|

市場調查報告書

商品編碼

1851637

小型風力發電機:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Small Wind Turbine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

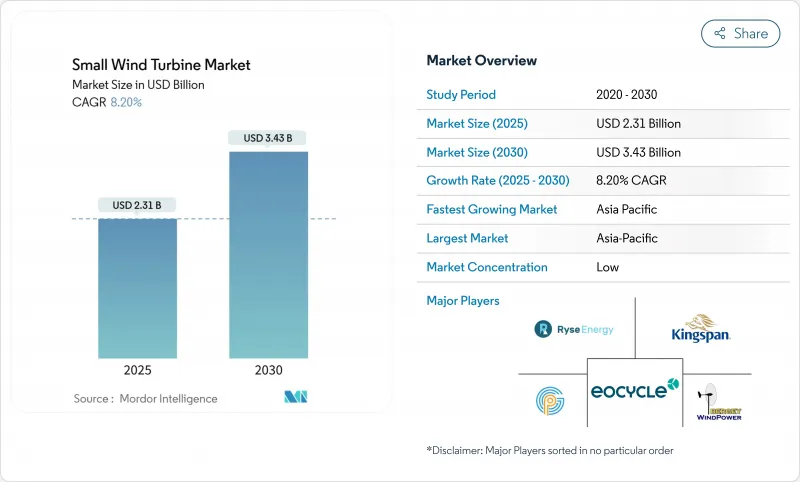

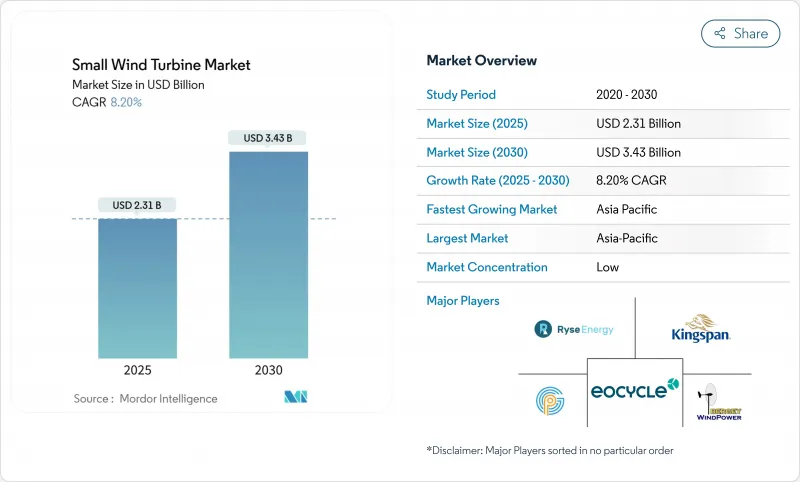

預計到 2025 年,小型風力發電機市場價值為 23.1 億美元,到 2030 年將達到 34.3 億美元,預測期(2025-2030 年)複合年成長率為 8.20%。

成長的驅動力來自政策獎勵、垂直軸技術的進步以及在電訊、農業和分散式能源系統中日益成長的應用。北美、歐盟和亞洲的公共資助計畫正在加速其普及,而機器學習驅動的渦輪機最佳化降低了全生命週期能源成本並提高了可靠性。企業購電協議正在推動併網計劃的需求,而風光互補系統正在擴大風力資源不穩定地區的市場規模。在10千瓦以下的細分市場,與屋頂太陽能的成本競爭仍然是一個限制因素,但效率的提高和新的安裝法規正在縮小這一差距。

全球小型風力發電機市場趨勢與洞察

加勒比海偏遠離島快速通電

離島的電力公司正在用包含小型風力發電機的混合可再生微電網取代柴油發電系統。各國政府和多邊貸款機構正在爭取優惠融資,以降低計劃前期成本並提高開發商的參與度。提供耐腐蝕塗層和模組化物流方案的渦輪機供應商正在該市場中獲得競爭優勢。每個站點的平均裝置容量仍低於50千瓦,產品系列從0千瓦到20千瓦不等。穩定的信風支持超過35%的發電容量,與純太陽能發電方案相比,縮短了投資回收期。島嶼電氣化計畫採用基於績效的收費系統,獎勵高運轉率,這凸顯了整合到新型渦輪機的數位監控平台的價值。

美國農村能源補貼推動了5千瓦以下風力渦輪機的需求

美國農村能源計畫(Rural Energy for America Program)已撥款1.8億美元,用於支持農場和農村小型企業的小型風力發電系統,該計劃將持續到2025年。津貼最高可涵蓋50%的資本成本,在平均風速超過6公尺/秒的地區,投資可在六年內回收成本。國家可再生能源實驗室(NREL)的競爭性改善項目(Competitive Improvement 計劃)透過資助原型認證和獲取第三方融資,彌補了以往的融資缺口。該計畫的目標是涵蓋400多個農場,到2027年將微型風力發電系統的累積裝置容量增加25兆瓦。將風力渦輪機與穀倉屋頂太陽能板結合,可以幫助種植者抵消白天的尖峰負載和晚間灌溉需求。根據該計劃獲得UL 6141認證的製造商有資格獲得聯邦政府的優先採購。

歐洲都市區基於高度的區域分類法規

在許多歷史街區,地方政府高度限制規定風力渦輪機輪轂高度不得超過10米,這限制了發電產量。不同的要求通常需要進行陰影閃爍和視覺評估,從而延長了計劃工期。噪音測量法規依賴模型而非經驗數據,這推高了工程成本。由於管轄權分散,相鄰市政當局對同一計劃的規定各不相同,這阻礙了開發商在整個城市範圍內擴張。歐盟風能一攬子計畫指南呼籲協調統一,但地方文物保護組織仍擁有否決權。供應商已推出可安裝在女兒牆下的短桅杆垂直軸風力渦輪機設計,但掃掠面積的減少降低了年度發電量。

細分市場分析

由於動態成熟且供應鏈成熟,水平軸風力發電機組預計在2024年仍將佔68%的市場佔有率。該細分市場在大型農場改造和農村住宅風力發電機更換領域佔據主導地位。製造商正將2-20kW的機型標準化,以滿足美國農業部和印度通訊業者的競標要求,從而實現規模經濟。垂直軸小型風力發電機組的市場規模預計將從較低的基數快速成長,年複合成長率將達到14%,超過水平軸風力發電機組。垂直軸風力發電機在屋頂和街道電線杆附近的湍流風環境中表現出色,其全方位葉片能夠捕捉多方向的陣風。透過遺傳學習演算法調整槳距角,可將功率係數提高至多0.45,使其更接近貝茨極限基準。較少的活動部件使得地面齒輪箱的安裝成為可能,從而減少了30%的維護車輛出勤次數,加速了其在商業車隊中的應用。

垂直軸風力發電機供應商與建築幕牆工程師合作,將風力發電機整合到幕牆中,滿足了歐盟的創新技術配額要求。反向旋轉的薩沃紐斯/達里厄斯混合轉子最大限度地減少了扭矩波動,並在5米距離處實現了35分貝以內的聲學特徵。東京大學的現場測試證實,即使在颱風般的強風下,軸承壽命也能達到15年,從而消除了人們對耐久性的擔憂。開發人員透過建構租賃協議,將服務和回收義務捆綁在一起,滿足了中國和歐盟的循環經濟法規。垂直軸風力發電機定位為補充而非顛覆性技術,能夠實現混合陣列,從而平衡整個場地的能源輸出。

2024年,0-5kW微型風力發電機將佔小型風力發電機市場46%的佔有率,這主要得益於政府補貼在農場、小屋和路邊感測器等場所的安裝。儘管由於電子產品的商品化,平均售價較去年同期下降了6%,但售後服務收入卻有所成長。中型機組(21-100kW)到2030年將以11%的複合年成長率成長,主要為通訊塔、工業和資料中心園區供電。開發人員傾向於選擇符合IEC 61400-2認證標準的機型,這些機型整合了故障穿越和無功功率支援功能,無需單獨的轉換器即可併並聯型。在60kW規模下,每千瓦單位的成本已降至2,300美元以下,縮小了與屋頂太陽能+儲能系統的成本差距。

在電網收費包含需求費用的城市商業區,6-20千瓦小型風力發電機的市場規模正在穩定成長。冷凍負載高的農民選擇15千瓦的渦輪機來抵銷晚間用電高峰。以往的部署得益於安裝人員的熟練操作,從而縮短了計劃前置作業時間。中型供應商提供延保服務,保證97%的技術可用性,並從綠色銀行獲得低成本貸款。可互通的SCADA系統將風力發電輸出與現場電池發行系統連接起來,最佳化自用率並避免併網限速。

小型風力發電機市場報告按軸類型(水平軸風力發電機、垂直軸風力發電機)、連接方式(離網、併網、混合)、安裝位置(屋頂/建築物整合、獨立塔架)、應用(住宅、商業、其他地區(北美地區)和其他地區(北美地區)。

區域分析

2024年,亞太地區將佔小型風力發電機市場48%的佔有率,年複合成長率達10%,主要得益於中國工業脫碳和印度通訊電氣化的發展。中國正強制要求到2030年,40%的產品必須獲得綠色認證,並鼓勵經濟特區在屋頂和庭院安裝風力渦輪機。印度鐵塔業者正積極採用可再生能源作為備用電源,混合能源競標中指定使用5千瓦微型風力渦輪機,並搭配太陽能光電和鋰電池組。日本在鐵路沿線附近進行垂直軸風力渦輪機示範計畫的同時,也嚴格執行聲學法規。東協島國正在建造社區微電網,越南製造商則向該地區的漁船出口10千瓦風力渦輪機。

歐洲仍然是一個成熟的平台,清晰的監管環境支持著穩定成長。可再生能源指令的修訂縮短了50千瓦以下計劃的授權時間,鼓勵在都市區部署風電。德國在部分地區免除了10公尺以下風力渦輪機的規劃許可,從而降低了25%的軟成本。挪威海德魯公司簽署的為期29年、總裝置容量235兆瓦的風電購電協議,展現了長期電力銷售的可靠性。丹麥嚴格的39分貝噪音上限對出口到世界各地的產品的聲學性能產生了影響。英國支持在島嶼地區擴大陸域風電項目,包括微型風力渦輪機,以期造福當地社區。

北美地區的政策正在提振市場需求。美國1.8億美元的津貼將加速農場風電部署,而美國國家再生能源實驗室(NREL)320萬美元的競爭力基金將推動認證過程。加拿大對諾德克斯(Nordex)247兆瓦公用事業級風力渦輪機的訂單激增,推動了零件的本地化生產。然而,由於屋頂太陽能的價格優勢,住宅風電的普及速度有所放緩。紐約州等州正在試行針對小型風力渦輪機的上網電價補貼政策,而加州則在試辦一項獎勵多技術系統的微電網補貼政策。墨西哥農村電氣化局已重新開放混合能源套件的競標,其中包括用於離網診所的1.5千瓦風力發電機組。

- Aeolos Wind Energy LtdBergey

- Windpower Co.

- City Windmills Holdings PLCWind

- Energy Solutions BVSD

- Wind Energy LtdUNITRON

- Energy Systems Pvt LtdNorthern

- Power Systems Inc.

- Shanghai Ghrepower Green EnergyTUGE

- Energia OURyse

- EnergyKingspan

- Group Limited(風能事業部)

- Eocycle Technologies Inc.

- XZERES Wind Corp.

- Fortis Wind Energy BVHY

- EnergyEndurance

- Wind Power Inc.

- Kliux Energies InternationalPika

- Energy(Generac)

- Envergate Energy AGSuzlon

- Energy Ltd( <=100千瓦段)

其他好處

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加勒比海偏遠離島快速通電

- 美國美國「農村能源促進美國」撥款計畫推動了對5千瓦以下風力渦輪機的需求激增

- 中國的「零碳工業」強制要求園區內可再生能源。

- 歐盟屋頂可再生能源指令促進建築物風力發電。

- 印度和東協的電信塔混合化議程

- Microwind在北歐資料中心叢集的企業購電協議數量增加

- 市場限制

- 歐洲都市區基於高度的區域分類法規

- 日本收緊聲排放標準

- 北美地區10千瓦以下屋頂太陽能光電發電系統與高平準化能源成本的對比

- 非洲缺乏長期維運生態系統,導致融資能力有差距。

- 供應鏈分析

- 監理展望

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按軸類型

- 水平軸風力發電機(HAWT)(上風型、下風型)

- 垂直軸風力發電機(VAWT)(薩沃紐斯式、達里厄斯式、陀螺式)

- 按額定容量(千瓦)

- 0 至 5 千瓦(微型)

- 6至20千瓦(小型)

- 21-100千瓦(中)

- 連結性別

- 離網

- 併網

- 混合式(風力發電+電池/光伏)

- 按安裝位置

- 屋頂/建築一體化型

- 獨立式塔架(地面安裝)

- 透過使用

- 住宅

- 商業(零售、辦公、飯店)

- 工業和倉儲業

- 農業和水產養殖

- 電信塔和遠端監控站點

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 北歐國家

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 策略性舉措(併購、夥伴關係、購電協議)

- 市場佔有率分析(主要企業的市場排名/佔有率)

- 公司簡介

- Aeolos Wind Energy Ltd

- Bergey Windpower Co.

- City Windmills Holdings PLC

- Wind Energy Solutions BV

- SD Wind Energy Ltd

- UNITRON Energy Systems Pvt Ltd

- Northern Power Systems Inc.

- Shanghai Ghrepower Green Energy Co. Ltd

- TUGE Energia OU

- Ryse Energy

- Kingspan Group Plc(Wind Division)

- Eocycle Technologies Inc.

- XZERES Wind Corp.

- Fortis Wind Energy BV

- HY Energy Co. Ltd

- Endurance Wind Power Inc.

- Kliux Energies International

- Pika Energy(Generac)

- Envergate Energy AG

- Suzlon Energy Ltd

第7章 市場機會與未來展望

The Small Wind Turbine Market size is estimated at USD 2.31 billion in 2025, and is expected to reach USD 3.43 billion by 2030, at a CAGR of 8.20% during the forecast period (2025-2030).

Growth is driven by policy incentives, vertical-axis technology advances, and rising use in telecom, agricultural, and distributed energy systems. Public funding programs in North America, the European Union, and Asia accelerate deployments, while machine-learning-enabled turbine optimization reduces lifetime energy costs and improves reliability. Corporate power purchase agreements expand demand for on-grid projects, and hybrid wind-solar systems extend the addressable market in regions with variable wind resources. Cost rivalry with rooftop solar remains a restraint in the sub-10 kW segment, but efficiency gains and new siting rules narrow the gap.

Global Small Wind Turbine Market Trends and Insights

Rapid Electrification of Remote Islands across the Caribbean

Remote island utilities are replacing diesel systems with hybrid renewable microgrids, including small wind turbines. Governments and multilateral lenders have earmarked concessional finance that reduces upfront project costs and broadens developer participation. Turbine suppliers that offer corrosion-resistant coatings and modular logistics packages gain a competitive advantage in these markets. The average installed capacity per site remains below 50 kW, aligning with 0-20 kW product lines. Steady trade winds support capacity factors above 35%, improving payback periods relative to solar-only designs. Island electrification programs adopt performance-based tariffs that reward high availability, reinforcing the value of digital monitoring platforms integrated into new turbine models.

Sub-5 kW Turbine Demand Surge from USDA Rural Energy Grants

The USD 180 million Rural Energy for America Program allocation in 2025 prioritizes micro wind systems for farms and rural small businesses. Grants cover up to 50% of capital costs, enabling paybacks under six years in regions with mean wind speeds above 6 m/s. The National Renewable Energy Laboratory's Competitiveness Improvement Project funds prototype certification that unlocks third-party financing, addressing historical bankability gaps. More than 400 farms are targeted, driving an incremental 25 MW of cumulative micro-class installations by 2027. Coupling turbines with barn-roof solar arrays allows producers to offset peak daytime loads and evening irrigation demand. Manufacturers that complete UL 6141 certification under the program qualify for preference in federal procurement.

Height-Based Zoning Restrictions in Urban Europe

Municipal height limits constrain turbine hub height to 10 m or less in many historic districts, curbing energy yield. Variance requests often require shadow-flicker and visual assessments that lengthen project timelines. Noise measurement rules rely on modeled rather than empirical data, adding engineering costs. Fragmented jurisdiction means identical projects face divergent rules between adjacent municipalities, discouraging developers from citywide rollouts. EU Wind Power Package guidance seeks harmonization, but local cultural heritage bodies retain veto power. Suppliers respond with stub-mast vertical-axis designs that fit below parapets, though lower swept area reduces annual output.

Other drivers and restraints analyzed in the detailed report include:

- China's Zero-Carbon Industrial Parks Mandating On-Site Renewables

- EU Rooftop-Renewables Directive Boosting Building-Integrated Wind

- High Levelized Cost of Energy versus Rooftop Solar in Sub-10 kW Segment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Horizontal configurations retained 68% of 2024 revenue on proven aerodynamics and supply chain maturity. The segment dominated large-farm repowering and rural household replacements. Manufacturers standardize 2-20 kW models to meet USDA and Indian telecom bid specifications, leveraging volume economies. The small wind turbine market size for vertical axis units grew quickly from a lower base and is forecast to post 14% CAGR, outpacing horizontal units. Vertical turbines thrive in disrupted wind flows near rooftops and street-level poles, where omnidirectional blades capture multidirectional gusts. Genetic learning algorithms that modulate pitch through each rotation improve power coefficients by up to 0.45, close to Betz-limit benchmarks. Reduced moving parts allow ground-level gearboxes, cutting maintenance truck rolls by 30% and encouraging commercial fleet adopters.

Vertical axis suppliers partner with facade engineers to embed turbines into curtain walls, meeting EU innovative-technology quotas. Savonius and Darrieus hybrids with contra-rotating rotors minimize torque ripple, lowering the acoustic signature to within 35 dB at a 5 m distance. University of Tokyo field tests verify 15-year bearing life even under typhoon gusts, addressing durability perceptions. Developers structure leasing deals that bundle services and recycle obligations, satisfying circular economy rules in China and the EU. The narrative positions vertical turbines as complementary rather than disruptive, allowing mixed arrays that smooth site energy output.

Micro class 0-5 kW systems delivered 46% of the small wind turbine market share in 2024, supported by grant-funded installations on farms, cabins, and roadside sensors. Average selling price fell 6% year-on-year as electronics commoditized, yet post-installation service revenues rose. Medium 21-100 kW units expand at 11% CAGR through 2030, serving telecom towers, industrial parks, and data-center campuses. Developers favor IEC 61400-2-certified models that integrate fault ride-through and reactive power support, enabling grid connection without separate converters. At 60 kW size, unit cost per kW drops below USD 2,300, closing the gap to rooftop solar plus storage stacks.

The small wind turbine market size for 6-20 kW equipment grows steadily in peri-urban business estates where grid tariffs include demand charges. Farmers with high refrigeration loads choose 15 kW turbines to offset evening peaks. Historical adoption benefits from accumulated installer skillsets that shorten project lead times. Medium-class suppliers bundle extended warranties that guarantee 97% technical availability, unlocking low-cost debt from green banks. Interoperable SCADA links wind output to onsite battery dispatch, optimizing self-consumption and avoiding interconnection curtailments.

The Small Wind Turbine Market Report is Segmented by Axis Type (Horizontal Axis Wind Turbines and Vertical Axis Wind Turbines), Capacity Rating (0 To 5 KW, 6 To 20 KW, and 21-100 KW), Connectivity (Off-Grid, On-Grid, and Hybrid), Installation Location (Rooftop/Building-Integrated and Freestanding Tower), Application (Residential, Commercial, and More), and Geography (North America, Europe, Asia-Pacific, South America, and More).

Geography Analysis

Asia-Pacific dominated the small wind turbine market with a 48% share in 2024 and is growing at a 10% CAGR on the back of Chinese industrial decarbonization and Indian telecom electrification. China's mandate for 40% certified green factory output by 2030 compels economic zones to install rooftop and courtyard turbines, while Jiangsu's recycling standards promote circular supply chains. India's tower operators commit to renewable energy for backup power, and hybrid tenders specify 5 kW microturbines alongside PV and lithium packs. Japan maintains stringent acoustic rules yet supports vertical-axis demonstrations near rail corridors. ASEAN island states deploy community microgrids, and Vietnamese manufacturers export 10 kW turbines to regional fishing fleets.

Europe remains a mature base where regulatory clarity supports incremental growth. The Renewables Directive revision cuts permitting delays for projects below 50 kW, boosting urban adoption. Germany exempts sub-10 m turbines from planning approval in selected Lander, cutting soft costs by 25%. Nordic data-center PPAs underpin a robust on-grid pipeline; Norsk Hydro's 29-year 235 MW wind PPA exemplifies confidence in long-dated offtake. Denmark's stringent 39 dB noise cap influences product acoustics exported worldwide. The United Kingdom supports island onshore wind expansions, including micro-turbines for community benefit shares.

North America's policy landscape rejuvenates demand. The USDA's USD 180 million grant pool accelerates farm deployments, and NREL's USD 3.2 million competitiveness fund advances certification pathways. Canada's 247 MW order boom for Nordex utility-scale turbines raises component localization that benefits small wind suppliers through shared transport links. However, residential adoption lags due to rooftop solar price advantage. States such as New York pilot feed-in tariffs specific to small wind, while California trials microgrid tariffs that reward multi-technology systems. Mexico's rural electrification agency reopens tenders for a hybrid kit, including 1.5 kW wind units for off-grid clinics.

- Aeolos Wind Energy Ltd

- Bergey Windpower Co.

- City Windmills Holdings PLC

- Wind Energy Solutions BV

- SD Wind Energy Ltd

- UNITRON Energy Systems Pvt Ltd

- Northern Power Systems Inc.

- Shanghai Ghrepower Green Energy Co. Ltd

- TUGE Energia OU

- Ryse Energy

- Kingspan Group Plc (Wind Division)

- Eocycle Technologies Inc.

- XZERES Wind Corp.

- Fortis Wind Energy BV

- HY Energy Co. Ltd

- Endurance Wind Power Inc.

- Kliux Energies International

- Pika Energy (Generac)

- Envergate Energy AG

- Suzlon Energy Ltd (<=100 kW segment)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Electrification of Remote Islands across the Caribbean

- 4.2.2 Sub-5 kW Turbine Demand Surge from U.S. USDA "Rural Energy for America" Grants

- 4.2.3 China's "Zero-Carbon Industrial Parks" Mandating On-site Renewables

- 4.2.4 EU Rooftop-Renewables Directive Boosting Building-Integrated Wind

- 4.2.5 Telecom Tower Hybridization Agenda in India & ASEAN

- 4.2.6 Increasing Corporate PPAs for Micro-Wind in Nordics' Data-Center Cluster

- 4.3 Market Restraints

- 4.3.1 Height-Based Zoning Restrictions in Urban Europe

- 4.3.2 Acoustic-Emission Standards Tightening in Japan

- 4.3.3 High LCOE versus Rooftop PV in North America <10 kW segment

- 4.3.4 Bankability Gaps due to Absence of Long-Term O&M Ecosystem in Africa

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 Market Size & Growth Forecasts

- 5.1 By Axis Type

- 5.1.1 Horizontal Axis Wind Turbines (HAWT) (Upwind, and Downwind)

- 5.1.2 Vertical Axis Wind Turbines (VAWT) (Savonius, Darrieus and Giromill)

- 5.2 By Capacity Rating (kW)

- 5.2.1 0 to 5 kW (Micro)

- 5.2.2 6 to 20 kW (Small)

- 5.2.3 21 to 100 kW (Medium)

- 5.3 By Connectivity

- 5.3.1 Off-Grid

- 5.3.2 On-Grid

- 5.3.3 Hybrid (Wind + Battery/PV)

- 5.4 By Installation Location

- 5.4.1 Rooftop/Building-Integrated

- 5.4.2 Freestanding Tower (Ground-Mounted)

- 5.5 By Application

- 5.5.1 Residential

- 5.5.2 Commercial (Retail, Offices, Hotels)

- 5.5.3 Industrial and Warehousing

- 5.5.4 Agricultural and Aquaculture

- 5.5.5 Telecom Towers and Remote Monitoring Sites

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Nordic Countries

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 ASEAN Countries

- 5.6.3.6 Australia

- 5.6.3.7 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Egypt

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Strategic Moves (M&A, Partnerships, PPAs)

- 6.2 Market Share Analysis (Market Rank/Share for key companies)

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.3.1 Aeolos Wind Energy Ltd

- 6.3.2 Bergey Windpower Co.

- 6.3.3 City Windmills Holdings PLC

- 6.3.4 Wind Energy Solutions BV

- 6.3.5 SD Wind Energy Ltd

- 6.3.6 UNITRON Energy Systems Pvt Ltd

- 6.3.7 Northern Power Systems Inc.

- 6.3.8 Shanghai Ghrepower Green Energy Co. Ltd

- 6.3.9 TUGE Energia OU

- 6.3.10 Ryse Energy

- 6.3.11 Kingspan Group Plc (Wind Division)

- 6.3.12 Eocycle Technologies Inc.

- 6.3.13 XZERES Wind Corp.

- 6.3.14 Fortis Wind Energy BV

- 6.3.15 HY Energy Co. Ltd

- 6.3.16 Endurance Wind Power Inc.

- 6.3.17 Kliux Energies International

- 6.3.18 Pika Energy (Generac)

- 6.3.19 Envergate Energy AG

- 6.3.20 Suzlon Energy Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment