|

市場調查報告書

商品編碼

1851462

彈性體:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Elastomers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

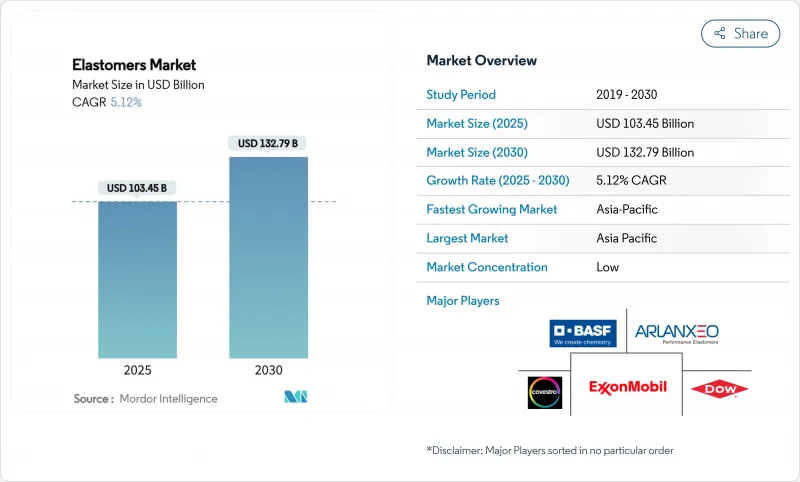

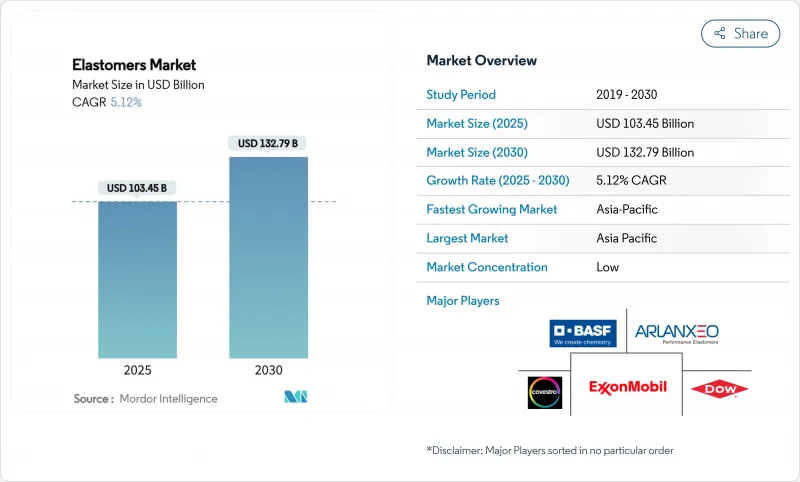

預計到 2025 年,彈性體市場規模將達到 1,034.5 億美元,到 2030 年將達到 1,327.9 億美元,在預測期(2025-2030 年)內,複合年成長率為 5.12%。

彈性體市場的成長軌跡與其能夠實現更輕量化的汽車平台、延長電動車續航里程以及在不犧牲耐用性的前提下滿足循環經濟的需求密切相關。熱塑性彈性體(TPE)正在取代傳統橡膠,因為它們可以在標準塑膠設備上進行熔融加工,從而縮短生產週期並實現閉迴路再生料閉合迴路,降低廢料率。亞太地區的快速都市化和對節能建築的需求推動了建築需求的持續成長。同時,醫療設備製造商正加速從PVC管材轉向能夠承受消毒的生物相容性TPE。

全球彈性體市場趨勢與洞察

汽車減重和對電動車零件日益成長的需求

電動車製造商正利用先進的彈性體材料來減輕電池外殼、懸吊防塵罩和流體管路的重量,從而直接提升車輛續航里程。例如,Hytrel TPC LCF 等材料與傳統聚合物相比,可減少 50% 的碳排放,並在低溫衝擊下保持柔韌性。商用車車主也對其重型電池組提出了同樣的需求,推動了高溫墊片和減振器等產品的多年研發項目。即使在全球輕型汽車銷售低迷的年份,原始設備製造商 (OEM) 仍將研發預算轉向輕量化密封解決方案,推動了彈性體市場的反週期成長。 Cooper Standard 的 Fortrex 平台凸顯了這一趨勢,與 EPDM 相比,其重量減輕了 53%,同時延長了使用壽命。充電站製造商也推動了對彈性體包覆成型部件的需求,因為這些部件必須能夠承受快速充電過程中的熱循環。

亞太地區的建築和基礎設施擴建

在中國、印度和東南亞的高層計劃和大型交通走廊中,彈性體密封膠的使用確保了機芯、結構玻璃系統和防水膜即使在地震荷載作用下也能保持建築圍護結構的完整性。政府的綠建築標準鼓勵使用低揮發性有機化合物(VOC)和節能材料,使得高性能熱塑性彈性體(TPE)和聚氨酯(PU)密封膠成為預設規格。科思創近期在台灣擴大了其澆注聚氨酯彈性體的產能,主要面向自動化工廠和風力發電機零件,從而增強了該地區的自給自足能力。智慧城市投資推動了對感測器外殼和空氣品質監測器的需求成長,這些產品需要紫外線穩定的彈性體外殼。承包商傾向於選擇本地配製的等級,以避免運輸延誤,這為全球供應商提供了與彈性體市場終端客戶接軌的機會。

原油和原料價格波動

為了維持利潤率,BASF等製造商對主要二醇類原料加收了每磅8-10美分的額外費用。供應緊張迫使加工商謹慎平衡庫存,儘管一些加工商正在轉向生物基原料,但供應量仍然有限。這種波動擾亂了預算,並可能導致資本支出推遲,從而抑制了彈性體市場的近期成長。

細分市場分析

熱可塑性橡膠不僅佔據了彈性體市場81.56%的佔有率,而且由於其閉合迴路再加工特性,有助於原始設備製造商(OEM)實現其回收目標,因此預計到2030年,其複合年成長率將達到5.35%,成為成長最快的彈性體材料。這種主導地位意味著,關鍵的汽車車窗密封件、線束護套和穿戴式裝置正擴大使用熱塑性彈性體(TPE)代替交聯橡膠,以縮短成型週期。

熱固性彈性體在溫度超過 150°C 的應用領域已佔據一席之地,例如渦輪增壓器軟管和油田封隔器。然而,即使在這些小眾領域,將 TPE 外層與硫化芯材混合的混合型彈性體也能兼具耐化學性和可回收性。因此,研究投資主要集中在成核劑、嵌段共聚物設計和催化劑系統上,旨在將 TPE 的使用溫度提高到 180°C 以上,同時又不影響其疲勞壽命。這些進展有望為彈性體市場帶來額外收入,並幫助加工商履行回收義務。

此彈性體市場報告按產品類型(熱可塑性橡膠和熱固性彈性體)、終端用戶行業(汽車及交通運輸、電氣及電子、醫療保健、工業機械及設備、其他)和地區(亞太地區、北美地區、歐洲地區、南美地區、中東和非洲)進行細分。市場預測以美元計價。

區域分析

亞太地區以42.34%的市佔率主導彈性體市場,年複合成長率達6.56%。中國仍然是關鍵參與者,為長三角Delta的高速鐵路墊片、家用電器密封件和輪胎工廠供應彈性體。印度的國有工業工業也在推動對用於大型設備的減震支架的需求,而東南亞的電子產業叢集則在消耗用於智慧型手機和平板電腦的耐熱包覆成型化合物。

北美透過輕型車輛、醫療設備和頁岩氣基礎設施的整合供應鏈,為彈性體市場提供支援。針對國內電動車電池工廠的政策獎勵,正在促進阻燃型TPE密封墊片的採購,這些墊片用於密封電池機殼。歐洲對永續性的重視,推動了經ISCC PLUS物料平衡系統檢驗的生物基EPDM和TPE混合物的應用。

南美洲、中東和非洲的基礎設施投資正在穩步成長。巴西是世界第四大聚氨酯生產國,而墨西哥灣沿岸的能源計劃需要耐酸性氣體的彈性密封。儘管這些地區的絕對規模較小,但隨著供應鏈日益本地化,它們具有長期的成長潛力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對更輕型汽車零件和電動車的需求不斷成長

- 亞太地區的建築和基礎設施擴建

- 熱可塑性橡膠(TPE)在軟性家用電器領域正迅速普及。

- 醫用非PVC管材應用快速成長

- 循環利用、可回收熱塑性塑膠(TPE)等級的出現

- 積層製造對彈性體長絲的需求

- 市場限制

- 原油和原料價格波動

- 加強對微塑膠和輪胎磨損的監管

- 高溫下性能差異化的生物基彈性體

- 專門食品單體供應鏈集中度

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 熱可塑性橡膠

- 熱固性彈性體

- 按最終用戶行業分類

- 汽車與運輸

- 電氣和電子

- 醫療保健

- 工業機械

- 消費品和鞋類

- 黏合劑、密封劑和被覆劑

- 其他(建築和施工、航太和國防等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Ace Elastomer Co., Ltd.

- Arkema

- ARLANXEO

- Avient Corporation

- BASF

- Covestro AG

- DingZing Advanced Materials Co., Ltd.

- Dow

- Exxon Mobil Corporation

- Firestone Building Products Company

- HEXPOL AB

- Huntsman Corporation

- KRAIBURG TPE GmbH

- Kuraray Co., Ltd.

- Lion Elastomers Co., Ltd

- Mitsui Chemicals, Inc.

- Sirmax SpA

- Suzhou Austin Novel Materials Co., Ltd.

- Teknor Apex, Inc.

- Trinseo LLC

- UBE Corporation

- Wanhua Chemical Group Co., Ltd.

第7章 市場機會與未來展望

The Elastomers Market size is estimated at USD 103.45 billion in 2025, and is expected to reach USD 132.79 billion by 2030, at a CAGR of 5.12% during the forecast period (2025-2030).

The upward trajectory of the Elastomers market is tied to the material's ability to deliver weight reduction in automotive platforms, extend electric-vehicle range, and meet circular-economy expectations without sacrificing durability. Thermoplastic grades are displacing conventional rubbers because they melt-process on standard plastics equipment, cut cycle times, and enable closed-loop re-grind streams that lower scrap rates. Rapid urbanization in Asia Pacific and the push for energy-efficient buildings keep construction demand elevated, while medical device makers accelerate the shift away from PVC tubing toward biocompatible TPEs that survive sterilization.

Global Elastomers Market Trends and Insights

Growing Demand for Lightweighting and EV Parts in Automotive

Electric-vehicle makers rely on advanced elastomers to shave kilograms from battery housings, suspension boots, and fluid-handling lines, which directly boosts driving range. Materials such as Hytrel TPC LCF cut carbon footprints by 50% compared with incumbent polymers, yet keep flexibility under low-temperature shock. Commercial fleet owners echo the same need in heavy-duty packs, fueling multi-year programs for high-temperature gaskets and vibration isolators. Even in a year when global light-vehicle sales slipped, OEMs funneled research and development budgets toward lightweight sealing solutions, creating a counter-cyclical lift for the Elastomers market. Cooper Standard's Fortrex platform highlights the trend with a 53% mass reduction versus EPDM while extending service life. Charging-station manufacturers add to demand because elastomeric over-mold parts must tolerate thermal cycling during fast charging.

Expansion of Construction and Infrastructure in Asia-Pacific

High-rise projects and mega-transport corridors across China, India, and Southeast Asia use elastomeric sealants to enable movement joints, glazing systems, and waterproof membranes that maintain building envelope integrity under seismic loads. Government green-building codes reward the use of low-VOC, energy-saving materials, turning high-performance TPE and PU sealants into default specifications. Covestro's recent capacity ramp-up in Taiwan for cast polyurethane elastomers is aimed at equipment used in automated factories and wind-turbine components, reinforcing regional self-sufficiency. Smart-city investments generate incremental pulls from sensor housings and air-quality monitors that require UV-stable elastomer skins. Contractors favor locally compounded grades to avoid shipping delays, giving global suppliers a reason to co-locate with end-markets in the Elastomers market.

Volatile Crude Oil and Feedstock Prices

Producers such as BASF implemented 8-10 cents per pound surcharges on key diols to maintain margins. Tight supply obliges converters to balance inventories carefully, and some shift sourcing to bio-based feedstocks, although volumes remain limited. The volatility clouds budgeting and can postpone capital expenditure, dampening near-term expansion of the Elastomers market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Penetration of Thermoplastic Elastomers in Flexible Consumer Electronics

- Surge in Medical-Grade PVC-Free Tubing Applications

- Stricter Micro-Plastic and Tire-Wear Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermoplastic elastomers not only own 81.56% share of the Elastomers market but also log the fastest 5.35% CAGR to 2030, thanks to closed-loop reprocessability that helps OEMs hit recycling targets. This dominance means every major automotive window seal, wire harness grommet, and wearable band increasingly relies on TPE, often replacing cross-linked rubber to shorten molding cycles.

Thermoset elastomers maintain footholds where temperatures exceed 150 °C, for instance, in turbocharger hoses and oil-field packers. Yet even in these niches, hybrid concepts mix TPE outer layers with vulcanized cores to marry chemical resistance with recyclability. Research investment, therefore, centers on nucleating agents, block-copolymer design, and catalyst systems that lift the service temperature of TPE beyond 180 °C without eroding fatigue life. Such advances are expected to channel additional revenue into the Elastomers market while helping processors meet take-back mandates.

The Elastomers Report is Segmented by Product Type (Thermoplastic Elastomers and Thermoset Elastomers), End-User Industry (Automotive and Transportation, Electrical and Electronics, Medical and Healthcare, Industrial Machinery and Equipment, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific captures 42.34% of the Elastomers market and outpaces all other regions with a 6.56% CAGR. China remains the centerpiece, channeling elastomers into high-speed rail gaskets, appliance seals, and tire plants clustered along the Yangtze River Delta. India's state-sponsored industrial corridors likewise lift demand for vibration-dampening mounts used in capital equipment, while Southeast Asia's electronics clusters consume heat-resistant over-mold compounds for smartphones and tablets.

North America sustains the Elastomers market through its integrated supply chain for light vehicles, medical devices, and shale-gas infrastructure. Policy incentives for domestic EV battery plants intensify the procurement of flame-retardant TPE gaskets that seal cell enclosures. Europe pivots heavily toward sustainability, driving the adoption of bio-attributed EPDM and TPE blends verified under ISCC PLUS mass-balance systems.

South America, the Middle-East, and Africa post steady gains in infrastructure spending. Brazil's polyurethane output ranks fourth globally, while Gulf energy projects need sour-gas-resistant elastomer seals. Although smaller in absolute terms, these regions provide long-run upside as supply-chain localization continues.

- Ace Elastomer Co., Ltd.

- Arkema

- ARLANXEO

- Avient Corporation

- BASF

- Covestro AG

- DingZing Advanced Materials Co., Ltd.

- Dow

- Exxon Mobil Corporation

- Firestone Building Products Company

- HEXPOL AB

- Huntsman Corporation

- KRAIBURG TPE GmbH

- Kuraray Co., Ltd.

- Lion Elastomers Co., Ltd

- Mitsui Chemicals, Inc.

- Sirmax S.p.A

- Suzhou Austin Novel Materials Co., Ltd.

- Teknor Apex, Inc.

- Trinseo LLC

- UBE Corporation

- Wanhua Chemical Group Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for lightweighting and EV parts in automotive

- 4.2.2 Expansion of construction and infrastructure in Asia Pacific

- 4.2.3 Rapid penetration of Thermoplastic Elastomers (TPEs) in flexible consumer electronics

- 4.2.4 Surge in medical?grade PVC-free tubing applications

- 4.2.5 Emergence of recycling-compatible circular Thermoplastic Elastomers (TPE )grades

- 4.2.6 Additive manufacturing demand for elastomeric filaments

- 4.3 Market Restraints

- 4.3.1 Volatile crude oil and feedstock prices

- 4.3.2 Stricter micro-plastic and tire-wear regulations

- 4.3.3 Performance gap of bio-based elastomers at high-temperature

- 4.3.4 Supply-chain concentration of specialty monomers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Thermoplastic Elastomers

- 5.1.2 Thermoset Elastomers

- 5.2 By End-user Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Electrical and Electronics

- 5.2.3 Medical and Healthcare

- 5.2.4 Industrial Machinery and Equipment

- 5.2.5 Consumer Goods and Footwear

- 5.2.6 Adhesives, Sealants and Coatings

- 5.2.7 Others (Building and Construction, Aerospace and Defense, etc)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ace Elastomer Co., Ltd.

- 6.4.2 Arkema

- 6.4.3 ARLANXEO

- 6.4.4 Avient Corporation

- 6.4.5 BASF

- 6.4.6 Covestro AG

- 6.4.7 DingZing Advanced Materials Co., Ltd.

- 6.4.8 Dow

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Firestone Building Products Company

- 6.4.11 HEXPOL AB

- 6.4.12 Huntsman Corporation

- 6.4.13 KRAIBURG TPE GmbH

- 6.4.14 Kuraray Co., Ltd.

- 6.4.15 Lion Elastomers Co., Ltd

- 6.4.16 Mitsui Chemicals, Inc.

- 6.4.17 Sirmax S.p.A

- 6.4.18 Suzhou Austin Novel Materials Co., Ltd.

- 6.4.19 Teknor Apex, Inc.

- 6.4.20 Trinseo LLC

- 6.4.21 UBE Corporation

- 6.4.22 Wanhua Chemical Group Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Shifting Focus toward the Development of Bio-based Products