|

市場調查報告書

商品編碼

1851550

數位氣味:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Digital Scent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

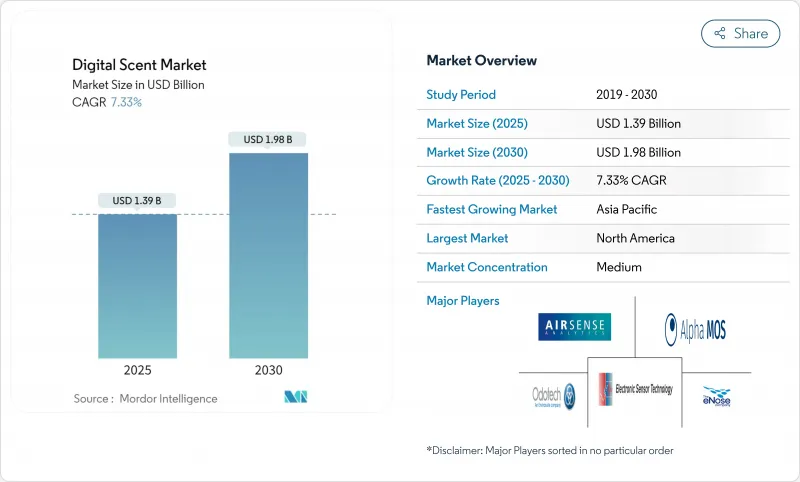

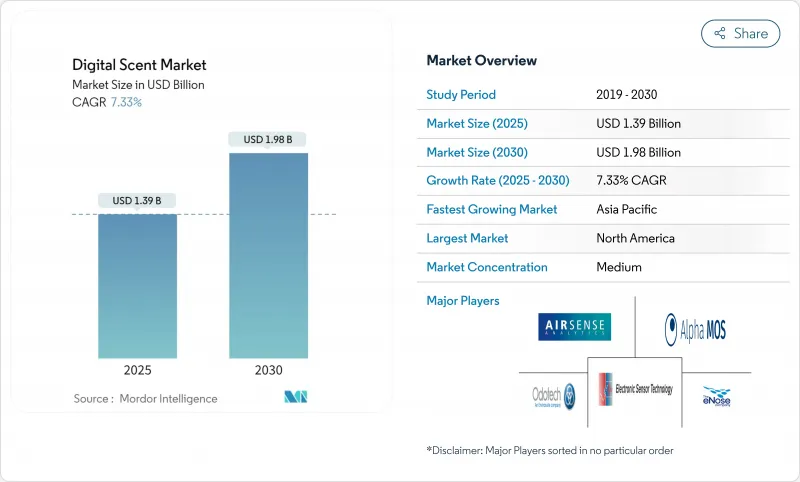

數位氣味市場預計到 2025 年將達到 13.9 億美元,到 2030 年將達到 19.8 億美元,年複合成長率為 7.33%。

人工智慧、物聯網網路和感測器小型化技術的穩定發展,正推動即時嗅覺數位化在醫療保健、國防、環境監測、消費性電子、身臨其境型媒體等領域的應用。基於呼吸的疾病診斷技術在臨床環境中展現出86%的準確率,這為商業性發展注入了強勁動力。美國「呼氣」(EXHALE)計畫正在資助研發用於部隊健康保護的手持式揮發性化合物偵測器。區域需求主要集中在北美,預計2024年,北美將佔據數位氣味市場37.6%的佔有率。同時,亞太地區預計將以9.3%的複合年成長率實現最快成長,這主要得益於日本氣味經濟的快速發展和中國感官智慧產業的蓬勃發展。儘管硬體銷售仍以電子鼻系統為主導(預計到2024年將佔據61.8%的市場佔有率),但隨著各大品牌開發手持式香氛設備和基於網路的配送平台,氣味合成器市場正在加速成長。至2024年,醫療診斷將引領終端應用普及,市佔率將達到34.4%;而隨著元宇宙開發者整合嗅覺回饋技術,VR/AR娛樂將以9.1%的複合年成長率成長。同時,日益嚴格的排放法規,例如歐盟甲醛濃度限制在0.062毫克/立方公尺(2026年生效),正推動供應商轉向可生物分解的濾芯化學技術。

全球數位氣味市場趨勢與洞察

將數位氣味融入身臨其境型虛擬實境和元宇宙體驗

與純視覺體驗相比,氣味增強虛擬實境(VR)可將記憶保持率提高 40%。實驗室規模的穿戴式介面可與視聽流無縫同步,在 0.07 秒內傳遞氣味線索。諸如 Aroma Shooter Wearable 之類的商業性原型產品採用可互換的氣味盒和藍牙連接來支援混合實境內容,目標開發者價格低於 400 美元。 OGDiffusion 等生成式人工智慧工具可從質譜分析結果中產生新的氣味,說明符匹配準確率高達 95%,從而縮短配方前置作業時間。諸如此類的進步使元宇宙平台脫穎而出,並促進了感測器公司和內容發布商之間的生態系統夥伴關係。

歐洲醫療保健體系中電子鼻診斷技術的應用

歐洲各大醫院正將體學納入篩檢流程。機器學習模型對膽固醇的估計平均絕對誤差在13.7%以內,使其應用範圍擴展到腫瘤科以外的領域。標準化呼吸分析已能解釋97.15%的人群變異性,而攜帶式多通道嗅覺測試儀則支持患者自行進行嗅覺評估,既能減輕診所的工作量,又能保持準確性。隨著醫保報銷機制的完善,電子鼻診斷正逐漸成為早期常規篩檢工具。

多感測器電子鼻的校準和維護成本很高。

感測器在不同溫度和濕度條件下的漂移會降低精度,需要每年重新校準,這可能占到初始硬體成本的30%。新的自校準演算法可以將與參考儀器的相關係數提高到0.9,並延長維護週期,但成本仍然是小型實驗室和食品加工商面臨的一大障礙。低成本的開放原始碼設計正在進入市場,但它們仍然需要專業人員的監督,這限制了它們在短期內的普及。

細分市場分析

電子鼻平台在2024年佔據了數位氣味市場61.8%的佔有率,醫院、工業企業和保全機構都優先考慮其久經考驗的分類精度和成熟度。配備1萬個可尋址氣體感測器的仿生晶片,在手持設備中實現了參考實驗室級的選擇性,而溫度調製的三氧化鎢薄膜則將檢測窗口縮短至不到一秒。預計數位氣味合成器市場將從2025年的4.4億美元成長到2030年的6.7億美元,複合年成長率達8.4%。供應商正在投資研發可生物分解的聚合物濾芯,以滿足即將生效的歐盟甲醛法規的要求。與人工智慧加速器的持續整合,實現了設備端頻譜匹配,從而降低了現場操作的延遲和頻寬消耗。

第二代硬體優先考慮便攜性。一款可在毫秒內識別爆炸物的信用卡設備正在緊急救援人員中進行試點,而一款頸掛式香氛擴散器則可將香氣與體育賽事和音樂會同步釋放。模組化設計理念允許互換感測器陣列、風扇組件和香氛盒等組件,從而延長設備使用壽命並降低整體擁有成本。這迭代式硬體藍圖將助力數位氣味市場從以實驗室為中心的實驗走向日常消費。

到2024年,醫療機構將佔數位氣味市場收入的34.4%,因為用於癌症、膽固醇、感染疾病的呼吸檢測正從研究走向實踐。與影像學和侵入性採樣相比,電子鼻診斷可以縮短等待時間並減少患者的不適感。同時,娛樂產業預計將以9.1%的複合年成長率成長,到2030年將達到1.2億美元,因為元宇宙平台、主題樂園和電子競技場館正在嵌入嗅覺元素,以增強沉浸感和品牌差異化。內容創作者正與感測器公司合作,自動觸發特定場景的氣味,並建立類似於影片串流媒體的訂閱式氣味包模式。

工業氣味合規、食品安全和智慧家居香氛系統構成了一個多元化的中階。汽車製造商正在嘗試客製化車內空氣特徵,而奢侈品零售商則引入氣味區域來延長顧客停留時間並提升購買意願。隨著各國政府越來越依賴電子鼻進行邊防安全和危險品篩檢,國防需求持續成長。總而言之,這些垂直領域使得數位氣味產業比任何單一領域都更能抵禦景氣衰退。

區域分析

2024年,北美將佔據數位氣味市場37.6%的佔有率,這得益於其雄厚的國防預算、創業投資網路以及領先的腫瘤治療中心對電子鼻療法的檢驗。加州空氣資源委員會的揮發性有機化合物(VOC)法規鼓勵工業部署能夠同時減少排放並符合規定的技術。該地區的軟體生態系統結合了雲端分析和硬體新興企業,以加速商業化進程並縮短產品上市週期。

亞太地區預計將以9.3%的複合年成長率實現最快成長,這主要得益於日本香水市場在兩年內幾乎翻番的成長,以及中國智慧城市計劃強制推行基於感測器的空氣品質監測。政府的創新補貼和不斷擴大的生產規模正在降低生產成本,從而推動消費者快速接受智慧香薰機和擴增實境(AR)香氛設備。當地企業正在將香氛轉化為語言和情感評分,拓展其在零售和酒店業的應用場景。

歐洲持續保持穩定的貢獻,這得益於工業排放指令以及大學與特種化學品公司之間長期的研發夥伴關係。即將於2026年實施的甲醛排放上限正在加速對合規墨盒材料和連續監測感測器的需求。一家領先的香水公司正利用其位於巴黎的數位工廠,與客戶共同打造人工智慧設計的香氛,以強化該地區的創造性供應鏈。儘管南美洲和中東及非洲目前所佔佔有率較小,但它們在環境合規和油氣安全方面蘊藏著日益成長的機遇,尤其是在洩漏現場檢測碳氫化合物的電子鼻領域。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 將數位氣味融入身臨其境型虛擬實境和元宇宙體驗

- 歐洲醫療保健途徑中電子鼻診斷的採用

- 歐盟和中國收緊工業氣味即時監測法規

- 化學和生物威脅偵測系統的國防合約

- 具備物聯網功能的智慧家庭香薰機,可實現人工智慧驅動的香味個人化

- 汽車和旗艦店中的高階品牌香氛行銷

- 市場限制

- 多感測器電子鼻的校準和維護成本很高。

- 缺乏標準化的數位氣味通訊協定導致互通性存在差距。

- 歐盟排放法規限制了墨盒配方

- 人工智慧模型缺乏大規模標註的嗅覺資料集

- 產業價值鏈分析

- 監理與技術展望

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 透過硬體

- 電子鼻

- 氣味合成器

- 香氛盒/模組

- 按最終用途行業分類

- 醫療診斷

- 食品飲料品管

- 環境監測和廢棄物管理

- 國防/安全

- 消費性電子產品和智慧家居

- 娛樂和虛擬實境/擴增實境

- 行銷與零售經驗

- 透過使用

- 醫學呼吸與疾病診斷(呼吸與體液)

- 品質檢驗和評級

- 氣味監測和污染控制

- 威脅和爆炸物探測

- 身臨其境型內容與遊戲

- 身臨其境型香氛行銷

- 按外形規格

- 固定/桌面系統

- 可攜式手持設備

- 穿戴式和嵌入式模組

- 網路感測器陣列

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 南美洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- GCC

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 策略趨勢

- 市佔率分析

- 公司簡介

- Alpha MOS SA

- Aryballe Technologies SA

- Electronic Sensor Technology Inc.

- Airsense Analytics GmbH

- Plasmion GmbH

- Odotech Inc.

- The eNose Company

- Comon Invent BV

- Aroma Bit, Inc.

- Aromajoin Corporation

- Scent Sciences Corporation

- Olorama Technology

- Aromyx Corporation

- Stratuscent Inc.

- Scentrealm Inc.

- Vapor Communications

- Olfactomics BV

- SmellSpace Pte Ltd

- Nose Labs AB

- Bosch Sensortec GmbH

第7章 市場機會與未來展望

The Digital Scent market size stood at USD 1.39 billion in 2025 and is projected to reach USD 1.98 billion by 2030, advancing at a 7.33% CAGR.

Steady progress in artificial intelligence, IoT networking, and sensor miniaturization is allowing real-time olfactory digitization across healthcare, defense, environmental monitoring, consumer electronics, and immersive media. Commercial momentum is anchored in breath-based disease diagnostics that have demonstrated 86% accuracy in clinical settings. Military procurement also underpins spending, with the U.S. EXHALE program funding handheld volatile-compound detectors for force health protection. Regional demand skews toward North America, which controlled 37.6% of the Digital Scent market in 2024, while Asia-Pacific is expanding the fastest on 9.3% CAGR as Japan's fragrance economy and China's perception-intelligence sector scale rapidly. Hardware revenues remain concentrated in electronic-nose (e-nose) systems that captured 61.8% share in 2024, yet scent synthesizers are pacing growth as brands develop handheld aroma devices and web-linked distribution platforms. Healthcare diagnostics led end-use adoption at 34.4% share in 2024, but VR/AR entertainment is projected to rise at 9.1% CAGR as metaverse developers integrate olfactory feedback. Stricter emission caps-such as the EU's 0.062 mg/m3 formaldehyde limit effective 2026-are simultaneously pushing vendors toward biodegradable cartridge chemistries.

Global Digital Scent Market Trends and Insights

Integration of Digital Scent in Immersive VR and Metaverse Experiences

Scent-enabled VR enhances memory retention by 40% versus visual-only experiences. Lab-scale wearable interfaces now deliver odor cues within 0.07 seconds, synchronizing seamlessly with audiovisual streams. Commercial prototypes such as Aroma Shooter Wearable use replaceable scent cartridges and Bluetooth links to mixed-reality content, targeting sub-USD 400 developer pricing. Generative AI tools like OGDiffusion create new fragrances from mass-spectrometry profiles with 95% descriptor matching accuracy, reducing formulation lead times. These advances differentiate metaverse platforms and spur ecosystem partnerships among sensor firms and content publishers.

Adoption of E-Nose Diagnostics in European Healthcare Pathways

European hospitals are embedding breathomics into screening protocols because e-noses align with histopathology in 86% of lung-cancer cases while costing roughly USD 10 per test. Machine-learning models estimate cholesterol within 13.7% mean absolute error, broadening use beyond oncology. Standardized breathprint analytics already explain 97.15% population variance, and portable multi-channel odor testers enable self-administered smell assessments that cut clinic workload while retaining accuracy. As reimbursement frameworks mature, e-nose diagnostics are on track to become routine early-stage screening tools.

High Calibration and Maintenance Costs of Multi-Sensor E-Noses

Annual recalibration can reach 30% of initial hardware cost because sensor drift undermines accuracy in diverse temperature and humidity conditions. Emerging self-calibrating algorithms boost correlation coefficients to 0.9 against reference instruments and lengthen maintenance intervals, yet cost remains a barrier for small laboratories and food processors. Lower-priced open-source designs are entering the market, but they still require skilled oversight, tempering near-term adoption.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Real-Time Industrial Odor Monitoring in EU and China

- Defense Contracts for Chemical and Bio-Threat Detection Systems

- Interoperability Gaps from Lack of Standard Digital Scent Protocols

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

E-nose platforms generated 61.8% of Digital Scent market revenue in 2024 as hospitals, industrial plants, and security agencies prioritized their proven classification accuracy and maturity. Biomimetic chips embedding 10,000 addressable gas sensors now provide reference-lab selectivity in handheld packages, while temperature-modulated tungsten-trioxide films shorten detection windows to under a second. The Digital Scent market size for scent synthesizers is projected to lift from USD 0.44 billion in 2025 to USD 0.67 billion by 2030 on 8.4% CAGR, supported by luxury retail and streaming-media clients seeking multisensory engagement. Vendors are investing in biodegradable polymer cartridges to meet looming EU formaldehyde limits. Ongoing convergence with AI accelerators allows on-device spectral matching, reducing latency and bandwidth consumption during field operations.

Second-generation hardware emphasizes portability. Credit-card devices that identify explosives in milliseconds are in pilot trials with first responders, while neckband diffusers synchronize aroma bursts to sporting events and music concerts. Modular design philosophies enable component swaps-sensor arrays, fan assemblies, cartridge bays-prolonging device life and lowering total cost of ownership. This iterative hardware roadmap supports the Digital Scent market's transition from lab-centric experiments to everyday consumer

Healthcare facilities accounted for 34.4% of Digital Scent market revenue in 2024 as breath tests for oncology, cholesterol, and infectious diseases moved from research to practice. E-nose diagnostics shorten wait times and reduce patient discomfort relative to imaging or invasive sampling. Meanwhile, the entertainment sector is forecast to capture an incremental USD 120 million by 2030, rising at 9.1% CAGR as metaverse platforms, theme parks, and esports arenas embed olfactory layers that heighten immersion and brand differentiation. Content producers collaborate with sensor firms to auto-trigger scene-specific aromas, creating subscription-based scent-pack models that mirror video streaming revenue structures.

Industrial odor compliance, food safety, and smart-home diffusers form a diversified mid-tier. Automotive OEMs are trialing cabin-air signature customization, and premium retailers deploy scent zones to boost dwell time and purchase intent. Governments' increasing reliance on e-nose installations for border security and hazardous-material screening continues to add to defense-derived demand. Collectively, these verticals reinforce the Digital Scent industry's resilience against single-sector slowdowns.

The Digital Scent Market Report is Segmented by Hardware (E-Nose, Scent Synthesizer, and More), End-Use Industry (Healthcare Diagnostics, Food and Beverage Quality Control, and More), Application (Medical Breath and Disease Diagnostics, Quality Inspection and Grading, and More), Form Factor (Fixed/Benchtop Systems, Portable Handheld Devices, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.6% of Digital Scent market revenue in 2024, benefiting from robust defense budgets, venture-capital networks, and leading oncology centers that validate e-nose therapeutics. California's Air Resources Board VOC regulations simultaneously incentivize industrial deployments that cut emissions and document compliance. Regional software ecosystems accelerate commercialization by pairing cloud analytics with hardware start-ups, shortening go-to-market cycles.

Asia-Pacific is forecast to grow at 9.3% CAGR, the fastest worldwide, as Japan's fragrance segment nearly doubled within two years and Chinese smart-city initiatives mandate sensor-based air-quality monitoring. Government innovation subsidies and manufacturing scale lower production costs, encouraging rapid consumer adoption of smart diffusers and AR-linked scent devices. Local firms translate scents into language and emotion scores, expanding retail and hospitality use cases.

Europe remains a steady contributor, underpinned by the Industrial Emission Directive and long-standing R&D partnerships between universities and specialty-chemicals companies. The impending 2026 formaldehyde limit accelerates demand for compliant cartridge materials and continuous-monitoring sensors. Leading fragrance houses leverage Paris-based digital factories to co-create AI-designed scents with clients, strengthening the region's creative supply chain. South America and the Middle East & Africa currently capture modest shares but show rising opportunity in environmental compliance and oil-and-gas safety, particularly where e-noses detect hydrocarbons at spill sites.

- Alpha MOS SA

- Aryballe Technologies SA

- Electronic Sensor Technology Inc.

- Airsense Analytics GmbH

- Plasmion GmbH

- Odotech Inc.

- The eNose Company

- Comon Invent BV

- Aroma Bit, Inc.

- Aromajoin Corporation

- Scent Sciences Corporation

- Olorama Technology

- Aromyx Corporation

- Stratuscent Inc.

- Scentrealm Inc.

- Vapor Communications

- Olfactomics BV

- SmellSpace Pte Ltd

- Nose Labs AB

- Bosch Sensortec GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Integration of Digital Scent in Immersive VR and Metaverse Experiences

- 4.2.2 Adoption of E-Nose Diagnostics in European Healthcare Pathways

- 4.2.3 Regulatory Push for Real-Time Industrial Odor Monitoring in EU and China

- 4.2.4 Defense Contracts for Chemical and Bio-Threat Detection Systems

- 4.2.5 IoT-Enabled Smart-Home Diffusers with AI Scent Personalization

- 4.2.6 Premium Brand Scent Marketing in Automotive and Flagship Retail

- 4.3 Market Restraints

- 4.3.1 High Calibration and Maintenance Costs of Multi-Sensor E-Noses

- 4.3.2 Interoperability Gaps from Lack of Standard Digital Scent Protocols

- 4.3.3 EU VOC-Emission Rules Limiting Cartridge Formulations

- 4.3.4 Scarcity of Large Annotated Olfactory Datasets for AI Models

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Hardware

- 5.1.1 E-Nose

- 5.1.2 Scent Synthesizer

- 5.1.3 Scent Cartridge/Module

- 5.2 By End-use Industry

- 5.2.1 Healthcare Diagnostics

- 5.2.2 Food and Beverage Quality Control

- 5.2.3 Environmental Monitoring and Waste Management

- 5.2.4 Defense and Security

- 5.2.5 Consumer Electronics and Smart Home

- 5.2.6 Entertainment and VR/AR

- 5.2.7 Marketing and Retail Experiences

- 5.3 By Application

- 5.3.1 Medical Breath and Disease Diagnostics (Breath and Fluid)

- 5.3.2 Quality Inspection and Grading

- 5.3.3 Odor Monitoring and Pollution Control

- 5.3.4 Threat and Explosive Detection

- 5.3.5 Immersive Content and Gaming

- 5.3.6 Immersive Aroma Marketing

- 5.4 By Form Factor

- 5.4.1 Fixed/Benchtop Systems

- 5.4.2 Portable Handheld Devices

- 5.4.3 Wearable and Embedded Modules

- 5.4.4 Networked Sensor Arrays

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries

- 5.5.5.1.2 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Overview, Market Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.3.1 Alpha MOS SA

- 6.3.2 Aryballe Technologies SA

- 6.3.3 Electronic Sensor Technology Inc.

- 6.3.4 Airsense Analytics GmbH

- 6.3.5 Plasmion GmbH

- 6.3.6 Odotech Inc.

- 6.3.7 The eNose Company

- 6.3.8 Comon Invent BV

- 6.3.9 Aroma Bit, Inc.

- 6.3.10 Aromajoin Corporation

- 6.3.11 Scent Sciences Corporation

- 6.3.12 Olorama Technology

- 6.3.13 Aromyx Corporation

- 6.3.14 Stratuscent Inc.

- 6.3.15 Scentrealm Inc.

- 6.3.16 Vapor Communications

- 6.3.17 Olfactomics BV

- 6.3.18 SmellSpace Pte Ltd

- 6.3.19 Nose Labs AB

- 6.3.20 Bosch Sensortec GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment