|

市場調查報告書

商品編碼

1851516

歐洲聚氯乙烯(PVC)市場:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Europe Polyvinyl Chloride (PVC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

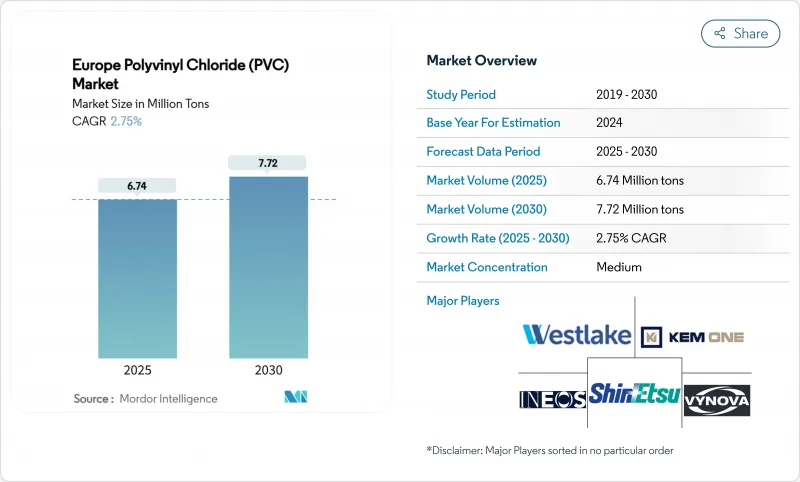

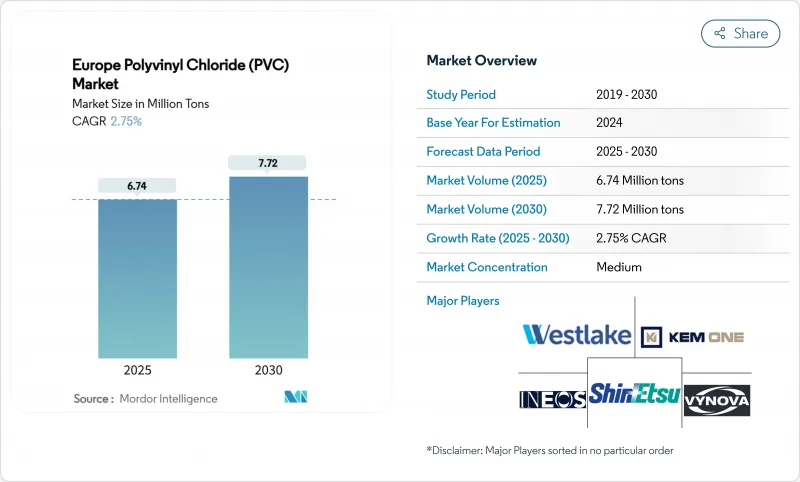

根據估計和預測,到 2025 年,歐洲聚氯乙烯市場規模將達到 674 萬噸,預計到 2030 年將達到 772 萬噸,在預測期(2025-2030 年)內複合年成長率為 2.75%。

對管道、型材和管件的強勁需求,加上住宅建設的逐步復甦,將支撐近期銷售成長。 REACH法規的壓力持續推動鈣鋅穩定劑的普及,但持續的基礎建設投入將緩解轉型成本。節能重建計畫、電網升級和水資源管理計劃支撐了結構性需求,而循環經濟政策則刺激了對再生和生物來源PVC的投資。由於一體化製造商利用其規模優勢、專用原料和專有技術來抵消合規成本,市場競爭強度仍然適中。

歐洲聚氯乙烯(PVC)市場趨勢與洞察

建設產業需求不斷成長

該地區住房短缺和建築老化推動了重建活動,進而帶動了歐洲PVC門窗及牆板市場的需求成長。硬質PVC正進一步滲透到翻新工程中,因為採用熱塑性嵌件增強的PVC框架可提升12-13%的隔熱性能,更能滿足歐盟能源效率計劃。成員國的維修資金正投入土木工程支出中,PVC在農業基礎設施(例如蓄水和排水系統)中的功能性和成本優勢也得到了充分體現。利率穩定和材料價格正常化提高了北歐市場計劃的可行性,而財政限制則繼續限制南歐的成長。整體而言,中期內,PVC管材和型材的需求將出現均衡成長。

汽車產業需求增加

電動車的興起正在改變汽車內裝組件的規格,為阻燃軟性PVC在汽車線束和地板材料的應用拓展了機會。預計到2025年初,德國汽車產量將年增3%,這將促進區域混煉廠的樹脂回收利用。添加生物基的PVC產品在維持拉伸性能和熱性能的同時,可將從原料開採到產品出廠的二氧化碳排放減少58%,使汽車製造商無需重新設計平台即可實現ESG目標。德國、法國和義大利北部周邊地區的成長叢集正在推動最佳化物流和準時制供應模式的發展。一級供應商正將數位化品管工具與材料創新相結合,以減少邊角料浪費並縮短生產週期。

零售商加速禁用PVC食品包裝

西歐大型超級市場正逐步淘汰PVC托盤和清潔薄膜,迫使加工商轉向整體式PET和紙基包裝。即將推出的《包裝和包裝廢棄物法規》將對PFAS和BPA施加更多限制,使傳統PVC配方的合規之路更加複雜。雖然藥品泡殼包裝仍不受限制,但高銷售量的生鮮食品產業將迅速轉向替代品,進而降低歐洲PVC市場對軟包裝薄膜的需求。品牌所有者的採購政策將向上游蔓延,迫使混料商對替代樹脂進行認證,並為一些對阻隔性要求極高的特定應用開發可回收的PVC混合物。東歐市場在實施禁令方面進展緩慢,這表明目前只是暫時放鬆管制,但最終將全部區域轉型。

細分市場分析

到2024年,硬質PVC將佔歐洲PVC市場佔有率的60.74%,因為管道、型材和管件在建築和供水網路中仍然佔據主導地位。低菸PVC雖然基數較小,但預計到2030年將以3.89%的複合年成長率高速成長,這主要得益於公共運輸、隧道和公共建設計劃消防安全法規的推動。在軟質PVC領域,用於醫療導管的生質塑膠基透明PVC的需求正在抵消食品包裝薄膜需求的下降。氯化PVC正在滲透到工業熱水管道領域,利用在地化生產來降低進口關稅和物流成本。

隨著成熟的需求模式將產運轉率穩定在80%左右,產能擴張將保持謹慎。擠出機生產商專注於模頭升級和線上測量系統以提高產量比率,而非待開發區生產線。加工商則需要在滿足化工視鏡等硬質透明零件訂單和滿足市政管道合約的大宗訂單之間取得平衡,因此產品組合的靈活性成為一項競爭優勢。由此可見,歐洲PVC市場正努力平衡穩定、大批量的硬質產品需求與低菸PVC和CPVC等特種產品的利基成長。

到了2024年,鈣鋅溶液將佔穩定劑消費量的42.88%,這清楚地顯示出歐盟鉛禁令後市場轉型的趨勢。預計到2030年,鈣鋅溶液的複合年成長率將達到3.61%,成為歐洲PVC市場添加劑價值成長的主要驅動力。目前,鉛基穩定劑在臨時放寬管制的情況下得以繼續使用,主要用於回收的硬質材料;而錫基穩定劑則仍局限於耐熱金屬絲塗層這一小眾市場。鋇鋅穩定劑和液態混合金屬穩定劑主要供應給特殊壓延機,但隨著統一的綠色化學標準向下游推廣,銷售量正在下滑。

化學品供應商正在主要擠出中心附近擴建模組化混煉設施,以確保準時交付和嚴格的混煉控制。與型材製造商的聯合認證專案加快了生產線變更核准,縮短了改造週期。穩定劑的轉型清晰地表明,監管要求正在重塑供應鏈,使那些擁有深厚研發實力和一體化物流的營運商受益。

歐洲 PVC 市場報告按產品類型(硬質 PVC、軟質 PVC、低煙PVC 等)、穩定劑類型(鈣基、鉛基、錫/有機錫基等)、應用(管道/配件、薄膜/片材、電線/電纜等)、最終用戶行業(建築/施工、汽車、電氣/電子等)和地區(德國、英國、法國等)進行法國細分。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 建設產業需求不斷成長

- 汽車產業需求增加

- 水利基礎設施計劃需求不斷成長

- 醫療保健產業對醫用PVC的需求

- 在包裝應用的使用日益增多

- 市場限制

- 零售商加快禁用食品包裝中的聚氯乙烯(PVC)成分

- REACH法規對傳統鉛和錫穩定劑的限制日益收緊。

- 生物基聚合物替代品在窗框型材中的興起

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 硬質PVC

- 透明硬質PVC

- 不透明硬質PVC

- 軟性聚氯乙烯

- 透明軟性PVC

- 不透明軟性聚氯乙烯

- 低煙PVC

- 氯化聚氯乙烯

- 硬質PVC

- 依穩定器類型

- 鈣基(Ca-Zn)

- 鉛基(Pb)

- 錫和有機錫基(Sn)

- 鋇基及其他(液態混合金屬)

- 透過使用

- 管道和配件

- 薄膜和片材

- 電線電纜

- 瓶子

- 型材、軟管和管材

- 其他用途

- 按最終用戶行業分類

- 建築/施工

- 車

- 電氣和電子

- 包裝

- 鞋類

- 衛生保健

- 其他終端用戶產業

- 按地區

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 土耳其

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Benvic Group

- Ercros SA

- Formosa Plastics Corporation

- Hanwa Solutions Chemical Division Corporation

- Industrie Generali SpA

- INEOS

- KEM ONE

- LG Chem

- Lukoil

- Oltchim SA

- Orbia

- Shin-Etsu Chemical Co. Ltd.

- SIBUR Holding PJSC

- Solvay

- Teknor Apex

- Vynova Group

- Westlake Corporation

第7章 市場機會與未來展望

The Europe Polyvinyl Chloride Market size is estimated at 6.74 million tons in 2025, and is expected to reach 7.72 million tons by 2030, at a CAGR of 2.75% during the forecast period (2025-2030).

Robust demand in pipes, profiles, and fittings, coupled with moderate recovery in residential construction, underpins near-term volume gains. Regulatory pressure from REACH continues to accelerate calcium-zinc stabilizer adoption, yet sustained infrastructure spending cushions transition costs. Energy-efficient renovation programs, electrical grid upgrades, and water-management projects anchor structural demand, while circular-economy mandates fast-track investment in recycling and bio-attributed PVC. Competitive intensity remains moderate as integrated producers leverage scale, captive feedstocks, and proprietary technology to offset compliance costs.

Europe Polyvinyl Chloride (PVC) Market Trends and Insights

Growing Demand from Construction Industry

The region's housing shortage and aging building stock keep renovation activity high, driving window-profile and siding volumes in the Europe PVC market. Thermal-performance gains of 12-13% in PVC frames reinforced with thermoplastic inserts improve compliance with EU energy-efficiency codes, further entrenching rigid PVC in retrofit projects. Member-state recovery funds earmark civil-works spending, with water-retention drainage systems illustrating PVC's functional and cost advantages in agricultural infrastructure. Stabilizing interest rates and normalized material prices enhance project viability across Northern markets, though fiscal constraints continue to cap growth in Southern Europe. The overall effect is a well-distributed, medium-term lift in PVC pipe and profile demand.

Increasing Demand from Automotive Industry

Electric-vehicle adoption is reshaping interior-component specifications, widening the aperture for flame-retardant flexible PVC in wire harnesses and floor coverings. German motor-vehicle output advanced 3% YoY in early 2025, boosting resin off-take from regional compounding plants. Bio-attributed PVC grades cut cradle-to-gate CO2 emissions by 58% while preserving tensile and thermal performance, enabling OEMs to meet ESG targets without platform redesign. Growth clusters around Germany, France, and northern Italy facilitate optimized logistics and just-in-sequence supply models. Tier-one suppliers are pairing digital quality-control tools with material innovations to eliminate trim waste and reduce cycle times.

Accelerating Retailer Bans on PVC Food Packaging

Large supermarket chains across Western Europe are phasing out PVC trays and cling films, pressuring converters to shift toward mono-material PET or paper-based formats. The forthcoming Packaging and Packaging Waste Regulation adds PFAS and BPA constraints, complicating compliance pathways for legacy PVC formulations. While pharmaceutical blister packs remain exempt, high-volume fresh-food segments experience immediate substitution, shaving flexible-film demand in the Europe PVC market. Brand-owner purchasing policies cascade upstream, compelling compounders to qualify alternative resins or develop recyclable PVC-blends for niche, barrier-critical applications. Eastern markets show lagged uptake of bans, offering temporary relief yet signaling an eventual region-wide transition.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand from Water Infrastructure Projects

- Healthcare Demand for Medical-Grade PVC

- Escalating REACH Restrictions on Legacy Lead and Tin Stabilizers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rigid grades anchored 60.74% of the Europe PVC market share in 2024 as pipes, profiles, and fittings retain dominance across building and water-supply networks. Low-smoke PVC, although a smaller base, is set to clock the strongest 3.89% CAGR through 2030 on the back of fire-safety regulations in mass-transit, tunnel, and public-assembly projects. Flexible PVC volumes face mixed fortunes: demand for bio-plasticized clear grades in medical tubing offsets contraction in food-packaging films. Chlorinated PVC penetrates industrial hot-water lines, leveraging localized production to mitigate import tariffs and logistics costs.

Capacity additions stay disciplined as mature demand patterns stabilize operating rates around 80%. Extruders focus on die-head upgrades and inline-measurement systems to boost yields rather than greenfield expansions. Product-mix agility becomes a competitive differentiator as converters juggle rigid-clear orders for chemical-processing sight-glasses alongside bulk commitments for municipal pipe contracts. The Europe PVC market thus balances steady, high-volume rigid demand with specialty growth niches in low-smoke and CPVC segments.

Calcium-zinc solutions held 42.88% of stabilizer consumption in 2024, a clear signal of market pivot after the EU lead ban These packages are projected to expand at 3.61% CAGR to 2030, driving most additive-level value growth in the Europe PVC market. Lead-based stabilizers now persist mainly in recycled rigid streams under temporary derogations, while tin systems linger in heat-resistant wire-coating niches. Barium-zinc and liquid-mixed-metal formats supply specialty sheet calendaring but face volume erosion as unified green-chemistry criteria spread downstream.

Chemical suppliers scale modular blending facilities near major extrusion hubs, ensuring just-in-time deliveries and tighter formulation control. Collaborative qualification programs with profile manufacturers accelerate line-change approvals, compressing conversion timelines. The stabilizer shift underscores how regulatory imperatives reshape supply chains in favor of actors with R&D depth and integrated logistics.

The Europe PVC Market Report is Segmented by Product Type (Rigid PVC, Flexible PVC, Low-Smoke PVC, and More), Stabilizer Type (Calcium Based, Lead Based, Tin and Organotin Based, and More), Application (Pipes and Fittings, Films and Sheets, Wires and Cables, and More), End-User Industry (Building and Construction, Automotive, Electrical and Electronics, and More), and Geography (Germany, France, United Kingdom, Italy, and More).

List of Companies Covered in this Report:

- Benvic Group

- Ercros S.A.

- Formosa Plastics Corporation

- Hanwa Solutions Chemical Division Corporation

- Industrie Generali S.p.A.

- INEOS

- KEM ONE

- LG Chem

- Lukoil

- Oltchim SA

- Orbia

- Shin-Etsu Chemical Co. Ltd.

- SIBUR Holding PJSC

- Solvay

- Teknor Apex

- Vynova Group

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand from construction industry

- 4.2.2 Increasing demand from automotive industry

- 4.2.3 Increasing demand from water infrastructure projects

- 4.2.4 Healthcare demand for medical-grade PVC

- 4.2.5 Rinsing Usage in Packaging Application

- 4.3 Market Restraints

- 4.3.1 Accelerating retailer bans on PVC food packaging

- 4.3.2 Escalating REACH restrictions on legacy lead and tin stabilizers

- 4.3.3 Rising bio-based polymer substitution in window-profile segment

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Rigid PVC

- 5.1.1.1 Clear Rigid PVC

- 5.1.1.2 Non-clear Rigid PVC

- 5.1.2 Flexible PVC

- 5.1.2.1 Clear Flexible PVC

- 5.1.2.2 Non-clear Flexible PVC

- 5.1.3 Low-smoke PVC

- 5.1.4 Chlorinated PVC

- 5.1.1 Rigid PVC

- 5.2 By Stabilizer Type

- 5.2.1 Calcium based (Ca-Zn)

- 5.2.2 Lead based Pb)

- 5.2.3 Tin and Organotin based (Sn)

- 5.2.4 Barium-based and Others (Liquid Mixed Metals)

- 5.3 By Application

- 5.3.1 Pipes and Fittings

- 5.3.2 Films and Sheets

- 5.3.3 Wires and Cables

- 5.3.4 Bottles

- 5.3.5 Profiles, Hoses and Tubings

- 5.3.6 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Building and Construction

- 5.4.2 Automotive

- 5.4.3 Electrical and Electronics

- 5.4.4 Packaging

- 5.4.5 Footwear

- 5.4.6 Healthcare

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 France

- 5.5.3 United Kingdom

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Turkey

- 5.5.7 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Rankinh Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Benvic Group

- 6.4.2 Ercros S.A.

- 6.4.3 Formosa Plastics Corporation

- 6.4.4 Hanwa Solutions Chemical Division Corporation

- 6.4.5 Industrie Generali S.p.A.

- 6.4.6 INEOS

- 6.4.7 KEM ONE

- 6.4.8 LG Chem

- 6.4.9 Lukoil

- 6.4.10 Oltchim SA

- 6.4.11 Orbia

- 6.4.12 Shin-Etsu Chemical Co. Ltd.

- 6.4.13 SIBUR Holding PJSC

- 6.4.14 Solvay

- 6.4.15 Teknor Apex

- 6.4.16 Vynova Group

- 6.4.17 Westlake Corporation

7 Market Opportunities and Future Outlook

- 7.1 PVC Recycling and Circularity

- 7.2 Bio-based Stabilizer and Plasticizer Platforms

- 7.3 White-space and unmet-need assessment