|

市場調查報告書

商品編碼

1851639

磁感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Magnetic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

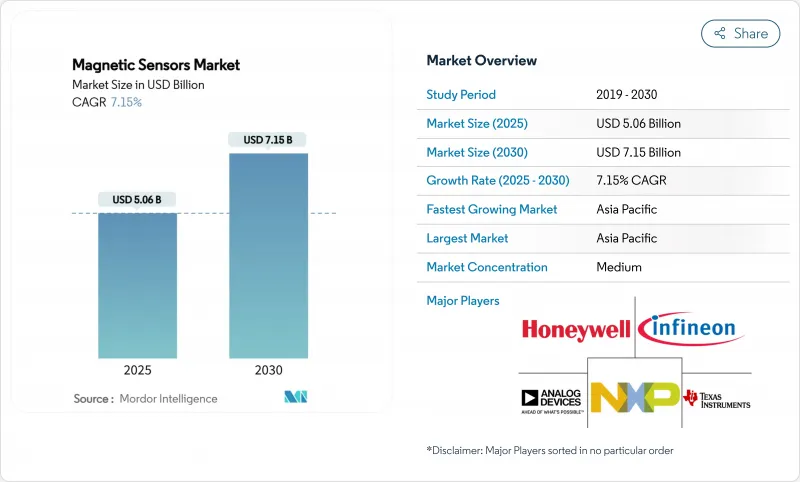

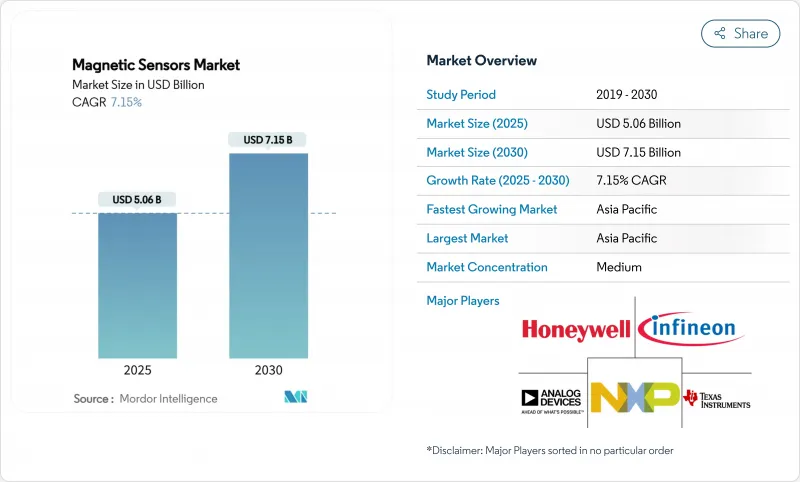

預計到 2025 年,磁感測器市場規模將達到 50.6 億美元,到 2030 年將達到 71.5 億美元,複合年成長率為 7.15%。

電動車動力系統的強制性要求、工業4.0生產線的進步以及三軸感測技術在消費性電子設備中的應用,共同支撐著這一穩步成長。汽車製造商正在指定更高精度的位置和電流感測器以滿足功能安全目標,而智慧型手機和穿戴式裝置品牌則正在整合微型隧道磁阻(TMR)晶粒,用於擴增實境和室內導航功能。資料中心營運商傾向於使用量子級TMR磁頭來提高儲存密度,這促使供應商轉向高階、高靈敏度的設計。稀土磁鐵的供應鏈風險依然高,迫使企業投資於回收、本地加工和替代材料。由於領先供應商專注於垂直整合、擴展TMR產品組合以及製定數位化輸出藍圖以在霍爾效應驅動的價格環境下保護淨利率,因此市場競爭較為溫和。

全球磁感測器市場趨勢與洞察

電動車動力系統的強制性電氣化

歐盟和加州的電動車法規正在推動各種感測器的廣泛應用,涵蓋從轉子位置和溫度追蹤到電池管理子系統等諸多領域。大陸集團的e-Motor轉子溫度感測器測量精度低至3°C,使設計人員能夠在保證性能的同時減少稀土元素磁體的用量。如此高的精度既符合法規要求,也有助於電動車平台實現成本控制目標。

三軸磁感測技術在智慧型手機和穿戴式裝置中已廣泛應用。

行動電話廠商正在整合3D磁感測器,以實現擴增實境疊加和精準的室內導航。小型TMR晶粒滿足角度精度和功耗要求,有助於跨產業需求的拓展。 TDK的Nivio™ xMR組件測量生物磁場的尺寸比實驗室級SQUID更小,這顯示其在醫療設備領域具有潛在的應用價值。

通用霍爾效應積體電路的價格已經下降

霍爾效應裝置正面臨來自中國低成本晶圓廠日益激烈的競爭。自2024年以來,釹的價格已下跌42%,這正在削弱高階供應商曾經擁有的材料成本優勢,加劇了競爭壓力。因此,供應商正將研發重心轉向差異化的TMR和GMR產品線,並整合訊號處理模組以保持價格競爭力。

細分市場分析

TMR感測器正以8.80%的複合年成長率快速成長,是主要技術中成長最快的。霍爾效應解決方案在成熟的模具和極具吸引力的價格的推動下,預計到2024年仍將佔據磁感測器市場48.0%的佔有率。然而,汽車安全系統和工業4.0機器人對-40°C至+150°C溫度範圍內亞度級角度精度的要求日益提高,而這正是TMR感測器的優勢所在。 Allegro MicroSystems公司推出的XtremeSense™感測器,其靈敏度是霍爾效應感測器的10倍,電流消耗降低了50%。

GMR 是一款中階產品,針對那些希望在不承擔 TMR 過高成本的情況下獲得更高靈敏度的客戶;而 AMR 則是一款小眾產品,適用於需要簡單訊號鏈的工業線性編碼器。磁通門和 SQUID 裝置則應用於高階實驗室、國防和醫療設備。鑑於這種技術組合,霍爾效應元件很可能在對成本敏感的領域繼續佔據主導地位,但 TMR 將在磁感測器市場佔據大部分增值佔有率。

到2024年,汽車產業將佔據磁感測器市場規模的56.0%。雖然電動動力傳動系統和ADAS的普及鞏固了這個市場基礎,但資料中心才是真正引人注目的成長點。用於HDD和SSD的量子級TMR磁頭正幫助超大規模資料中心以9.60%的複合年成長率提升Terabyte儲存密度。營運商還在配電單元中部署霍爾電流感測器,以最佳化機架級能耗,協助實現脫碳目標。在醫療保健領域,TDK的生物磁創新技術正推動非侵入式影像和植入監測技術的發展,開啟新的應用前景。

磁感測器市場按技術(霍爾效應、AMR、GMR、TMR 及其他技術)、應用(汽車、消費性電子及其他)、終端用戶產業(汽車OEM廠商和一級供應商、消費性電子OEM廠商及其他)、輸出訊號(數位、類比)和地區進行細分。市場預測以美元計價。

區域分析

亞太地區將在2024年以42.0%的市佔率引領磁感測器市場,年複合成長率將達到9.40%,這主要得益於中國半導體製造廠和日本精密感測器技術的強勁成長。中國稀土出口限制既是挑戰也是機會。國內晶圓廠將獲得穩定的磁鐵供應,而出口型汽車製造商則將尋求替代來源。日本的TMR(三磁鐵磁阻)藍圖將利用其在計量技術方面的優勢推動感測器小型化,從而惠及汽車和醫療產業。韓國的儲存設備巨頭將增加對高密度TMR磁頭的需求,而印度不斷擴大的汽車生產也將擴大該地區的基本客群。

儘管原料供應面臨挑戰,北美市場依然至關重要。 Allegro MicroSystems 預測,2024 會計年度銷售額將達到 10.5 億美元,年增 38%,主要得益於電動車領域的成長。像 Noveon Magnetics 在德克薩斯的工廠這樣的計劃,雖然得到了州政府對國內稀土加工的激勵措施支持,但其產量在未來幾年內仍將落後於亞洲。汽車製造商嚴重依賴當地的感測器設計中心來滿足美國公路交通安全管理局 (NHTSA) 的軟體更新要求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電動車動力系統的強制性電氣化

- 智慧型手機和穿戴式裝置中三軸磁感測技術的普及

- 汽車產業對ADAS和電動馬達定位的需求日益成長

- 工廠自動化向工業4.0轉型

- 車載直流快速充電電流監測

- 在資料中心的硬碟/固態硬碟磁頭中採用量子級TMR技術

- 市場限制

- 通用霍爾效應積體電路的價格已經下降

- 稀土元素磁鐵供應鏈的集中化

- 高速電氣化平台的電磁干擾合規成本

- xMR感測器專利相關的智慧財產權訴訟風險

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過技術

- 霍爾效應

- 異性磁電阻(AMR)

- 巨磁電阻(GMR)

- 隧道磁阻(TMR)

- 其他技術

- 透過使用

- 車

- 消費性電子產品

- 工業自動化

- 醫療保健和醫療設備

- 航太/國防

- 資料中心和伺服器存儲

- 其他用途

- 按最終用途行業分類

- 汽車OEM廠商和一級供應商

- 消費性電子產品OEM廠商

- 工業設備製造商

- 能源與公共產業

- 醫療保健原始設備製造商

- 航太與國防主控

- 透過輸出訊號

- 數位式(IC/SPI、SENT、PSI5)

- 類比(線性電壓/電流)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- ASEAN-5

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 土耳其

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Infineon Technologies AG

- Allegro MicroSystems LLC

- NXP Semiconductors NV

- TDK Corporation

- Honeywell International Inc.

- Analog Devices Inc.

- STMicroelectronics NV

- Murata Manufacturing Co. Ltd

- TE Connectivity Ltd

- Texas Instruments Inc.

- NVE Corporation

- Crocus Technology Inc.

- Omron Corporation

- Asahi Kasei Microdevices(AKM)

- Diodes Incorporated

- Melexis NV

- ams-OSRAM AG

- Sensitec GmbH

- TT Electronics plc

- Robert Bosch GmbH

- Lake Shore Cryotronics Inc.

第7章 市場機會與未來展望

The magnetic sensor market size is worth USD 5.06 billion in 2025 and is forecast to reach USD 7.15 billion by 2030, reflecting a 7.15% CAGR.

Rising electric-vehicle drivetrain mandates, the advance of Industry 4.0 production lines, and expanding 3-axis sensing in consumer devices underpin this steady growth. Automakers are specifying higher-accuracy position and current sensors to meet functional-safety targets, while smartphone and wearable brands integrate miniature tunnel-magnetoresistance (TMR) dies for augmented-reality and indoor-navigation functions. Data-center operators champion quantum-grade TMR heads to lift storage density, pushing suppliers toward premium, high-sensitivity designs. Supply-chain risk around rare-earth magnets remains an overhang, forcing companies to invest in recycling, local processing, and substitute materials. Competitive intensity is moderate as leading vendors focus on vertical integration, TMR portfolio expansion, and digital-output roadmaps to protect margins in an environment of Hall-effect price erosion.

Global Magnetic Sensors Market Trends and Insights

EV drivetrain electrification mandates

Electric-vehicle regulations in the European Union and California spur wider sensor deployment, stretching from rotor position and temperature tracking to battery-management subsystems. Continental's e-Motor Rotor Temperature Sensor trims measurement tolerance to 3 °C, allowing designers to cut rare-earth magnet content while protecting performance assemblymag.com. Such precision supports both compliance targets and cost-containment strategies across EV platforms.

Proliferation of 3-axis magnetic sensing in smartphones and wearables

Handset vendors embed 3-D magnetic sensors to deliver augmented-reality overlays and accurate indoor navigation. Miniature TMR dies meet the angular-accuracy and power requirements, stimulating cross-industry demand spillovers. TDK's Nivio(TM) xMR component measures biomagnetic fields in a footprint smaller than laboratory-grade SQUIDs, hinting at medical-device spill-over potential.

Price erosion in commoditised Hall-effect ICs

Hall-effect devices face rising competition from low-cost Chinese fabs. The 42% fall in neodymium prices since 2024 compounds pressure by eroding the material-cost moat once held by premium suppliers. Vendors therefore channel R&D into differentiated TMR and GMR lines or integrate signal-processing blocks to sustain pricing power.

Other drivers and restraints analyzed in the detailed report include:

- Growing ADAS and e-motor position needs in automotive

- Factory automation shift to Industry 4.0

- Supply-chain concentration in rare-earth magnetics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

TMR sensors are expanding at 8.80% CAGR, the fastest pace among major technologies. Hall-effect solutions still hold 48.0% of the magnetic sensor market share in 2024 due to mature tooling and attractive pricing. Yet automotive safety systems and Industry 4.0 robots now specify sub-degree angular accuracy across -40 °C to +150 °C ranges, a window where TMR excels. Allegro MicroSystems markets XtremeSense(TM) implementations with 10 X sensitivity and 50% lower current draw than Hall-effect peers.

GMR represents a middle path for customers demanding enhanced sensitivity without the cost premium of TMR, while AMR retains a niche in linear industrial encoders requiring simple signal chains. Fluxgate and SQUID devices serve high-end laboratory, defense, and medical equipment. The technology mix suggests Hall-effect incumbency in cost-sensitive lines will persist, but TMR will absorb most incremental value creation within the magnetic sensor market.

Automotive accounted for 56.0% of the magnetic sensor market size in 2024. The proliferation of electric powertrains and ADAS keeps that base stable, yet the standout growth story is data centers. Quantum-grade TMR heads for HDDs and SSDs help hyperscalers raise terabyte density at a 9.60% CAGR. Operators also deploy Hall-based current sensors in power-distribution units to optimize rack-level energy use amid decarbonization targets. Industrial automation contributes steady volume as factories digitize assembly lines, while healthcare opens nascent upside through non-invasive imaging and implant monitoring supported by TDK's biomagnetic innovations.

Magnetic Sensor Market is Segmented by Technology (Hall-Effect, AMR, GMR, TMR, Other Technologies), Application (Automotive, Consumer Electronics, and More), End-Use Industry (Automotive OEMs and Tier-1s, Consumer Electronics OEMs, and More), Output Signal (Digital, Analog), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the magnetic sensor market with 42.0% share in 2024 and is heading toward a 9.40% CAGR, powered by China's semiconductor fabs and Japan's precision sensor know-how. Chinese export curbs on rare-earths create both threat and windfall: domestic fabs gain a captive magnet supply, while export-oriented carmakers scramble for alternate sourcing. Japan's TMR roadmap leverages metrology depth to push sensor miniaturization that feeds both auto and medical verticals. South Korea's storage-device majors lift demand for high-density TMR heads, and India's expanding vehicle output widens the regional customer base.

North America remains pivotal despite material-supply pain points. Allegro MicroSystems booked USD 1.05 billion sales in fiscal 2024, up 38% in e-mobility-linked lines. State incentives for domestic rare-earth processing underpin projects such as Noveon Magnetics' Texas plant, though volumes will lag Asia for several years. Automakers rely heavily on local sensor design centers to meet National Highway Traffic Safety Administration software-update requirements.

- Infineon Technologies AG

- Allegro MicroSystems LLC

- NXP Semiconductors NV

- TDK Corporation

- Honeywell International Inc.

- Analog Devices Inc.

- STMicroelectronics NV

- Murata Manufacturing Co. Ltd

- TE Connectivity Ltd

- Texas Instruments Inc.

- NVE Corporation

- Crocus Technology Inc.

- Omron Corporation

- Asahi Kasei Microdevices (AKM)

- Diodes Incorporated

- Melexis NV

- ams-OSRAM AG

- Sensitec GmbH

- TT Electronics plc

- Robert Bosch GmbH

- Lake Shore Cryotronics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV drivetrain electrification mandates

- 4.2.2 Proliferation of 3-axis magnetic sensing in smartphones and wearables

- 4.2.3 Growing ADAS and e-motor position needs in automotive

- 4.2.4 Factory automation shift to Industry 4.0

- 4.2.5 On-board DC-fast-charging current monitoring

- 4.2.6 Quantum-grade TMR adoption in data-center HDD/SSD heads

- 4.3 Market Restraints

- 4.3.1 Price erosion in commoditised Hall-effect ICs

- 4.3.2 Supply-chain concentration in rare-earth magnetics

- 4.3.3 EMI compliance costs for high-speed electrification platforms

- 4.3.4 IP litigation risk around xMR sensor patents

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Hall-Effect

- 5.1.2 Anisotropic Magnetoresistance (AMR)

- 5.1.3 Giant Magnetoresistance (GMR)

- 5.1.4 Tunnel Magnetoresistance (TMR)

- 5.1.5 Other Technologies

- 5.2 By Application

- 5.2.1 Automotive

- 5.2.2 Consumer Electronics

- 5.2.3 Industrial Automation

- 5.2.4 Healthcare and Medical Devices

- 5.2.5 Aerospace and Defense

- 5.2.6 Data-Center and Server Storage

- 5.2.7 Other Applications

- 5.3 By End-Use Industry

- 5.3.1 Automotive OEMs and Tier-1s

- 5.3.2 Consumer Electronics OEMs

- 5.3.3 Industrial Equipment Manufacturers

- 5.3.4 Energy and Utilities

- 5.3.5 Healthcare OEMs

- 5.3.6 Aerospace and Defense Primes

- 5.4 By Output Signal

- 5.4.1 Digital (IC/SPI, SENT, PSI5)

- 5.4.2 Analog (Linear Voltage/Current)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN-5

- 5.5.4.6 Australia and New Zealand

- 5.5.4.7 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Turkey

- 5.5.5.2 Israel

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 UAE

- 5.5.5.5 South Africa

- 5.5.5.6 Nigeria

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Infineon Technologies AG

- 6.4.2 Allegro MicroSystems LLC

- 6.4.3 NXP Semiconductors NV

- 6.4.4 TDK Corporation

- 6.4.5 Honeywell International Inc.

- 6.4.6 Analog Devices Inc.

- 6.4.7 STMicroelectronics NV

- 6.4.8 Murata Manufacturing Co. Ltd

- 6.4.9 TE Connectivity Ltd

- 6.4.10 Texas Instruments Inc.

- 6.4.11 NVE Corporation

- 6.4.12 Crocus Technology Inc.

- 6.4.13 Omron Corporation

- 6.4.14 Asahi Kasei Microdevices (AKM)

- 6.4.15 Diodes Incorporated

- 6.4.16 Melexis NV

- 6.4.17 ams-OSRAM AG

- 6.4.18 Sensitec GmbH

- 6.4.19 TT Electronics plc

- 6.4.20 Robert Bosch GmbH

- 6.4.21 Lake Shore Cryotronics Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment