|

市場調查報告書

商品編碼

1851513

防護塗料:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Protective Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

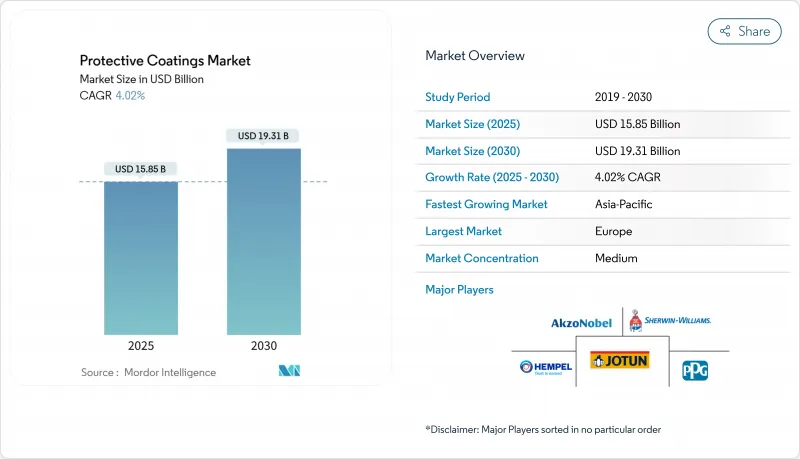

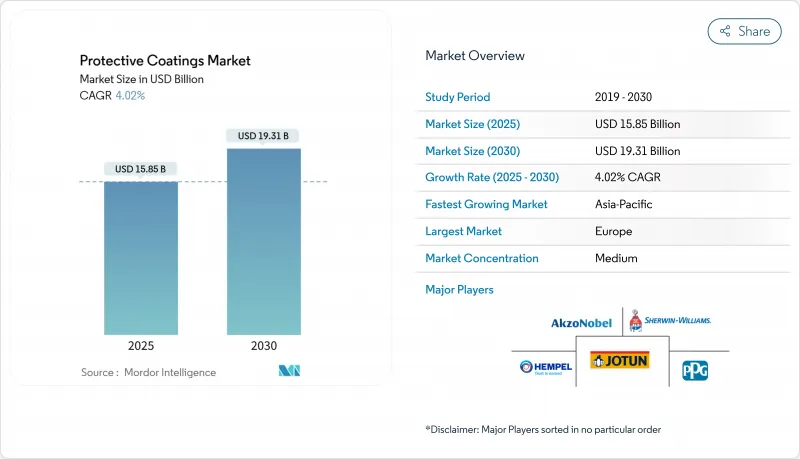

預計到 2025 年,防護塗料市場規模將達到 158.5 億美元,到 2030 年將達到 193.1 億美元,預測期(2025-2030 年)複合年成長率為 4.02%。

受嚴格的環境法規和巨額基礎設施投資的推動,歐洲預計將佔據最大市場佔有率,而亞太地區預計將以5.23%的複合年成長率(CAGR)成為到2030年成長最快的地區。基礎設施建設、向更環保的化學品轉型以及可再生能源和汽車輕量化的日益普及是推動成長的最主要因素。聚氨酯產品引領樹脂需求,儘管面臨揮發性有機化合物(VOC)的壓力,溶劑型化學品仍然佔據主導地位,而奈米技術正在為自修復和智慧表面開闢新的前景。儘管主要供應商之間的行業整合仍在繼續,但新興經濟體以及塑膠和複合材料基材的先進解決方案仍存在市場空白。

全球防護塗料市場趨勢與洞察

加大對基礎建設的投資

大規模的公共投資,尤其是在交通、能源和市政計劃領域,支撐著防護塗料市場的發展。光是美國《基礎設施投資與就業法案》就投入數十億美元用於橋樑和道路的修復,推動了對長效防腐蝕系統的需求。中國、印度和歐盟也在實施類似的計劃,這些計劃推動了耐久性要求的提高,進而促使高性能配方受到青睞。資產所有者越來越重視生命週期經濟效益而非初始成本,要求使用維護週期更長的優質產品。因此,聚氨酯和富鋅環氧樹脂系統在鋼橋和裸露鋼筋混凝土的應用中越來越受歡迎。在沿海地區,鹽分、濕度和溫度循環會加速劣化,因此市場受益更為顯著。

綠色塗料的需求不斷成長

揮發性有機化合物(VOC)排放限制持續收緊,加州空氣資源委員會(CARB)的規定現已成為全球標竿。配方師正積極應對,研發水性、高固含量和粉末配方,以提供與傳統溶劑型產品相當的耐腐蝕性。環保替代方案也有助於資產所有者履行其永續性承諾。防護塗料市場正經歷生物基聚氨酯分散體和低耗能固化粉末混合物的快速規模化應用。技術研發的重點在於樹脂改性,以縮短乾燥時間,同時保持光澤和機械性能。如今,可量化的環境足跡,而不僅僅是物理性能,正日益成為競爭差異化的關鍵因素。

揮發性有機化合物排放法規

更嚴格的VOC排放限制將迫使企業進行再製造,從而推高原料成本並促使生產工廠進行設備改造。合規性也會延長終端用戶的認證週期,最終使掌握水性或粉末塗料技術的供應商更佔優勢。隨著資產所有者轉向更環保的標準並減少因溶劑型塗料逐步淘汰而造成的收入損失,先行者將獲得市場佔有率。隨著時間的推移,技術創新將抵消大部分利潤率下降,使合規生產商成為首選參與企業。

細分市場分析

到2024年,聚氨酯將佔總收入的30.34%,這反映了其在基礎設施、汽車和能源資產領域無與倫比的靈活性。預計到2030年,該細分市場將以4.79%的複合年成長率成長,成為樹脂類產品中成長最快的。隨著資產所有者傾向於選擇具有高耐磨性和長效耐候性的系統,這些技術進步將推動聚氨酯在防護塗料市場的佔有率成長。生物基和濕固化多元醇的進步在不犧牲性能的前提下進一步改善了其環保特性。此外,離岸風力發電機中,模量和抗侵蝕性的平衡至關重要。

高固態和減水型聚氨酯正在再形成市場競爭格局。能夠配製出既不犧牲適用期又不影響光澤保持性的聚氨酯產品的供應商,正在從溶劑型環氧樹脂轉向聚氨酯的計劃中贏得更多市場佔有率。同時,奈米二氧化矽和石墨烯添加劑提高了抗刮性和熱穩定性,使汽車透明塗層更具吸引力。因此,預計到2030年,聚氨酯將在樹脂保護塗料市場中佔據更大的佔有率。

到2024年,溶劑型塗料將佔總收入的71.59%,這反映了其在嚴苛環境條件下卓越的成膜性能。海上平台、化工廠和管道維護塗料市場主要採用溶劑型塗料,因為資產停機成本遠高於環境遵循成本。儘管面臨監管方面的挑戰,溶劑型塗料在2030年之前仍將保持可觀的市場佔有率。然而,水性塗料的發展勢頭最為強勁,年複合成長率將達到4.58%,這得益於樹脂成分的突破性進展,這些進展增強了塗料的阻隔性並加快了乾燥速度。粉末塗料技術也正憑藉其零VOC認證和噴塗物可回收性,在鋼結構、型材和消費性電子設備等領域不斷拓展應用。

區域分析

永續性政策和建築環境老化共同推動了防護塗料的普及。嚴格的REACH法規促使水性配方和高固含量配方推廣,迫使供應商投資研發更環保的化學技術。

隨著都市化和工業擴張的持續進行,亞太地區的應用量成長最為迅速。中國正將防護塗料的需求導向高速鐵路路基、石化聯合企業和大型造船廠。區域內河橋樑的升級改造也延長了維修週期。在印度,國家基礎設施管道項目也反映了這一趨勢,顯著增加了鋼筋混凝土的防腐蝕表面積。

北美地區雖然處於中間位置,但在高階技術領域至關重要。美國基礎建設方案正將資金用於老舊的州際橋樑、機場和淡水系統。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加大對基礎建設的投資

- 綠色塗料需求不斷成長

- 汽車產業的應用不斷擴大

- 新能源領域需求不斷成長

- 海洋產業消費增加

- 市場限制

- VOC排放法規

- 某些地區技術純熟勞工短缺

- 原物料價格波動

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依樹脂類型

- 環氧樹脂

- 聚氨酯

- 乙烯基酯

- 聚酯纖維

- 醇酸

- 其他樹脂(丙烯酸樹脂、富鋅樹脂等)

- 透過技術

- 溶劑型

- 水溶液

- 粉末

- 其他製程(高固含量、紫外線固化等)

- 按基礎材料

- 金屬

- 具體的

- 塑膠和複合材料

- 其他基材(木材、玻璃等)

- 按最終用途行業分類

- 石油和天然氣

- 管道(包括氫氣管道)

- 其他

- 礦業

- 電力

- 風力發電

- 其他發電部門

- 基礎設施

- 水處理

- 供水管路(飲用水和污水排放)

- 海水淡化和飲用水處理

- 工業用水基礎設施

- 其他終端用戶產業(化工/石化、汽車、船舶)

- 石油和天然氣

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 策略趨勢

- 市佔率(%)分析

- 公司簡介

- Advanced Polymer Coatings

- Akzo Nobel NV

- Asian Paints PPG Pvt. Ltd.

- Axalta Coating Systems, LLC

- BASF

- Belzona International Ltd.

- Berger Paints India

- Chugoku Marine Paints, Ltd.

- DuluxGroup Ltd.

- Hempel A/S

- Jotun

- Kansai Paint Co.,Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- Teknos Group

- The Sherwin-Williams Company

- Tikkurila

第7章 市場機會與未來展望

The Protective Coatings Market size is estimated at USD 15.85 billion in 2025, and is expected to reach USD 19.31 billion by 2030, at a CAGR of 4.02% during the forecast period (2025-2030).

Europe commanded the largest share, sustained by rigorous environmental rules and sizable infrastructure outlays, while Asia-Pacific is projected to record the fastest 5.23% CAGR through 2030. Infrastructure development, the transition toward eco-friendly chemistries, and rising adoption in renewable energy and automotive lightweighting are the most influential growth drivers. Polyurethane products lead resin demand, solvent-borne chemistries still prevail despite VOC pressure, and nanotechnology is opening new horizons for self-healing and smart surfaces. Industry consolidation among top suppliers continues, yet white-space opportunities persist in emerging economies and in advanced solutions for plastic and composite substrates.

Global Protective Coatings Market Trends and Insights

Increasing Investments in Infrastructure Construction

Massive public spending on transport, energy, and civic projects underpins the protective coatings market. The United States Infrastructure Investment and Jobs Act alone is injecting multibillion-dollar capital into bridge and road rehabilitation, boosting demand for long-life anticorrosive systems. Similar programs in China, India, and the European Union converge on durability mandates that favor high-performance formulations. Asset owners increasingly weigh lifecycle economics over upfront cost, translating into premium grades with extended maintenance intervals. Polyurethane and zinc-rich epoxy systems are thus gaining specification priority in steel bridges and rebar-exposed concrete. The market benefit is magnified in coastal regions where salt, humidity, and temperature cycling accelerate degradation.

Growing Green Coatings Demand

Regulations capping VOC emissions tighten year by year, especially under California Air Resources Board limits that now set reference benchmarks worldwide. Formulators respond with waterborne, high-solids, and powder chemistries demonstrating parity in corrosion resistance with legacy solvent products. Eco-friendly alternatives also help asset owners meet corporate sustainability pledges. The protective coatings market sees rapid scale-up of bio-based polyurethane dispersions and low-energy-cure powder blends. Technology development focuses on resin modifications that shorten drying time while sustaining gloss and mechanical performance. Competitive differentiation increasingly rests on quantifiable environmental footprints rather than solely on physical properties.

Regulations Related to VOC Emissions

Stricter VOC caps force reformulation, drive raw-material cost inflation, and compel capital upgrades in production plants. Compliance also prolongs qualification cycles with end users but eventually favors suppliers that master water-borne or powder technologies. Early movers capture share as asset owners pivot to greener standards, cushioning revenue loss from solvent-grade phase-outs. Over time, innovation offsets most margin erosion and positions compliant producers as preferred partners.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Utilization from the Automotive Industry

- Growing Demand from the New Energy Sector

- Skilled Labor Shortage in Certain Geographies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, polyurethane captured 30.34% of revenue, reflecting unparalleled flexibility across infrastructure, automotive, and energy assets. The segment is forecast to expand at a 4.79% CAGR through 2030, the fastest among resins. These advance lifts the polyurethane share of the protective coatings market as asset owners gravitate to systems exhibiting high abrasion resistance and long exterior durability. Advancements in bio-based polyols and moisture-cure variants further improve environmental profiles without sacrificing performance. Demand also benefits from rapid uptake in blade leading-edge protection for offshore wind turbines, where elastic moduli balance and erosion resistance are critical.

High solids and water-reducible grades reshape the competitive field. Suppliers that can formulate polyurethane without sacrificing pot life or gloss retention gain share in projects migrating away from solvent-based epoxies. Meanwhile, nano-silica and graphene additives raise scratch resistance and thermal stability, heightening appeal in automotive clearcoats. As a result, the polyurethane segment is set to account for an even larger slice of the protective coatings market size for resins by 2030.

Solvent-borne systems held 71.59% of sales in 2024, reflecting unmatched film formation under extreme ambient conditions. They dominate maintenance coatings on offshore platforms, chemical plants, and pipelines where asset downtime costs eclipse environmental compliance fees. Despite regulatory headwinds, the protective coatings market maintains a sizable solvent-borne volume through 2030 because no alternate cures reliably at very low temperatures or high humidity. Nevertheless, waterborne lines chart the most dynamic trajectory with a 4.58% CAGR, aided by resin synthesis breakthroughs that enhance barrier properties and accelerate drying. Powder technology also expands footprints in fabricated steel, aluminum profiles, and consumer equipment, leveraging zero-VOC credentials and recyclability of overspray.

The Protective Coatings Market Report Segments the Industry by Resin Type (Epoxy, Polyurethane, Vinyl Ester, Polyester, and More), Technology (Solvent-Borne, Water-Borne, Powder, and Other Technologies), Substrate (Metal, Concrete, and More), End-User Industry (Oil and Gas, Mining, Power, Infrastructure, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Europe remained the principal regional stronghold in 2024 with a 50.37% share of the market, as sustainability policy blended with an aging built environment to drive protective coating uptake. Stringent REACH regulations turbocharge the adoption of waterborne and high-solids formulations, compelling suppliers to invest in greener chemistries.

Asia-Pacific delivers the swiftest volume escalation as urbanization and industrial expansion persist. China channels protective coating demand into high-speed rail track beds, petrochemical complexes, and massive shipyards. Provincial initiatives to upgrade inland waterway bridges also enlarge refurbishment cycles. India mirrors this trajectory with its National Infrastructure Pipeline, creating substantial steel and concrete surface areas for corrosion control systems.

North America occupies an intermediate position yet remains pivotal for high-specification technologies. United States infrastructure packages direct capital toward aging interstate bridges, airports, and freshwater systems.

- Advanced Polymer Coatings

- Akzo Nobel N.V.

- Asian Paints PPG Pvt. Ltd.

- Axalta Coating Systems, LLC

- BASF

- Belzona International Ltd.

- Berger Paints India

- Chugoku Marine Paints, Ltd.

- DuluxGroup Ltd.

- Hempel A/S

- Jotun

- Kansai Paint Co.,Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- Teknos Group

- The Sherwin-Williams Company

- Tikkurila

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Investments in Infrastructure Construction

- 4.2.2 Growing Green Coatings Demand

- 4.2.3 Increasing Utilzation from the Automotive Industry

- 4.2.4 Growing Demand from the New Energy Sector

- 4.2.5 Rising Consumption from the Marine Industry

- 4.3 Market Restraints

- 4.3.1 Regulations Related to VOC Emissions

- 4.3.2 Skilled Labor Shortage in Certain Geographies

- 4.3.3 Fluctuating Raw Material Prices

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Epoxy

- 5.1.2 Polyurethane

- 5.1.3 Vinyl Ester

- 5.1.4 Polyester

- 5.1.5 Alkyd

- 5.1.6 Other Resins (Acrylic. Zinc-Rich, etc.)

- 5.2 By Technology

- 5.2.1 Solvent-borne

- 5.2.2 Water-borne

- 5.2.3 Powder

- 5.2.4 Other Technologies (High-Solids, UV-Cured, etc.)

- 5.3 By Substrate

- 5.3.1 Metal

- 5.3.2 Concrete

- 5.3.3 Plastic and Composites

- 5.3.4 Other Substrates (Wood, Glass, etc)

- 5.4 By End-use Industry

- 5.4.1 Oil and Gas

- 5.4.1.1 Pipeline (incl. Hydrogen Pipeline)

- 5.4.1.2 Others

- 5.4.2 Mining

- 5.4.3 Power

- 5.4.3.1 Wind Energy

- 5.4.3.2 Other Power Generating Sectors

- 5.4.4 Infrastructure

- 5.4.5 Water Treatment

- 5.4.5.1 Distribution Pipeline (potable Water and Wastewater Discharge)

- 5.4.5.2 Desalination and Potable Water Treatment

- 5.4.5.3 Industrial Water Infrastructure

- 5.4.6 Other End-User Industries(Chemicals and Petrochemicals, Automotive, Marine)

- 5.4.1 Oil and Gas

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share(%) Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.3.1 Advanced Polymer Coatings

- 6.3.2 Akzo Nobel N.V.

- 6.3.3 Asian Paints PPG Pvt. Ltd.

- 6.3.4 Axalta Coating Systems, LLC

- 6.3.5 BASF

- 6.3.6 Belzona International Ltd.

- 6.3.7 Berger Paints India

- 6.3.8 Chugoku Marine Paints, Ltd.

- 6.3.9 DuluxGroup Ltd.

- 6.3.10 Hempel A/S

- 6.3.11 Jotun

- 6.3.12 Kansai Paint Co.,Ltd.

- 6.3.13 Nippon Paint Holdings Co., Ltd.

- 6.3.14 PPG Industries, Inc.

- 6.3.15 RPM International Inc.

- 6.3.16 Sika AG

- 6.3.17 Teknos Group

- 6.3.18 The Sherwin-Williams Company

- 6.3.19 Tikkurila

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Nano-engineered Smart Self-healing Coatings

- 7.3 Bio-based Resin Systems for Offshore Wind Towers