|

市場調查報告書

商品編碼

1851518

熱塑性聚氨酯(TPU):市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Thermoplastic Polyurethane (TPU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

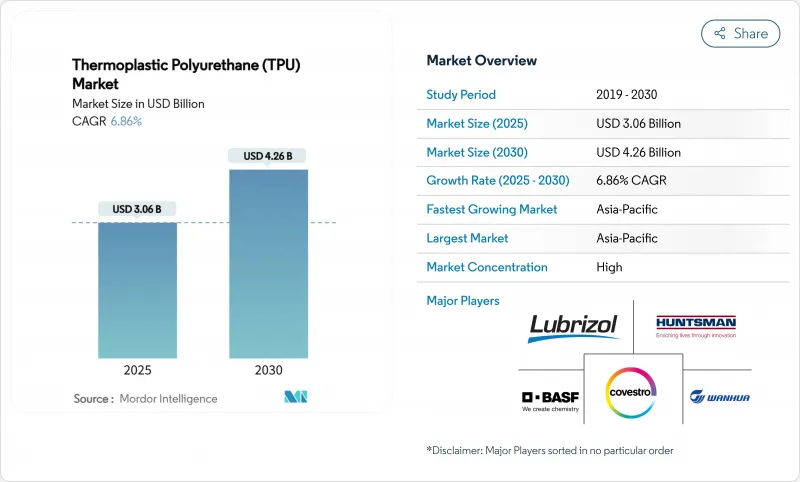

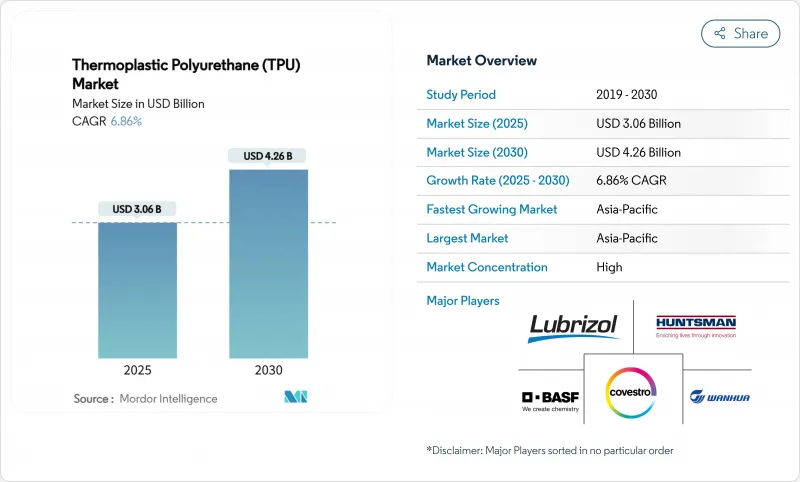

熱塑性聚氨酯市場預計在 2025 年達到 30.6 億美元,預計到 2030 年將達到 42.6 億美元,預測期(2025-2030 年)複合年成長率為 6.86%。

鞋類、汽車、醫療設備和積層製造等產業需求的成長推動了熱塑性聚氨酯(TPU)市場的發展,加工商們正在尋找兼具拉伸性、耐磨性和易加工性的材料。聚酯材料因其機械性能和成本的平衡而備受青睞,而生物基材料和封閉式設計則有助於品牌滿足永續性的要求。電動車重量的減輕、TPU在穿戴式健康監測設備中的應用以及TPU薄膜在軟性太陽能組件中日益廣泛的使用,進一步擴大了TPU市場的潛在用戶群。儘管亞太地區憑藉其一體化的供應鏈和龐大的下游生產能力,競爭最為激烈,但北美製造商在法規遵循和專業創新方面仍處於領先地位。

全球熱塑性聚氨酯(TPU)市場趨勢與洞察

穿戴式醫療設備

連續血糖監測儀、智慧型心臟貼片和新一代導管的快速普及推動了醫用熱塑性聚氨酯(TPU)的需求。這些設備需要觸感柔軟、具有長期皮膚相容性和抗扭結性。 Avient公司將其位於蘇州的、通過ISO 13485認證的NEUSoft TPU生產線產能擴大了三倍,從而實現了對亞洲醫療技術製造商的本地化供應。隨後,Lubrizol和Polyhose公司也在泰米爾納德邦建立了管材工廠,使其神經血管產品的產能擴大了五倍。此類垂直領域的投資透過縮短前置作業時間和確保材料等級能夠通過嚴格的生物相容性測試,加速了熱塑性聚氨酯市場的發展。

3D列印耗材和粉末

積層製造正在革新原型製作流程,使功能部件能夠模擬最終用途的性能。BASF的 Ultrasint TPU01 採用粉末床熔融平台生產,粉末回收率高達 80%,邵氏 A 硬度為 88-90,其能量回彈性能適用於晶格中底和汽車減震管。製程穩定性降低了廢料,而回收粉末降低了單一部件的成本,從而鼓勵一級供應商將 TPU 應用於批量生產。最終,這將帶來更大的設計自由度、更快的迭代速度以及熱塑性聚氨酯市場的更廣泛應用。

1,4-丁二醇原料的揮發性

聚酯和聚醚型熱塑性聚氨酯(TPU)的軟段化學成分含有1,4-丁二醇。供應中斷和對兩用物項法規的嚴格審查推高了交易價格,並使庫存計劃更加複雜。化學品經銷商報告稱,由於物質文件受限,清關速度放緩,導致需求激增期間前置作業時間延長。生產商正透過多通路採購策略和遠期合約進行避險,但仍面臨利潤率壓縮,這抑制了熱塑性聚氨酯市場的產能擴張計畫。

細分市場分析

預計到2024年,聚酯型TPU將佔熱塑性聚氨酯市場銷售額的40%,複合年成長率達7.87%,成為該市場中規模最大且成長最快的細分市場。其優異的耐油耐脂性能使其在液壓軟管、電線塗層和汽車動力皮帶等領域佔據主導地位。BASF的Elastollan B CF系列產品可將生產週期縮短25%,並將硬度範圍從邵氏A 25擴展至邵氏D 70,製造出兼具透明度和低溫衝擊強度的零件。這有助於提高生產效率,並為二次加工商帶來更佳的經濟效益。

聚醚型熱塑性聚氨酯(TPU)滿足了對耐水解性要求較高的領域的需求,例如氣動管道和戶外電纜。聚己內酯型TPU正作為更小巧、可生物吸收的支架材料而不斷發展。靜電紡絲奈米纖維能夠模擬細胞外基質,並支持藥物的控釋,從而拓展了臨床研究的管道。多樣化的化學特性使熱塑性聚氨酯市場能夠滿足各行業不同的性能要求。

區域分析

預計到2024年,亞太地區將佔全球銷售額的58%,並在2030年前維持7.71%的年均成長率。中國垂直整合的供應鏈透過集中原料、混煉和加工,降低了供應成本。 Avient在蘇州的投資實現了導管級TPU的本地化生產,縮短了區域醫療器材製造商的前置作業時間。同時,路博潤在印度的導管計劃將使區域產能提升五倍,進而增強對心血管OEM廠商的供應。

北美位居第二,這主要得益於高性能運動產品、一次性醫療拋棄式和特殊薄膜領域的應用。儘管對二異氰酸酯的監管日益嚴格提高了市場准入門檻,但也推動了低遊離異氰酸酯預聚物和生物基碳路線的創新。積層製造的投資也促進了區域材料差異化,從而支持熱塑性聚氨酯市場的細分成長。

歐洲在循環經濟框架內展現領導地位,各大品牌紛紛支持可再生碳原料及透明的報廢處理體系,加速了對生質能平衡型TPU產品的需求。德國和法國的汽車製造商正在採用TPU密封件以滿足歐盟的車輛排放目標,而義大利的時尚品牌則在高階配件領域採用無溶劑TPU合成皮革。

南美洲和中東及非洲地區雖然仍在發展中,但卻是具有戰略意義的地區。巴西鞋類製造商正在增加可回收TPU顆粒的消費量,而阿拉伯聯合大公國的建築商則指定使用能夠承受沙漠紫外線照射的TPU屋頂防水卷材。由於當地產能仍有限,跨國製造商紛紛建立分銷中心和技術服務中心,以滲透熱塑性聚氨酯市場的新興節點。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 穿戴式醫療設備推動對醫用級TPU的需求

- 3D列印耗材和粉末加速了原型製作的廣泛應用。

- 生物基單一材料鞋履計畫促進消費

- 軟性太陽能和建築膜材從PVC轉向TPU

- 不斷擴展的工業應用

- 市場限制

- 1,4-BDO原料價格波動影響聚酯/醚類TPU價格

- 加強對異氰酸酯暴露的監管

- 汽車應用中高溫TPEE和TPV的替代風險

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 聚酯TPU

- 聚醚TPU

- 聚己內酯TPU

- 透過使用

- 壓製產品

- 射出成型產品

- 膠水

- 其他用途

- 按最終用途行業分類

- 鞋類

- 車

- 醫療的

- 電氣和電子

- 建造

- 重型工程

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 策略趨勢

- 市佔率分析

- 公司簡介

- BASF

- Avient Corporation

- Coim Group

- Covestro AG

- Dongsung

- Epaflex Polyurethanes SpA

- Hexpol AB

- Huntsman International LLC

- Miracll Chemicals Co. Ltd

- Mitsui Chemicals Inc.

- Novotex Italiana SpA

- Sumei Chemical Co. Ltd

- Suzhou Austen New Mstar Technology Ltd

- Taiwan PU Corporation

- The Lubrizol Corporation

- Tosoh Corporation

- Trinseo

- Wanhua Chemical Group Co. Ltd

第7章 市場機會與未來展望

The Thermoplastic Polyurethane Market size is estimated at USD 3.06 billion in 2025, and is expected to reach USD 4.26 billion by 2030, at a CAGR of 6.86% during the forecast period (2025-2030).

Expanding demand across footwear, automotive, medical devices, and additive manufacturing anchors this growth as converters seek materials that combine elasticity, abrasion resistance, and ease of processing. Polyester grades hold sway because they balance mechanical performance with cost, while bio-based content and closed-loop designs help brands meet sustainability mandates. Rising lightweighting in electric vehicles, strong adoption in wearable health monitors, and increased use of TPU membranes in flexible solar modules further widen the addressable base of the thermoplastic polyurethane market. Regional competitive intensity is highest in Asia-Pacific due to integrated supply chains and sizable downstream capacity, yet North American producers set the pace on regulatory compliance and specialty innovation.

Global Thermoplastic Polyurethane (TPU) Market Trends and Insights

Wearable medical devices

Surging adoption of continuous glucose monitors, smart cardiac patches and next-generation catheters is intensifying the pull for medical-grade TPU. These devices require soft touch, long-term skin compatibility and kink resistance. Avient tripled capacity for its NEUSoft TPU in Suzhou under ISO 13485 certification to localize supply for Asian health-tech manufacturers . Lubrizol and Polyhose followed with a Tamil Nadu tubing plant that scales neurovascular products five-fold . Such vertical investments shorten lead times and lock in material grades that can pass stringent biocompatibility testing, adding momentum to the thermoplastic polyurethane market.

3D-printing filaments & powders

Additive manufacturing reshapes prototype cycles by enabling functional parts that mimic end-use performance. BASF's Ultrasint TPU01 runs on powder-bed fusion platforms with 80% powder recyclability and 88-90 Shore A hardness, delivering energy return suited to lattice midsoles and impact-absorbing automotive ducts. Process stability lowers scrap while recycled powder cuts cost per part, encouraging tier-1 suppliers to integrate TPU into serial production. The resulting design freedom accelerates iteration and supports broader adoption across the thermoplastic polyurethane market.

1,4-BDO feedstock volatility

Polyester and polyether TPU rely on 1,4-butanediol for soft-segment chemistry. Supply disruptions and dual-use regulatory scrutiny raise transaction prices and complicate inventory planning. Chemical distributors report that controlled-substance documentation slows customs clearance, extending lead times during demand spikes. Producers hedge with multi-sourcing strategies and forward contracts but still face margin compression that restrains capacity expansion plans in the thermoplastic polyurethane market.

Other drivers and restraints analyzed in the detailed report include:

- Bio-based mono-material footwear

- PVC-to-TPU shift in membranes

- Tightening isocyanate regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyester TPU generated 40% of 2024 revenue and is projected to grow at 7.87% CAGR, establishing it as both the largest and fastest segment within the thermoplastic polyurethane market. Robust oil and grease resistance underpins its dominance in hydraulic hoses, wire coatings and dynamic automotive belts. BASF's Elastollan B CF series trims cycle times by 25% and widens hardness coverage from 25 Shore A to 70 Shore D, enabling parts that combine clarity with low-temperature impact strength. The resulting productivity gains improve economic viability for secondary converters.

Polyether TPU sustains demand where hydrolysis resistance is paramount, such as pneumatic tubes and outdoor cables. Polycaprolactone TPU, though smaller, advances in bio-resorbable scaffolds. Electrospun nanofibers mimic extracellular matrices and support controlled drug release, expanding clinical research pipelines. Diversified chemistry assures that the thermoplastic polyurethane market can address divergent performance specifications across industries.

The Thermoplastic Polyurethane Market Report Segments the Industry by Product Type (Polyester TPU, Polyether TPU, Polycaprolactone TPU), Application (Extruded Products, Injection Molded Products, and More), End-User Industry (Footwear, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 58% of global revenue in 2024 and is set to compound at 7.71% annually to 2030. China's vertically integrated supply chain secures raw materials, compounding and conversion under one roof, thereby compressing cost to serve. Avient's Suzhou investment localises catheter-grade TPU production, cutting lead times for regional device makers. Concurrently, Lubrizol's Indian tubing project lifts regional capacity five-fold and enhances supply resilience for cardiovascular OEMs.

North America ranks second owing to high adoption in performance sports, medical disposables and specialty films. Regulatory tightening on diisocyanates elevates barriers to entry yet spurs innovation in low-free-isocyanate prepolymers and bio-based carbon routes. Investments in additive manufacturing also advance regional material differentiation, supporting niche growth inside the thermoplastic polyurethane market.

Europe leverages its leadership in circular economy frameworks. Brands favour renewable carbon feedstocks and transparent end-of-life schemes, accelerating demand for biomass-balanced TPU grades. Automotive suppliers in Germany and France integrate TPU seal profiles to meet EU fleet emission targets, while Italian fashion houses adopt solvent-free TPU synthetic leather for luxury accessories.

South America and the Middle East & Africa remain nascent but strategic. Brazilian footwear clusters consume increasing volumes of recyclable TPU pellets, while United Arab Emirates contractors specify TPU roofing membranes to withstand desert UV exposure. Local production remains limited, encouraging multinational producers to establish distribution hubs and technical service centers to penetrate these emerging nodes of the thermoplastic polyurethane market.

- BASF

- Avient Corporation

- Coim Group

- Covestro AG

- Dongsung

- Epaflex Polyurethanes SpA

- Hexpol AB

- Huntsman International LLC

- Miracll Chemicals Co. Ltd

- Mitsui Chemicals Inc.

- Novotex Italiana SpA

- Sumei Chemical Co. Ltd

- Suzhou Austen New Mstar Technology Ltd

- Taiwan PU Corporation

- The Lubrizol Corporation

- Tosoh Corporation

- Trinseo

- Wanhua Chemical Group Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Wearable Medical Devices Driving Medical-Grade TPU Demand

- 4.2.2 3D-Printing Filaments & Powders Accelerating Prototyping Adoption

- 4.2.3 Bio-Based Mono-Material Footwear Programs Boosting Consumption

- 4.2.4 PVC-to-TPU Shift in Flexible Solar & Architectural Membranes

- 4.2.5 Rising Usage in Industrial Applications

- 4.3 Market Restraints

- 4.3.1 1,4-BDO Feedstock Volatility Inflating Polyester/Ether TPU Prices

- 4.3.2 Tightening Isocyanate-Exposure Regulations

- 4.3.3 Displacement Risk from High-Heat TPEE & TPV in Automotive Application

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Polyester TPU

- 5.1.2 Polyether TPU

- 5.1.3 Polycaprolactone TPU

- 5.2 By Application

- 5.2.1 Extruded Products

- 5.2.2 Injection Molded Products

- 5.2.3 Adhesives

- 5.2.4 Other Applications

- 5.3 By End-Use Industry

- 5.3.1 Footwear

- 5.3.2 Automotive

- 5.3.3 Medical

- 5.3.4 Electrical & Electronics

- 5.3.5 Construction

- 5.3.6 Heavy Engineering

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordics

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Chile

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 Asia Pacific

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global & Market Overview, Core Segments, Financials, Strategy, Rank/Share, Products, Recent Developments)

- 6.3.1 BASF

- 6.3.2 Avient Corporation

- 6.3.3 Coim Group

- 6.3.4 Covestro AG

- 6.3.5 Dongsung

- 6.3.6 Epaflex Polyurethanes SpA

- 6.3.7 Hexpol AB

- 6.3.8 Huntsman International LLC

- 6.3.9 Miracll Chemicals Co. Ltd

- 6.3.10 Mitsui Chemicals Inc.

- 6.3.11 Novotex Italiana SpA

- 6.3.12 Sumei Chemical Co. Ltd

- 6.3.13 Suzhou Austen New Mstar Technology Ltd

- 6.3.14 Taiwan PU Corporation

- 6.3.15 The Lubrizol Corporation

- 6.3.16 Tosoh Corporation

- 6.3.17 Trinseo

- 6.3.18 Wanhua Chemical Group Co. Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment

- 7.2 Shifting Focus Toward the Development of Bio-based Products