|

市場調查報告書

商品編碼

1851636

茂金屬聚乙烯(mPE):市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Metallocene Polyethylene (mPE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

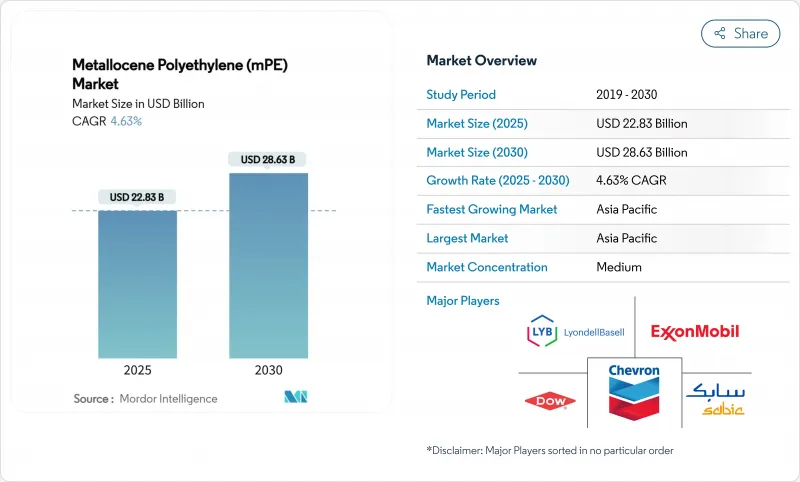

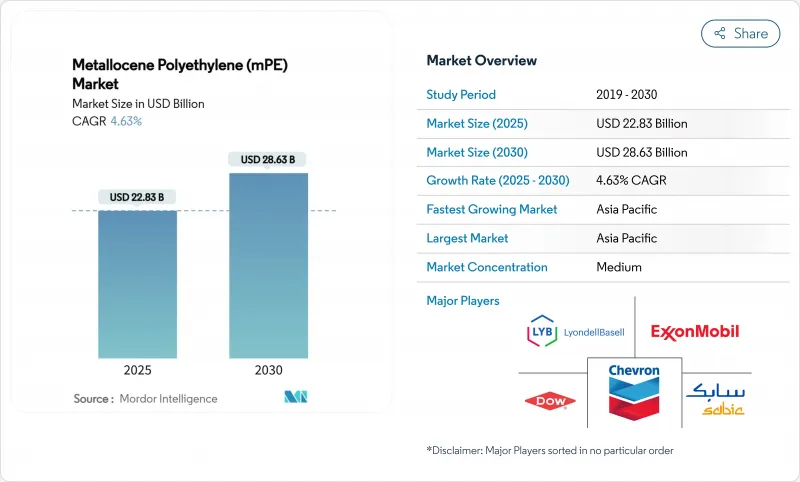

預計到 2025 年,茂金屬聚乙烯市場價值將達到 228.3 億美元,到 2030 年將達到 286.3 億美元,預測期(2025-2030 年)複合年成長率為 4.63%。

對高透明度薄型薄膜的強勁需求、太陽能板封裝生產線的規模化以及農業現代化,共同支撐著這一成長趨勢。生產商受益於單活性位點觸媒技術,該技術可實現窄分子量分佈,從而在薄型薄膜上實現穩定的機械強度和優異的光學性能。中國乙烯產能的擴張、印度電子商務的蓬勃發展以及中東產能的投資,都在共同增強上游供應安全。同時,向循環塑膠的轉型正在進行,戰略重點是高回收率和生物基原料。因此,茂金屬聚乙烯市場預計將在提升性能的同時兼顧永續性目標,使其成為下一代軟性包裝解決方案的核心。

全球茂金屬聚乙烯(mPE)市場趨勢及洞察

對高透明度薄型包裝薄膜的需求日益成長

隨著加工商不斷向更薄的薄膜過渡,同時保持其機械完整性,單活性位點催化劑促進了共聚單體的均勻分佈,從而在確保薄膜透明度的同時,也提升了衝擊強度。通常情況下,薄膜厚度可減少15-20%,從而降低材料用量和碳排放強度,直接支持品牌所有者的永續性承諾。窄分子量分佈還能減少吹膜生產線上的邊角料廢棄物,提高包裝袋產量,並提升加工業者的營運利潤率。像Exceed XP這樣的優質茂金屬等級薄膜具有全年適用的韌性,適用於低溫運輸物流。同時,全通路零售的快速發展也帶來了小包裹處理壓力的增加,因此需要更強韌、更輕的薄膜。

包裝產業對薄膜和片材的快速應用

隨著零售商優先考慮貨架效率和降低物流成本,軟包裝正在食品、家居護理和個人護理類別中取代硬質包裝。茂金屬聚乙烯具有更強的熱黏性和更寬的密封窗口,可減少高速立式成形充填密封設備的洩漏。接觸性應用中聚氯乙烯的禁用加速了向可回收聚乙烯混合物的轉變,例如PreservaWrap系列產品,該系列產品在不含氯乙烯的情況下,實現了與聚氯乙烯相同的透明度。醫療設備製造商也因其生物相容性而從聚氯乙烯轉向茂金屬聚乙烯,這增強了醫療保健行業的需求並擴大了該細分市場。

乙烯原料成本波動

原油和天然氣價格的波動會影響乙烯價格,擠壓特種樹脂生產商的利潤空間,因為他們需要支付15-20%的催化劑溢價。維修電裂解裝置和碳捕集裝置會增加資本成本,在原物料價格上漲時造成壓力。垂直一體化的中東生產商保持著成本領先優勢,而依賴進口的亞洲生產商則面臨更大的波動。雖然生物乙烯生產路線可以部分對沖波動,但它們需要同步進行基礎設施建設,從而需要前期投資投資。

細分市場分析

到2024年,mLLDPE將佔據茂金屬聚乙烯市場的59.01%。憑藉其優異的抗穿刺性和抗衝擊強度,mLLDPE保持著市場領先地位,即使受到15-20%的下切衝擊也不會導致包裝破損。許多飲料包裝袋生產商將在2024年全面轉向使用mLLDPE。在管道塗層領域,mLLDPE的柔韌性降低了捲繞式管道系統搬運過程中開裂的風險。

受開發中國家對壓力管道和化學品桶的需求推動,預計2030年,中高密度聚乙烯(mHDPE)的複合年成長率將達到6.65%。抗應力開裂等級的mHDPE也用於吹塑成型的燃料箱和引擎室零件。小眾的中高密度聚乙烯(mlDPE)產品線則用於對熔體強度要求極高的特殊流鑄膜應用。超高分子量聚乙烯(UHMWPE)技術的進步也正在擴大人工關節和防護設備的市場,從而提升茂金屬聚乙烯市場的價值。

預計到2024年,鋯茂催化劑的市佔率將達到62.75%。鋯茂催化劑已在氣相和溶液反應器中得到驗證,具有良好的操作性能。這項可靠的性能記錄縮短了食品接觸認證所需的時間。

茂金屬體係以5.25%的複合年成長率快速成長,在高溫聚合方面表現出色,可顯著提高氣相聚合效率。近期配體技術的創新降低了90°C以上的活性損失,進一步拓展了商業性潛力。雙位點和混合設計可在一步聚合中整合窄分子量和寬分子量組分,從而實現可自訂的熔體流變性能。這些技術創新正在進一步豐富茂金屬聚乙烯市場的產品線。

茂金屬聚乙烯市場報告按類型(茂金屬線型低密度聚乙烯(mLLDPE)、茂金屬高密度聚苯乙烯(mHDPE) 等)、催化劑類型(單活性位點鋯茂、鉿茂、Postmetallocene等)、應用(薄膜、片材等)、終端用戶行業(包裝、農業等)和地區(亞太地區、北美地區等)進行細分。

區域分析

亞太地區將在2024年佔據46.21%的市場佔有率,這主要得益於中國新增180萬噸乙烯裝置以及印度包裝產業的復甦。這些投資將確保該地區加工商獲得穩定的原料供應,並加快交貨速度。包裝、建築膜材和汽車燃料箱等領域的需求預計都將推動亞太地區對茂金屬聚乙烯的需求,使茂金屬聚乙烯市場保持在5.71%的複合年成長率。

北美依靠頁岩乙烷的成本優勢和在催化劑創新方面的領先地位。陶氏化學計畫在亞伯達建造的淨零排放裂解裝置將為低排放氣體優質樹脂的生產提供支援。墨西哥受益於反向一體化,從美國墨西哥灣沿岸地區進口原料,並將其加工成高附加價值薄膜,用於國內消費和出口。

歐洲日益嚴格的塑膠法規對需求構成挑戰,同時也為可回收軟質包裝的發展鋪平了道路。德國汽車產業優先考慮輕量化,而北歐零售商則傾向採用單一材料結構,以簡化機械回收。道達爾能源旗下的阿米拉爾綜合體雖然是一家中東公司,但其產品大量供應歐洲,填補了歐洲國內供應的缺口。南美洲以及中東和非洲地區正在崛起,成為快速成長的叢集。巴西溫室產業的發展和卡達聚合物綜合體的擴建將進一步推動茂金屬聚乙烯市場的發展。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對高透明度、薄型包裝薄膜的需求不斷成長

- 包裝產業對薄膜和片材的採用

- 農業多層膜和地工止水膜的發展

- 太陽能電池封裝中轉向基於mPE的連接層

- 用於客製化等級的催化劑切換式軟性裂解機

- 市場限制

- 乙烯原料成本波動

- 嚴格的一次性薄膜法規

- 專利後單活性位點催化劑相關的智慧財產權糾紛

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 茂金屬線型低密度聚乙烯(mLLDPE)

- 茂金屬高密度聚苯乙烯(mHDPE)

- 其他類型(例如,茂金屬低密度聚乙烯(mLDPE))

- 按催化劑類型

- 單點鋯新世

- 鉿茂和Postmetallocene

- 雙站點和混合系統

- 透過使用

- 電影

- 床單

- 其他應用(擠壓塗布等)

- 按最終用戶行業分類

- 包裹

- 農業

- 車

- 建築/施工

- 醫療保健

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 印尼

- 越南

- 馬來西亞

- 菲律賓

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 土耳其

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Braskem

- Chevron Phillips Chemical Company LLC.

- Dow

- Exxon Mobil Corporation

- INEOS

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals, Inc.

- Prime Polymer Co., Ltd.

- PTT Global Chemical Public Company Limited

- SABIC

- SIBUR Holding PJSC

- TotalEnergies

- Univation Technologies, LLC.

- WR Grace and Co.-Conn

第7章 市場機會與未來展望

The Metallocene Polyethylene Market size is estimated at USD 22.83 billion in 2025, and is expected to reach USD 28.63 billion by 2030, at a CAGR of 4.63% during the forecast period (2025-2030).

Robust demand for high-clarity down-gauged films, the scale-up of solar panel encapsulant lines, and modernization in agriculture sustain this growth path. Producers benefit from single-site catalyst technology that yields narrow molecular weight distribution, enabling consistent mechanical strength and superior optical properties at lower gauges. China's ethylene capacity additions, India's e-commerce boom, and capacity investments in the Middle East together reinforce upstream supply security, while ongoing shifts toward circular plastics keep strategic focus on advanced recycling and bio-based feedstocks. The Metallocene polyethylene market therefore marries performance gains with sustainability objectives and positions itself as a core enabler of next-generation flexible packaging solutions.

Global Metallocene Polyethylene (mPE) Market Trends and Insights

Rising Demand for High-Clarity, Down-Gauged Packaging Films

Converters continue to migrate toward thinner films that preserve mechanical integrity, and single-site catalysts facilitate uniform comonomer distribution that yields clarity alongside dart impact strength. Typical gauge reductions of 15-20% lower material use and carbon intensity, directly supporting brand-owner sustainability pledges. Narrow molecular weight distribution also cuts edge-trim waste on blown-film lines and improves bag-making throughput, which increases operating margins for convertors. Premium metallocene grades such as Exceed XP provide year-round toughness suited to cold-chain logistics, while the rapid rise of omnichannel retail elevates parcel-handling stresses that require stronger but lighter films.

Surge in Adoption of Films and Sheets in Packaging Industry

Flexible formats replace rigid containers across food, home-care, and personal-care sectors as retailers prioritize shelf efficiency and lower logistics costs. Metallocene polyethylene delivers stronger hot-tack and wider sealing windows, reducing leakers on high-speed vertical form-fill-seal equipment. Trade bans on PVC in contact applications accelerate transition toward recyclable polyethylene blends, illustrated by PreservaWrap lines that replicate PVC clarity without chloride content. Medical device makers also pivot from PVC to metallocene polyethylene for biocompatibility, which reinforces healthcare demand and widens segment reach.

Volatile Ethylene Feedstock Costs

Swing crude and natural-gas prices cascade into ethylene swings, compressing margins for specialty resin producers who pay a 15-20% catalyst premium. Electrified crackers and carbon-capture retrofits inflate capital cost, adding pressure during feedstock spikes. Vertically integrated Middle Eastern producers retain cost leadership while Asian converters reliant on imports see steeper volatility. Bio-ethylene routes partly hedge volatility yet call for parallel infrastructure build-out, raising upfront cash needs.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Multilayer Agricultural Films and Geomembranes

- Solar-Panel Encapsulant Shift to mPE-Based Tie Layers

- Stringent Single-Use Film Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

mLLDPE commanded 59.01% Metallocene polyethylene market share in 2024. The segment retains leadership thanks to superior puncture resistance and dart impact strength that allow 15-20% down-gauging without packaging failure. Many beverage pouch producers shifted entirely to mLLDPE structures in 2024. In pipe coatings, mLLDPE's flexibility reduces cracking risk during coil-on-reel handling.

mHDPE is forecast to log a 6.65% CAGR through 2030, boosted by pressure pipe and chemical drum demand in developing economies. Stress-crack-resistant grades also penetrate fuel tank blow-molding and under-hood parts. Niche mLDPE lines serve specialty cast-film uses where melt strength is crucial. UHMWPE advances broaden reach into artificial joints and protective gear markets, fortifying value pools for the Metallocene polyethylene market.

Zirconocene catalysts held 62.75% share in 2024. Producers favor their proven operability across gas-phase and solution reactors. Strong track records shorten qualification times, essential for food-contact certifications.

Hafnocene systems, expanding at 5.25% CAGR, excel in high-temperature polymerization that enables faster gas-phase throughput. Recent ligand innovations temper activity drop-off above 90 °C, widening the commercial window. Dual-site and hybrid designs merge narrow and broad molecular fractions in one step, unlocking tailored melt rheology. These innovations further diversify offerings within the Metallocene polyethylene market.

The Metallocene Polyethylene Market Report is Segmented by Type (Metallocene Linear Low-Density Polyethylene (mLLDPE), Metallocene High-Density Polyethylene (mHDPE), and More), Catalyst Type (Single-Site Zirconocene, Hafnocene and Post-Metallocene, and More), Application (Films, Sheets, and More), End-User Industry (Packaging, Agriculture, and More), and Geography (Asia-Pacific, North America, and More).

Geography Analysis

Asia-Pacific led with 46.21% share in 2024, anchored by China's new 1.8 million t ethylene units and India's packaging upturn. These investments ensure feedstock security and shorten delivery time for regional converters. Packaging, construction membranes, and automotive fuel tanks together lifted regional off-take and are expected to keep the Metallocene polyethylene market on a 5.71% CAGR trajectory.

North America relies on shale-linked ethane cost advantages and catalyst innovation leadership. Dow's forthcoming net-zero cracker in Alberta is poised to support premium resin output with low embedded emissions. Mexico secures back-integration gains by importing feedstock from US Gulf complexes and converting into value-added films for domestic consumption and export.

Europe's strict plastic rules challenge demand yet simultaneously open space for recyclable flexible packaging. Germany's auto sector values weight reduction, and Nordic retailers champion mono-material structures that simplify mechanical recycling. TotalEnergies' Amiral complex, though Middle Eastern, channels volumes into Europe, supplementing short domestic supply. South America and the Middle East & Africa remain emerging yet fast-growing clusters. Brazil's greenhouse sector and Qatar's polymer complex expansion add incremental pull on the Metallocene polyethylene market.

- Braskem

- Chevron Phillips Chemical Company LLC.

- Dow

- Exxon Mobil Corporation

- INEOS

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsui Chemicals, Inc.

- Prime Polymer Co., Ltd.

- PTT Global Chemical Public Company Limited

- SABIC

- SIBUR Holding PJSC

- TotalEnergies

- Univation Technologies, LLC.

- W. R. Grace and Co.-Conn

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for high-clarity, down-gauged packaging films

- 4.2.2 Surge in Adoption of Films and Sheets in Packaging Industry

- 4.2.3 Growth of multilayer agricultural films and geomembranes

- 4.2.4 Solar-panel encapsulant shift to mPE-based tie layers

- 4.2.5 Catalyst-switch flexible crackers enabling custom grades

- 4.3 Market Restraints

- 4.3.1 Volatile ethylene feedstock costs

- 4.3.2 Stringent single-use film regulations

- 4.3.3 Post-patent IP disputes on single-site catalysts

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Metallocene Linear Low-density Polyethylene (mLLDPE)

- 5.1.2 Metallocene High-density Polyethylene (mHDPE)

- 5.1.3 Other Types (Metallocene Low-density Polyethylene (mLDPE), etc.)

- 5.2 By Catalyst Type

- 5.2.1 Single-site Zirconocene

- 5.2.2 Hafnocene and post-metallocene

- 5.2.3 Dual-site and hybrid systems

- 5.3 By Application

- 5.3.1 Films

- 5.3.2 Sheets

- 5.3.3 Other Applications (Extrusion Coatings, etc.)

- 5.4 By End-User Industry

- 5.4.1 Packaging

- 5.4.2 Agriculture

- 5.4.3 Automotive

- 5.4.4 Building and Construction

- 5.4.5 Medical and Healthcare

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Thailand

- 5.5.1.6 Indonesia

- 5.5.1.7 Vietnam

- 5.5.1.8 Malaysia

- 5.5.1.9 Philippines

- 5.5.1.10 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Turkey

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Egypt

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Braskem

- 6.4.2 Chevron Phillips Chemical Company LLC.

- 6.4.3 Dow

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 INEOS

- 6.4.6 LG Chem

- 6.4.7 LyondellBasell Industries Holdings B.V.

- 6.4.8 Mitsui Chemicals, Inc.

- 6.4.9 Prime Polymer Co., Ltd.

- 6.4.10 PTT Global Chemical Public Company Limited

- 6.4.11 SABIC

- 6.4.12 SIBUR Holding PJSC

- 6.4.13 TotalEnergies

- 6.4.14 Univation Technologies, LLC.

- 6.4.15 W. R. Grace and Co.-Conn

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment