|

市場調查報告書

商品編碼

1851610

區塊鏈即服務:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Blockchain-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

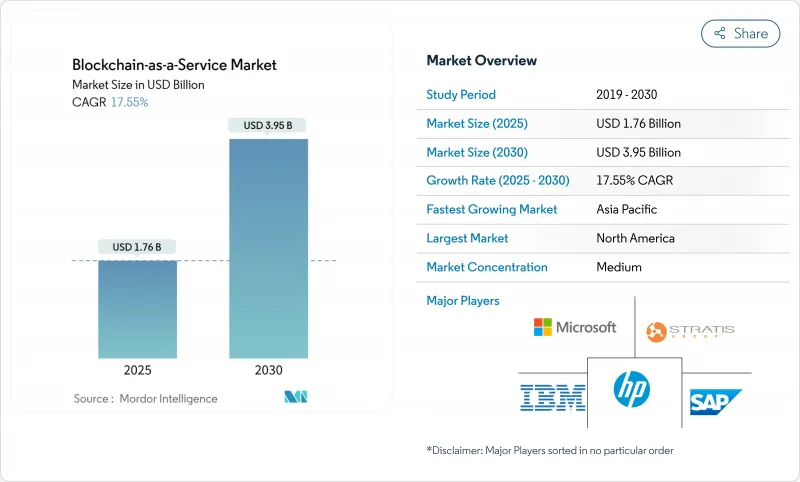

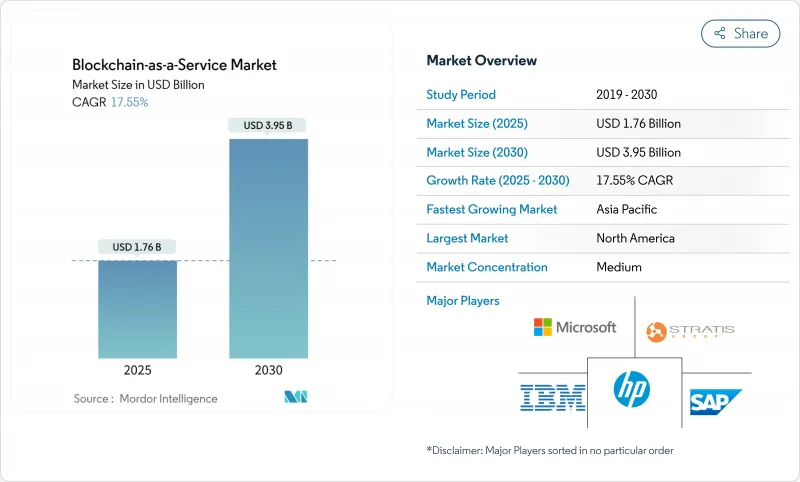

預計到 2025 年,區塊鏈即服務市場規模將達到 17.6 億美元,到 2030 年將達到 39.5 億美元,在此期間的複合年成長率將達到 17.55%。

隨著企業從小型概念驗證轉向生產部署,區塊鏈即服務(BaaS)市場正蓬勃發展,這得益於監管環境的日益清晰以及雲端服務供應商將分散式帳本工具整合到更廣泛的基礎設施組合中。各國央行的數位貨幣試點項目,尤其是國際清算銀行的mBridge計劃,正在創造企業級區塊鏈平台的下游需求。雲端超大規模資料中心業者提供的配套服務降低了採購摩擦,而歐盟加密資產市場監管條例等法規結構也為企業支出提供了依據。北美地區的沙盒計劃和亞太地區政府資助的代幣化計劃進一步加速了區塊鏈的普及。同時,人才短缺和通訊協定層面互通性方面的不足仍然是需要關注的問題,並可能限制近期的成長。

全球區塊鏈即服務市場趨勢與洞察

受監管產業對防篡改資料完整性的需求日益成長

為了滿足嚴格的審核追蹤和證明要求,醫療保健、金融和製藥業正在擴大採用區塊鏈技術。 Change Healthcare 的 Hyperledger Fabric 實現方案每天已處理約 5,000 萬筆交易,並儲存不可竄改的日誌。追蹤藥品來源的歐洲藥品法規也在推動類似的應用。金融機構透過在監管機構根據《藥品和資訊合規法案》(MiCA) 認定為可信的區塊鏈上記錄監管數據,從而減輕了合規工作量。區塊鏈即服務 (BaaS) 市場被定位為合規賦能工具,尤其是在審核越來越傾向於使用不可篡改的記錄而非傳統資料庫的情況下。因此,隨著已開發國家每推出一項新的數據整合政策,市場對區塊鏈的需求將持續成長。

雲端超大規模營運商正在將 BaaS 捆綁到其更廣泛的 X 即服務堆疊中。

微軟正在將區塊鏈、人工智慧和物聯網整合到 Azure 中,使客戶能夠透過熟悉的入口網站和現有合約啟用帳本。亞馬遜雲端服務和Google雲端也紛紛效仿,Kaleido 與 Azure 的合作提供了 500 多個預先建置 API,可輕鬆整合到企業工具中。這種捆綁式服務縮短了採購週期,尤其對那些缺乏深厚密碼學專業知識的中型企業而言更是如此,並且使營運成本保持可變性而非資本密集。這種打包策略使所有管理雲端工作負載的客戶都能了解區塊鏈即服務市場,從而使採用區塊鏈即服務成為一個漸進式而非變革性的決策。

標準碎片化和通訊協定互通性差距

儘管IEEE和ISO仍在製定相關框架,但由於缺乏通用的即插即用標準,企業不得不客製化建造跨鏈連接器。 Sensor 日誌的研究表明,此類架構會增加複雜性並暴露新的攻擊面。這阻礙了跨國公司跨境推廣試點項目,從而減緩了區塊鏈即服務市場累積數量的成長。在主導性的互通性通訊協定成熟之前,供應商必須將藍圖資源投入到建構自身橋樑。

細分市場分析

到2024年,平台即服務(PaaS)將構成比收入的38.0%,這主要得益於其整合開發環境和可配置性,這些優勢吸引了大型企業。同時,託管服務預計將以19.98%的複合年成長率(CAGR)實現最快成長。這主要源自於企業對承包營運、安全性修補程式和全天候執行時間運作的需求,而無需自行運行節點。大型跨國公司的財務團隊已表示,遷移到託管帳簿以實現跨境流動性後,西門子銀行帳戶減少了一半,每年節省了2000萬美元。諮詢和實施工作對於連接傳統ERP系統和滿足特定行業(例如金融和醫療保健行業)的法規要求仍然至關重要。

企業在需要對共識設定進行精細控制但又傾向於雲端收費時,也會採用基礎設施即服務 (IaaS)。同時,軟體即法規(SaaS)套件正在開放抽象智慧合約編譯的 API,降低了小型開發者的入門門檻。此外,日益嚴格的合規性要求使得不可篡改的審核追蹤成為預設要求,這促使即使是風險規避型的董事會也核准訂閱。這種持續的需求正在支撐區塊鏈即服務 (BaaS) 市場在待開發區和現有棕地配置的成長。

到2024年,公共雲端將佔據區塊鏈即服務(BaaS)市場63.0%的佔有率,因為超大規模雲端服務商能夠提供彈性擴展和高服務等級協定(SLA)。混合雲將以22.10%的複合年成長率成長,因為金融機構和製藥公司為了遵守《居住通訊法》(MiCA)及類似政策規定的資料駐留要求,會將敏感資料保留在本地。混合拓撲結構透過將生產鏈置於防火牆後,同時利用公有雲建置開發沙箱,從而加快迭代速度。

當資料主權或敏感工作負載限制外部基礎設施的使用時,私有私有雲端便成為首選。歐盟新推出的營運彈性規則進一步推動了應急計畫的製定,並使混合架構更具吸引力。因此,我們在區塊鏈即服務市場中持續看到架構的多樣性。企業為了因應成本審核和新的合規要求,正在不同環境之間遷移工作負載,這確保了對編配工具的長期需求。

區塊鏈即服務市場報告按組件(平台即服務 (PaaS)、基礎設施即服務 (IaaS)、其他)、部署模式(公共雲端、私有雲端、其他)、組織規模(大型企業、中小企業)、應用(智慧合約、支付、其他)、最終用戶垂直行業(IT 和通訊、製造業、其他)和地區進行細分。

區域分析

北美地區繼續保持主導地位,預計到2024年將佔據區塊鏈即服務市場41.0%的佔有率,這主要得益於大型創業融資,例如由高盛和Citadel主導的Digital Asset 1.35億美元融資。總部位於美國的超大規模雲端服務供應商正在將帳本工具整合到其主流雲端產品中,使現有客戶能夠快速上線。儘管一些州已推出監管沙盒以加速試點項目,但全國各地政策的碎片化仍然造成了合規性的不確定性,並延緩了跨州推廣的進程。

亞太地區以18.69%的複合年成長率實現了最快成長。新加坡和香港政府支持的央行數位貨幣(CBDC)和代幣化計劃正在創造顯著的成功案例,吸引銀行和金融科技公司入駐商業平台。日本、韓國和中國的製造地正利用亞洲內部貿易走廊,將區塊鏈應用於供應鏈和永續性報告等領域。大學的區塊鏈實驗室正在擴大區域人才儲備,有助於緩解其他地區普遍存在的開發者短缺問題。

歐洲將受益於MiCA的統一規則,該規則將於2024年12月全面生效。汽車、奢侈品和食品公司將部署成熟可靠的解決方案,以滿足監管機構和消費者的需求,例如雷諾的XCEED供應鏈系統。歐洲中央銀行倡導數位資產市場一體化,這將促使各銀行採用分散式帳本基礎設施來實現後勤部門現代化,並維持短期合約交易。中東和非洲的新興市場正在嘗試將區塊鏈應用於普惠金融和碳權登記,但由於技術能力有限,其整體應用仍處於起步階段。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 受監管產業對防篡改資料完整性的需求日益成長

- 雲端超大規模營運商將 BaaS 打包到更廣泛的 XaaS 服務堆疊中

- 關於代幣化和穩定幣的監管清晰度正在逐步提高。

- 中央銀行沙盒計畫購買BaaS後端

- 新冠疫情後企業級區塊鏈試點計畫激增

- 利用區塊鏈永續性帳本進行範圍 3排放審核(非正式審計)

- 市場限制

- 標準碎片化和通訊協定互通性差距

- 分散式帳本工程人才短缺

- 關於智慧合約可執行性的法律原則尚不明確。

- 雲端成本上漲使概念驗證預算受到密切關注(儘管並未引起太多關注)。

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按組件

- 平台即服務 (PaaS)

- 基礎設施即服務 (IaaS)

- 軟體即服務 (SaaS) SDK 和 API

- 諮詢及實施服務

- 託管/營運服務

- 按部署模式

- 公共雲端

- 私有雲端

- 混合雲

- 按組織規模

- 主要企業

- 小型企業

- 透過使用

- 智慧合約

- 供應鏈可追溯性

- 數位身分和KYC

- 沉澱

- 管治、風險與合規

- 其他

- 按行業

- 銀行、金融服務和保險(BFSI)

- 醫療保健和生命科學

- 資訊科技和電信

- 零售與電子商務

- 製造業

- 能源與公共產業

- 政府/公共部門

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 中東和非洲

- 中東

- 海灣合作理事會(沙烏地阿拉伯、阿拉伯聯合大公國、卡達等)

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 肯亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services(AWS)

- Oracle Corporation

- SAP SE

- Hewlett-Packard Enterprise

- Huawei Technologies Co. Ltd.

- Alibaba Cloud

- Tencent Cloud

- R3

- ConsenSys

- Blockstream Inc.

- Stratis Group Ltd.

- PayStand Inc.

- Kaleido

- Guardtime

- Dragonchain Inc.

- Bitfury Group

- LeewayHertz

- Wipro Limited

- Accenture plc

- Infosys Limited

- NTT DATA

- LG CNS

- Tech Mahindra

第7章 市場機會與未來展望

The Blockchain-as-a-Service market size reached USD 1.76 billion in 2025 and is projected to climb to USD 3.95 billion by 2030, registering a 17.55% CAGR over the period.

The Blockchain-as-a-Service market is gaining momentum as enterprises move from small-scale proofs of concept toward production deployments, spurred by clearer regulations and cloud providers that embed distributed-ledger tools within broader infrastructure bundles. Central-bank digital-currency pilots, especially the Bank for International Settlements' mBridge project, are generating downstream demand for enterprise blockchain platforms. Cloud hyperscalers' bundled offerings reduce procurement friction, while regulatory frameworks such as the European Union's Markets in Crypto-Assets regulation legitimize enterprise spending. North American sandbox programs and Asia Pacific's state-funded tokenization initiatives further accelerate uptake. At the same time, ongoing talent shortages and protocol-level interoperability gaps remain watchpoints that could temper short-term growth.

Global Blockchain-as-a-Service Market Trends and Insights

Rising demand for tamper-proof data integrity across regulated industries

Health, finance, and pharmaceuticals increasingly adopt blockchain to meet stringent audit-trail and provenance mandates. Change Healthcare's Hyperledger Fabric deployment already processes about 50 million daily transactions while preserving immutable logs. European pharmaceutical rules that track medicine provenance drive similar uptake. Financial institutions cut compliance workloads by recording regulatory data on chains that regulators deem trustworthy under MiCA. These sector mandates position the Blockchain-as-a-Service market as a compliance enabler, particularly as auditors begin to prefer immutable records over traditional databases. Demand, therefore, scales with every new data-integrity policy in advanced economies.

Cloud hyperscalers bundling BaaS into broader X-as-a-Service stacks

Microsoft integrates blockchain, AI, and IoT on Azure, letting clients activate ledgers through familiar portals and existing contracts. Amazon Web Services and Google Cloud follow, while Kaleido's Azure tie-up offers more than 500 pre-built APIs that snap into enterprise tools. Bundling cuts procurement cycles, especially for mid-market firms without deep cryptography skills, and keeps operating costs variable instead of capital-intensive. This packaging strategy keeps the Blockchain-as-a-Service market visible to every customer managing cloud workloads, making adoption an incremental, rather than transformative, decision.

Fragmented standards and protocol interoperability gaps

IEEE and ISO continue to draft frameworks, yet no universal plug-and-play standard exists, forcing enterprises to custom-build cross-chain connectors iso.org. Sensors-journal research shows such architectures add complexity and new attack surfaces. Multinationals therefore hesitate to scale pilots across borders, which slows cumulative contract flow into the Blockchain-as-a-Service market. Until dominant interoperability protocols mature, vendors must allocate road-map resources to proprietary bridges that elevate costs and lengthen implementation timelines.

Other drivers and restraints analyzed in the detailed report include:

- Gradual regulatory clarity on tokenization and stablecoins

- Central-bank sandbox programs sourcing BaaS back-ends

- Talent shortage in distributed-ledger engineering

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platform-as-a-Service contributed 38.0% revenue in 2024, underpinned by integrated development environments and configurability that attract large corporations. Managed Services, however, grows fastest at 19.98% CAGR as organizations seek turnkey operations, security patching and 24/7 uptime without running nodes themselves. Large multinational treasury teams cite tangible savings; Siemens cut bank accounts by half and saved USD 20 million each year after migrating to managed ledgers for cross-border liquidity. Consulting and implementation work remains essential to bridge legacy ERP systems and to meet sector-specific regulations in finance and healthcare.

Enterprises also adopt Infrastructure-as-a-Service when they need granular control over consensus settings yet still prefer cloud billing. Meanwhile, software-as-a-service toolkits expose APIs that abstract smart-contract compilation, lowering entry barriers for small developers. Rising compliance workloads make immutable audit trails a default requirement, so even risk-averse boards now approve subscriptions. This persistent demand anchors the Blockchain-as-a-Service market across both greenfield and brownfield deployments.

Public Cloud captured 63.0% of the Blockchain-as-a-Service market share in 2024 because hyperscalers provide elasticity and high service-level agreements. Still, Hybrid Cloud is on track for a 22.10% CAGR as financial institutions and pharmaceutical firms hold sensitive data on-premises to satisfy residency laws under MiCA and similar policies. Hybrid topologies keep production chains behind firewalls while using public cloud for development sandboxes, which speeds iteration.

Private Cloud persists where data sovereignty or classified workloads prohibit any external infrastructure. The European Union's new operational-resilience rules further motivate contingency planning, making hybrid designs attractive. As a result, the Blockchain-as-a-Service market sees consistent architectural diversity: enterprises swap workloads between environments in response to cost audits or new compliance directives, ensuring long-run demand for orchestration tools.

The Blockchain As A Service Market Report is Segmented by Component (Platform-As-A-Service (PaaS), Infrastructure-As-A-Service (IaaS), and More), Deployment Model (Public Cloud, Private Cloud, and More), Organization Size (Large Enterprises and Small and Medium Enterprises), Application (Smart Contracts, Payments and Settlement, and More), End-User Vertical (IT and Telecom, Manufacturing, and More), and Geography.

Geography Analysis

North America continued to dominate in 2024 with a 41.0% Blockchain-as-a-Service market share, buoyed by deep venture funding such as Digital Asset's USD 135 million round led by Goldman Sachs and Citadel. US-based hyperscalers integrate ledger tools into mainstream cloud menus, allowing quick uptakes among existing clients. Regulatory sandboxes in several states accelerate production pilots, though nationwide policy fragmentation still injects compliance uncertainty that slows multi-state rollouts.

Asia Pacific records the steepest growth at an 18.69% CAGR. Government-backed CBDC and tokenization projects in Singapore and Hong Kong create visible proof points, drawing banks and fintechs onto commercial platforms. Manufacturing hubs across Japan, South Korea and China deploy blockchains for supply-chain and sustainability reporting use cases, leveraging intra-Asia trade corridors. Regional talent pools expand through university blockchain labs, helping offset developer shortages seen elsewhere.

Europe benefits from MiCA's uniform rules that became fully effective in December 2024. Automotive, luxury and food companies implement provenance solutions to satisfy regulators and consumers, exemplified by Renault's XCEED supply-chain systeM. The European Central Bank's advocacy for digital-assets market integration encourages banks to modernize back offices with distributed-ledger infrastructure, sustaining near-term contract flow. Emerging markets in the Middle East and Africa experiment with blockchain for financial inclusion and carbon credit registries, yet overall adoption remains nascent due to limited technical capacity.

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services (AWS)

- Oracle Corporation

- SAP SE

- Hewlett-Packard Enterprise

- Huawei Technologies Co. Ltd.

- Alibaba Cloud

- Tencent Cloud

- R3

- ConsenSys

- Blockstream Inc.

- Stratis Group Ltd.

- PayStand Inc.

- Kaleido

- Guardtime

- Dragonchain Inc.

- Bitfury Group

- LeewayHertz

- Wipro Limited

- Accenture plc

- Infosys Limited

- NTT DATA

- LG CNS

- Tech Mahindra

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for tamper-proof data integrity across regulated industries

- 4.2.2 Cloud hyperscalers bundling BaaS into broader X-as-a-Service stacks

- 4.2.3 Gradual regulatory clarity on tokenization and stablecoins

- 4.2.4 Central-bank sandbox programs sourcing BaaS back-ends

- 4.2.5 Explosion of enterprise-grade blockchain pilots post-COVID-19

- 4.2.6 Scope-3 emissions auditing via blockchain sustainability ledgers (under-radar)

- 4.3 Market Restraints

- 4.3.1 Fragmented standards and protocol interoperability gaps

- 4.3.2 Talent shortage in distributed-ledger engineering

- 4.3.3 Uncertain jurisprudence on smart-contract enforceability

- 4.3.4 Rising cloud spend scrutiny dampening POC budgets (under-radar)

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Platform-as-a-Service (PaaS)

- 5.1.2 Infrastructure-as-a-Service (IaaS)

- 5.1.3 Software-as-a-Service (SaaS) SDKs and APIs

- 5.1.4 Consulting and Implementation Services

- 5.1.5 Managed/Operations Services

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises

- 5.4 By Application

- 5.4.1 Smart Contracts

- 5.4.2 Supply-Chain Traceability

- 5.4.3 Digital Identity and KYC

- 5.4.4 Payments and Settlement

- 5.4.5 Governance, Risk and Compliance

- 5.4.6 Others

- 5.5 By End-User Vertical

- 5.5.1 Banking, Financial Services and Insurance (BFSI)

- 5.5.2 Healthcare and Life Sciences

- 5.5.3 IT and Telecom

- 5.5.4 Retail and E-commerce

- 5.5.5 Manufacturing

- 5.5.6 Energy and Utilities

- 5.5.7 Government and Public Sector

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Netherlands

- 5.6.3.7 Russia

- 5.6.3.8 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC (Saudi Arabia, UAE, Qatar, etc.)

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Kenya

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 Amazon Web Services (AWS)

- 6.4.4 Oracle Corporation

- 6.4.5 SAP SE

- 6.4.6 Hewlett-Packard Enterprise

- 6.4.7 Huawei Technologies Co. Ltd.

- 6.4.8 Alibaba Cloud

- 6.4.9 Tencent Cloud

- 6.4.10 R3

- 6.4.11 ConsenSys

- 6.4.12 Blockstream Inc.

- 6.4.13 Stratis Group Ltd.

- 6.4.14 PayStand Inc.

- 6.4.15 Kaleido

- 6.4.16 Guardtime

- 6.4.17 Dragonchain Inc.

- 6.4.18 Bitfury Group

- 6.4.19 LeewayHertz

- 6.4.20 Wipro Limited

- 6.4.21 Accenture plc

- 6.4.22 Infosys Limited

- 6.4.23 NTT DATA

- 6.4.24 LG CNS

- 6.4.25 Tech Mahindra

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment