|

市場調查報告書

商品編碼

1851613

聚氨酯泡沫塗料:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Spray Polyurethane Foam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

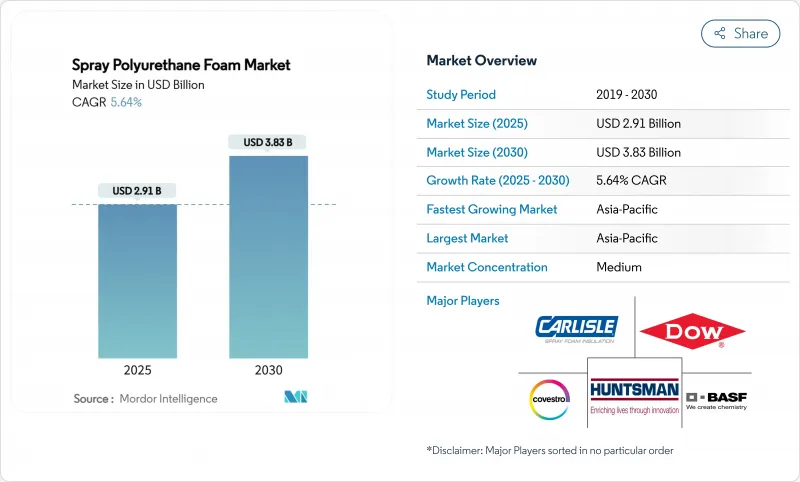

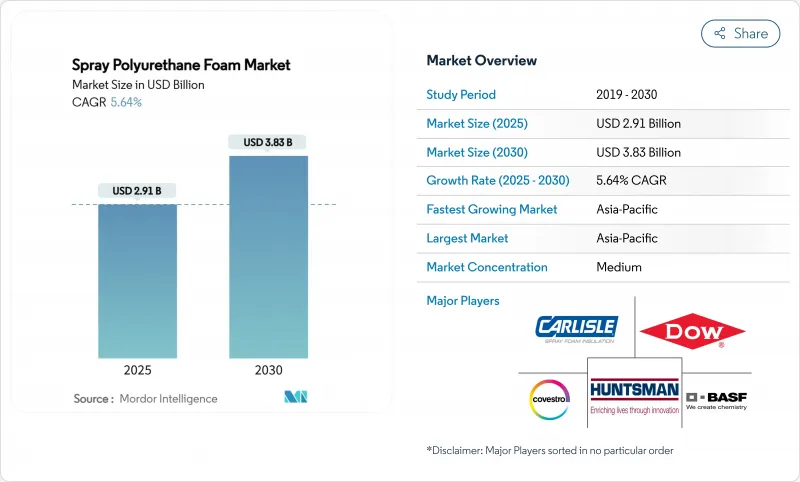

預計到 2025 年,聚氨酯泡沫塗料市場規模將達到 29.1 億美元,到 2030 年將達到 38.3 億美元,在預測期(2025-2030 年)內複合年成長率為 5.64%。

隨著建築節能法規的日益嚴格和低全球暖化潛勢(GWP)強制規定的實施,低溫運輸投資加速,對高價值隔熱材料的需求也隨之成長。製造商正在以氫氟烯烴和其他新一代發泡取代高GWP的氫氟碳化合物(HFC),以符合美國環保署(EPA)於2025年1月1日生效的《技術過渡限制規則》(epa.gov)。安裝商的整合、維修活動的活性化以及與環境、社會和治理(ESG)相關的資金籌措進一步推動了住宅、商業和工業計劃的發展勢頭,而二氧化碳基多元醇的技術創新則為供應商帶來了長期的永續性收益。

全球聚氨酯泡沫塗料市場趨勢及洞察

嚴格的建築節能規範與強制性維修

2024 年國際節能規範將封閉式噴塗泡棉指定為首選的空氣屏障解決方案,迫使建築師指定更高的 R 值和防潮性能。加州 2023 年規範和佛羅裡達州 2026 年規範更新均簡化了維修許可流程,降低了拆除成本,並加速了市場需求,尤其是在低坡度商業屋頂方面。這些規則的改變擴大了維修範圍,鼓勵使用混合隔熱材料組件,並促使承包商加強培訓和資本投入,以採用雙組分系統。

人們越來越關注溫室氣體排放

企業淨零排放目標正與建築業主成本目標相融合,凸顯了噴塗泡沫材料能夠根據美國環保署能源之星計劃,將供暖和製冷能耗降低高達10%的能力。 Installed Building Products公司報告稱,自2020年以來,噴塗泡沫材料的二氧化碳排放減少了55%,同時產量也大幅成長,這表明該技術實現了成長與排放的脫鉤。像Johns Manville這樣的製造商,即使節能產品的產量增加,其絕對排放也實現了兩位數的下降,這凸顯了永續性和盈利的一致性。

玻璃纖維與纖維素之間的競爭

注重成本的房屋建築商仍然傾向於選擇玻璃纖維棉氈,這得益於其長期穩定的供應商網路和較低的設備要求。根據家庭創新研究實驗室(Home Innovation Research Labs)的數據,隨著多用戶住宅的成長和材料成本的降低,噴塗泡棉的市場佔有率已從11%下降至8%,凸顯了其對價格的敏感度。玻璃纖維製造商正透過提供更高密度的產品來縮小性能差距,而纖維素則利用其再生材料的品牌影響力來吸引具有環保意識的消費者。因此,噴塗泡棉供應商必須加強其在生命週期節能方面的價值通訊,以彌補較高的前期投資成本。

細分市場分析

到2024年,雙組分高壓噴塗系統將佔據37.62%的市場佔有率,這主要得益於其現場混合的穩定性、卓越的R值以及在商業建築領域獲得監管部門的認可。BASF在湛江新建的異氰酸酯和TPU生產線增強了當地的供應能力,並鞏固了該領域在亞太地區的領先地位。隨著基礎設施計劃對抗震和溫度變化性能的需求日益成長,半剛性噴塗泡沫正以7.19%的複合年成長率快速擴張。單組分罐裝產品為小型計劃提供了便利,而低壓噴塗套件適用於對散熱要求極高的敏感基材。

整合品牌策略的推廣體現了一種競爭策略:Holcim 的 Enverge® 品牌整合了其 Gaco™ 和 SES™ 產品組合,為承包商提供屋頂、牆面和特殊泡棉材料的單一規範路徑。產品多元化帶來了交叉銷售機會,包括適用於太陽能屋頂和橋面的半剛性創新產品,以及旨在滿足防火法規要求的噴砂灌注系統。擁有豐富產品目錄和區域技術中心的供應商仍然最有優勢贏得規格訂單。

聚氨酯泡沫塗料市場報告按產品類型(雙組分高壓噴塗泡沫、雙組分低壓噴塗泡沫、其他)、應用(隔熱、防水、石棉封裝、密封劑、其他)、最終用途行業(住宅、商業建築、工業、其他)和地區(亞太地區、北美、歐洲、南美、中東和非洲)進行細分。

區域分析

預計到2024年,亞太地區將佔據聚氨酯泡沫塗料市場48.19%的佔有率,年複合成長率達7.66%,主要得益於快速的都市化、工廠擴張以及節能規範的實施。同時,預計到2030年,印度的暖通空調(HVAC)產業規模將達到300億美元,年複合成長率達15.8%,這將推動建築外牆升級改造的需求。日本和韓國在地震帶對建築外牆有著嚴格的要求,因此更傾向於使用輕盈、高黏結性的隔熱材料,例如噴塗泡沫。東南亞國協正在擴大水產品和疫苗的低溫運輸儲存能力,從而提振了區域需求。BASF在亞太地區多年期195億美元的投資計劃,體現了供應商對該地區市場吸收能力的信心。

北美市場成熟且穩定,聯邦政府逐步淘汰氫氟碳化合物(HFC)的政策統一了合規標準,並降低了規範的複雜性。加拿大寒冷的氣候有利於厚層閣樓噴塗泡沫的使用,而墨西哥則憑藉近岸外包和汽車製造業的成長,已成為全球第四大聚氨酯消費國。建築商之間的整合使得全美各地的建築商能夠在美國和加拿大實現外牆解決方案的標準化,而TopBuild不斷擴展的網路也為此提供了支持。

儘管宏觀經濟環境疲軟,但歐洲的淨零排放目標和一波翻新將刺激需求。二異氰酸酯培訓法規雖然會帶來一些摩擦,但最終將有利於資金雄厚且擁有完善環境、健康與安全 (EHS) 體系的製造商。科思創的 DreamResource計劃推出了以 20% 二氧化碳為原料的硬質泡沫,展現了歐洲在循環化學領域的領先地位。列日大學開發了一種不含異氰酸酯、以 70-90% 生物基原料製成的泡沫,凸顯了區域產學合作的重要性。巴西、沙烏地阿拉伯和阿拉伯聯合大公國率先將噴塗泡沫應用於大型商業計劃,預示著未來市場規模將持續成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 嚴格的建築節能法規和維修義務

- 人們越來越關注溫室氣體排放

- 低溫運輸和冷藏物流的成長

- ESG掛鉤綠色債券融資輔助SPF升級

- 對適用於太陽能屋頂的高升力泡沫材料的需求

- 市場限制

- 玻璃纖維與纖維素之間的競爭

- 二異氰酸酯法規和限制

- HFO發泡劑供應波動

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 雙組分高壓噴塗泡沫

- 雙組分低壓噴塗泡沫

- 單組件形式 (OCF)

- 半硬質噴塗泡沫

- 透過使用

- 隔熱材料

- 防水的

- 石棉封裝

- 密封劑

- 其他應用(混凝土提升、填充空隙等)

- 按最終用途行業分類

- 住宅大樓

- 商業建築

- 工業和基礎設施

- 農業和特殊產業

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- BASF

- Accella Polyurethane Systems

- Carlisle Spray Foam Insulation

- Covestro AG

- Dow

- FOAM-LOK(Firestone)

- GACO

- Huntsman Corporation LLC

- ISOTHANE LTD

- Johns Manville

- NCFI Polyurethanes

- Rhino Linings

- SOPREMA Canada.

- SWD Urethane

第7章 市場機會與未來展望

The Spray Polyurethane Foam Market size is estimated at USD 2.91 billion in 2025, and is expected to reach USD 3.83 billion by 2030, at a CAGR of 5.64% during the forecast period (2025-2030).

This expansion occurs as building-energy codes tighten, low-GWP regulations take effect, and cold-chain investment accelerates, driving higher-value insulation demand. Manufacturers are swapping high-GWP HFCs for hydrofluoroolefin and other next-generation blowing agents to comply with the EPA's Technology Transitions Restrictions rule that began on 1 January 2025 epa.gov. Consolidation among installers, growing retrofit activity, and ESG-linked financing further reinforce momentum across residential, commercial, and industrial projects, while innovation in CO2-based polyols positions suppliers for long-term sustainability gains.

Global Spray Polyurethane Foam Market Trends and Insights

Strict Building-Energy Codes and Retrofit Mandates

The 2024 International Energy Conservation Code elevates closed-cell spray foam as a preferred air-barrier solution, compelling architects to specify higher R-values and moisture control measures. California's 2023 standards and Florida's 2026 code update both streamline retrofit approvals, lowering removal costs and accelerating demand, particularly for low-slope commercial roofs These rule changes widen the retrofit addressable base, encourage hybrid insulation assemblies, and push contractors toward more training and equipment investment that favors two-component systems.

Rising Concerns Over GHG Emissions

Corporate net-zero goals merge with building-owner cost targets, highlighting spray foam's ability to cut heating-and-cooling energy by up to 10% according to the EPA's Energy Star program. Installed Building Products reported a 55% CO2 reduction from spray foam use since 2020 while materially increasing output, showing the technology's decoupling of growth from emissions. Manufacturers such as Johns Manville logged double-digit drops in absolute emissions even as energy-saving product volumes rose, underscoring alignment between sustainability and profitability.

Competition from Fiberglass and Cellulose

Cost-focused residential builders still default to fiberglass batts, supported by long-standing installer networks and low equipment requirements. Home Innovation Research Labs data showed an 11% to 8% pullback in spray foam share amid multifamily growth and material cost saving, highlighting price sensitivity. Fiberglass makers are narrowing performance gaps with higher-density offerings, while cellulose leverages recycled content branding to appeal to eco-minded consumers. Spray foam suppliers must therefore sharpen value messaging around lifecycle energy savings to overcome higher upfront spend.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Cold-Chain and Refrigerated Logistics

- ESG-Linked Green-Bond Financing for SPF Upgrades

- Regulations and Restrictions on Di-Isocyanates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment anchored by two-component high-pressure systems held a 37.62% spray polyurethane foam market share in 2024, reflecting consistent on-site mixing, superior R-values, and code acceptance in commercial construction. BASF's new isocyanate and TPU lines in Zhanjiang strengthen local supply chains, reinforcing the segment's dominance in Asia-Pacific. Semi-rigid spray foam is expanding at a 7.19% CAGR as infrastructure projects need flexibility for vibration and temperature swings. One-component cans address small-project convenience, while low-pressure kits cover sensitive substrates where reduced exothermic heat is critical.

A push for integrated brands illustrates competitive strategy: Holcim's Enverge(R) label merges Gaco(TM) and SES(TM) portfolios, giving installers a single specification path for roof, wall, and specialty foams. Product diversification frames cross-selling opportunities, with semi-rigid innovations aimed at solar-ready roofs and bridge decks, and intumescent-infused systems targeting fire-resistance regulations. Suppliers that maintain broad catalogs and regional technical centers remain best positioned to seize specification wins.

The Spray Polyurethane Foam Market Report is Segmented by Product Type (Two-Component High-Pressure Spray Foam, Two-Component Low-Pressure Spray Foam, and More), Application (Insulation, Waterproofing, Asbestos Encapsulation, Sealant, Other Application), End-Use Industry (Residential Buildings, Commercial Buildings, Industrial and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa).

Geography Analysis

Asia-Pacific captured 48.19% of spray polyurethane foam market share in 2024 and is forecast to climb at 7.66% CAGR, driven by rapid urbanization, factory expansions, and energy-code adoption. China's real-estate slowdown redirects stimulus toward urban renewal, boosting retrofit insulation spend, while India's HVAC sector is set to hit USD 30 billion by 2030 on a 15.8% CAGR pathway, raising demand for building envelope upgrades. Japan and South Korea enforce stringent envelope requirements in seismic zones, favoring lightweight, high-adhesion insulation such as spray foam. ASEAN nations expand cold-chain capacity for seafood and vaccine storage, pulling regional demand upward. BASF's multi-year USD 19.5 billion Asia-Pacific investment plan exemplifies supplier confidence in the region's absorption capacity.

North America remains a mature but stable arena where federal HFC phase-outs harmonize compliance and keep specification complexity low. Canada's cold climates sustain thick-layer attic spray foam usage, while Mexico emerges as the world's fourth-largest polyurethane consumer on near-shoring momentum and automotive manufacturing growth. Consolidation among contractors enables national builders to standardize envelope solutions across the US and Canada, reinforced by TopBuild's network expansion.

Europe's net-zero directives and renovation wave stimulate demand despite tepid macro-economics. Di-isocyanate training rules introduce friction but ultimately favor well-capitalized manufacturers with robust EHS programs. Covestro's DreamResource project introduces rigid foam containing 20% CO2 as feedstock, demonstrating European leadership in circular chemistry. University of Liege advances isocyanate-free foams with 70-90% biobased content, underscoring regional academic-industry collaboration. In South America and the Middle East and Africa, energy-efficiency codes are tightening gradually; early movers in Brazil, Saudi Arabia, and the UAE adopt spray foam in commercial megaprojects, signaling future volume uplift.

- BASF

- Accella Polyurethane Systems

- Carlisle Spray Foam Insulation

- Covestro AG

- Dow

- FOAM-LOK (Firestone)

- GACO

- Huntsman Corporation LLC

- ISOTHANE LTD

- Johns Manville

- NCFI Polyurethanes

- Rhino Linings

- SOPREMA Canada.

- SWD Urethane

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strict Building-Energy Codes and Retrofit Mandates

- 4.2.2 Rising Concerns over GHG Emissions

- 4.2.3 Growth in Cold-Chain and Refrigerated Logistics

- 4.2.4 ESG-linked green bond financing for SPF upgrades

- 4.2.5 High-lift Foam Demand for Solar-Ready Roofs

- 4.3 Market Restraints

- 4.3.1 Competition from Fiberglass and Cellulose

- 4.3.2 Regulations and Restrictions on Di-isocyanates

- 4.3.3 HFO Blowing-agent Supply Volatility

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Two-Component High-Pressure Spray Foam

- 5.1.2 Two-Component Low-Pressure Spray Foam

- 5.1.3 One-Component Foam (OCF)

- 5.1.4 Semi-Rigid Spray Foam

- 5.2 By Application

- 5.2.1 Insulation

- 5.2.2 Waterproofing

- 5.2.3 Asbestos Encapsulation

- 5.2.4 Sealant

- 5.2.5 Other Application (Concrete Lifting / Void Filling, etc.)

- 5.3 By End-use Industry

- 5.3.1 Residential Buildings

- 5.3.2 Commercial Buildings

- 5.3.3 Industrial and Infrastructure

- 5.3.4 Agriculture and Specialty

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Accella Polyurethane Systems

- 6.4.3 Carlisle Spray Foam Insulation

- 6.4.4 Covestro AG

- 6.4.5 Dow

- 6.4.6 FOAM-LOK (Firestone)

- 6.4.7 GACO

- 6.4.8 Huntsman Corporation LLC

- 6.4.9 ISOTHANE LTD

- 6.4.10 Johns Manville

- 6.4.11 NCFI Polyurethanes

- 6.4.12 Rhino Linings

- 6.4.13 SOPREMA Canada.

- 6.4.14 SWD Urethane

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment