|

市場調查報告書

商品編碼

1851622

高效能資料分析:市場佔有率分析、產業趨勢、統計資料和成長預測(2025-2030 年)High-Performance Data Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

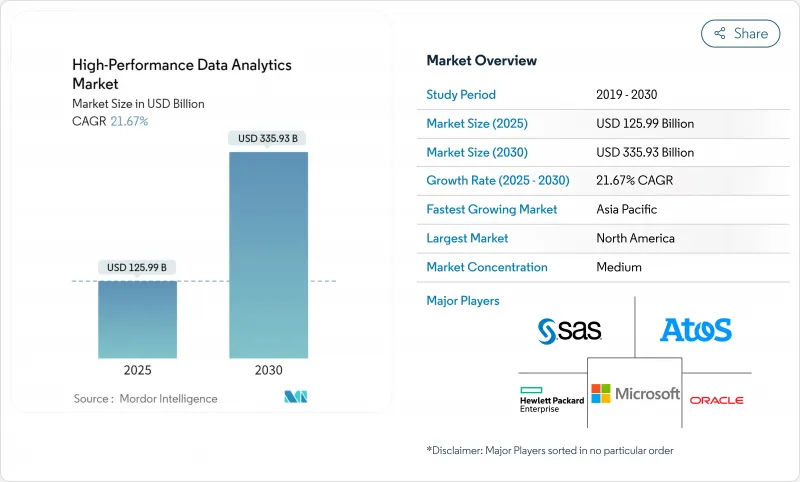

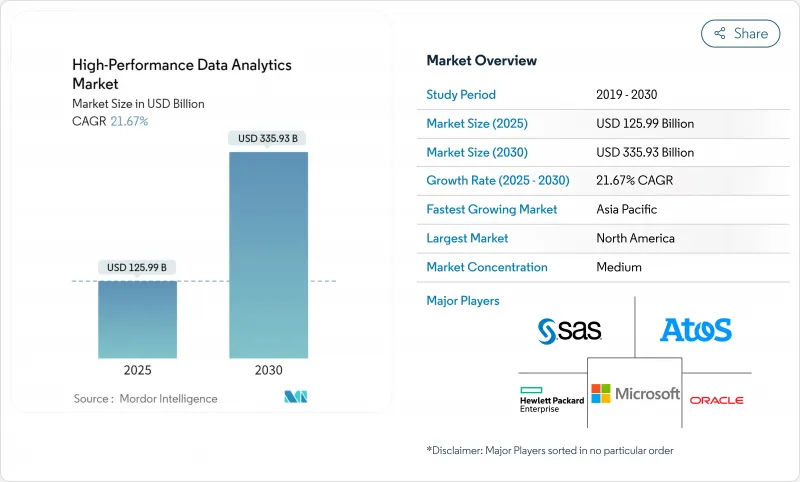

預計到 2025 年,高效能資料分析市場規模將達到 1,259.9 億美元,到 2030 年將達到 3,359.3 億美元,複合年成長率為 21.67%。

人工智慧、雲端運算和海量企業數據的融合推動了這一趨勢。金融服務業仍然是領先的採用者,因為即時詐欺分析對於安全的交易銀行至關重要。雖然軟體收入佔46.2%,但藉助專業的AI諮詢服務,服務業務正在快速成長。目前,本地部署佔據主導地位,市場佔有率高達57.8%,但雲端基礎方案顯然是成長引擎,年複合成長率高達30.1%,這得益於供應商不斷擴大全球GPU容量。從區域來看,北美佔35.4%的市場佔有率,但亞太地區預計將實現最快成長,這得益於其快速推進的數位轉型計畫。大型企業仍佔據主導地位,但中小企業正在縮小差距,這主要得益於GPU租賃價格的暴跌,例如H100實例每小時僅需3.35美元,比超大規模資料中心的標價低90%以上。

全球高性能資料分析市場趨勢與洞察

金融服務業加速採用即時分析技術進行詐欺偵測

金融機構的社交工程詐騙增加了十倍,目前已佔數位銀行詐騙案件的23%。道明銀行憑藉其企業級即時監控能力榮獲2024年FICO決策獎。其人工智慧平台在處理1Gbps資料流的同時,實現了98.5%的偵測準確率,且無延遲。因此,銀行、金融服務和保險(BFSI)機構正在將低延遲分析技術融入支付系統、信用風險評分和客戶調查中,以保護其聲譽和財務資本。這些應用推動了高效能資料分析市場整體5.2%的複合年成長率。

人工智慧/機器學習模型訓練的快速成長需要Petabyte級資料處理。

生成式人工智慧模型中的參數數量每六個月加倍,這需要Petabyte的資料擷取和百萬兆級計算群集。與人工智慧工作負載相關的超大規模資料中心投資將從2024年的1,627.9億美元增加到2030年的6,085.4億美元。微軟和Google等供應商正合計投入1,550億美元用於下一代人工智慧設施建設。這些資本支出將推動對分散式檔案系統、高吞吐量互連和高階調度軟體的需求,從而推動市場成長6.8%。

專用高效能運算叢集的總擁有成本高

預計到2025年,資料中心建設的資本支出將超過2,500億美元,而不斷成長的電力需求預計到2030年還將增加5,000億美元。在許多開發中國家,電力短缺阻礙了本地高效能運算(HPC)設施的推出。總合設備、冷卻和熟練員工的成本,企業難以證明部署本地叢集的合理性,這限制了在資源匱乏地區的部署,最終導致整體複合年成長率僅2.1%。

細分市場分析

到2024年,軟體業務將貢獻46.2%的收入,反映出市場對使用者友善分析引擎、資料架構層和AI編配工具的需求。供應商正在整合工作流程自動化和特徵儲存功能,以加速跨業務部門的模型部署。 DevOps的整合正在加強回饋循環,授權模式也正轉向基於使用量的收費,以使成本與價值創造保持一致。硬體收入依然至關重要,這主要得益於晶片技術的進步,例如NVIDIA Blackwell Ultra GPU,它為變壓器工作負載提供了高密度的張量核心。

服務是成長最快的細分市場,預計到 2030 年將以 25.4% 的複合年成長率成長。諮詢團隊現在將資料策略設計、MLOps 實施和持續模型調校服務打包在一起,以填補複雜混合架構中的專業知識缺口。服務提供者開始提供人工智慧即服務 (AIaaS) 產品,包括託管特徵工程、偏差審核和聯邦學習編配。這種轉變擴大了潛在需求,並推動了高效能資料分析即服務合約的市場規模成長,尤其是在首次採用者群體中。

到2024年,本地部署將佔市場佔有率的57.8%,這主要得益於對延遲和數據主權要求較高的行業,例如政府和銀行業。企業表示,直接控制硬體以及遵守嚴格的資料居住法規是其主要動機。許多企業也利用現有資料中心的沉沒成本,透過更新節點來最佳化運轉率,而不是完全遷移到雲端。

受彈性擴展、按需付費和全球邊緣區域部署的推動,雲端平台正以 30.1% 的複合年成長率成長。為了緩解監管方面的擔憂,服務提供者擴展了機密運算實例和主權雲端區域。混合雲和多重雲端模式如今已成為綠地計畫的主流,將本地加速器與用於人工智慧訓練的突發容量相結合。這種轉變擴大了高效能資料分析的市場規模(該市場採用按需付費模式),同時也降低了資源受限企業的進入門檻。

區域分析

2024年,北美地區營收維持35.4%的成長,這得益於其龐大的超大規模資料中心網路和企業級人工智慧的早期應用。美國資料中心供應量年增26%至5.2吉瓦,與人工智慧推理需求的激增相符。像道明銀行這樣的銀行正在利用全國範圍的支付遙測數據進行即時詐騙評分,這凸顯了該行業的成熟度。 2024年,北維吉尼亞的租金將上漲41.6%,顯示產能緊張正在推動資料中心建設的持續進行。

亞太地區是成長最快的地區,預計複合年成長率將達到28%。印度計劃在2026年將其裝置容量加倍,達到約1.8吉瓦,這得益於國內外投資者數十億美元的投資承諾。台灣預計到2028年將投資超過30億美元用於晶片設計模擬和大規模語言模型訓練。中國正在縮小與美國在模型品質方面的差距,地方補貼正在推動下一代人工智慧框架的發展。然而,嚴格的資料本地化規定迫使企業建構特定國家的分析架構,而不是統一的全球架構。

歐洲正在擴大邊緣到雲端的轉型計劃,以實現製造業和關鍵基礎設施的現代化。歐盟的目標是到2030年實現75%的企業雲採用率,並部署1萬個氣候友善邊緣節點。各國政府正在資助6G測試平台、通訊邊緣雲端試點計畫以及需要低延遲分析的工業元宇宙示範計畫。歐洲首家人工智慧工廠將於2024年投入營運,為希望在不匯出資料的情況下訓練模型的汽車、航太和能源公司提供自主運算服務。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加速北美銀行、金融服務和保險 (BFSI) 行業採用即時分析技術進行詐欺檢測

- 亞洲人工智慧/機器學習模型訓練需求激增,需要Petabyte級資料處理。

- 歐洲智慧製造領域邊緣到雲端高效能運算的成長

- 中東各國政府的國防巨量資料現代化項目

- 可再生能源和電網最佳化措施推動南美洲高效能運算分析的發展

- GPU/CPU叢集的單核心價格正在下降,使得全球中小企業都能負擔得起高效能運算(HPC)服務。

- 市場限制

- 加勒比海和非洲專用高效能運算叢集的總擁有成本高昂

- 歐洲和大洋洲高效能運算和平行程式設計專家短缺

- 資料主權法規限制了亞洲的跨境雲分析。

- 新興市場的基礎設施可靠性問題阻礙了數據的連續傳輸。

- 監理展望

- 技術展望

- 高效能叢集運算的演進

- 網格計算

- 記憶體內分析

- 資料庫庫內分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按組件

- 硬體

- 軟體

- 服務

- 按部署模式

- 本地部署

- 按需/雲端

- 按組織規模

- 小型企業

- 主要企業

- 按最終用戶行業分類

- 銀行、金融服務和保險(BFSI)

- 政府和國防部

- 能源與公共產業

- 零售與電子商務

- 醫療保健和生命科學

- 資訊科技和通訊服務

- 製造業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 秘魯

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 亞太其他地區

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 策略發展

- 供應商定位分析

- 公司簡介

- Amazon Web Services, Inc.(AWS)

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Hewlett Packard Enterprise(HPE)

- Dell Technologies Inc.

- SAS Institute Inc.

- Oracle Corporation

- Fujitsu Limited

- Intel Corporation

- ATOS SE

- Juniper Networks Inc.

- NEC Corporation

- Cisco Systems, Inc.

- Teradata Corporation

- Cray Inc.(HPE Cray)

- Altair Engineering Inc.

- Cloudera, Inc.

- Huawei Technologies Co., Ltd.

- Hitachi Vantara LLC

- Super Micro Computer, Inc.

第7章 市場機會與未來展望

The high-performance data analytics market is valued at USD 125.99 billion in 2025 and is forecast to reach USD 335.93 billion by 2030, registering a 21.67% CAGR.

Momentum comes from the convergence of AI, cloud computing, and the swelling volume of enterprise data. Financial services remain a prime adopter as real-time fraud analytics become essential for secure transaction banking. Software accounts for 46.2% revenue, while services are expanding fastest on the back of specialized AI consulting. On-premise deployments presently lead with 57.8% share, yet cloud-based solutions are the clear growth engine at a 30.1% CAGR as providers scale global GPU capacity. Regionally, North America commands 35.4% share, but Asia-Pacific is on track for the quickest gains given sweeping digital-transformation programs. Large enterprises dominate adoption, though SMEs are narrowing the gap thanks to plummeting GPU rental rates, exemplified by USD 3.35-per-hour H100 instances that undercut hyperscaler list prices by more than 90%.

Global High-Performance Data Analytics Market Trends and Insights

Accelerating Adoption of Real-Time Analytics in BFSI for Fraud Detection

Financial institutions have recorded a tenfold rise in social-engineering scams, now 23% of digital-banking fraud cases, prompting rapid rollouts of high-performance fraud-detection engines. TD Bank achieved enterprise-wide real-time monitoring after winning the 2024 FICO Decisions Award. AI-enabled platforms are attaining 98.5% detection accuracy while processing 1 Gbps data streams without latency. As a result, BFSI institutions are embedding low-latency analytics into payment rails, credit-risk scoring, and know-your-customer checks to safeguard reputational and financial capital. These deployments underpin a 5.2% lift in the overall CAGR for the high-performance data analytics market.

Surge in AI/ML Model Training Requiring Petabyte-Scale Data Processing

Generative-AI models are doubling in parameter count every six months, demanding petabyte-scale data ingestion and exascale compute clusters. Hyperscale data-center investment tied to AI workloads is set to climb from USD 162.79 billion in 2024 to USD 608.54 billion by 2030. Providers such as Microsoft and Google have earmarked a combined USD 155 billion for next-generation AI facilities. This capital outlay elevates demand for distributed file systems, high-throughput interconnects, and advanced scheduling software, translating into a 6.8% positive push on market growth.

High Total Cost of Ownership for Dedicated HPC Clusters

Capital expenditure on data-center builds is projected to surpass USD 250 billion in 2025, and expanding power needs add a further USD 500 billion through 2030. Many developing nations face electricity shortfalls that hinder the launch of local HPC facilities. Organizations struggle to justify on-premise clusters once equipment, cooling, and skilled-staff costs are tallied, curbing adoption in resource-constrained regions and trimming overall CAGR by 2.1%.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Edge-to-Cloud HPC for Smart Manufacturing

- Falling Cost-Per-Core for GPU/CPU Clusters Enabling Affordable HPC for SMEs

- Shortage of Skilled HPC & Parallel-Programming Professionals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The software segment generated 46.2% of revenue in 2024, reflecting demand for user-friendly analytics engines, data-fabric layers, and AI orchestration tools. Vendors are embedding workflow automation and feature-store capabilities that hasten model deployment across business units. DevOps integration is tightening feedback cycles, and license structures are shifting toward consumption-based billing that aligns cost with value creation. Hardware sales remain foundational, propelled by silicon advances such as NVIDIA Blackwell Ultra GPUs that field higher tensor-core density for transformer workloads.

Services are the quickest-expanding line, projected at 25.4% CAGR through 2030. Consulting teams now bundle data-strategy design, MLOps implementation, and continuous-model-tuning services, filling expertise gaps in complex hybrid stacks. Providers are launching AI-as-a-Service offerings that include managed feature engineering, bias auditing, and federated-learning orchestration. These shifts broaden addressable demand and lift the high-performance data analytics market size for service engagements, especially among first-time enterprise adopters.

On-premise deployments held 57.8% share in 2024, anchored by sectors that guard latency or sovereignty, including government and banking. Organizations cite direct hardware control and compliance with strict data-residency statutes as prime motives. Many firms also leverage existing data-center sunk costs, optimizing occupancy rates by refreshing nodes rather than migrating wholesale to cloud.

Cloud platforms are climbing at a 30.1% CAGR, propelled by elastic scaling, consumption pricing, and global edge-zone rollouts. Providers have broadened confidential-computing instances and sovereign-cloud regions to mollify regulatory concerns. Hybrid and multi-cloud patterns now dominate greenfield projects, combining local accelerators with burst capacity for AI training. The shift is enlarging the high-performance data analytics market size attached to consumption models while easing entry for resource-constrained enterprises.

The High-Performance Data Analytics Market Report is Segmented by Component (Hardware, Software, and Services), Deployment Model (On-Premise, and On-Demand/Cloud), Organization Size (Small and Medium Enterprises, and Large Enterprises), End-User Industry (BFSI, Government and Defense, Energy and Utilities, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained 35.4% revenue leadership in 2024, buoyed by deep hyperscaler footprints and early enterprise AI adoption. U.S. data-center supply rose by 26% year on year to 5.2 GW, matching proliferating AI inference demand. Banks such as TD leverage national payment telemetry for instant fraud scoring, underscoring sector maturity. Rental rates in Northern Virginia advanced 41.6% in 2024, evidencing tight capacity that spurs continued build-outs.

Asia-Pacific is the fastest-growing region with a 28% CAGR outlook. India plans to double installed data-center capacity to nearly 1.8 GW by 2026, underwritten by multibillion-dollar commitments from domestic and global investors. Taiwan's facility builds are forecast to exceed USD 3 billion by 2028 to service chip-design simulations and large-language-model training. China is closing the model-quality gap with the United States, with provincial grants catalyzing next-generation AI frameworks. Yet, stringent data-localization rules are compelling firms to engineer country-specific analytics stacks rather than unified global fabrics.

Europe is scaling edge-to-cloud initiatives to modernize manufacturing and critical infrastructure. The EU aims to reach 75% business-cloud adoption and deploy 10,000 climate-neutral edge nodes by 2030. National programs channel capital toward 6G testbeds, telco-edge cloud pilots, and industrial metaverse demonstrators that require low-latency analytics. The opening of the first European AI factories in 2024 provides sovereign compute for automotive, aerospace, and energy firms seeking to train models without exporting data.

- Amazon Web Services, Inc. (AWS)

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Dell Technologies Inc.

- SAS Institute Inc.

- Oracle Corporation

- Fujitsu Limited

- Intel Corporation

- ATOS SE

- Juniper Networks Inc.

- NEC Corporation

- Cisco Systems, Inc.

- Teradata Corporation

- Cray Inc. (HPE Cray)

- Altair Engineering Inc.

- Cloudera, Inc.

- Huawei Technologies Co., Ltd.

- Hitachi Vantara LLC

- Super Micro Computer, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Adoption of Real-Time Analytics in BFSI for Fraud Detection in North America

- 4.2.2 Surge in AI/ML Model Training Requiring Petabyte-Scale Data Processing in Asia

- 4.2.3 Growth of Edge-to-Cloud HPC for Smart Manufacturing in Europe

- 4.2.4 National Defense Big-Data Modernization Programs Across Middle East Governments

- 4.2.5 Renewable-Energy Grid Optimization Initiatives Driving HPC Analytics in South America

- 4.2.6 Falling Cost-per-Core for GPU/CPU Clusters Enabling Affordable HPC for SMEs Globally

- 4.3 Market Restraints

- 4.3.1 High Total Cost of Ownership for Dedicated HPC Clusters in Caribbeans and Africa

- 4.3.2 Shortage of Skilled HPC and Parallel Programming Professionals in Europe and Oceania

- 4.3.3 Data-Sovereignty Regulations Limiting Cross-Border Cloud Analytics in Asia

- 4.3.4 Infrastructure Reliability Issues in Emerging Markets Hampering Continuous Data Streams

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.5.1 High-Performance Cluster Computing Evolution

- 4.5.2 Grid Computing

- 4.5.3 In-Memory Analytics

- 4.5.4 In-Database Analytics

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 Market Size and Growth Forecasts

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Deployment Model

- 5.2.1 On-Premise

- 5.2.2 On-Demand/Cloud

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By End-User Industry

- 5.4.1 Banking, Financial Services and Insurance (BFSI)

- 5.4.2 Government and Defense

- 5.4.3 Energy and Utilities

- 5.4.4 Retail and E-Commerce

- 5.4.5 Healthcare and Life Sciences

- 5.4.6 Telecommunication and IT Services

- 5.4.7 Manufacturing

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Peru

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Amazon Web Services, Inc. (AWS)

- 6.3.2 Google LLC

- 6.3.3 Microsoft Corporation

- 6.3.4 IBM Corporation

- 6.3.5 Hewlett Packard Enterprise (HPE)

- 6.3.6 Dell Technologies Inc.

- 6.3.7 SAS Institute Inc.

- 6.3.8 Oracle Corporation

- 6.3.9 Fujitsu Limited

- 6.3.10 Intel Corporation

- 6.3.11 ATOS SE

- 6.3.12 Juniper Networks Inc.

- 6.3.13 NEC Corporation

- 6.3.14 Cisco Systems, Inc.

- 6.3.15 Teradata Corporation

- 6.3.16 Cray Inc. (HPE Cray)

- 6.3.17 Altair Engineering Inc.

- 6.3.18 Cloudera, Inc.

- 6.3.19 Huawei Technologies Co., Ltd.

- 6.3.20 Hitachi Vantara LLC

- 6.3.21 Super Micro Computer, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment