|

市場調查報告書

商品編碼

1851537

熱可塑性橡膠(TPE):市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Thermoplastic Elastomer (TPE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

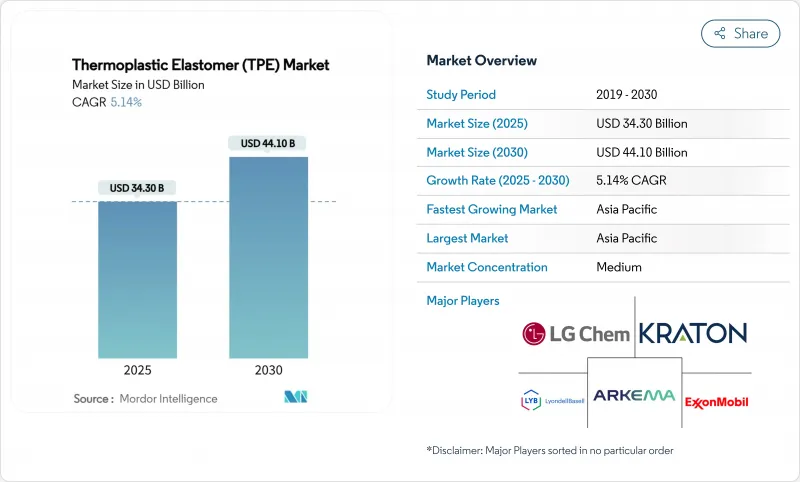

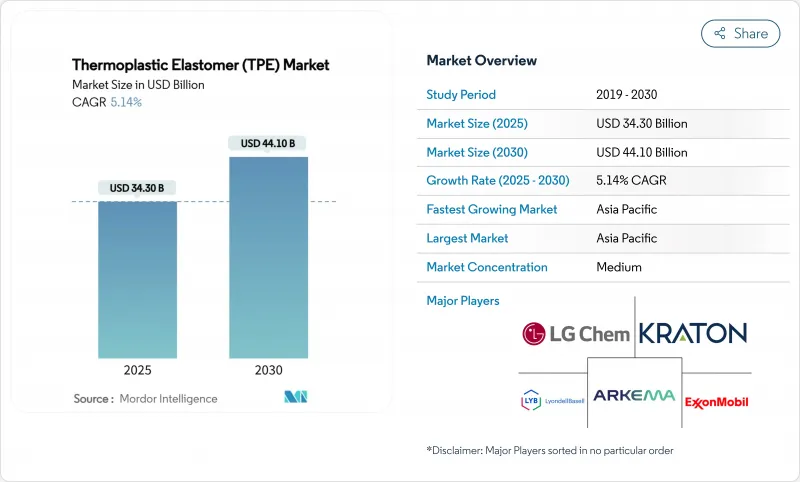

預計到 2025 年熱可塑性橡膠市場規模為 343 億美元,到 2030 年將達到 441 億美元,預測期(2025-2030 年)複合年成長率為 5.14%。

這項進展凸顯了該材料兼具橡膠般的柔韌性和熱塑性塑膠的加工效率,對於汽車電氣化、下一代醫療設備以及循環製造的要求至關重要。生產商正在擴大區域產能,並推出低碳、高回收成分等級的產品,以滿足永續性法規和企業淨零排放目標。亞太地區仍然是生產和消費中心,這得益於其龐大的汽車和電子供應鏈、醫療保健投資以及對電動車的政策支持。醫療保健現代化以及用更俱生物相容性的替代品取代PVC和乳膠的趨勢正在加速發展,而電池電動車中輕量化線束和充電硬體的需求進一步推動了對高利潤化合物的需求。儘管己二酸價格波動且機器成本不斷上漲,但熱可塑性橡膠市場仍保持穩健成長,因為各行業都在尋求更輕、可回收且更易於設計的材料。

全球熱可塑性橡膠(TPE)市場趨勢與洞察

促進電動車電線電纜的輕量化

電動車革命正在從根本上改變電線電纜的規格,熱可塑性橡膠)正成為減輕重量和最佳化性能的關鍵推動因素。塞拉尼斯公司的Hytrel TPC-LCF耐溫範圍為-40 度C至130 度C,同時碳排放量減少50%,充分展現了聚合物護套如何幫助減輕電動車線束的重量。交聯聚烯正在高壓線路中取代矽橡膠,提供耐磨性,縮短佈線路徑,並減少銅的使用。亞太地區,尤其是中國汽車製造商,佔據了電動車生產的大部分佔有率,這使得當地的複合材料生產商在成長軌道上佔據領先地位。 TPE護套也被應用於車載充電墊片和冷卻液管,提高了每輛車的平均聚合物含量,並推動了熱可塑性橡膠市場的收入成長。

在暖氣、通風和空調(HVAC)行業中不斷擴展的應用

熱泵和新型冷媒的普及應用提高了密封和減振方面的要求。 TE Connectivity 將使用壽命可靠性作為採購標準之一,推動了以耐高溫 TPE 取代 EPDM 用於墊圈和軟管內襯。 DSM 的 Arnitel HT 可實現一體式熱風管道,重量減輕 40%,組件成本降低 50%。數位化控制的壓縮機也需要軟性安裝支架來容納感測器並降低噪音,而熱可塑性橡膠市場上的特殊 TPE 化合物恰好能滿足這一需求。

己二酸供應導致熱塑性聚氨酯(TPU)價格波動

原料成本上漲正給熱塑性聚氨酯 (TPU) 價值鏈帶來巨大的利潤壓力,其中己二酸供應受限已成為影響價格穩定和生產計畫的關鍵瓶頸。BASF提高了丁二醇衍生物的價格,加劇了 TPU 生產商的成本波動。科騰聚合物在 SIS 展會上將價格提高了 330 噸,顯示嵌段共聚物的價格也出現了類似的上漲。石油原料價格上漲和物流中斷導致加工商面臨價差收窄的困境,並促使一些目標商標產品製造商 (OEM) 推遲熱可塑性橡膠市場中非關鍵的 TPU 相關計劃。

細分市場分析

熱塑性烯烴預計將在熱可塑性橡膠市場細分領域佔據最大佔有率,2024年營收佔比將達到25.59%,並預計到2030年將以7.39%的複合年成長率持續成長。汽車製造商正將TPE-O應用於保險桿飾板、氣壩密封件和底盤護板等領域,因為它易於與聚丙烯基材黏合,並具有優異的耐候性。建築型材和消費品領域的銷售量也在成長,這主要得益於聚丙烯基合金的成本優勢。

TPU因其在運動鞋、輸送機和導管護套等對耐磨性要求極高的應用領域備受青睞,在以金額為準位居第二。儘管己二酸價格波動仍限制其成長勢頭,但高價值細分市場仍能維持淨利率。 TPV緊跟在後,主要用於引擎室空氣管理零件,這些零件必須承受高達140°C的峰值溫度。苯乙烯嵌段共聚物在黏合劑和拋棄式刮鬍刀領域保持著一定的市場佔有率,而TPC和TPA則在傳動帶、氣動管路和增壓空氣管等領域不斷擴大應用。像Teknor Apex公司用於電動車電池密封件的Sarlink TPV這樣的特種化合物,充分展現了配方技術如何在熱可塑性橡膠市場中帶來溢價優勢。

區域分析

亞太地區將佔據熱可塑性橡膠市場最大的區域佔有率,2024銷售額將達到46.84%,預計到2030年將維持6.45%的複合年成長率。中國生產全球近三分之一的汽車,也是智慧型手機和消費性電子產品叢集的中心。英威達(INVISTA)將其上海尼龍66產能翻倍至每年40萬噸,凸顯了原料的自給自足,這為複合材料生產商的成長提供了支持。韓國供應顯示器和電池組件,而印度則擴大了可再生能源電線電纜的生產,從而促進了區域內貿易。

北美依然是創新的溫床。總部位於底特律的原始設備製造商 (OEM) 指定使用生物基熱塑性聚苯乙烯 (TPV) 窗密封件,而波士頓地區的醫療設備新興企業則在試點新型導管塗層,鞏固了其盈利的細分市場。塞拉尼斯公司在華創國際塑膠橡膠展 (Chinaplas) 上推出的 Hytrel TPC-LCF 塗層在德克薩斯研發,符合美國《通貨膨脹削減法案》的獎勵,可減少 50% 的二氧化碳排放。自 2025 年起生效的石化產品進口關稅可能會使樹脂成本增加 12% 至 20%,這將促使複合材料生產商重新掌控中間體生產並擴大國內 TPU 生產線產能。

歐洲環境指令將加速採用含60%再生材料的熱塑性彈性體(TPE),例如Avient公司的reSound REC GP 7820。德國一級供應商正在測試符合歐盟7冷啟動要求的熱塑性聚苯乙烯(TPV)散熱器軟管。同時,西班牙和義大利正在推廣使用Arnitel HT管道的熱泵維修,以實現其脫碳目標。儘管南美洲、中東和非洲目前的市場規模較小,但隨著基礎設施的擴展,它們具有長期的成長潛力。墨西哥現在是全球第四大聚氨酯市場,這反映了美國汽車供應鏈的近岸外包以及TPU射出成型製造商向原始設備製造商(OEM)靠攏的趨勢。波灣合作理事會國家正在投資建造特種彈性體產業中心,以實現經濟多元化,擺脫對原油出口的依賴,這預示著熱可塑性橡膠需求的下游區域化趨勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 促進電動車電線電纜的輕量化

- 在暖氣、通風和空調(HVAC)行業中日益成長的應用

- 家用電器中的應用日益廣泛

- 來自醫療保健行業的需求增加

- 鞋類和體育用品需求

- 市場限制

- 己二酸供應導致熱塑性聚氨酯(TPU)價格波動

- 高昂的製造成本和設備成本

- 軟熱塑性塑膠3D列印面臨的挑戰

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 苯乙烯嵌段共聚物(TPE-S)

- 熱塑性烯烴(TPE-O)

- 熱塑性硫化橡膠(TPV)

- 熱塑性聚氨酯(TPU)

- 熱塑性共聚酯(TPC)

- 熱塑性聚醯胺(TPA)

- 透過使用

- 汽車與運輸

- 建築/施工

- 鞋類

- 電氣和電子

- 醫療的

- 其他用途(家用產品、黏合劑和密封劑、暖通空調)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Arkema

- Asahi Kasei Corporation.

- Avient Corporation

- BASF

- Celanese

- Covestro AG

- Group Dynasol

- dsm-firmenich

- DuPont

- Evonik Industries AG

- Exxon Mobil Corporation

- Huntsman International LLC

- Kraton Corporation

- Lanxess

- LCY

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Group Corporation.

- SABIC

- Teknor Apex

- Sumitomo Chemical Co., Ltd.

- APAR Industries Ltd.

- The Lubrizol Corporation

第7章 市場機會與未來展望

The Thermoplastic Elastomer Market size is estimated at USD 34.30 billion in 2025, and is expected to reach USD 44.10 billion by 2030, at a CAGR of 5.14% during the forecast period (2025-2030).

This advance highlights the material's ability to combine rubber-like flexibility with thermoplastic processing efficiency, a combination now integral to vehicle electrification, next-generation medical devices, and circular manufacturing mandates. Producers are expanding regional capacity and introducing low-carbon, recycled-content grades to satisfy sustainability regulations and corporate net-zero targets. Asia-Pacific continues to anchor production and consumption thanks to its extensive automotive and electronics supply chains, healthcare investment, and policy support for electric vehicles. Healthcare modernization and the ongoing replacement of PVC and latex with biocompatible alternatives add another layer of momentum, while lighter wire harnesses and charging hardware in battery-electric cars further pull demand into high-margin formulations. Despite adipic-acid volatility and elevated machinery costs acting as brakes, the thermoplastic elastomers market retains a resilient growth profile as industries seek lighter, recyclable, and more design-flexible materials.

Global Thermoplastic Elastomer (TPE) Market Trends and Insights

EV Light Weighting Push in Automotive Wire and Cable

The electric vehicle revolution is fundamentally reshaping wire and cable specifications, with thermoplastic elastomers emerging as critical enablers of weight reduction and performance optimization. Celanese's Hytrel TPC-LCF delivers a 50% carbon-footprint cut while enduring -40 °C to 130 °C, illustrating how polymeric jacketing helps reduce harness weight in electric vehicles. Cross-linked polyolefins now displace silicone in high-voltage lines, providing abrasion resistance that shortens routing paths and trims copper usage. Asia-Pacific, led by Chinese OEMs, dominates EV output, so local compounders secure volume growth first. TPE jacketing is also moving into onboard charging pads and coolant tubes, lifting average polymer content per vehicle and magnifying revenue inside the thermoplastic elastomers market.

Growing Application in the Heating, Ventilation, and Air Conditioning (HVAC) Industry

Heat-pump adoption and new refrigerants intensify sealing and vibration requirements. TE Connectivity cites lifetime reliability as a procurement benchmark, spurring substitution of EPDM with higher-temperature TPEs in gaskets and hose liners. DSM's Arnitel HT permits single-piece hot-air ducts, cutting weight 40% and part cost 50%, a direct gain for installers targeting energy-efficient retrofits. Digitally controlled compressors also need flexible mounts that dampen noise while hosting sensors, a niche well served by specialty TPE compounds in the thermoplastic elastomers market.

Thermoplastic Polyurethane (TPU) Price Volatility Due to Adipic Acid Supply

Raw material cost inflation is creating significant margin pressure across the Thermoplastic Polyurethane (TPU) value chain, with adipic acid supply constraints representing a critical bottleneck that affects pricing stability and production planning. BASF raised butanediol derivative prices, amplifying cost swings for TPU makers . Kraton implemented a USD 330 t increase on SIS, signifying parallel inflation across block copolymers. When petroleum feedstocks spike and logistics falter, converters face slimmer spreads, prompting some Original Equipment Manufacturers (OEMs) to defer non-critical projects that rely on TPU inside the thermoplastic elastomers market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Utilization in Consumer Electronics

- Increasing Demand from Healthcare Industry

- High Manufacturing and Equipment Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermoplastic olefins led with 25.59% 2024 revenue and are forecast to post the segment-best 7.39% CAGR through 2030, sustaining the largest slice of the thermoplastic elastomers market size at segment level. Automakers rely on TPE-O for bumper fascia, air-dam seals, and under-body panels because the blends bond readily with polypropylene substrates and resist weathering. Construction profiles and consumer goods add volume, especially where cost targets favor PP-based alloys.

TPU holds the number-two spot by value, favored for abrasion-critical uses in athletic shoes, conveyor belts, and catheter jacketing. Growth momentum remains tempered by adipic-acid price instability, yet high value-added niches preserve margins. TPV follows closely in under-hood air-management parts that must tolerate 140 °C peaks. Styrenic block copolymers keep share in adhesives and disposable razors, while TPC and TPA extend reach into drive belts, pneumatic tubing, and charge-air ducts. Specialty compounding, such as Teknor Apex's Sarlink TPV for EV battery seals, demonstrates how formulation know-how unlocks premium pricing within the thermoplastic elastomers market.

The Thermoplastic Elastomers Market Report is Segmented by Product Type (Styrenic Block Copolymers (TPE-S), Thermoplastic Olefins (TPE-O), Thermoplastic Vulcanizates (TPV), and More), Application (Automotive and Transportation, Building and Construction, Footwear, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific claimed 46.84% of 2024 value, the highest thermoplastic elastomers market share among regions, and is on course for a 6.45% CAGR to 2030. China represents the fulcrum, producing nearly one in three vehicles globally and hosting expansive smartphone and appliance clusters. INVISTA's move to double Nylon 6,6 capacity to 400,000 t/y in Shanghai underscores raw-material self-sufficiency that underpins compounder growth. South Korea supplies display and battery components, while India escalates wire-and-cable builds for renewable energy, sustaining intra-regional trade.

North America remains innovation-heavy. Detroit OEMs specify bio-based TPV window seals, and Boston-area medical device startups pilot new catheter coatings, locking in profitable niches. Celanese's Hytrel TPC-LCF, launched at Chinaplas yet developed in Texas, achieves a 50% carbon-footprint cut, aligning with US Inflation Reduction Act incentives. Tariffs on petrochemical imports, effective 2025, could add 12-20% to resin costs, nudging compounders to reshore intermediate production and potentially opening capacity for domestic TPU lines.

Europe's environmental directives accelerate uptake of recycled-content TPEs such as Avient's reSound REC GP 7820, which contains 60% post-consumer feedstock . German Tier 1s test TPV radiator hoses that meet Euro 7 cold-start requirements. Meanwhile, Spain and Italy deploy heat-pump retrofits that use Arnitel HT ducting to meet decarbonization targets. South America and the Middle East & Africa are smaller today yet offer long-run upside as infrastructure expands. Mexico is now the world's fourth-largest polyurethane market, reflecting near-shoring of US automotive supply chains and drawing TPU injection molders closer to OEMs. Gulf Cooperation Council countries invest in specialty elastomer hubs to diversify away from crude exports, hinting at localized downstream demand within the thermoplastic elastomers market.

- Arkema

- Asahi Kasei Corporation.

- Avient Corporation

- BASF

- Celanese

- Covestro AG

- Group Dynasol

- dsm-firmenich

- DuPont

- Evonik Industries AG

- Exxon Mobil Corporation

- Huntsman International LLC

- Kraton Corporation

- Lanxess

- LCY

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Group Corporation.

- SABIC

- Teknor Apex

- Sumitomo Chemical Co., Ltd.

- APAR Industries Ltd.

- The Lubrizol Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV Light Weighting Push in Automotive Wire and Cable

- 4.2.2 Growing Application in the Heating, Ventilation, and Air Conditioning (HVAC) Industry

- 4.2.3 Increasing Utilization in Consumer Electronics

- 4.2.4 Increasing Demand from Healthcare Industry

- 4.2.5 Subtantial Demand from Footwear and Sports Equipment

- 4.3 Market Restraints

- 4.3.1 TPU (Thermoplastic Polyurethane) Price Volatility Due to Adipic Acid Supply

- 4.3.2 High Manufacturing and Equipment Cost

- 4.3.3 Challenges of 3D Printing with Soft Thermoplastics

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Styrenic Block Copolymers (TPE-S)

- 5.1.2 Thermoplastic Olefins (TPE-O)

- 5.1.3 Thermoplastic Vulcanizates (TPV)

- 5.1.4 Thermoplastic Polyurethane (TPU)

- 5.1.5 Thermoplastic Copolyester (TPC)

- 5.1.6 Thermoplastic Polyamide (TPA)

- 5.2 By Application

- 5.2.1 Automotive and Transportation

- 5.2.2 Building and Construction

- 5.2.3 Footwear

- 5.2.4 Electrical and Electronics

- 5.2.5 Medical

- 5.2.6 Other Applications (Household Goods, Adhesive and Sealants, HVAC)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Arkema

- 6.4.2 Asahi Kasei Corporation.

- 6.4.3 Avient Corporation

- 6.4.4 BASF

- 6.4.5 Celanese

- 6.4.6 Covestro AG

- 6.4.7 Group Dynasol

- 6.4.8 dsm-firmenich

- 6.4.9 DuPont

- 6.4.10 Evonik Industries AG

- 6.4.11 Exxon Mobil Corporation

- 6.4.12 Huntsman International LLC

- 6.4.13 Kraton Corporation

- 6.4.14 Lanxess

- 6.4.15 LCY

- 6.4.16 LG Chem

- 6.4.17 LyondellBasell Industries Holdings B.V.

- 6.4.18 Mitsubishi Chemical Group Corporation.

- 6.4.19 SABIC

- 6.4.20 Teknor Apex

- 6.4.21 Sumitomo Chemical Co., Ltd.

- 6.4.22 APAR Industries Ltd.

- 6.4.23 The Lubrizol Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Bio-Based Thermoplastic Elastomers