|

市場調查報告書

商品編碼

1851572

商用機器人:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Commercial Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

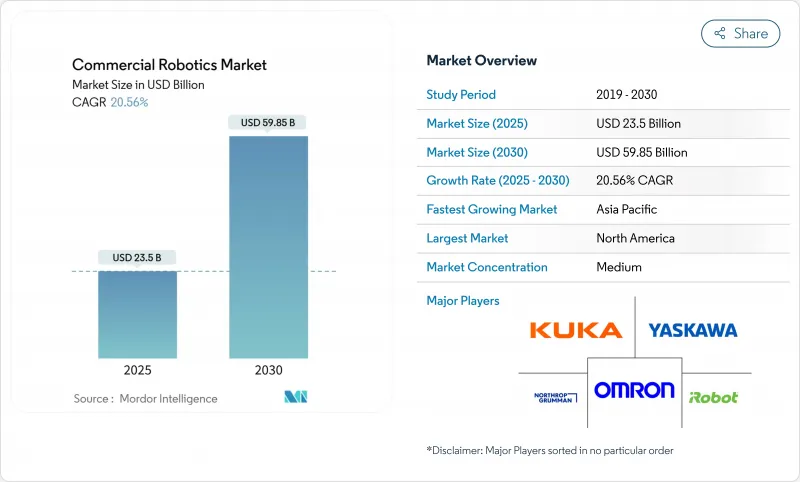

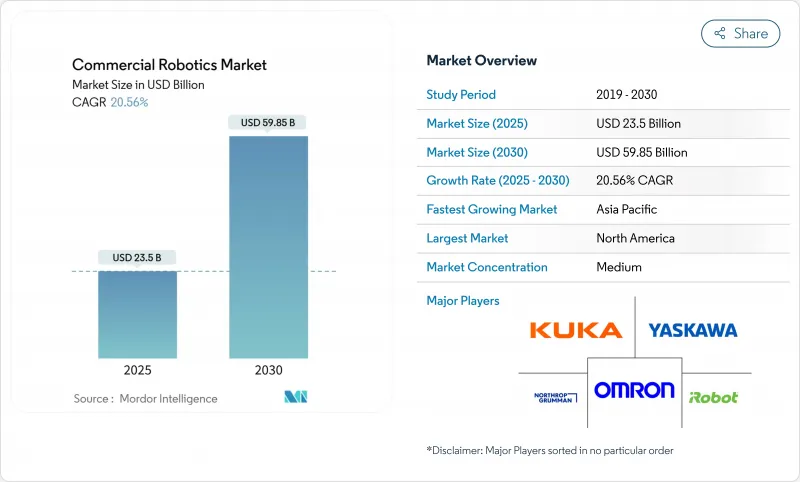

預計到 2025 年,商用機器人市場規模將達到 235 億美元,到 2030 年將達到 598.5 億美元,年複合成長率為 20.6%。

隨著人工智慧和邊緣運算硬體的融合,機器人能夠在本地執行感知和操作任務,將延遲降低到個位數毫秒級,市場需求強勁。預計到本十年末,美國將損失850萬個工作崗位,製造業和物流業持續面臨嚴重的勞動力短缺,推動自動化預算不斷成長。政府採購週期帶動了國防和安全平台訂單的成長,而大型電商公司正在部署數十萬台移動機器人以縮短履約時間。同時,中國1,380億美元的投資計畫也凸顯了亞太地區對自主系統日益成長的需求。

全球商用機器人市場趨勢與洞察

人工智慧、邊緣運算和機器人技術的融合

商用機器人市場受益於設備端人工智慧推理技術,該技術能夠彌補雲端延遲,實現即時導航選擇,並支援生成任務規劃。亞馬遜經營超過75萬台倉庫機器人,並透過視覺模型和本地處理的結合,實現了25%的效率提升。約翰迪爾的第二代自主控制系統展示了邊緣人工智慧如何實現作物行間厘米級的精準導航,並提升非結構化田地中的運作。隨著大規模行為模型的成熟,機器人將從基於規則的行為轉向自學習程序,從而將資本設備重塑為可升級的數位資產。這種轉變提升了軟體的價值,並將商用機器人市場推向平台經濟,在平台經濟模式下,演算法的維修無需機械改造即可提升現有設備的性能。

勞動力短缺和工資通膨上升

隨著人口結構變化導致勞動力萎縮,製造商面臨生產線人力短缺的困境。據估計,到2030年,美國工廠將有200萬工人失業,而從2021年開始,將有550億美元的資金投入自動化領域。機器人技術可以減少重複性和危險性的工作,在提高員工留任率的同時,維持生產效率。隨著工業機器人硬體價格降至每台10,856美元,中型工廠的投資回收期平均只需一到三年。訂閱式融資模式進一步降低了進入門檻。因此,商用機器人市場與企業對人才和生產力的需求相契合,將機器人定位為勞動力增強工具,而非取代威脅。

機器人系統的初始成本高

包括整合和培訓在內,實施預算仍超過10萬美元,減緩了中小企業採用此技術的速度。機器人即服務(Robot-as-a-Service)合約透過將設備、軟體和維護打包成月費,有助於降低資本成本。 Tennant與Brain Corp簽訂的價值3200萬美元的契約,為已投入運作的6500台自主清潔設備提供支持,證明了設施維護領域訂閱模式的可行性。模組化設計和標準化介面旨在縮短工程時間,但生態系統工具仍在發展中,尤其是在整合商網路薄弱的新興國家。

細分市場分析

到2024年,硬體收入將佔總收入的66.5%,這清楚地表明了構成每個機器人平台物理核心的致動器、驅動器和感測器等有效載荷的資本密集度。然而,軟體收入將實現22.1%的複合年成長率,反映了公司向智慧定義價值的轉型。 ABB超過80%的產品組合都整合了人工智慧功能,可實現即時路徑規劃、動態力控制和基於數位雙胞胎的模擬。服務部門目前尚未貢獻收入,但隨著裝置量的成熟,其收入也在成長。

軟體利潤代表策略轉型。隨著硬體組件的同質化,演算法堆疊決定了差異化。亞馬遜配備觸覺感測器的 Vulcan 機器人能夠搬運先前由人工揀貨員完成的 75% 的庫存單位,而如果沒有先進的抓取軟體,這是不可能實現的。因此,預計在未來十年後半期,軟體商用機器人市場規模將超過機械製造成本,從而重塑供應商的權力平衡,並推動訂閱模式的獲利。

2024年,無人機業務收入佔比達38.1%,主要得益於FAA Part 108法規允許的巡檢、測繪和最後一公里配送服務。醫療平台成長最快,複合年成長率達21.3%,主要得益於醫院為滿足微創手術需求而增購達文西手術系統。直覺外科公司(Intuitive Surgical)2025年第一季營收達22.5億美元,主要得益於其系統用戶基數成長15%。

這一類別轉變凸顯了醫療保健領域對精準化的需求以及老年護理的人口結構變化。同時,田間機器人正在農業和建築業中迅速普及,而自動導引運輸車則在結構化的工業路線中佔據主導地位。產品組合的多樣性表明,商用機器人市場將更依賴多模態平台的成長,而非任何單一類別的主導地位。

區域分析

到2024年,北美仍將佔全球銷售額的36.5%,主要得益於國防費用和大規模自動駕駛車輛在電子商務領域的應用。資助的研究項目和創業投資叢集將加速商業化進程,從而實現從試點到全面工廠規模部署的快速過渡。矽谷的技術出口將進一步支持加拿大和墨西哥的平台標準化。

亞太地區將呈現最強勁的成長勢頭,到2030年複合年成長率將達到21.6%。中國已承諾向工業機器人供應鏈注入約1,380億美元,使其國內供應商的佔有率在2020年至2023年間從30%提升至47%。日本和韓國已總合撥款超過10億美元用於人形機器人和製造機器人,並促成了官民合作關係的商業化。在東南亞,快速的都市化和不斷上漲的工資水準將進一步推動當地製造商採用工業機器人,以提高生產效率。

歐洲是一個成熟且對創新友善的市場,它將成熟的汽車自動化技術與嚴格的安全標準結合。該地區的「適航55」排放計畫鼓勵採用能夠最佳化能源和廢棄物排放的服務機器人。中東/非洲和南美洲仍處於起步階段,受限於整合商的缺乏和資金籌措不足。然而,港口自動化計劃和礦業機器人正逐步吸引試點訂單,預示著長期需求的成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 人工智慧、邊緣運算和機器人技術的融合

- 勞動力短缺和工資通膨上升

- 電子商務的興起推動了倉儲機器人的發展

- 政府和國防部門增加對無人系統的投入

- 超老化經濟體中的老年護理服務:引入機器人

- 加速關鍵基礎設施檢測機器人相關法規的製定

- 市場限制

- 機器人系統的初始成本高

- 聯網機器人的網路安全漏洞

- 稀土永磁材料供應鏈風險

- 熟練的整合商和維護技術人員短缺

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢對市場的影響

第5章 市場規模與成長預測

- 按組件

- 硬體

- 軟體

- 服務

- 按機器人類型

- 無人機/無人飛行器

- 野外機器人

- 醫療機器人

- 自主機器人

- 其他類型

- 透過使用

- 醫療保健

- 國防與安全

- 農業和林業

- 海洋與近海

- 倉儲和物流

- 其他用途

- 透過移動性

- 固定機器人

- 移動地面機器人

- 空中機器人

- 海洋/水下機器人

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd.

- FANUC Corp.

- KUKA AG

- Yaskawa Electric Corp.

- Mitsubishi Electric Corp.

- Northrop Grumman Corp.

- Omron Adept Technologies Inc.

- iRobot Corp.

- Honda Motor Co. Ltd.

- Alphabet Inc.(Intrinsic X)

- Boston Dynamics Inc.

- DJI Technology Co. Ltd.

- Teradyne Inc.(Universal Robots and Mobile Industrial Robots)

- Amazon Robotics(Amazon.com Inc.)

- Intuitive Surgical Inc.

- AgEagle Aerial Systems Inc.

- SANY Heavy Industry Co. Ltd.

- Insitu Inc.(Boeing)

- Baidu Apollo Robotics

- Kraken Robotics Inc.

第7章 市場機會與未來展望

The commercial robotics market size is valued at USD 23.50 billion in 2025 and is projected to register USD 59.85 billion by 2030, advancing at a 20.6% CAGR.

Robust demand stems from the fusion of artificial intelligence with edge-computing hardware that allows robots to execute perception and manipulation tasks locally, trimming latency to single-digit milliseconds. Acute labor shortages continue to tighten across manufacturing and logistics, pushing automation budgets higher as companies look to fill a projected 8.5 million U.S. job gap by decade-end. Government procurement cycles further stimulate orders for defense and security platforms, while large e-commerce players deploy hundreds of thousands of mobile robots to compress fulfillment times. Concurrently, China's state-backed USD 138 billion capital plan underscores Asia-Pacific's accelerating demand for autonomous systems.

Global Commercial Robotics Market Trends and Insights

Technological Convergence of AI, Edge Computing and Robotics

The commercial robotics market benefits from on-device AI inference that offsets cloud latency, enables split-second navigation choices, and supports generative task planning. Amazon operates more than 750,000 warehouse robots that deliver 25% efficiency gains by pairing vision models with local processing. John Deere's second-generation autonomy stack illustrates how edge AI permits centimeter-level steering in crop rows, enhancing uptime in unstructured fields. As large movement models mature, robots switch from rules-based motion to self-learning routines, reframing capital equipment into upgradeable digital assets. This shift elevates software value and propels the commercial robotics market toward platform economics where algorithm improvements lift installed-base capability without mechanical retrofits.

Rising Labor Shortages and Wage Inflation

Manufacturers struggle to staff production lines as demographic shifts shrink labor pools. Vacancies could remove 2 million workers from U.S. factories by 2030, leading to an estimated USD 55 billion redirection of capital toward automation since 2021. Robotics mitigates repetitive and hazardous tasks, improving retention while sustaining throughput. As hardware prices have fallen to USD 10,856 per industrial robot, payback periods for mid-sized plants now average 1-3 years. Subscription financing models further lower entry barriers. Consequently, the commercial robotics market is positioned as a labor-augmentation tool rather than a displacement threat, aligning with corporate mandates to secure talent and productivity simultaneously.

High Up-front Cost of Robotic Systems

Total deployment budgets still top USD 100,000 once integration and training are included, delaying adoption for smaller firms. Robot-as-a-Service contracts help flatten capital curves by bundling equipment, software, and maintenance into monthly fees. Tennant's USD 32 million agreement with Brain Corp underpins 6,500 autonomous cleaning units already in service, proving subscription models in facility care. Modular designs and standardized interfaces aim to trim engineering hours, but ecosystem tooling remains nascent, especially in emerging economies where integrator networks are thin.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of E-commerce Boosting Warehouse Robotics

- Increased Government and Defense Spend on Unmanned Systems

- Cyber-security Vulnerabilities in Connected Robots

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware generated 66.5% of 2024 revenue, underscoring the capital intensity of actuators, drives, and sensor payloads that form each robotic platform's physical backbone. Yet software posted a 22.1% CAGR, reflecting enterprise migration toward intelligence-defined value. Over 80% of ABB's portfolio now bundles AI features that enable real-time path planning, dynamic force control, and digital twin-based simulation. Services contributed residual revenue but are widening as installed bases mature.

Software gains illustrate a strategic pivot. As hardware components commoditize, algorithm stacks dictate differentiation. Amazon's tactile-sensor-equipped Vulcan robot moves 75% of stock-keeping units once reserved for human pickers, a feat impossible without advanced gripping software. Consequently, the commercial robotics market size for software is projected to outpace mechanical build spend by late decade, reshaping supplier power balances and enabling subscription monetization.

Drones accounted for 38.1% of 2024 turnover, buoyed by inspection, mapping, and last-mile delivery services authorized under FAA Part 108 rules that permit beyond-visual-line-of-sight flights. Medical platforms posted the swiftest rise at 21.3% CAGR, with hospitals installing additional da Vinci systems to satisfy minimally invasive procedure demand. Intuitive Surgical recorded USD 2.25 billion Q1 2025 revenue on a 15% system-base expansion.

The category shift underscores healthcare's appetite for precision and demographic-driven eldercare requirements. Meanwhile, field robots demonstrate traction in agriculture and construction, while autonomous guided vehicles dominate structured industrial pathways. Portfolio diversity signals that the commercial robotics market will rely on multi-modal platform growth rather than single-category dominance.

The Commercial Robotics Market Report is Segmented by Component (Hardware, Software, and Services), Type of Robot (Drones/UAVs, Field Robots, Medical Robots, and More), Application (Medical and Healthcare, Defense and Security, Agriculture and Forestry, Marine and Offshore, and More), Mobility (Stationary Robots, Mobile Ground Robots, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 36.5% revenue leadership in 2024, driven by defense outlays and hyperscale e-commerce deployments that utilize extensive autonomous fleets. Funded research programs and venture capital clusters accelerate commercialization cycles, allowing quick transition from pilot pilots to full plant-scale installations. Technology exports from Silicon Valley further support platform standardization in Canada and Mexico.

Asia-Pacific posts the steepest trajectory at 21.6% CAGR through 2030. China's pledge to inject nearly USD 138 billion backs industrial robot supply chains, raising indigenous supplier share from 30% to 47% between 2020 and 2023. National plans in Japan and South Korea collectively allocate more than USD 1 billion for humanoid and manufacturing-grade robots, channeling public-private partnerships into commercialization. Rapid urbanization and wage escalations across Southeast Asia further cultivate adoption among local manufacturers seeking productivity gains.

Europe remains a mature but innovation-active market, combining established automotive automation with stringent safety standards. The region's fit-for-55 emissions plan favors service robots that optimize energy and waste footprints. Middle East and Africa and South America remain nascent, constrained by integrator scarcity and limited financing. Nonetheless, port automation projects and mining robots are slowly catalyzing pilot orders that foreshadow longer-term demand.

- ABB Ltd.

- FANUC Corp.

- KUKA AG

- Yaskawa Electric Corp.

- Mitsubishi Electric Corp.

- Northrop Grumman Corp.

- Omron Adept Technologies Inc.

- iRobot Corp.

- Honda Motor Co. Ltd.

- Alphabet Inc. (Intrinsic X)

- Boston Dynamics Inc.

- DJI Technology Co. Ltd.

- Teradyne Inc. (Universal Robots and Mobile Industrial Robots)

- Amazon Robotics (Amazon.com Inc.)

- Intuitive Surgical Inc.

- AgEagle Aerial Systems Inc.

- SANY Heavy Industry Co. Ltd.

- Insitu Inc. (Boeing)

- Baidu Apollo Robotics

- Kraken Robotics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological convergence of AI, edge computing and robotics

- 4.2.2 Rising labor shortages and wage inflation

- 4.2.3 Expansion of e-commerce boosting warehouse robotics

- 4.2.4 Increased government and defense spend on unmanned systems

- 4.2.5 Eldercare service-robot adoption in super-aging economies

- 4.2.6 Regulatory fast-tracking of inspection robots for critical infrastructure

- 4.3 Market Restraints

- 4.3.1 High up-front cost of robotic systems

- 4.3.2 Cyber-security vulnerabilities in connected robots

- 4.3.3 Supply-chain risk for rare-earth permanent-magnet materials

- 4.3.4 Shortage of skilled integrators and maintenance technicians

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Type of Robot

- 5.2.1 Drones / UAVs

- 5.2.2 Field Robots

- 5.2.3 Medical Robots

- 5.2.4 Autonomous Guided Robots

- 5.2.5 Other Types

- 5.3 By Application

- 5.3.1 Medical and Healthcare

- 5.3.2 Defense and Security

- 5.3.3 Agriculture and Forestry

- 5.3.4 Marine and Offshore

- 5.3.5 Warehousing and Logistics

- 5.3.6 Other Applications

- 5.4 By Mobility

- 5.4.1 Stationary Robots

- 5.4.2 Mobile Ground Robots

- 5.4.3 Aerial Robots

- 5.4.4 Marine / Underwater Robots

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 FANUC Corp.

- 6.4.3 KUKA AG

- 6.4.4 Yaskawa Electric Corp.

- 6.4.5 Mitsubishi Electric Corp.

- 6.4.6 Northrop Grumman Corp.

- 6.4.7 Omron Adept Technologies Inc.

- 6.4.8 iRobot Corp.

- 6.4.9 Honda Motor Co. Ltd.

- 6.4.10 Alphabet Inc. (Intrinsic X)

- 6.4.11 Boston Dynamics Inc.

- 6.4.12 DJI Technology Co. Ltd.

- 6.4.13 Teradyne Inc. (Universal Robots and Mobile Industrial Robots)

- 6.4.14 Amazon Robotics (Amazon.com Inc.)

- 6.4.15 Intuitive Surgical Inc.

- 6.4.16 AgEagle Aerial Systems Inc.

- 6.4.17 SANY Heavy Industry Co. Ltd.

- 6.4.18 Insitu Inc. (Boeing)

- 6.4.19 Baidu Apollo Robotics

- 6.4.20 Kraken Robotics Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment