|

市場調查報告書

商品編碼

1851576

行車記錄器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Dashboard Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

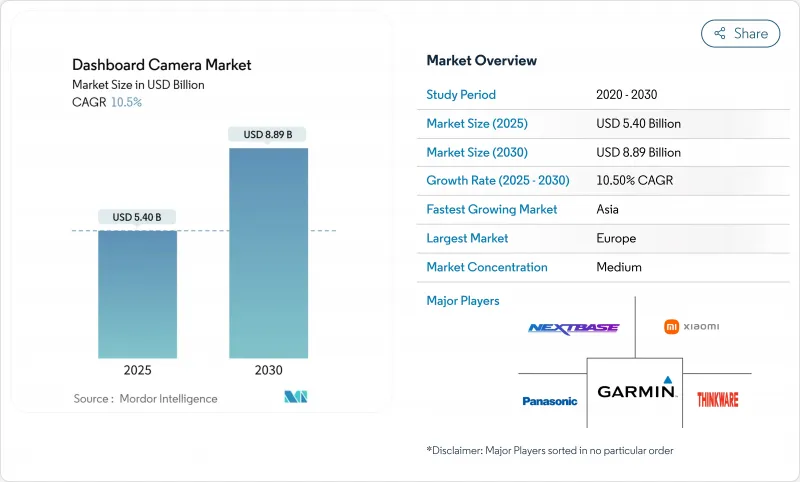

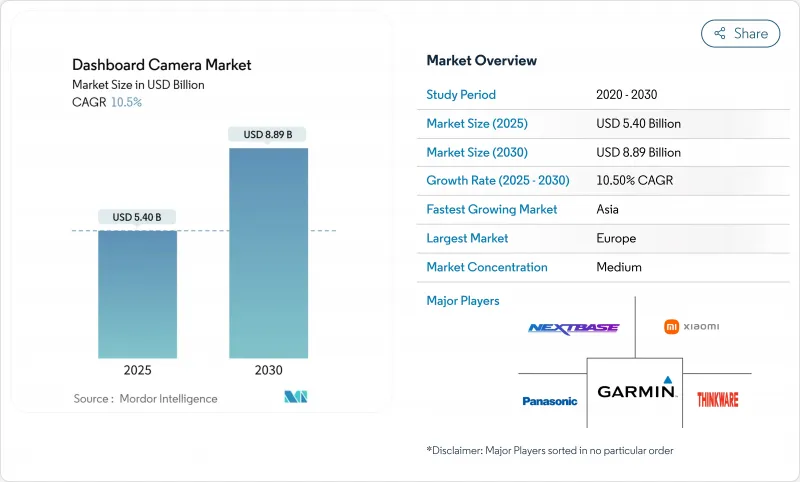

預計到 2025 年,行車記錄器市場規模將達到 54 億美元,到 2030 年將達到 88.9 億美元,複合年成長率為 10.50%。

歐洲強制安裝車載資料記錄器、北美保險遠端資訊處理專案擴展以及人工智慧的快速應用提升了車隊營運商對遠端資訊處理價值的認知,這些因素共同推動了遠端資訊處理技術的快速發展。同時,亞洲強大的汽車製造業和對遠端資訊處理技術持開放態度的保險公司也為該地區的快速成長提供了支持。技術差異化正從硬體轉向軟體,雲端連接分析、符合GDPR標準的儲存以及耐熱設計等因素正在提升品牌偏好。隨著售後市場專家、車隊遠端資訊處理供應商和原始設備製造商(OEM)紛紛湧入這一互聯視訊領域,競爭日趨激烈,推動了新的夥伴關係和白牌供應模式的出現。

全球行車記錄器市場趨勢與洞察

隨著歐洲強制實施緊急呼叫資料記錄器(eCall-Event Data Recorder),原廠預裝行車記錄器變得越來越普遍。

2024年7月生效的法規將要求歐盟所有新乘用車儲存碰撞相關資料。製造商必須確保其產品符合法規要求,供應商必須確保長期的平台供應,而售後市場品牌則必須將重心轉向經銷商配件和車輛改裝。德國一級電子公司正迅速推進符合GDPR要求的韌體和加密儲存技術,這使得全球平台在向其他市場出口歐盟檢驗技術時更具優勢。

美國和英國物流採用人工智慧賦能的車隊視訊遠端資訊處理技術

一家大型運輸公司已從事故審查轉向預測性指引。人工智慧分析可自動標記尾隨、分心和疲勞駕駛等行為,使安全管理人員能夠更早介入,從而減少索賠並協商降價的保險費。可擴展的雲端審查減少了人工影像搜尋,並支援在數千輛牽引車和貨車上進行企業級部署。擁有專有電腦視覺技術的供應商正在贏得與渴望實現視訊優先差異化的遠端資訊處理整合商的策略夥伴關係。

德國和奧地利的GDPR錄音限制

強制循環錄製、匿名化和最短保存期限增加了韌體的複雜性和成本。奧地利交通管理部門對違規行為處以最高 2,000 萬歐元(約 2,180 萬美元)的罰款。德國聯邦法院裁定行車記錄器證據可在訴訟中被採納後,法律的清晰度有所提高,但硬體供應商仍要求提供特定地區的 SKU,這削弱了規模經濟效益。

細分市場分析

到2024年,基礎型行車記錄器將佔據58%的市場佔有率,而智慧型/人工智慧整合行車記錄器到2030年將以12.2%的複合年成長率快速成長。智慧型行車記錄器可以將影片轉化為警示訊息,幫助車隊減少索賠並降低保費。個人用戶購買基礎行車記錄器是為了獲得經濟實惠的證據,而高階用戶則擴大選擇支援應用程式和雲端上傳功能的裝置。掌握電腦視覺智慧財產權的供應商能夠確保持續的訂閱收入,並延緩行車記錄器市場的硬體同質化。

同時,保險公司在協商保費時會引用人工智慧產生的風險評估報告,這提振了保險公司和第三人意外責任險對行車記錄器的需求。雖然私家車車主仍然對價格比較敏感,但豪華車買家則更傾向於選擇具備應用程式功能的設備,這些功能可以提供緊急上傳和遠端監控等安心保障。隨著空中升級的普及,韌體藍圖而非外觀設計,很可能成為行車記錄器品牌在市場中保持競爭力的關鍵因素。

到2024年,單通道設計將佔據72%的收入佔有率,而雙通道系統正以11.1%的複合年成長率成長,這主要得益於車隊對車頭和車廂內影片證據的需求。物流公司報告稱,當車內影像可用時,糾紛解決速度可提高30%,證明了增加資本支出的合理性。叫車司機和家長構成了多視角套件的主要零售客戶群體,而原始設備製造商(OEM)正在整合現有的泊車輔助感測器,以觸發選擇性車廂錄像,從而在滿足隱私合規性的同時擴大覆蓋範圍。

消費者對後視+車內視角功能的接受度一直不高,主要受安裝複雜性和隱私顧慮的限制。然而,叫車司機和家長等特定族群願意為360°全景影像付費。汽車製造商正在利用現有的泊車輔助感測器實現選擇性車內錄影,以兼顧安全性和隱私性。

區域分析

到2024年,歐洲將以35%的市佔率領先,這主要得益於強制性eCall事件資料記錄器(EDDR)的普及,推動了視訊證據制度化。北歐市場的採用率高於平均水平,因為保險公司已將影像用於理賠分診。自動人臉模糊等隱私保護措施現已成為標準規範,雖然增加了開發複雜性,但也提升了消費者的信任度。

到2030年,亞洲將以11.6%的複合年成長率成為全球成長最快的地區。中國將受益於製造業的規模經濟以及政府對智慧城市津貼,這些補貼鼓勵使用連網攝影機。韓國保險公司將提供結構化的遠距資訊處理信貸,加速家庭用戶的普及。印度2026年起實施的商用ADAS(高級駕駛輔助系統)要求,使該國成為主要的需求推動力。當地供應商已開始根據印度公路運輸和公路部的指導方針,試用針對季風潮濕環境最佳化的加固型設備。

北美車隊發展勢頭強勁。貨運公司正在將影片整合到現有的電子記錄設備 (ELD) 和路線最佳化系統中,而具有前瞻性的保險公司和風險管理機構也傾向於使用攝影機證據來控制訴訟成本。西南地區的極端高溫,以及中東和非洲的氣候,仍受到硬體可靠性問題的限制。隨著檢驗的現場數據的出現,投資耐熱設計的供應商將釋放其巨大潛力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐洲強制實施eCall事件資料記錄器規定推動原廠安裝行車記錄儀

- 美國和英國物流採用人工智慧驅動的車隊視訊遠端資訊處理技術

- 特斯拉、寶馬和現代等汽車廠商預先安裝的行車記錄器加速了亞太地區的普及。

- 加拿大和韓國的保險遠端資訊處理折扣

- 政府商用車輛視訊證據法規(例如印度2026年法規)

- 保險公司主導4K/UHD 視訊品質以提高理賠清晰度

- 市場限制

- 德國和奧地利的GDPR錄音限制

- 連網行車記錄器網路安全漏洞揭露

- 因高溫導致的設備故障(例如中東地區(RMA 率超過 15%))

- 雙攝影機/車內攝影機安裝的複雜性和隱私問題

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 透過技術

- 基本的

- 進步

- 智慧/人工智慧整合

- 依產品類型

- 單通道

- 雙通道

- 後視/環繞

- 視訊品質

- 標清和高畫質

- 全高清

- 4K/UHD

- 透過使用

- 私家車

- 商業車隊

- 透過分銷管道

- 店內

- 線上

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家(瑞典、挪威、丹麥、芬蘭)

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東協(印尼、泰國、馬來西亞、越南、菲律賓)

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Garmin Ltd.

- Nextbase

- Thinkware Corporation

- Cobra Electronics(Cedar Electronics)

- Pittasoft Co. Ltd.(BlackVue)

- Xiaomi Corp.

- DOD Tech

- HP Inc.

- Lukas(Qronetek)

- Kenwood Corp.(JVC Kenwood)

- Philips NV(Dashcam Line)

- Steelmate Automotive

- Papago Inc.

- RoadHawk UK

- AsusTek Computer Inc.

- Vantrue

- Viofo Ltd.

- Panasonic Corporation

第7章 市場機會與未來展望

The dashboard camera market size is valued at USD 5.40 billion in 2025 and is forecast to reach USD 8.89 billion by 2030, reflecting a 10.50% CAGR.

This expansion stems from compulsory in-vehicle data recorders in Europe, expanding insurance telematics programs in North America, and rapid AI integration that raises perceived value among fleet operators. Europe's firm regulatory stance has positioned factory-fit units as the new norm, while Asia's thriving automotive production base and telematics-friendly insurers underpin the fastest regional growth momentum. Technological differentiation has pivoted from hardware to software; cloud-connected analytics, GDPR-compliant storage, and heat-resistant designs now determine brand preference. Competition is intensifying as aftermarket specialists, fleet telematics vendors, and OEMs converge on the same connected-video opportunity, prompting new partnerships and white-label supply models.

Global Dashboard Camera Market Trends and Insights

European eCall-Event Data Recorder mandate driving factory-fit dashcams

The July 2024 regulation obliges every new passenger vehicle in the EU to store crash-related data, making video capture a logical extension that OEMs are embedding at the production line . Manufacturers gain a compliance differentiator, suppliers secure long-term platform volume, and aftermarket brands must pivot toward dealer accessories and fleet retrofits. German Tier-1 electronics firms have moved quickly with GDPR-ready firmware and encrypted storage, giving them an edge as global platforms export EU-validated technology to other markets.

AI-enabled fleet video telematics adoption in US and UK logistics

Large carriers have transitioned from incident review to predictive coaching. AI analytics automatically flag tail-gating, distraction, or fatigue, enabling safety managers to intervene early, cut claims, and negotiate lower premiums . Scalable cloud review reduces manual footage trawling and makes enterprise deployments feasible across thousands of tractors and vans. Vendors that own proprietary computer-vision stacks now command strategic partnerships with telematics integrators eager for video-first differentiation.

GDPR-driven recording restrictions in Germany and Austria

Loop recording, anonymization, and minimal retention periods are compulsory, raising firmware complexity and cost. The Austrian traffic authority enforces fines up to EUR 20 million (USD 21.8 million) for non-compliance. Legal clarity improved after Germany's Federal Court allowed dashcam evidence in lawsuits, but hardware vendors still need region-specific SKUs, eroding economies of scale.

Other drivers and restraints analyzed in the detailed report include:

- OEM-installed dashcams by global automakers accelerating APAC uptake

- Insurance telematics discounts in Canada and selected APAC markets

- Heat-induced device failures in Middle East markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Basic dashcam technology retained the largest 58% market share in 2024, while smart/AI-integrated units register the fastest 12.2% CAGR through 2030. Smart models convert video into coaching alerts, helping fleets cut claims and negotiate lower premiums. Personal users still buy basic units for cost-effective evidence, yet upscale buyers increasingly choose app-linked devices with cloud uploads. Suppliers that control computer-vision IP secure recurring subscription revenue, buffering hardware commoditization within the dashboard camera market.

Concurrently, insurers cite AI-generated risk profiles when negotiating premiums, reinforcing demand from both carriers and self-insured corporates. Personal vehicle owners remain price-focused, yet upscale buyers gravitate to app-enhanced devices offering emergency upload and remote-viewing peace of mind. As over-the-air updates become commonplace, firmware road-maps rather than optics will anchor brand stickiness within the dashboard camera market.

Single-channel designs led with 72% revenue share in 2024, but dual-channel systems are growing at an 11.1% CAGR on the strength of fleet demand for forward-plus-cabin evidence. Logistics firms report 30% faster dispute resolution when interior footage is available, validating higher capital spend. Ride-hailing drivers and parents form a niche retail audience for multi-view kits, whereas OEMs integrate existing park-assist sensors to trigger selective cabin recording, merging privacy compliance with expanded coverage.

Consumer adoption of rear-plus-cabin views is slower; installation complexity and privacy hesitancy dampen uptake. Nonetheless, ride-hailing drivers and parents are niche segments willing to pay for 360° coverage. OEMs are experimenting with leveraging existing park-assist sensors to trigger selective interior recording, blending safety with privacy compliance.

The Dashboard Camera Market Report is Segmented by Technology (Basic, Advanced, Smart/AI-Integrated), Product Type (Single-Channel, Dual-Channel, Rear-View/Surround), Video Quality (SD and HD, Full-HD, 4K/UHD), Application (Personal Vehicles, Commercial Fleets), Distribution Channel (In-Store, and Online), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe led with 35% share in 2024, anchored by the eCall-Event Data Recorder mandate that institutionalized video evidence. Northern markets exhibit above-average attach rates as insurers embrace footage for claims triage. Privacy safeguards such as automatic face blurring are now baseline specifications, adding development complexity yet raising consumer trust.

Asia posts the fastest 11.6% CAGR to 2030. China benefits from scale manufacturing economies and municipal smart-city grants that endorse connected cameras. South Korea's insurers offer structured telematics credits, accelerating household adoption. India's 2026 commercial ADAS requirement positions the country as a major demand catalyst; localized suppliers already pilot rugged units tuned for monsoon humidity under guidelines from the Ministry of Road Transport and Highways.

North America shows robust fleet momentum. Carriers integrate video with existing ELD and route-optimization stacks, while progressive insurers and risk-management pools endorse camera evidence to curb litigation costs. Extreme-heat regions of the Southwest, alongside Middle-Eastern and African climates, remain constrained by hardware reliability issues; vendors investing in thermal-resistant designs stand to unlock latent potential as validated field data emerges.

- Garmin Ltd.

- Nextbase

- Thinkware Corporation

- Cobra Electronics (Cedar Electronics)

- Pittasoft Co. Ltd. (BlackVue)

- Xiaomi Corp.

- DOD Tech

- HP Inc.

- Lukas (Qronetek)

- Kenwood Corp. (JVC Kenwood)

- Philips N.V. (Dashcam Line)

- Steelmate Automotive

- Papago Inc.

- RoadHawk UK

- AsusTek Computer Inc.

- Vantrue

- Viofo Ltd.

- Panasonic Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 European eCall-Event Data Recorder Mandate Driving Factory-Fit Dashcams

- 4.2.2 AI-Enabled Fleet Video Telematics Adoption in US and UK Logistics

- 4.2.3 OEM-Installed Dashcams by Tesla, BMW and Hyundai Accelerating APAC Uptake

- 4.2.4 Insurance Telematics Discounts in Canada and South Korea

- 4.2.5 Government Commercial Fleet Video Evidence Regulation (e.g. India 2026 Regulation)

- 4.2.6 Insurer-driven 4K/UHD video-quality adoption for claim clarity

- 4.3 Market Restraints

- 4.3.1 GDPR-Driven Recording Restrictions in Germany and Austria

- 4.3.2 Cyber-Vulnerability Disclosures in Connected Dashcams

- 4.3.3 Heat-Induced Device Failures (e.g., Middle-East (>15 % RMA))

- 4.3.4 Installation complexity and privacy hesitancy for dual/in-cabin cameras

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Basic

- 5.1.2 Advanced

- 5.1.3 Smart / AI-Integrated

- 5.2 By Product Type

- 5.2.1 Single-Channel

- 5.2.2 Dual-Channel

- 5.2.3 Rear-View/Surround

- 5.3 By Video Quality

- 5.3.1 SD and HD

- 5.3.2 Full-HD

- 5.3.3 4K / UHD

- 5.4 By Application

- 5.4.1 Personal Vehicles

- 5.4.2 Commercial Fleets

- 5.5 By Distribution Channel

- 5.5.1 In-store

- 5.5.2 Online

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics (Sweden, Norway, Denmark, Finland)

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN (Indonesia, Thailand, Malaysia, Vietnam, Philippines)

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Garmin Ltd.

- 6.4.2 Nextbase

- 6.4.3 Thinkware Corporation

- 6.4.4 Cobra Electronics (Cedar Electronics)

- 6.4.5 Pittasoft Co. Ltd. (BlackVue)

- 6.4.6 Xiaomi Corp.

- 6.4.7 DOD Tech

- 6.4.8 HP Inc.

- 6.4.9 Lukas (Qronetek)

- 6.4.10 Kenwood Corp. (JVC Kenwood)

- 6.4.11 Philips N.V. (Dashcam Line)

- 6.4.12 Steelmate Automotive

- 6.4.13 Papago Inc.

- 6.4.14 RoadHawk UK

- 6.4.15 AsusTek Computer Inc.

- 6.4.16 Vantrue

- 6.4.17 Viofo Ltd.

- 6.4.18 Panasonic Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment