|

市場調查報告書

商品編碼

1851602

隔熱塗料:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Thermal Insulation Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

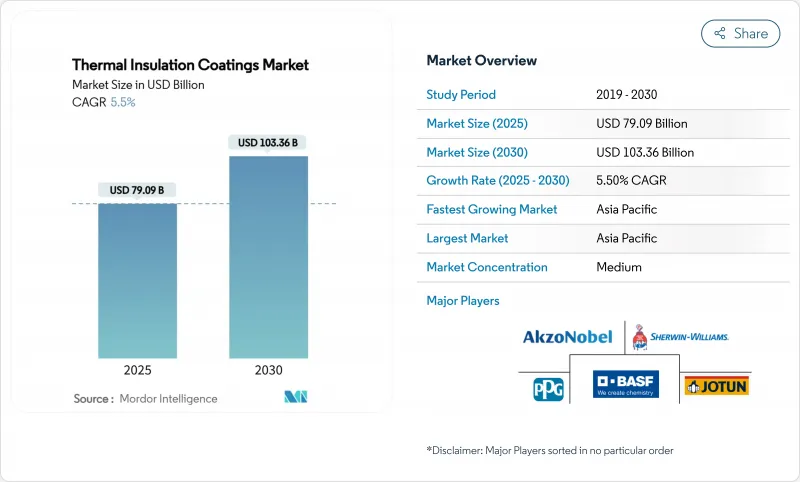

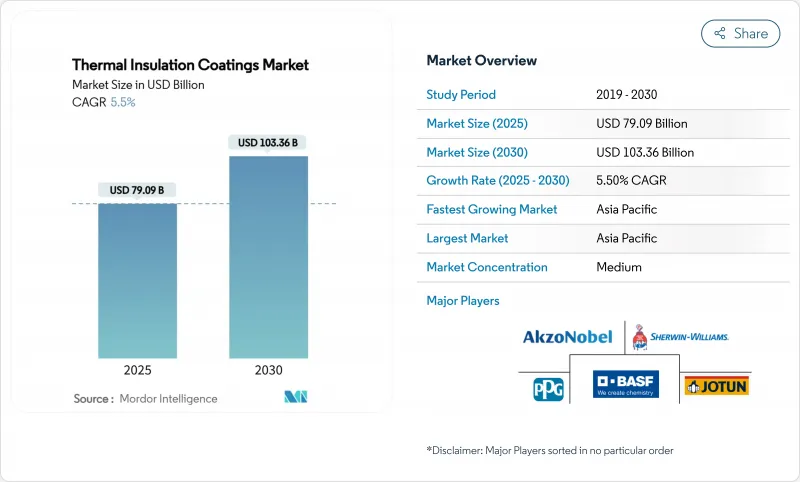

預計到 2025 年,隔熱塗料市場規模將達到 790.9 億美元,到 2030 年將達到 1,033.6 億美元,預測期(2025-2030 年)複合年成長率為 5.5%。

這一優異表現表明,市場對高性能保溫材料的需求將持續成長,遠遠超出傳統建築應用領域,涵蓋電氣化製程熱系統、液化天然氣基礎設施和電池溫度控管等。歐洲各地能源效率法規、脫碳需求以及第四代區域供熱管網的建設,正在加速採用能夠承受超過1200°C高溫的先進隔熱材料。同時,亞太地區的工業擴張正在擴大煉油廠、石化企業和汽車零件行業高性能塗料的基本客群,而北美的航太專案則推動了超高溫釔安定氧化鋯(YSZ)系統的應用。由此產生的競爭環境將使那些將垂直整合與材料科學進步相結合的供應商受益,例如,採用氣凝膠-環氧樹脂混合配方,實現低於0.020 W m-1 K-1的熱導率。

全球隔熱塗料市場趨勢及洞察

新建煉油廠

全球煉油廠建設持續推動隔熱塗料市場的發展。印度、中國和阿拉伯灣地區的新煉油廠在蒸餾塔和熱交換器殼體上採用多層環氧樹脂隔熱層,工作溫度介於200°C至800°C之間。計劃業主擴大將防腐蝕和數位膜厚監測功能整合到同一塗層方案中,以減少非計劃性停機並延長設備使用壽命。能夠提供適用於常溫和循環溫度環境認證的供應商,正獲得大量大型資本計劃訂單。

擴大區域供熱和製冷網路

第四代區域供熱製冷網路將在較低的供熱溫度下運行,因此需要使用能夠承受反覆熱循環並降低輸送損耗的塗層。丹麥市政能源合作社已證明,先進的隔熱材料可以將年度熱損耗降低幾個百分點,並提高熱泵效率。德國和瑞典也正在進行類似的維修,使用氣凝膠底漆,以滿足更嚴格的隔熱目標。

高額資金需求

等離子噴塗室、自動化龍門架和可控氣氛固化爐造價數百萬美元,限制了新進業者的產能。因此,大型綜合製造商主導長期供應協議,而小型施用器則面臨資金籌措難題。正如近期一家多元化化工集團內部的資產剝離討論所表明的那樣,資產組合重組凸顯了資本密集型行業面臨的壓力。

細分市場分析

預計到2024年,環氧樹脂體系將維持36.19%的隔熱塗料市場佔有率,這主要得益於其優異的附著力和耐化學腐蝕性,尤其適用於煉油廠管路、船舶甲板和海上平台。這些產品將支撐亞太和中空地區規劃中的防護襯裡計劃,佔據隔熱塗料市場的大部分佔有率。採用空心玻璃微球增強配方,可在不犧牲塗層韌性的前提下,達到0.180 W m-1 K-1或更低的導熱係數。

目前二氧化矽氣凝膠塗層的銷售額仍處於個位數成長階段,但預計到2030年將達到5.91%的複合年成長率。其0.015 W m⁻¹ K⁻¹的超低電導率使其能應用於以往需要真空絕熱板的常壓環境。透過將氣凝膠粉末共分散在環氧樹脂基體中,製造商將機械強度與近乎超高的絕緣性能相結合,進一步提升了該行業對未來技術規範的影響力。在航太領域,熵穩定氧化物和氧化釔穩定氧化鋯(YSZ)平台正瞄準工作溫度超過1200°C的渦輪葉片蒙皮,預示著技術交叉融合的更多機會。

到2024年,液態噴塗線將佔據熱障塗層市場45.19%的佔有率,繼續以6.45%的複合年成長率領先其他噴塗方式。其主要優勢在於能夠無縫覆蓋焊接和彎曲半徑,並且由於整合了機器人噴頭,生產速度得以提高。目前,加工廠正在部署視覺分析技術來測量濕膜厚度並自動校正噴槍速度,從而最大限度地減少過噴並提高產量比率。粉末噴塗線在網殼結構以外的區域以及某些利用靜電吸引形成均勻塗層的管道中仍然具有應用價值。

隔熱塗料市場報告按樹脂類型(丙烯酸、環氧樹脂、聚氨酯等)、塗料形式(液體噴塗、粉末、真空沉澱)、應用(建築外牆、工業設備和管道、儲存槽和容器等)、最終用戶行業(建築和施工、工業/製造、汽車等)和地區(亞太地區、北美、歐洲等)進行細分。

區域分析

亞太地區預計到2024年將佔總收入的40.08%,這主要得益於中國、印度和韓國的計劃儲備。該地區各國政府正優先考慮煉油自給自足,直接推動了隔熱塗料市場的發展。此外,日本的液化低溫運輸以及服務東南亞島嶼的浮體式儲存再氣化裝置(FSRA)計畫也正在加速推進。

北美地區得益於航太航太推進計畫和重工業區製程熱電氣化試點計畫的支持。聯邦刺激計畫鼓勵社區進行節能維修,引導市政公用事業公司採用先進的覆層材料以減少輸電損耗。諸如2020年加拿大建築節能規範等法規提高了牆體結構的隔熱要求,從而推動了噴塗陶瓷微球產品需求的成長。

歐洲在政策主導的脫碳領域持續保持領先地位,並佔據了人口最密集的區域供熱市場,這推動了經現場熱循環耐久性檢驗的塗層不斷升級。新建重工業設施的短缺使得人們的關注點轉向對老舊工業園區維修,加裝高溫熱泵系統,而塗層可以有效降低導熱油迴路中的傳導損失。同時,中東和非洲正利用石油資本投資計劃,擴大石化工業的塗層應用;南美洲的礦區也開始採用塗層來保護製程容器免受腐蝕性酸和晝夜溫差的影響。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 新煉油廠的建設

- 擴大區域供熱和製冷網路

- 建設產業需求增加

- 重工業製程熱的電氣化。

- 液化天然氣低溫運輸物流快速成長

- 市場限制

- 高額資金需求

- 易揮發原料(環氧樹脂和聚氨酯)價格

- 在高溫資產中的適用性有限

- 供應鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依樹脂類型

- 丙烯酸纖維

- 環氧樹脂

- 聚氨酯

- 釔安定氧化鋯(YSZ)

- 其他樹脂類型(例如二氧化矽氣凝膠基樹脂等)

- 按塗層類型

- 液體噴霧

- 粉末

- 真空沉澱

- 透過使用

- 建築物外牆(牆壁、屋頂)

- 工業設備和管道

- 儲存槽和容器

- 汽車零件

- 船體外殼和甲板結構

- 航太和渦輪機零件

- 按最終用戶行業分類

- 建築/施工

- 工業/製造業

- 車

- 海洋

- 其他(食品加工、製藥)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- AkzoNobel NV

- BASF

- Behr Process LLC

- DAW SE

- Dow

- Evonik Industries AG

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd

- Mascoat

- Nippon Paint Holdings Co., Ltd

- OC Oerlikon Management AG

- PPG Industries, Inc.

- RPM International

- Sharpshell Engineering

- Sika AG

- Synavax

- The Sherwin-Williams Company

第7章 市場機會與未來展望

The Thermal Insulation Coatings Market size is estimated at USD 79.09 billion in 2025, and is expected to reach USD 103.36 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

This performance signals sustained demand that now stretches far beyond conventional construction use cases and into electrified process-heat systems, LNG infrastructure, and battery thermal management. Enforceable energy-efficiency codes, mounting decarbonization mandates, and the build-out of fourth-generation district-heating grids across Europe are accelerating the adoption of advanced thermal barriers capable of service temperatures above 1,200 °C. In parallel, Asia-Pacific's industrial expansion is widening the customer base for high-performance coatings in refineries, petrochemicals, and automotive components, while North American aerospace programs are stimulating uptake of ultra-high-temperature yttria-stabilized zirconia (YSZ) systems. The resulting competitive environment rewards suppliers that combine vertical integration with materials science advances, such as hybrid aerogel-epoxy formulations that deliver sub-0.020 W m-1 K-1 thermal conductivity.

Global Thermal Insulation Coatings Market Trends and Insights

Construction of New Refineries

Global refinery buildouts continue to anchor the thermal insulation coatings market. New complexes in India, China, and the Arabian Gulf specify multilayer epoxy barriers for distillation towers and heat-exchanger shells that run between 200 °C and 800 °C. Project owners increasingly bundle corrosion resistance and digital thickness monitoring into the same coating package to curb unplanned outages and extend asset life. Suppliers that can certify systems for both normal and cyclic temperature environments gain access to the largest capital projects pipeline.

Expansion of District Heating and Cooling Networks

Fourth-generation district-heating grids operate at lower supply temperatures, demanding coatings capable of reducing distribution losses while surviving repetitive thermal cycling. Denmark's municipal energy cooperatives demonstrate that advanced insulation can shave multiple percentage points from annual heat losses, thereby improving heat-pump efficiency. Similar retrofits across Germany and Sweden specify aerogel-infused primers to meet the stricter heat-retention targets.

High Capital Requirement

Plasma-spray booths, automated gantries, and controlled-atmosphere curing ovens can cost several million USD, limiting new-entrant capacity. Large integrated producers therefore dominate long-run supply contracts, while smaller applicators face financing hurdles. Portfolio restructuring, as seen in recent divestiture discussions inside diversified chemistry groups, underscores capital intensity pressures.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand for Construction Industry

- Electrification of Process-Heat in Heavy Industry

- Volatile Raw-Material (Epoxy and PU) Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy systems retained a 36.19% share of the thermal insulation coatings market in 2024, buoyed by strong adhesion and chemical resistance that suit refinery piping, marine deck plates, and offshore platforms. They underpin a significant portion of the thermal insulation coatings market size for protective-lining projects scheduled across APAC and the Middle East. Enhanced formulations embed hollow-glass microspheres to bring thermal conductivity below 0.180 W m-1 K-1 without sacrificing film toughness.

Silica-aerogel coatings, while holding only single-digit revenue today, record a 5.91% CAGR to 2030. Ultra-low conductivity readings of 0.015 W m-1 K-1 unlock ambient-pressure applications that once demanded vacuum-insulated panels. Manufacturers co-disperse aerogel powder into epoxy matrices to combine mechanical strength with near-super-insulating performance, giving the segment outsized influence on future specifications. At the aerospace frontier, entropy-stabilized oxide and YSZ platforms target turbine-blade skins running above 1,200 °C, suggesting further technology crossover opportunities.

Liquid spray lines captured 45.19% of thermal insulation coatings market share in 2024 and continue to outpace other forms at a 6.45% CAGR. Their chief advantages include seamless coverage on weld seams and radius bends, plus production-rate gains from robot-integrated spray heads. Process yards now deploy vision analytics to gauge wet-film thickness and self-correct gun speed, minimizing overspray and improving yield. Powder lines remain relevant in gridshell architecture and certain pipeline externals where electrostatic attraction ensures uniform film builds.

The Thermal Insulation Coatings Market Report is Segmented by Resin Type (Acrylic, Epoxy, Polyurethane, and More), Coating Form (Liquid Spray, Powder, Vacuum-Deposited), Application (Building Envelope, Industrial Equipment and Pipelines, Storage Tanks and Vessels, and More), End-User Industry (Building and Construction, Industrial/Manufacturing, Automotive, and More), and Geography (Asia Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific holds 40.08% of 2024 revenue, reflecting megaproject pipelines in China, India, and South Korea. Regional governments prioritize refinery self-sufficiency, which directly inflates the thermal insulation coatings market. Added momentum comes from LNG cold-chain terminals in Japan and floating storage regasification units serving Southeast Asian islands.

North America is assisted by aerospace propulsion programs and process-heat electrification pilots in heavy industry alleys. Federal stimulus packages encourage district-energy retrofits, steering municipal utilities toward advanced coating overlays that lower distribution losses. Regulations like Canada's National Energy Code for Buildings 2020, which lifts thermal-resistance requirements for wall assemblies, anchor recurrent demand for spray-applied ceramic microsphere products.

Europe maintains leadership in policy-driven decarbonization and commands the densest district-heating market, fostering continuous specification upgrades for coatings with validated ex-situ thermal-cycling endurance. Scarcity of new-build heavy industry shifts focus to retrofitting aging industrial parks with high-temperature heat-pump systems, where coatings moderate conductive losses on hot-oil loops. Meanwhile, the Middle-East and Africa leverages oil-capex programs to expand adoption in petrochemical parks, whereas South America's mining belts employ coatings to buffer process vessels against aggressive acids and wide daily temperature swings.

- AkzoNobel N.V.

- BASF

- Behr Process LLC

- DAW SE

- Dow

- Evonik Industries AG

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd

- Mascoat

- Nippon Paint Holdings Co., Ltd

- OC Oerlikon Management AG

- PPG Industries, Inc.

- RPM International

- Sharpshell Engineering

- Sika AG

- Synavax

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Construction of New Refineries

- 4.2.2 Expansion of District Heating and Cooling Networks

- 4.2.3 Increasing demand for the construction industry

- 4.2.4 Electrification of Process-Heat in Heavy Industry

- 4.2.5 Surge in LNG Cold-Chain Logistics

- 4.3 Market Restraints

- 4.3.1 High Capital Requirement

- 4.3.2 Volatile Raw-Material (Epoxy and PU) Prices

- 4.3.3 Limited Applicability in Ultra High Temperature Assets

- 4.4 Supply Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Acrylic

- 5.1.2 Epoxy

- 5.1.3 Polyurethane

- 5.1.4 Yttria-Stabilised Zirconia (YSZ)

- 5.1.5 Other Resin Types (Silica Aerogel-Based, etc.)

- 5.2 By Coating Form

- 5.2.1 Liquid Spray

- 5.2.2 Powder

- 5.2.3 Vacuum-Deposited

- 5.3 By Application

- 5.3.1 Building Envelope (Walls, Roofs)

- 5.3.2 Industrial Equipment and Pipelines

- 5.3.3 Storage Tanks and Vessels

- 5.3.4 Automotive Components

- 5.3.5 Marine Hull and Deck Structures

- 5.3.6 Aerospace and Turbine Parts

- 5.4 By End-user Industry

- 5.4.1 Building and Construction

- 5.4.2 Industrial/Manufacturing

- 5.4.3 Automotive

- 5.4.4 Marine

- 5.4.5 Others (Food Processing, Pharma)

- 5.5 By Geography

- 5.5.1 Asia Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AkzoNobel N.V.

- 6.4.2 BASF

- 6.4.3 Behr Process LLC

- 6.4.4 DAW SE

- 6.4.5 Dow

- 6.4.6 Evonik Industries AG

- 6.4.7 Hempel A/S

- 6.4.8 Jotun

- 6.4.9 Kansai Paint Co., Ltd

- 6.4.10 Mascoat

- 6.4.11 Nippon Paint Holdings Co., Ltd

- 6.4.12 OC Oerlikon Management AG

- 6.4.13 PPG Industries, Inc.

- 6.4.14 RPM International

- 6.4.15 Sharpshell Engineering

- 6.4.16 Sika AG

- 6.4.17 Synavax

- 6.4.18 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment