|

市場調查報告書

商品編碼

1851668

石膏板:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Gypsum Board - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

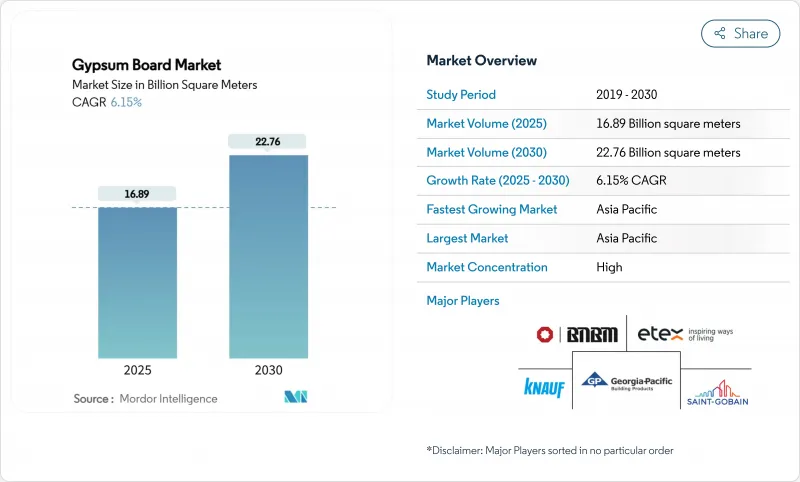

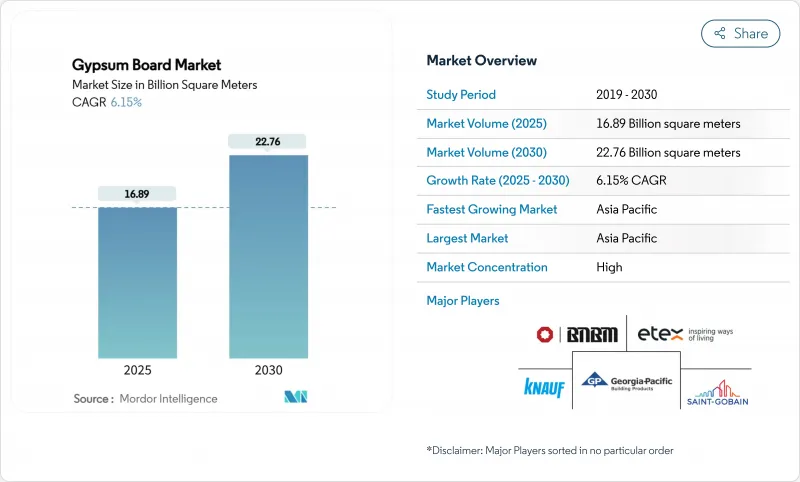

預計到 2025 年,石膏板市場規模將達到 168.9 億平方公尺,到 2030 年將達到 227.6 億平方公尺,在預測期(2025-2030 年)內,複合年成長率將達到 6.15%。

亞太地區的建築熱潮、北美長期存在的住房短缺以及歐洲日益嚴格的碳排放法規正在重塑市場競爭格局。德克薩斯州和蒙特婁的產能擴張計劃表明,生產商如何在成本控制和永續性投資之間取得平衡。同時,輕質預裝飾解決方案的普及正在幫助承包商緩解勞動力短缺問題。隨著燃煤電廠的淘汰速度超乎預期,再生和合成原料的重要性日益凸顯。儘管纖維水泥在潮濕地區市場佔據主導地位,但其價格仍然合理,而大規模的基礎設施更新計畫也持續支撐著石膏板市場的整體銷售成長。

全球石膏板市場趨勢與洞察

亞太地區房屋建設激增

快速的城市交通推動開發人員建造高密度住宅,而石膏板系統相比濕石膏有助於縮短室內施工週期。儘管中國2024年的水泥產量下降了10%,但由於開發商專注於加快裝修工程以確保現金流,石膏板的生產仍保持穩定。在印度,政府支持的住房計畫增加了穩定的基準需求,而東南亞的計劃則因其卓越的防火性能而被指定用於學校和交通樞紐。全部區域的勞動力短缺也增加了預製板的吸引力,因為預製板可以減少現場施工。

成熟市場的翻新和改造浪潮正在加速。

預計到2025年,美國房屋翻新支出將增加至5,090億美元,扭轉先前兩年的萎縮局面。由於美國40%的房屋建於1970年以前,牆體更換必須符合嚴格的防火和隔熱標準,這直接推動了對石膏板的需求。屋主平均花費4700美元進行室內維修,其中防黴防潮板材是他們的首選。歐盟類似的維修規定也推動了高性能隔熱隔音板材訂單的成長。這些動態使得石膏板市場即使在景氣衰退時期也能維持穩定的銷售量。

天然石膏和能源價格波動劇烈

預計到2024年,美國石膏礦產量將達到2,200萬噸,單價會因礦井深度和運輸距離的不同而出現顯著差異。由於煅燒過程嚴重依賴天然氣,石膏板價格對燃料價格波動十分敏感。隨著燃煤電廠的退役導致合成煤供應減少,工廠將從更遠的礦床購買煤炭,這將推高運費並增加成本風險。雖然節能窯爐和區域倉儲中心在一定程度上緩解了這種影響,但投入成本的波動仍會在短期內抑製石膏板市場的成長。

細分市場分析

到2024年,牆板將佔石膏板市場佔有率的60.31%,在住宅室內裝修中得到廣泛認可,成本和法規遵從性是推動產品規格選擇的主要因素。然而,預裝飾板預計到2030年將以7.52%的複合年成長率成長,比整個石膏板市場高出一個百分點以上。

雖然價格比廣受歡迎的X型石膏板高出20-30%,但它仍然是廚房、浴室和醫療走廊等停工成本高昂場所的熱門選擇。製造商透過將這些特性與工廠預塗漆相結合,獲得了更高的利潤。隨著承包商越來越傾向於「可直接塗漆」的交貨,預塗漆石膏板有望在石膏板市場佔據更大的佔有率。

石膏板市場報告按產品類型(牆板、天花板、預裝飾板)、原料(天然石膏、合成(脫硫)石膏、再生石膏)、應用領域(住宅、商業、機構、工業)和地區(亞太地區、北美、歐洲、南美、中東和非洲)進行細分。市場預測以單位提供。

區域分析

2024年,亞太地區將佔全球石膏板出貨量的46.62%,這主要得益於中國龐大的房地產市場需求以及印度的「全民住房」計畫。預計到2030年,該地區將以7.46%的複合年成長率成長,儘管面臨政治和信貸風險,但仍將確保石膏板市場在亞太地區的銷售佔比領先地位。

北美代表著以翻新改造主導的穩定市場。歐洲儘管宏觀經濟指標放緩,但正走在監管主導的道路上,RE2020及類似框架強化了對碳最佳化設計的需求。南美和中東及非洲則代表著充滿機會的前沿地區,較低的人均石膏板普及率為未來石膏板市場成長留下了空間。

製造商透過環境產品聲明來凸顯自身優勢,並經常使用回收材料以滿足競標要求。儘管建築用石膏板的生產量低於亞太地區,但受環境、社會和治理 (ESG) 因素驅動的溢價確保了石膏板市場的獲利成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞太地區房屋建設激增

- 成熟市場的改造和翻新浪潮正在加速。

- 轉向輕質高強度石膏板解決方案

- 政府對防火、隔音和節能建築的獎勵

- 成本優勢:合成(脫硫)石膏的供應

- 市場限制

- 天然石膏和能源價格波動

- 纖維水泥和其他替代板材日益普及

- 碳中和指令加強了二氧化碳排放法規

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 牆板

- 天花板面板

- 裝飾板

- 按原料

- 天然石膏

- 合成(脫硫)石膏

- 再生石膏

- 透過使用

- 住房

- 商業

- 機構

- 產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 馬來西亞

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 土耳其

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 卡達

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- BNBM

- Etex Group

- Everest Industries Limited

- Georgia-Pacific Gypsum LLC

- Global Gypsum Board Co LLC(Gypcore)

- Holcim

- Jason New Materials

- Knauf Group

- National Gypsum Services Company

- Osman Group

- PABCO Gypsum

- Saint-Gobain

- Shandong Taihe Dongxin Co.,Ltd

- VANS Gypsum

- Volma

- Winstone Wallboards Limited

- YOSHINO GYPSUM CO.,LTD.

第7章 市場機會與未來展望

The Gypsum Board Market size is estimated at 16.89 Billion square meters in 2025, and is expected to reach 22.76 Billion square meters by 2030, at a CAGR of 6.15% during the forecast period (2025-2030).

Ongoing fire-safety and energy-efficiency mandates anchor demand, while Asia-Pacific's construction boom, chronic housing shortages in North America, and tightening embodied-carbon rules in Europe shape the competitive field. Capacity expansion projects in Texas and Montreal illustrate how producers balance cost discipline with sustainability investments. Meanwhile, the shift toward lightweight and pre-decorated solutions helps contractors mitigate labor shortages, and recycled or synthetic feedstocks gain strategic importance as coal-powered electricity retires faster than expected. Fiber-cement's encroachment in wet areas keeps pricing rational, yet broad infrastructure renewal programs continue to backstop volume growth across the gypsum board market.

Global Gypsum Board Market Trends and Insights

Surging Residential Construction in APAC

Rapid urban migration pushes developers toward high-density housing, and gypsum board systems help shorten interior fit-out cycles compared with wet plaster. Although China's overall cement output fell 10% in 2024, wallboard volumes remained resilient because developers focused on accelerating finishing work to unlock cash flows. India's government-backed housing schemes add steady baseline demand, while Southeast Asian megaprojects specify gypsum for its proven fire resistance in schools and transit hubs. Labor shortages across the region strengthen the appeal of factory-finished boards that reduce on-site trades.

Accelerating Renovation and Remodeling Wave in Mature Markets

Renovation outlays in the United States climbed to USD 509 billion in 2025, reversing two years of contraction. Forty percent of U.S. dwellings pre-date 1970, so wall replacements align with tighter fire and insulation codes, directly lifting gypsum demand. Homeowners spent an average USD 4,700 on interior upgrades, with mold- and moisture-resistant boards ranking high on shopping lists. Similar retrofit mandates in the EU catalyze orders for high-performance panels that combine thermal and acoustic gains. These dynamics sustain a stable volume base for the gypsum board market during economic slowdowns.

Volatile Natural Gypsum and Energy Prices

Mined gypsum output touched 22 million tons in the United States during 2024, but unit costs varied widely by mine depth and haulage distance. Calcination relies heavily on natural gas, making board pricing sensitive to fuel swings. As decommissioning of coal plants removes synthetic supply, mills draw from deposits located farther afield, inflating freight bills and amplifying cost risk. Energy-efficient kilns and regional warehouse hubs partly soften the blow, yet input volatility still trims the gypsum board market growth trajectory in the near term.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Lightweight and High-Strength Drywall Solutions

- Government Incentives for Fire, Sound, and Energy-Efficient Buildings

- Rising Penetration of Fibre-Cement and Other Panel Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wall board retained 60.31% gypsum board market share in 2024, sustained by universal acceptance in residential interiors where cost and code compliance drive specification. Pre-decorated panels, however, are forecast to post 7.52% CAGR to 2030, a speed more than one percentage point above the overall gypsum board market.

Premium segments now favor mold-, moisture- or impact-modified boards such as PURPLE XP, priced at a 20-30% uplift over generic Type X, yet often selected for kitchens, baths, and healthcare corridors where downtime is costly. Manufacturers bundle these attributes with factory coatings to seize higher-margin value capture. As contractors increasingly pursue "paint-ready" delivery, pre-decorated formats are poised to widen their share within the gypsum board market.

The Gypsum Board Report is Segmented by Product Type (Wall Board, Ceiling Board, and Pre-Decorated Board), Raw Material (Natural Gypsum, Synthetic (FGD) Gypsum, and Recycled Gypsum), Application (Residential, Commercial, Institutional, and Industrial), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Units).

Geography Analysis

Asia-Pacific claimed 46.62% of 2024 shipments, thanks to China's massive real-estate backlog and India's Housing for All program. Regional growth at 7.46% CAGR through 2030 ensures the gypsum board market remains volume-weighted to this geography despite political and credit risk clouds.

North America embodies renovation-driven steadiness. Europe's pathway is more regulation-led, as RE2020 and similar frameworks reinforce demand for carbon-optimized designs despite slower macro indicators. Together, the three regions shape the competitive map, while South America, and Middle-East and Africa remain opportunity frontiers where lower per-capita penetration leaves headroom for future gypsum board market growth.

Manufacturers differentiate through environmental product declarations, often bundling recycled content to meet tender prerequisites. Although construction output is flatter than Asia-Pacific, premium ESG-minded pricing offsets slower unit growth, safeguarding revenue expansion inside the gypsum board market.

- BNBM

- Etex Group

- Everest Industries Limited

- Georgia-Pacific Gypsum LLC

- Global Gypsum Board Co LLC (Gypcore)

- Holcim

- Jason New Materials

- Knauf Group

- National Gypsum Services Company

- Osman Group

- PABCO Gypsum

- Saint-Gobain

- Shandong Taihe Dongxin Co.,Ltd

- VANS Gypsum

- Volma

- Winstone Wallboards Limited

- YOSHINO GYPSUM CO.,LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Residential Construction in APAC

- 4.2.2 Accelerating Renovation and Remodeling Wave in Mature Markets

- 4.2.3 Shift Toward Lightweight and High-Strength Drywall Solutions

- 4.2.4 Government Incentives for Fire, Sound, and Energy-Efficient Buildings

- 4.2.5 Cost-Advantaged Synthetic (FGD) Gypsum Availability

- 4.3 Market Restraints

- 4.3.1 Volatile Natural Gypsum and Energy Prices

- 4.3.2 Rising Penetration of Fibre-Cement and Other Panel Alternatives

- 4.3.3 Carbon-Neutral Mandates Raising Embodied-Carbon Scrutiny

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Wall Board

- 5.1.2 Ceiling Board

- 5.1.3 Pre-decorated Board

- 5.2 By Raw Material

- 5.2.1 Natural Gypsum

- 5.2.2 Synthetic (FGD) Gypsum

- 5.2.3 Recycled Gypsum

- 5.3 By Application

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Institutional

- 5.3.4 Industrial

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Malaysia

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Turkey

- 5.4.3.8 Nordics

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Nigeria

- 5.4.5.4 Egypt

- 5.4.5.5 Qatar

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 BNBM

- 6.4.2 Etex Group

- 6.4.3 Everest Industries Limited

- 6.4.4 Georgia-Pacific Gypsum LLC

- 6.4.5 Global Gypsum Board Co LLC (Gypcore)

- 6.4.6 Holcim

- 6.4.7 Jason New Materials

- 6.4.8 Knauf Group

- 6.4.9 National Gypsum Services Company

- 6.4.10 Osman Group

- 6.4.11 PABCO Gypsum

- 6.4.12 Saint-Gobain

- 6.4.13 Shandong Taihe Dongxin Co.,Ltd

- 6.4.14 VANS Gypsum

- 6.4.15 Volma

- 6.4.16 Winstone Wallboards Limited

- 6.4.17 YOSHINO GYPSUM CO.,LTD.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment