|

市場調查報告書

商品編碼

1851490

六亞甲基二胺:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)Hexamethylenediamine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

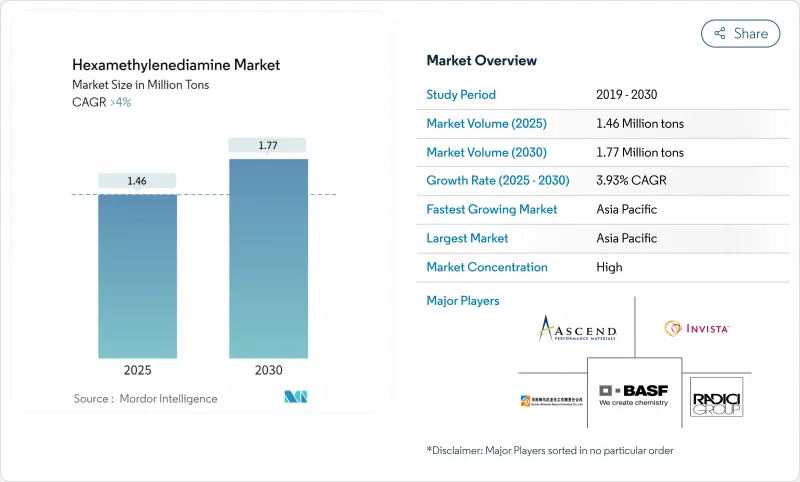

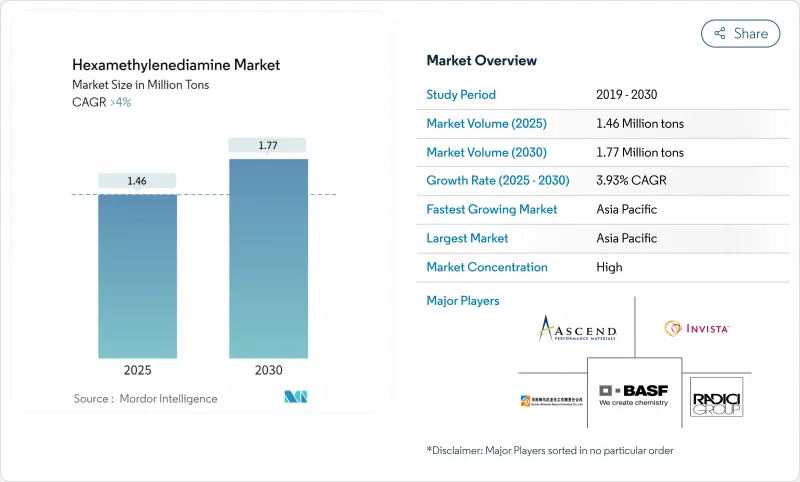

預計到 2025 年,六亞甲基二胺市場規模將達到 146 萬噸,到 2030 年將達到 177 萬噸,在預測期(2025-2030 年)內,複合年成長率將超過 4%。

儘管強勁的需求源自於尼龍6,6的生產,但己二腈至六亞甲基二胺產業鏈的產能限制正促使亞太、北美和歐洲地區進行新的投資。對輕量化汽車零件的策略性關注、疫情後技術紡織品的復甦以及環氧樹脂固化劑等特種應用的穩定成長,都支撐著生產擴張。為應對近期的供應衝擊,生產商加快了垂直整合步伐,並試行使用生物基原料,以期降低成本和減少排放。同時,原油價格波動導致的原料供應不穩定、REACH主導胺類物質排放的限制以及生物基路線規模化生產的風險,都對前景構成了壓力。

全球六亞甲基二胺市場趨勢與洞察

尼龍66在汽車輕量化零件的應用日益廣泛

汽車輕量化目標正在加速尼龍6,6的應用,而下游滲透率的提升則推動了六亞甲基二胺市場的發展。汽車製造商重視聚醯胺的強度重量比、耐熱性和可回收性,尤其是在電池電動車領域,因為重量直接影響續航里程。亞太地區的汽車製造商正在擴大尼龍進氣歧管和結構件的使用,同時聚醯胺產能也在擴張,這增強了區域平衡,並為一體化供應商帶來了回報。在北美,一級供應商正在圍繞尼龍6,6重新設計引擎室零件,以適應渦輪增壓帶來的熱負荷。因此,材料替代趨勢正在推動結構性而非週期性的需求成長。

從己二腈到HMD的產能快速擴張

2024年的供應衝擊暴露了對少數己二腈裝置的依賴。生產商的應對措施包括消除瓶頸,並在中國、墨西哥灣沿岸和西歐等地新建生產線,以增加己二腈-己二胺的產能。英威達運作梅特蘭工廠以及Ascend在阿拉巴馬州擴建90噸/年產能,正是這一趨勢的典型體現。雖然這波擴張緩解了原料供應緊張的局面,但也可能導致短期供應過剩和區域價格波動加劇。儘管如此,大多數業者仍然認為,為了保障下游尼龍的經濟效益,並在以亞洲為中心的終端用戶叢集中獲得地理優勢,這些資本投資是合理的。

原油衍生己二腈價格波動

由於己二腈的價格與原油和石腦油之間的價差密切相關,上游價格波動會迅速傳導至己二胺合約結算,給非一體化企業帶來壓力。 2015年中國煉油廠事故凸顯了集中風險,隨後煉油廠停產加劇了現貨溢價。進口量龐大的歐洲對價格波動最為敏感,增加了專業尼龍紡絲生產商的利潤壓力。歐元疲軟推高了以美元計價的原物料價格,進一步降低了競爭力。這些因素正在推動反向一體化計劃,並促使企業更加關注生物基路線,以期將成本與原油價格波動脫鉤。

細分市場分析

至2024年,尼龍產量將佔六亞甲基二胺市場的78.19%。該細分市場產量將達到114萬噸,主要由汽車引擎室零件和地毯纖維驅動。在預測期內,該細分市場將支撐最大的絕對需求成長,但複合年成長率僅為3.68%。相較之下,環氧樹脂固化劑和除生物劑中間體等特種應用將以5.05%的速度成長,使其在六亞甲基二胺市場的佔有率從2025年的25萬噸成長到2030年的32萬噸。

多元化發展至利潤率更高的細分市場可降低收入受尼龍價格週期波動的影響。透過供應可配製的尼龍等級,生產商可以縮短客戶認證時間並降低轉換成本。這種方法也能充分利用現有的精煉生產線,使新增資本支出相對於收入維持在較低水準。因此,預計在所有地區,特種尼龍等級的採用率將繼續超過基礎聚合物的成長速度。

六亞甲基二胺市場報告按應用(尼龍生產、塗料中間體、除生物劑、其他應用(固化劑、潤滑劑等))、終端用戶行業(紡織、塑膠、汽車、其他終端用戶行業(油漆和塗料、石油化工等))和地區(亞太地區、北美、歐洲、南美、中東和非洲)進行細分。

區域分析

亞太地區佔據六亞甲基二胺市場52.06%的佔有率,反映了中國從煉油到尼龍的完整產業鏈以及該地區汽車和紡織業的蓬勃發展。預計該地區的需求將以4.96%的複合年成長率成長,從2025年的76萬噸成長到2030年的近97萬噸。各國政府正大力推動先進材料叢集建設,而鄰近己二酸原料產地也縮短了供應鏈。例如,英威達在上海投資17.5億元人民幣,產能翻倍,這樣的投資項目強化了當地的供應鏈,提升了競爭力。

北美市佔率主要得益於頁岩油原料和汽車樹脂的需求。然而,與進口產品的成本競爭以及近期主要生產商的破產程序凸顯了其對價格週期的脆弱性。生產商正專注於高純度和生物基樹脂的生產,以確保利潤率並吸引電子和醫療設備原始設備製造商的收購。

歐洲專注於永續性和特色細分市場。BASF在法國新建的年產260公斤的工廠整合了先進的精煉技術和節能反應器,以滿足日益嚴格的脫碳要求。法國關於胺類排放的REACH法規比其他地區更為嚴格,這增加了合規成本,但也為本地生產提供了價格競爭力優勢。

南美洲和中東及非洲地區都在利用天然氣經濟的優勢,擴大下游塑膠需求。巴西汽車製造業的復甦和沙烏地阿拉伯的化工多元化舉措,為該地區的HMD企業創造了機遇,儘管基數較小。跨境合資企業正在開拓這些新興市場,但政治和物流風險意味著其成長速度將低於亞太地區。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 尼龍66在輕量化汽車零件的應用日益廣泛

- 從己二腈到六甲基二甲胺的快速產能積累

- 轉向生物基己二腈原料

- 六亞甲基二胺基環氧固化劑的出現。

- 紡織業對六亞甲基二胺的需求不斷成長

- 市場限制

- 原油衍生己二腈價格波動

- 生物基六亞甲基二胺技術的規模化風險

- REACH法規對胺類排放有嚴格的規定

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 透過使用

- 尼龍生產

- 塗料中間體

- 除生物劑

- 其他用途(硬化劑、潤滑劑等)

- 按年級

- 標準工業級

- 高純度

- 生物基級

- 按最終用途行業分類

- 車

- 紡織品

- 塑膠

- 其他終端用戶產業(油漆塗料、電子產品等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 印尼

- 越南

- 馬來西亞

- 菲律賓

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 土耳其

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Ascend Performance Materials

- BASF

- Cathay Biotech Inc.

- Dow

- DOMO Chemicals

- Evonik Industries AG

- Genomatica Inc.

- INVISTA

- Radici Partecipazioni SpA

- Solvay

- Shenma Industrial Co. Ltd

- Spectrum Chemical

- Thermo Fisher Scientific Inc.

第7章 市場機會與未來展望

The Hexamethylenediamine Market size is estimated at 1.46 million tons in 2025, and is expected to reach 1.77 million tons by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

Demand strength is rooted in nylon 6,6 production, while capacity constraints in the adiponitrile-to-hexamethylenediamine chain are triggering fresh investment across Asia-Pacific, North America and Europe. Strategic focus on lightweight vehicle parts, the post-pandemic revival of technical textiles and the steady uptake of specialty applications such as epoxy curing agents underpin volume expansion. Producers have responded to recent supply shocks by accelerating vertical integration and by piloting bio-based feedstocks that promise lower cost and reduced emissions. At the same time, crude-linked feedstock volatility, REACH-driven amine-emission limits and scale-up risk for bio routes temper the outlook.

Global Hexamethylenediamine Market Trends and Insights

Increasing Consumption of Nylon 6,6 in Lightweight Vehicle Parts

Automotive light-weighting targets are accelerating nylon 6,6 adoption, and the downstream pull-through is boosting the hexamethylenediamine market. Vehicle makers value polyamide's strength-to-weight ratio, heat resistance and recyclability, particularly for battery-electric models where mass directly affects range. Asia-Pacific OEMs are ramping nylon intake manifold and structural-member usage alongside regional polyamide capacity additions, tightening regional balances and rewarding integrated suppliers. In North America, Tier-1 suppliers are redesigning engine-bay components around nylon 6,6 to cope with turbo-charging heat loads. The material substitution trend is therefore driving a structural, rather than merely cyclical, uplift in hexamethylenediamine demand.

Rapid Capacity Additions for Adiponitrile-to-HMD

Supply shocks in 2024 exposed reliance on a handful of adiponitrile units. Producers reacted by green-lighting de-bottlenecks and grass-roots lines that push integrated adiponitrile-hexamethylenediamine capacities higher in China, the Gulf Coast and Western Europe. INVISTA's Maitland restart and Ascend's 90 kt/y Alabama build-out epitomize the trend. While the wave will ease feedstock tightness, it also risks short-term oversupply and sharper regional price swings. Still, most operators deem the capex justified to safeguard downstream nylon economics and capture proximity advantages in Asia-centric end-use clusters.

Volatility in Crude-Derived Adiponitrile Prices

Because adiponitrile tracks crude-naphtha spreads, upstream price shifts transmit quickly to hexamethylenediamine contract settlements, squeezing unintegrated players. The 2015 China plant accident underscored concentration risk, and subsequent refinery outages kept spot premiums wide. Import-heavy Europe feels swings most acutely, amplifying margin pressure on captive nylon spinners. Currency movement adds another layer: a weak euro inflates dollar-indexed feedstocks, further eroding competitiveness. These factors spur back-integration projects and intensify interest in bio-routes that decouple cost from oil volatility.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Bio-Based Adiponitrile Feedstocks

- Emergence of HMD-Based Epoxy Curing Agents

- Scale-Up Risk for Bio-Based HMD Technologies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Nylon production retained a commanding 78.19% slice of the hexamethylenediamine market in 2024. The segment's volume translates to 1.14 million tons, supported by automotive under-the-hood parts and carpet fibers. This pool underpins the largest absolute demand increment over the forecast horizon, but its CAGR trails at 3.68%. In contrast, specialty uses such as epoxy curing agents and biocide intermediates are expanding at a 5.05% pace, lifting their share of the hexamethylenediamine market size from 0.25 million tons in 2025 toward 0.32 million tons in 2030.

Diversification into higher-margin niches mitigates revenue exposure to nylon price cycles. Producers supply formulation-ready grades that shorten customer qualification time, reinforcing switching costs. The approach also leverages existing purification trains, so incremental capex stays low relative to returns. As a result, specialty penetration is expected to continue outpacing base-polymer growth across all regions.

The Hexamethylenediamine Market Report is Segmented by the Application (Nylon Production, Intermediate for Coatings, Biocides, and Other Applications (Curing Agents, Lubricants, Etc. )), End-User Industry (Textile, Plastics, Automotive, and Other End-User Industries (Paints and Coatings, Petrochemicals, Etc. )), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific's 52.06% stake in the hexamethylenediamine market reflects China's integrated refinery-to-nylon ecosystem and the region's outsized automotive and textile sectors. Regional demand rises at a 4.96% CAGR, lifting volume from 0.76 million tons in 2025 to nearly 0.97 million tons by 2030. Governments promote advanced materials clusters, and proximity to adipic-acid feedstock shortens supply lines. Investments such as INVISTA's RMB 1.75 billion capacity doubling in Shanghai anchor the local supply chain and strengthen competitiveness.

North America's share is underpinned by shale-advantaged feedstocks and captive automotive resin demand. Yet, cost competition from imports and recent bankruptcy proceedings at a major producer underscore vulnerability to price cycles. Producers emphasize high-purity and bio-based grades to defend margins and secure offtake from electronics and medical OEMs.

Europe is focusing on sustainability and specialty niches. BASF's new 260 kt/y French plant integrates advanced purification and energy-efficient reactors that align with tightening decarbonization directives. REACH restrictions on amine emissions are stricter than other regions, raising compliance costs yet providing a non-price competitive moat for local output.

South America plus the Middle East and Africa both regions leverage competitive gas economics and expanding downstream plastics demand. Brazil's automotive-production rebound and Saudi Arabia's chemicals diversification initiatives open windows for regional HMD units, albeit from a small base. Political and logistical risk keeps growth moderate compared with Asia-Pacific, but cross-border joint ventures are positioning to tap these frontier volumes.

- Ascend Performance Materials

- BASF

- Cathay Biotech Inc.

- Dow

- DOMO Chemicals

- Evonik Industries AG

- Genomatica Inc.

- INVISTA

- Radici Partecipazioni SpA

- Solvay

- Shenma Industrial Co. Ltd

- Spectrum Chemical

- Thermo Fisher Scientific Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Consumption of Nylon 6,6 in Lightweight Vehicle Parts

- 4.2.2 Rapid Capacity Additions for Adiponitrile-to-HMDA

- 4.2.3 Shift towards Bio-based Adiponitrile Feedstocks

- 4.2.4 Emergence of Hexamethylenediamine -based Epoxy Curing Agents

- 4.2.5 Growing Demand for Hexamethylenediamine from Textile Industry

- 4.3 Market Restraints

- 4.3.1 Volatility in Crude-Derived Adiponitrile Prices

- 4.3.2 Scale-up Risk for Bio-based Hexamethylenediamine Technologies

- 4.3.3 Stringent REACH Restrictions on Amine Emissions

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Nylon Production

- 5.1.2 Intermediates of Coating

- 5.1.3 Biocides

- 5.1.4 Other Applications (Curing Agents, Lubricants, etc.)

- 5.2 By Grade

- 5.2.1 Standard Industrial Grade

- 5.2.2 High-Purity Grade

- 5.2.3 Bio-based Grade

- 5.3 By End-use Industry

- 5.3.1 Automotive

- 5.3.2 Textiles

- 5.3.3 Plastics

- 5.3.4 Other End-user Industries (Paints and Coatings, Electronics, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Indonesia

- 5.4.1.7 Vietnam

- 5.4.1.8 Malaysia

- 5.4.1.9 Philippines

- 5.4.1.10 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Turkey

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 South Africa

- 5.4.5.5 Nigeria

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Ascend Performance Materials

- 6.4.2 BASF

- 6.4.3 Cathay Biotech Inc.

- 6.4.4 Dow

- 6.4.5 DOMO Chemicals

- 6.4.6 Evonik Industries AG

- 6.4.7 Genomatica Inc.

- 6.4.8 INVISTA

- 6.4.9 Radici Partecipazioni SpA

- 6.4.10 Solvay

- 6.4.11 Shenma Industrial Co. Ltd

- 6.4.12 Spectrum Chemical

- 6.4.13 Thermo Fisher Scientific Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment