|

市場調查報告書

商品編碼

1851455

合成鑽石:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Synthetic Diamond - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

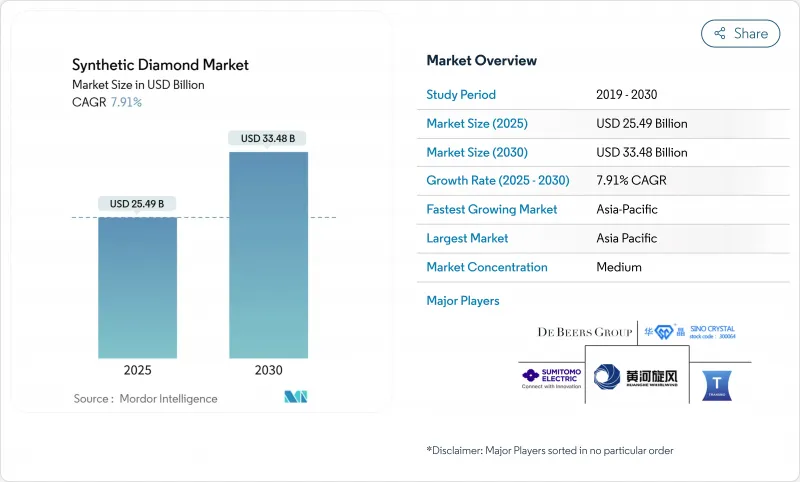

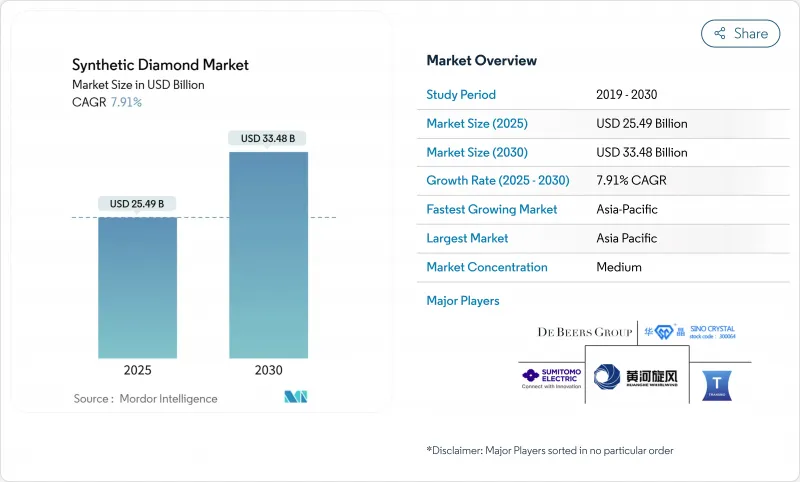

2025 年合成鑽石市場規模估計為 254.9 億美元,預計到 2030 年將達到 334.8 億美元,在預測期(2025-2030 年)內複合年成長率為 7.91%。

通訊、電動車、航太和精密製造等產業的需求不斷成長,推動了收入的持續成長;同時,持續的永續性要求正促使消費者放棄開採的天然寶石,轉而選擇人造替代品。亞太地區已佔據大部分鑽石晶片和超磨粒磨料的供應市場,這得益於各國政府的慷慨激勵政策和電子產品出口的激增。隨著技術驅動型參與企業擴大其化學氣相沉積(CVD)產能,能夠生產出裝置級純度的鑽石,競爭日益激烈,對現有的高溫高壓(HPHT)模式構成了直接挑戰。同時,波灣合作理事會(GCC)的奢侈品牌正利用色彩繽紛的實驗室培育寶石來滿足具有環保意識的消費者的需求,並將產品線拓展到傳統婚禮珠寶之外。監管的不確定性和認證標準的不統一是主要的阻力,尤其是在零售價格調整削弱了終端用戶對轉售價值的認知的情況下。然而,以性能主導的高科技領域仍然能夠確保淨利率。

全球合成鑽石市場趨勢與洞察

亞洲地區 CVD 鑽石在 5G/6G 射頻濾波器的應用日益廣泛

CVD單晶矽晶圓散熱效率為22W/cm*K,可製造更小巧、更可靠的高頻濾波器,從而支援高密度5G和未來的6G網路。垂直整合的OEM廠商,尤其是在中國、韓國和台灣地區,正在將鑽石晶粒黏接層嵌入大規模多輸入多輸出(mMIMO)天線。當地設備供應商報告稱,由於功耗降低和基地台壽命延長,營運商的總體擁有成本得到了顯著降低。

電動車電池超級工廠推動工業鑽石需求激增

多晶鑽石塗層精密研磨對於切割富矽陽極、雷射轉移隔膜以及對鋁製外殼進行表面處理至關重要。美國和歐洲的超大型電池工廠目前在其超過70%的高速加工工位中使用鑽石工具,這提高了每個汽車平臺的單位消費量。鑽石鑄造晶圓逆變器的尺寸僅為傳統設計的六分之一,但性能卻更優,顯示其熱和電特性能夠提升動力傳動系統的效率。

監管和認證方面的挑戰

印度中央消費者保護局要求零售商在出貨單和行銷資料上註明鑽石的產地和培育方法。在美國,珠寶飾品監管委員會也推出了類似的指導方針,加強了審核要求,鼓勵企業投資光譜檢測和自動化篩檢設備。各地法規的差異使跨境貿易變得複雜,也使經銷商面臨法律風險。

細分市場分析

由於毛坯鑽石在建築、石油天然氣鑽探和精密切割工具等領域有著廣泛的應用,這些領域都充分利用了毛坯鑽石無與倫比的硬度和導熱性,因此,2024年毛坯鑽石佔據了合成鑽石市場佔有率的66%。美國地質調查局記錄顯示,美國國內毛坯鑽石產量為1.6億克拉,價值5,300萬美元,較上年增加5%。

儘管拋光寶石的噸位較小,但卻是成長最快的品類,預計年複合成長率將達到9.84%。消費者的廣泛接受、設計靈活性的提升以及等離子後處理的進步(導致市場飽和度增加),都推動了中階珠寶飾品連鎖店銷售的成長。根據美國寶石學院(GIA)的數據顯示,化學氣相沉積(CVD)樣品提交量已超過高溫高壓(HPHT)樣品提交量,其中彩色寶石和三克拉以上寶石的銷量同比成長顯著。即使批發價格在預測期內保持穩定,拋光寶石預計也將在全通路零售通路中佔據更大的貨架空間。

區域分析

亞太地區預計到2024年將佔全球銷售額的56%,並將繼續保持最快的成長速度,到2030年複合年成長率將達到8.35%。河南、山東和古吉拉突邦的生產群集擁有從晶種合成到成品珠寶飾品的垂直整合營運模式。中國在實驗室反應器領域的優勢使其具備成本優勢,而印度取消5%的鑽石晶種進口關稅也吸引了海外合資企業。

北美地區在高性能應用領域仍然至關重要,尤其是在量子感測和寬能能隙功率電子領域。 Adamas One公司位於南卡羅來納州的工廠目前擁有12個反應堆,每月可生產3000克拉原石,該公司正著力推進受知識產權保護的生長通訊協定,並贏得了航太和醫療行業的合約。

歐洲保持著穩定而又創新型的地位。德國工具製造商和法國光電新興企業正在將鑽石嵌件應用於汽車輕量化領域。英國的學術生態系統,特別是國家量子計算中心,正在推進氮空位(NV)缺陷工程技術在安全通訊的應用。在歐洲以外,中東地區將杜拜視為貿易和生產中心。

其他好處

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲地區採用CVD鑽石製造5G/6G射頻濾波器的比例正在增加。

- 電動車電池超級工廠推動工業鑽石需求激增

- 對超磨粒的需求不斷成長

- 超磨粒在航太複合材料自動化數控加工的應用。

- 海灣合作理事會的奢侈品牌正將其永續性轉向實驗室培育的彩色寶石。

- 市場限制

- 監管和認證方面的挑戰

- 複雜的製造過程

- 消費者對LGD價格下跌與天然鑽石價格下跌的對比感到困惑

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模和成長預測(價值和數量)

- 依產品類型

- 拋光錶面

- 珠寶

- 電子學

- 衛生保健

- 其他拋光類型

- 粗糙的

- 建造

- 礦業

- 石油和天然氣

- 其他粗略類型

- 拋光錶面

- 透過製造程序

- 高壓高溫(HPHT)

- 化學沉澱(CVD)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ADAMAS ONE

- Applied Diamond Inc.

- Coherent Corp.

- De Beers Group(Element Six)

- Diamond Foundry

- Henan Huanghe Whirlwind CO.,Ltd.

- Heyaru Group

- ILJIN DIAMOND CO., LTD.

- John Crane(Advanced Diamond Technologies, Inc.)

- NEW DIAMOND TECHNOLOGY LLC

- PURE LAB DIAMONDS

- Sandvik AB

- Sumitomo Electric Industries, Ltd.

- Swarovski AG

- Tecdia, Inc.

- Washington Diamond

- Zhengzhou Sino-Crystal Diamond Co.,Ltd.

- Zhuhai Zhong Na Diamond Co.,Ltd Inc.

第7章 市場機會與未來展望

The Synthetic Diamond Market size is estimated at USD 25.49 billion in 2025, and is expected to reach USD 33.48 billion by 2030, at a CAGR of 7.91% during the forecast period (2025-2030).

Escalating demand from telecommunications, electric vehicles, aerospace, and high-precision manufacturing is accelerating revenue streams, while persistent sustainability mandates are steering customers away from mined stones toward engineered alternatives. Asia Pacific, already supplying most diamond wafers and super-abrasive tools, benefits from generous state incentives and surging electronics exports. Competition is intensifying because technology-focused entrants are scaling Chemical Vapor Deposition (CVD) capacity that can achieve device-grade purity, posing a direct challenge to the incumbent High Pressure High Temperature (HPHT) model. Meanwhile, luxury brands in the Gulf Cooperation Council are leveraging fancy-color lab-grown stones to satisfy environmentally conscious consumers, widening the addressable base beyond traditional bridal jewelry. Regulatory uncertainty and uneven certification standards remain the chief headwinds, especially as retail price corrections undermine perceived resale value among end users, but the performance-driven high-tech arena continues to shield margins.

Global Synthetic Diamond Market Trends and Insights

Rising Adoption of CVD Diamonds for 5G/6G RF Filters in Asia

CVD single-crystal wafers dissipate heat at 22 W/cm*K, enabling smaller and more reliable radio-frequency filters that underpin dense 5G and future 6G networks. Large-area substrate work sponsored by DARPA is migrating into commercial foundries, particularly in China, South Korea, and Taiwan, where vertically integrated OEMs are embedding diamond die-attach layers inside massive multiple-input multiple-output (mMIMO) antennas. Local equipment vendors report lower power consumption and longer base-station lifetimes, giving operators measurable total-cost-of-ownership gains.

Industrial Diamond Demand Surge from EV Battery Gigafactories

Precision grinding wheels with polycrystalline diamond coatings are indispensable for cutting silicon-rich anodes, laser-scribing separator films, and surfacing aluminum casings. Giga-scale battery plants in the United States and Europe now specify diamond tooling in over 70% of high-speed machining stations, elevating unit consumption per vehicle platform. Diamond Foundry's wafer-based inverter, six times smaller than the incumbent design yet more powerful, underscores how thermal and electrical properties improve drivetrain efficiency.

Regulatory and Certification Challenges

The Central Consumer Protection Authority in India requires retailers to specify production origin and growth method on invoices and marketing collateral, adding compliance costs and compelling supply-chain transparency. In the United States, Jewelers Vigilance Committee guidelines similarly tighten audit obligations, prompting firms to invest in spectroscopy and automated screening equipment. Divergent rules by region complicate cross-border trading and create legal exposure for distributors.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Super-Abrasives

- Luxury Brands' Sustainability Pivot to Lab-Grown Fancy-Color Stones in the GCC

- Consumer Confusion Over Lab-Grown Diamond Price Depreciation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rough stones captured 66% of the synthetic diamond market share in 2024, owing to heavy uptake in construction, oil-and-gas drilling, and precision cutting tools, all of which leverage unmatched hardness and thermal conductivity. The U.S. Geological Survey recorded domestic output of 160 million carats valued at USD 53 million, a 5% rise on the prior year.

Polished stones, though smaller in tonnage, are the fastest-expanding category at a projected 9.84% CAGR. Wider consumer acceptance, heightened design flexibility, and advances in plasma post-processing that enhance color saturation are boosting volumes across mid-tier jewelry chains. The Gemological Institute of America notes that CVD submissions now exceed HPHT samples, with fancy colors and 3-carat-plus stones up sharply year over year. Over the forecast horizon, polished gems are expected to secure incremental shelf space in omnichannel retail, even as wholesale prices stabilize.

The Synthetic Diamond Market Report Segments the Industry by Product Type (Polished and Rough), Manufacturing Process (High Pressure, High Temperature (HPHT) and Chemical Vapor Deposition (CVD)), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific anchored 56% of global revenue in 2024 and continues to post the fastest regional growth at an 8.35% CAGR through 2030. Production clusters in Henan, Shandong, and Gujarat host vertically integrated operations that span seed synthesis to finished jewelry. China's dominance in lab reactors provides cost advantages, while India's abolition of a 5% import duty on diamond seeds attracts overseas joint ventures.

North America remains pivotal for high-performance applications, particularly in quantum sensing and wide-band-gap power electronics. Adamas One Corp's South Carolina facility, which currently runs 12 reactors producing 3,000 rough carats monthly, emphasizes IP-protected growth protocols to secure aerospace and medical contracts.

Europe maintains a stable but innovation-oriented stance. German toolmakers and French photonics startups incorporate diamond inserts to meet automotive lightweighting mandates. The United Kingdom's academic ecosystem, notably the National Quantum Computing Centre, advances Nitrogen-Vacancy (NV) defect engineering for secure communications. Outside Europe, the Middle East positions Dubai as a trading and production hub.

- ADAMAS ONE

- Applied Diamond Inc.

- Coherent Corp.

- De Beers Group (Element Six)

- Diamond Foundry

- Henan Huanghe Whirlwind CO.,Ltd.

- Heyaru Group

- ILJIN DIAMOND CO., LTD.

- John Crane (Advanced Diamond Technologies, Inc.)

- NEW DIAMOND TECHNOLOGY LLC

- PURE LAB DIAMONDS

- Sandvik AB

- Sumitomo Electric Industries, Ltd.

- Swarovski AG

- Tecdia, Inc.

- Washington Diamond

- Zhengzhou Sino-Crystal Diamond Co.,Ltd.

- Zhuhai Zhong Na Diamond Co.,Ltd Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of CVD Diamonds for 5G/6G RF Filters Asia

- 4.2.2 Industrial Diamond Demand Surge from EV Battery Gigafactories

- 4.2.3 Growing Demand for Super Abrasives

- 4.2.4 Super-abrasive Usage in Automated CNC Machining for Aerospace Composites

- 4.2.5 Luxury Brands' Sustainability Pivot to Lab-Grown Fancy-Color Stones in the GCC

- 4.3 Market Restraints

- 4.3.1 Regulatory and Certification Challenges

- 4.3.2 Complex Manufacturing Process

- 4.3.3 Consumer Confusion Over LGD Price Depreciation vs. Natural Diamonds

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Product Type

- 5.1.1 Polished

- 5.1.1.1 Jewelry

- 5.1.1.2 Electronics

- 5.1.1.3 Healthcare

- 5.1.1.4 Other Polished Types

- 5.1.2 Rough

- 5.1.2.1 Construction

- 5.1.2.2 Mining

- 5.1.2.3 Oil and Gas

- 5.1.2.4 Other Rough Types

- 5.1.1 Polished

- 5.2 By Manufacturing Process

- 5.2.1 High Pressure High Temperature (HPHT)

- 5.2.2 Chemical Vapor Deposition (CVD)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordics

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ADAMAS ONE

- 6.4.2 Applied Diamond Inc.

- 6.4.3 Coherent Corp.

- 6.4.4 De Beers Group (Element Six)

- 6.4.5 Diamond Foundry

- 6.4.6 Henan Huanghe Whirlwind CO.,Ltd.

- 6.4.7 Heyaru Group

- 6.4.8 ILJIN DIAMOND CO., LTD.

- 6.4.9 John Crane (Advanced Diamond Technologies, Inc.)

- 6.4.10 NEW DIAMOND TECHNOLOGY LLC

- 6.4.11 PURE LAB DIAMONDS

- 6.4.12 Sandvik AB

- 6.4.13 Sumitomo Electric Industries, Ltd.

- 6.4.14 Swarovski AG

- 6.4.15 Tecdia, Inc.

- 6.4.16 Washington Diamond

- 6.4.17 Zhengzhou Sino-Crystal Diamond Co.,Ltd.

- 6.4.18 Zhuhai Zhong Na Diamond Co.,Ltd Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Applications in Orthopedic Medical Devices