|

市場調查報告書

商品編碼

1851457

汽車輪胎:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Tires - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

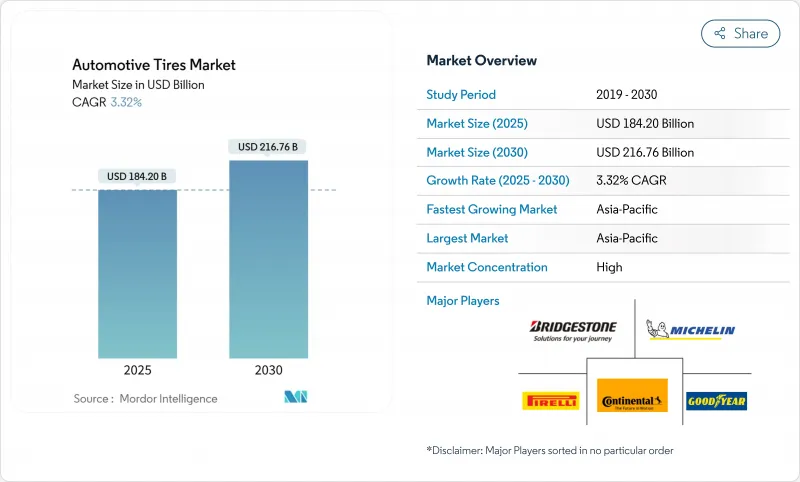

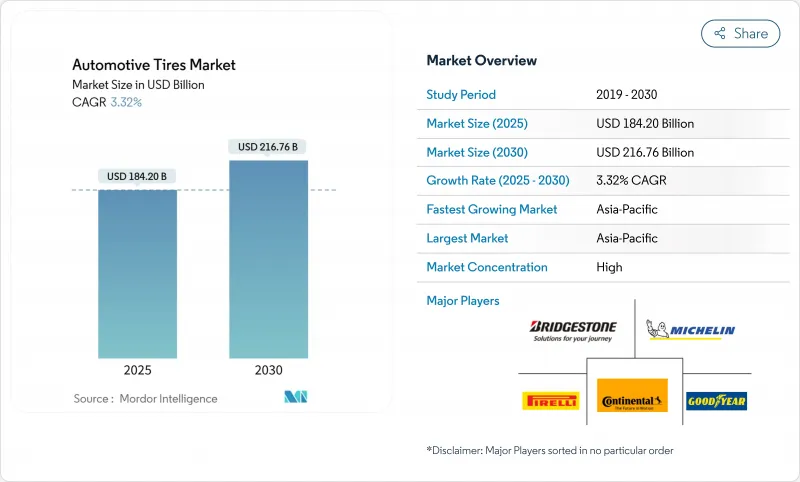

預計到 2025 年,汽車輪胎市場規模將達到 1,842 億美元,到 2030 年將達到 2,167.6 億美元,年複合成長率為 3.32%。

電動車的興起推動了對超低噪音和低滾動阻力產品的需求,永續性政策促進了國內合成橡膠投資,而消費者對更大尺寸輪轂的偏好則推高了平均售價。北美和歐洲在互聯性和高性能輪胎領域不斷創新,而亞洲憑藉其深厚的製造實力和不斷成長的汽車保有量,將繼續保持其地理優勢。東南亞橡膠葉病和歐洲炭黑物流帶來的供應壓力凸顯了供應鏈韌性的重要性。然而,隨著車隊現代化和數據驅動的智慧輪胎合約開闢新的收入來源,整體汽車輪胎市場仍在持續擴張。

全球汽車輪胎市場趨勢與洞察

電氣化帶來了對超低噪音輪胎的需求

電動動力系統消除了遮罩噪音,使輪胎與路面的相互作用成為聲學設計的重中之重。歐盟日益嚴格的外部噪音法規進一步強化了這一趨勢,主流汽車輪胎市場也要求採用類似的技術以滿足合規性和舒適性要求。供應商能夠在原物料成本上漲的情況下,滿足性能和法規要求,確保獲得夢寐以求的原廠配套標準,並保持價格穩定。

中國強制使用低滾動阻力輪胎

第六階段燃油經濟法規要求消費量降低15%,滾動阻力問題特別突出。國內外品牌紛紛推出富含二氧化矽的輪胎配方,可將研發週期縮短至18個月,並將燃油經濟性提升8%。透過中國認證所取得的成果可以迅速推廣至整個亞洲的生產,從而在不重複研發成本的情況下,提升整個汽車輪胎市場的基準技術水準。

橡膠葉病對東南亞的影響

印尼的橡膠樹害蟲(Pestalotiopsis)導致橡膠乳膠產量下降,天然橡膠現貨價格較去年同期上漲33%,全球輪胎工廠的利潤空間也因此受到擠壓。由於受害橡膠樹需要10年才能達到割膠成熟期,因此恢復過程將會十分緩慢。種植者正轉向種植銀膠菊和俄羅斯蒲公英等本地品種,但距離商業性規模種植仍需數個種植季,中期內成本壓力仍將持續。

細分市場分析

到2024年,全季輪胎將繼續保持在汽車輪胎市場的領先地位,市佔率將達到62.28%。儘管冬季輪胎尺寸較小,但由於歐洲安全法規的實施,其市場需求預計將會成長,並在2025年至2030年間以4.24%的複合年成長率成為成長最快的輪胎類型。夏季輪胎在氣溫持續較高的地區仍然很受歡迎,而全地形/泥地輪胎則更受注重越野性能的SUV車主青睞。目前,製造商正在將高矽配方與自我調整胎紋相結合,使一種胎面即可應對高溫和輕度積雪路面,從而降低經銷商的庫存管理難度。

研發投入也正著力滿足電動車的需求。高階冬季輪胎產品對電動車買家越來越有吸引力,因為發泡襯墊可以降低車廂噪音,橡膠化學品在零下溫度下仍能保持柔韌性。越來越多的車隊開始為送貨車指定三峰雪花認證,這表明相關法規的範圍正在擴大。同時,數據主導的輪胎換位服務正在延長輪胎壽命,並將收入轉向增值冬季更換套餐。這些相互關聯的趨勢正在推動季節性產品線的發展,使其不再局限於簡單的溫度範圍。

到2024年,子午線輪胎將佔據汽車輪胎市場86.24%的佔有率,這主要得益於其燃油效率高、操控穩定和胎面壽命長等優勢。斜交輪胎在低速、高負荷應用領域仍佔有一席之地,但其影響力逐漸縮小。最具顛覆性的發展是無氣輪胎領域,預計到2030年,該領域將以每年5.67%的速度成長,因為工程車輛、軍用車輛和場地維護車輛對防刺穿輪胎的需求運作。熱塑性輻條和複合材料胎體正在縮小與傳統子午線輪胎在滾動阻力方面的差距。

試點計畫表明,考慮到補胎和停機時間,無氣輪胎在整個生命週期內可節省成本,這促使原始設備製造商(OEM)在下一個開發週期中對乘用車進行測試。子午線輪胎供應商則透過增強輪胎邊緣填充物和採用輕薄鋼絲帶束層來減輕重量而不犧牲強度,旨在隨著電動車整備質量的增加而保護市場佔有率。可回收性法規進一步推動了人們對單一材料、無氣輪胎設計的興趣,因為這種設計簡化了報廢處理流程。最終呈現的是一種雙管齊下的創新競賽,而非完全的替代方案。

到2024年,乘用車將佔汽車輪胎總銷量的57.18%,鞏固其作為汽車輪胎市場核心的主導地位。 SUV和跨界車的持續成長正推動輪胎製造商研發更高載重指數和更大直徑的輪胎。專為純電動車設計的輪胎市場表現尤為突出,隨著全球電動車註冊量的激增,預計其複合年成長率將達到10.92%。電池品質的增加和瞬時扭力的提升將推動對更堅固的胎體、富含二氧化矽的胎面以及隔音減震器的需求。

在早期平台工程階段,高階汽車製造商擴大與合作夥伴共同開發客製化的純電動車輪胎,並融入品牌專屬尺寸以確保替換需求。在更換通路,續航里程最佳化行銷正說服注重成本的消費者接受15%至30%的溢價,以換取每次充電行駛里程的增加。同時,輕型商用車的電氣化催生了用於宅配。

區域分析

到2024年,亞洲將佔全球汽車輪胎市場佔有率的54.66%,並在2030年之前保持最高的複合年成長率(CAGR),達到6.51%。中國憑藉其龐大的整車製造商(OEM)群體將繼續保持區域主導地位,而印度SUV市場的蓬勃發展正在推動對18-20英寸輪胎和高階進口輪胎的需求。東南亞橡膠葉病導致天然橡膠供應受限,促使企業轉向合成橡膠和銀膠菊等替代作物。

北美位居第二,這得益於成熟的替換輪胎市場以及商用車智慧輪胎平台的快速普及。美國關係法案(IRA)促進了國內合成橡膠產能的提升,從而降低了供應鏈風險;電動車的普及也推動了以續航里程和降噪為重點的特種輪胎產品線的發展。

歐洲持續優先發展優質、永續產品。 2024年的標籤改革將引導消費者選擇高等級替代品,並獎勵那些擁有豐富科技產品的品牌。然而,炭黑的物流挑戰導致前置作業時間延長、庫存成本上升,促使人們關注再生炭黑,並加強與供應商的合作。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場促進因素

- 歐盟乘用車電氣化主導了對超低噪音輪胎的需求。

- 為符合中國第六階段燃油標準,強制使用低迴油輪胎

- 北美最後一公里配送車隊的物聯網智慧輪胎合約

- 美國IRA相關合成橡膠產能將提升當地供應穩定性。

- 印度SUV車型18吋超大輪轂的流行推高了每輛車的平均售價。

- 歐盟2024年輪胎標籤改革將提升A級更換需求。

- 市場限制

- 東南亞橡膠葉病導致原料成本上漲

- 電動車整備品質過高會引發保固索賠

- 歐洲炭黑運輸瓶頸

- 美國禁止在織布機上使用含氟脫模劑

- 價值/供應鏈分析

- 監管和技術展望

- 波特五力模型

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(價值及數量)

- 按輪胎類型

- 夏天

- 冬天

- 四季

- 全地形/泥地

- 透過輪胎設計

- 徑向

- 偏見

- 非氣動/無氣式

- 按車輛類型

- 搭乘用車

- SUV 與跨界車

- 輕型商用車

- 大型商用卡車和巴士

- 摩托車

- 非公路及特殊車輛(OTR、農業、礦業、賽車)

- 透過使用

- 公路

- 非公路用途(建築、礦業、農業)

- 最終用戶

- OEM

- 售後市場(替換件和翻新件)

- 按輪圈尺寸

- 15吋或更小

- 15到20英寸

- 20吋或以上

- 透過推進力

- 內燃機汽車

- 電池電動車

- 混合動力汽車和燃料電池汽車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 策略趨勢

- 市佔率分析

- 公司簡介

- Bridgestone Corporation

- Michelin Group

- Goodyear Tire & Rubber Company

- Continental AG

- Pirelli & C. SpA

- Hankook Tire & Technology

- Yokohama Rubber Co., Ltd.

- Sumitomo Rubber Industries

- MRF Ltd.

- Apollo Tyres

- JK Tyre & Industries

- Kumho Tire

- Toyo Tire Corporation

- Nexen Tire

- Zhongce Rubber Group

- Linglong Tire

- CEAT Ltd.

- Sailun Group

- Nokian Tyres

- Triangle Tire

第7章 市場機會與未來展望

The Automotive Tire Market stands at USD 184.20 billion in 2025 and is forecast to reach USD 216.76 billion by 2030, expanding at a 3.32% CAGR.

Multiple dynamics shape this trajectory: electric-vehicle adoption raises demand for ultra-low-noise and low-rolling-resistance products; sustainability policies encourage domestic synthetic-rubber investment; and consumer preference for larger rim diameters lifts average selling prices. Asia's manufacturing depth and rising vehicle ownership keep it the geographic anchor, while North America and Europe innovate around connectivity and premium performance. Supply-side pressures from Southeast-Asian rubber-leaf disease and European carbon-black logistics highlight the need for supply-chain resilience. Yet, the overall automotive tire market continues to expand as fleets modernize and data-rich smart-tire contracts unlock new revenue streams.

Global Automotive Tires Market Trends and Insights

Electrification-Led Demand for Ultra-Low-Noise Tires

Electric drivetrains remove engine masking noise, placing tire-road interaction at the acoustic forefront. Premium EV makers pay more premiums for noise-canceling foam products and tuned tread patterns that cut in-cabin decibels by up to 20%.The European Union's stricter exterior-noise limits reinforce this trend, and the automotive tire market now sees mainstream segments requesting similar technology for compliance and comfort. Suppliers can meet performance and regulation, secure coveted OE fitments, and maintain price discipline despite higher raw-material costs.

Mandatory low-RRR Rire Adoption in China

Phase-6 fuel-efficiency rules mandate a 15% consumption improvement, spotlighting rolling resistance. Domestic and global brands are compressing R&D cycles to 18 months to deliver silica-rich compounds capable of 8% fuel-economy gains. Gains achieved for Chinese homologation rapidly cascade into broader Asian production, elevating baseline technology across the automotive tire market without duplicative R&D spend.

Southeast-Asian Rubber-Leaf Disease Impact

Pestalotiopsis infestation has cut latex yields in Indonesia, pushing natural-rubber spot prices up 33% year-on-year and squeezing margins for tire plants worldwide. Recovery is slow because affected trees need up to 10 years to reach tapping maturity. Producers diversify toward guayule and Russian dandelion sources, yet commercial scale remains several seasons away, sustaining cost pressure through the medium term.

Other drivers and restraints analyzed in the detailed report include:

- 18-inch-plus Rim Boom in Indian SUVs

- EU-2024 Tire-Label Revamp

- Excess EV Curb-Weight Accelerating Warranty Claims

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

All-season products maintained leadership in 2024 with 62.28% of the automotive tire market share, helped by their year-round convenience in varied climates. Winter tires, although smaller, are projected to post the fastest 4.24% CAGR between 2025 and 2030 as safety mandates in Europe widen adoption. Summer lines remain popular in regions with consistently high temperatures, while all-terrain/mud-terrain patterns capture SUV owners who value off-road capability. Manufacturers now blend high-silica compounds with adaptive sipes so a single tread can tolerate both heat and light snow, lowering inventory complexity for dealers.

R&D spending also targets electric-vehicle needs: foam inserts reduce cabin noise and rubber chemistries hold flexibility below freezing, making premium winter SKUs attractive to EV buyers. More fleets specify three-peak-mountain-snowflake certification on delivery vans, underscoring growing regulatory reach. Meanwhile, data-driven tire rotation services lengthen tread life, shifting revenue toward value-added winter-changeover packages. These interplay trends ensure seasonal lines evolve well beyond simple temperature bands.

Radial construction captured 86.24% of the automotive tire market share in 2024, due to fuel efficiency, stable handling, and long tread life. Bias ply endures in low-speed, heavy-load niches, yet its influence keeps shrinking. The most disruptive advance is the non-pneumatic/airless segment, which is forecast to grow 5.67% annually through 2030 as construction, military, and grounds-maintenance fleets seek puncture-proof uptime. Thermoplastic spokes and composite webs are narrowing the rolling-resistance gap with conventional radials.

Pilot programs show airless tires delivering lifecycle cost savings once puncture repairs and downtime are factored in, persuading OEMs to schedule passenger-car trials in the next development cycle. Radial suppliers answer with reinforced bead fillers and slimmer steel belts that trim mass without sacrificing strength, aiming to defend share while EV curb weights climb. Regulations on recyclability further elevate interest in single-material airless designs that simplify end-of-life processing. The outcome is a two-track innovation race rather than an outright substitution.

Passenger cars accounted for 57.18% of the 2024 volume, cementing their place at the core of automotive tire market size. SUVs and crossovers continue encroaching, nudging tire makers toward higher load indices and taller diameters. The standout growth story is BEV-specific tires, slated for a robust 10.92% CAGR as global electric-vehicle registrations soar. Added battery mass and instant torque drive demand for stronger casings, silica-rich treads, and acoustic dampers.

During early platform engineering, premium automakers increasingly co-develop bespoke BEV tires, embedding brand-exclusive dimensions that lock in replacement revenue. In the replacement channel, range-optimization marketing persuades cost-sensitive buyers to accept 15-30% price premiums when they can verify extra miles per charge. Meanwhile, light-commercial-vehicle electrification sparks new SKUs with reinforced sidewalls for parcel-delivery duty. This vehicle-mix evolution accelerates product complexity throughout the supply chain.

The Automotive Tire Market Report is Segmented by Tire Type (Summer, Winter, and More), Tire Design (Radial, Bias, and More), Vehicle Type (Passenger Cars and More), Application (On-Road and Off-Road), End User (OEM and Aftermarket) Rim-Size (Less Than 15 Inches and More), Propulsion (ICE, BEV, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia held 54.66% of the automotive tire market in 2024 and sustained the highest 6.51% CAGR to 2030. China anchors regional dominance through its vast OEM base, while India's SUV boom fuels demand for 18-20-inch sizes and premium imports. Rubber-leaf disease in Southeast Asia constrains natural rubber supply, encouraging synthetic rubber diversification and alternative crops such as guayule.

North America ranks second, supported by mature replacement sales and rapid adoption of smart-tire platforms in commercial fleets. Domestic synthetic-rubber capacity fostered by the U.S. IRA reduces supply-chain risk, while rising EV penetration spurs specialized tire lines that prioritize range and noise reduction.

Europe continues to prioritize premium and sustainable products. The 2024 label overhaul guides consumers toward high-grade replacements, rewarding brands with technology-rich portfolios. Carbon-black logistics challenges, however, lengthen lead times and boost inventory costs, prompting interest in recovered carbon black and tighter supplier collaboration.

- Bridgestone Corporation

- Michelin Group

- Goodyear Tire & Rubber Company

- Continental AG

- Pirelli & C. SpA

- Hankook Tire & Technology

- Yokohama Rubber Co., Ltd.

- Sumitomo Rubber Industries

- MRF Ltd.

- Apollo Tyres

- JK Tyre & Industries

- Kumho Tire

- Toyo Tire Corporation

- Nexen Tire

- Zhongce Rubber Group

- Linglong Tire

- CEAT Ltd.

- Sailun Group

- Nokian Tyres

- Triangle Tire

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Electrification-led demand for ultra-low-noise tires in EU passenger cars

- 4.1.2 Mandatory low-RRR tire adoption to meet China Phase-6 fuel norms

- 4.1.3 IoT-enabled smart-tire contracts in North-American last-mile fleets

- 4.1.4 On-shored synthetic-rubber capacity under U.S. IRA boosting local supply security

- 4.1.5 18-inch-plus rim boom in Indian SUVs lifting ASP per unit

- 4.1.6 EU-2024 tyre-labelling revamp pushing A-rated replacement demand

- 4.2 Market Restraints

- 4.2.1 Southeast-Asian rubber-leaf disease inflating raw-material costs

- 4.2.2 Excess EV curb-weight accelerating warranty claims

- 4.2.3 Carbon-black shipping bottlenecks in Europe

- 4.2.4 Impending US PFAS ban on fluorinated mould-release agents

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory or Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers / Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value & Volume)

- 5.1 By Tire Type

- 5.1.1 Summer

- 5.1.2 Winter

- 5.1.3 All-Season

- 5.1.4 All-Terrain / Mud-Terrain

- 5.2 By Tire Design

- 5.2.1 Radial

- 5.2.2 Bias

- 5.2.3 Non-pneumatic / Airless

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 SUVs & Crossovers

- 5.3.3 Light Commercial Vehicles

- 5.3.4 Heavy Commercial Trucks & Buses

- 5.3.5 Two-Wheelers

- 5.3.6 Off-the-Road & Specialty (OTR, Agriculture, Mining, Racing)

- 5.4 By Application

- 5.4.1 On-Road

- 5.4.2 Off-Road (Construction, Mining, Agriculture)

- 5.5 By End User

- 5.5.1 OEM

- 5.5.2 Aftermarket (Replacement & Retread)

- 5.6 By Rim Size

- 5.6.1 Below 15 inches

- 5.6.2 15 - 20 inches

- 5.6.3 Above 20 inches

- 5.7 By Propulsion

- 5.7.1 Internal-Combustion Vehicles

- 5.7.2 Battery-Electric Vehicles

- 5.7.3 Hybrid & Fuel-Cell Vehicles

- 5.8 Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Rest of North America

- 5.8.2 Europe

- 5.8.2.1 Germany

- 5.8.2.2 United Kingdom

- 5.8.2.3 France

- 5.8.2.4 Italy

- 5.8.2.5 Rest of Europe

- 5.8.3 Asia-pacific

- 5.8.3.1 China

- 5.8.3.2 Japan

- 5.8.3.3 India

- 5.8.3.4 South Korea

- 5.8.3.5 Rest of Asia-Pacific

- 5.8.4 South America

- 5.8.4.1 Brazil

- 5.8.4.2 Argentina

- 5.8.4.3 Rest of South America

- 5.8.5 Middle East

- 5.8.5.1 GCC

- 5.8.5.2 Turkey

- 5.8.5.3 Rest of Middle East

- 5.8.6 Africa

- 5.8.6.1 South Africa

- 5.8.6.2 Nigeria

- 5.8.6.3 Rest of Africa

- 5.8.1 North America

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank / Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Bridgestone Corporation

- 6.3.2 Michelin Group

- 6.3.3 Goodyear Tire & Rubber Company

- 6.3.4 Continental AG

- 6.3.5 Pirelli & C. SpA

- 6.3.6 Hankook Tire & Technology

- 6.3.7 Yokohama Rubber Co., Ltd.

- 6.3.8 Sumitomo Rubber Industries

- 6.3.9 MRF Ltd.

- 6.3.10 Apollo Tyres

- 6.3.11 JK Tyre & Industries

- 6.3.12 Kumho Tire

- 6.3.13 Toyo Tire Corporation

- 6.3.14 Nexen Tire

- 6.3.15 Zhongce Rubber Group

- 6.3.16 Linglong Tire

- 6.3.17 CEAT Ltd.

- 6.3.18 Sailun Group

- 6.3.19 Nokian Tyres

- 6.3.20 Triangle Tire

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment