|

市場調查報告書

商品編碼

1851603

電動馬達:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Electric Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

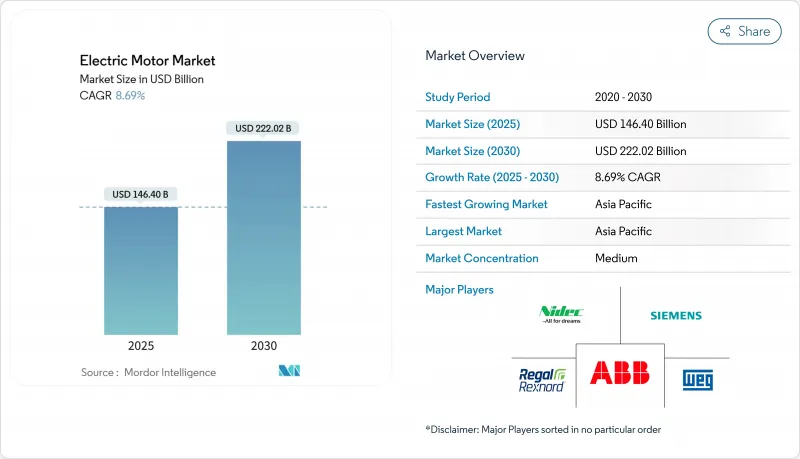

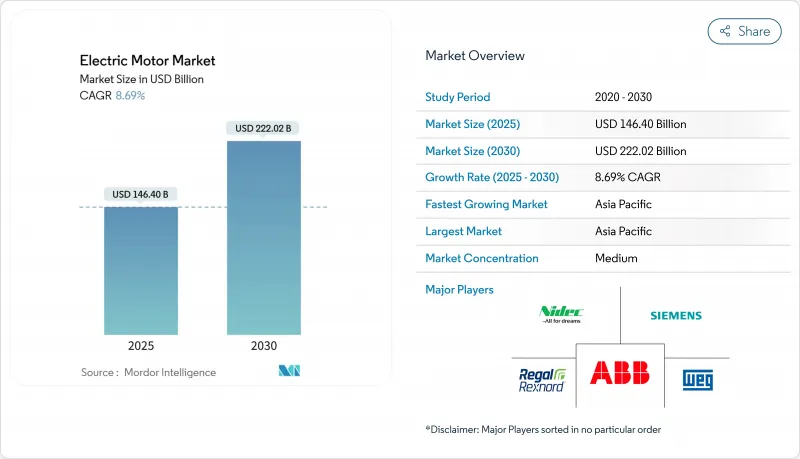

預計到 2025 年,全球馬達市場規模將達到 1,464 億美元,到 2030 年將達到 2,220.2 億美元,預測期(2025-2030 年)複合年成長率為 8.69%。

全球電氣化進程、日益嚴格的最低能源效率法規以及電動車、暖通空調升級和可再生能源計劃需求的成長,共同推動了馬達產業的成長。 IEC能源效率等級的強化,加上歐盟生態設計指令以及北美和亞洲的同等法規,正在加速傳統馬達的更換銷售。同時,中國、印度和東南亞製造業的持續擴張增加了工業機械的數量,而物聯網賦能的預測性維護平台則縮短了更換週期。這導致市場轉向IE4和IE5能源效率等級、永磁架構和整合驅動,同時也加劇了研發競爭和供應商整合。

全球馬達市場趨勢與洞察

亞洲離散製造業製造業自動化快速電氣化

到2024年,中國工廠的機器人密度將達到每萬名員工322台機器人,每台機器人配備6至12個伺服馬達。越南和印度正在複製這一自動化發展趨勢,推動供應鏈多元化,並刺激對具有更嚴格速度-扭矩範圍的精密馬達的迫切需求。終端用戶現在更注重全生命週期效率而非前期成本,這促使亞洲二線工業對高效節能型馬達的需求不斷成長。伺服驅動單元的數位雙胞胎可以縮短試運行時間,並為電機OEM廠商創造新的業務收益來源。隨著自動化向小批量生產轉移,馬達驅動的可配置性和快速調諧能力正成為馬達市場中至關重要的採購因素。

聯邦能源標準推動美國家庭維修中暖通空調系統的加速普及

最新的能源效率比(SEER)標準將導致數百萬套傳統暖通空調系統不符合標準,從而在2027年之前每年形成15%的更換管道。變速馬達可將居民用電量降低高達40%,而適用於寒冷氣候的熱泵將於2024年底開始推廣,使其覆蓋範圍擴大到北部各州。公用事業公司正透過分時電價來改善經濟效益,這種電價有利於變頻壓縮機,從而進一步推動了IE4級風扇和鼓風機馬達的穩步普及。承包商現在將可即時報告負載曲線的連網控制系統捆綁銷售,並將資料傳輸到分析平台,以便為未來的維修最佳化設備尺寸。這些監管變化將使北美馬達市場穩步走上成長軌道。

釹的價格不穩定給永磁馬達的經濟效益帶來了壓力。

釹現貨價格在經歷了早期的飆升後,過去12個月下跌了42%,這使得牽引馬達馬達項目的物料清單預測變得更加複雜。電動車平台需要多達5公斤的磁性材料,因此價格波動會影響整個車系。原始設備製造商(OEM)透過雙重採購和試驗減少磁鐵數量的拓撲結構(例如鐵氧體輔助同步馬達)來規避風險。對同步磁阻設計的研究雖然可以提供無磁鐵扭力圖,但需要嚴格的空氣間隙處理流程。不確定性促使採購團隊傾向於簽署長期承購協議,但持續的波動仍可能抑制馬達市場的成長。

細分市場分析

到2024年,交流馬達將佔全球銷量的73.34%,其9.4%的複合成長率將使其在2030年之前繼續主導馬達市場。感應馬達在輸送機、水泵和風扇領域仍佔據主導地位,而同步馬達在對速度精度要求極高的應用中也越來越受歡迎。如今,數位驅動器能夠自動調節轉子磁通,從而提高千瓦時效率,並使IE4感應馬達系統能夠直接取代IE2傳統馬達系統。在直流馬達方面,無刷馬達設計正在延長無人機和電動自行車的維護週期,在不威脅交流馬達整體市場佔有率的前提下,開闢出一片屬於自己的獨特市場。

儘管AC馬達憑藉著成熟的模具、充足的備件和簡化的安裝方式,在棕地改裝中仍佔據主導地位,但軸向拓撲結構的出現帶來了新的競爭。伺服級馬達為先進機器人提供動力,將回饋編碼器與邊緣運算結合,實現毫秒的運動控制。在此背景下,電機市場將繼續青睞那些能夠將規模經濟與平台化模組化相結合的供應商。

受智慧家電、暖通空調風扇和手持設備等產品興起的推動,到2024年,小功率馬達將佔總出貨量的52%。嚴格的絕緣封裝限制推動了小型化,而無鹵絕緣薄膜和粉末冶金齒輪的出現則緩解了熱限制。相較之下,500匹馬力以上的馬達年複合成長率將達到8%,雖然銷量不高,但對營收的影響卻十分顯著。大型永磁馬達目前驅動14兆瓦的離岸風電機艙,而礦用輸送機則需要堅固耐用的全封閉式風冷式(TEFC)外殼來應對沙漠氣候。

功率範圍為1-500馬力的整體式馬達仍是生產線的核心,得益於變頻驅動器,可實現20-30%的節能。隨著OEM廠商不斷擴展其IE4產品目錄,該細分市場正逐漸模糊跨界融合的界限,將小型馬達緊湊的定子結構與高功率馬達的冷卻策略相結合。不同功率等級的成長動態差異,使得整個馬達市場的成長機會變得更加複雜。

電動馬達市場報告按馬達類型(DC馬達、AC馬達、其他)、輸出功率等級(分數馬力、其他)、電壓(低壓、中壓、高壓)、應用(工業機械、暖通空調和冷凍、其他)、最終用戶產業(住宅、商業、工業)和地區(北美、歐洲、亞太、南美、中東和非洲)進行細分。

區域分析

亞太地區預計到2024年將佔全球銷售額的42.6%,到2030年將以10.7%的複合年成長率成長。廣東省的電機產業叢集整合了鑄造、繞線和驅動電子等端到端前置作業時間。越南的工業吸引了契約製造將馬達再進口給區域供應商,拓寬了供應鏈。政府對高效設備的激勵措施正在推動紡織廠和半導體廠快速採用IE4級馬達。

北美擁有第二大市場佔有率,這主要得益於聯邦暖通空調能源效率法規和蓬勃發展的自動化生態系統。中西部地區的汽車工廠透過預測性維護維修,將停機時間減少了高達 45%,推動了持續的續約訂單。美國電池工廠的建設正將牽引馬達研發資金投入一個合作實驗室,用於測試轉子疊片在高速負載循環下的性能。加拿大陸上風電改造計畫正在將採購重點轉向更輕的直驅電機,從而推動了電機市場的發展。

歐洲持續成長得益於離岸風電和嚴格的生態設計法規這兩大支柱。北海港口正在擴建機艙,以管理配備直驅式永磁發電機的15兆瓦風力發電機組。製造商將服務中心集中在波蘭和西班牙,以履行五年一次的大修合約。歐盟能源價格的波動促使工業用戶優先考慮IE4維修,進而縮短投資回收期。

中東和非洲雖然絕對規模較小,但海水淡化廠和瓦斯增壓站的成長速度卻高於預期。阿拉伯聯合大公國的EPC合約指定使用IECEx認證的防爆電機,從而催生了高利潤率的需求。在南美洲,巴西和智利的工業運作帶動了中壓泵驅動裝置和糖廠壓榨機訂單的回升。在所有地區,能源效率法規的趨同都維持了馬達市場的需求動能。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 最新進展

- 市場促進因素

- 亞洲離散製造業製造業自動化快速電氣化

- 聯邦能源標準推動美國家庭維修中暖通空調系統的加速普及

- 歐洲離岸風力發電機安裝量激增,需要高功率永磁馬達。

- 中國電池電動車動力傳動系統的擴張正在推動對高效牽引馬達的需求。

- 工業IoT驅動的預測性維護加速了北美老舊馬達的更換

- 政府對最低排放標準的強制規定推動了IE4和IE5馬達的全球銷售。

- 市場限制

- 釹的價格不穩定給永磁馬達的經濟效益帶來了壓力。

- IGBT模組的供應限制限制了高壓馬達的生產。

- 中東石油和天然氣產業防爆馬達認證週期長

- 整合伺服驅動器的興起降低了獨立馬達的商機。

- 供應鏈分析

- 監理展望

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依馬達類型

- AC馬達(感應式(非同步)、同步式)

- DC馬達(有刷和無刷直流馬達)

- 其他(密封馬達、步進馬達)

- 按額定輸出

- 分數馬力(1 馬力或以下)

- 整數馬力(1-500 馬力)

- 高功率(超過500馬力)

- 透過電壓

- 低電壓(低於1千伏特)

- 中壓(1至6千伏特)

- 高壓(6千伏特或更高)

- 透過使用

- 工業機械

- 暖通空調和製冷

- 汽車與運輸

- 電器產品

- 公共產業和能源

- 其他(農業、石油和天然氣、採礦)

- 按最終用途行業分類

- 住房

- 商業

- 產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 北歐國家

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、夥伴關係、購電協議)

- 市場佔有率分析(主要企業的市場排名/佔有率)

- 公司簡介

- ABB Ltd.

- Siemens AG

- Nidec Corporation

- Regal Rexnord Corporation

- WEG SA

- Toshiba Corporation

- Hitachi Ltd.

- Rockwell Automation, Inc.

- AMETEK, Inc.

- Johnson Electric Holdings Ltd.

- TECO Electric & Machinery Co., Ltd.

- Mitsubishi Electric Corporation

- Baldor Electric Company

- Brook Crompton Holdings Ltd.

- Anhui Wannan Electric Machine Co., Ltd.

- Kirloskar Electric Company Ltd.

- Hyosung Heavy Industries

- Danaher Motion(Kollmorgen)

- Yaskawa Electric Corporation

- Fuji Electric Co., Ltd.

- Robert Bosch GmbH

- Schneider Electric SE

- SEW-Eurodrive GmbH & Co. KG

- Emerson Electric Co.

第7章 市場機會與未來展望

The Electric Motor Market size is estimated at USD 146.40 billion in 2025, and is expected to reach USD 222.02 billion by 2030, at a CAGR of 8.69% during the forecast period (2025-2030).

Growth is anchored in the worldwide push for electrification, stricter minimum-efficiency regulations, and rising demand from electric vehicles, HVAC upgrades, and renewable-energy projects. Tighter IEC efficiency classes, combined with the EU Ecodesign Directive and comparable rules in North America and Asia, are accelerating replacement sales of legacy motors. Simultaneously, sustained expansion of manufacturing in China, India, and Southeast Asia is raising unit volumes in industrial machinery, while IoT-enabled predictive-maintenance platforms shorten replacement cycles. The resulting shift toward IE4 and IE5 designs, permanent-magnet architectures, and integrated drives is heightening R&D competition and driving consolidation among suppliers.

Global Electric Motor Market Trends and Insights

Rapid Electrification of Manufacturing Automation in Asia's Discrete Industries

Robot density in Chinese factories reached 322 units per 10,000 workers in 2024, each robot integrating 6-12 servo motors. Vietnam and India are replicating this automation curve to attract supply-chain diversification, spurring localized demand for precision motors with tighter speed-torque envelopes. End users now make procurement choices on lifetime efficiency rather than upfront cost, lifting premium-efficiency unit penetration rates across tier-2 Asian industrial parks. Digital twins for servo-driven cells cut commissioning time and signal an emerging service revenue pool for motor OEMs. As automation migrates to small-batch production, configurability and rapid motor-drive tuning have become decisive buying factors in the electric motor market.

Accelerating HVAC Adoption in US Residential Retrofits Driven by Federal Energy Standards

The latest SEER mandates rendered millions of legacy HVAC systems non-compliant, opening a 15% annual replacement channel through 2027. Variable-speed motors trim residential electricity demand by up to 40%, and cold-climate heat-pump launches in late 2024 expanded viability into northern states. Utilities sweeten the economics with time-of-use tariffs that reward inverter-driven compressors, reinforcing a steady pull for IE4-grade fan and blower motors. Contractors now bundle connected controls that report real-time load profiles, feeding analytics platforms that refine sizing for future retrofits. This regulatory-enabled shift keeps North America firmly on the growth path of the electric motor market.

Volatile Neodymium Prices Pressuring Permanent-Magnet Motor Economics

Neodymium spot prices slid 42% in the past 12 months after earlier spikes, complicating BOM forecasts for traction-motor programs. EV platforms require up to 5 kg of magnet material, so price swings ripple through entire model portfolios. OEMs hedge by dual-sourcing and experimenting with magnet-reduced topologies such as ferrite-assisted synchronous motors. Parallel research on synchronous-reluctance designs offers magnet-free torque maps but demands tight air-gap machining. The uncertainty nudges procurement teams toward long-term offtake contracts, yet sustained volatility could still shave growth from the electric motor market.

Other drivers and restraints analyzed in the detailed report include:

- Surging Offshore Wind Turbine Installations Requiring High-Power Permanent-Magnet Motors in Europe

- Battery Electric Vehicle Powertrain Ramp-Up in China Catalyzing High-Efficiency Traction Motors Demand

- Supply Constraints of IGBT Modules Limiting High-Voltage Motor Production

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

AC units generated 73.34% of global revenue in 2024, and their 9.4% compound growth will keep them central to the electric motor market size narrative through 2030. Induction models remain the default for conveyors, pumps, and fans, while synchronous variants proliferate where speed precision matters. Digital drives now auto-tune rotor flux to squeeze extra kilowatt-hours, making IE4 induction systems a drop-in swap for IE2 legacy fleets. On the DC side, brushless designs extend service intervals in drones and e-bikes, carving defensible niches without threatening overall AC share.

Mature tooling, abundant spare parts, and simplified installation secure AC motors' hold on brownfield retrofits, yet emerging axial-flux topologies hint at fresh competitive stakes. Servo grades feed advanced robotics, fusing feedback encoders with edge computing for millisecond-level motion control. Against this backdrop, the electric motor market continues to reward suppliers that blend scale economics with platform-ready modularity.

Fractional-horsepower units cornered 52% of 2024 shipments as smart appliances, HVAC blowers, and handheld devices multiplied. Tight packaging constraints spur emphasis on miniaturization, with halogen-free insulation films and powder-metal gears lifting thermal limits. In contrast, >500 HP machines will post an 8% CAGR, creating an outsized revenue impact despite modest volumes. Large-frame permanent-magnet motors now propel 14-MW offshore wind nacelles, while mining conveyors demand rugged TEFC housings rated for desert climates.

Integral-horsepower brackets (1-500 HP) remain the backbone of process lines, benefitting from variable-frequency drives that unlock 20-30% energy savings. As OEMs broaden their IE4 catalogs, segment crossover formats blur, blending compact stator geometries of small motors with the cooling strategies of their high-power cousins. All told, divergent growth dynamics within power classes reinforce the complexity of sizing opportunities across the electric motor market.

The Electric Motor Market Report is Segmented by Motor Type (DC Motor, AC Motor, and Others), Output Power Rating (Fractional Horsepower, and Others), Voltage (Low Voltage, Medium Voltage, and High Voltage), Application (Industrial Machinery, HVAC and Refrigeration, and Others), End-Use Industry (Residential, Commercial, and Industrial), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific led with 42.6% of 2024 revenue and will clock a 10.7% CAGR to 2030 as China maintains volume leadership and India accelerates Make-in-India initiatives. Guangdong-based motor clusters integrate end-to-end casting, winding, and drive electronics, compressing lead times for domestic EV customers. Vietnam's industrial parks lure contract manufacturers that back-source motors to regional suppliers, widening supply webs. Government incentives on high-efficiency equipment encourage swift adoption of IE4 grades across textile and semiconductor fabs.

North America holds the second-largest stake, energized by federal HVAC efficiency laws and a vibrant automation ecosystem. Predictive-maintenance retrofits in Midwest auto plants cut downtime by up to 45%, nudging continuous replacement orders. The US battery-plant build-out funnels traction-motor R&D spend into joint labs that test rotor laminations under high-speed duty cycles. Canada's on-shore wind repowering schemes shift procurement toward lighter direct-drive units, enriching the electric motor market.

Europe sustains growth on dual pillars of offshore wind and stringent Ecodesign rules. Ports on the North Sea expand nacelle staging capacity to manage 15-MW turbines outfitted with direct-drive PM generators. Manufacturers centralize service hubs in Poland and Spain to satisfy 5-year overhaul contracts. EU energy-price volatility pushes industrial users to prioritise IE4 retrofits, shortening payback horizons.

The Middle East and Africa, though smaller in absolute terms, post above-trend growth from water-desalination plants and gas booster stations. UAE EPC contracts specify explosion-proof motors with IECEx certification, creating pockets of high-margin demand. South America's industrial restarts in Brazil and Chile reignite orders for medium-voltage pump drives and sugar-mill crushers. Across all regions, regulatory convergence on efficiency keeps demand momentum intact for the electric motor market.

- ABB Ltd.

- Siemens AG

- Nidec Corporation

- Regal Rexnord Corporation

- WEG S.A.

- Toshiba Corporation

- Hitachi Ltd.

- Rockwell Automation, Inc.

- AMETEK, Inc.

- Johnson Electric Holdings Ltd.

- TECO Electric & Machinery Co., Ltd.

- Mitsubishi Electric Corporation

- Baldor Electric Company

- Brook Crompton Holdings Ltd.

- Anhui Wannan Electric Machine Co., Ltd.

- Kirloskar Electric Company Ltd.

- Hyosung Heavy Industries

- Danaher Motion (Kollmorgen)

- Yaskawa Electric Corporation

- Fuji Electric Co., Ltd.

- Robert Bosch GmbH

- Schneider Electric SE

- SEW-Eurodrive GmbH & Co. KG

- Emerson Electric Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Recent Trends & Developments

- 4.3 Market Drivers

- 4.3.1 Rapid Electrification of Manufacturing Automation in Asia?s Discrete Industries

- 4.3.2 Accelerating HVAC Adoption in US Residential Retrofits Driven by Federal Energy Standards

- 4.3.3 Surging Offshore Wind Turbine Installations Requiring High-Power Permanent-Magnet Motors in Europe

- 4.3.4 Battery Electric Vehicle Powertrain Ramp-Up in China Catalyzing High-Efficiency Traction Motors Demand

- 4.3.5 Industrial IoT-Enabled Predictive Maintenance Boosting Replacement of Aging Motors in North America

- 4.3.6 Government Mandates on MEPS Propelling IE4 & IE5 Motor Sales Globally

- 4.4 Market Restraints

- 4.4.1 Volatile Neodymium Prices Pressuring Permanent-Magnet Motor Economics

- 4.4.2 Supply Constraints of IGBT Modules Limiting High-Voltage Motor Production

- 4.4.3 Lengthy Certification Cycles for Explosion-Proof Motors in Middle-East Oil & Gas

- 4.4.4 Growing Adoption of Integrated Servo Drives Reducing Stand-Alone Motor Revenue Opportunities

- 4.5 Supply-Chain Analysis

- 4.6 Regulatory Outlook

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Motor Type

- 5.1.1 AC Motor (Induction (Asynchronous), Synchronous)

- 5.1.2 DC Motor (Brushed, Brushless (BLDC))

- 5.1.3 Others (Hermetic Motor, Stepper Motor)

- 5.2 By Output Power Rating

- 5.2.1 Fractional Horsepower (Below 1 HP)

- 5.2.2 Integral Horsepower (1 to 500 HP)

- 5.2.3 High-Power (Above 500 HP)

- 5.3 By Voltage

- 5.3.1 Low Voltage (Below 1 kV)

- 5.3.2 Medium Voltage (1 to 6 kV)

- 5.3.3 High Voltage (Above 6 kV)

- 5.4 By Application

- 5.4.1 Industrial Machinery

- 5.4.2 HVAC and Refrigeration

- 5.4.3 Automotive and Transportation

- 5.4.4 Residential Appliances

- 5.4.5 Utilities and Energy

- 5.4.6 Others (Agriculture, Oil and Gas, Mining)

- 5.5 By End-Use Industry

- 5.5.1 Residential

- 5.5.2 Commercial

- 5.5.3 Industrial

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Nordic Countries

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Malaysia

- 5.6.3.6 Thailand

- 5.6.3.7 Indonesia

- 5.6.3.8 Vietnam

- 5.6.3.9 Australia

- 5.6.3.10 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Egypt

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Siemens AG

- 6.4.3 Nidec Corporation

- 6.4.4 Regal Rexnord Corporation

- 6.4.5 WEG S.A.

- 6.4.6 Toshiba Corporation

- 6.4.7 Hitachi Ltd.

- 6.4.8 Rockwell Automation, Inc.

- 6.4.9 AMETEK, Inc.

- 6.4.10 Johnson Electric Holdings Ltd.

- 6.4.11 TECO Electric & Machinery Co., Ltd.

- 6.4.12 Mitsubishi Electric Corporation

- 6.4.13 Baldor Electric Company

- 6.4.14 Brook Crompton Holdings Ltd.

- 6.4.15 Anhui Wannan Electric Machine Co., Ltd.

- 6.4.16 Kirloskar Electric Company Ltd.

- 6.4.17 Hyosung Heavy Industries

- 6.4.18 Danaher Motion (Kollmorgen)

- 6.4.19 Yaskawa Electric Corporation

- 6.4.20 Fuji Electric Co., Ltd.

- 6.4.21 Robert Bosch GmbH

- 6.4.22 Schneider Electric SE

- 6.4.23 SEW-Eurodrive GmbH & Co. KG

- 6.4.24 Emerson Electric Co.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment