|

市場調查報告書

商品編碼

1851543

LED構裝:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030年)LED Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

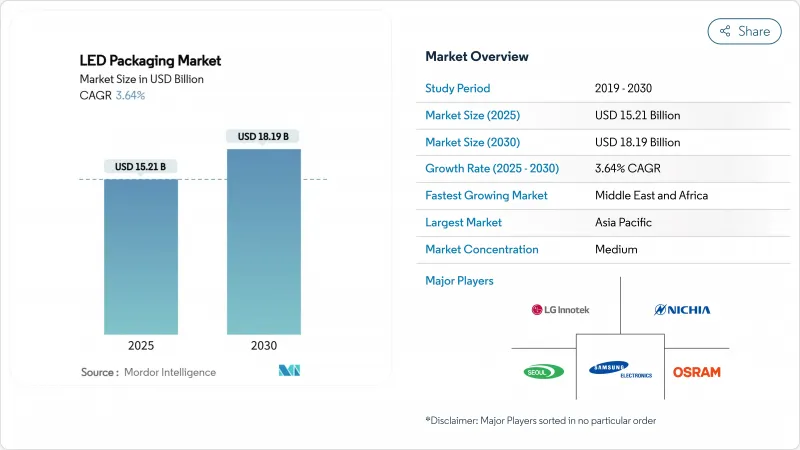

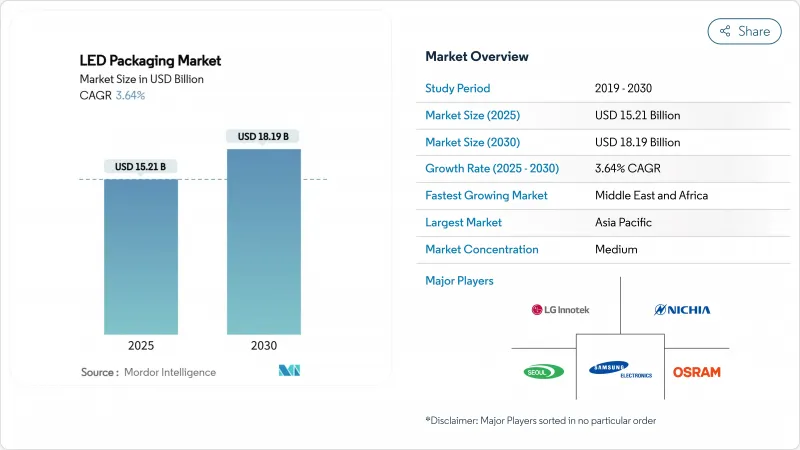

預計到 2025 年, LED構裝市場規模將達到 152.1 億美元,到 2030 年將達到 181.9 億美元,年複合成長率為 3.64%。

價值成長並非來自大眾化燈具,而是來自高階細分市場,例如汽車自我調整頭燈、UV-C紫外線殺菌模組和mini-LED顯示器背光。性能驅動型封裝架構,包括晶片級封裝(CSP)和先進陶瓷基板,正隨著汽車製造商和麵板製造商對更嚴格的熱容差和更薄設計的需求而不斷擴大市場佔有率。政策主導的螢光禁令以及政府對化合物半導體產能的資助進一步推動了LED構裝市場的發展,而地緣政治供應鏈本地化也在影響投資決策。同時,智慧財產權糾紛和基板成本的波動提高了進入門檻並增加了資本需求,從而削弱了成長動能。

全球LED構裝市場趨勢與洞察

電視和IT面板向迷你/微型LED背光技術的過渡

Mini LED背光技術的應用正在重塑高階電視和顯示器市場,各大品牌利用100-200微米的晶片實現了超過2000個局部調光區域,峰值亮度超過2000尼特。封裝在電路板上的製程保持了材料成本的競爭力,而晶片封裝在玻璃上的製程則正在興起,用於超薄工業設計。由於Mini LED在陽光下可視性和使用壽命方面優於OLED,汽車駕駛座顯示器的可尋址面積正在不斷擴大。高密度陣列會產生高熱負荷,因此需要高效散熱且不增加厚度的陶瓷基板和CSP解決方案。隨著消費性電子製造商陸續公佈其Mini LED藍圖,上游封裝公司正在確保產能以支援多年的面板更換週期,從而擴大了LED構裝市場。

CSP在歐洲和韓國的汽車頭燈領域迅速普及。

晶片級封裝無需引線鍵合,顯著降低了光學高度,支援超過 150°C 的結溫,同時降低 20% 的消費量。領先的自我調整光束系統,例如 ams Osram 的 EVIYOS 2.0(整合 25,600 個可獨立尋址像素),展示了 CSP 如何實現對光分佈的精確控制。歐洲關於眩光和能源效率的法規正在加速這一轉變,韓國供應商已將 CSP 用於空間受限的車內環境照明模組。一級頭燈規範要求 10 萬小時的使用壽命,迫使封裝廠商對陶瓷腔體和高導熱晶粒晶片貼裝進行認證。這一趨勢凸顯了LED構裝市場的策略轉變,高階汽車照明正將 CSP 作為安全關鍵燈具的參考架構。

藍寶石晶片價格波動

藍寶石晶圓佔封裝成本的20%之多,但其季度價格波動往往超過30%,擠壓了代工封裝廠商的毛利率。晶體生長集中在亞太地區少數幾家供應商手中,這意味著地緣政治摩擦和電力短缺可能迅速導致供不應求。儘管主要廠商正在探索雷射剝離技術以實現基板的再利用,但高昂的資本投入限制了該技術的應用,使其僅限於一級廠商。這使得中小企業在沒有回收對沖措施的情況下,面臨原料風險,削弱了其擴大生產的能力,並限制了整個LED構裝市場的韌性。

細分市場分析

CSP(複合表面封裝)的出貨量正以5.4%的複合年成長率成長,反映出其在汽車頭燈和超薄顯示器背光等領域的應用日益廣泛。從以金額為準來看,CSP在LED構裝市場中的佔有率也在不斷成長。隨著對整修照明的需求持續成長,SMD(表面貼裝元件)的出貨量預計在2024年將占到43%,因為其單位成本超過了小型化帶來的優勢。覆晶型LED主要面向3W以上的細分市場,雖然專利費較高,但由於其能夠製造符合自我調整光束法規的緊湊型光學元件,因此在LED構裝市場中保持著獨特的佔有率。混合型和無封裝結構仍處於實驗階段,受到貼片週期時間和重工挑戰的限制。

晶圓級封裝的持續創新模糊了晶片製造和封裝組裝之間的界限。台灣的半導體組裝測試外包(OSAT)供應商正在擴大扇出型CSP生產線,以滿足電視和智慧型手機背光製造商的緊急訂單。另一方面,歐洲一級汽車製造商透過強制執行嚴格的AEC-Q102可靠性測試來確保雙重採購,從而有效地將新興供應商拒之門外。這種分化凸顯了LED構裝市場中成本最佳化和效能最佳化兩種模式並存的現況。

到2024年,導線架架構仍將佔出貨量的34%,但隨著設計人員追求導熱係數超過150 W/mK,氮化鋁基陶瓷腔體的出貨量將增加4.3%。汽車、UV-C和園藝照明燈具將推高結溫,導致有機基板過早劣化,因此陶瓷成為必需品。因此,基於陶瓷基板的LED構裝市場將與功率密度呈線性成長,而非與出貨量呈線性成長。

封裝材料化學的演進與LED封裝技術的發展同步進行。具有更優異排氣性能的抗紫外線矽凝膠可防止在滅菌循環過程中變色,而銀銅合金接合線則抵消了黃金帶來的成本增加。遠程磷光體和玻璃封裝磷光體解決方案可望實現穩定的色移,但由於資本密集度高且年複合成長率為-0.5%,中型廠商仍在觀望。因此,材料的選擇已成為一種策略性對沖。陶瓷材料用於提高熱裕度,有機材料用於降低成本,玻璃封裝磷光體用於提高頻譜均勻性,所有這些材料都在LED構裝市場中爭奪市場佔有率。

區域分析

亞太地區佔全球LED構裝市場68%的佔有率,其主導地位源自於垂直整合的電子供應鏈和國內消費。中國的基礎建設和節能政策推動了銷售量,而台灣OSAT(外包半導體封裝測試)領軍企業如日月光(ASE)在人工智慧硬體訂單的推動下,2025年第二季營收季訂單11%。日本正利用其在汽車級可靠性方面的專業知識,而韓國面板製造商則在推廣CSP(聚光燈太陽能)車頭燈模組。資料中心建設對高顯色指數(CRI)陶瓷封裝的需求也將推動該地區的成長。

北美的成長軌跡取決於監管催化劑,而非自然維修周期。螢光禁令和美國能源部能源效率法規確保了LED燈在2030年前的替代市場,從而保證了基準出貨量不受宏觀經濟波動的影響。美國《晶片技術創新法案》(CHIPS Act)的激勵措施,包括為Wolfspeed的碳化矽生產線提供7.5億美元的資金,體現了政府對化合物半導體供應鏈的政策支持。

歐洲市場正朝著高階汽車需求和嚴格的環保設計標準發展。德國汽車製造商率先部署自我調整頭燈,並傾向於採用CSP和覆晶封裝,而更嚴格的眩光法規則要求實現像素級控制。同時,永續性框架優先考慮生命週期光通量維持率,從而強化了對陶瓷基板波灣合作理事會的基礎設施計劃正在其碳減排藍圖圖下整合智慧節能照明。南美洲的市佔率落後,但隨著交通走廊升級和電費上漲,LED維修在經濟上更具吸引力,因此仍有成長空間。這些區域趨勢清晰地表明,監管意圖和基礎設施投資將如何重新平衡整個LED構裝市場的需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電視和IT面板向迷你/微型LED背光技術的過渡

- CSP技術在歐洲和韓國迅速應用於汽車頭燈。

- 北美政策主導的螢光逐步淘汰

- 亞洲資料中心蓬勃發展,推動高顯色指數照明應用。

- 用於即時消毒的UV-C LED需求激增

- 台灣和中國的LED構裝(OSAT)業務成長

- 市場限制

- 藍寶石晶片價格波動

- 覆晶設計中的智慧財產權交叉授權壁壘

- 轉型為磷光體玻璃需要大量資金投入

- 3W以上封裝的功率密度溫度控管限制

- 生態系分析

- 監理與技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按包裝類型

- 表面黏著型元件(SMD)

- 板載晶片(COB)

- 晶片級封裝(CSP)

- 覆晶

- 混合/無封裝設計

- 透過包裝材料

- 導線架和基板

- 陶瓷基板

- 鍵合線/晶片連接

- 封裝樹脂和矽膠鏡片

- 磷光體和遠程磷光體膜

- 按輸出範圍

- 低/中功率(小於1瓦)

- 高功率(1至3瓦)

- 高功率(超過 3W)

- 透過使用

- 一般照明

- 住宅

- 商業和工業

- 汽車照明

- 外觀(頭燈、日行燈)

- 內部的

- 背光

- 電視機和顯示器

- 手機和平板電腦

- Flash &指示牌

- 手機閃光燈

- 數位電子看板和廣告牌

- 專門食品和紫外線/紅外線

- 園藝

- 紫外線C波段消毒

- 一般照明

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 其他南美洲

- 亞太地區

- 中國

- 日本

- 印度

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Samsung Electronics Co., Ltd.

- Nichia Corporation

- OSRAM Opto Semiconductors GmbH

- LG Innotek Co., Ltd.

- Seoul Semiconductor Co., Ltd.

- Lumileds Holding BV

- Everlight Electronics Co., Ltd.

- Cree LED(Smart Global Holdings)

- Stanley Electric Co., Ltd.

- Toyoda Gosei Co., Ltd.

- Citizen Electronics Co., Ltd.

- TT Electronics plc

- Bridgelux, Inc.

- Epistar Corp.(Ennostar)

- Lite-On Technology Corp.

- Lextar Electronics Corp.

- Edison Opto Corp.

- Dominant Opto Technologies Sdn Bhd

- NationStar Optoelectronics Co., Ltd.

- MLS Co., Ltd.(Forest Lighting)

第7章 市場機會與未來展望

The LED packaging market size stands at USD 15.21 billion in 2025 and is forecast to touch USD 18.19 billion by 2030, registering a 3.64% CAGR.

Incremental value is coming less from commoditized lamps and more from premium niches such as adaptive automotive headlamps, UV-C disinfection modules and Mini-LED display backlights. Performance-oriented package architectures, notably chip-scale package (CSP) and advanced ceramic substrates, are gaining share as carmakers and panel makers demand tighter thermal tolerances and thinner form factors. Policy-driven fluorescent lamp bans and government funding for compound-semiconductor capacity add further impetus to the LED packaging market, while geopolitical supply-chain localization shapes investment decisions. Simultaneously, intellectual-property disputes and substrate cost volatility temper the growth trajectory by raising barriers to entry and amplifying capital requirements.

Global LED Packaging Market Trends and Insights

Transition to Mini/Micro-LED Backlighting in TVs and IT Panels

Mini-LED backlight adoption is reshaping premium TV and monitor categories as brands leverage 100-200 µm chips to unlock >2,000 local-dimming zones and >2,000-nit peak brightness. Package-on-Board formats keep the bill-of-materials competitive, yet Chip-on-Glass is emerging for ultra-slim industrial designs. Automotive cockpit displays extend the addressable volume because sunlight readability and life-cycle robustness favor Mini-LED over OLED. Densely packed arrays trigger higher thermal loads, directing demand toward ceramic-substrate and CSP solutions that dissipate heat efficiently without sacrificing thickness. As consumer-electronics makers publicize Mini-LED roadmaps, upstream packaging houses position capacity to catch a multi-year panel-replacement cycle, thereby widening the LED packaging market.

Rapid CSP Adoption in Automotive Headlamps across Europe and Korea

Chip-scale packages eliminate wire bonds and significantly shrink optical height, reducing energy draw by 20% while handling junction temperatures beyond 150 °C. Flagship adaptive-beam systems such as ams OSRAM's EVIYOS 2.0 integrate 25,600 individually addressable pixels, demonstrating how CSP enables finer light distribution control. European regulations on glare and energy efficiency accelerate the switch, and Korean suppliers use CSP for constrained interior ambient lighting modules. Headlamp Tier-1s stipulate 100,000-hour lifetimes, compelling package houses to qualify ceramic cavity and high-thermal-conductivity die attach. The momentum underscores a strategic inflection where premium automotive lighting steers the LED packaging market toward CSP as the reference architecture for safety-critical luminaires.

Volatility of Sapphire Wafer Pricing

Sapphire wafers contribute up to 20% of package cost, yet quarterly price swings often top 30%, squeezing gross margins for contract packagers. Because crystal growth is clustered in a handful of APAC vendors, geopolitical friction or power rationing quickly feeds into spot shortages. Large manufacturers explore Laser Lift-Off to reclaim substrates for reuse, but the capex burden confines adoption to top-tier producers. Smaller firms thus endure raw-material risk without the hedge of recycling, dampening their ability to scale output and constraining the LED packaging market's overall elasticity.

Other drivers and restraints analyzed in the detailed report include:

- Policy-Led Phase-Out of Fluorescent Lamps in North America

- Data-Centre Boom Driving High-CRI Lighting in Asia

- IP Cross-Licensing Barriers for Flip-Chip Designs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

CSP shipments climb at a 5.4% CAGR, reflecting their rising acceptance in automotive headlights and ultra-thin display backlights. In value terms, CSP contributes a growing slice of the LED packaging market size as lamp makers pay premiums for thermal headroom and pixel-level control. SMD formats still anchor 43% of shipments in 2024, sustaining refurb-lighting demand where unit cost outweighs miniaturization benefits. Flip-chip variants target >3 W niches, and while their royalty load is high, they enable compact optics aligned with adaptive-beam regulations, thereby sustaining a differentiated share of the LED packaging market. Hybrid and package-free constructs stay experimental, constrained by pick-and-place cycle-times and rework challenges.

Continuous innovation around wafer-level encapsulation blurs the boundary between chip fabrication and package assembly. Outsourced semiconductor assembly and test (OSAT) providers in Taiwan scale fan-out CSP lines to satisfy surge orders from TV and smartphone backlight makers. Conversely, European automotive Tier-1s secure dual sourcing by mandating stringent AEC-Q102 reliability tests, effectively locking out nascent vendors. The bifurcation accentuates how cost-optimized versus performance-optimized lanes coexist in the LED packaging market.

Lead-frame architectures still represented 34% of shipments in 2024, yet ceramic cavities based on aluminum nitride grow at 4.3% as designers chase thermal conductivity >150 W/mK. Automotive, UV-C and horticulture luminaires push junction temperatures where organic boards degrade prematurely, making ceramics a necessity. The LED packaging market size for ceramic substrates thus scales alongside power densities instead of shipment tonnage.

Encapsulation chemistries evolve in lockstep. UV-resistant silicone gels with improved outgassing properties prevent discoloration during sterilization cycles, while silver-copper alloy bonding wires offset gold cost exposure. Although remote-phosphor and phosphor-in-glass solutions promise color-shift stability, mid-tier players defer the investment, wary of -0.5% CAGR drag from capital intensity. Hence, material choice has become a strategic hedge: ceramics for thermal margin, organics for cost, and glass-embedded phosphors for spectral uniformity-all vying for allocation within the LED packaging market.

The LED Packaging Market Report is Segmented by Packaging Type (Surface-Mount Device, Chip-On-Board, Chip-Scale Package, and More), Package Material (Lead-Frame and Substrate, Ceramic Substrate, and More), Power Range (Low and Mid-Power (Less Than 1 W), High-Power (1-3 W), and More), Application (General Lighting, Automotive Lighting, Backlighting, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands 68% of the LED packaging market, a dominance rooted in its vertically integrated electronics supply chain and domestic consumption. China's infrastructure rollouts and energy-efficiency mandates drive volume, while Taiwan's OSAT giants such as ASE posted 11% sequential revenue growth in Q2 2025 on the back of AI-hardware orders. Japan leans on auto-grade reliability know-how, and South Korea's panel makers advance CSP headlamp modules. Regional growth also leverages data-centre build-outs that require high-CRI ceramic packages.

North America's trajectory hinges on regulatory catalysts rather than organic renovation cycles. The fluorescent lamp ban and DOE efficacy rules create a captive LED replacement window to 2030, ensuring baseline shipments regardless of macro swings. US CHIPS Act incentives, including USD 750 million for Wolfspeed's silicon-carbide line, illustrate policy support for compound-semiconductor supply chains.

Europe's market tilts toward premium automotive demand and strict eco-design codes. German OEMs pioneer adaptive headlamp rollouts that favor CSP and flip-chip packages, while stricter glare regulations necessitate pixel-level control. Simultaneously, sustainability frameworks prioritize lifetime lumen maintenance, reinforcing the preference for ceramic substrates. Middle East & Africa, though smaller today, is forecast to expand at a 5.2% CAGR as Gulf Cooperation Council infrastructure projects integrate smart, energy-efficient lighting under carbon-reduction roadmaps. South America trails in share but holds upside from transportation-corridor upgrades and rising electricity tariffs that make LED retrofits financially compelling. Together, these regional vectors underscore how regulatory intent and infrastructure investment recalibrate demand across the LED packaging market.

- Samsung Electronics Co., Ltd.

- Nichia Corporation

- OSRAM Opto Semiconductors GmbH

- LG Innotek Co., Ltd.

- Seoul Semiconductor Co., Ltd.

- Lumileds Holding B.V.

- Everlight Electronics Co., Ltd.

- Cree LED (Smart Global Holdings)

- Stanley Electric Co., Ltd.

- Toyoda Gosei Co., Ltd.

- Citizen Electronics Co., Ltd.

- TT Electronics plc

- Bridgelux, Inc.

- Epistar Corp. (Ennostar)

- Lite-On Technology Corp.

- Lextar Electronics Corp.

- Edison Opto Corp.

- Dominant Opto Technologies Sdn Bhd

- NationStar Optoelectronics Co., Ltd.

- MLS Co., Ltd. (Forest Lighting)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Transition to Mini/Micro-LED Backlighting in TVs and IT Panels

- 4.2.2 Rapid CSP Adoption in Automotive Headlamps across Europe and Korea

- 4.2.3 Policy-Led Phase-Out of Fluorescent Lamps in North America

- 4.2.4 Data-Centre Boom Driving High-CRI Lighting in Asia

- 4.2.5 Surge in UV-C LED Demand for Point-of-Use Disinfection

- 4.2.6 Outsourced LED Packaging (OSAT) Growth in Taiwan and China

- 4.3 Market Restraints

- 4.3.1 Volatility of Sapphire Wafer Pricing

- 4.3.2 IP Cross-Licensing Barriers for Flip-Chip Designs

- 4.3.3 Capital-Intensive Transition to Phosphor-in-Glass

- 4.3.4 Power Density Heat-Management Limitations Above 3 W Packages

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Packaging Type

- 5.1.1 Surface-Mount Device (SMD)

- 5.1.2 Chip-on-Board (COB)

- 5.1.3 Chip-Scale Package (CSP)

- 5.1.4 Flip-Chip

- 5.1.5 Hybrid/Package-Free Designs

- 5.2 By Package Material

- 5.2.1 Lead-Frame and Substrate

- 5.2.2 Ceramic Substrate

- 5.2.3 Bonding Wire/Die-Attach

- 5.2.4 Encapsulation Resin and Silicone Lens

- 5.2.5 Phosphor and Remote Phosphor Films

- 5.3 By Power Range

- 5.3.1 Low and Mid-Power (Less than 1 W)

- 5.3.2 High-Power (1-3 W)

- 5.3.3 Ultra-High-Power (Above 3 W)

- 5.4 By Application

- 5.4.1 General Lighting

- 5.4.1.1 Residential

- 5.4.1.2 Commercial and Industrial

- 5.4.2 Automotive Lighting

- 5.4.2.1 Exterior (Headlamp, DRL)

- 5.4.2.2 Interior

- 5.4.3 Backlighting

- 5.4.3.1 TV and Monitor

- 5.4.3.2 Mobile and Tablet

- 5.4.4 Flash and Signage

- 5.4.4.1 Mobile Camera Flash

- 5.4.4.2 Digital Signage and Billboards

- 5.4.5 Specialty and UV/IR

- 5.4.5.1 Horticulture

- 5.4.5.2 UV-C Disinfection

- 5.4.1 General Lighting

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Samsung Electronics Co., Ltd.

- 6.4.2 Nichia Corporation

- 6.4.3 OSRAM Opto Semiconductors GmbH

- 6.4.4 LG Innotek Co., Ltd.

- 6.4.5 Seoul Semiconductor Co., Ltd.

- 6.4.6 Lumileds Holding B.V.

- 6.4.7 Everlight Electronics Co., Ltd.

- 6.4.8 Cree LED (Smart Global Holdings)

- 6.4.9 Stanley Electric Co., Ltd.

- 6.4.10 Toyoda Gosei Co., Ltd.

- 6.4.11 Citizen Electronics Co., Ltd.

- 6.4.12 TT Electronics plc

- 6.4.13 Bridgelux, Inc.

- 6.4.14 Epistar Corp. (Ennostar)

- 6.4.15 Lite-On Technology Corp.

- 6.4.16 Lextar Electronics Corp.

- 6.4.17 Edison Opto Corp.

- 6.4.18 Dominant Opto Technologies Sdn Bhd

- 6.4.19 NationStar Optoelectronics Co., Ltd.

- 6.4.20 MLS Co., Ltd. (Forest Lighting)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment