|

市場調查報告書

商品編碼

1851436

雲端遷移:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Cloud Migration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

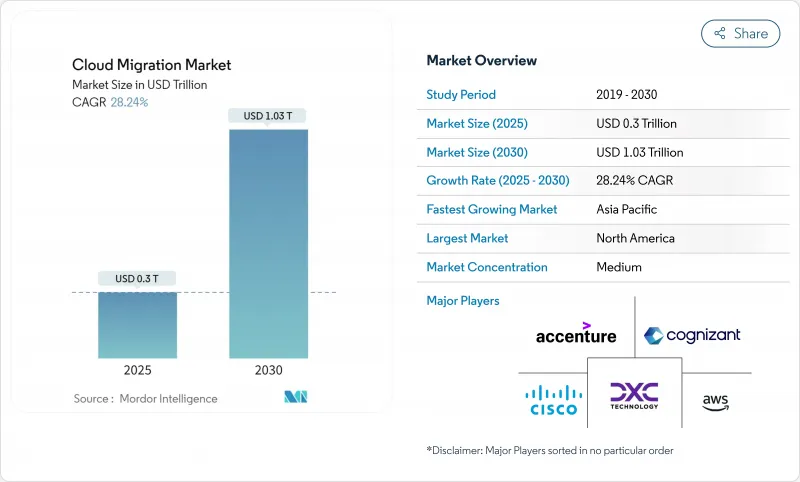

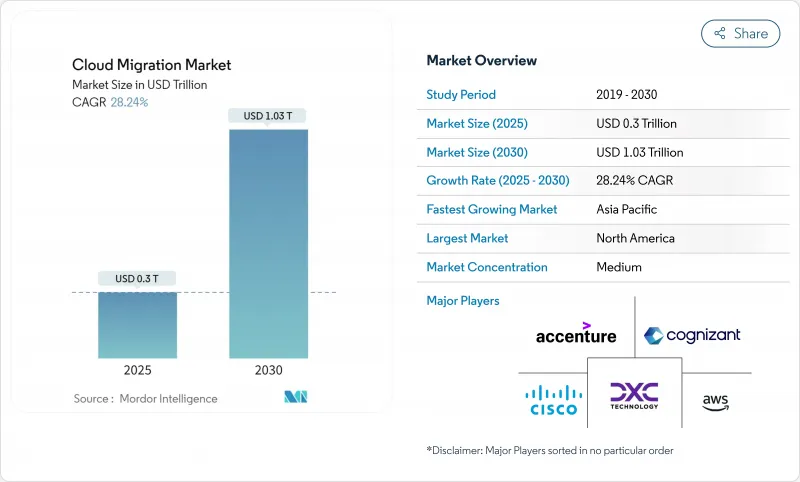

預計到 2025 年,雲端遷移市場規模將達到 3,000 億美元,到 2030 年將達到 1.03 兆美元,年複合成長率為 28.24%。

這種快速成長反映了企業正從資本密集的本地資產轉向可擴展的雲端環境,從而實現更快的創新週期和更好的成本控制。推動這一趨勢的因素包括:生成式人工智慧工作負載的加速發展、混合雲策略的擴展以及日益嚴格的範圍 3 碳排放報告要求(這些要求有利於雲端原生架構)。儘管公有雲仍保持領先地位,但隨著企業努力平衡效能、合規性和成本最佳化目標,混合雲模式正在興起。大型企業的雲端採用率仍然很高,但隨著自動化遷移工具鏈降低技術門檻,中小企業正在縮小差距。按行業分類,銀行、金融服務和保險 (BFSI) 以及醫療保健行業的雲端採用率正在加速成長,而超大規模雲端服務提供商和垂直領域專家則在對供應商鎖定和退出費用的擔憂下,繼續擴展其服務組合。

全球雲端遷移市場趨勢與洞察

經濟高效且擴充性的雲端部署優勢

將工作負載遷移到雲端後,企業營運成本節省了 20-30%,這主要得益於無需進行資本密集的硬體更新週期,以及按需合理配置資源。 Infomart 的 B2B 平台遷移到 Oracle 雲端基礎架構後,資料中心成本降低了 38%,同時提升了效能彈性。靈活的資源配置使企業能夠應對突如其來的需求高峰,而無需像實體資料中心環境那樣經歷 6-12 個月的採購延遲。從基礎設施維護中節省下來的預算擴大被用於推動創新舉措,從而提升競爭力。這些累積效益使得成本合理化策略成為預期複合年成長率影響最大的因素。

遠距辦公和自備設備辦公(BYOD)的普及率正在上升

隨著混合辦公模式的普及,企業正強制將協作套件、身分服務和安全管理遷移到雲端,以確保無論使用者身處何地或使用何種設備,都能獲得一致的使用者體驗。最近的一項調查顯示,89% 的 IT 領導者計劃在 2025 年增加雲端支出,以支援分散式團隊。自帶裝置辦公室 (BYOD) 讓邊界安全更加複雜,促使企業轉向更容易以雲端原生方式實施的零信任架構。因此,企業正日益重視安全存取服務邊緣、端點管理和即時分析層,以確保員工隨時隨地都能有效率地運作。這一趨勢將在不久的將來對計劃流程產生重大影響,尤其是在北美和歐洲地區。

資料安全和監管合規風險

歐洲企業難以將《一般資料保護規則》(GDPR) 與公共雲端服務模式協調,而全球金融機構則疲於應對重疊的司法管轄區規則,這些規則很少明確規定雲端資料流。責任共用模式往往模糊了加密、日誌和事件回應的課責。在某些情況下,主權雲端要求迫使企業為本地化容量支付額外費用或維護本地基礎設施,從而延長了遷移時間。這些因素幾乎限制了所有行業的成長,尤其是在醫療保健、銀行和政府部門。

細分市場分析

混合部署成長最快,年複合成長率高達 18.7%,企業在滿足本地部署的低延遲需求和公共雲端的標準優勢之間尋求平衡。公共雲端目前仍佔據 55.4% 的市場佔有率,這主要得益於超大規模雲端供應商成熟的安全態勢。邊緣雲端整合將運算資源更靠近用戶,同時保持彈性後端分析連接,未來的架構將支援將多個執行節點整合到單一工作流程中。能夠編配工作負載跨節點部署的遷移專家仍供不應求。

企業不再將部署視為非此即彼的選擇。金融機構將交易引擎部署在私有叢集上以實現亞毫秒延遲,同時將監管報告任務卸載到成本效益更高的公共儲存桶中。醫療機構在本地處理影像數據,並將匿名化後的資料集路由到雲端的AI管道。正是這些細緻入微的部署方案解釋了為何混合部署方案在雲端遷移市場中持續擴大其市場佔有率。

到2024年,大型企業將佔據雲端遷移市場62%的佔有率,這反映了它們多年期的轉型預算和全球佈局。然而,中小企業將呈現18%的複合年成長率,這主要得益於打包式遷移工具鏈的普及,這些工具鏈能夠縮短設定時間並降低專業知識門檻。雲端服務供應商目前正在對其產品進行細分,例如為財富500強客戶提供深度諮詢服務,為中小企業提供標準化的模板,從而在不損害淨利率的前提下擴大其服務範圍。

中小企業傾向於選擇SaaS替代方案和託管服務,以避免組建成本高昂的內部營運團隊。相反,大型企業通常會在數十個業務部門內進行漸進式架構重構,並由卓越中心提供支持,這些中心負責制定管治和安全藍圖。這種差異迫使服務供應商採取不同的市場策略,以適應不同客戶群的預算週期和合規要求。

區域分析

到2024年,北美將佔全球雲端支出的37.8%,這主要得益於早期採用者專注於人工智慧最佳化和多重雲端成本管治。美國憑藉聯邦政府的雲端計畫(例如83億美元的現代化預算)處於領先地位,而加拿大和墨西哥則利用網路骨幹網路的改進來加速雲端採用。在全部區域,企業正在整合預測性工作負載部署引擎,以最佳化消費模型並控制出口費用,從而鞏固北美作為雲端遷移市場核心參與者的地位。

亞太地區預計到2030年將以18.5%的複合年成長率成長,這主要得益於各國數位轉型基金和對超大規模資料中心的投資。微軟已累計29億美元在日本擴建資料中心,顯示對日本雲端運算發展前景充滿信心。預計到2028年,印度的雲端運算市場規模將達到255億美元,這反映出銀行、金融服務和保險(BFSI)、零售、政府等行業的廣泛現代化。中國本土雲端服務供應商憑藉客製化的自主服務,在數據本地化規則的支持下,持續擴大市場佔有率。該地區多元化的監管環境造就了混合雲端和多重雲端架構的複雜局面,企業在遷移過程中必須應對這些挑戰。

歐洲正經歷穩定成長與嚴格的資料主權法規並存的局面。德國和英國仍然是最大的採用者,而法國和西班牙則支持賦能本土供應商的主權雲端框架。 GDPR 的實施要求所有計劃都必須進行細緻的駐留映射和加密管治。因此,混合策略正成為主流,將敏感工作負載保留在國內,並利用可擴展的區域節點執行分析和人工智慧任務。這種動態將使歐洲的遷移模式在整個預測期內始終與合規優先的架構保持一致。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 經濟高效且擴充性的雲端部署優勢

- 遠距辦公和自備設備辦公(BYOD)的普及

- 政府數位轉型基金

- 混合/多重雲端策略的興起

- 重構以加速生成式人工智慧工作負載

- 範圍 3彙報以推進碳意識轉型

- 市場限制

- 資料安全和監管合規風險

- 傳統應用程式的複雜性和互通性

- 雲端出口費用上漲如何影響整體擁有成本

- 主權雲端指令可能導致供應商鎖定

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 宏觀經濟因素的影響

- 投資分析

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依部署類型

- 公有雲

- 私有雲端

- 混合雲

- 多重雲端

- 按公司規模

- 中小企業

- 主要企業

- 按服務類型

- Infrastructure-as-a-Service(IaaS)

- Platform-as-a-Service(PaaS)

- Software-as-a-Service(SaaS)

- 透過遷移方法

- 遷移和重新託管

- 平台重構

- 重構/重新架構

- 替代方案(SaaS 替代方案)

- 按最終用戶行業分類

- 銀行、金融服務和保險(BFSI)

- 醫療保健和生命科學

- 零售與電子商務

- 政府/公共部門

- 資訊科技/通訊

- 製造業

- 能源與公共產業

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 非洲

- 南非

- 奈及利亞

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Accenture plc

- Amazon Web Services Inc.

- Cisco Systems Inc.

- Cognizant Technology Solutions Corporation

- DXC Technology Company

- Evolve IP LLC

- Google LLC

- International Business Machines Corporation(IBM)

- Microsoft Corporation

- Oracle Corporation

- Rackspace Technology Inc.

- Flexera Software LLC(RightScale)

- Tech Mahindra Limited

- VMware Inc.

- WSM International LLC

- Infosys Limited

- HCL Technologies Limited

- Capgemini SE

- Atos SE

- Fujitsu Limited

- Alibaba Cloud(Alibaba Group Holding Limited)

- Kyndryl Holdings Inc.

- Tata Consultancy Services Limited

- NTT Data Corporation

第7章 市場機會與未來展望

The cloud migration market size stands at USD 0.30 trillion in 2025 and is on track to reach USD 1.03 trillion by 2030, expanding at a 28.24% CAGR.

This rapid upside reflects how enterprises are shifting from capital-intensive on-premises assets toward scalable cloud environments that permit faster innovation cycles and superior cost control. Momentum is fueled by generative-AI workload acceleration, expanding hybrid strategies, and mounting Scope-3 carbon-reporting obligations that favor cloud-native architectures. Public cloud keeps its leadership position, yet hybrid patterns are gaining ground as firms work to balance performance with compliance and cost-optimization goals. Large enterprises remain the biggest spenders, but small and medium enterprises (SMEs) are closing the gap as automated migration toolchains lower technical barriers. Across industries, Banking, Financial Services and Insurance (BFSI) and Healthcare are pacing adoption, while hyperscale providers and niche specialists continue to broaden service portfolios amid vendor-lock-in and egress-fee concerns.

Global Cloud Migration Market Trends and Insights

Cost-efficiency and Scalability Advantages of Cloud Adoption

Enterprises continue to realize 20-30% operational-expenditure savings after moving workloads to the cloud, primarily by eliminating capital-intensive hardware refresh cycles and right-sizing resources on demand. Infomart's business-to-business platform migration to Oracle Cloud Infrastructure cut data-center costs by 38% while boosting performance flexibility. Elastic resource provisioning now allows organizations to handle unexpected demand spikes without the six-to-twelve-month procurement delays common in physical data-center environments. Budget freed from infrastructure upkeep is increasingly redirected toward innovation initiatives that sharpen competitive differentiation. These cumulative benefits give cost-rationalization strategies the highest positive impact on the forecast CAGR.

Rising Remote-work & BYOD Penetration

Hybrid work models have solidified, prompting organizations to migrate collaboration suites, identity services and security controls to the cloud to guarantee consistent user experiences across locations and devices. A recent survey shows 89% of IT leaders intend to raise cloud spending in 2025 to support distributed teams. BYOD complicates perimeter security, steering enterprises toward zero-trust architectures that are easier to enforce in cloud-native form. Consequently, migrations increasingly encompass secure access service edge, endpoint management and real-time analytics layers that maintain workforce productivity from any location. This trend exerts a strong, near-term pull on project pipelines, particularly in North America and Europe.

Data-security and Regulatory-compliance Risks

European firms struggle to reconcile General Data Protection Regulation (GDPR) stipulations with public-cloud service models, while global financial institutions juggle overlapping jurisdictional rules that rarely address cloud data flows explicitly. The shared-responsibility model often blurs accountability for encryption, logging and incident response. In some cases, sovereign-cloud requirements force organizations to pay premiums for localized capacity or retain on-premises infrastructure, extending migration timelines. These factors temper growth across nearly every industry, especially healthcare, banking and government.

Other drivers and restraints analyzed in the detailed report include:

- Government Digital-transformation Funding

- Proliferation of Hybrid / Multi-cloud Strategies

- Legacy-application Complexity and Interoperability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hybrid deployments are the fastest riser, advancing at an 18.7% CAGR as enterprises balance low-latency on-premises demands with public-cloud scale. Public cloud still holds 55.4% cloud migration market share due to the mature security posture of hyperscale providers. Edge-cloud integrations now push compute closer to the user while maintaining elastic backend analytics connectivity, signaling that future architectures will combine multiple execution venues within a single workflow. Migration specialists able to orchestrate workload placement across these nodes remain in high demand.

Enterprises no longer view deployment as a binary choice. Financial institutions position trading engines on private clusters for sub-millisecond latency while offloading regulatory reporting to cost-efficient public buckets. Healthcare groups process imaging data on-site, then route anonymized sets to AI pipelines in the cloud. These nuanced blueprints underline why hybrid options will keep expanding their footprint within the cloud migration market.

Large enterprises accounted for 62% of cloud migration market size in 2024, reflecting multi-year transformation budgets and global rollouts. Yet SMEs exhibit an 18% CAGR, propelled by packaged migration toolchains that cut setup time and lower expertise thresholds. Cloud providers now segment offerings-white-glove consulting for Fortune 500 clients versus prescriptive templates for smaller firms-thereby widening addressable demand without eroding margins.

SMEs gravitate toward SaaS replacements and managed services to avoid staffing expensive in-house operations teams. Conversely, large entities pursue phased re-architecting across dozens of business units, often underpinned by center-of-excellence teams that codify governance and security blueprints. This bifurcation requires service vendors to maintain differentiated go-to-market motions tailored to each cohort's budget cycles and compliance obligations.

The Cloud Migration Market Report is Segmented by Deployment Type (Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud), Enterprise Size (Small and Medium Enterprises, Large Enterprises), Service Type (IaaS, Paas, Saas), Migration Approach (Lift-And-Shift, Re-Platform, Refactor/Re-architect, Replace), End-User Vertical (BFSI, Healthcare, Retail, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 37.8% of 2024 spend, anchored by early adopters that now focus on AI optimization and multi-cloud cost governance. The United States leads through federal cloud programs such as the USD 8.3 billion modernization budget, while Canada and Mexico leverage improved network backbones to accelerate adoption. Across the region, organizations are integrating predictive workload placement engines to refine consumption models and curb egress charges, reinforcing North America's position at the core of the cloud migration market.

Asia-Pacific is projected to post an 18.5% CAGR to 2030, propelled by state-level digital-transformation funds and hyperscaler investments. Microsoft earmarked USD 2.9 billion for data-center expansion in Japan, demonstrating confidence in Japan's cloud trajectory. India is on course for a USD 25.5 billion cloud sector by 2028, reflecting widespread modernization across BFSI, retail and government. China's domestic providers, supported by data-localization rules, continue to grow market share via tailored sovereign offerings. The region's diverse regulatory landscape shapes a patchwork of hybrid and multi-cloud designs that migration firms must navigate.

Europe pairs steady growth with stringent data-sovereignty controls. Germany and the United Kingdom remain the largest adopters, yet France and Spain are championing sovereign-cloud frameworks that bolster domestic vendors. GDPR enforcement compels meticulous residency mapping and encryption governance across every project. Consequently, hybrid strategies dominate, allowing sensitive workloads to stay on national soil while analytics and AI tasks harness scalable regional nodes. This dynamic will keep Europe's migration profile firmly tied to compliance-first architectures throughout the forecast period.

- Accenture plc

- Amazon Web Services Inc.

- Cisco Systems Inc.

- Cognizant Technology Solutions Corporation

- DXC Technology Company

- Evolve IP LLC

- Google LLC

- International Business Machines Corporation (IBM)

- Microsoft Corporation

- Oracle Corporation

- Rackspace Technology Inc.

- Flexera Software LLC (RightScale)

- Tech Mahindra Limited

- VMware Inc.

- WSM International LLC

- Infosys Limited

- HCL Technologies Limited

- Capgemini SE

- Atos SE

- Fujitsu Limited

- Alibaba Cloud (Alibaba Group Holding Limited)

- Kyndryl Holdings Inc.

- Tata Consultancy Services Limited

- NTT Data Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost-efficiency and scalability advantages of cloud adoption

- 4.2.2 Rising remote-work and BYOD penetration

- 4.2.3 Government digital-transformation funding

- 4.2.4 Proliferation of hybrid / multi-cloud strategies

- 4.2.5 Generative-AI workload acceleration of refactoring

- 4.2.6 Scope-3 reporting pushes carbon-aware migrations

- 4.3 Market Restraints

- 4.3.1 Data-security and regulatory-compliance risks

- 4.3.2 Legacy-application complexity and interoperability

- 4.3.3 Escalating cloud-egress fees impact TCO

- 4.3.4 Vendor lock-in fears amid sovereign-cloud mandates

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macro-Economic Factors

- 4.8 Investment Analysis

- 4.9 Porter's Five Forces

- 4.9.1 Threat of New Entrants

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Bargaining Power of Suppliers

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Type

- 5.1.1 Public Cloud

- 5.1.2 Private Cloud

- 5.1.3 Hybrid Cloud

- 5.1.4 Multi-Cloud

- 5.2 By Enterprise Size

- 5.2.1 Small and Medium Enterprises (SMEs)

- 5.2.2 Large Enterprises

- 5.3 By Service Type

- 5.3.1 Infrastructure-as-a-Service (IaaS)

- 5.3.2 Platform-as-a-Service (PaaS)

- 5.3.3 Software-as-a-Service (SaaS)

- 5.4 By Migration Approach

- 5.4.1 Lift-and-Shift (Re-hosting)

- 5.4.2 Re-platform

- 5.4.3 Refactor / Re-architect

- 5.4.4 Replace (SaaS Substitution)

- 5.5 By End-user Vertical

- 5.5.1 Banking, Financial Services and Insurance (BFSI)

- 5.5.2 Healthcare and Life Sciences

- 5.5.3 Retail and E-commerce

- 5.5.4 Government and Public Sector

- 5.5.5 IT and Telecommunication

- 5.5.6 Manufacturing

- 5.5.7 Energy and Utilities

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Turkey

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Accenture plc

- 6.4.2 Amazon Web Services Inc.

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Cognizant Technology Solutions Corporation

- 6.4.5 DXC Technology Company

- 6.4.6 Evolve IP LLC

- 6.4.7 Google LLC

- 6.4.8 International Business Machines Corporation (IBM)

- 6.4.9 Microsoft Corporation

- 6.4.10 Oracle Corporation

- 6.4.11 Rackspace Technology Inc.

- 6.4.12 Flexera Software LLC (RightScale)

- 6.4.13 Tech Mahindra Limited

- 6.4.14 VMware Inc.

- 6.4.15 WSM International LLC

- 6.4.16 Infosys Limited

- 6.4.17 HCL Technologies Limited

- 6.4.18 Capgemini SE

- 6.4.19 Atos SE

- 6.4.20 Fujitsu Limited

- 6.4.21 Alibaba Cloud (Alibaba Group Holding Limited)

- 6.4.22 Kyndryl Holdings Inc.

- 6.4.23 Tata Consultancy Services Limited

- 6.4.24 NTT Data Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment