|

市場調查報告書

商品編碼

1851447

汽車開關:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automotive Switch - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

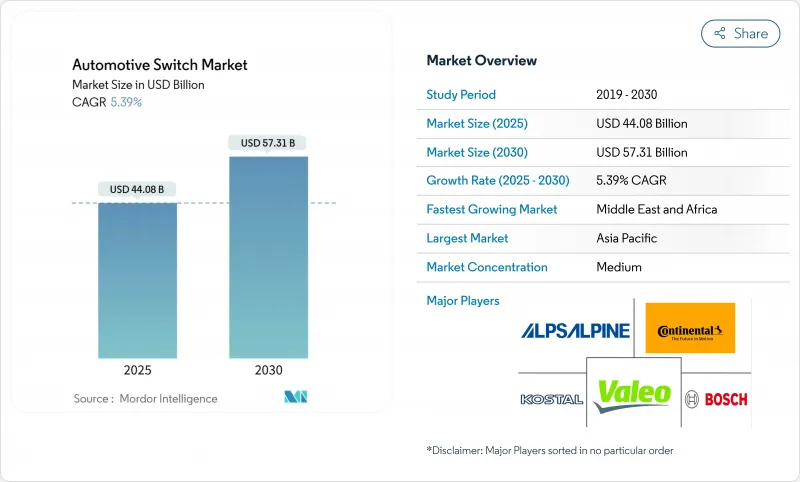

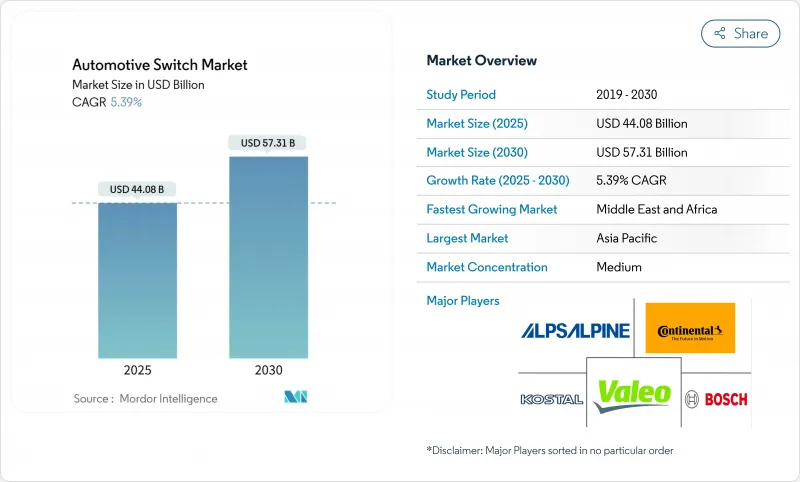

預計到 2025 年汽車開關市場規模將達到 440.8 億美元,到 2030 年將達到 573.1 億美元,年複合成長率為 5.39%。

這種成長反映了汽車產業向軟體定義型汽車的更廣泛轉變,在這種模式下,開關作為人機互動的第一道防線,連接著機械感知和電子智慧。與燃油車相比,純電動車需要更多的銅和高壓電路。資訊娛樂系統和高級駕駛輔助系統(ADAS)功能的擴展、對豪華照明座艙的追求以及更嚴格的ISO 26262安全法規,都提高了人們對所有開關功能的要求。隨著觸覺和電容式技術挑戰機械技術的現狀,競爭日益激烈;同時,銅和稀土供應鏈的衝擊迫使製造商重新思考採購、成本規避和地域生產佈局。

全球汽車開關市場趨勢與洞察

汽車電氣化的興起

電動動力傳動系統有著獨特的控制需求,包括電池管理、能量回收煞車和熱最佳化,這需要能夠承受高電壓並保持觸覺反應的專用開關。Panasonic汽車的集中式ECU架構展示了移除發熱硬體後電子元件含量如何大幅成長。預計到2024年,巴西插電式汽車的銷量將激增90%,達到177,360輛,凸顯了需求模式的快速變化。中國計劃在2026年推出100%國產晶片的汽車,將進一步重塑零件採購格局。這些因素將透過擴大開關的產量和功能多樣性來推動汽車開關市場的發展。

高級資訊娛樂和ADAS功能的成長

基於高通驍龍平台的雲端互聯駕駛座需要通訊與外部感測器、語音助理和空中升級後端通訊的多功能控制器。大陸集團的可程式觸覺旋鈕只需一個旋鈕即可模擬多種按鍵手感,滿足下一代儀表板的空間和設計需求。安全至關重要的ADAS(高級駕駛輔助系統)層需要通過ISO 26262認證的開關,以確保車道維持等功能的冗餘執行。 ADAS改裝後市場規模已接近10億美元,擴大了老舊車輛尋求新增安全功能的潛在需求。

銅和稀土價格波動

自2024年2月以來,銅價已上漲近20%,預計到2025年將超過每噸15,000美元,這將推高所有使用高純度觸點的機械開關的材料成本。同時,中國對稀土出口的限制已迫使鈴木和福特等汽車製造商短期停產。為了保障汽車開關市場的利潤,開關製造商正在採取措施對沖材料成本風險、重新設計接點佈局,並評估低品質合金。

細分市場分析

機械式開關設計預計在2024年仍將佔據93.82%的市場佔有率,其可靠性已得到驗證,能夠抵禦極端溫度、灰塵和振動。按鈕用於處理高頻用戶操作,搖桿單元控制二進位功能,撥片則用於管理方向盤上的指令。即使顯示器不斷發展,機械式開關的汽車開關市場也預計將穩定成長。

觸控開關目前市場規模較小,但隨著豪華車和大眾高階車型逐漸採用嵌入式背光面板,預計到2030年將以8.17%的複合年成長率成長。大陸集團的靜電回授旋鈕無需齒輪即可模擬機械定位感,而Snaptron的可焊接觸覺圓頂則可使年產能增加一倍。混合模組將電容式感測整合在薄塑膠蓋下,同時仍能提供觸覺回饋,這不僅賦予了OEM廠商設計上的自由,也保留了汽車開關市場所期望的傳統觸感。

由於各司法管轄區對方向燈、危險警告燈和警示燈等功能都有嚴格的號誌要求,指示器控制產品在2024年佔總收入的25.11%。即使在全數位化駕駛座中,指示器應用的汽車開關市場規模仍然保持穩定,因為即使螢幕故障,外部照明指令也必須正常運作。

得益於電動車中里程感應式熱感邏輯技術的應用,HVAC(空調)介面正以5.57%的複合年成長率快速成長。東海理化(Tokai Rika)的套模噴塗工藝已被豐田Hiace)採用,該工藝在降低生產能耗的同時,還能實現耐刮擦的外殼。觸控螢幕的普及並不會完全取代空調控制系統,使用者仍需要透過觸覺方式即時控制除濕和除霜,這支撐了整個汽車開關市場的需求。

區域分析

亞太地區在汽車開關市場佔有領先地位,目前是全球最大的汽車開關市場,預計2024年銷售量將佔全球總銷售量的49.88%。憑藉中國、日本、韓國和印度強大的供應鏈叢集,以及充足的電動車獎勵,隨著全球汽車製造商擴大在地化生產,亞太地區始終處於領先地位。泰國首個電動皮卡計畫和印尼富含鎳的電池走廊進一步鞏固了亞太地區的領先地位。

儘管中東和非洲地區面積較小,但到2030年,其複合年成長率將達到7.58%,成為成長最快的地區。沙烏地阿拉伯價值29億美元的汽車計劃儲備,包括Seah投資13億美元的電動車綜合體,以及計畫在2025年建成的5萬個公共充電樁,正在推動海灣地區各國對電動車的需求。杜拜到2030年實現4.2萬輛電動車的目標,進一步拉大了成長差距。

北美和歐洲市場保持強勁勢頭,將高階品牌與高配置的ADAS(高級駕駛輔助系統)和資訊娛樂系統結合。南美市場正在崛起,巴西斥資300億雷亞爾(約60億美元)的Stellantis計畫確保了區域製造能力的提升。生產能力靠近最終組裝地點的供應商更有能力應對不斷變化的貿易和合規壓力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 汽車電氣化進程

- 高級資訊娛樂和ADAS功能的成長

- 新興國家汽車產量增加

- 高階室內設計對照明和電容式開關的需求

- 採用觸覺/壓力觸摸開關技術

- 功能安全(ISO 26262)冗餘開關設計的需求

- 市場限制

- 銅和稀土原料價格波動;

- 朝向基於顯示器的觸控介面轉變

- 觸覺穹頂子組件供應瓶頸

- 更嚴格的電磁相容性法規會增加檢驗成本。

- 價值鏈分析

- 技術展望

- 監管環境

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按開關類型

- 機械開關

- 旋鈕

- 按鈕

- 置物櫃

- 撥動開關/撥片

- 觸控開關

- 電容式墊片

- 觸覺回饋

- 多功能/組合模組

- 機械開關

- 透過使用

- 指示器系統開關

- 暖通空調控制

- 電動車窗/車門鎖開關

- 方向盤控制開關

- 座椅和內裝舒適性開關

- 燈光和雨刷開關

- 引擎管理系統(EMS)開關

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中型/大型商用車輛

- 按銷售管道

- OEM

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 土耳其

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Alps Alpine Co. Ltd

- Robert Bosch GmbH

- Continental AG

- HELLA GmbH & Co KGaA

- Omron Corporation

- Panasonic Holdings Corp

- Tokai Rika Co. Ltd

- Minda Corporation Ltd

- ZF Friedrichshafen AG

- Leopold Kostal GmbH & Co. KG

- Valeo SA

- Toyodenso Co Ltd

- TE Connectivity Ltd

- LS Automotive

- Denso Corporation

- Nidec Mobility

- Joyson Electronics

第7章 市場機會與未來展望

The automotive switch market size stands at USD 44.08 billion in 2025 and is forecast to reach USD 57.31 billion by 2030, advancing at a 5.39% CAGR.

The upswing reflects a wider transition to software-defined vehicles where switches act as frontline human-machine interfaces that connect mechanical feel with electronic intelligence. Electrification now shapes material demand and cost structures, as each battery-electric vehicle needs far more copper and high-voltage circuitry than its combustion counterpart. Greater infotainment and ADAS content, the push for luxurious illuminated cabins, and stricter ISO 26262 safety rules all raise the functional expectations placed on every switch. Competitive rivalry intensifies as haptic and capacitive technologies challenge the mechanical status quo, while supply-chain shocks surrounding copper and rare-earths force manufacturers to rethink sourcing, cost hedging, and regional production footprints.

Global Automotive Switch Market Trends and Insights

Rise in Vehicle Electrification

Electric powertrains introduce unique control needs-battery management, regenerative braking, and thermal optimization all require purpose-built switches that tolerate higher voltage while preserving tactile response. Panasonic Automotive's centralized ECU architecture shows how electronics content balloons once combustion hardware is removed. Brazil's plug-in sales jumped 90% in 2024 to 177,360 units, underscoring how quickly demand patterns shift. China's plan to launch cars using 100% domestically sourced chips by 2026 will further reshape component procurement paths . These forces collectively lift the automotive switch market by broadening both unit volumes and the variety of switch functions.

Growth of Advanced Infotainment & ADAS Features

Cloud-linked cockpits built on Qualcomm's Snapdragon platforms require multifunction controllers able to talk to exterior sensors, voice assistants, and over-the-air update back-ends. Continental's programmable haptic knob enables a single dial to mimic many different detents, satisfying space and styling goals in next-generation dashboards . Safety-critical ADAS layers demand switches certified to ISO 26262, ensuring redundant actuation for features such as lane-keeping. The retrofit ADAS aftermarket, approaching USD 1 billion, expands addressable demand among older vehicles seeking new safety functions.

Volatile Prices of Copper & Rare-Earth Inputs

Copper prices climbed nearly 20% after February 2024 and are on track to top USD 15,000 per ton in 2025, inflating the bill-of-materials for every mechanical switch that uses high-purity contacts. Parallel restrictions on Chinese rare-earth exports have already forced short production pauses at OEMs, including Suzuki and Ford. Switch makers are hedging material costs, redesigning contact layouts, and evaluating lower-mass alloys to protect margins inside the automotive switch market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Vehicle Output in Emerging Economies

- Premium-Interior Demand for Illuminated & Capacitive Switches

- Shift Toward Display-Based Touch Interfaces

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mechanical designs retained 93.82% of 2024 revenue, proving their reliability in temperature, dust, and vibration extremes. Buttons handle high-frequency user tasks, rocker units govern binary functions, and paddles manage steering-mounted commands. The automotive switch market size for mechanical variants is projected to expand steadily even as displays grow, because safety codes continue to demand tactile backup controls.

Touch-based switches hold modest volume today but carry an 8.17% CAGR to 2030 as luxury and mass-premium trims migrate to flush lit panels. Continental's electrostatic feedback knob reproduces mechanical detents without gears, and Snaptron's solderable tactile domes can double annual output capacity. This convergence blurs the line: hybrid modules bundle capacitive sensing beneath a thin plastic cap yet still generate a click, giving OEMs styling freedom while maintaining the legacy feel expected in the automotive switch market.

Indicator controls owned 25.11% of 2024 revenue because every jurisdiction mandates robust signaling for turn, hazard, and warning functions. The automotive switch market size for indicator applications remains secure even in fully digital cockpits, as external lighting commands must work when screens fail.

HVAC interfaces earn the fastest 5.57% CAGR thanks to range-sensitive thermal logic in electric cars. Tokai Rika's in-mold-painting process, already used on Toyota's Hiace, slashes energy use during manufacturing while delivering scratch-resistant fascias. Climate controls cannot disappear into touchscreens entirely; users need immediate tactile access to demist or defrost, sustaining demand across the automotive switch market.

The Automotive Switch Market Report is Segmented by Switch Type (Mechanical Switches, Touch-Based Switches, and More), Application (Indicator System Switches, HVAC Controls, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM and Aftermarket), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia Pacific spearheads the automotive switch market with 49.88% revenue in 2024, making it the largest market today. Entrenched supply clusters in China, Japan, South Korea, and India, plus robust EV incentives, keep the region in front as global OEMs scale local production. Thailand's first electric pickup program and Indonesia's nickel-rich battery corridor reinforce APAC's leadership.

The Middle East & Africa, while smaller, posts the fastest 7.58% CAGR through 2030. Saudi Arabia's USD 2.9 billion pipeline of automotive projects, including Ceer's USD 1.3 billion EV complex, alongside 50,000 public chargers planned by 2025, accelerates switch demand across Gulf economies. Dubai's target of 42,000 EVs by 2030 further widens the growth gap.

North America and Europe retain strong positions by marrying premium nameplates with high-content ADAS and infotainment systems. South America gains steady ground as Brazil's R$30 billion (USD 6.0 billion) Stellantis program secures regional manufacturing. Suppliers able to locate production close to final assembly sites remain best placed to navigate evolving trade and compliance pressures.

- Alps Alpine Co. Ltd

- Robert Bosch GmbH

- Continental AG

- HELLA GmbH & Co KGaA

- Omron Corporation

- Panasonic Holdings Corp

- Tokai Rika Co. Ltd

- Minda Corporation Ltd

- ZF Friedrichshafen AG

- Leopold Kostal GmbH & Co. KG

- Valeo SA

- Toyodenso Co Ltd

- TE Connectivity Ltd

- LS Automotive

- Denso Corporation

- Nidec Mobility

- Joyson Electronics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in vehicle electrification

- 4.2.2 Growth of advanced infotainment & ADAS features

- 4.2.3 Rising vehicle output in emerging economies

- 4.2.4 Premium-interior demand for illuminated & capacitive switches

- 4.2.5 Adoption of haptic/force-touch switch technology

- 4.2.6 Functional-safety (ISO 26262) need for redundant switch designs

- 4.3 Market Restraints

- 4.3.1 Volatile prices of copper & rare-earth inputs

- 4.3.2 Shift toward display-based touch interfaces

- 4.3.3 Supply bottlenecks in tactile-dome sub-components

- 4.3.4 Tighter EMC limits raising validation costs

- 4.4 Value/Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Switch Type

- 5.1.1 Mechanical Switches

- 5.1.1.1 Knob

- 5.1.1.2 Button

- 5.1.1.3 Rocker

- 5.1.1.4 Toggle/Paddle

- 5.1.2 Touch-based Switches

- 5.1.2.1 Capacitive Touchpad

- 5.1.2.2 Haptic-feedback Surface

- 5.1.3 Multifunction / Combination Modules

- 5.1.1 Mechanical Switches

- 5.2 By Application

- 5.2.1 Indicator System Switches

- 5.2.2 HVAC Controls

- 5.2.3 Power Window and Door-Lock Switches

- 5.2.4 Steering-Wheel Control Switches

- 5.2.5 Seat and Interior Comfort Switches

- 5.2.6 Lighting and Wiper Switches

- 5.2.7 Engine-Management (EMS) Switches

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Egypt

- 5.5.5.4 Turkey

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Alps Alpine Co. Ltd

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Continental AG

- 6.4.4 HELLA GmbH & Co KGaA

- 6.4.5 Omron Corporation

- 6.4.6 Panasonic Holdings Corp

- 6.4.7 Tokai Rika Co. Ltd

- 6.4.8 Minda Corporation Ltd

- 6.4.9 ZF Friedrichshafen AG

- 6.4.10 Leopold Kostal GmbH & Co. KG

- 6.4.11 Valeo SA

- 6.4.12 Toyodenso Co Ltd

- 6.4.13 TE Connectivity Ltd

- 6.4.14 LS Automotive

- 6.4.15 Denso Corporation

- 6.4.16 Nidec Mobility

- 6.4.17 Joyson Electronics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment