|

市場調查報告書

商品編碼

1851594

汽車電控系統:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automotive Electronic Control Unit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

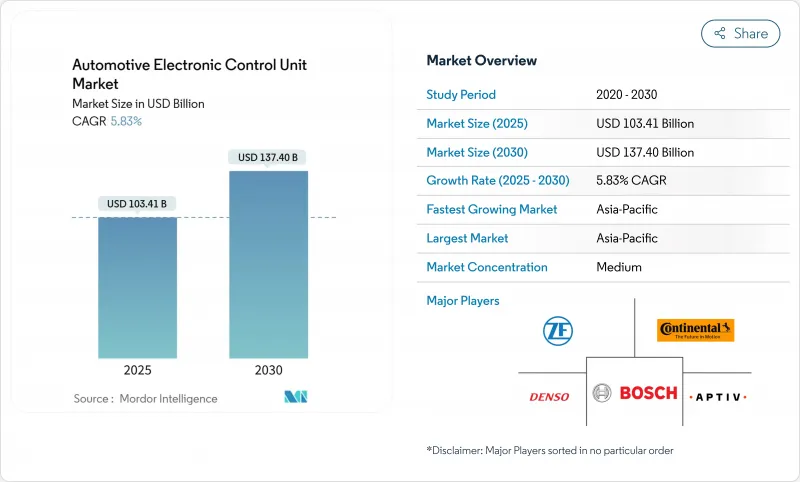

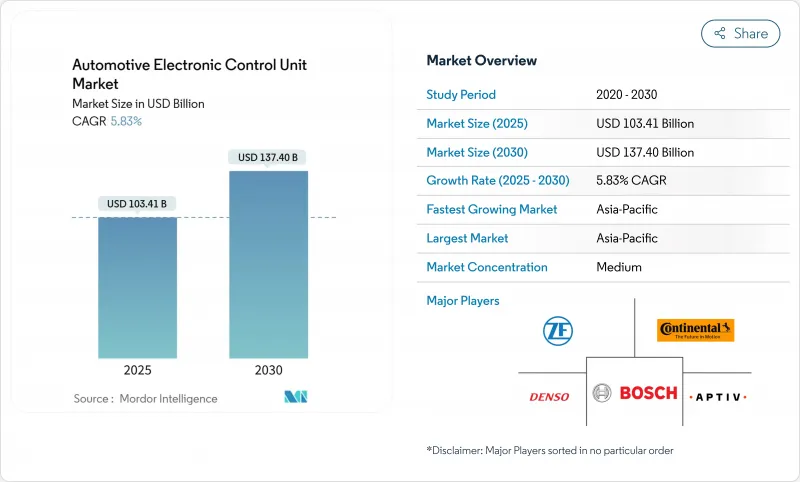

預計到 2025 年,汽車電控系統市場規模將達到 1,034.1 億美元,到 2030 年將達到 1,374 億美元,預測期(2025-2030 年)複合年成長率為 5.83%。

關鍵成長促進因素包括高級駕駛輔助系統 (ADAS) 的監管期限、乘用車和商用車的快速電氣化以及向集中式車輛架構的轉變。純電動車需要多個新的控制區域,例如電池、逆變器、車載充電器和溫度控管,這增加了每輛車的半導體元件數量。

全球汽車電控系統市場趨勢與洞察

電氣化浪潮正在增加每輛車的ECU數量。

純電動動力傳動系統引入了專用的控制單元,用於電池管理、逆變器邏輯、充電協商和能量回收煞車。每項功能都會增加傳統燃油平台所不需要的處理開銷,因此預計每輛車的半導體支出將從2019年的420美元增加到2030年的1350美元。混合動力配置增加了整合複雜性,因為演算法必須無縫協調兩種動力源。據康明斯稱,其電子動力傳動系統控制模組可最佳化柴油、氫、天然氣和純電動系統,該公司預計,由於燃料策略多樣化,ECU的數量將會增加。因此,隨著OEM廠商推出新的純電動或燃料電池項目,汽車電控系統市場將迎來銷售成長。

美國、歐盟和中國的ADAS強制令推動了市場需求

歐盟將於2024年7月實施修訂後的一般安全法規,要求所有新車配備智慧速度輔助、自動緊急煞車和倒車偵測功能。在中國,根據其智慧網聯汽車法規,預計到2024年上半年,L2級智慧網聯汽車的普及率將達到新乘用車銷售量的42.4%。美國國家公路交通安全管理局(NHTSA)正在為北美製定類似的ADAS(高級駕駛輔助系統)法規。這兩項法規均要求使用高可靠性控制器,並具備即時感測器融合和功能安全診斷能力。這將導致汽車電控系統市場需求增加,並直接向市場供應。

全球晶片供應不穩定

汽車電子控制單元 (ECU) 仍依賴成熟的 90 奈米以上製程技術,而該節點的全球晶圓產能長期受限。德國電子經銷商協會 (VDA) 預測,到 2030 年,汽車製造商的半導體需求將增加兩倍,但在晶片總產量中的佔有率僅從 8% 成長到 14%。由於代工生產線難以改造以適應後續節點,即使前沿節點的供應有所改善,供不應求仍然存在。西門子正在推廣基於模型的檢驗,該技術允許軟體團隊在晶片到貨前檢驗ECU 代碼,從而在一定程度上保護程式免受物理晶片短缺的影響。儘管如此,供不應求仍可能導致整車上市延遲,並使汽車電控系統市場的複合年成長率下降幾個百分點。

細分市場分析

儘管內燃機平台在2024年仍將維持61.32%的汽車電控系統)市場佔有率,但純電動車在2025年至2030年間將以6.63%的複合年成長率(CAGR)成為成長最快的領域。 2024年全球電動卡車註冊量將激增近80%,其中中國將推出超過430款純電動重型卡車。康明斯重點介紹了其靈活的控制韌體,該固件可適應從柴油到氫燃料再到全電池組的多種動力系統,這表明動力系統的多樣性如何增加代碼複雜性和ECU的總需求。

相較之下,隨著排放氣體法規逐年收緊,燃油車平台對引擎管理單元的需求依然強勁。將於2024年實施的歐7排放標準將要求車載監測顆粒過濾器和電池耐久性,並在現有動力傳動系統ECU中增加新的診斷通道。因此,未來十年,汽車製造商將面臨雙平台策略:既要保持燃油車控制的穩健性,也要為混合動力和純電動車專案增加電子控制功能。這種矛盾支撐著汽車電控系統市場收入的穩定成長,即便動力傳動系統總成架構日益多元化。

到2024年,動力傳動系統控制器將佔據汽車電控系統( ECU)市場41.38%的佔有率。然而,高階駕駛輔助系統(ADAS)和安全控制器將以4.31%的複合年成長率成長,引領汽車電控系統市場的創新。歐洲通用安全法規和中國的智慧連網指南要求具備自動緊急煞車、駕駛員監控攝影機和援助輔助等功能,而這些功能都依賴專用的高頻寬微控制器。隨著LiDAR和雷達價格分佈的持續下降,感測器融合工作量的增加正在推動對64位元多核心處理器的需求。

車身、舒適性和照明子系統展現了傳統領域的發展方向。區域控制器如今取代了車窗、空調和座椅馬達等多個獨立控制盒。資訊娛樂和遠端資訊處理系統目前仍佔比最小,但空中下載服務和訂閱模式正迫使汽車製造商將主機升級到吉赫級系統晶片。安全法規以及數位服務收入意味著,即使動力傳動系統趨於飽和,汽車電控系統市場仍有發展空間。

汽車電控系統( ECU)市場按動力系統(內燃機、混合動力、純電動車)、應用領域(高級駕駛輔助系統 (ADAS)、安全系統及其他)、ECU容量(16位ECU、32位ECU、64位ECU)、自動駕駛級別(傳統級別(L0-L1)、其他級別)、他(其他級別)、他進行細分車輛及其區域進行細分(L0-L1)。市場預測以價值(美元)和銷售(輛)為單位。

區域分析

到2024年,亞太地區將佔汽車電控系統)市場48.71%的佔有率,年複合成長率(CAGR)達7.83%,這主要得益於中國智慧網聯汽車藍圖和國內半導體供應鏈的強大優勢。 L2級自動駕駛滲透率超過40%,顯示該地區正在快速採用新的控制技術。光是2024年,中國汽車製造商就將推出超過430款純電動卡車車型。日本和韓國正透過統一的自動駕駛法規加速發展,而印度的生產連結獎勵計畫正將該國打造成為未來的電子製造中心。這些舉措共同確保了ECU訂單的充足供應,使亞太地區在汽車電控系統市場中佔據領先地位。

歐洲依然是規則最嚴格的地區。將於2024年5月生效的歐7排放標準,將在核心排放氣體法規的基礎上增加電池耐久性指標,並要求使用更複雜的動力傳動系統控制器。同時,通用安全法規要求所有輕型車輛都必須配備智慧速度輔助系統、倒車影像和駕駛監控系統。為了實現晶片供應本地化,歐洲投資銀行向恩智浦半導體(NXP)提供了10億歐元的貸款,用於汽車雷達和5奈米處理器的研發。大陸集團則積極回應,為售後市場新增了700種引擎管理產品。這些因素正助力歐洲在汽車電控系統( ECU)市場穩步擴大佔有率。

北美正利用財政獎勵來彌合技術差距。博世從美國《晶片法案》(CHIPS Act)中獲得了高達2.25億美元的資金,用於生產電力傳動系統所需的碳化矽晶圓。美國環保署(EPA)的第三階段溫室氣體減量計畫要求整車製造商(OEM)從2027年開始減少重型卡車的排放。 《維修法案》(REPAIR Act)提案開放診斷數據,以鼓勵獨立維修,並將影響整車製造商和售後市場參與者之間ECU軟體的分配方式。恩智浦半導體(NXP)和VIS正在新加坡投資78億美元興建一座300毫米晶圓廠,預計2027年開始投產。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電氣化浪潮將增加每輛車的ECU數量。

- 美國、歐盟和中國的ADAS強制令推動了市場需求

- 集中式/分區式電子電氣架構需要高效能ECU

- 半導體成本的快速下降使得64位元架構的轉型成為可能。

- 網路安全和空中升級功能現已納入採購標準

- 重型和非公路車輛電氣化催生了新的ECU TAM

- 市場限制

- 全球晶片供應波動

- 軟體和硬體整合的複雜性

- 原始設備製造商不願將數據管理委託給一級供應商。

- 新的「維修權」法案威脅售後市場ECU利潤率

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭的激烈程度

第5章 市場規模與成長預測

- 透過推進力

- 內燃機

- 混合

- 電池電動車

- 透過使用

- ADAS和安全系統

- 車身控制與舒適系統

- 資訊娛樂與通訊系統

- 動力傳動系統系統

- 按ECU容量

- 16位ECU

- 32位ECU

- 64位ECU

- 依自主程度

- 常規型(L0 至 L1)

- 半自動駕駛(L2-L3)

- 自主(L4-L5)

- 按車輛類型

- 搭乘用車

- 商用車輛

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Aptiv PLC

- Lear Corporation

- ZF Friedrichshafen AG

- Hyundai Mobis Co. Ltd.

- Hitachi Astemo, Ltd.

- Nidec Corporation

- Panasonic Corporation(Automotive)

- Magneti Marelli(Marelli Holdings)

- Leopold Kostal GmbH & Co. KG

- Autoliv Inc.

- Veoneer Inc.

- Valeo SA

- NXP Semiconductors

- Renesas Electronics

- Infineon Technologies AG

- Texas Instruments Inc.

- Visteon Corporation

- Pektron Group

第7章 市場機會與未來展望

The Automotive Electronic Control Unit Market size is estimated at USD 103.41 billion in 2025, and is expected to reach USD 137.40 billion by 2030, at a CAGR of 5.83% during the forecast period (2025-2030).

The primary growth engines are regulatory deadlines for advanced driver-assistance systems, rapid electrification of passenger and commercial fleets, and the migration to centralized vehicle architectures. Battery electric vehicles require multiple new control domains-battery, inverter, on-board charger, and thermal management, multiplying the semiconductor bill of materials per vehicle.

Global Automotive Electronic Control Unit Market Trends and Insights

Electrification Wave Raises ECU Count Per Vehicle

Battery electric powertrains introduce dedicated control units for battery management, inverter logic, charging negotiation, and regenerative braking. Each function adds processing overhead that traditional combustion platforms never required, lifting semiconductor spend per vehicle from USD 420 in 2019 to an expected USD 1,350 by 2030. Hybrid configurations magnify integration complexity because algorithms must coordinate two propulsion sources seamlessly. Cummins reports that its electronic powertrain control modules optimize diesel, hydrogen, natural-gas, and fully electric systems, a preview of how diversified fuel strategies will keep ECU counts elevated. Consequently, the automotive electronic control unit market gains incremental volume every time an OEM launches a new battery-electric or fuel-cell program.

ADAS Mandates in US, EU, China Boost Demand

The European Union activated the revised General Safety Regulation in July 2024, obligating every new car to ship with intelligent speed assistance, autonomous emergency braking, and reversing detection. China's Level-2 penetration reached 42.4% of new passenger-car sales in 1H 2024 under its intelligent connected-vehicle rules, and NHTSA is advancing similar ADAS provisions for North America. Each mandate needs a high-reliability controller capable of real-time sensor fusion and functional-safety diagnostics. The resulting volume uplift directly feeds the automotive electronic control unit market.

Global Chip-Supply Volatility

Automotive ECUs still rely on mature 90 nm and larger process technology, a node class where global wafer capacity is chronically tight. VDA estimates that semiconductor demand from automakers will triple by 2030 while their share of overall chip output rises only from 8% to 14%. Suppliers cannot easily pivot foundry lines to trailing-edge nodes, so shortages linger even as leading-edge supply improves. Siemens promotes model-based verification that allows software teams to validate ECU code before silicon arrives, somewhat insulating programs from physical chip scarcity. Still, shortfalls can delay entire vehicle launches, knocking percentages off the automotive electronic control unit market CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Centralized/Zonal E/E Architectures Need High-Performance ECUs

- Cyber-Secure, Over-the-Air Update Capability Becomes Sourcing Criterion

- OEM Reluctance to Cede Data-Control to Tier-1s

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Even though internal-combustion platforms retained 61.32% of the automotive electronic control unit market share in 2024, battery electric vehicles added the fastest 6.63% CAGR between 2025 and 2030. Heavy-duty segments supercharge the trend: global electric-truck registrations jumped nearly 80% in 2024, with China launching more than 430 battery-electric heavy-duty models. Cummins emphasizes flexible control firmware that can adapt from diesel to hydrogen to full battery packs, illustrating how propulsion diversity increases code complexity and total ECU demand.

In contrast, combustion platforms continue to place large orders for engine-management units because emissions rules tighten every model year. Euro 7, published in 2024, mandates onboard monitoring of particulate filters and battery durability, adding new diagnostics channels to existing powertrain ECUs. OEMs therefore face a dual platform strategy through the decade: maintain robust combustion controls while adding incremental electronics for hybrid and pure EV programs. This tension supports steady incremental revenue for the automotive electronic control unit market even as powertrain architectures diverge.

Powertrain controllers generated 41.38% of the automotive electronic control unit market share in 2024 because every vehicle-combustion, hybrid, or full electric-still needs torque, thermal, and energy management. ADAS & safety controllers, however, expand at 4.31% CAGR, making them the innovation flagship of the automotive electronic control unit market. Europe's General Safety Regulation and China's intelligent-connected guidelines require features such as automatic emergency braking, driver-monitoring cameras, and intelligent speed assistance, each relying on dedicated high-bandwidth microcontrollers. As lidar and radar migrate down price tiers, sensor-fusion loads grow, intensifying demand for 64-bit multicore processors.

Body, comfort, and lighting subsystems illustrate how legacy domains evolve; zonal controllers now replace multiple discrete boxes for windows, HVAC, and seat motors. Infotainment and telematics remain the smallest slice, but OTA services and subscription models compel OEMs to upgrade head units to gigahertz-class system-on-chips. The combined push from safety regulation and digital-service revenue gives the automotive electronic control unit market continuous headroom even after powertrain saturation.

The Automotive Electronic Control Unit Market is Segmented by Propulsion (Internal Combustion Engine, Hybrid, and Battery Electric Vehicle), Application (ADAS and Safety System, and More), ECU Capacity(16-Bit ECU, 32-Bit ECU, and 64-Bit ECU), Autonomy Level (Conventional (L0-L1), and More), Vehicle Type ( Passenger Car, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific anchored 48.71% of the automotive electronic control unit market share in 2024, thanks to China's intelligent-connected vehicle roadmap and deep domestic semiconductor supply chain advantages, expanding at a CAGR of 7.83%. Level-2 penetration above 40% underscores how quickly the region adopts new control domains, and Chinese OEMs launched more than 430 battery-electric truck models in 2024 alone. Japan and South Korea added momentum with unified autonomous-driving legislation, while India's Production Linked Incentive scheme positions the country as a future electronics manufacturing hub. Collectively, these programs guarantee a dense pipeline of ECU contracts, securing Asia-Pacific's lead within the automotive electronic control unit market.

Europe follows as the strictest rule-setter. Euro 7, published in May 2024, layers battery durability metrics on top of core emissions caps, demanding more complex powertrain controllers. The General Safety Regulation simultaneously mandates intelligent speed assistance, reversing cameras, and driver-monitoring systems in all light vehicles. To localize chip supply, the European Investment Bank extended a EUR 1 billion loan to NXP for R&D in automotive radar and 5 nm processors. Continental responded by adding 700 new engine-management references for the aftermarket, illustrating how European suppliers monetize regulatory churn. These factors position Europe for steady share gains in the automotive electronic control unit market.

North America leans on financial incentives to close technology gaps. Bosch secured up to USD 225 million from the US CHIPS Act to build silicon-carbide wafers for electric drivetrains, and the EPA's Phase 3 greenhouse gas plan obligates OEMs to slash heavy-truck emissions beginning in 2027. The REPAIR Act proposes open diagnostic data to foster independent servicing, influencing how ECU software is partitioned between OEMs and aftermarket players. NXP and VIS meanwhile will spend USD 7.8 billion on a 300 mm fab in Singapore-production starts 2027-to guarantee regional supply resilience for future automotive electronic control unit market demand.

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Aptiv PLC

- Lear Corporation

- ZF Friedrichshafen AG

- Hyundai Mobis Co. Ltd.

- Hitachi Astemo, Ltd.

- Nidec Corporation

- Panasonic Corporation (Automotive)

- Magneti Marelli (Marelli Holdings)

- Leopold Kostal GmbH & Co. KG

- Autoliv Inc.

- Veoneer Inc.

- Valeo SA

- NXP Semiconductors

- Renesas Electronics

- Infineon Technologies AG

- Texas Instruments Inc.

- Visteon Corporation

- Pektron Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification wave raises ECU count per vehicle

- 4.2.2 ADAS mandates in US, EU, China boost demand

- 4.2.3 Centralised / zonal E/E architectures need high-performance ECUs

- 4.2.4 Rapid semiconductor cost declines enable 64-bit migration

- 4.2.5 Cyber-secure, over-the-air (OTA) update capability becomes sourcing criterion (under-reported)

- 4.2.6 Heavy-duty & off-highway electrification creates a new ECU TAM (under-reported)

- 4.3 Market Restraints

- 4.3.1 Global chip-supply volatility

- 4.3.2 Software-hardware integration complexity

- 4.3.3 OEM reluctance to cede data-control to tier-1s (under-reported)

- 4.3.4 Emerging right-to-repair laws threaten aftermarket ECU margins (under-reported)

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Propulsion

- 5.1.1 Internal Combustion Engine

- 5.1.2 Hybrid

- 5.1.3 Battery Electric Vehicle

- 5.2 By Application

- 5.2.1 ADAS & Safety Systems

- 5.2.2 Body Control & Comfort Systems

- 5.2.3 Infotainment & Communication Systems

- 5.2.4 Powertrain Systems

- 5.3 By ECU Capacity

- 5.3.1 16-bit ECU

- 5.3.2 32-bit ECU

- 5.3.3 64-bit ECU

- 5.4 By Autonomy Level

- 5.4.1 Conventional (L0-L1)

- 5.4.2 Semi-Autonomous (L2-L3)

- 5.4.3 Autonomous (L4-L5)

- 5.5 By Vehicle Type

- 5.5.1 Passenger Car

- 5.5.2 Commercial Vehicle

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Egypt

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 Denso Corporation

- 6.4.4 Aptiv PLC

- 6.4.5 Lear Corporation

- 6.4.6 ZF Friedrichshafen AG

- 6.4.7 Hyundai Mobis Co. Ltd.

- 6.4.8 Hitachi Astemo, Ltd.

- 6.4.9 Nidec Corporation

- 6.4.10 Panasonic Corporation (Automotive)

- 6.4.11 Magneti Marelli (Marelli Holdings)

- 6.4.12 Leopold Kostal GmbH & Co. KG

- 6.4.13 Autoliv Inc.

- 6.4.14 Veoneer Inc.

- 6.4.15 Valeo SA

- 6.4.16 NXP Semiconductors

- 6.4.17 Renesas Electronics

- 6.4.18 Infineon Technologies AG

- 6.4.19 Texas Instruments Inc.

- 6.4.20 Visteon Corporation

- 6.4.21 Pektron Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment