|

市場調查報告書

商品編碼

1851459

電磁閥:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Solenoid Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

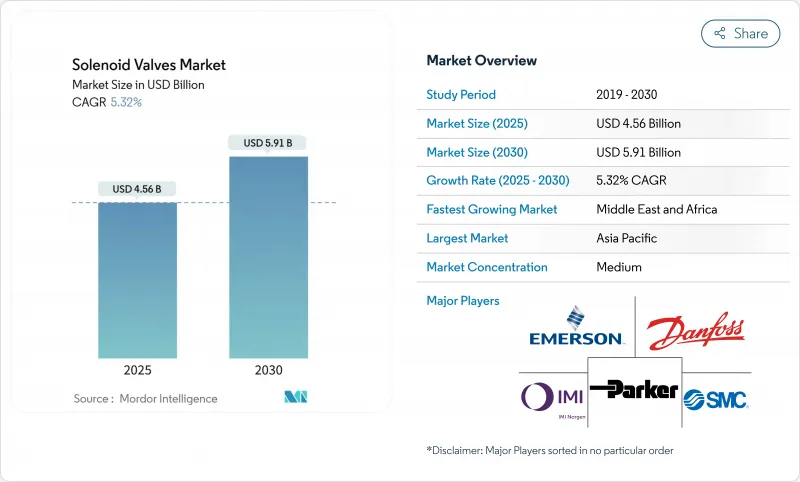

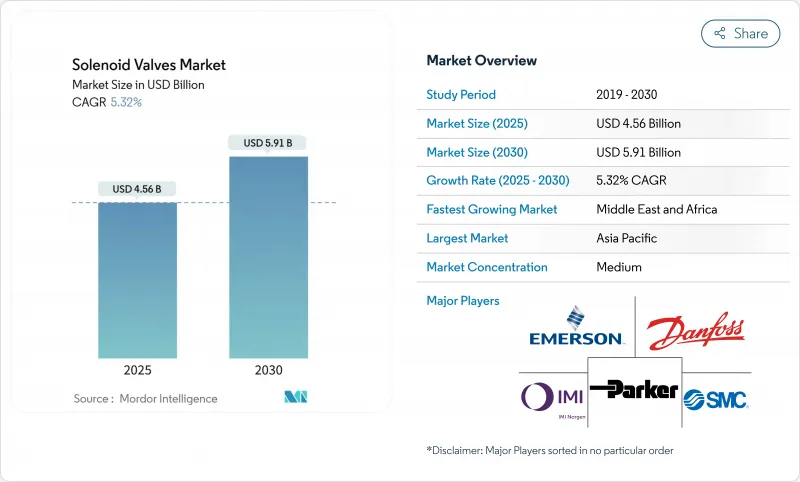

預計到 2025 年,電磁閥市場規模將達到 45.6 億美元,到 2030 年將達到 59.1 億美元,在此期間的複合年成長率為 5.32%。

需求將主要來自水資源再利用、頁岩氣井口、氫氣電解槽和輕型電動車(EV)熱感自動化計劃。亞太地區仍維持銷售主導,而中東和非洲地區由於經濟多元化計劃,成長速度最快。技術差異化正轉向零排放驅動、支援IO-Link的診斷以及輕質工程塑膠,以滿足車輛續航里程目標。儘管面臨來自亞洲低成本製造商日益激烈的價格競爭以及合金成本的波動,原始設備製造商(OEM)仍然優先考慮智慧、易於維護的電磁閥架構,以減少停機時間並實現預測性維護。

全球電磁閥市場趨勢與洞察

歐盟和海灣合作理事會工業污水再利用計畫的擴展

歐盟的《循環經濟指令》和波灣合作理事會的《水資源短缺指令》正在推動對先進處理廠的投資,這些處理廠需要自動化學藥劑注入、反沖洗控制和級間切換。電磁閥能夠提供手動裝置無法比擬的精確、低洩漏驅動,尤其是在處理配方隨進水水質波動而變化的情況下。中東地區採用零液體排放裝置的石油生產商傾向於選擇不銹鋼或雙層壁閥體以及數位位置反饋裝置,以滿足環境審核的要求。

小型電動車溫度控管迴路的普及化需要微型螺線管

新一代電動車電池冷卻系統、電力電子冷卻器和車廂空調系統整合了多迴路電路,這些電路依賴快速、節能的微型電磁閥。像三華汽車這樣的供應商正在將冷媒型電磁閥商業化,這些電磁閥能夠在容量有限的電池組中循環運行數百萬次。輕量化的PEEK閥體和低功耗線圈可以提高續航里程,使這一領域成為電磁閥市場的核心成長引擎。

在高於 120 度C 的應用中,高開關循環疲勞

在蒸氣管路和高溫反應器中,電磁線圈容易發生加速介電擊穿。雖然市面上已有優質耐高溫銅線圈和全氟橡膠密封件,但高昂的材料成本限制了它們在價格敏感型計劃中的應用。而那些面臨維修週期延長的公用事業公司則必須選擇更換為更高密度的線圈,這進一步減緩了電磁閥市場的成長。

細分市場分析

直動式電磁閥將在2024年佔據42%的市場佔有率,預計2025年市場收入將達到19億美元。其結構簡單、壓力降小、循環速度快,使其非常適合用於公用供水管和OEM機械。然而,以6.9%的複合年成長率快速發展的先導式電磁閥正日益應用於井口、動力鍋爐和大型化學反應器等需要大於25毫米介面和超過100巴壓力的應用領域。艾默生頁岩氣解決方案正是這一轉變的體現,該方案將活塞隔膜與微型電磁先導相結合,能夠提供每小時數千立方公尺的標準壓力。升級到預測性維護平台的產業也非常青睞先導式電磁閥的低湧入電流和更安靜的關閉特性。

線圈必須能夠承受上游壓力的波動,隔膜需要採用耐磨彈性體材料,而外殼通常整合一個螺紋感測器,用於向PLC提供資料。亞洲製造商目前正在大規模複製經典的先導式結構,這加劇了價格競爭,但也提高了新興經濟體的供應量,擴大了電磁閥市場。

雙向截止閥仍是市場主導產品,佔2024年銷售額的55%,約佔電磁閥市場23億美元的佔有率。它們廣泛應用於灌溉、壓縮空氣和基礎製程隔離領域。然而,隨著食品飲料和生物技術產業對快速產品切換的需求,三通切換閥預計將以每年6.4%的速度成長。這些閥門無需手動更換閥芯即可在生產、CIP清洗和滅菌流程之間切換,滿足衛生製造的要求。一些製藥設備將20個或更多三通閥整合到一個數位歧管中,從而減少30%的佔地面積並加快安裝速度。

製造商透過採用無空腔內結構和符合FDA標準的密封件來應對這項挑戰,從而消除了污染物可能積聚的死角。控制軟體將每個連接埠映射到一個PLC標籤,實現了基於配方的流路控制。多端口創新也已應用於半導體濕式製程台,在這些製程台上,化學品必須在幾毫秒內流經多個清洗槽和蝕刻槽,這進一步推動了三通電磁閥在市場上的應用。

區域分析

亞太地區預計到2024年將佔全球銷售額的34%,這主要得益於中國龐大的電子產品生產能力、日本的精密機器人技術以及印度不斷成長的藥品出口。政府對國內半導體和電池工廠的支持正在推動相關技術的廣泛應用,而日本和韓國的氫氣試點計畫則需要能夠承受700巴氣體壓力的高可靠性閥門。此外,中國沿海地區的水資源再利用政策也帶動了市政部門的新需求。

預計中東和非洲地區將以7.50%的複合年成長率成長,受益於沙烏地阿拉伯的「2030願景」多元化計劃和阿拉伯聯合大公國的石化超級基地。阿曼和沙烏地阿拉伯NEOM的氫氣和氨出口計畫需要用於低溫和高壓工況的專用先導式閥門。非洲的需求成長雖然不大,但成長方向多元化,這主要得益於南非礦業脫水業務的成長和埃及食品工業的擴張。

北美頁岩氣、液化天然氣和製藥業正推動售後市場銷售穩定成長。科羅拉多和德克薩斯州正在快速部署零排放井口閥,並透過監管主導的資本投資更新現有設備。在加拿大,一座碳捕集示範工廠正在尋找耐腐蝕電磁閥來處理混合二氧化碳流。歐洲作為一個成熟且創新主導的地區,正在向綠色氫能數位化製造轉型。儘管整體成長放緩,但這項轉型確保了智慧IO-Link閥門的價值,並鞏固了電磁閥市場的高階價格分佈。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟和海灣合作理事會工業污水再利用計畫的擴展

- 小型電動車溫度控管迴路的普及化需要微型螺線管

- 在東協地區快速維修傳統飲料生產線,使其符合衛生標準。

- 美國和阿根廷頁岩盆地的天然氣井自動化

- 歐洲和日本氫電解槽的建設趨勢

- 製藥業4.0時代提升了對智慧IO-Link閥門的偏好

- 市場限制

- 在高於 120°C 的應用中,高開關循環疲勞

- 特殊合金(例如雙相不銹鋼)的價格波動

- 拉丁美洲現場性能驗證技術純熟勞工短缺

- 醫療器材原始設備製造商對壓電微閥的競爭日益激烈

- 價值/供應鏈分析

- 監理與技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 定價分析(如適用)

- 行業標準和法規

- 技術概覽

- 電磁閥的發展演變及其在電動車/自動駕駛汽車中的新應用

- 關鍵設計和技術考慮因素

第5章 市場規模與成長預測

- 運行原理

- 直接作用型

- 飛行員駕駛

- 按連接埠/串流配置

- 雙向

- 三人行

- 超過四邊

- 按閥體材質

- 黃銅

- 防鏽的

- 鋁

- 工程塑膠和複合材料

- 按尺寸

- 超小型(小於5毫米)

- 超小型(5-10毫米)

- 微型(10-25毫米)

- 小光圈(25-50毫米)

- 大光圈(50毫米或以上)

- 按最終用戶行業分類

- 飲食

- 過濾系統

- 灌裝/注射生產線

- 車

- 氣壓懸吊

- 燃油噴射和廢氣排放

- 安全保障系統

- 變速箱和傳動系統

- 其他(暖通空調、門)

- 化工/石油化工

- 儲存方向控制

- 隔離閥

- 發電

- 蒸氣控制和給水器

- 升降機和水泵

- 洪水系統

- 石油和天然氣

- 挖掘

- 礦業

- 下游供應

- 醫療保健和製藥

- 按行業(農業技術、航太、紡織、其他)

- 飲食

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、合資、智慧財產權)

- 市佔率分析

- 公司簡介

- Emerson Electric Co.(ASCO)

- Danfoss A/S

- Parker-Hannifin Corp.

- SMC Corp.

- IMI plc

- Burkert GmbH and Co. KG

- Curtiss-Wright Corp.

- AirTAC International Group

- Kendrion NV

- The Lee Co.

- CEME SpA

- PeterPaul Electronics Co.

- CKD Corp.

- Anshan Solenoid Valve Co.

- KANKEO SANGYO Co.

- Rotex Automation

- Festo SE and Co. KG

- ODE Srl

- GEMU Group

- Genebre SA

第7章 市場機會與未來展望

The solenoid valves market size is valued at USD 4.56 billion in 2025 and is forecast to reach USD 5.91 billion by 2030, reflecting a 5.32% CAGR over the period.

Demand stems from automation projects in water reuse, shale-gas wellheads, hydrogen electrolyzers, and compact electric-vehicle (EV) thermal loops. Asia-Pacific retains volume leadership, while the Middle East and Africa exhibits the fastest expansion because of economic diversification programs. Technology differentiation is shifting toward zero-emissions actuation, IO-Link-enabled diagnostics, and lightweight engineering plastics that satisfy automotive range targets. Despite growing price competition from low-cost Asian producers and alloy cost swings, OEMs continue to prioritize smart, service-friendly solenoid architectures that limit downtime and enable predictive maintenance.

Global Solenoid Valves Market Trends and Insights

Expansion of Industrial Waste-water Re-use Schemes in EU & GCC

Circular-economy directives in the European Union and water-scarcity mandates in the Gulf Cooperation Council are accelerating investments in advanced treatment plants that need automated chemical dosing, back-flush control, and stage switching. Solenoid valves enable precise, low-leak actuation that manual devices cannot match, especially when treatment recipes shift with feed-water variability. Oil producers adopting zero-liquid-discharge plants in the Middle East prefer stainless-steel or duplex bodies coupled with digital position feedback to meet environmental audits.

Surge in Compact EV Thermal-Management Loops Requiring Micro-Solenoids

Battery cooling, power-electronics chillers, and cabin HVAC in next-generation EVs integrate multi-loop circuits that depend on fast, energy-efficient micro-solenoids. Suppliers such as Sanhua Automotive have commercialized refrigerant versions able to cycle millions of times while operating inside constrained battery packs. Lightweight PEEK bodies and low-power coils extend driving range, making the segment a core growth engine for the solenoid valves market.

High Switching-Cycle Fatigue in >120 °C Applications

Steam lines and high-temperature reactors expose solenoid coils to accelerated insulation breakdown. Premium high-temp copper windings and perfluoro-elastomer seals are available but raise bill-of-material cost, curbing adoption in price-sensitive projects. Utilities facing extended maintenance intervals perceive risk in swapping to higher-density windings, moderating growth for the solenoid valves market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Retrofit of Legacy Beverage Lines in ASEAN for Hygienic Design

- Gas Well-Head Automation in Shale Basins of US & Argentina

- Price Volatility of Specialty Alloys (e.g., Duplex Stainless)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Direct-acting valves led the solenoid valves market with 42% share in 2024, translating to an estimated USD 1.9 billion of 2025 revenue. Their simple architecture, minimal pressure drop, and fast cycling suit utilities water lines and OEM machinery. Yet pilot-operated mechanisms, advancing at 6.9% CAGR, increasingly service wellheads, power boilers, and large chemical reactors that require ports above 25 mm and pressures exceeding 100 bar. Emerson's shale-gas solution highlights the shift, pairing a minute electromagnetic pilot with a piston diaphragm able to pass thousands of standard cubic meters per hour. Industries upgrading to predictive maintenance platforms value the lower inrush current and quieter closing profile typical of pilot-operated units.

The move alters supply-chain needs: coils must tolerate fluctuating upstream pressures, diaphragms demand abrasion-resistant elastomers, and housings often integrate threaded sensors that feed PLCs. Asian fabricators now replicate classic pilot-operated geometries at scale, intensifying price pressure but also expanding availability across emerging economies, thereby broadening the solenoid valves market.

Two-way shut-off valves remain the workhorse, holding 55% revenue in 2024, roughly USD 2.3 billion of solenoid valves market size. They dominate irrigation, compressed-air, and basic process isolation. However, as food, beverage, and biotech adopters demand rapid SKU changeovers, three-way diverter designs grow 6.4% annually. These valves alternate between production, CIP, and sterilization streams without manual spool changes, aligning with hygienic directives. Certain pharmaceutical skids now bundle twenty or more three-way units on a single digital manifold, trimming footprint by 30% and slashing install time.

Manufacturers respond with cavity-free internals and FDA-approved seals that eliminate dead legs where contaminants accumulate. Control software maps each port to PLC tags, enabling recipe-driven flow paths. Multi-port innovations bleed into semiconductor wet benches, where chemistries must route through multiple rinse and etch tanks in milliseconds, reinforcing three-way adoption across the solenoid valves market.

The Solenoid Valves Market Report is Segmented by Operating Principle (Direct-Acting, Pilot-Operated), Port Configuration (Two-Way, Three-Way, and Four-Way), Material (Brass, Steel, Aluminum, and Plastics), Size (Micro, Sub, Mini, Small, and Large), End-User (Food, Automotive, Chemical, Oil and Gas, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific, home to 34% of 2024 revenue, leverages China's vast electronics output, Japan's precision robotics, and India's expanding pharma exports. Governments supporting domestic semiconductor fabs and battery plants fuel manifold adoption, while hydrogen pilot corridors in Japan and Korea demand high-integrity valves able to tolerate 700 bar gaseous service. Additionally, rising water-reuse mandates in coastal Chinese provinces add fresh municipal demand.

The Middle East and Africa, posting a projected 7.50% CAGR, benefits from Vision 2030 diversification projects in Saudi Arabia and petrochemical mega-sites in the UAE. Hydrogen-ammonia export plans from Oman and Saudi NEOM require specialized pilot-operated valves compatible with cryogenic and high-pressure duty. African growth centers on South African mining dewatering and Egyptian food-processing expansion, driving moderate yet diverse uptake.

North America contributes steady aftermarket turnover in shale gas, LNG, and pharma. The rapid rollout of zero-emissions wellhead valves across Colorado and Texas showcases regulatory-driven capex that refreshes installed bases. In Canada, carbon-capture demonstration plants call for corrosion-proof solenoids handling CO2 mixed streams. Europe, a mature yet innovation-led region, pivots to green hydrogen and digitalized manufacturing. That pivot secures value for smart IO-Link-ready valves despite slower headline growth, anchoring premium price bands within the solenoid valves market.

- Emerson Electric Co. (ASCO)

- Danfoss A/S

- Parker-Hannifin Corp.

- SMC Corp.

- IMI plc

- Burkert GmbH and Co. KG

- Curtiss-Wright Corp.

- AirTAC International Group

- Kendrion N.V.

- The Lee Co.

- CEME S.p.A

- PeterPaul Electronics Co.

- CKD Corp.

- Anshan Solenoid Valve Co.

- KANKEO SANGYO Co.

- Rotex Automation

- Festo SE and Co. KG

- ODE S.r.l.

- GEMU Group

- Genebre S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Industrial Waste-water Re-use Schemes in EU and GCC

- 4.2.2 Surge in Compact EV Thermal-Management Loops Requiring Micro-Solenoids

- 4.2.3 Rapid Retrofit of Legacy Beverage Lines in ASEAN for Hygienic Design

- 4.2.4 Gas Well-Head Automation in Shale Basins of US and Argentina

- 4.2.5 Hydrogen Electrolyzer Build-Out in Europe and Japan

- 4.2.6 Growing Preference for Smart, IO-Link-Enabled Valves in Pharma 4.0

- 4.3 Market Restraints

- 4.3.1 High Switching-Cycle Fatigue in greater than 120 degree C Applications

- 4.3.2 Price Volatility of Specialty Alloys (e.g., Duplex SS)

- 4.3.3 Skilled Labor Shortage for Field Retro-Commissioning in LATAM

- 4.3.4 Rising Competition from Piezo-Electric Micro-Valves in Medical OEMs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Pricing Analysis (if applicable)

- 4.8 Industry Standards and Regulations

- 4.9 Technology Snapshot

- 4.9.1 Evolution of Solenoid Valves and Emerging EV / AV Uses

- 4.9.2 Major Design and Technical Considerations

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Operating Principle

- 5.1.1 Direct-Acting

- 5.1.2 Pilot-Operated

- 5.2 By Port/Flow Configuration

- 5.2.1 Two-Way

- 5.2.2 Three-Way

- 5.2.3 Four-Way and Above

- 5.3 By Valve Body Material

- 5.3.1 Brass

- 5.3.2 Stainless Steel

- 5.3.3 Aluminum

- 5.3.4 Engineering Plastics and Composites

- 5.4 By Size

- 5.4.1 Micro-Miniature (less than 5 mm)

- 5.4.2 Sub-Miniature (5-10 mm)

- 5.4.3 Miniature (10-25 mm)

- 5.4.4 Small Diaphragm (25-50 mm)

- 5.4.5 Large Diaphragm (greater than 50 mm)

- 5.5 By End-user Industry

- 5.5.1 Food and Beverage

- 5.5.1.1 Filtration Systems

- 5.5.1.2 Filling / Dosing Lines

- 5.5.2 Automotive

- 5.5.2.1 Air-Suspension

- 5.5.2.2 Fuel Injection and Emission

- 5.5.2.3 Safety and Security Systems

- 5.5.2.4 Transmission and Driveline

- 5.5.2.5 Others (HVAC, Doors)

- 5.5.3 Chemical and Petrochemical

- 5.5.3.1 Direction Control for Storage

- 5.5.3.2 Isolation Valves

- 5.5.4 Power Generation

- 5.5.4.1 Steam Control and Feeders

- 5.5.4.2 Lifts and Pumping

- 5.5.4.3 Deluge Systems

- 5.5.5 Oil and Gas

- 5.5.5.1 Drilling

- 5.5.5.2 Extraction

- 5.5.5.3 Downstream Supply

- 5.5.6 Healthcare and Pharmaceutical

- 5.5.7 Other Verticals (Agri-Tech, Aerospace, Textile, etc.)

- 5.5.1 Food and Beverage

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 Israel

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 United Arab Emirates

- 5.6.4.4 Turkey

- 5.6.4.5 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Egypt

- 5.6.5.3 Rest of Africa

- 5.6.6 South America

- 5.6.6.1 Brazil

- 5.6.6.2 Argentina

- 5.6.6.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JV, IP)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Emerson Electric Co. (ASCO)

- 6.4.2 Danfoss A/S

- 6.4.3 Parker-Hannifin Corp.

- 6.4.4 SMC Corp.

- 6.4.5 IMI plc

- 6.4.6 Burkert GmbH and Co. KG

- 6.4.7 Curtiss-Wright Corp.

- 6.4.8 AirTAC International Group

- 6.4.9 Kendrion N.V.

- 6.4.10 The Lee Co.

- 6.4.11 CEME S.p.A

- 6.4.12 PeterPaul Electronics Co.

- 6.4.13 CKD Corp.

- 6.4.14 Anshan Solenoid Valve Co.

- 6.4.15 KANKEO SANGYO Co.

- 6.4.16 Rotex Automation

- 6.4.17 Festo SE and Co. KG

- 6.4.18 ODE S.r.l.

- 6.4.19 GEMU Group

- 6.4.20 Genebre S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment