|

市場調查報告書

商品編碼

1851596

石墨:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Graphite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

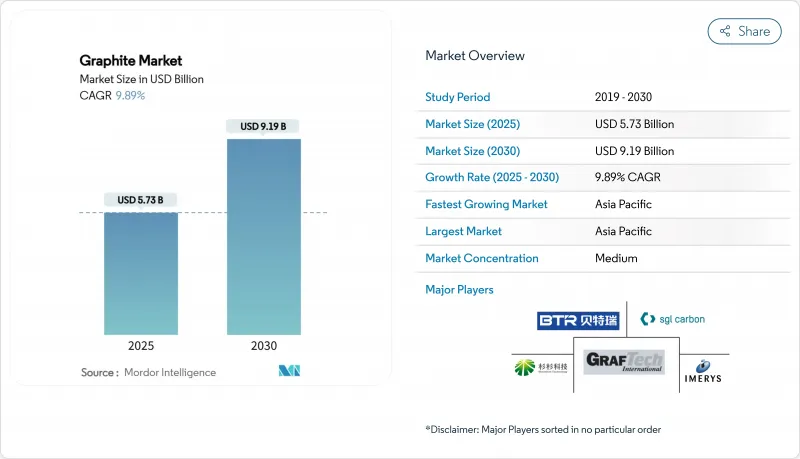

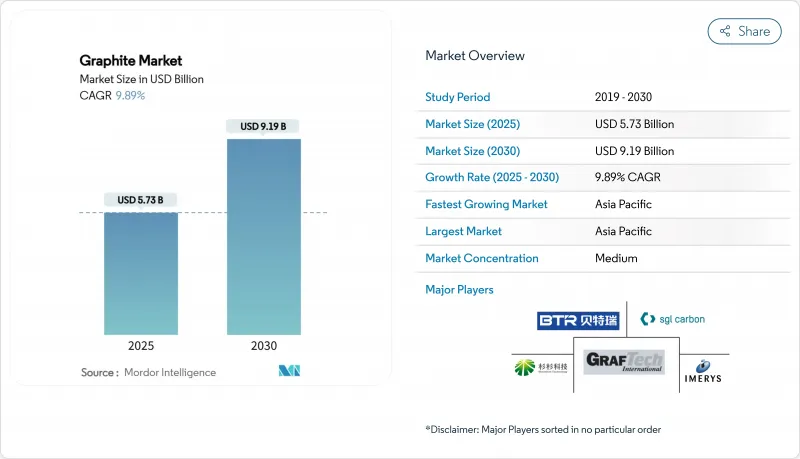

預計到 2025 年石墨市場規模為 57.3 億美元,到 2030 年將達到 91.9 億美元,預測期(2025-2030 年)複合年成長率為 9.89%。

強勁的電池需求、鋼鐵製造業的結構性轉變以及關鍵材料供應鏈在地化努力的加強,共同推動了這一發展趨勢。石墨產業正經歷從大宗商品產業向戰略性材料產業的重大轉型,為交通運輸、電力和重工業的脫碳轉型提供支援。亞太地區自然資源的集中以及北美和歐洲的政策獎勵,正在推動對採礦、加工和回收資產的新投資。同時,不斷上漲的資本成本和日益嚴格的環境法規促使合資企業在確保負責任採購的同時分散風險。合約期限的延長是推動這一趨勢的新興因素,如今承購協議的期限通常為10年或更長。

全球石墨市場趨勢與洞察

鋰離子電池產業需求不斷成長

目前,電池製造商佔據石墨市場最大佔有率,該細分市場年複合成長率超過17%,顯示未來十年將持續加速成長。電動車品牌間日益激烈的價格競爭加劇了陽極的成本敏感性,並使天然石墨更具偏好,其每噸價格比合成石墨低數千美元。這是因為合成石墨的生產需要3000°C的高溫,而天然石墨的提煉溫度通常低於1800°C。近期的競標數據顯示,汽車製造商願意接受首圈效率略有下降,以換取天然材料更優的ESG(環境、社會和治理)表現。

亞洲和中東鋼鐵產量不斷成長

為減少排放而轉向電弧爐(EAF)顯著推動了對高功率石墨電極的需求。隨著機械和汽車應用在鋼鐵消費量中所佔佔有率的不斷增加,對電極耐久性和導電性的需求也隨之成長。電極純度、出鋼間隔時間和爐子整體能源效率之間存在直接聯繫,因此電極供應商可以透過證明其產品硫氮含量低來獲得溢價。

嚴格的環境法規

碳定價法規和範圍 3 揭露框架鼓勵生產商採用再生能源,並試行美國能源局開發的低溫催化石墨化技術。

細分市場分析

儘管合成石墨目前佔據主導地位(預計到2024年將佔58.09%的市場佔有率),但天然石墨的市場佔有率正在迅速成長。諸如鹼燒結合微波加熱等新型純化工藝,如今已能生產出純度高達99.95%的天然石墨,縮小了以往的性能差距。由此可見,OEM採購平台中出現的生命週期評估數據正促使採購策略向天然石墨傾斜,即便其直接電池能量密度略低。

生質能衍生合成石墨引發了人們對供應安全的擔憂,因為它可能減少對開採的天然石墨和石油針狀焦的依賴。先驅性研究證實,木質素基前驅體可產生層間距適合鋰離子嵌入的紊亂層狀碳。由此得出一個新的推論:天然鱗片石墨和生物石墨的雙重籌資策略正逐漸成為應對地緣政治動盪和碳價上漲的有效對沖手段。

區域分析

目前,亞太地區的石墨市佔率為55.42%,年複合成長率超過11%,成長最快。中國的領先地位歸功於叢集將片狀石墨礦、精煉生產線和球化廠整合到單一物流走廊。一種新興理論認為,印尼和馬來西亞等東南亞國協正效法中國的叢集模式,吸引中游加工企業,希望在價值鏈中打造新的節點。

北美正從依賴進口的消費群向新興的生產市場轉型,這得益於《通貨膨脹削減法案》的稅額扣抵(該政策可報銷合格陽極組件成本的10%)。歐洲石墨產業的發展更受監管導向而非資源供應的影響。電池中強制性的最低再生材料基準值將促使超級工廠與回收商簽訂多年供應協議。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 鋰離子電池產業需求不斷成長

- 亞洲和中東鋼鐵產量不斷成長

- 加強打造以循環為導向的社會

- 電子產業對導電石墨的需求日益成長

- 來自航太和國防工業的需求不斷成長

- 市場限制

- 嚴格的環境法規

- 優質天然石墨供應有限

- 原物料價格波動

- 價值鏈分析

- 監理與環境展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 天然石墨

- 合成石墨

- 透過使用

- 電極

- 耐火材料、鑄造廠及鑄造廠

- 電池

- 潤滑油

- 其他用途(散熱材料、摩擦材料、煞車襯等)

- 按最終用戶行業分類

- 冶金

- 電子元件

- 車

- 其他產業(能源、航太和國防等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Asbury Carbons

- BTR New Material Group Co., Ltd.

- GrafTech International

- Graphit Kropfmuhl GmbH

- Imerys

- Mason Resources Inc.

- Mersen

- Nippon Kokuen Group

- Northern Graphite

- POCO

- Resonac Holdings Corporation

- SGL Carbon

- Shanghai Shanshan Technology Co., Ltd.

- Syrah Resources Limited

- Tokai Carbon Co., Ltd.

- Triton Minerals Limited

第7章 市場機會與未來展望

The Graphite Market size is estimated at USD 5.73 billion in 2025, and is expected to reach USD 9.19 billion by 2030, at a CAGR of 9.89% during the forecast period (2025-2030).

Robust battery demand, structural shifts in steelmaking, and intensifying efforts to localize critical-material supply chains collectively underpin this trajectory. The graphite industry is experiencing a decisive shift from a bulk commodity sector to a strategic materials arena supporting decarbonization across mobility, power, and heavy industry. Natural-resource concentration in Asia-Pacific and policy incentives in North America and Europe are catalyzing new investment in mining, processing, and recycling assets. Simultaneously, the rising cost of capital and stricter environmental scrutiny are encouraging joint ventures that spread risk while ensuring responsible sourcing. A fresh inference that emerges is that contract structures are lengthening off-take agreements now regularly span 10-plus years, signaling buyers' willingness to lock in feedstock security even at higher prices.

Global Graphite Market Trends and Insights

Augmenting Demand from the Lithium-ion Battery Industry

Battery manufacturers now account for the single largest slice of the graphite market share, and the segment's 17%-plus CAGR indicates sustained acceleration through the decade. Intensifying price competition among electric-vehicle (EV) brands magnifies the cost sensitivity of anodes, tilting preference toward natural graphite that offers a multithousand-dollar per-tonne advantage over synthetic alternatives. This cost gradient is widening as energy prices rise, because synthetic production requires temperatures of 3,000 °C, whereas natural purification usually runs below 1,800 °C. One inference observable from recent tender data is that automakers are accepting slightly lower first-cycle efficiency in exchange for natural graphite's better ESG profile, illustrating how carbon-footprint metrics have become commercially material.

Increase in Steel Production in Asia and the Middle East

The shift toward electric-arc furnaces (EAF) for emissions abatement is materially lifting demand for ultra-high-power graphite electrodes. Machinery and automotive applications now drive a larger share of steel consumption, implicitly elevating electrode durability and conductivity requirements. A fresh inference is that electrode suppliers can certify lower sulfur and nitrogen contents, secure premium price realizations because EAF operators see a direct link between electrode purity, tap-to-tap time, and overall furnace energy efficiency.

Stringent Environmental Regulations

Carbon-pricing regimes and Scope-3 disclosure frameworks are prompting producers to adopt renewable power and to pilot low-temperature catalytic graphitization developed by the U.S. Department of Energy, which halves energy use and compresses production cycles from weeks to hours.

Other drivers and restraints analyzed in the detailed report include:

- Increase in Natural Graphite Recycling Initiatives

- Growing Demand from the Electronics Industry

- Limited Availability of High-Quality Natural Graphite

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Natural graphite is rapidly gaining market share despite synthetic graphite's current dominance at 58.09% of the market in 2024. Fresh purification processes such as caustic baking combined with microwave heating now deliver 99.95% purity, closing the historical performance gap. A clear inference is that life-cycle-assessment data, which now feature in OEM purchasing dashboards, are tipping procurement policies in favor of natural graphite even when immediate cell-level energy density is marginally lower.

Supply-security concerns amplify interest in biomass-derived synthetic graphite, which could reduce dependence on mined natural graphite and petroleum needle-coke routes. Pilot studies confirm that lignin-based precursors yield turbostratic carbon with an interlayer spacing conducive to lithium intercalation. The fresh inference is that dual-sourcing strategies, natural flake plus bio-graphite, are surfacing as an attractive hedge against geopolitical disruption and carbon-price escalation.

The Graphite Market Report Segments the Industry by Type (Natural Graphite and Synthetic Graphite), Application (Electrodes, Refractories, Casting, and Foundries, Batteries, Lubricants, and Other Applications), End-User Industry (Metallurgy, Electronic, Automotive, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific currently captures 55.42% graphite market share and registers the fastest regional CAGR at above 11%. China's dominance stems from integrated clusters that combine flake-graphite mines, purification lines, and spheronization plants into a single logistics corridor. A fresh inference is that ASEAN nations such as Indonesia and Malaysia are courting mid-stream processors, hoping to replicate China's cluster model and thus create alternative nodes in the value chain.

North America is transitioning from an import-dependent consumer base to an emerging producer, helped by the Inflation Reduction Act's tax credits that reimburse 10% of qualified anode-component costs. Europe's graphite industry is shaped by regulatory leadership rather than resource endowment. Mandatory minimum recycled-content thresholds in batteries are pushing gigafactories to sign multi-year supply contracts with recyclers.

- Asbury Carbons

- BTR New Material Group Co., Ltd.

- GrafTech International

- Graphit Kropfmuhl GmbH

- Imerys

- Mason Resources Inc.

- Mersen

- Nippon Kokuen Group

- Northern Graphite

- POCO

- Resonac Holdings Corporation

- SGL Carbon

- Shanghai Shanshan Technology Co., Ltd.

- Syrah Resources Limited

- Tokai Carbon Co., Ltd.

- Triton Minerals Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Augmenting Demand from the Lithium-ion Battery Industry

- 4.2.2 Increase in Steel Production in Asia and the Middle East

- 4.2.3 Increase in Natural Graphite Recycling Initiatives

- 4.2.4 Growing Demand for Conductive Graphite from Electronics Industry

- 4.2.5 Increasing Demand from Aerospace and Defense Industry

- 4.3 Market Restraints

- 4.3.1 Stringent Environmental Regulations

- 4.3.2 Limited Availability of High-Quality Natural Graphite

- 4.3.3 Fluctuation in Raw Material Prices

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Environmental Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Type

- 5.1.1 Natural Graphite

- 5.1.2 Synthetic Graphite

- 5.2 By Application

- 5.2.1 Electrodes

- 5.2.2 Refractories, Casting and Foundries

- 5.2.3 Batteries

- 5.2.4 Lubricants

- 5.2.5 Other Applications (Thermal Management Materials, Friction Products and Brake Linings,etc.)

- 5.3 By End-user Industry

- 5.3.1 Metallurgy

- 5.3.2 Electronic

- 5.3.3 Automotive

- 5.3.4 Other Industries (Energy, Aerospace and Defence, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Asbury Carbons

- 6.4.2 BTR New Material Group Co., Ltd.

- 6.4.3 GrafTech International

- 6.4.4 Graphit Kropfmuhl GmbH

- 6.4.5 Imerys

- 6.4.6 Mason Resources Inc.

- 6.4.7 Mersen

- 6.4.8 Nippon Kokuen Group

- 6.4.9 Northern Graphite

- 6.4.10 POCO

- 6.4.11 Resonac Holdings Corporation

- 6.4.12 SGL Carbon

- 6.4.13 Shanghai Shanshan Technology Co., Ltd.

- 6.4.14 Syrah Resources Limited

- 6.4.15 Tokai Carbon Co., Ltd.

- 6.4.16 Triton Minerals Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Increasing Applications of Graphite in Green Technologies

- 7.3 Increasing Graphene Demand and Nuclear Energy