|

市場調查報告書

商品編碼

1851444

石墨烯:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Graphene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

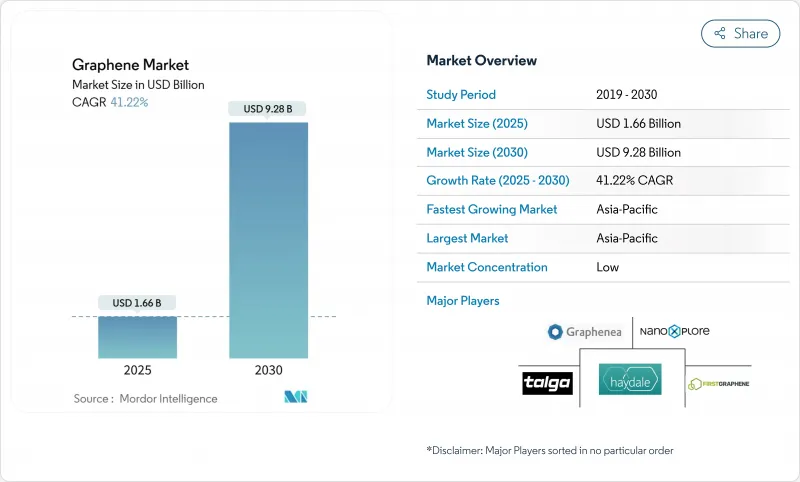

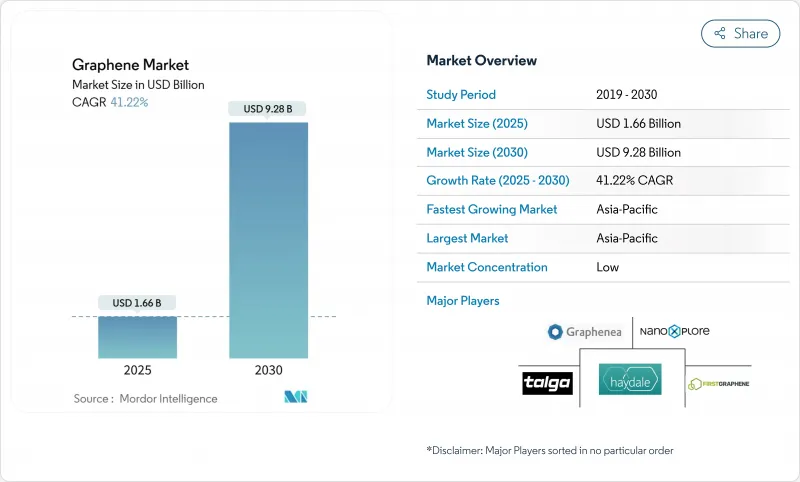

預計到 2025 年,石墨烯市場規模將達到 16.6 億美元,到 2030 年將達到 92.8 億美元,2025 年至 2030 年的複合年成長率為 41.22%。

這種快速成長表明,商業規模生產的障礙正在逐漸消除,而石墨烯正從實驗室走向主流工業供應鏈。製程產量比率的提高、單位成本的下降以及與下游用戶的緊密整合,支撐著電池、航太複合材料和醫療設備等高成長細分領域的持續需求。亞太地區預計到2024年將佔總收入的46%,年複合成長率將達到44.69%,這得益於其密集的電子產業集群、積極的政府資助以及材料和最終產品製造商之間的密切合作。隨著企業建立專注於特定應用領域的垂直定位,市場區隔程度正在加劇。例如,產業對電池化學相關智慧財產權的加強控制已成為一項至關重要的競爭優勢。

全球石墨烯市場趨勢與洞察

石墨烯有助於航太業的發展

與傳統複合材料相比,石墨烯增強碳纖維聚合物可減輕20%至30%的質量,同時維持甚至提升機械性能。嵌入式石墨烯感測器網格可提供即時結構健康數據,從而實現預測性維護週期並減少計劃外停機時間。北美和歐洲的民航機專案首先將這些多功能結構整合到輔助零件、雷達罩、整流罩和內裝板中,然後再擴展到關鍵承重零件。隨著早期服役數據的積累,法規核准流程正在縮短,從而加快了亞太地區飛機製造商的供應商資格認證。隨著碳定價機制的收緊,噴射機燃料的節省可直接轉化為更低的排放費,這增加了航空公司簽訂長期石墨烯複合材料材料供應協議的獎勵,並為材料製造商提供了更清晰的需求預測。

石墨烯防腐塗層在中東海水淡化基礎設施的應用

海灣合作理事會(波灣合作理事會)的公共產業運作在高鹽度和高溫環境下,這些環境會腐蝕鋼製管道和壓力容器。石墨烯塗層隔離層可有效阻止離子入侵,進而延長設備使用壽命15至20年,並降低高達30%的維修預算。同時,氧化石墨烯塗層也能將薄膜的水通量提高80%至90%,使業者能夠提高單位裝置容量的處理量,並抵銷能源成本。預計到2030年,該地區的海水淡化能力將加倍,因此,在新工廠建設中使用石墨烯保護膜已成為競標規範中日益嚴格的要求,這促使當地製造商從現有供應商處獲得該技術的許可。

高昂的生產成本

化學氣相沉積 (CVD) 可提供先進電子產品所需的純度,但其真空室和溫度控制系統會增加運作成本,限制了其在價格分佈應用領域的應用。材料研究人員指出,批次間的差異會使下游品管變得複雜,並令規避風險的客戶望而卻步。一種使用熔鹽的替代電解法預計將在不犧牲晶體有序性的前提下將成本降低高達 90%,但其商業化仍處於早期測試階段。在實現規模化效益之前,許多大眾市場產品仍將繼續依賴更便宜的填充材,從而限制石墨烯的供應量。

細分市場分析

預計到2024年,石墨烯奈米微片將佔石墨烯市場銷售額的57%,並在2030年之前以47.63%的複合年成長率成長,鞏固其在石墨烯市場領先產品的地位。其薄而寬的形貌使其易於分散在聚合物、金屬和瀝青中,從而在低負載下提高材料的強度和阻隔性。銷量的成長降低了單價,進一步推動了市場需求。 Aberdyne公司專有的超大超薄、無缺陷石墨烯奈米片製造流程預計將於2025年中期授權給一家化學合作夥伴進行生產,這將擴大供應,並為尋求可預測批次性能的航太和電池開發商提供支援。

片狀材料、薄膜以及氧化石墨烯(GO)正效法奈米片,填補重要的應用空白。 GO的親水性使其適用於生物醫用水凝膠,例如能夠響應血糖濃度升高而發揮作用的雙交聯敷料,可促進慢性傷口癒合。化學氣相沉積(CVD)法製備的多層薄膜雖然成本較高,但卻能展現量子輸運現象,這對於高速電晶體和新一代感測器至關重要。混合發泡彈性體在微波頻寬已展現約75 dB的衰減性能。

區域分析

亞太地區主導石墨烯市場,預計2024年營收將成長46%,複合年成長率高達44.69%,位居成長最快地區之首。中國在石墨原料上游和電池組裝下游領域均處於主導,擁有強大的生態系統優勢。國家補貼正用於支持多噸級氧化石墨烯生產線的擴建,以滿足國內儲能整合商的需求。韓國企業正在實現石墨供應多元化,減少對非洲的依賴,同時擴大富矽負極的產能,間接推動了石墨烯作為導電添加劑的應用。

北美正在努力提升供應鏈韌性:加州一家鋰金屬工廠將斥資 2,000 萬美元維修,預計將於 2025 年底開始生產 200 兆瓦時的石墨烯增強型鋰硫電池;此外,內華達州計劃於 2027 年建成一座 10 吉瓦時的超級工廠。聯邦採購指南優先考慮國防電子產品的國內生產,這將進一步支持晶圓級 CVD 產能的擴張。

歐洲擁有深厚的學術專長,曼徹斯特、劍橋和亞琛等地均設有研究中心,在標準磁場中實現 100% 室溫磁阻等突破性成就,充分展現了該地區基礎科學的實力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 石墨烯對航太產業的貢獻

- 石墨烯防腐蝕塗層在中東海水淡化基礎設施的應用

- 擴大儲能應用

- 對電子產品和半導體的需求不斷成長

- 石墨烯電磁干擾屏蔽泡棉在歐洲5G基礎建設的商業化應用

- 市場限制

- 高昂的生產成本

- 可能的替代方案

- 大面積CVD石墨烯生產線需要高額資本投資。

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 石墨烯薄片和薄膜

- 石墨烯奈米微片(GNPs)

- 氧化石墨烯(GO)

- 奈米片

- 其他

- 透過使用

- 合成的

- 儲能和發電

- 印刷軟性電子

- 生物醫學與醫療保健

- 畫

- 其他

- 按最終用戶行業分類

- 電子與通訊

- 航太/國防

- 能源與電力

- 生物醫學與醫療保健

- 其他(汽車、化工、塗料)

- 按地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐的

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- ACS Material

- Cabot Corporation

- Directa Plus SpA

- First Graphene Ltd

- G6 Materials Corp.

- Global Graphene Group

- Grafoid Inc

- Graphene Manufacturing Group Ltd

- Graphenea

- Haydale Graphene Industries plc

- NanoXplore Inc.

- Perpetuus Advanced Materials

- Talga Group

- The Sixth Element(Changzhou)Materials Technology Co.,Ltd

- Thomas Swan & Co. Ltd

- Universal Matter Inc

- Versarien plc

- Vorbeck Materials Corp.

第7章 市場機會與未來展望

The graphene market size is estimated at USD 1.66 billion in 2025 and is expected to reach USD 9.28 billion by 2030, expanding at a 41.22% CAGR between 2025-2030.

This steep ascent signals that commercial-scale production hurdles are receding, moving graphene decisively from the laboratory into mainstream industrial supply chains. Increased process yields, falling unit costs, and closer integration with downstream users now underpin sustained demand from high-growth niches such as batteries, aerospace composites, and biomedical devices. Asia-Pacific remains the centre of gravity: the region held 46% of 2024 revenue and is growing at a 44.69% CAGR thanks to dense electronics clusters, active government funding, and tight coupling between material producers and end-product manufacturers. Fragmentation is increasing as companies carve out vertical positions around specialty uses; intellectual-property control over graphene-enhanced battery chemistries, for example, is already a decisive competitive lever.

Global Graphene Market Trends and Insights

Graphene Aiding the Aerospace Industry

Lightweighting remains a core airline objective, and graphene-reinforced carbon-fiber polymers are yielding 20-30% mass reductions versus legacy composites while maintaining or improving mechanical performance. Embedded graphene sensor meshes also deliver real-time structural-health data, enabling predictive maintenance cycles and lowering unplanned downtime. Commercial aircraft programs in North America and Europe first integrate such multifunctional structures into secondary parts, radomes, fairings, and interior panels, before scaling to primary load-bearing components. Regulatory pathways are shortening as early-service data accumulate, accelerating supplier qualification for Asia-Pacific airframe builders. With jet-fuel savings translating directly into lower emissions fees under tightening carbon-pricing regimes, airlines are incentivised to secure long-term graphene composite supply agreements, reinforcing demand visibility for material producers.

Adoption of Graphene Anti-corrosion Coatings in the Middle-East Desalination Infrastructure

Gulf Cooperation Council utilities operate in extreme salinity and high-temperature environments that corrode steel piping and pressure vessels. Graphene-laden barrier layers impede ion ingress, extending asset life by 15-20 years and cutting maintenance budgets by up to 30%. Because graphene oxide coatings simultaneously raise membrane water flux 80-90%, operators gain higher throughput per installed capacity, which offsets energy expenses, crucial where desalination already accounts for a material share of national electricity demand. As regional capacity is projected to double by 2030, tender specifications increasingly mandate graphene protection for new-build plants, stimulating local formulators to license technology from established providers.

High Production Cost

Chemical-vapor-deposition (CVD) delivers the purity required for advanced electronics, yet its vacuum chambers and temperature control systems drive operating expenditure that limits adoption to premium-priced applications. Material researchers report batch-to-batch variability that complicates downstream quality control, deterring risk-averse customers. Alternative electrolysis routes in molten salts could cut costs by up to 90% without sacrificing crystalline order, though commercialisation remains in early trials. Until scale efficiencies arrive, many mass-market products will continue to rely on cheaper filler materials, capping graphene volumes.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Energy-Storage Applications

- Growing Demand in Electronics and Semiconductors

- Availability of Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Graphene nanoplatelets captured 57% of 2024 sales and are on track for a 47.63% CAGR to 2030, cementing their status as the workhorse of the graphene market. Their thin but wide morphology disperses easily in polymers, metals, and asphalt, delivering strength and barrier gains at low loadings. Volume growth is lowering unit prices, which further reinforces demand momentum. Avadain's proprietary large-thin-defect-free flake process, licensed to a chemical partner for mid-2025 production, is expected to widen supply and support aerospace and battery developers seeking predictable performance batches.

Sheets and films, and graphene oxide (GO) each trail nanoplatelets but fill essential niches. GO's hydrophilicity suits biomedical hydrogels that accelerate chronic-wound healing, as shown in double-cross-linked dressings that respond to elevated glucose levels. CVD-grown multilayer films, though costlier, unlock quantum transport phenomena valuable for high-speed transistors and next-generation sensors. Demand for three-dimensional foams is also rising where electromagnetic shielding and thermal interface performance are critical; hybrid graphene-foam elastomers have exhibited around 75 dB attenuation across microwave bands.

The Graphene Market Report Segments the Industry by Product Type (Graphene Sheets and Films, Graphene Nanoplatelets (GNP), Graphene Oxide (GO), Nanoplatelets, and Others), Application (Composites, Energy Storage and Harvesting, and More), End-User Industry (Electronics and Telecommunication, Aerospace and Defense, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific dominates the graphene market with 46% revenue in 2024 and the fastest 44.69% CAGR outlook. China's upstream leadership in graphite feedstock and downstream battery assembly grants ecosystem advantages; state grants have underwritten multi-tonne GO expansion lines that feed domestic energy-storage integrators. South Korean groups are diversifying graphite supply from Africa while scaling silicon-rich anode capacity, which indirectly elevates graphene usage for conductivity additives.

North America is pursuing supply-chain resilience. A USD 20 million retrofit of a lithium-metal facility in California will start 200 MWh of graphene-enhanced lithium-sulfur cell output in late 2025, with a 10 GWh Nevada gigafactory planned for 2027. Federal procurement guidelines prioritising domestic content for defense electronics further incentivise local wafer-scale CVD capacity builds.

Europe benefits from deep academic expertise clustered around Manchester, Cambridge and Aachen. Breakthroughs such as 100% room-temperature magnetoresistance in standard magnetic fields illustrate the region's basic-science prowess.

- ACS Material

- Cabot Corporation

- Directa Plus S.p.A.

- First Graphene Ltd

- G6 Materials Corp.

- Global Graphene Group

- Grafoid Inc

- Graphene Manufacturing Group Ltd

- Graphenea

- Haydale Graphene Industries plc

- NanoXplore Inc.

- Perpetuus Advanced Materials

- Talga Group

- The Sixth Element (Changzhou) Materials Technology Co.,Ltd

- Thomas Swan & Co. Ltd

- Universal Matter Inc

- Versarien plc

- Vorbeck Materials Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Graphene Aiding the Aerospace Industry

- 4.2.2 Adoption of Graphene Anti-corrosion Coatings in Middle-East Desalination Infrastructure

- 4.2.3 Expansion of Energy Storage Applications

- 4.2.4 Growing Demand in Electronics and Semiconductors

- 4.2.5 Commercialization of Graphene EMI-shielding Foams for European 5G Infrastructure

- 4.3 Market Restraints

- 4.3.1 High Production Cost

- 4.3.2 Avalability of Substitutes

- 4.3.3 High capex needs for large-area CVD graphene production lines

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Graphene Sheets and Films

- 5.1.2 Graphene Nanoplatelets (GNP)

- 5.1.3 Graphene Oxide (GO)

- 5.1.4 Nanoplatelets

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Composites

- 5.2.2 Energy Storage and Harvesting

- 5.2.3 Printed and Flexible Electronics

- 5.2.4 Biomedical and Healthcare

- 5.2.5 Coatings and Paints

- 5.2.6 Others

- 5.3 By End-user Industry

- 5.3.1 Electronics and Telecommunications

- 5.3.2 Aerospace and Defense

- 5.3.3 Energy and Power

- 5.3.4 Biomedical and Healthcare

- 5.3.5 Others (Automotive, Chemical, and Coatings)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 South Korea

- 5.4.1.4 India

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Turkey

- 5.4.5.4 South Africa

- 5.4.5.5 Egypt

- 5.4.5.6 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ACS Material

- 6.4.2 Cabot Corporation

- 6.4.3 Directa Plus S.p.A.

- 6.4.4 First Graphene Ltd

- 6.4.5 G6 Materials Corp.

- 6.4.6 Global Graphene Group

- 6.4.7 Grafoid Inc

- 6.4.8 Graphene Manufacturing Group Ltd

- 6.4.9 Graphenea

- 6.4.10 Haydale Graphene Industries plc

- 6.4.11 NanoXplore Inc.

- 6.4.12 Perpetuus Advanced Materials

- 6.4.13 Talga Group

- 6.4.14 The Sixth Element (Changzhou) Materials Technology Co.,Ltd

- 6.4.15 Thomas Swan & Co. Ltd

- 6.4.16 Universal Matter Inc

- 6.4.17 Versarien plc

- 6.4.18 Vorbeck Materials Corp.

7 Market Opportunities and Future Outlook

- 7.1 Development of Graphene Nanodevices for DNA Sequencing

- 7.2 Adoption of Graphene into Photodetectors

- 7.3 White-space and Unmet-need Assessment