|

市場調查報告書

商品編碼

1851595

汽車液壓系統:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Hydraulic Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

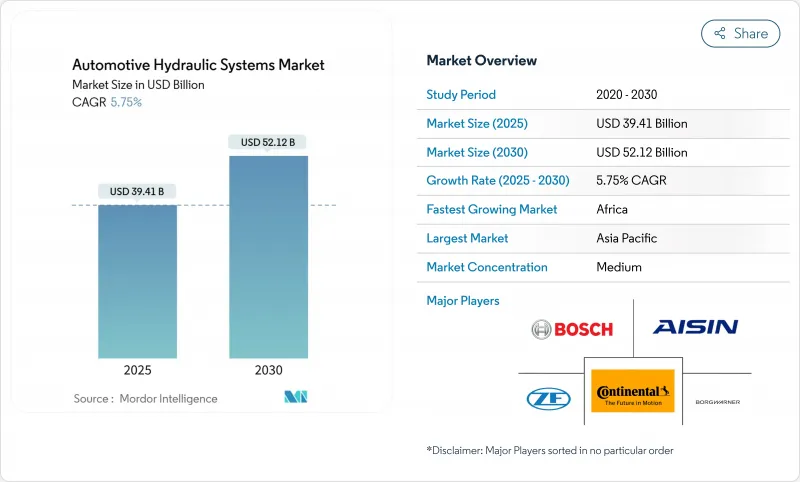

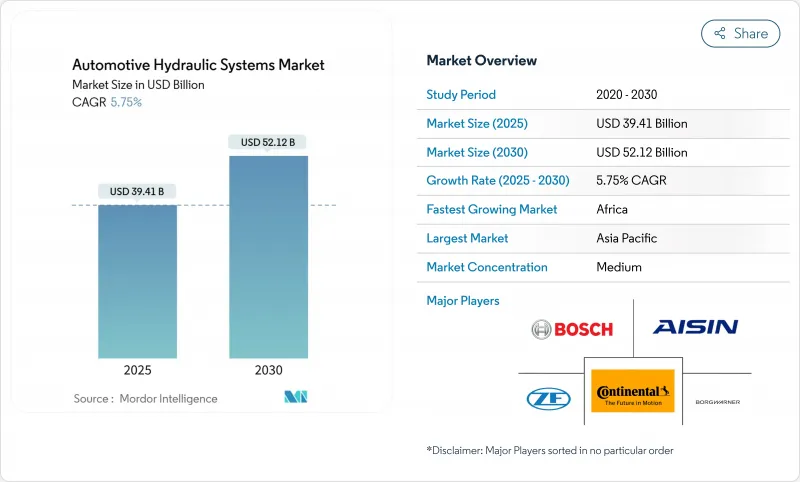

預計到 2025 年,汽車液壓系統市場規模將達到 394.1 億美元,到 2030 年將達到 521.2 億美元,複合年成長率為 5.75%。

儘管電氣化進程不斷推進,但該行業仍保持穩步發展,這反映出其有能力繼續發揮其在煞車、轉向和懸吊方面的核心作用。日益嚴格的全球煞車安全法規、不斷成長的商用車產量以及L3+級自動駕駛平台中電液模組的廣泛應用,持續推動市場需求。亞太地區憑藉中國產量的成長和印度產能的擴張,仍然是製造中心;而非洲作為基礎設施投資的驅動力,則代表著新的機會。同時,高階汽車製造商依靠液壓懸吊來提升駕駛舒適性,而商用車則優先考慮液壓懸吊試驗的可靠性,而非實驗性的替代方案。

全球汽車液壓系統市場趨勢與洞察

全球商用車產量與銷售成長

卡車和客車生產蓬勃發展,需要多個高壓迴路用於煞車、轉向和輔助驅動,導致每輛車的液壓元件數量增加。預計到2024年,印度汽車工業將生產3,060萬輛汽車,將提振國內外市場對液壓系統的需求。美國車隊營運商面臨底盤短缺,導致卡車利用率提高,需要定期進行液壓系統維護。零排放卡車電動動力傳動系統雖然仍採用液壓系統,但引入了額外的溫度控管迴路,進一步減少了元件數量。營運商重視久經考驗的耐用性,這將在電氣化進程不斷推進的同時,支撐汽車液壓系統市場的發展。

加強煞車安全法規(ABS、ESC、EBS)

新規要求汽車製造商安裝自動緊急煞車系統和增強型穩定性控制系統,這些系統依賴精確的液壓調節。美國國家公路交通安全管理局 (NHTSA) 的 FMVSS 127 標準規定,自 2029 年 9 月起,美國所有輕型車輛的碰撞避免速度目標為 62 英里/小時。歐盟即將實施的歐 7 標準將引入煞車顆粒物限制,推動低粉塵液壓元件的普及。這些要求將帶動汽車液壓系統市場對可尋址先進閥門、助力器和微型泵浦的需求。

快速過渡到全電動煞車和轉向系統

純電動車平台追求輕量化和精準控制,傾向於採用無需液壓管路的電子機械單元。在美國,環保署(EPA)的多污染物排放法規正在加速這項轉型。隨著電動車淘汰液壓零件,德國供應商也正在調整其生產佈局。商用卡車由於對液壓系統的要求更高,轉型速度較為緩慢,長期替代風險也對汽車液壓系統市場帶來壓力。

細分市場分析

到2024年,煞車系統將佔汽車液壓系統總銷量的45.12%,佔據市場主導地位。諸如美國國家公路交通安全管理局(NHTSA)的緊急煞車規則等監管要求確保了市場需求的持續穩定,即使是純電動車也保留了液壓備用迴路。同時,動力方向盤輔助系統正以6.52%的複合年成長率快速成長,因為電動液壓轉向器在能源效率和轉向手感之間取得了平衡。這表明,在電氣化平台上,汽車液壓系統的市場規模仍有可能繼續擴大。

由於防碰撞系統需要高壓調節,煞車性能穩定。轉向輔助功能因依賴快速液壓響應的主動車道維持技術而不斷增強。懸吊應用將受益於高階汽車對乘坐舒適性的需求,而隨著引擎電氣化,離合器和風扇驅動的應用將會減少。商用車中的再生液壓儲能是一個新興細分市場,將做出雖小但穩定的貢獻。

到2024年,主缸將佔零件銷售額的35.26%,凸顯其在各類車輛中的通用性。液壓幫浦的複合年成長率將達到7.46%,成為成長最快的零件,因為進階駕駛輔助功能需要按需供壓。這些數據表明,液壓泵將佔據汽車液壓系統市場佔有率的一部分,標誌著控制架構正從被動式轉向主動式轉變。

由於採用了複合材料管路的輕量化設計,儲液罐、軟管和歧管的價值提升。閥門和致動器也因整合感測器實現閉合迴路控制而價值增加。在開發不含 PFAS 的流體解決方案之前,蓄能器的發展前景尚不明朗,但預計它們在混合動力懸吊儲能領域仍將具有長期應用價值。

汽車液壓系統市場按應用(例如,煞車、離合器、懸吊)、組件(例如,主缸、工作缸)、車輛類型(例如,乘用車、輕型商用車)、銷售管道(例如,OEM、售後市場)和地區進行細分。市場預測以價值(美元)和銷售量(單位)為單位。

區域分析

至2024年,亞太地區將佔全球汽車液壓系統銷售的48.89%,凸顯其作為汽車液壓系統市場中心的地位。預計2024年5月,中國汽車產量將達到235.3萬輛,較去年同期成長7.6%,其中新能源車型產量將成長33.6%。預計2024年印度汽車產量將達到3,060萬輛,將擴大該地區汽車液壓系統的市場規模,並支撐長期需求。日本對電動車的補貼政策減少了部分動力傳動系統液壓系統的應用,但同時維持了對煞車系統和懸吊系統的需求,促使供應商調整產品組合。儘管亞太地區擁有深厚的供應鏈和豐富的勞動力資源,使其成為大眾市場零件的首選,但PFAS和洩漏法規正迫使工廠升級其流體處理流程。

在北美,嚴格的安全法規和快速的電氣化正在推動液壓系統需求的雙重浪潮。美國國家公路交通安全管理局 (NHTSA) 的新評估通訊協定和聯邦機動車輛安全標準 (FMVSS) 127 維持了煞車液壓系統的技術複雜性,而美國環保署 (EPA) 的排放法規則加速了電動車的普及,這可能會減少未來的車輛保有量。美國仍然是 L3 級自動駕駛中心,這為電液模組專家提供了研發優勢。加拿大和墨西哥正在透過美墨加協定 (USMCA) 下的一體化走廊加強其區域規模,儘管政策有所變化,但仍能穩定對北美組裝的供應。

歐洲在規則制定方面處於領先地位,但隨著歐7顆粒物和PFAS排放法規的實施,其成本競爭力日益下降,迫使企業進行昂貴的重新設計,而這筆費用只有財力雄厚的企業才能承擔。非洲將在2030年前實現7.57%的複合年成長率,基數較低,主要得益於奈及利亞、肯亞和埃及的基礎設施投資,這些投資將提振非公路液壓系統的需求。南美洲將隨著採礦和農業設備的蓬勃發展而保持穩定成長,但宏觀經濟的不確定性將使前景蒙上陰影。中東市場既保留了傳統的動力傳動系統偏好,又有產業政策獎勵,這可能會鼓勵本地液壓系統組裝。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 全球商用車產量與銷售成長

- 加強煞車安全法規(ABS、ESC、EBS)

- 豪華車對液壓懸吊的需求日益成長

- 用於3級以上自動駕駛系統的電液模組

- 新興市場入門級電動車的低成本液壓動力總成

- 混合懸吊中的再生液壓儲能

- 市場限制

- 快速過渡到全電動煞車和轉向系統

- 液壓油洩漏引發的環境問題

- 原料短缺推高了彈性體密封的成本。

- OEM廠商對機器人計程車乾式線傳煞車的偏好

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過使用

- 煞車

- 離合器

- 暫停

- 動力方向盤輔助

- 風扇驅動系統

- 汽門機構(挺桿/致動器)

- 其他

- 按組件

- 主缸

- 從動缸/輪缸

- 水庫

- 軟管和管件

- 液壓泵浦

- 閥門和歧管

- 致動器/增壓器

- 蓄能器及密封件

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中型和大型商用車輛

- 非公路用車(農業和建築)

- 按銷售管道

- OEM

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Continental AG

- Aisin Corporation

- BorgWarner Inc.

- Valeo SA

- Eaton Corporation plc

- Schaeffler AG

- KYB Corporation

- WABCO(ZF CVCS)

- JTEKT Corporation

- GKN Automotive

- Denso Corporation

- Nexteer Automotive Group

- Nissin Kogyo Co. Ltd

- Hitachi Astemo Ltd

- Brembo SpA

- Mando Corp

第7章 市場機會與未來展望

The Automotive Hydraulics Systems Market is valued at USD 39.41 billion in 2025 and is forecast to expand to USD 52.12 billion by 2030, registering a 5.75% CAGR.

Despite electrification, the steady advance reflects the sector's ability to preserve its core braking, steering, and suspension roles. Stricter global brake-safety mandates, rising commercial-vehicle output, and the spread of electro-hydraulic modules into Level 3+ autonomous driving platforms continue to lift demand. Thanks to China's production growth and India's capacity additions, Asia-Pacific remains the manufacturing hub, while Africa represents an emerging opportunity as infrastructure spending gains traction. At the same time, premium-vehicle makers rely on hydraulic suspension to differentiate ride quality, and commercial fleets prioritize tried-and-tested hydraulic reliability over experimental alternatives.

Global Automotive Hydraulic Systems Market Trends and Insights

Rising Global Commercial Vehicle Production & Sales

Surging truck and bus output increases hydraulic content per unit because heavy platforms need multiple high-pressure circuits for braking, steering, and auxiliary drives. India's industry produced 30.6 million vehicles in 2024, reinforcing hydraulic demand across domestic and export markets. U.S. fleet operators face chassis shortages, prompting higher utilisation of trucks requiring regular hydraulic upkeep. Electric powertrains in zero-emission trucks introduce extra thermal management loops that remain hydraulic, further sustaining component volumes. Operators value proven durability, which supports the automotive hydraulics systems market even as electrification spreads.

Stricter Brake-Safety Mandates (ABS, ESC, EBS)

New rules oblige carmakers to install automatic emergency braking and enhanced stability control that rely on precise hydraulic modulation. NHTSA's FMVSS 127 covers all U.S. light vehicles from September 2029 and sets collision-avoidance speed targets of 62 mph. The EU's upcoming Euro 7 standards bring brake particle limits, driving the adoption of low-dust hydraulic components. These requirements enlarge the addressable demand for advanced valves, boosters, and micro-pumps within the automotive hydraulics systems market

Rapid Shift to Fully-Electric Brake & Steering Systems

Battery EV platforms target weight savings and precise control, favouring electromechanical units that omit fluid lines. EPA multi-pollutant standards accelerate this transition in the United States. German suppliers reorganise production footprints as electric models trim hydraulic content. Commercial trucks move more slowly because of higher force requirements, yet long-term substitution risk weighs on the automotive hydraulics systems market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Premium-Vehicle Demand for Hydraulic Suspension

- Electro-Hydraulic Modules for Level-3+ AD Systems

- Environmental Concerns Over Hydraulic-Fluid Leakage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Brakes generated 45.12% of 2024 revenue, giving this segment the largest stake in the automotive hydraulics systems market. Regulatory mandates such as NHTSA's emergency braking rule lock in resilient demand, and even pure EVs retain hydraulic backup circuits. Meanwhile, power-steering assist expands at a 6.52% CAGR as electro-hydraulic racks balance energy efficiency with steering feel. This illustrates how the automotive hydraulics systems market size can keep climbing inside electrified platforms.

Brake content remains stable because collision-avoidance systems need high-pressure modulation. Steering assist rises on the back of active-lane technologies that depend on fast hydraulic response. Suspension applications benefit from premium-car demand for ride comfort, while clutch and fan-drive uses fade in line with engine electrification. Regenerative hydraulic energy storage in commercial vehicles marks an emerging sub-segment with modest but steady contributions

Master cylinders constituted 35.26% of component sales in 2024, underscoring their universal fit across vehicle classes. Their dominance ensures stable volume, while hydraulic pumps post the highest 7.46% CAGR as advanced driver assistance features require on-demand pressure. These figures translate into a portion of the automotive hydraulics systems market share for pumps, signalling a pivot from passive to active control architectures.

Reservoirs, hoses, and manifolds record incremental gains driven by lightweight designs using composite lines. Valves and actuators climb in value because integrated sensors enable closed-loop control. Accumulators face mixed prospects pending PFAS-free fluid solutions, yet research promises long-term relevance in hybrid suspension energy storage.

The Automotive Hydraulic Systems Market is Segmented by Application (Brakes, Clutch, Suspension, and More), Component (Master Cylinder, Slave Cylinder, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific commands 48.89% of global revenue in 2024, underscoring its status as the centre of gravity for the automotive hydraulics systems market. China produced 2.353 million vehicles in May 2024, a 7.6% year-on-year rise, while new-energy models jumped 33.6%. India's 2024 output of 30.6 million units enlarges the regional automotive hydraulics systems market size and anchors long-term demand. Japan's subsidy-backed EV rollout reduces some power-train hydraulic applications yet preserves brake and suspension needs, prompting suppliers to recalibrate portfolios. Deep supply chains and abundant labour make Asia-Pacific the default choice for volume components, though PFAS and leakage regulations force factories to upgrade fluid-handling processes.

North America mixes rigorous safety regulations with fast-tracking electrification, creating a dual pull on hydraulic demand. NHTSA's new assessment protocols and FMVSS 127 sustain technical complexity in brake hydraulics, while EPA emissions rules accelerate EV adoption that can trim future volumes. The United States remains a Level 3 automation hub, giving electro-hydraulic module specialists a development advantage. Canada and Mexico buttress regional scale through integrated corridors under USMCA, stabilising supply for North American assemblers despite policy shifts.

Europe leads on rule-making yet battles eroding cost competitiveness, as Euro 7 particle limits and PFAS curbs force costly redesigns that only well-funded firms can absorb. Africa delivers the fastest 7.57% CAGR through 2030 from a low base, with infrastructure spending in Nigeria, Kenya and Egypt lifting off-highway hydraulic demand. South America shows steady growth tied to mining and agriculture machinery, though macroeconomic volatility clouds visibility. Middle Eastern markets combine legacy power-train preferences with industrial-policy incentives that could seed local hydraulic assembly.

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Continental AG

- Aisin Corporation

- BorgWarner Inc.

- Valeo SA

- Eaton Corporation plc

- Schaeffler AG

- KYB Corporation

- WABCO (ZF CVCS)

- JTEKT Corporation

- GKN Automotive

- Denso Corporation

- Nexteer Automotive Group

- Nissin Kogyo Co. Ltd

- Hitachi Astemo Ltd

- Brembo SpA

- Mando Corp

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global commercial?vehicle production & sales

- 4.2.2 Stricter brake-safety mandates (ABS, ESC, EBS)

- 4.2.3 Growing premium-vehicle demand for hydraulic suspension

- 4.2.4 Electro-hydraulic modules for Level-3+ AD systems

- 4.2.5 Low-cost hydraulic packs for entry-level EVs in emerging markets

- 4.2.6 Regenerative hydraulic energy-storage in hybrid suspensions

- 4.3 Market Restraints

- 4.3.1 Rapid shift to fully-electric brake & steering systems

- 4.3.2 Environmental concerns over hydraulic?fluid leakage

- 4.3.3 Elastomer-seal raw-material shortages inflating costs

- 4.3.4 OEM preference for dry brake-by-wire in robotaxi fleets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Application

- 5.1.1 Brakes

- 5.1.2 Clutch

- 5.1.3 Suspension

- 5.1.4 Power-steering Assist

- 5.1.5 Fan-drive Systems

- 5.1.6 Valve-train (Tappets/Actuators)

- 5.1.7 Others

- 5.2 By Component

- 5.2.1 Master Cylinder

- 5.2.2 Slave / Wheel Cylinder

- 5.2.3 Reservoir

- 5.2.4 Hose & Tubing

- 5.2.5 Hydraulic Pump

- 5.2.6 Valve & Manifold

- 5.2.7 Actuator / Booster

- 5.2.8 Accumulator & Seals

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium & Heavy-duty Commercial Vehicles

- 5.3.4 Off-highway Vehicles (Ag & Construction)

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 ZF Friedrichshafen AG

- 6.4.3 Continental AG

- 6.4.4 Aisin Corporation

- 6.4.5 BorgWarner Inc.

- 6.4.6 Valeo SA

- 6.4.7 Eaton Corporation plc

- 6.4.8 Schaeffler AG

- 6.4.9 KYB Corporation

- 6.4.10 WABCO (ZF CVCS)

- 6.4.11 JTEKT Corporation

- 6.4.12 GKN Automotive

- 6.4.13 Denso Corporation

- 6.4.14 Nexteer Automotive Group

- 6.4.15 Nissin Kogyo Co. Ltd

- 6.4.16 Hitachi Astemo Ltd

- 6.4.17 Brembo SpA

- 6.4.18 Mando Corp

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessmen