|

市場調查報告書

商品編碼

1851452

美國工廠自動化和工業控制:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)United States Factory Automation And Industrial Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

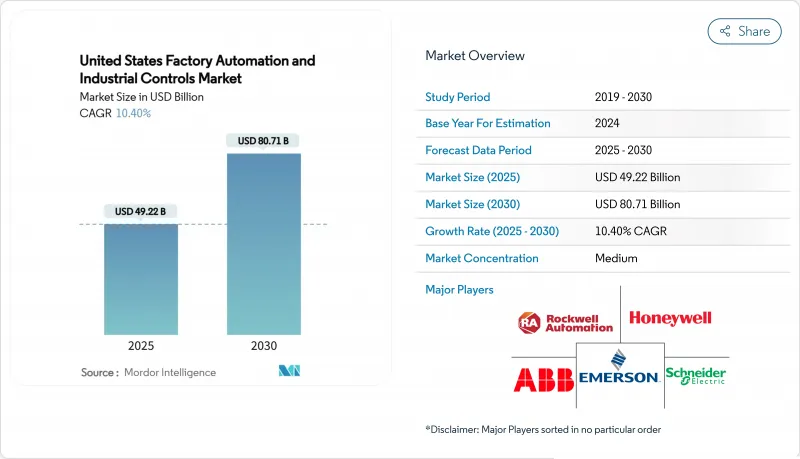

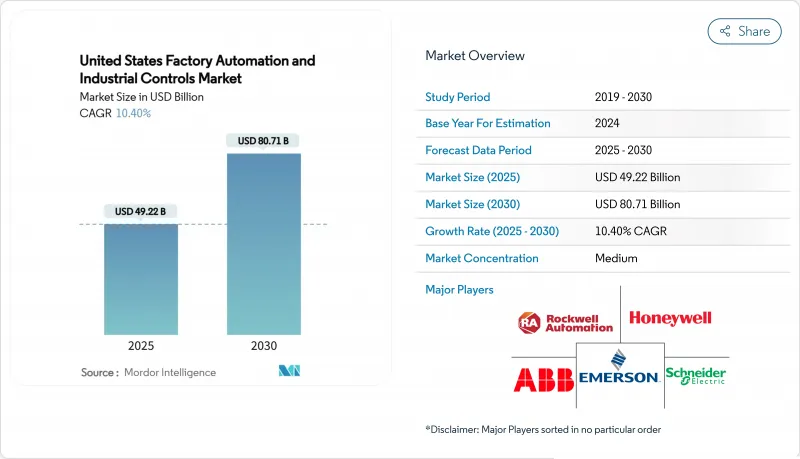

美國工廠自動化和工業控制市場預計到 2025 年將達到 492.2 億美元,到 2030 年將達到 807.1 億美元,年複合成長率為 10.40%。

這項成長預測反映了製造業向智慧生產線的轉型,這種轉型旨在彌補勞動力短缺,遵守更嚴格的安全獎勵,並利用《晶片製造和生產創新法案》(CHIPS Act)和《通貨膨脹削減法案》(Inflation Reduction Act)提供的回流激勵措施。半導體製造廠、電池工廠和清潔能源組件製造商引領新的資本投資,而棕地也在競相進行改造,配備可程式邏輯控制器(PLC)、機器視覺系統和工業IoT感測器,以實現即時維修。儘管硬體支出仍然佔據主導地位,但隨著製造商尋求基於結果的契約,包含網路安全、預測性維護和性能保證等服務的契約正日益受到青睞。雖然網路風險上升和關稅不確定性仍然是挑戰,但州和聯邦政府的政策協調一致,鼓勵國內數位化製造業的發展,從而增強了整體投資前景。

美國工廠自動化與工業控制市場趨勢與洞察

回流工廠獎勵和《晶片製造和生產法案》(CHIPS Act)加速了半導體工廠的自動化進程。

《晶片與科學法案》引發了美國史上規模最大的物料輸送浪潮,亞利桑那州、德克薩斯和俄亥俄州數十億美元的工廠紛紛採用超潔淨機器人、奈米級精度運動系統以及可最大限度減少顆粒污染的自動化物料搬運系統。每增加10億美元的晶片製造投資,通常都會帶動對高速晶圓搬運機器人、機器學習驅動的製程控制系統以及安全整合PLC平台的需求,從而推動2億至3億美元的自動化支出。各州的稅收抵免政策進一步促使大型計劃向南部和西部山區轉移,這些地區新建的待開發區工廠可以從第一天起就採用全數位化、無人值守的製造單位。隨著工廠業主尋求能夠縮短認證週期並保護機密性的承包解決方案,提供硬體、MES軟體和全生命週期服務的供應商正在獲得競爭優勢。

勞動力短缺推動協作機器人的應用

目前製造業面臨75萬個工作機會的缺口,到2030年,這數字可能高達210萬。為了應對這一局面,經營團隊正擴大部署協作機器人(cobot)來處理單調重複性的工作,同時提升員工在品質、維護、數據分析等方面的技能。調查顯示,57%的工廠認為機器人將增強而非取代人類的工作,即使在工會化的工廠中,機器人的應用也不斷成長。汽車組裝引領著這一潮流,但隨著即插即用的協作機器人價格更加親民,並配備了無需代碼的編程介面,中小規模的工廠也紛紛效仿。聯邦和州政府的培訓津貼正在推動這一趨勢,用於支付機器人操作和安全認證計畫的學費,加速勞動力與技術的融合。

美國各類棕地設施中傳統OT互通性所面臨的挑戰

歷經數次工業革命而建成的工廠運作著各種專有通訊協定,導致資料流難以無縫銜接。系統整合商經常會遇到千禧年之前安裝的PLC,這些PLC缺乏原生乙太網路介面,迫使他們使用客製化驅動程序,從而增加計劃成本和風險。諸如基於TSN的OPC UA之類的開放架構旨在實現連接標準化,但由於停機時間窗口仍然狹窄且資本預算仍然不足,進展速度低於軟體供應商的預期。自動化巨頭和組件供應商之間的合作項目已經開始發布預認證的互通性軟體包,但許多規模較小的公司仍在推遲計劃,直到投資的商業價值明確為止。

細分市場分析

到2024年,硬體支出將佔總支出的72%,製造商將採購機器人、驅動器、感測器和人機介面(HMI)來實現生產線的數位化。儘管美國工廠自動化和工業控制硬體市場的規模預計將以中位數個位數的速度成長,但服務領域的擴張速度將更快,這預示著市場將轉向基於訂閱的支援、遠端狀態監控和效能保證。領先的供應商正在將軟體許可、網路安全管理和人員培訓捆綁到多年期合約中,從而穩定收入並將獎勵與客戶產量掛鉤。軟體平台將車間數據與製造執行系統(MES)和雲端分析連接起來,實現閉合迴路最佳化,從而減少廢料和能源消耗。雖然硬體層仍然至關重要,但價值獲取正在轉移到整合商和原始設備製造商(OEM)身上,他們將設備、數據和專業知識與可衡量的成果聯繫起來。

服務板塊12.8%的複合年成長率反映了製造商更傾向於可預測的營運支出而非前期投資。領先的汽車製造商和消費品公司青睞「即服務」型機器人焊接單元、「視覺即服務」檢測和「安全即服務」解決方案,以規避技術過時的風險。擁有遠端營運中心的供應商提供全天候支援和即時洞察,在不增加人員配置的情況下縮短平均維修時間,並推動持續改進。此類模式創造了新的利潤空間,並在競爭激烈的硬體市場中使供應商脫穎而出。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 回流激勵措施和《晶片製造和生產法案》(CHIPS Act)加速了美國半導體工廠的自動化進程

- 勞動力短缺推動美國製造業採用協作機器人。

- 《通膨抑制法案》促進清潔能源製造業發展,推動先進自動化投資

- 美國職業安全與健康管理局 (OSHA) 加強機械安全合規性,推動了對安全整合控制系統的需求。

- 美國OEM供應商網路中用於即時OEE最佳化的棕地工業物聯網改裝

- 擴大電動車產能需要靈活、高速的組裝組裝線

- 市場限制

- 美國各類棕地設施中傳統OT互通性所面臨的挑戰

- 儘管有稅額扣抵,但高昂的初始資本支出限制了美國中型製造商的採用。

- 互聯控制系統中的網路安全風險阻礙了其廣泛應用。

- 貿易政策波動影響關鍵自動化組件的供應

- 價值/供應鏈分析

- 行業法規和政策

- 監管/技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

- 關鍵案例研究和部署場景

第5章 市場規模與成長預測

- 按組件

- 硬體

- 軟體

- 服務

- 按類型

- 工業控制系統

- 分散式控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 監控與數據採集(SCADA)

- 產品生命週期管理(PLM)

- 製造執行系統(MES)

- 人機介面(HMI)

- 其他工業控制系統

- 現場設備

- 機器視覺

- 工業機器人

- 馬達和驅動器

- 安全系統

- 感測器和發射器

- 其他現場設備

- 工業控制系統

- 按最終用戶行業分類

- 石油和天然氣

- 化工/石油化工

- 電力/公共產業

- 飲食

- 汽車與運輸

- 製藥

- 半導體和電子學

- 金屬和採礦

- 紙漿和造紙

- 其他終端用戶產業

- 按地區(美國)

- 美國東北部

- 美國中西部

- 美國南部

- 美國西部

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Rockwell Automation Inc.

- Siemens AG

- Schneider Electric SE

- Emerson Electric Co.

- ABB Ltd

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Omron Corporation

- Yokogawa Electric Corporation

- Fanuc Corporation

- Bosch Rexroth AG

- KUKA AG

- Kawasaki Heavy Industries Ltd.

- Beckhoff Automation GmbH and Co. KG

- GE Vernova(GE Automation and Controls)

- Keyence Corporation

- Danfoss Drives A/S

- Parker Hannifin Corporation

- Yaskawa Electric Corporation

- Banner Engineering Corp.

- Advantech Co.

- Cognex Corporation

- Delta Electronics

- Hitachi Industrial Equipment Systems Co.

- BandR Industrial Automation GmbH

第7章 市場機會與未來展望

The United States factory automation and industrial controls market reached USD 49.22 billion in 2025 and is forecast to climb to USD 80.71 billion by 2030, advancing at a 10.40% CAGR.

The projected growth reflects a manufacturing pivot toward smart production lines that offset labor shortages, comply with stricter safety rules, and capture reshoring incentives delivered through the CHIPS Act and Inflation Reduction Act. Semiconductor fabs, battery plants, and clean-energy component makers lead new capital expenditure, while brownfield sites race to retrofit programmable logic controllers (PLCs), machine-vision systems, and industrial IoT sensors for real-time optimization. Hardware continues to dominate spending, yet service-led contracts that bundle cybersecurity, predictive maintenance, and performance guarantees are gaining momentum as manufacturers pursue outcome-based agreements. Heightened cyber-risk and tariff uncertainty remain hurdles, but the overall investment thesis is reinforced by state and federal policy alignment that rewards domestic, digitally enabled production.

United States Factory Automation And Industrial Controls Market Trends and Insights

Reshoring incentives & CHIPS Act accelerate semiconductor factory automation

The CHIPS and Science Act has triggered the largest wave of domestic semiconductor investment on record, with multibillion-dollar fabs in Arizona, Texas, and Ohio specifying ultra-clean robotics, nanometer-precision motion systems, and automated material handling that minimize particle contamination. Every USD 1 billion allocated to chip fabrication typically pulls USD 200-300 million of automation spend, magnifying demand for high-speed wafer transfer robots, machine-learning-driven process control, and safety-integrated PLC platforms. State-level abatements further shift large projects toward the South and Mountain West, where purpose-built greenfield sites can adopt fully digital, lights-out manufacturing cells from day one. Suppliers that bundle hardware, MES software, and lifecycle services gain a competitive edge as fab owners seek turnkey solutions that shorten qualification cycles and protect sensitive.

Labor shortage drives collaborative robotics adoption

Manufacturing payrolls face a 750,000-person gap today and risk 2.1 million unfilled roles by 2030, pressing management teams to deploy collaborative robots (cobots) that assume monotonous, high-repetition tasks while up-skilling employees into quality, maintenance, and data-analytics positions. Surveys show 57% of plants report that robots augment rather than eliminate human jobs, reinforcing adoption even in unionized facilities. Automotive assemblers are first movers, but small and midsize job shops follow suit as plug-and-play cobots drop in price and gain no-code programming interfaces. Federal and state training grants amplify the trend by covering tuition for certificate programs in robot operation and safety, accelerating labor-technology convergence.

Legacy OT interoperability challenges in diverse U.S. brownfield facilities

Plants built across several industrial revolutions run a patchwork of proprietary protocols, making seamless data flow difficult. Integrators often confront PLCs installed before Y2K with no native Ethernet interface, forcing custom drivers that inflate project cost and risk. Open-architecture movements such as OPC UA over TSN aim to standardize connectivity, but progress is slower than software vendors predict because downtime windows remain narrow and capital budgets are stretched. Collaborative initiatives involving automation majors and component suppliers have begun to release pre-certified interoperability bundles, yet many small firms still delay projects until clearer return on investment emerges

Other drivers and restraints analyzed in the detailed report include:

- Clean-energy manufacturing boost from Inflation Reduction Act

- OSHA-enforced machine-safety compliance raises demand for safety-integrated control systems

- Cyber-security risks in connected control systems hinder deployment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware accounted for 72% spending in 2024 as manufacturers purchased robots, drives, sensors, and HMIs to digitalize production lines. The United States factory automation and industrial controls market size for hardware is projected to post mid-single-digit growth while services expand faster, signaling a transition toward subscription-based support, remote condition monitoring, and performance guarantees. Leading suppliers bundle software licenses, cybersecurity management, and workforce training into multi-year agreements that stabilize revenue and align incentives with customer output. Software platforms bridge field data to MES and cloud analytics, enabling closed-loop optimization that lowers scrap and energy intensity. The hardware layer thus remains indispensable, yet value capture is migrating to integrators and OEMs that orchestrate devices, data, and domain expertise into measurable outcomes.

The services segment's 12.8% CAGR reflects manufacturer preference for predictable operating expenditure over upfront capital outlay. As-a-service robotic welding cells, vision-as-a-service inspection, and security-as-a-service packages resonate with tier-one automotive and consumer packaged goods firms seeking to hedge technology obsolescence. Vendors that co-locate remote operations centers provide 24/7 support and real-time insight, shortening mean time to repair and driving continuous improvement cycles without inflating headcount. Such models unlock new margin pools and differentiate suppliers in a crowded hardware market.

United States Factory Automation and Industrial Controls Market Report is Segmented by Component (Hardware, Software, and More), Type (Industrial Control Systems and Field Devices), and End-User Industry (Oil and Gas, Metals and Mining, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Rockwell Automation Inc.

- Siemens AG

- Schneider Electric SE

- Emerson Electric Co.

- ABB Ltd

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Omron Corporation

- Yokogawa Electric Corporation

- Fanuc Corporation

- Bosch Rexroth AG

- KUKA AG

- Kawasaki Heavy Industries Ltd.

- Beckhoff Automation GmbH and Co. KG

- GE Vernova (GE Automation and Controls)

- Keyence Corporation

- Danfoss Drives A/S

- Parker Hannifin Corporation

- Yaskawa Electric Corporation

- Banner Engineering Corp.

- Advantech Co.

- Cognex Corporation

- Delta Electronics

- Hitachi Industrial Equipment Systems Co.

- BandR Industrial Automation GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Reshoring Incentives and CHIPS Act Accelerating Semiconductor Factory Automation in the U.S.

- 4.2.2 Labor Shortage Driving Collaborative Robotics Adoption Across U.S. Manufacturing

- 4.2.3 Clean-Energy Manufacturing Boost from Inflation Reduction Act Stimulating Advanced Automation Investments

- 4.2.4 OSHA-Enforced Machine-Safety Compliance Elevating Demand for Safety-Integrated Control Systems

- 4.2.5 Brownfield IIoT Retrofits for Real-Time OEE Optimization Among U.S. OEM Supplier Network

- 4.2.6 EV Production Expansion Necessitating Flexible High-Speed Assembly Automation Lines

- 4.3 Market Restraints

- 4.3.1 Legacy OT Interoperability Challenges in Diverse U.S. Brownfield Facilities

- 4.3.2 High Initial CapEx Limiting Adoption by Mid-Sized U.S. Manufacturers Despite Tax Credits

- 4.3.3 Cyber-Security Risks in Connected Control Systems Hindering Deployment

- 4.3.4 Trade Policy Volatility Impacting Supply of Critical Automation Components

- 4.4 Value / Supply-Chain Analysis

- 4.5 Industry Policies and Regulations

- 4.6 Regulatory or Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Key Case Studies and Implementation Scenarios

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Type

- 5.2.1 Industrial Control Systems

- 5.2.1.1 Distributed Control System (DCS)

- 5.2.1.2 Programmable Logic Controller (PLC)

- 5.2.1.3 Supervisory Control and Data Acquisition (SCADA)

- 5.2.1.4 Product Lifecycle Management (PLM)

- 5.2.1.5 Manufacturing Execution System (MES)

- 5.2.1.6 Human Machine Interface (HMI)

- 5.2.1.7 Other Industrial Control Systems

- 5.2.2 Field Devices

- 5.2.2.1 Machine Vision

- 5.2.2.2 Industrial Robotics

- 5.2.2.3 Motors and Drives

- 5.2.2.4 Safety Systems

- 5.2.2.5 Sensors and Transmitters

- 5.2.2.6 Other Field Devices

- 5.2.1 Industrial Control Systems

- 5.3 By End-user Industry

- 5.3.1 Oil and Gas

- 5.3.2 Chemical and Petrochemical

- 5.3.3 Power and Utilities

- 5.3.4 Food and Beverage

- 5.3.5 Automotive and Transportation

- 5.3.6 Pharmaceutical

- 5.3.7 Semiconductor and Electronics

- 5.3.8 Metals and Mining

- 5.3.9 Pulp and Paper

- 5.3.10 Other End-user Industries

- 5.4 By Region (United States)

- 5.4.1 Northeast U.S.

- 5.4.2 Midwest U.S.

- 5.4.3 South U.S.

- 5.4.4 West U.S.

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Rockwell Automation Inc.

- 6.4.2 Siemens AG

- 6.4.3 Schneider Electric SE

- 6.4.4 Emerson Electric Co.

- 6.4.5 ABB Ltd

- 6.4.6 Mitsubishi Electric Corporation

- 6.4.7 Honeywell International Inc.

- 6.4.8 Omron Corporation

- 6.4.9 Yokogawa Electric Corporation

- 6.4.10 Fanuc Corporation

- 6.4.11 Bosch Rexroth AG

- 6.4.12 KUKA AG

- 6.4.13 Kawasaki Heavy Industries Ltd.

- 6.4.14 Beckhoff Automation GmbH and Co. KG

- 6.4.15 GE Vernova (GE Automation and Controls)

- 6.4.16 Keyence Corporation

- 6.4.17 Danfoss Drives A/S

- 6.4.18 Parker Hannifin Corporation

- 6.4.19 Yaskawa Electric Corporation

- 6.4.20 Banner Engineering Corp.

- 6.4.21 Advantech Co.

- 6.4.22 Cognex Corporation

- 6.4.23 Delta Electronics

- 6.4.24 Hitachi Industrial Equipment Systems Co.

- 6.4.25 BandR Industrial Automation GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment