|

市場調查報告書

商品編碼

1851437

多因素身份驗證 (MFA):市場佔有率分析、行業趨勢、統計數據和成長預測 (2025-2030)Multifactor Authentication (MFA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

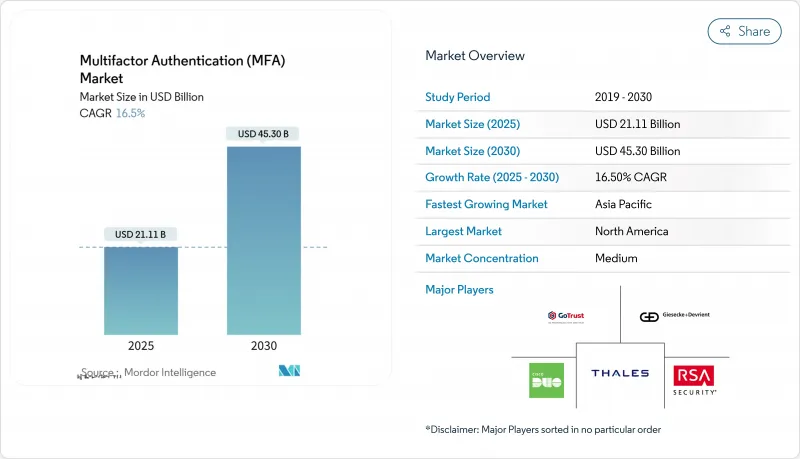

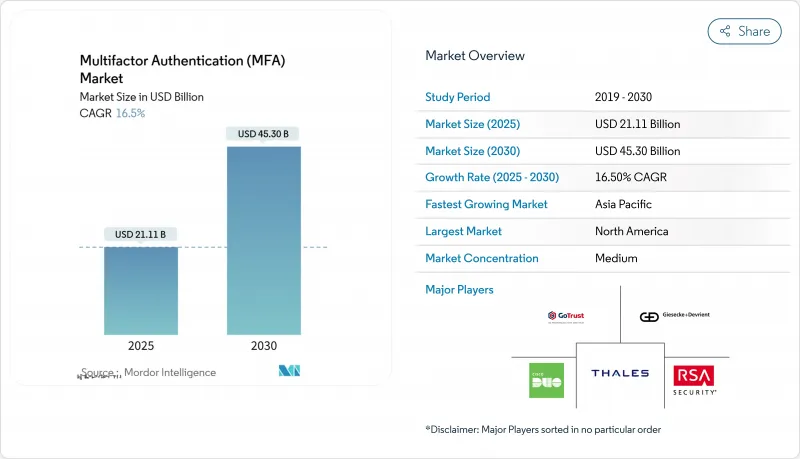

2025年全球多因子身分驗證市場規模目前為211.1億美元,預計2030年將達453億美元。

推動這一成長趨勢的因素包括:零信任理念的普及、資料保護法規的強化以及勒索軟體的興起,這些因素促使人們迫切需要投資於更強大的身份驗證技術。諸如美國2025年《健康保險流通與責任法案》(HIPAA)安全規則和歐洲數位身分錢包法規等,正促使採購方向從基本的一次性密碼(OTP)工具轉向防釣魚的金鑰和硬體符記,這印證了多因素身分驗證市場正向高信任解決方案轉型。同時,安全晶片供應鏈的衝擊以及不斷上漲的A2P簡訊費用,也促使買家轉向基於軟體或裝置嵌入式的身份驗證元件。北美在零信任領域的領先地位、亞太地區的行動身分識別舉措以及歐洲的錢包法規,正在形成一個全球性的飛輪效應,這將使多因素身分驗證產業在2030年之前保持兩位數的成長。

全球多因素身份驗證 (MFA) 市場趨勢與洞察

受監管產業快速轉向零信任安全架構

零信任架構要求對每個會話進行持續身份驗證,將多因素身份硬體符記(MFA) 從附加元件提升為核心控制措施。根據加拿大金融機構監理辦公室 (OSFI) B-13 的規定,加拿大銀行必須逐步淘汰簡訊驗證碼 (SMS OTP),並在日常營運中採用硬體代幣和生物辨識因素。包括 Capital One 在內的美國大型金融機構已承諾在 2025 年底前取消員工密碼,並以基於裝置憑證的金鑰取而代之,從而降低撞庫攻擊的風險。供應商正積極回應,建構統一員工、人員編制和機器身分的平台架構,從而拓展多因素身分驗證市場生態系統。

勒索軟體即服務(RaaS)的激增正在推高保險費。

網路保險公司現在將防釣魚的多因素身份驗證 (MFA) 視為一項基本的安全措施。如果僅使用電子郵件或簡訊驗證碼 (SMS-OTP) 進行身份驗證,保險公司可能會拒絕承保或提高保費,因此投資 MFA 可以直接對沖保險成本。隨著中間人攻擊套件的普及,企業董事會正在將資金從邊界防火牆轉向身份驗證,這推動了歷來轉型緩慢的中型企業對多因素身份驗證的需求。

傳統 SCADA/ICS 環境中的多因素身份驗證 (MFA)互通性有限

工業網路依賴於確定性的延遲和持續的執行時間。增加一個登入步驟會帶來停機風險,因此工廠營運商選擇將營運技術 (OT) 與資訊技術 (IT) 分離,而不是改造現有系統以全面實施多因素身份驗證 (MFA),這限制了重工業領域多因素身份驗證市場的收入潛力。

細分市場分析

到2024年,軟體解決方案將貢獻48.3%的收入,佔據多因素身份驗證市場最大的佔有率。訂閱許可、API套件和雲端主機簡化了混合辦公模式的部署。隨著企業從邊界管理過渡到整合合規性彙報和自適應風險指標的身份架構,該細分市場的價值提案將進一步提升。以WebAuthn工具鏈和SDK為代表的無密碼平台正經歷著19.2%的複合年成長率,這反映出買家傾向於選擇能夠清除憑證資料庫並從源頭上抵禦網路釣魚的身份驗證方式。雖然硬體對於需要隔離儲存安全元件的受監管工作負載仍然至關重要,但晶片短缺正在推高代幣成本,並促使預算轉向軟體。

對實施專業知識的需求正使託管服務成為一個極具吸引力的細分市場。服務合作夥伴透過設計使用者宣傳活動、維修舊版應用程式以及監控多因素身份驗證 (MFA) 控制面板,將一次性產品引入轉化為持續的諮詢收入。因此,大型整合商正將產品部署與更廣泛的零信任計劃捆綁在一起,從而提高了平均合約價值,並強化了多因素身份驗證市場向以平台為中心的採購模式轉變的趨勢。

到2024年,雙重登入仍將貢獻46.4%的收入,主要得益於身分驗證器應用程式和簡訊驗證碼提供的快速風險緩解功能。然而,隨著瀏覽器和行動作業系統廠商將FIDO2整合到原生工作流程中,防釣魚金鑰正以18.4%的複合年成長率快速成長。微軟決定預設將新用戶帳戶設為無密碼帳戶,這提供了一個強而有力的參考模型。雖然在某些政府和金融領域,要求三個或更多因素的多因素身份驗證框架仍然是強制性的,但更廣泛的商業性目標正轉向基於風險的動態增強驗證強度的編配。

多因素身份驗證市場按產品類型(硬體、軟體、服務)、身份驗證模型(雙重因素、多因素、其他)、部署模式(本地部署、雲端、混合部署)、企業規模(中小企業、大型企業)、存取管道(VPN、遠端登入、其他)、最終用戶產業(銀行、金融機構、其他小型企業、大型企業)、存取管道(VPN、遠端登入、其他)、最終用戶產業(銀行、金融機構、其他小型企業、大型企業)、存取管道(VPN、遠端登入、其他)、最終用戶產業(銀行、金融機構、其他小型企業、大型企業)、存取管道(VPN、遠端登入、其他)、最終用戶產業(銀行、金融機構、其他小型企業、大型企業)、存取管道(VPN、遠端登入、其他)、最終用戶產業(銀行、金融機構、其他小型企業、大型企業)和地區進行細分。市場預測以美元計價。

區域分析

預計北美地區2024年的營收成長率將維持在37.8%,到2030年將以14.2%的複合年成長率持續成長。美國關於關鍵基礎設施網路安全的行政命令和加拿大的OSFI B-13法規已將多因素身份驗證(MFA)制度化,推動了該地區身份SaaS供應商生態系統的創新週期。因此,隨著零信任採購進入維護階段,供應商提升銷售自我調整分析功能,北美多因素身份驗證市場規模正在穩步擴大。

由於政府識別項目的推動,亞太地區可望實現16.5%的複合年成長率。日本的「我的號碼」(My Number)智慧型手機憑證目前已為超過650家企業提供登入服務;新加坡的銀行正在用FIDO令牌取代簡訊驗證碼,從而擴大其主流應用。澳洲的數位身分框架正在向聯邦政府服務部門推廣使用密碼卡,這促使私營部門紛紛效仿。東南亞和印度等新興經濟體正透過以行動生物辨識技術取代傳統密碼來拓展市場。

在歐洲,27 個國家的 2024/1183 號法規實現了錢包登錄的標準化,實現了兩位數的成長率;公共部門確保了供應商的規模,而私營在線服務提供商必須實現互操作,否則將面臨客戶流失的風險;中東和非洲的部署量隨著雲遷移和網路彈性競標的增加而增加,為全球多因素身份驗證市場帶來了全球多因素身份驗證市場的來源。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 受監管產業快速轉向零信任安全架構

- 勒索軟體即服務(RaaS)的激增正在推高保險費。

- 歐盟電子政府網站必須採用基於FIDO的強認證

- 推播通知釣魚套件推動了對反釣魚多因素身份驗證 (MFA) 的需求。

- 基於人工智慧的深度造假攻擊正迫使生物識別變得更加精準。

- 曼達洛人式公私威脅情報共用模式(美國與五眼聯盟)

- 市場限制

- 在傳統的SCADA/ICS環境中,MFA互通性受到限制。

- A2P 價格上漲導致 OTP 簡訊費用上升

- 行動身份驗證系統使用者體驗的分散化阻礙了員工的採用。

- 硬體符記晶片短缺和安全元件供應風險

- 供應鏈分析

- 監理與技術展望

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 硬體

- 令牌(USB、智慧卡、智慧鑰匙)

- 生物辨識設備(指紋、手掌、臉部)

- 其他裝置(穿戴式裝置、智慧卡 - NFC)

- 軟體

- 身份驗證解決方案(TOTP、推送、U2F)

- 行動應用(原生應用程式、SDK)

- 服務

- 管理及專業服務

- 硬體

- 通過認證模型

- 雙重認證(2FA)

- 多元素(3F 和 4F)

- 自適應/基於風險的多因素分析

- 無密碼(WebAuthn、Passkeys)

- 透過部署模式

- 本地部署

- 雲

- 公共

- 私人的

- 混合

- 按公司規模

- 中小企業

- 主要企業

- 透過接入通道

- VPN和遠端登入

- Web 和 SaaS 應用

- 移動勞動力

- 按最終用戶行業分類

- 銀行和金融機構

- 加密貨幣和Web3交易所

- 技術(SaaS、IT 服務、DevOps)

- 政府(聯邦政府、州政府、地方政府、系統整合商)

- 醫療保健和製藥

- 零售與電子商務

- 能源、公共產業和製造業

- 教育、移民和公共服務

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 以色列

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性舉措(資金籌措、夥伴關係)

- 市佔率分析

- 公司簡介

- Giesecke+Devrient GmbH

- Thetis

- GoTrustID Inc.

- Thales Group

- Duo Security(Cisco Systems Inc.)

- RSA Security LLC

- Okta Inc.

- Google LLC(Alphabet Inc.)

- Ping Identity Corp.

- ManageEngine(Zoho Corp.)

- Microsoft Corp.

- TeleSign Corp.(Proximus Group)

- HID Global Corp.

- OneSpan Inc.

- CyberArk Software Ltd.

- ForgeRock Inc.

- Entrust Corp.

- SecureAuth Corp.

- Symantec Corp.(Broadcom Inc.)

- Keyless Technologies

- Secret Double Octopus

- Trusona Inc.

第7章 市場機會與未來展望

The global multifactor authentication market size currently stands at USD 21.11 billion in 2025 and is projected to reach USD 45.30 billion by 2030, reflecting a strong 16.50% CAGR.

This growth trajectory is underpinned by zero-trust adoption, tightening data-protection directives, and escalating ransomware premiums that drive urgent investment in stronger authentication. Regulatory mandates such as the 2025 HIPAA Security Rule in the United States and the European Digital Identity Wallet regulation are shifting procurement from basic OTP tools to phishing-resistant passkeys and hardware tokens, confirming the multifactor authentication market's transition toward high-assurance solutions. At the same time, supply-chain shocks to secure-element chips and escalating A2P SMS fees are pushing buyers to favor software-based or device-embedded factors. North America's zero-trust leadership, Asia-Pacific's mobile-identity initiatives, and Europe's wallet regulation together create a global flywheel that sustains double-digit expansion for the multifactor authentication industry through 2030.

Global Multifactor Authentication (MFA) Market Trends and Insights

Rapid Migration to Zero-Trust Security Architectures Across Regulated Industries

Zero-trust blueprints now require continuous identity checks on every session, elevating MFA from an optional add-on to core control. Canadian banks must abandon SMS OTP under OSFI B-13, pushing hardware tokens and biometric factors into routine operations. U.S. financial majors, including Capital One have pledged to remove employee passwords by end-2025, substituting device-certificate-anchored passkeys that cut credential-stuffing risk. Vendors respond by building platform fabrics that unify authentication across workforce, customer, and machine identities, strengthening the multifactor authentication market's ecosystem breadth.

Surge in Ransomware-as-a-Service Driving Insurance Premium Hikes

Cyber insurers now treat phishing-resistant MFA as baseline hygiene. Policies are refused or repriced upward where email-only or SMS-OTP remains in place, making MFA investment a direct insurance-cost hedge. As adversary-in-the-middle kits commoditize, boards shift funding from perimeter firewalls to identity assurance, propelling multifactor authentication market demand among mid-size enterprises previously slow to modernize.

Legacy SCADA/ICS Environments' Limited MFA Interoperability

Industrial networks depend on deterministic latency and continuous uptime. Injecting extra login steps risks downtime, so plant operators isolate OT from IT rather than retrofit full MFA, capping reachable multifactor authentication market revenue in heavy industry.

Other drivers and restraints analyzed in the detailed report include:

- Mandated FIDO-Based Strong Authentication for EU e-Government Portals

- Push-Notification Phishing Kits Raising Demand for Phishing-Resistant MFA

- Rising OTP SMS Costs Amid A2P Fee Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software solutions generated 48.3% of 2024 revenue and anchor the largest slice of the multifactor authentication market. Subscription licensing, API toolkits, and cloud consoles streamline rollouts across hybrid workforces. The segment's value proposition scales further as enterprises migrate perimeter controls into identity fabrics that integrate compliance reporting and adaptive risk metrics. Passwordless platforms-led by WebAuthn toolchains and SDKs-are clocking 19.2% CAGR, reflecting buyer preference for factors that erase credential databases and defeat phishing at the root. Hardware remains indispensable for regulated workloads that stipulate isolated secure-element storage, yet chip shortages inflate token costs and nudge budgets toward software.

Demand for implementation expertise turns managed services into an attractive niche. Service partners design enrollment campaigns, retrofit legacy apps, and monitor MFA dashboards, turning one-off product placement into recurring advisory revenue. As a result, large integrators bundle rollouts with broader zero-trust projects, lifting average contract values and reinforcing the multifactor authentication market's shift to platform-centric procurement.

Two-factor login still underpins 46.4% of 2024 revenue, primarily through authenticator apps and SMS codes that deliver quick risk reduction. However, phishing-resistant passkeys are expanding at 18.4% CAGR as browser and mobile-OS vendors bake FIDO2 into native workflows. Microsoft's decision to make new consumer accounts passwordless by default supplies a powerful reference model. Multifactor frameworks requiring three or more factors remain compulsory in select government and financial segments, but the broader commercial appetite pivots toward risk-based orchestration that elevates factor strength dynamically.

Multifactor Authentication Market is Segmented by Offering Type (Hardware, Software, Services), Authentication Model (Two-Factor, Multifactor, and More), Deployment Mode (On-Premises, Cloud, Hybrid), Enterprise Size (SMEs, Large Enterprises), Access Channel (VPN and Remote Login, and More), End-User Industry (Banking and Financial Institutions, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.8% revenue in 2024 and should log 14.2% CAGR to 2030. U.S. executive orders on critical-infrastructure cybersecurity and Canadian OSFI B-13 collectively institutionalize MFA, while the ecosystem of identity SaaS vendors headquartered in the region keeps innovation cycles brisk. The multifactor authentication market size for North America thus scales steadily as zero-trust procurement enters the maintenance phase and vendors upsell adaptive analytics.

Asia-Pacific is on a 16.5% CAGR trajectory thanks to government identity programs. Japan's My Number smartphone credential now underpins login for over 650 firms, and Singapore's banks have replaced SMS with FIDO tokens, broadening mainstream adoption. Australia's Digital ID framework rolls out passkeys for federal services, spurring private-sector copycats. Emerging economies across Southeast Asia and India extend market runway by leapfrogging legacy passwords straight into mobile biometrics.

Europe advances at solid double digits as Regulation 2024/1183 standardizes wallet login across 27 nations. Public-sector volume guarantees vendor scale, and private online-service providers must interoperate or risk customer churn. The Middle East and Africa, though starting from a smaller base, record increasing deployments aligned with cloud migration and cyber-resilience bids, adding diversified revenue streams to the global multifactor authentication market.

- Giesecke+Devrient GmbH

- Thetis

- GoTrustID Inc.

- Thales Group

- Duo Security (Cisco Systems Inc.)

- RSA Security LLC

- Okta Inc.

- Google LLC (Alphabet Inc.)

- Ping Identity Corp.

- ManageEngine (Zoho Corp.)

- Microsoft Corp.

- TeleSign Corp. (Proximus Group)

- HID Global Corp.

- OneSpan Inc.

- CyberArk Software Ltd.

- ForgeRock Inc.

- Entrust Corp.

- SecureAuth Corp.

- Symantec Corp. (Broadcom Inc.)

- Keyless Technologies

- Secret Double Octopus

- Trusona Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid migration to Zero-Trust security architectures across regulated industries

- 4.2.2 Surge in ransomware-as-a-service driving insurance premium hikes

- 4.2.3 Mandated FIDO-based strong authentication for e-Government portals in EU

- 4.2.4 Push-notification phishing kits raising demand for phishing-resistant MFA

- 4.2.5 AI-powered deep-fake attacks forcing higher-factor biometrics

- 4.2.6 Mandalorian Class Public-Private threat-intel sharing models (US and Five-Eyes)

- 4.3 Market Restraints

- 4.3.1 Legacy SCADA/ICS environments limited MFA interoperability

- 4.3.2 Rising OTP SMS costs amid A2P fee inflation

- 4.3.3 Fragmented mobile authenticator UX hurting workforce adoption

- 4.3.4 Hardware token chip shortages and secure-element supply risk

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering Type

- 5.1.1 Hardware

- 5.1.1.1 Tokens (USB, Smart-card, Smartkey)

- 5.1.1.2 Biometric Devices (Fingerprint, Palm-vein, Facial)

- 5.1.1.3 Other Devices (Wearables, Smartcards-NFC)

- 5.1.2 Software

- 5.1.2.1 Authenticator Solutions (TOTP, Push, U2F)

- 5.1.2.2 Mobile Apps (Native, SDK)

- 5.1.3 Services

- 5.1.3.1 Managed and Professional Services

- 5.1.1 Hardware

- 5.2 By Authentication Model

- 5.2.1 Two-Factor (2FA)

- 5.2.2 Multifactor (3F and 4F)

- 5.2.3 Adaptive / Risk-Based MFA

- 5.2.4 Password-less (WebAuthn, Passkeys)

- 5.3 By Deployment Mode

- 5.3.1 On-premises

- 5.3.2 Cloud

- 5.3.2.1 Public

- 5.3.2.2 Private

- 5.3.3 Hybrid

- 5.4 By Enterprise Size

- 5.4.1 Small and Medium-sized Enterprises (SMEs)

- 5.4.2 Large Enterprises

- 5.5 By Access Channel

- 5.5.1 VPN and Remote Login

- 5.5.2 Web and SaaS Applications

- 5.5.3 Mobile Workforce

- 5.6 By End-user Industry

- 5.6.1 Banking and Financial Institutions

- 5.6.2 Cryptocurrency and Web3 Exchanges

- 5.6.3 Technology (SaaS, IT Services, DevOps)

- 5.6.4 Government (Federal, State, Local, Integrators)

- 5.6.5 Healthcare and Pharmaceutical

- 5.6.6 Retail and E-commerce

- 5.6.7 Energy, Utilities and Manufacturing

- 5.6.8 Education, Immigration and Public Services

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 GCC

- 5.7.5.1.2 Turkey

- 5.7.5.1.3 Israel

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Egypt

- 5.7.5.2.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (Funding, Partnerships)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Giesecke+Devrient GmbH

- 6.4.2 Thetis

- 6.4.3 GoTrustID Inc.

- 6.4.4 Thales Group

- 6.4.5 Duo Security (Cisco Systems Inc.)

- 6.4.6 RSA Security LLC

- 6.4.7 Okta Inc.

- 6.4.8 Google LLC (Alphabet Inc.)

- 6.4.9 Ping Identity Corp.

- 6.4.10 ManageEngine (Zoho Corp.)

- 6.4.11 Microsoft Corp.

- 6.4.12 TeleSign Corp. (Proximus Group)

- 6.4.13 HID Global Corp.

- 6.4.14 OneSpan Inc.

- 6.4.15 CyberArk Software Ltd.

- 6.4.16 ForgeRock Inc.

- 6.4.17 Entrust Corp.

- 6.4.18 SecureAuth Corp.

- 6.4.19 Symantec Corp. (Broadcom Inc.)

- 6.4.20 Keyless Technologies

- 6.4.21 Secret Double Octopus

- 6.4.22 Trusona Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment