類似的規定,使得單絲設計從區域性偏好轉變為全球競標的基本要求。

電子商務的快速成長推動了對貨架即用包裝的合規性需求。

隨著線上訂單量激增,履約中心不堪重負,大型零售商紛紛提出嚴格的貨架就緒要求,如果供應商發運不符合規定的包裝,將處以超過發票金額3%的扣回爭議帳款罰款。與GS1 Sunrise 2027藍圖相符的序列化2D條碼和不斷擴展的RFID強制應用,將庫存準確性直接嵌入包裝盒中,從而實現自動分揀和即時庫存檢查。包裝如今已成為資料載體,減少了成本高昂的人工掃描,也為價格更高的智慧包裝提供了合理的理由。整合的NFC標籤進一步幫助品牌在開箱時檢驗產品真偽,並啟動基於應用程式的促銷活動,為零售包裝市場的參與企業創造了更多行銷應用程式場景。

紙板價格波動

箱板紙價格一年內波動幅度可達15%至25%,北美一家大型紙廠於2025年1月宣布每噸漲價70美元,這一漲幅將在幾週內反映在加工商的帳單上。然而,規模較小的獨立加工商面臨利潤空間壓縮,或不得不將額外費用轉嫁給客戶,導致其在競標中失去競爭力。亞太地區新增產能或許能夠緩解價格波動,但歐洲能源成本的上漲意味著原物料供應前景仍不明朗。

細分市場分析

紙和紙板仍將是快速消費品批量生產的預設基材,預計到2024年將佔據零售包裝市場55.34%的佔有率。底紙板提供耐用的運輸保護,同時其可印刷的牛皮紙表面也便於品牌宣傳和可回收性聲明。折疊式紙板在需要兼顧高階圖案和剛性的領域,尤其是在糖果甜點禮品包裝方面,正逐漸興起。硫酸鹽漂白的固態適用於需要防油和亮白度的冷藏乳製品。白色襯裡的塑合板則適用於需要經濟實惠且外觀美觀的平價穀物和家庭必需品。

到2030年,混合材料和其他材料的年複合成長率將達到7.43%,因為加工商會將生物聚合物、阻隔塗層和感測器層融合到單一結構中。 PLA和PHA混合物為農產品提供了可堆肥的選擇,初步的商業化生產表明其在潮濕的供應鏈中具有良好的貨架穩定性。採用導電油墨的智慧標籤可以無縫整合到PET視窗中,將二級包裝轉變為可掃描的商業節點。雖然塑膠仍主要應用於需要防潮和防穿刺性能的特定領域,但水性分散塗層的進步使得纖維基材即使在冷凍庫環境下也能挑戰現有的多層薄膜。隨著全球品牌採用這些混合產品來滿足不同地區的減廢棄物目標,同時又不犧牲功能性,零售包裝市場將從中受益。

零售包裝市場按產品類型(紙/紙板、塑膠、混合材料、其他材料)、包裝類型(模切展示盒、瓦楞紙箱、收縮包裝托盤、其他)、最終用戶應用(食品飲料、家居及家庭護理、個人護理及化妝品、其他)和地區進行細分。市場預測以美元計價。

區域分析

到2030年,亞太地區將以9.01%的複合年成長率領跑,中國、印度和東南亞正在推進供應鏈現代化並部署自動化履約印刷機,以滿足高階家電產品上市的需求;同時,本地大型紙漿和造紙企業也在努力提升瓦楞紙板生產線的產能,以滿足電商包裝箱需求的激增。在澳洲和紐西蘭,政府禁止使用某些一次性塑膠的政策將加速乳製品和農產品出口商採用纖維可重複使用包裝(SRP)。跨國包裝加工商正在新加坡和上海擴建設計中心,透過在地化全球品牌形象,使其更符合當地文化特色,從而支持零售包裝市場銷售的成長。

歐洲將維持其2024年35.63%的市場佔有率,並繼續保持最大單一地區的地位。基於PPWR的更嚴格的回收目標將於2025年生效,這將推動德國、法國和北歐地區採用標準化的單絲規格。與英國Courtauld Commitment等零售商的合作正在提高消費後回收率目標,並刺激對閉合迴路箱板紙廠的投資。義大利正利用傳統圖形技術包裝其高價值葡萄酒和糖果甜點出口產品,並將壓花工藝融入其易撕型SRP包裝中。西班牙溫室種植的農產品產業正在採用通風模切技術,以最佳化從安達盧西亞包裝廠到北歐配送中心的空氣流通。

在北美,融合門市自提且直接面對消費者的全通路零售模式日趨成熟,但需求依然強勁。美國量販店正將RFID技術推廣至一般商品,例如在穀物包裝的二級包裝中嵌入標籤,以降低缺貨率。加拿大雜貨商正在試行使用水性塗層的纖維性肉類托盤,以應對即將訂定的聯邦塑膠減量法規。墨西哥的加工廠受惠於近岸外包,刺激了對用於跨國運往美國的瓦楞紙箱的需求。總體而言,在勞動力市場緊張的情況下,對自動化的投資仍然是維持服務水準和維持零售包裝市場健康成長的關鍵因素。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 循環經濟法規加速了單纖維SRP的採用。

- 電子商務的快速成長推動了對貨架即用包裝(SRP)的合規性需求

- 零售業勞動力短缺-SRP計畫將店內工時減少40%

- 人工智慧驅動的包裝線自動化提高了換線速度

- 品牌和製造商利用建議零售價來提高商店轉換率。

- 數位印刷的經濟效益使得在建議零售價 (SRP) 下進行小批量促銷成為可能。

- 市場限制

- 紙板價格波動

- 缺乏全球統一的供應鏈標準會推高供應鏈成本

- RFID/智慧標籤整合成本(SRP格式)

- 超級市場違規罰款和扣回爭議帳款

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依材料類型

- 紙和紙板

- 紙板

- 折疊紙盒(FBB)

- 固體漂白硫酸鹽(SBS)

- 白色塑合板(WLC)

- 塑膠

- PET

- 高密度聚苯乙烯

- PP

- 生質塑膠(PLA、PHA)

- 混合材料和其他材料

- 紙和紙板

- 按包裝類型

- 模切展示容器

- 標準RSC模切

- 高精度預印模切

- 瓦楞紙箱

- 書架女士 RSC

- 手把整合SRP

- 收縮包裝托盤

- PE收縮膜

- 可堆肥收縮膜

- 更改範例

- 高牆箱

- 零售展示櫃

- 塑膠容器

- 可嵌套式寵物箱

- 硬質塑膠托盤

- 其他(站立袋、可重複使用的手提袋)

- 模切展示容器

- 透過最終用戶使用

- 食物

- 已調理食品

- 生鮮食品

- 肉類和家禽

- 麵包糖果甜點

- 飲料

- 軟性飲料

- 酒精飲料

- 乳類飲料

- 家居用品

- 個人護理和化妝品

- 家用電器

- 其他(DIY/園藝、寵物食品)

- 食物

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲、紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Mondi Group

- Smurfit Westrock

- International Paper Company

- Georgia-Pacific LLC

- Oji Holdings Corporation

- Rengo Co., Ltd.

- Klabin SA

- Pratt Industries

- Graphic Packaging International

- STI Group

- Cardboard Box Company

- Weedon Group

- Caps Cases Limited

- Vanguard Packaging Inc.

- TricorBraun

- Huhtamaki Oyj

- Orora Limited

- Sealed Air Corporation

- Amcor PLC

- Sonoco Products Company

- Visy Industries

- Packaging Corporation of America

第7章 市場機會與未來展望

The retail ready packaging market size is valued at USD 75.35 billion in 2025 and is projected to touch USD 100.16 billion by 2030, advancing at a 5.86% CAGR.

Expanding e-commerce sales, growing retailer mandates for shelf-ready formats and acute in-store labor shortages keep demand elevated. Large chains now specify exact case dimensions and opening designs, cutting replenishment time by as much as 40%. At the same time, Extended Producer Responsibility schemes in Europe and multiple US states push suppliers toward single-material fiber solutions that reduce disposal costs and simplify recycling. Mergers such as Amcor's union with Berry Global and Sonoco's Eviosys acquisition expand vertically integrated platforms able to fund automation and rapid design customization, giving them an edge with global brand owners. In response, mid-tier converters increase spending on AI-enabled equipment that trims line-changeover from hours to minutes, unlocking profitable micro-batch runs that meet localized promotions

Global Retail Ready Packaging Market Trends and Insights

Circular-economy regulations accelerating single-material fiber SRP adoption

The European Union's Packaging and Packaging Waste Regulation (PPWR) effective January 2025 introduces recyclability thresholds that make multi-layer laminates financially unattractive. Compliance fees on restricted combinations run as high as USD 739 per tonne, encouraging retailers and brand owners to converge on mono-fiber structures that slide seamlessly into existing curbside programs. Global consumer-goods companies standardize these formats across regions to avoid managing duplicate specifications, giving compliant converters first-mover advantage. Similar momentum builds in the United States where California's SB 343 limits the use of recycling symbols to substrates proven recyclable at scale.As comparable rules emerge in Canada, Japan and key Latin American markets, single-material designs transition from regional preference to baseline requirement for global tenders.

E-commerce hyper-growth raising shelf-ready packaging compliance demand

Online order volumes strain fulfillment centers, so large retailers institute strict shelf-ready requirements and apply charge-back penalties that can exceed 3% of invoice value when suppliers ship non-compliant cases. Serialized 2D barcodes aligned with the GS1 Sunrise 2027 roadmap and expanding RFID mandates embed inventory accuracy directly into the case, allowing automated sortation and real-time stock checks. Packaging now acts as a data carrier that lowers costly manual scans, justifying higher-priced smart formats. Integrated NFC tags additionally let brands validate product authenticity and launch app-based promotions at the point of unboxing, creating an incremental marketing use-case for retail ready packaging market participants.

Corrugated containerboard price volatility

Linerboard prices moved 15-25% within a single year, and a USD 70 per-ton increase announced for January 2025 by a leading North American mill flows through converter invoices within weeks. Because finishing adds a further 20-30% mark-up, brand owners see case costs swing sharply, complicating promotion budgets.Vertically integrated majors smooth exposure by owning mills, yet small independents face margin compression or must pass on surcharges that hurt competitiveness in tenders. Volatility may ease once additional capacity comes online in Asia-Pacific, but elevated energy costs in Europe keep the input outlook uncertain.

Other drivers and restraints analyzed in the detailed report include:

- Retailer labor shortages driving SRP adoption for 40% man-hour reduction

- AI-enabled packaging line automation boosting changeover speed

- Lack of global SRP standardization inflating supply-chain costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper and paperboard controlled 55.34% of retail ready packaging market share in 2024 and remains the default substrate for high-volume FMCG goods. Corrugated containerboard supplies durable transit protection while presenting printable kraft surfaces that align with branding and recyclability claims. Folding boxboard gains ground where premium graphics and rigidity coexist, notably in confectionery gift packs. Solid bleached sulfate safeguards chilled dairy launches that need grease resistance and bright whiteness. White-lined chipboard supports value-tier cereals and household staples that seek cost efficiency with acceptable shelf finish.

Hybrid and other materials expand at a 7.43% CAGR through 2030 as converters fuse bio-polymers, barrier coatings and sensor layers into single structures. PLA and PHA blends open compostable options for produce, and early commercial runs demonstrate shelf performance in humid supply chains. Smart labels relying on conductive inks integrate seamlessly onto PET windows, turning secondary packs into scan-ready commerce nodes. Although plastics retain niche roles demanding moisture or puncture protection, advances in aqueous dispersion coatings allow fiber substrates to challenge incumbent multilayer films even in freezer environments. The retail ready packaging market benefits as global brands adopt these hybrids to meet diverging regional waste-reduction targets without sacrificing functionality.

Retail Ready Packaging Market is Segmented by Material Type (Paper and Paperboard, Plastics, Hybrid and Other Materials), Package Type (Die-Cut Display Containers, Corrugated Cardboard Boxes, Shrink-Wrapped Trays, and More), End-User Application (Food, Beverage, Household and Home-Care Products, Personal Care and Cosmetics, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific delivers the highest 9.01% CAGR through 2030 with China, India and Southeast Asia modernizing supply chains and installing automated fulfillment facilities. Local corrugators upgrade to multi-color flexo machines to target premium consumer electronics launches, while regional pulp-and-paper majors debottleneck containerboard mills to satisfy surging e-commerce case demand. Government policies in Australia and New Zealand banning certain single-use plastics accelerate fiber SRP adoption across dairy and produce exporters. Multinational converters expand design centers in Singapore and Shanghai to localize global brand imagery for regional cultural nuances, underpinning volume growth for the retail ready packaging market.

Europe retains 35.63% 2024 share, the largest single regional block. Strict recycling targets under PPWR take effect in 2025, driving standardized mono-fiber formats in Germany, France and the Nordics. Retail alliances such as the United Kingdom's Courtauld Commitment elevate post-consumer content goals, spurring investment in closed-loop containerboard mills. Italy leverages heritage graphics to position high-value wine and confectionery exports, integrating embellished embossing into tear-open SRP. Spain's greenhouse produce sector adopts vented die-cuts that optimize airflow from Andalusia packing sites to Northern European distribution hubs.

North America exhibits mature but resilient demand as omnichannel retailing blends store pick-up and direct-to-consumer flows. US mass merchants broaden RFID rollouts to general merchandise, embedding serialized tags in secondary packs to cut out-of-stock rates. Canadian grocers pilot fiber-based meat trays laminated with aqueous coatings to comply with upcoming federal plastic reduction rules. Mexican maquiladoras benefit from nearshoring, stimulating corrugated case orders for cross-border shipments into the United States. Overall, automation investment remains the key lever for maintaining service levels in a tight labor market, sustaining healthy unit expansion for the retail ready packaging market.

- Mondi Group

- Smurfit Westrock

- International Paper Company

- Georgia-Pacific LLC

- Oji Holdings Corporation

- Rengo Co., Ltd.

- Klabin S.A.

- Pratt Industries

- Graphic Packaging International

- STI Group

- Cardboard Box Company

- Weedon Group

- Caps Cases Limited

- Vanguard Packaging Inc.

- TricorBraun

- Huhtamaki Oyj

- Orora Limited

- Sealed Air Corporation

- Amcor PLC

- Sonoco Products Company

- Visy Industries

- Packaging Corporation of America

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Circular-economy regulations accelerating single-material fibre SRP adoption

- 4.2.2 E-commerce hyper-growth raising shelf-ready packaging (SRP) compliance demand

- 4.2.3 Retailer labour shortages - SRP cuts in-store man-hours by 40 %

- 4.2.4 AI-enabled packaging line automation boosting change-over speed

- 4.2.5 Branded manufacturers using SRP to lift on-shelf conversion rates

- 4.2.6 Digital-printing economics enabling micro-batch promotions in SRP

- 4.3 Market Restraints

- 4.3.1 Corrugated containerboard price volatility

- 4.3.2 Lack of global SRP standardisation inflating supply-chain cost

- 4.3.3 RFID / smart-label integration costs in SRP formats

- 4.3.4 Supermarket non-compliance fines and charge-backs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Paper and Paperboard

- 5.1.1.1 Corrugated Containerboard

- 5.1.1.2 Folding Boxboard (FBB)

- 5.1.1.3 Solid Bleached Sulfate (SBS)

- 5.1.1.4 White-lined Chipboard (WLC)

- 5.1.2 Plastics

- 5.1.2.1 PET

- 5.1.2.2 HDPE

- 5.1.2.3 PP

- 5.1.2.4 Bio-plastics (PLA, PHA)

- 5.1.3 Hybrid and Other Materials

- 5.1.1 Paper and Paperboard

- 5.2 By Package Type

- 5.2.1 Die-cut Display Containers

- 5.2.1.1 Standard RSC Die-cuts

- 5.2.1.2 High-graphic Pre-print Die-cuts

- 5.2.2 Corrugated Cardboard Boxes

- 5.2.2.1 Shelf-ready RSC

- 5.2.2.2 Handle-integrated SRP

- 5.2.3 Shrink-wrapped Trays

- 5.2.3.1 PE Shrink

- 5.2.3.2 Compostable Shrink

- 5.2.4 Modified Cases

- 5.2.4.1 High Wall Cases

- 5.2.4.2 Retail-display Cases

- 5.2.5 Plastic Containers

- 5.2.5.1 Nestable Crates

- 5.2.5.2 Rigid Plastic Trays

- 5.2.6 Others (Stand-up Pouches, Re-usable Totes)

- 5.2.1 Die-cut Display Containers

- 5.3 By End-User Application

- 5.3.1 Food

- 5.3.1.1 Ready-to-eat Meals

- 5.3.1.2 Fresh Produce

- 5.3.1.3 Meat and Poultry

- 5.3.1.4 Bakery and Confectionery

- 5.3.2 Beverage

- 5.3.2.1 Soft Drinks

- 5.3.2.2 Alcoholic Beverages

- 5.3.2.3 Dairy Drinks

- 5.3.3 Household and Home-care Products

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Consumer Electronics and Appliances

- 5.3.6 Others (DIY and Garden, Pet Food)

- 5.3.1 Food

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia and New Zealand

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 Middle East

- 5.4.4.1.1 United Arab Emirates

- 5.4.4.1.2 Saudi Arabia

- 5.4.4.1.3 Turkey

- 5.4.4.1.4 Rest of Middle East

- 5.4.4.2 Africa

- 5.4.4.2.1 South Africa

- 5.4.4.2.2 Nigeria

- 5.4.4.2.3 Egypt

- 5.4.4.2.4 Rest of Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Mondi Group

- 6.4.2 Smurfit Westrock

- 6.4.3 International Paper Company

- 6.4.4 Georgia-Pacific LLC

- 6.4.5 Oji Holdings Corporation

- 6.4.6 Rengo Co., Ltd.

- 6.4.7 Klabin S.A.

- 6.4.8 Pratt Industries

- 6.4.9 Graphic Packaging International

- 6.4.10 STI Group

- 6.4.11 Cardboard Box Company

- 6.4.12 Weedon Group

- 6.4.13 Caps Cases Limited

- 6.4.14 Vanguard Packaging Inc.

- 6.4.15 TricorBraun

- 6.4.16 Huhtamaki Oyj

- 6.4.17 Orora Limited

- 6.4.18 Sealed Air Corporation

- 6.4.19 Amcor PLC

- 6.4.20 Sonoco Products Company

- 6.4.21 Visy Industries

- 6.4.22 Packaging Corporation of America

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment