|

市場調查報告書

商品編碼

1851548

詐騙偵測與預防(FDP):市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Fraud Detection And Prevention (FDP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

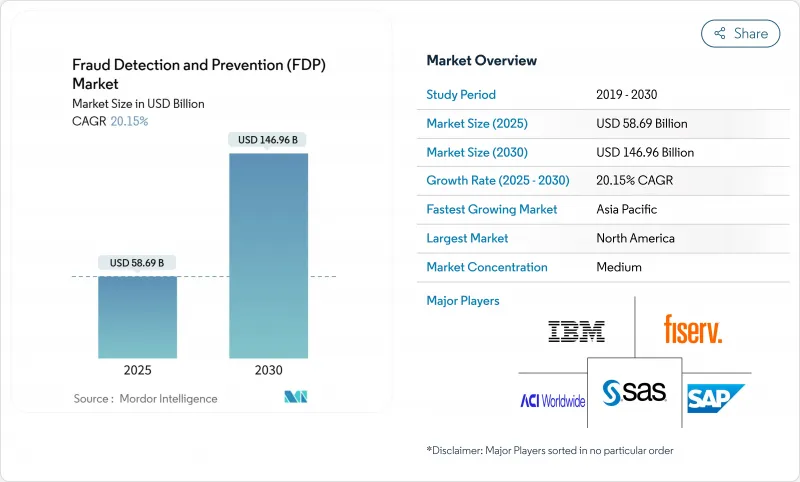

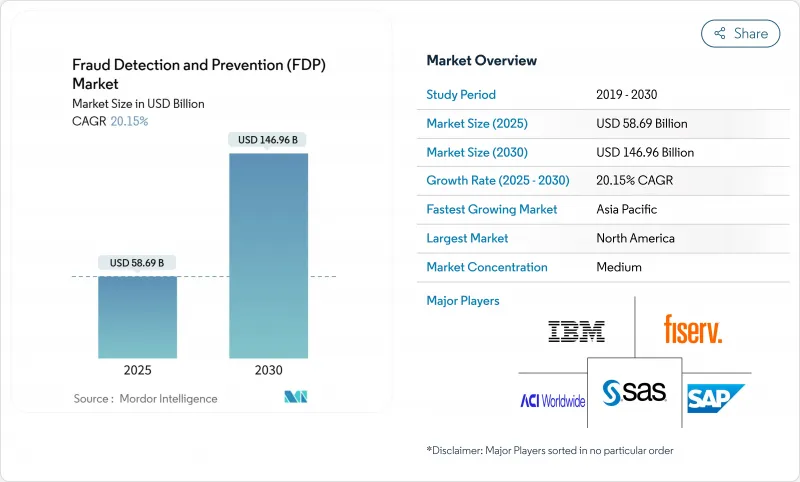

預計到 2025 年,詐欺偵測和預防市場規模將達到 586.9 億美元,到 2030 年將達到 1,469.6 億美元。

這種陡峭的成長軌跡反映了深度造假詐騙、合成身份和其他人工智慧驅動的威脅的激增,這些威脅正使傳統規則引擎不堪重負,並推動對自適應機器學習防禦的需求。監理力度,特別是歐洲的PSD3和PSR一攬子計畫(將於2026年起強制執行強客戶認證(SCA)),正在加速技術更新周期,因為銀行正尋求即時協調安全性、合規性和客戶體驗。行動優先的支付習慣和相關立法(例如菲律賓的《金融帳戶詐騙預防法》)正在推動各國詐欺偵測和預防市場的發展,該法案強制要求進行自動化即時監控。供應鏈詐騙的興起,例如假冒零件詐騙的三位數激增,進一步凸顯了企業如何日益將安全視為保護收入的手段,而不僅僅是合規成本。

全球詐騙偵測與預防 (FDP) 市場趨勢與洞察

數位支付與電子商務的興起

隨著行動電子錢包、QR碼和非接觸感應卡在結帳流程中佔據主導地位,攻擊面不斷擴大,舊有系統難以有效分析這些交易。因此,即時分析設備指紋和行為生物特徵對於區分合法客戶和機器人/腳本驅動的刷卡攻擊至關重要。預計到2023年,電子商務詐騙損失將達到480億美元,其中非接觸式交易(CNP)是主要促進因素。為此,商家正轉向雲端基礎的風險引擎,這些引擎可在毫秒內完成交易評分。零售平台正擴大將這些引擎直接整合到付款閘道中,以在保持結帳速度的同時降低扣回爭議帳款風險。隨著數位化優先的消費者持續推動實體店客流量,各大主要地區對可擴展的、能夠適應新型支付方式(例如先買後付和即時信用額度)的檢測系統的需求日益成長。

高監理合規壓力

歐洲的PSD3和PSR修訂版已將強客戶認證(SCA)的範圍從雙因素認證擴展到共用強制性受益人姓名認證以及金融機構間即時詐欺資料共享。隨著銀行整合各項產品以降低合規成本,提供涵蓋認證、分析和彙報的單一平台的供應商獲得了競爭優勢。跨境貿易的全球化特性迫使美國銀行和支付服務提供者(PSP)在服務歐盟客戶時必須達到歐洲的SCA基準,從而有效地將更嚴格的標準推廣至全球。亞太地區也出現了類似的舉措,新加坡和澳洲的監管機構已將營運許可證與受監控的詐欺閾值掛鉤。因此,合規要求正在縮短實施週期,促使規避風險的金融機構轉向雲端基礎設施,以便快速更新規則和模型,而無需冗長的變更管理週期。

高誤報率會損害客戶體驗

過於敏感的規則集可能會將合法消費標記為可疑交易,觸發人工審核,從而削弱即時支付的承諾。客戶調查顯示,如果合法交易連續兩次被拒,一年內更換銀行的可能性會增加兩倍。現代人工智慧引擎可以透過分析個人消費習慣、季節性出行模式和設備偏好降低誤報率,在不犧牲識別率的前提下,將誤報數量減少一半。然而,向即時支付的轉變將決策視窗壓縮到僅幾秒,幾乎沒有人工干預的空間。因此,金融機構正在更加謹慎地調整風險閾值,並接受小額詐欺損失略高的情況,以保障整體轉換率和客戶滿意度指標。

細分市場分析

解決方案佔據了詐欺偵測和預防市場規模的 63.9%,凸顯了分析引擎、身分驗證模組和調查員儀表板的關鍵作用。供應商正在利用自適應機器學習來最佳化規則庫,使金融機構能夠每天處理Terabyte的行為數據,並近乎即時地回應新的攻擊特徵。解決方案收入也反映了監管報告模組的收入,這些模組可以將偵測資料轉換為符合審核要求的格式,使風險負責人無需使用其他工具即可滿足 PSD3、GDPR 或 OCC 的審查要求。

儘管服務板塊規模較小,但其複合年成長率 (CAGR) 高達 21.5%,這主要得益於董事會將全天候監控委託給託管安全專家,由他們提供校準模型、精選的全球威脅情報源和事件後取證服務。資料科學和網路安全營運領域的人才短缺,使得以結果為導向、保證檢測率服務等級協定 (SLA) 的合約更具吸引力。同時,諮詢業務正圍繞解決方案部署展開,例如重組 KYC 流程、最佳化警報分級和簡化爭議解決流程。預計到 2030 年,這種技術與專業知識的整合將推動服務收入佔比接近三分之一,從而鞏固其在更廣泛的詐欺偵測和預防市場中的策略地位。

到2024年,本地部署將佔總收入的56.1%,因為頂級銀行會利用其現有基礎設施,並透過在自有資料中心處理個人識別資訊 (PII) 來遵守資料居住法規。這些公司傾向於採用混合模式,將模型訓練遷移到雲端,但將生產評分節點部署在私有叢集中,以最大限度地降低延遲。借助這種架構,即使在假日高峰尖峰時段,詐欺預防的延遲也能控制在10毫秒以內。

然而,雲端原生平台正以 22.7% 的複合年成長率 (CAGR) 主導市場,而且這一差距很可能迅速縮小。訂閱定價模式使中型金融機構和金融科技公司能夠透過將授權費與交易成長掛鉤來避免資本支出。領先的供應商現在預先打包了持續配置工具鏈,這些工具鏈每週多次更新偵測模型,從而縮短了發現新詐騙活動的視窗期。高級加密和機密計算區域解決了長期存在的安全問題,而 ISO 27001 和 SOC 2 等認證則讓審核放心。這些優勢的綜合作用使雲端成為未來詐欺偵測和預防市場的首選。

詐欺檢測和預防市場按組件(解決方案、服務)、部署類型(雲端、本地部署)、組織規模(中小企業、大型企業)、最終用戶行業(銀行、金融服務和保險、零售/電子商務、醫療保健等)以及地區進行細分。市場預測以美元計價。

區域分析

北美地區佔2024年總收入的27.5%,是各地區中佔比最高的。這主要得益於該地區早期採用雲端運算、先進的威脅情報共用以及龐大的技術預算。美國財政部等聯邦機構在部署人工智慧主導的異常檢測技術後,於2024會計年度追回了10億美元的支票詐騙損失。美國信用卡網路也積極推廣基於人工智慧的預核准評分,以遏制非接觸式支付(CNP)扣回爭議帳款,並將詐欺邏輯直接嵌入支付系統。加拿大各銀行正在組成聯合聯盟,共同打擊新興的即時支付系統詐騙,並在訊號交換方面展現區域合作。

歐洲也在迅速擴展監管,PSD3 和 PSR 引入了強制性的收件人姓名匹配和即時風險回饋。 GDPR 的限制將推動隱私保護型聯邦學習的創新,使銀行能夠在無需傳輸原始資料的情況下進行跨行模型訓練。根據新的 eIDAS 更新,電訊將被要求過濾欺騙性電話和惡意短信,從而將詐騙檢測和預防市場擴展到電訊基礎設施領域。西班牙等國對未實施這些措施的通訊業者處以 200 萬歐元(235 萬美元)的罰款,並將安全要求深度納入其營運許可證。

亞太地區正以20.1%的複合年成長率(CAGR)領先全球,這主要得益於行動支付的普及以及分散的合規環境,後者迫使供應商提供可配置的策略引擎。菲律賓的《金融帳戶詐騙預防法》強制要求金融機構實施規模化的詐騙預防系統,而印度儲備銀行(RBI)則強制要求對統一支付介面(UPI)即時支付進行基於人工智慧的交易監控。中國當地正在試行將人工智慧應用於福利分配中的腐敗分析,證明了人工智慧的應用範圍不僅限於金融科技領域,還可以用於公共資金的監控。這些動態共同推動了亞太地區對靈活、即時解決方案的需求,提升了亞太地區在全球詐欺偵測和預防市場中的地位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 數位支付與電子商務的興起

- 高監理合規壓力

- 人工智慧/機器學習賦能的分析技術可提高偵測準確性

- 令牌化和 3-D Secure 2.3 推動了普及

- 開放銀行/即時支付管道-新的詐騙途徑

- 生成式人工智慧加劇了深度造假詐騙

- 市場限制

- 高假陽性率會損害客戶體驗。

- 與舊有系統整合的複雜性

- 缺乏用於訓練人工智慧模型的標記資料集

- 隱私保護條例下的資料共用限制

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估市場的宏觀經濟因素

第5章 市場規模與成長預測

- 按組件

- 解決方案

- 詐欺分析

- 認證

- 報告

- 視覺化

- 其他

- 服務

- 解決方案

- 透過部署模式

- 雲

- 本地部署

- 按組織規模

- 小型企業

- 主要企業

- 按最終用戶行業分類

- BFSI

- 零售與電子商務

- 資訊科技和電訊

- 衛生保健

- 能源與公共產業

- 製造業

- 政府/公共部門

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- SAP SE

- IBM Corporation

- SAS Institute Inc.

- ACI Worldwide Inc.

- Fiserv Inc.

- Experian PLC

- DXC Technology Company

- BAE Systems PLC

- RSA Security LLC(Dell Technologies)

- Oracle Corporation

- NICE Ltd

- Equifax Inc.

- LexisNexis Risk Solutions

- Fair Isaac Corporation(FICO)

- Cybersource Corporation(Visa)

- Global Payments Inc.

- Feedzai SA

- Signifyd Inc.

- Riskified Ltd.

- Kount Inc.

第7章 市場機會與未來展望

The fraud detection and prevention market reached USD 58.69 billion in 2025 and is set to climb to USD 146.96 billion by 2030, translating into a 20.15% CAGR.

This steep trajectory mirrors the surge in deepfake scams, synthetic identities, and other AI-enabled threats that overwhelm legacy rule engines and elevate demand for adaptive machine-learning defenses. Regulatory momentum, notably the European PSD3 and PSR package that tightens Strong Customer Authentication (SCA) from 2026, accelerates technology refresh cycles as banks look to align security, compliance, and customer experience in real time. Fraud detection and prevention market in various countries is fueled by mobile-first payment habits and laws such as the Philippines' Anti-Financial Account Scamming Act that mandates automated, real-time monitoring. Intensifying supply-chain fraud, evidenced by triple-digit spikes in counterfeit component scams, further underscores because organizations now treat security as a revenue-protection lever, not merely a compliance cost.

Global Fraud Detection And Prevention (FDP) Market Trends and Insights

Rising Digital Payments and E-commerce Volumes

Mobile wallets, QR codes, and contactless cards now dominate checkout flows, expanding attack surfaces that legacy systems cannot parse effectively. Real-time analysis of device fingerprinting and behavioral biometrics has therefore become mandatory to distinguish legitimate customers from bots or scripted card-testing attacks.E-commerce fraud losses reached USD 48 billion in 2023, with card-not-present (CNP) transactions as the chief culprit, pushing merchants toward cloud-based risk engines that score transactions in milliseconds. Retail platforms increasingly embed these engines directly in payment gateways to preserve checkout speed while reducing chargeback exposure. As digital-first consumers continue to displace in-store traffic, demand for scalable detection that adapts to novel payment formats-such as buy-now-pay-later and instant-credit lines-intensifies across every major geography.

Stringent Regulatory Compliance Pressures

Europe's PSD3 and PSR overhaul expands SCA beyond two-factor credentials to include mandatory payee name verification and real-time fraud data sharing among financial institutions. Vendors that deliver single platforms covering authentication, analytics, and reporting gain an edge as banks consolidate point products to rein in compliance overhead. The global nature of cross-border commerce compels US banks and PSPs to meet European SCA benchmarks when serving EU clients, effectively exporting stricter standards worldwide. Similar momentum appears in Asia-Pacific, where regulators in Singapore and Australia link operating licences to monitored fraud thresholds. Compliance thus compresses deployment timelines, pushing even risk-averse institutions toward cloud infrastructures that offer rapid rule and model updates without lengthy change-control cycles.

High False-Positive Rates Hurting Customer Experience

Overly sensitive rule sets can tag legitimate spend as suspicious, triggering manual reviews that stall instant-payment expectations. Customer surveys show that two consecutively declined genuine transactions triple the likelihood of switching banks within a year. Modern AI engines reduce noise by profiling individual spending rhythms, seasonal travel patterns, and device preferences, cutting false-positive counts by up to half without sacrificing catch rates. Yet the shift to real-time settlement compresses decision windows to mere seconds, leaving no room for human intervention. Institutions therefore calibrate risk thresholds more carefully, accepting marginally higher fraud loss on low-ticket items to protect overall conversion and satisfaction metrics.

Other drivers and restraints analyzed in the detailed report include:

- AI/ML-Enabled Analytics Improving Detection Accuracy

- Generative-AI Deepfake Fraud Escalation

- Integration Complexity with Legacy Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions hold 63.9% of the fraud detection and prevention market size, underscoring the foundational role of analytics engines, authentication modules, and investigator dashboards. Vendors refine rule libraries with adaptive machine learning, letting financial institutions ingest terabytes of behavioral data per day and respond to fresh attack signatures in near real time. Solutions revenue also reflects regulatory reporting modules that convert detection data into audit-ready formats, allowing risk officers to satisfy PSD3, GDPR, or OCC exams without separate tooling.

Services, although smaller, are expanding at 21.5% CAGR as boards delegate 24/7 monitoring to managed-security specialists that provide calibrated models, curated global threat feeds, and post-incident forensics. Talent shortages in data science and cyber-ops elevate the appeal of outcome-based contracts that guarantee detection-rate SLAs. In parallel, consulting wraps around solution deployments to re-engineer KYC flows, optimize alert triage, and streamline dispute resolution. This convergence of technology and expertise is expected to lift services to almost one-third of 2030 revenue, reinforcing their strategic position within the broader fraud detection and prevention market.

On-premises installations retained 56.1% of 2024 revenue as tier-one banks leveraged sunk infrastructure and met data-residency statutes by processing PII in their own data centers. These firms favor hybrid patterns that shift model training to the cloud yet keep production scoring nodes in private clusters to minimize latency. Under such architectures, anti-fraud latency remains below 10 milliseconds even at holiday peak volumes.

Cloud-native platforms, however, outpace all others at a 22.7% CAGR and will narrow the share gap rapidly. Subscription pricing aligns license fees with transaction growth, letting mid-tier lenders and fintechs avoid capital outlays. Leading vendors now pre-package continuous deployment toolchains that refresh detection models multiple times per week, shortening exposure windows to novel frauds. Advanced encryption and confidential-compute zones address lingering sovereignty worries, while certifications like ISO 27001 and SOC 2 reassure auditors. These advantages collectively establish cloud as the future default for the fraud detection and prevention market.

Fraud Detection and Prevention Market is Segmented by Component (Solutions, Services), Deployment Mode (Cloud, On-Premises), Organization Size (SMEs, Large Enterprises), End-User Industry (BFSI, Retail and E-Commerce, Healthcare, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the largest regional slice at 27.5% of 2024 revenue, supported by early cloud adoption, sophisticated threat intelligence sharing, and sizeable technology budgets. Federal agencies such as the US Treasury recovered USD 1 billion in check fraud during fiscal 2024 after deploying AI-driven anomaly detection, signaling public-sector validation that further stimulates private-sector uptake. US card networks likewise advocate AI-based pre-authorization scoring to curb CNP chargebacks, embedding fraud logic directly in payment rails. Canadian banks collaborate in a joint consortium to combat emerging real-time rail fraud, demonstrating regional co-operation on signals exchange.

Europe follows with rapid regulatory expansion as PSD3 and PSR introduce mandatory payee-name matching and real-time risk feeds. GDPR constraints drive innovation in privacy-preserving federated learning, allowing banks to train cross-bank models without raw-data transfers. Telecom operators must filter spoofed calls and malware SMS under new eIDAS updates, broadening the fraud detection and prevention market into telco infrastructure. Nations such as Spain impose EUR 2 million (USD 2.35 million) fines on carriers that fail to implement these measures, embedding security requirements deep in operational licences.

Asia-Pacific records the fastest 20.1% CAGR, led by high mobile payment penetration and fragmented compliance terrain that forces vendors to offer configurable policy engines. The Philippines' Anti-Financial Account Scamming Act compels fraud systems scaled to institution size, while India's RBI mandates AI-powered transaction monitoring for UPI instant payments. Mainland China pilots AI corruption analytics on welfare distributions, proving applicability beyond fintech into public-fund oversight. Together, these dynamics amplify regional demand for flexible, real-time solutions, elevating APAC's weighting in the global fraud detection and prevention market.

- SAP SE

- IBM Corporation

- SAS Institute Inc.

- ACI Worldwide Inc.

- Fiserv Inc.

- Experian PLC

- DXC Technology Company

- BAE Systems PLC

- RSA Security LLC (Dell Technologies)

- Oracle Corporation

- NICE Ltd

- Equifax Inc.

- LexisNexis Risk Solutions

- Fair Isaac Corporation (FICO)

- Cybersource Corporation (Visa)

- Global Payments Inc.

- Feedzai SA

- Signifyd Inc.

- Riskified Ltd.

- Kount Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising digital payments and e-commerce volumes

- 4.2.2 Stringent regulatory compliance pressures

- 4.2.3 AI/ML-enabled analytics improving detection accuracy

- 4.2.4 Tokenization and 3-D Secure 2.3 boosting adoption

- 4.2.5 Open Banking/instant-payment rails - new fraud vectors

- 4.2.6 Generative-AI deepfake fraud escalation

- 4.3 Market Restraints

- 4.3.1 High false-positive rates hurting CX

- 4.3.2 Integration complexity with legacy systems

- 4.3.3 Lack of labelled data sets for AI model training

- 4.3.4 Data-sharing limits under privacy regulations

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Fraud Analytics

- 5.1.1.2 Authentication

- 5.1.1.3 Reporting

- 5.1.1.4 Visualization

- 5.1.1.5 Others

- 5.1.2 Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premises

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Retail and E-commerce

- 5.4.3 IT and Telecom

- 5.4.4 Healthcare

- 5.4.5 Energy and Utilities

- 5.4.6 Manufacturing

- 5.4.7 Government and Public Sector

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SAP SE

- 6.4.2 IBM Corporation

- 6.4.3 SAS Institute Inc.

- 6.4.4 ACI Worldwide Inc.

- 6.4.5 Fiserv Inc.

- 6.4.6 Experian PLC

- 6.4.7 DXC Technology Company

- 6.4.8 BAE Systems PLC

- 6.4.9 RSA Security LLC (Dell Technologies)

- 6.4.10 Oracle Corporation

- 6.4.11 NICE Ltd

- 6.4.12 Equifax Inc.

- 6.4.13 LexisNexis Risk Solutions

- 6.4.14 Fair Isaac Corporation (FICO)

- 6.4.15 Cybersource Corporation (Visa)

- 6.4.16 Global Payments Inc.

- 6.4.17 Feedzai SA

- 6.4.18 Signifyd Inc.

- 6.4.19 Riskified Ltd.

- 6.4.20 Kount Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment